- Home

- »

- Beauty & Personal Care

- »

-

Refillable Deodorants Market Size & Share Report, 2030GVR Report cover

![Refillable Deodorants Market Size, Share & Trends Report]()

Refillable Deodorants Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Refillable Spray Deodorants, Refillable Stick Deodorants), By Packaging (Metal, Glass, Plastic, Paper), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-145-4

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Refillable Deodorants Market Size & Trends

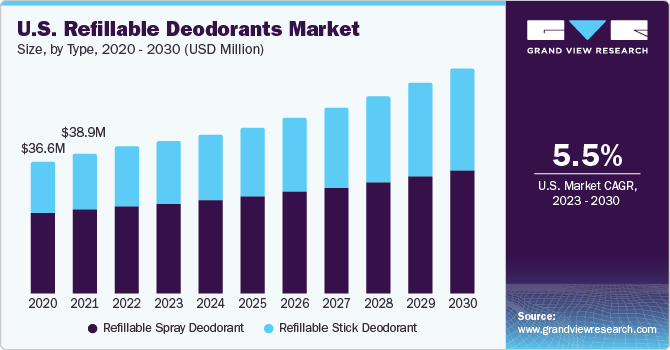

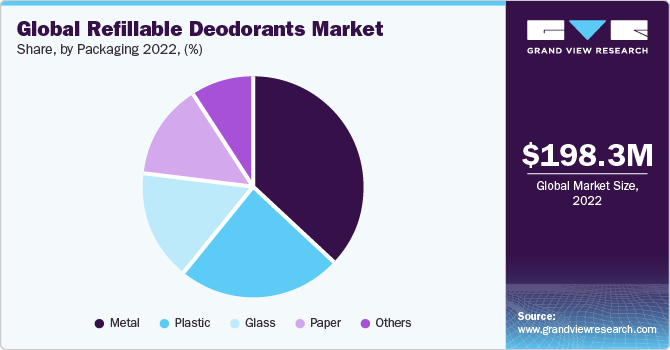

The global refillable deodorants market size was estimated at USD 198.30 million in 2022 and is expected to reach USD 343.01 million by 2030, growing at a CAGR of 7.1% from 2023 to 2030. The global market is experiencing significant growth due to shifting consumer preferences towards eco-friendly and responsible consumption, which is driving the demand for refillable deodorants.

Key Market Trends & Insights

- North America dominated the market in 2022 with the largest revenue share of about 33%.

- Central & South America is expected to witness a CAGR of 8.6% from 2023 to 2030.

- Based on type, the refillable spray deodorant segment dominated the global market with a revenue share of around 60% in 2022.

- Based on packaging, the metal packaging segment dominated the global market in 2022 with a revenue share of approximately 37%.

Market Size & Forecast

- 2022 Market Size: USD 198.30 Million

- 2030 Projected Market Size: USD 343.01 Million

- CAGR (2023-2030): 7.1%

- North America: Largest market in 2022

Skincare products, color cosmetics, fragrance-related products, and hair care have gained prominence as essential components among millennials in their daily grooming routines. Among the primary factors driving market growth is the increasing awareness among consumers regarding their personal grooming. In addition, the introduction of eco-friendly packaging of refillable deodorants featuring natural, non-toxic, and organic ingredients has further contributed to the market's expansion.

The market has witnessed substantial growth in terms of sales value due to the convenient availability of these products across multiple sales outlets, such as specialty stores, pharmacies, and beauty salons. In addition, increased investments in research and development have played a positive role in introducing novel and efficacious products that cater to a wide range of consumer needs and preferences.

Furthermore, aluminum is becoming increasingly unpopular. Consumers are presently steering clear of this soft metal, which has been a staple ingredient in deodorant products for a long time. This shift is driven by concerns that aluminum in underarm products may be linked to health issues such as breast cancer and Alzheimer's disease, although there are differing opinions on this matter. As a result, more and more consumers are scrutinizing product labels in search of alternatives to aluminum.

Packaging Insights

Based on packaging, the metal packaging segment for refillable deodorants dominated the global market in 2022 with a revenue share of approximately 37%. Stainless steel packaging displays a premium and chic aesthetic, appealing to those who appreciate both functionality and style. As such, refillable deodorants with stainless steel packaging provide a blend of sustainability, durability, and visual appeal, making them a popular choice for consumers seeking an eco-conscious and elegant personal care option.

Other packaging such as recycled paper or plastic for refillable deodorants is anticipated to grow at the fastest CAGR of about 8.8% over the forecast period. Consumers are increasingly driving change, advocating for sustainable alternatives, including packaging for refillable deodorants. Shifting consumer preferences are compelling companies to rethink their packaging choices in favor of more eco-friendly options.

According to a 2020 study by IBM and the National Retail Federation, 70% of US consumers desire eco-friendly products and are willing to pay a premium for sustainability. Products labeled as "sustainable" have experienced 5.6 times faster growth compared to conventional alternatives. These findings underscore consumer perception towards brands that disregard environmental concerns. This awakening has prompted the entire industry, including giants like Unilever and L'Oreal, to commit to making all plastic packaging reusable, recyclable, or refillable by 2025.

Type Insights

Based on type, the refillable spray deodorant dominated the global market with a revenue share of around 60% in 2022. Refillable spray deodorants have gained popularity owing to their environmental appeal which resonates with a growing number of eco-conscious consumers. Key players are investing in innovative solutions to cater to the consumer’s requirement to reduce their carbon footprint. For instance, in September 2023, Respray introduced a refillable spray deodorant system that allows customers to continue using their preferred deodorant format. This solution comprises a refillable deodorant can and dedicated refill stations located in drugstores and supermarkets, enabling customers to independently refill their deodorant products.

Refillable stick deodorant is estimated to grow at the fastest CAGR of about 8.4% over the forecast period. Stick deodorants provide precise and targeted application, allowing users to apply the product directly to the underarm area without overspray. This can be especially beneficial for individuals who prefer controlled applications. In May 2023, an international player namely PiperWai Natural Deodorant launched a refillable deodorant stick in May 2023, which is lightweight, travel-friendly, and easy to use.

Regional Insights

North America dominated the market in 2022 with the largest revenue share of about 33%. The increasing number of consumers who are conscious about their appearance and the growing adoption of refillable deodorants among middle- and high-income individuals support the sales of refillable deodorants in the region. As of September 2022, data from Spate indicates that in the U.S., searches for "deodorant" in conjunction with "refillable" have reached a monthly volume of 12,890, marking a notable 32% year-on-year growth. In addition, the presence of established manufacturers such as Procter & Gamble and Unilever, along with the growing number of retailers, is expected to further support market growth.

Central & South America is expected to witness a CAGR of 8.6% from 2023 to 2030. There is an increasing regional demand for all-natural, safe, and clean formulations in beauty and personal care products that include refillable deodorants driven by consumers' growing awareness and preference for eco-friendly and health-conscious options. They seek products that align with their desire for sustainable and responsible choices, promoting a cleaner lifestyle and supporting the environment.

Distribution Channel Insights

In terms of distribution channels, the offline channel held a majority market share of about 60% in 2022. The retail stores serve as convenient and accessible locations for consumers to purchase these products. Shoppers can easily find refill stations and select their preferred deodorant brand, scent, or formula while doing their regular shopping, enhancing the overall shopping experience. Manufacturers such as Salt of the Earth Natural Deodorants based in the UK launched natural refillable deodorant in March 2023 at Boots retail stores spread throughout the UK Scents such as vanilla and lavender were the most popular fragrances among the consumers.

The online distribution channel segment is anticipated to register the fastest CAGR of about 8.0% over the forecast period. The growth of the market through e-commerce is driven by the convenience and accessibility offered by online shopping platforms that have made it easier for consumers to browse, compare, and purchase a wide range of beauty products from the comfort of their homes. The availability of detailed product information, customer reviews, and educational content online empowers consumers to make informed choices, boosting their confidence in purchasing products online. In addition, Proverb Skincare offers an online subscription for refillable deodorants in the form of two gift boxes, which can be used for four months thereby saving the need to buy individual product every time.

Key Companies & Market Share Insights

The refillable deodorant industry is becoming more competitive, with a mix of both major and smaller manufacturers. Key industry players are implementing various strategies, including mergers, acquisitions, partnerships, product introductions, innovative approaches, and promotional efforts to maintain their competitiveness in the market.

-

In September 2023, Respray introduced a refillable spray deodorant system that allows customers to continue using their preferred deodorant format. This solution comprises a refillable deodorant can and dedicated refill stations located in drugstores and supermarkets, enabling customers to independently refill their deodorant products.

-

In April 2021, Dove launched refillable deodorants to reduce plastic waste. The deodorants from the brand owned by Unilever are available in a compact stainless-steel container, which is white. The design incorporates plastic that is sourced from 98% recycled materials.

Key Refillable Deodorants Companies:

- Unilever Plc.

- The Procter & Gamble Company

- by Humankind

- Grove Collaborative, Inc.

- Noniko

- Myro

- Asuvi

- The Lekker Company

- Fussy Ltd

- Proverb Skincare

Refillable Deodorants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 209.21 million

Revenue forecast in 2030

USD 343.01 million

Growth rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; Australia & New Zealand; Brazil; South Africa; UAE

Key companies profiled

Unilever Plc.; The Procter & Gamble Company; by Humankind; Grove Collaborative, Inc.; Noniko; Myro; Asuvi; The Lekker Company; Fussy Ltd; Proverb Skincare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refillable Deodorants Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global refillable deodorants market report based on type, packaging, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Refillable Spray Deodorant

-

Refillable Stick Deodorant

-

-

Packaging Outlook (Revenue, USD Million, 2017 - 2030)

-

Metal

-

Glass

-

Plastic

-

Paper

-

Others (Recycled Paper, Recycled Plastic, etc.)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

Supermarket/Hypermarket

-

Specialty Store

-

Drugstores/Pharmacies

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global refillable deodorants market was estimated at USD 198.30 million in 2022 and is expected to reach USD 209.21 million in 2023.

b. The global refillable deodorants market is expected to grow at a compound annual growth rate of 7.1% from 2022 to 2030 to reach USD 343.01 million by 2030.

b. North America dominated the refillable deodorants market with a share of around 33% in 2022. The growth of the regional market is driven by rise in consumers who prefer eco-friendly products and established key players in the region.

b. Some of the key players operating in the refillable deodorant market include Unilever Plc.; The Procter & Gamble Company; by Humankind; Grove Collaborative, Inc.; Noniko; Myro; Asuvi; The Lekker Company; Fussy Ltd; Proverb Skincare

b. Key factors that are driving the refillable deodorant market growth include increasing spending on personal care products and growing preference towards environmentally friendly products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.