- Home

- »

- Biotechnology

- »

-

Regenerative Medicine Market Size & Share Report, 2030GVR Report cover

![Regenerative Medicine Market Size, Share & Trends Report]()

Regenerative Medicine Market Size, Share & Trends Analysis Report By Product (Cell-based Immunotherapies, Gene Therapies), By Therapeutic Category, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-952-4

- Number of Report Pages: 230

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Regenerative Medicine Market Size & Trends

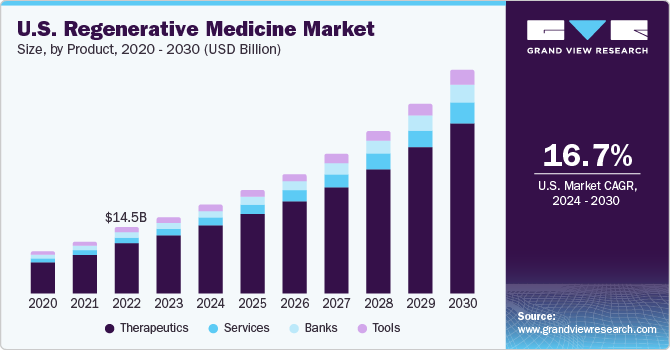

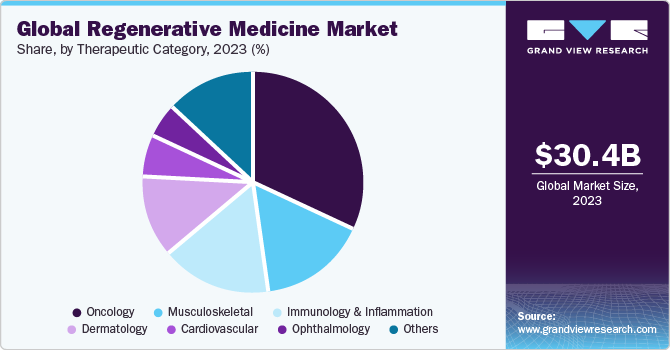

The global regenerative medicine market size was valued at USD 30.43 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 16.79% from 2024 to 2030. Recent advancements in biological therapies have resulted in a gradual shift in preference toward personalized medicinal strategies over the conventional treatment approach. This has created opportunities for companies that are involved in the development of biological therapeutics. Furthermore, the rise in the incidence of degenerative disorders has led to an increase in focus on research to discover novel regenerative therapies.

The COVID-19 outbreak has considerably impacted various markets, including the regenerative medicine and T-cell therapy manufacturing market. The SARS-CoV-2 coronavirus crisis has significantly affected the delivery of CAR T-cell therapies. This impact is not just limited to patient care. It has extended beyond patient care to administration, logistics, and limited healthcare resources. Several universities have slowed down clinical trial enrollment and other research activities. However, the market continues to expand as market players such as Novartis provide access to therapies like Athersys, Inc.’s MultiStem, which is a highly relevant COVID-19 therapy.

Furthermore, regenerative medicines have been identified to have the unique ability to alter the fundamental mechanisms of diseases. Regenerative therapies in trials provide promising solutions for specific chronic indications with unmet medical needs. In December 2021, Novartis announced the introduction of T-ChargeTM, a next-generation CAR-T platform that would be a beneficial tool for novel investigational CAR-T cell therapies.

Significant advancements in molecular medicines have resulted in the development of gene-based therapy, which uses targeted delivery of DNA as a medicine to fight against various disorders. Gene therapy has high potential in the treatment of cancer and diabetes type 1 & 2 through restoring gene function. Currently, gene-based therapies are used in the treatment of patients suffering from cancer, oncology, infectious diseases, cardiovascular disorders, monogenic diseases, genetic disorders, ophthalmological indications, and diseases of the central nervous system. These factors have contributed to the growth of the market.

In addition, a strong product pipeline in clinical trials and the presence of government & private funding to support research are expected to drive market growth over the forecast period. The presence of highly efficient products such as grafts, tissue patches, ointments, and scaffolds has resulted in the development of regenerative medicines for use in dermatology as well as musculoskeletal treatments. Advancements in nanotechnology that have further improved the efficiency of these products are expected to significantly contribute to revenue generation.

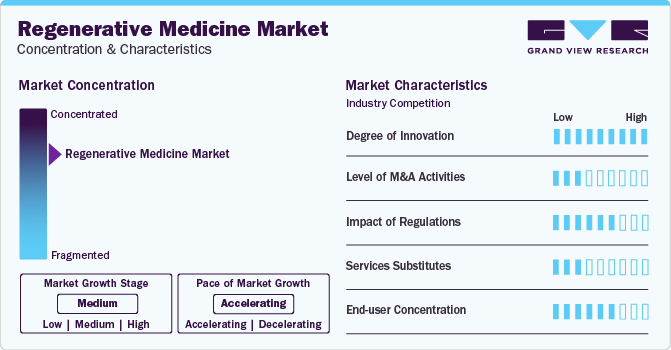

Market Concentration & Characteristics

The market growth stage for regenerative medicine market is medium however, the pace of market growth is accelerating. The regenerative medicine market is experiencing rapid growth driven by innovative approaches such as regenerative therapy, regenerative knee treatment, stem cell regeneration, and cell regeneration therapy. As advancements in medical science continue to unfold, regenerative medicine offers promising solutions for tissue repair and replacement. Regenerative knee treatments, leveraging stem cell regeneration, hold particular significance in addressing orthopedic challenges. Patients seeking alternatives to traditional surgeries are increasingly turning to regenerative therapies, which harness the body's natural healing mechanisms. The potential to enhance patient outcomes and reduce the burden of chronic conditions propels the market forward, making regenerative medicine a focal point in the ever-evolving landscape of healthcare.

Regulations play a pivotal role in fostering the growth of the regenerative medicine market by providing clear guidelines, expedited approval processes, and tailored approaches that accommodate the unique nature of these advanced therapies. Regulatory agencies, such as the FDA and EMA, offer pathways like RMAT designation and orphan drug designations, incentivizing companies to invest in the development of regenerative medicine products, particularly those targeting rare diseases. The adoption of adaptive regulatory approaches and ongoing collaboration between stakeholders further contribute to the industry's expansion. Additionally, regulatory support extends beyond approval processes, encompassing funding initiatives and partnerships that stimulate research and development, thereby creating a conducive environment for innovation in regenerative medicine.

Market Dynamics

Advancements in cell biology, genomic research, and gene editing technology are anticipated to fuel the growth of the industry. Stem cell-based regenerative therapies are in-clinical trials, which may help restore damaged specialized cells in many serious and fatal diseases such as cancer, Alzheimer’s, neurodegenerative diseases, and spinal cord injuries. For instance, various research institutes have adopted Human Embryonic Stem Cells (hESCs) to develop treatments of Age-related Macular Degeneration (AMD).

AMD is a condition caused by cumulative damage to choriocapillaris, Bruch's membrane, and retinal pigment epithelium (RPE), which leads to the loss and dysfunction of RPE cells. Moreover, AMD is one of the leading causes of loss of vision in geriatric population. Hence, the rise in the number of stem cell therapies in clinical trials for spinal cord injury, heart failure, and diabetes type 1 is anticipated to influence market growth.

Technological advancements such as stem cells, tissue engineering, and nanotechnology have made regenerative medicines highly interdisciplinary in the field. Stem cells are undifferentiated cells, which have the capability to repair and/or regenerate into other cells such as cartilage, tendons, ligaments, muscle, and bones. In July 2021, BlueRock Therapeutics received FDA approval for its pluripotent stem cell-derived dopaminergic neuron therapy, DA01, for advanced Parkinson’s disease treatment. This approval was expected to expand the company’s offerings.

Furthermore, with the increasing demand for disease treatment therapies, companies have focused their efforts on accelerating R&D for gene therapies that target the cause of disease at a genomic level. The cell and gene therapies in the U.S. pipeline programs (Phase I-III trials) grew from 289 in 2018 to 362 by 2019 according to the data published by PhRMA. This represents an increase of 25% in a single year. Continuous advancements in this field would further boost the demand for regenerative medicines.

Product Insights

The therapeutics segment held the largest market share of 76.24% in 2023, owing to the growing geriatric population coupled with higher incidence rates of age-related as well as degenerative disorders. Increased prevalence of diseases with unmet medical solutions, such as cancer, diabetes, and neurodegenerative diseases including AMD, has encouraged researchers to develop alternative options. In April 2022, Kite, a Gilead Company announced of receiving U.S. FDA authorization for its CAR T-cell therapy product, Yescarta, which could be used for the treatment of refractory or relapsed large B-cell lymphoma.

The banks segment is expected to witness the fastest CAGR of 17.34% from 2024 to 2030. Banks are usually research-focused and are established with an intention to accelerate research by reducing the efforts, time, and cost for researchers in the collection, storage, and curation of human tissues or cells. However, with the rising adoption of cell-based and tissue engineering approaches in medical applications, the number of banks providing services for non-research applications has witnessed a rise. Thus, the rise in number of clinical trials for stem cell and tissue-based regenerative therapies along with an increase in demand for regenerative therapies is expected to influence segment growth.

Therapeutic Category Insights

The oncology segment held the largest market share in 2023 and is expected to witness the fastest CAGR of 17.62% from 2024 to 2030. The growing prevalence of cancer is expected to positively influence the global market throughout the forecast period. According to the American Cancer Society estimate, the overall number of new cancer cases in 2023 was approximately 1,958,310 and the number of cancer-related deaths was 609,820 in the U.S.

The global cancer impact has resulted in worldwide efforts to decrease mortality and increase efficient treatment options pertaining to cancer. Therefore, Various government organizations along with private companies have made high investments in cancer research and the development of regenerative & advanced cell therapies. In January 2023, Calidi Biotherapeutics (CBT) and First Light Acquisition Group (FLAG) entered into a partnership agreement that aims to revolutionize oncolytic virotherapies with the help of stem cell-based platforms and further boost the market growth.

The cardiovascular segment is anticipated to witness significant growth during the forecast period. Advancements in cell-based therapies and regenerative medicines have accelerated the growth of the segment. Many key players are involved in the development of regenerative therapies to repair, restore, and revascularize damaged heart tissues. There is growing adoption of single and mixed cells from autologous as well as allogeneic sources to study the effect on CVDs. In addition, advanced biologics, small molecules, and gene therapy are being investigated to stimulate the regeneration of damaged heart cells. These factors would further fuel global market growth.

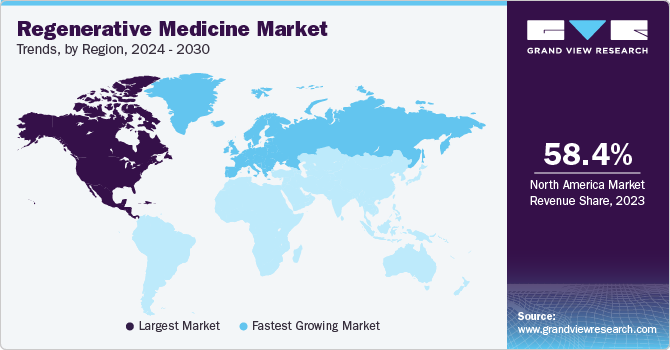

Regional Insights

North America held the largest market share in the global market in 2023. The high growth is attributed to the availability of government and private funding for development, the presence of advanced tech frameworks to support the rapid detection of chronic diseases and high healthcare spending in the region. Moreover, several ongoing clinical trials for regenerative medicine by significant market players have contributed to the region’s growth. In December 2021, Bristol Myers Squibb received U.S. FDA approval for Orencia for the prevention of acute graft versus host disease in adults and pediatric patients 2 years of age and elderly patients undertaking hematopoietic stem cell transplantation (HSCT).

Europe is expected to experience the fastest CAGR of 18.79% from 2024 to 2030. This growth rate is attributed to the rapid adoption of cell-based approaches in healthcare, the rising geriatric population in the region, and the emergence of key players. In recent years, China has emerged with rapid expansion in infrastructure and facilities to accelerate stem cell research. This in turn, is anticipated to fuel the growth of regenerative medicine in the region.

Australia Regenerative Medicine Market

The regenerative medicine market is in high demand in Australia due to a confluence of factors. Australians, like many globally, are seeking advanced healthcare solutions, and regenerative medicine presents a groundbreaking approach. The aging population, coupled with a growing awareness of alternative treatments, fosters a demand for regenerative therapies. Moreover, Australia's robust research infrastructure and commitment to medical innovation contribute to the flourishing market. Patients are increasingly drawn to regenerative medicine's potential to treat various conditions, from degenerative diseases to injuries, enhancing the overall quality of healthcare. The convergence of scientific progress and patient preference positions regenerative medicine as a sought-after and evolving frontier in Australian healthcare.

Key Companies & Market Share Insights

Companies in the regenerative medicine sector are deploying multifaceted strategies to stay competitive in a rapidly evolving market. First and foremost, research and development investments remain paramount, enabling companies to pioneer cutting-edge technologies and stay ahead of the curve. Establishing strategic partnerships and collaborations with academic institutions and other industry players facilitates knowledge exchange and accelerates innovation. Robust intellectual property portfolios safeguard unique approaches, granting a competitive edge. Additionally, companies are focusing on efficient regulatory navigation, ensuring timely approvals and market access. As the market expands, cultivating strong relationships with healthcare providers and institutions becomes pivotal for adoption. Finally, fostering patient awareness and education through targeted marketing initiatives is crucial for building trust and ensuring a broader acceptance of regenerative medicine solutions in the healthcare landscape.

Key Regenerative Medicine Companies:

- AstraZeneca plc

- F. Hoffmann-La Roche Ltd.

- Integra Lifesciences Corp.

- Astellas Pharma, Inc.

- Cook Biotech, Inc.

- Bayer AG

- Pfizer, Inc.

- Merck KGaA

- Abbott

- Vericel Corp.

- Novartis AG

- GlaxoSmithKline (GSK)

Recent Developments

-

In October 2023, Editas drug, Inc. stated that the FDA has given EDIT-301, a research-stage gene editing drug, Regenerative Medicine Advanced Therapy (RMAT) classification for the treatment of severe sickle cell disease (SCD). In October 2022, Astellas Pharma Inc. and Pantherna Therapeutics GmbH announced a technology evaluation agreement to develop mRNA-based regenerative medicine programs through direct reprogramming. Their collaborative effort aims to expand treatment options for diseases with high unmet medical needs by targeting new organs

-

In July 2022, Mogrify Limited and Astellas Pharma Inc. announced a collaborative research agreement to develop regenerative medicine approaches for sensorineural hearing loss. Astellas Gene Therapies will fund the research and provide expertise in AAV-based genetic medicine, while Mogrify will leverage its bioinformatic platform for screening and validation to identify potential therapeutic factors. Their shared goal is to transform the lives of patients with hearing loss through innovative regenerative therapies

-

In January 2022, Novartis unveiled a strategic collaboration with Alnylam to harness Alnylam's established siRNA technology in inhibiting a target identified at Novartis Institutes for BioMedical Research. By merging regenerative medicine principles with cutting-edge siRNA technology, both companies aim to create a potential treatment fostering the regrowth of functional liver cells, offering an alternative to transplantation for patients suffering from liver failure

Regenerative Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 35.47 billion

Revenue forecast in 2030

USD 90.01 billion

Growth rate

CAGR of 16.79% from 2024 to 2030

Historical data

2018 – 2023

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, therapeutic category, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

AstraZeneca plc; F. Hoffmann-La Roche Ltd.; Integra Lifesciences Corp.; Astellas Pharma, Inc.; Cook Biotech, Inc.; Bayer AG; Pfizer, Inc.; Merck KGaA; Abbott; Vericel Corp.; Novartis AG; GlaxoSmithKline (GSK).

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Regenerative Medicine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global regenerative medicine market report based on product, therapeutic category, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutics

-

Primary cell-based therapeutics

-

Dermatology

-

Musculoskeletal

-

Surgical

-

Dental

-

Others

-

-

Stem Cell & Progenitor Cell-based therapeutics

-

Autologous

-

Allogenic

-

Others

-

-

Cell-based Immunotherapies

-

Gene Therapies

-

Tools

-

Banks

-

Services

-

-

Therapeutic Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatology

-

Musculoskeletal

-

Immunology & Inflammation

-

Oncology

-

Cardiovascular

-

Ophthalmology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global regenerative medicine market size was estimated at USD 30.43 billion in 2023 and is expected to reach USD 35.47 billion in 2024

b. The global regenerative medicine market is expected to grow at a compound annual growth rate of 16.79% from 2024 to 2030 to reach USD 90.01 billion by 2030.

b. North America dominated the regenerative medicine market with a share of 58.4% in 2023. This is attributable to the availability of advanced technologies and the presence of research institutes involved in the development of novel therapeutics in the region.

b. Some key players operating in the regenerative medicine market include Integra LifeSciences Corporation; MiMedx Group, Inc.; AstraZeneca; F. Hoffmann-La Roche Ltd; Merck & Co., Inc.; Pfizer Inc.; and Baxter.

b. Key factors that are driving the market growth include the presence of a strong pipeline portfolio and a high number of clinical trials, high economic impact of regenerative medicine and technological advances in regenerative medicine.

Table of Contents

Chapter 1. Regenerative Medicine Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.2.1. Information analysis

1.2.2. Market formulation & data visualization

1.2.3. Data validation & publishing

1.3. Information Procurement

1.3.1. Primary Others

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Market Model

1.7. Objectives

1.7.1. Objective 1

1.7.2. Objective 2

Chapter 2. Regenerative Medicine Market: Executive Summary

2.1. Market Outlook

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Regenerative Medicine Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Trends and Outlook

3.3. Market Dynamics

3.3.1. Presence of a strong pipeline and a large number of clinical trials

3.3.2. High economic impact of regenerative medicine

3.3.3. Emerging applications of gene therapy in regenerative medicine

3.3.4. Increasing government & private funding to support the development of regenerative medicine

3.3.5. Technological advancements in regenerative medicine (stem cell, tissue engineering, and nanotechnology)

3.3.6. Increase in strategic partnerships to accelerate development & commercialization of regenerative medicines

3.3.7. Rising prevalence of chronic diseases & genetic disorders, degenerative diseases, and bone & joint diseases leading to rise in demand for regenerative treatments

3.4. Market Restraint Analysis

3.4.1. High cost of treatment

3.4.2. Regulatory issues pertaining to stem cells, tissues engineering, and regenerative medicines

3.5. Business Environment Analysis

3.5.1. PESTEL Analysis

3.5.2. Porter’s Five Forces Analysis

3.5.3. COVID-19 Impact Analysis

3.6. Technology Overview

3.7. Cost Structure Analysis

3.8. User Perspective Analysis

3.9. Market Entry Strategies

3.10. Case Studies

3.11. Challenges Analysis (COVID-19)

3.12. Opportunities Analysis

3.13. Challenges in Manufacturing T-cell Therapies Against COVID-19

3.14. Key Market Initiatives

3.15. Conclusion

Chapter 4. Product Business Analysis

4.1. Global Regenerative Medicine Market: Product Movement Analysis

4.2. Therapeutics

4.2.1. Therapeutics Market, 2018 - 2030 (USD Million)

4.2.2. Primary Cell-Based Therapeutics

4.2.2.1. Primary Cell-Based Therapeutics Market, 2018 - 2030 (USD Million)

4.2.2.2. Dermatology

4.2.2.2.1. Dermatology Market, 2018 - 2030 (USD Million)

4.2.2.3. Musculoskeletal

4.2.2.3.1. Musculoskeletal Market, 2018 - 2030 (USD Million)

4.2.2.4. Surgical

4.2.2.4.1. Surgical Market, 2018 - 2030 (USD Million)

4.2.2.5. Dental

4.2.2.5.1. Dental Market, 2018 - 2030 (USD Million)

4.2.2.6. Others

4.2.2.6.1. Others Market, 2018 - 2030 (USD Million)

4.2.3. Stem Cell & Progenitor Cell-based therapeutics

4.2.3.1. Stem Cell & Progenitor Cell-based therapeutics Market, 2018 - 2030 (USD Million)

4.2.3.2. Autologous

4.2.3.2.1. Autologous Market, 2018 - 2030 (USD Million)

4.2.3.3. Allogenic

4.2.3.3.1. Allogenic Market, 2018 - 2030 (USD Million)

4.2.3.4. Others

4.2.3.5. Others Market, 2018 - 2030 (USD Million)

4.2.4. Cell-based Immunotherapies

4.2.4.1. Cell-based Immunotherapies Market, 2018 - 2030 (USD Million)

4.2.5. Gene Therapies

4.2.5.1. Gene Therapies Market, 2018 - 2030 (USD Million)

4.3. Tools

4.3.1. Tools Market, 2018 - 2030 (USD Million)

4.4. Banks

4.4.1. Banks Market, 2018 - 2030 (USD Million)

4.5. Services

4.5.1. Services Market, 2018 - 2030 (USD Million)

Chapter 5. Therapeutic Category Business Analysis

5.1. Global Regenerative Medicine Market: Therapeutic Category Movement Analysis

5.2. Dermatology

5.2.1. Dermatology Market, 2018 - 2030 (USD Million)

5.3. Musculoskeletal

5.3.1. Musculoskeletal Market, 2018 - 2030 (USD Million)

5.4. Immunology & Inflammation

5.4.1. Immunology & Inflammation Market, 2018 - 2030 (USD Million)

5.5. Oncology

5.5.1. Oncology Market, 2018 - 2030 (USD Million)

5.6. Cardiovascular

5.6.1. Cardiovascular Market, 2018 - 2030 (USD Million)

5.7. Ophthalmology

5.7.1. Ophthalmology Market, 2018 - 2030 (USD Million)

5.8. Others

5.8.1. Others Market, 2018 - 2030 (USD Million)

Chapter 6. Regional Business Analysis

6.1. Global Regenerative Medicine Market Share By Region, 2022 & 2030

6.2. North America

6.2.1. North America Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.2.2. U.S.

6.2.2.1. Key Country Dynamics

6.2.2.2. Competitive Scenario

6.2.2.3. Regulatory Framework

6.2.2.4. Target Disease Prevalence

6.2.2.5. U.S. Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.2.3. Canada

6.2.3.1. Key Country Dynamics

6.2.3.2. Competitive Scenario

6.2.3.3. Regulatory Framework

6.2.3.4. Target Disease Prevalence

6.2.3.5. Canada Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.3. Europe

6.3.1. Europe Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.3.2. Germany

6.3.2.1. Key Country Dynamics

6.3.2.2. Competitive Scenario

6.3.2.3. Regulatory Framework

6.3.2.4. Target Disease Prevalence

6.3.2.5. Germany Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.3.3. UK

6.3.3.1. Key Country Dynamics

6.3.3.2. Competitive Scenario

6.3.3.3. Regulatory Framework

6.3.3.4. Target Disease Prevalence

6.3.3.5. UK Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.3.4. France

6.3.4.1. Key Country Dynamics

6.3.4.2. Competitive Scenario

6.3.4.3. Regulatory Framework

6.3.4.4. Target Disease Prevalence

6.3.4.5. France Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.3.5. Italy

6.3.5.1. Key Country Dynamics

6.3.5.2. Competitive Scenario

6.3.5.3. Regulatory Framework

6.3.5.4. Target Disease Prevalence

6.3.5.5. Italy Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.3.6. Spain

6.3.6.1. Key Country Dynamics

6.3.6.2. Competitive Scenario

6.3.6.3. Regulatory Framework

6.3.6.4. Target Disease Prevalence

6.3.6.5. Spain Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.3.7. Denmark

6.3.7.1. Key Country Dynamics

6.3.7.2. Competitive Scenario

6.3.7.3. Regulatory Framework

6.3.7.4. Target Disease Prevalence

6.3.7.5. Denmark Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.3.8. Sweden

6.3.8.1. Key Country Dynamics

6.3.8.2. Competitive Scenario

6.3.8.3. Regulatory Framework

6.3.8.4. Target Disease Prevalence

6.3.8.5. Sweden Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.3.9. Norway

6.3.9.1. Key Country Dynamics

6.3.9.2. Competitive Scenario

6.3.9.3. Regulatory Framework

6.3.9.4. Target Disease Prevalence

6.3.9.5. Norway Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.4. Asia Pacific

6.4.1. Asia Pacific Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.4.2. Japan

6.4.2.1. Key Country Dynamics

6.4.2.2. Competitive Scenario

6.4.2.3. Regulatory Framework

6.4.2.4. Target Disease Prevalence

6.4.2.5. Japan Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.4.3. China

6.4.3.1. Key Country Dynamics

6.4.3.2. Competitive Scenario

6.4.3.3. Regulatory Framework

6.4.3.4. Target Disease Prevalence

6.4.3.5. China Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.4.4. India

6.4.4.1. Key Country Dynamics

6.4.4.2. Competitive Scenario

6.4.4.3. Regulatory Framework

6.4.4.4. Target Disease Prevalence

6.4.4.5. India Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.4.5. South Korea

6.4.5.1. Key Country Dynamics

6.4.5.2. Competitive Scenario

6.4.5.3. Regulatory Framework

6.4.5.4. Target Disease Prevalence

6.4.5.5. South Korea Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.4.6. Australia

6.4.6.1. Key Country Dynamics

6.4.6.2. Competitive Scenario

6.4.6.3. Regulatory Framework

6.4.6.4. Target Disease Prevalence

6.4.6.5. Australia Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.4.7. Thailand

6.4.7.1. Key Country Dynamics

6.4.7.2. Competitive Scenario

6.4.7.3. Regulatory Framework

6.4.7.4. Target Disease Prevalence

6.4.7.5. Thailand Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.5. Latin America

6.5.1. Latin America Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.5.2. Brazil

6.5.2.1. Key Country Dynamics

6.5.2.2. Competitive Scenario

6.5.2.3. Regulatory Framework

6.5.2.4. Target Disease Prevalence

6.5.2.5. Brazil Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.5.3. Mexico

6.5.3.1. Key Country Dynamics

6.5.3.2. Competitive Scenario

6.5.3.3. Regulatory Framework

6.5.3.4. Target Disease Prevalence

6.5.3.5. Mexico Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.5.4. Argentina

6.5.4.1. Key Country Dynamics

6.5.4.2. Competitive Scenario

6.5.4.3. Regulatory Framework

6.5.4.4. Target Disease Prevalence

6.5.4.5. Argentina Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.6. MEA

6.6.1. MEA Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.6.2. South Africa

6.6.2.1. Key Country Dynamics

6.6.2.2. Competitive Scenario

6.6.2.3. Regulatory Framework

6.6.2.4. Target Disease Prevalence

6.6.2.5. South Africa Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.6.3. Saudi Arabia

6.6.3.1. Key Country Dynamics

6.6.3.2. Competitive Scenario

6.6.3.3. Regulatory Framework

6.6.3.4. Target Disease Prevalence

6.6.3.5. Saudi Arabia Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.6.4. UAE

6.6.4.1. Key Country Dynamics

6.6.4.2. Competitive Scenario

6.6.4.3. Regulatory Framework

6.6.4.4. Target Disease Prevalence

6.6.4.5. UAE Regenerative Medicine Market, 2018 - 2030 (USD Million)

6.6.5. Kuwait

6.6.5.1. Key Country Dynamics

6.6.5.2. Competitive Scenario

6.6.5.3. Regulatory Framework

6.6.5.4. Target Disease Prevalence

6.6.5.5. Kuwait Regenerative Medicine Market, 2018 - 2030 (USD Million)

Chapter 7. Competitive Landscape

7.1. Company Categorization

7.2. Strategy Mapping

7.3. Company Market/Position Share Analysis, 2022

7.4. Company Profiles/Listing

7.4.1. AstraZeneca plc.

7.4.1.1. Overview

7.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.1.3. Product Benchmarking

7.4.1.4. Strategic Initiatives

7.4.2. F. Hoffmann-La Roche Ltd.

7.4.2.1. Overview

7.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.2.3. Product Benchmarking

7.4.2.4. Strategic Initiatives

7.4.3. Integra Lifesciences Corp.

7.4.3.1. Overview

7.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.3.3. Product Benchmarking

7.4.3.4. Strategic Initiatives

7.4.4. Astellas Pharma, Inc.

7.4.4.1. Overview

7.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.4.3. Product Benchmarking

7.4.4.4. Strategic Initiatives

7.4.5. Cook Biotech, Inc.

7.4.5.1. Overview

7.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.5.3. Product Benchmarking

7.4.5.4. Strategic Initiatives

7.4.6. Bayer AG

7.4.6.1. Overview

7.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.6.3. Product Benchmarking

7.4.6.4. Strategic Initiatives

7.4.7. Pfizer, Inc.

7.4.7.1. Overview

7.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.7.3. Product Benchmarking

7.4.7.4. Strategic Initiatives

7.4.8. Merck KGaA

7.4.8.1. Overview

7.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.8.3. Product Benchmarking

7.4.8.4. Strategic Initiatives

7.4.9. Abbott

7.4.9.1. Overview

7.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.9.3. Product Benchmarking

7.4.9.4. Strategic Initiatives

7.4.10. Vericel Corp.

7.4.10.1. Overview

7.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.10.3. Product Benchmarking

7.4.10.4. Strategic Initiatives

7.4.11. Novartis AG

7.4.11.1. Overview

7.4.11.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.11.3. Product Benchmarking

7.4.11.4. Strategic Initiatives

7.4.12. GlaxoSmithKline

7.4.12.1. Overview

7.4.12.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

7.4.12.3. Product Benchmarking

7.4.12.4. Strategic Initiatives

List of Tables

Table 1 List Of Secondary Sources

Table 2 List Of Abbreviations

Table 3 Global Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 4 Global Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 5 North America Regenerative Medicine Market, by Country, 2018 - 2030 (USD Million)

Table 6 North America Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 7 North America Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 8 U.S. Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 9 U.S. Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 10 Canada Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 11 Canada Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 12 Europe Regenerative Medicine Market, by Country, 2018 - 2030 (USD Million)

Table 13 Europe Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 14 Europe Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 15 Germany Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 16 Germany Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 17 U.K. Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 18 U.K. Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 19 France Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 20 France Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 21 Italy Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 22 Italy Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 23 Spain Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 24 Spain Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 25 Denmark Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 26 Denmark Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 27 Norway Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 28 Norway Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 29 Sweden Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 30 Sweden Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 31 Asia Pacific Regenerative Medicine Market, by Country, 2018 - 2030 (USD Million)

Table 32 Asia Pacific Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 33 Asia Pacific Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 34 China Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 35 China Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 36 Japan Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 37 Japan Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 38 India Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 39 India Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 40 Australia Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 41 Australia Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 42 South Korea Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 43 South Korea Regenerative Medicine Market, by services, 2018 - 2030 (USD Million)

Table 44 Thailand Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 45 Thailand Regenerative Medicine Market, by services, 2018 - 2030 (USD Million)

Table 46 Latin America Regenerative Medicine Market, by Country, 2018 - 2030 (USD Million)

Table 47 Latin America Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 48 Latin America Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 49 Brazil Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 50 Brazil Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 51 Mexico Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 52 Mexico Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 53 Argentina Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 54 Argentina Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 55 Middle East & Africa Regenerative Medicine Market, by Country, 2018 - 2030 (USD Million)

Table 56 Middle East & Africa Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 57 Middle East & Africa Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 58 South Africa Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 59 South Africa Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 60 Saudi Arabia Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 61 Saudi Arabia Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 62 UAE Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 63 UAE Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 64 Kuwait Regenerative Medicine Market, by product, 2018 - 2030 (USD Million)

Table 65 Kuwait Regenerative Medicine Market, by therapeutic category, 2018 - 2030 (USD Million)

Table 66 Participant’s Overview

Table 67 Financial Performance

Table 68 Key Companies Undergoing Expansions

Table 69 Key Companies Undergoing Acquisitions

Table 70 Key Companies Undergoing Collaborations

Table 71 Key Companies Launching New Products/Services

Table 72 Key Companies Undergoing Partnerships

Table 73 Key Companies Undertaking Other Strategies

List of Figures

Fig. 1 Market Others process

Fig. 2 Data triangulation techniques

Fig. 3 Primary Others pattern

Fig. 4 Market Others approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Market summary, 2023 (USD Million)

Fig. 9 Market segmentation & scope

Fig. 10 Market driver impact

Fig. 11 Market restraint impact

Fig. 12 Penetration & growth prospect mapping

Fig. 13 Porter’s analysis

Fig. 14 SWOT analysis

Fig. 15 Global regenerative medicine therapeutics market, 2018 - 2030 (USD Million)

Fig. 16 Global primary cell-bases therapeutics market, 2018 - 2030 (USD Million)

Fig. 17 Global dermatology primary cell-bases therapeutics market, 2018 - 2030 (USD Million)

Fig. 18 Global musculoskeletal primary cell-bases therapeutics market, 2018 - 2030 (USD Million)

Fig. 19 Global surgical primary cell-bases therapeutics market, 2018 - 2030 (USD Million)

Fig. 20 Global dental primary cell-bases therapeutics market, 2018 - 2030 (USD Million)

Fig. 21 Global other primary cell-based therapeutics market, 2018 - 2030 (USD Million)

Fig. 22 Global autologous stem cell & progenitor cell-based therapeutics market, 2018 - 2030 (USD Million)

Fig. 23 Global autologous stem cell & progenitor cell-based therapeutics market, 2018 - 2030 (USD Million)

Fig. 24 Global allogeneic stem cell & progenitor cell-based therapeutics market, 2018 - 2030 (USD Million)

Fig. 25 Global other stem cell & progenitor cell-based therapeutics market, 2018 - 2030 (USD Million)

Fig. 26 Global cell-based immunotherapies market, 2018 - 2030 (USD Million)

Fig. 27 Global gene therapies market, 2018 - 2030 (USD Million)

Fig. 28 Global regenerative medicines tools, 2018 - 2030 (USD Million)

Fig. 29 Global banks market for regenerative medicine, 2018 - 2030 (USD Million)

Fig. 30 Global regenerative medicine services market, 2018 - 2030 (USD Million)

Fig. 31 Regenerative medicine market: Therapeutic category outlook and key takeaways

Fig. 32 Regenerative medicine market: Therapeutic category movement analysis (USD Million)

Fig. 33 Global dermatological therapeutics category market, 2018 - 2030 (USD Million)

Fig. 34 Global musculoskeletal therapeutics category market, 2018 - 2030 (USD Million)

Fig. 35 Global immunology & inflammation therapeutics category market, 2018 - 2030 (USD Million)

Fig. 36 Global oncology therapeutics category market, 2018 - 2030 (USD Million)

Fig. 37 Global cardiovascular therapeutics category market, 2018 - 2030 (USD Million)

Fig. 38 Global ophthalmology therapeutics market, 2018 - 2030 (USD Million)

Fig. 39 Global other therapeutics category market, 2018 - 2030 (USD Million)

Fig. 40 Global Regenerative Medicine Market: Regional outlook and key takeaways

Fig. 41 North America Regenerative Medicine Market, 2018 - 2030 (USD million)

Fig. 42 U.S. key country dynamics

Fig. 43 U.S. Regenerative Medicine Market, 2018 - 2030 (USD million)

Fig. 44 Canada key country dynamics

Fig. 45 Canada Regenerative Medicine Market, 2018 - 2030 (USD million)

Fig. 46 Europe Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 47 Germany key country dynamics

Fig. 48 Germany Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 49 France key country dynamics

Fig. 50 France Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 51 U.K. key country dynamics

Fig. 52 U.K. Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 53 Italy key country dynamics

Fig. 54 Italy Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 55 Spain key country dynamics

Fig. 56 Spain Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 57 Denmark key country dynamics

Fig. 58 Denmark Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 59 Sweden key country dynamics

Fig. 60 Sweden Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 61 Norway key country dynamics

Fig. 62 Norway Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 63 Asia-Pacific Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 64 China key country dynamics

Fig. 65 China Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 66 India key country dynamics

Fig. 67 India Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 68 South Korea key country dynamics

Fig. 69 South Korea Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 70 Japan key country dynamics

Fig. 71 Japan Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 72 Australia key country dynamics

Fig. 73 Australia Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 74 Thailand key country dynamics

Fig. 75 Thailand Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 76 Latin America Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 77 Brazil key country dynamics

Fig. 78 Brazil Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 79 Mexico key country dynamics

Fig. 80 Mexico Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 81 Argentina key country dynamics

Fig. 82 Argentina Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 83 MEA Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 84 South Africa key country dynamics

Fig. 85 South Africa Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 86 Saudi Arabia key country dynamics

Fig. 87 Saudi Arabia Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 88 UAE key country dynamics

Fig. 89 UAE Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 90 Kuwait key country dynamics

Fig. 91 Kuwait Regenerative Medicine Market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 92 Market participant categorization

Fig. 93 Regenerative Medicine Market share analysis, 2023

Fig. 94 Strategy frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Regenerative Medicine Product Outlook (Revenue, USD Million, 2018 - 2030)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Regenerative Medicine Therapeutic Category Outlook (Revenue, USD Million, 2018 - 2030 )

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Regenerative Medicine Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- North America Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- U.S.

- U.S. Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- U.S. Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- U.S. Regenerative Medicine Market, By Product (USD Million)

- Canada

- Canada Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Canada Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Canada Regenerative Medicine Market, By Product (USD Million)

- North America Regenerative Medicine Market, By Product (USD Million)

- Europe

- Europe Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Europe Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- UK

- UK Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- UK Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- UK Regenerative Medicine Market, By Product (USD Million)

- Germany

- Germany Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Germany Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Germany Regenerative Medicine Market, By Product (USD Million)

- France

- France Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- France Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- France Regenerative Medicine Market, By Product (USD Million)

- Italy

- Italy Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Italy Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Italy Regenerative Medicine Market, By Product (USD Million)

- Spain

- Spain Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Spain Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Spain Regenerative Medicine Market, By Product (USD Million)

- Denmark

- Denmark Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Denmark Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Denmark Regenerative Medicine Market, By Product (USD Million)

- Norway

- Norway Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Norway Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Norway Regenerative Medicine Market, By Product (USD Million)

- Sweden

- Sweden Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Sweden Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Sweden Regenerative Medicine Market, By Product (USD Million)

- Europe Regenerative Medicine Market, By Product (USD Million)

- Asia Pacific

- Asia Pacific Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Asia Pacific Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Japan

- Japan Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Japan Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Japan Regenerative Medicine Market, By Product (USD Million)

- China

- China Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- China Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- China Regenerative Medicine Market, By Product (USD Million)

- India

- India Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- India Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- India Regenerative Medicine Market, By Product (USD Million)

- South Korea

- South Korea Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- South Korea Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- South Korea Regenerative Medicine Market, By Product (USD Million)

- Thailand

- Thailand Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Thailand Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Thailand Regenerative Medicine Market, By Product (USD Million)

- Asia Pacific Regenerative Medicine Market, By Product (USD Million)

- Latin America

- Latin America Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Latin America Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Brazil

- Brazil Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Brazil Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Brazil Regenerative Medicine Market, By Product (USD Million)

- Mexico

- Mexico Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Mexico Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Mexico Regenerative Medicine Market, By Product (USD Million)

- Argentina

- Argentina Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Argentina Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Argentina Regenerative Medicine Market, By Product (USD Million)

- Latin America Regenerative Medicine Market, By Product (USD Million)

- MEA

- MEA Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- MEA Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- South Africa

- South Africa Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- South Africa Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- South Africa Regenerative Medicine Market, By Product (USD Million)

- Saudi Arabia

- Saudi Arabia Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Saudi Arabia Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Saudi Arabia Regenerative Medicine Market, By Product (USD Million)

- UAE

- UAE Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- UAE Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- UAE Regenerative Medicine Market, By Product (USD Million)

- Kuwait

- Kuwait Regenerative Medicine Market, By Product (USD Million)

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary cell-based therapeutics

- Tools

- Banks

- Services

- Therapeutics

- Kuwait Regenerative Medicine Market, By Therapeutic Category (USD Million)

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

- Kuwait Regenerative Medicine Market, By Product (USD Million)

- MEA Regenerative Medicine Market, By Product (USD Million)

- North America

Regenerative Medicine Market Dynamics

Drivers: Presence Of A Strong Pipeline And Increasing Number Of Clinical Trials

A robust investigational pipeline is a significant investment in the high potential of new products in the future. In addition, the presence of a strong pipeline is one of the major drivers in the regenerative medicine market. Companies invest heavily in research & development to upgrade their products with the latest technology and fulfill the unmet needs of patients. A strong pipeline expands the growth potential of the company. Due to easy access to data through genomic, proteomic, and Electronic Health Record (EHR) databases, numerous companies are investigating various cell-based therapies to aid in the treatment of previously untreatable conditions. Furthermore, the growing demand for robust therapies to address the rising cancer prevalence is contributing to growth in clinical trial numbers. In 2022, the maximum percent of all clinical trials, as shown in the below figure, were based in oncology, particularly in leukemia, lymphoma, and cancers of the breast, cervix, bladder, colon, esophagus, ovaries, brain, pancreas, and others. Around 700 companies are currently working on developing cell-based therapies for various diseases. This is anticipated to increase the competition among companies to create a specific and efficient pipeline.

High Economic Impact Of Regenerative Medicine

The growing burden of chronic diseases is significantly increasing healthcare expenditure across the globe. About 25% of the total healthcare expenditure is generated from around 1% of the diseases. Demographic trends, such as the rising geriatric population, are expected to double over the coming two decades. These trends are projected to have a major impact on healthcare expenses. For instance, in the U.S., the population aged over 65 years is expected to rise by 8% from 2010 to 2030. This unprecedented demographic shift is expected to increase the pressure on the healthcare system. One of the approaches to reduce the pressure on the healthcare system is developing an effective alternative treatment for diseases that cost the most. These include stroke & cardiovascular diseases, neurodegenerative disorders, and diabetes. Furthermore, regenerative medicines have been identified to have the unique ability to alter the fundamental mechanisms of diseases. Regenerative therapies in trials provide promising solutions for specific chronic indications with unmet medical needs. These solutions involve using different products and approaches, including tissue-engineered products, gene therapy, biologics, small molecules, allogeneic & autologous stem cells, and combinational products that show promising therapeutic applications. Combined efforts from government, biotechnology & pharmaceutical companies, private investors, and healthcare providers are anticipated to impact market growth significantly.

Restraints: High Treatment Costs

Regenerative medicines are often highly personalized, which makes it difficult to manufacture and evaluate their safety, cost-effectiveness, & efficacy. Hence, the cost of treatment increases, restraining market growth. Furthermore, stringent regulations and high operational costs are raising entry barriers for this market. As manufacturing costs increase, the cost of these novel therapies and medicines surges. In addition, the time required for developing therapeutics based on regenerative medicines is more than conventional medicines. Consequently, the cost incurred in developing products in both generations is anticipated to increase the treatment cost. In addition, according to DVC stem, the average stem cell therapy cost can range between USD 5000 and USD 50,000. Similarly, several newly launched gene therapies can incur significant treatment costs for the patients. For instance, Luxturna launched with a cost of USD 425,000 per eye, and Zolgensma launched with a price of USD 2.12 million. Hence, the high cost of the therapies might restrict market growth.

What Does This Report Include?

This section will provide insights into the contents included in this regenerative medicine market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Regenerative medicine market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Regenerative medicine market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the regenerative medicine market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for regenerative medicine market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of regenerative medicine market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-