- Home

- »

- Medical Devices

- »

-

Regulatory Affairs Market Size, Share & Growth Report, 2030GVR Report cover

![Regulatory Affairs Market Size, Share & Trends Report]()

Regulatory Affairs Market Size, Share & Trends Analysis Report By Services, By Categories, By Service Provider, By Company Size, By Product Stage, By Indication, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-065-9

- Number of Report Pages: 175

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Regulatory Affairs Market Size & Trends

The global regulatory affairs market size was valued at USD 13.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.7% over the forecast period. The main drivers of this market are growth in emerging fields, such as orphan drugs, immunotherapies, personalized medicines, specialty therapies, and combination therapies, changes in regulatory requirements, and a rise in the prevalence of new diseases that require effective vaccines and therapies, which necessitate regulatory guidelines to maintain safety, quality, and effectiveness. Moreover, an increasing number of players focusing on inorganic growth strategies such as mergers, partnerships, acquisitions, etc., are further anticipated to boost the growth of the regulatory affairs market. For instance, in January 2023, AmerisourceBergen Corporation announced the completion of its acquisition of PharmaLex GmbH. PharmaLex’s portfolio services, such as regulatory affairs, scientific affairs and development consulting, quality management, pharmacovigilance, and compliance services, helped AmerisourceBergen Corporation to expand its services across the biopharmaceutical and pharmaceutical regulatory affairs field.

The demand for drugs related to COVID-19 was high during the pandemic, and that boosted the clinical development process and, in turn, increased the regulatory process for creating an effective and safe environment for the clinical trial process to proceed. The regulatory authorities have demonstrated flexibility in the development of COVID-19 products while maintaining high levels of effectiveness, quality, and tolerability. Furthermore, several regulatory authorities released guidelines related to the pandemic and released emergency use authorization for several products that are used against the coronavirus.

The globalization of biopharmaceuticals and medical device companies is likely to be one of the major market drivers. The emerging markets from the Asia Pacific, Latin America, and MIDDLE EAST & AFRICA offer low product development & manufacturing costs, tax benefits, and the availability of skilled labor at relatively low costs with supportive regulations.

The abovementioned factors have made the regional markets attractive prospects in terms of outsourcing and expansion for biopharmaceutical & medical device companies, thus, stimulating the demand for regulatory services. The healthcare industry is not only focusing on the development of new therapies for the treatment of different diseases, but they are also shifting its focus on target gene therapy, precision medicine, and specialty drugs that are used to treat one or a specific kind of disorder and disease. Furthermore, medical devices are combined with some of these products to enhance the quality of drug dose, delivery, and patient monitoring, thus complicating the regulatory strategy and pathway to market it.

Services Insights

Based on services, the regulatory writing & publishing segment dominated the market and accounted for the largest revenue share of 36.6% in 2022. The global market for regulatory affairs can be categorized into regulatory consulting, legal representation, regulatory writing & publishing, product registration & clinical trial applications, and other services. The main drivers of the regulatory writing & publishing segment are increased outsourcing of these services by large- and mid-size biopharmaceutical and medical device companies. Big pharma and medical device companies outsource part of regulatory affairs functions such as regulatory writing and publishing service, which helps them to focus on their core competencies and efficiently manage their internal resources. Big biopharmaceutical and medical device companies with established regulatory affairs departments are expected to generate high demand for regulatory writing & publishing services during the analysis timeframe.

The legal representation segment is expected to rise with the fastest CAGR of 9.5% during the forecast period. This is due to the increase in the complexity of regulations in healthcare and the increase in healthcare reforms, especially in emerging regions like the Asia Pacific and MIDDLE EAST & AFRICA. For instance, clinical trials in Europe cannot be conducted by sponsors who do not have their registered entity in the European Union, and there is a mandatory requirement of legal representation provided by companies based in Europe to conduct clinical trials in any of the European Union member states. However, several large-sized companies are focusing on extending their services across foreign geographies, which will significantly enhance their regional hold as well as increase their market share. For instance, in February 2023, Freyr announced a new device contract with Avicenna.AI, an artificial intelligence-based medical device company in France. Under the agreement clause, Freyr will provide product registration and legal representation services to Avicenna.AI in the Argentina market.

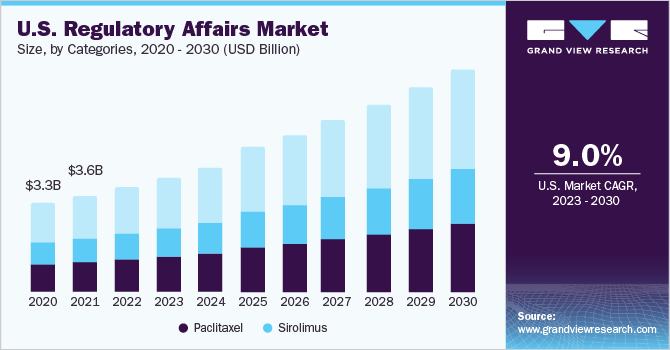

Categories Insights

Based on Categories, the medical device segment dominated the global market and accounted for the maximum share of 40.4% of the overall revenue in 2022. The segment can be broadly categorized into drugs, biologics, and medical devices. High shares of the medical device segment can be attributed to the increasing outsourcing activities of medical devices by pharmaceutical companies so they can focus on their core competencies. Increasing demand for wearable medical devices, rapid advancements in material sciences, and complexities of drug-device combinations are among factors anticipated to propel the growth of this segment.

The biologics segment is anticipated to witness a stable growth rate of 8.0% during the analysis timeframe. In the biotechnology industry, the product manufacturing process is very critical, as even a slight change in environmental conditions can adversely alter the structure and cells of a biological product. Furthermore, the manufacturing process, facility, and equipment are designed to prevent microbial contamination throughout the process, as a contaminated product can be potentially life-threatening for patients. Thus, the systems used throughout the process guarantee a safe & sterile product. The requirement for maintaining a zero-error margin in the biotechnology process is anticipated to fuel the need for regulatory affairs services. Hence, increasing approvals of biologics is one of the major factors supporting the sound growth of the segment in the regulatory affairs market. For instance, as per the National Library of Medicine, fifteen biologics have been approved in 2022, of which one is an antibody-drug conjugate (ADC), nine are monoclonal antibodies (mAbs), and five are proteins.

Product Stage Insight

The clinical studies product stage segment dominated the global market in 2022 and accounted for the maximum revenue share of 46.6% of the global revenue. The emergence of new diseases and the rising prevalence of chronic diseases are the key factors that are anticipated to increase the number of clinical trials conducted to meet healthcare needs. These regulations make sure that the clinical studies are carried out transparently and guided so that the trials are authentic and are adequately exposed to humans, and show credible data.

The preclinical product stage segment is expected to register the fastest growth rate of 9.4% during the forecast period. The fastest growth of this segment can be attributed to the increasing demand for novel disease treatments, such as COVID-19, Zika virus, and Ebola, as well as the increasing prevalence of various existing diseases, such as Cardiovascular Diseases (CVDs), cancer, and neurological diseases.

Company Size Insight

Based on company size, the global market has been further sub-categorized into small-sized, medium-sized, and large-sized companies. The medium-sized companies segment dominated the global market in 2022 and accounted for the largest share of more than 47.0% of the overall revenue in the same year. The presence of various mid-sized established providers, particularly privately held ones, is expected to contribute to this segment’s growth. These companies have a strong presence in multiple or selected markets around the world and provide various services, from a few to full-length.

The large-scale service providers segment is anticipated to witness a lucrative CAGR of 9.1% during the forecast timeframe. Large-scale service providers are popular among the leading pharma, biotechnology, and medical device firms. The presence of a broad range of services and the availability of these providers in various geographies can enable ease of business and thus act as the primary factor contributing to their popularity, especially among larger companies. Furthermore, large pharma companies generally prefer to have a long-term collaboration with their service providers to avoid sudden disturbances in their operations and, thus, prefer a service provider that can meet their regulatory needs to support their various ramp-up and cross-scale operations.

Indication Insight

The oncology segment accounted for the maximum revenue share of 32.9% in 2022. This can be attributed to the high prevalence of cancer, prompting a need for safe and effective treatment options. Furthermore, oncology is one of the most profitable markets for pharmaceutical & biotechnology companies, thereby increasing the R&D projects undertaken by these players. For instance, Merck is focused on improving and expanding its oncology segment. This is reflected in its clinical development initiative involving 700 clinical trials for Keytruda as monotherapy and more than 400 trials with various Keytruda combinations. Hence, growth in anti-cancer therapeutics has simultaneously boosted demand for its quality regulatory services, thus supporting the segment’s growth.

The immunology segment is expected to register the fastest CAGR of 10.3% during the forecast period. The segment's high growth is attributed to its potential to facilitate the treatment of various cardiovascular, neurological, oncological, and inflammatory diseases. This can be attributed to the presence of immune cells throughout the body, as well as the presence of tissue-specific immune cells in organs. The robust immunology pipeline of pharmaceutical and biopharmaceutical companies is anticipated to boost segment growth further. For instance, as of 2022, Novartis had nearly 33 drugs in the pipeline for treating immunological conditions. The high number of drugs in the pipeline for immunological drugs is expected to support the demand for regulatory services in the forecast.

Service Provider Insight

The in-house segment accounted for a revenue share of 42.8% in 2022. In-house regulatory affairs function has declined in the past few years and is anticipated to continue declining over the forecast period. Key reasons for the decline include increasing number of small- and medium-scale pharma/biotech/medical device companies, which lack funds and infrastructure to support an in-house regulatory affairs department. Furthermore, these firms find it difficult to hire experienced and technically sound full-time employees as they are emerging companies and have budget constraints. Hence, in-house regulatory affairs department is not preferred by small-scale companies, and they outsource nearly 90% of their regulatory solutions.

The outsourcing segment is expected to register the fastest CAGR of 10.3% during the forecast period. This can be attributed to increasing popularity of these services as outsourcing enables healthcare companies to reduce costs, prioritize strategic projects, reduce staff training time, and improve overall efficiency as well as provides greater flexibility. Availability of various outsourcing models suitable for different company sizes is also anticipated to boost the outsourcing market. For instance, Functional Service Provider (FSP) model is suitable for large biotechnology & pharmaceutical companies, while the hybrid model is generally suitable for medium-sized companies and end-to-end service model is suitable for small-sized companies. The different models carter to customized needs of the clients, thereby boosting the adoption of outsourcing by pharmaceutical and biotechnology firms.

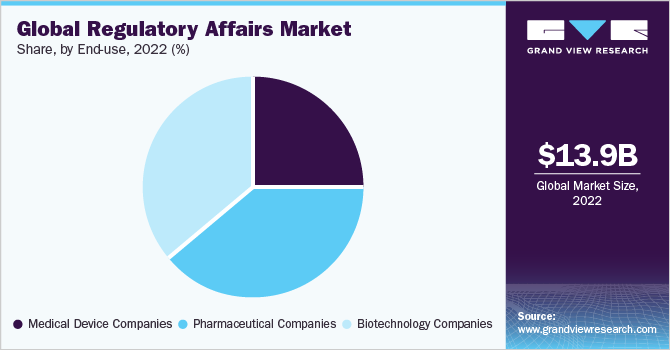

End-use Insight

The pharmaceutical companies segment dominated the market in 2022 and accounted for the maximum share of more than 38.7% of the global revenue. Based on end-uses, the global market for regulatory affairs has been further subdivided into medical device companies, biotechnology companies, and pharmaceutical companies. The pharmaceutical companies segment is also projected to register the fastest growth rate from 2023 to 2030. High growth can be attributed to the increase in the number of approved pharmaceutical products. For instance, as per the U.S. Food and Drug Administration, the year 2021 witnessed the launch of 50 novel drugs. Thus, a rise in the commercialization of new drugs in the U.S. is anticipated to increase the demand for product approval, registration, licensing, and related regulatory services.

Biotechnology companies are estimated to be the second-fastest-growing end-use segment during the forecast period witnessing a stable CAGR of 8.6% from 2023 to 2030. This is due to the high demand for biologics, the rise in investment in manufacturing of biologics, and improvements in infrastructure, which are anticipated to boost the demand for regulatory services, such as audit & validation, quality & assurance, GMP practices, BLA filings, and patent filings.

Regional Insight

The Asia Pacific dominated the market & accounted for the largest revenue share of more than 37.5% in 2022. The region is anticipated to expand further at the fastest CAGR from 2023 to 2030 owing to the improved regulatory landscape, cost savings, growing number of clinical trials conducted in the region, and an increasing number of biopharmaceutical companies venturing into the region. Furthermore, the availability of a skilled workforce within the region at a lower cost compared to the U.S. is another factor expected to propel market growth. Rising demand for biosimilars and medical devices is also expected to contribute to the growth of the biopharmaceutical and medical devices market within the region. For instance, Biocon, a reputed firm based in India in the field of biopharmaceuticals, is working on the development of various novel treatments, which are expected to be launched in the market over the forecast period, thereby raising the demand for regulatory assistance.

North America is projected to witness a considerable CAGR of 8.8% from 2023 to 2030. This region has the most outstanding regulatory system in the world. The main driving factors for this market are a rise in biologics approvals; an increase in outsourcing of regulatory affairs services by large biopharmaceuticals; and growing R&D expenditure. North America is known to have one of the most stringent regulatory systems in the world. There has been a tremendous increase in the approval of biologics, which accounted for 39.0% of total new drug approvals in 2021, and this indicates the growing pipeline of biotechnology products. Stringent regulatory processes and growing R&D expenditure in North America are anticipated to increase the demand for outsourcing regulatory affairs services by large biopharmaceuticals.

Key Companies & Market Share Insights

The market is highly competitive, marked by the presence of a large number of domestic as well as international players. Companies are engaging in product launches, mergers & acquisitions, collaborations, and expansion of geographic presence to strengthen their market position. For instance, in February 2020, ICON plc acquired MedPass. The main aim of this acquisition is to strengthen ICON’s diagnostic research and medical device services through the addition of new clinical and regulatory capabilities in Europe. Some prominent players in the global regulatory affairs market include:

-

Accell Clinical Research, LLC

-

Genpact

-

Criterium, Inc.

-

ICON plc

-

Promedica International

-

WuXi AppTec

-

Medpace

-

Charles River Laboratories.

-

Labcorp Drug Development

-

Parexel International Corporation

-

Freyr

-

Pharmalex GmbH

-

NDA Group AB

-

Pharmexon

-

Qvigilance

-

BlueReg

-

Cambridge Regulatory Services

-

VCLS

Regulatory Affairs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.1 billion

Revenue Forecast in 2030

USD 27.0 billion

Growth rate

CAGR of 8.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Services, categories, indication, stage, service provider, company size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Turkey; The Netherlands; Switzerland; Sweden; India; Japan; China; Australia; South Korea; Indonesia; Malaysia; Singapore; Thailand; Taiwan Brazil; Mexico; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Egypt; Israel

Key companies profiled

Accell Clinical Research, LLC; Genpact; Criterium, Inc.; ICON plc; Promedica International; WuXi AppTec; Medpace; Charles River Laboratories.; Labcorp Drug Development; Parexel International Corporation; Freyr; Pharmalex GmbH; NDA Group AB; Pharmexon; Qvigilance; BlueReg; Cambridge Regulatory Services; VCLS

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Regulatory Affairs Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global regulatory affairs market report on the basis of services, categories, indication, stage, service provider, company size, end-use, and region.

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Writing

-

Publishing

-

-

Product Registration & Clinical Trial Applications

-

Other Services

-

-

Categories Outlook (Revenue, USD Million, 2018 - 2030)

-

Drugs

-

Innovator

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

Generics

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

-

Biologics

-

Biotech

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

ATMP

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

Biosimilars

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

Medical Devices

-

Diagnostics

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

Therapeutics

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Others

-

-

Product Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical studies

-

PMA

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Company Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Pharmaceutical Companies

-

Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Turkey

-

The Netherlands

-

Switzerland

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Malaysia

-

Singapore

-

Thailand

-

Taiwan

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global regulatory affairs market size was estimated at USD 13.9 billion in 2022 and is expected to reach USD 15.1 billion in 2023.

b. The global regulatory affairs market is expected to grow at a compound annual growth rate of 8.7% from 2023 to 2030 to reach USD 27.0 billion by 2030.

b. The Asia Pacific dominated the regulatory affairs market with a share of 37.5% in 2022. This is attributable to a relatively lower cost for outsourcing, a skilled workforce with technical expertise, and expansion of life sciences companies in countries such as India & China.

b. Some of the players operating in the regulatory affairs market are Accell Clinical Research, LLC.; GenPact Ltd.; Criterium, Inc.; PRA Health Sciences; Promedica International; WuXi AppTec, Inc., and Freyr.

b. The entry of life sciences companies in the global regulatory affairs market and the evolution of new areas such as orphan drugs, biosimilars, ATMP’s and personalized medicine are relatively new factors expected to contribute to the market growth, as new areas would require advanced technical expertise for compliance with regulatory requirements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."