- Home

- »

- Medical Devices

- »

-

Regulatory Affairs Outsourcing Market Size Report, 2030GVR Report cover

![Regulatory Affairs Outsourcing Market Size, Share & Trends Report]()

Regulatory Affairs Outsourcing Market (2024 - 2030) Size, Share & Trends Analysis Report By Services, By Category (Pharmaceuticals, Medical Devices), By Company Size, By Indication, By Product Stage, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-556-4

- Number of Report Pages: 275

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Regulatory Affairs Outsourcing Market Summary

The global regulatory affairs outsourcing market size was estimated at USD 6.6 billion in 2023 and is projected to reach USD 11.31 billion by 2030, growing at a CAGR of 8.3% from 2024 to 2030. Outsourcing regulatory affairs has become an increasingly important practice in the healthcare industry.

Key Market Trends & Insights

- The Asia Pacific dominated the market and accounted for the largest revenue share of more than 39.9% in 2023.

- The U.S. accounts for a major share of clinical trial applications across the globe.

- By product stage, the clinical studies segment dominated the market and accounted for the largest revenue share of 46.8% in 2023.

- By company sizes, the medium-sized companies segment accounted for 46.7% of the revenue share in 2023.

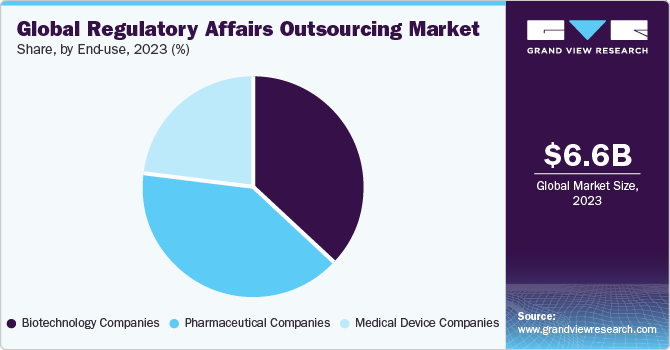

- By end use, the pharmaceutical companies segment dominated the market and accounted for the largest share of more than 40.3% in 2023.

- By category, drugs segment dominated the market and accounted for the largest share of 39.7% in 2023.

- By indication, the oncology segment dominated the market and accounted for the largest share of more than 33.3% in 2023.

- By service, the product registration and clinical trial applications segment dominated the market and accounted for the largest revenue share of over 26.0% of the global revenue.

Market Size & Forecast

- 2023 Market Size: USD 6.6 Billion

- 2030 Projected Market Size: USD 11.31 Billion

- CAGR (2024-2030): 8.3%

- Asia Pacific: Largest market in 2023

An increase in geographical expansion activities by companies that aim for speedy approvals in local markets is expected to contribute to the adoption of outsourcing models for regulatory services. The outsourcing market for regulatory affairs is expanding rapidly due to increased R&D activities, rising preference for personalized medicine and biologics augmenting the volume of clinical trial applications and product registrations.Further, healthcare companies are under constant pressure to procure timely clinical approvals from regulators in different nations. Such actions further promote the demand for regulatory affairs services, thus contributing to market growth. Also, increasing demand to obtain approval for new products while maintaining compliance, driving market progression. According to a survey sponsored by Genpact, 72.0% of executives from the life sciences industry consider regulatory compliance as one of the top three challenges life sciences companies face. Regulatory departments often face the burden of handling multiple tasks simultaneously and must ensure compliance with stringent regulatory standards. An increase in efforts by companies to expand their geographical reach and gain rapid approvals in global markets is expected to further contribute to the adoption of outsourcing models for regulatory services. High pressure on life sciences companies to reduce development costs further propels market growth opportunities. Growing usage of generics and demand for drugs & medical devices at affordable prices is expected to reduce healthcare costs, thereby boosting preference for regulatory affairs outsourcing.

Rising out-of-pocket expenditure among developed and developing countries, uneven economic growth, and measures taken by several governments to reduce the cost of drugs are a few factors contributing to the economic and competitive pressure, which, in turn, is expected to drive the demand for regulatory affairs outsourcing among life science companies. Product-specific clinical advice & strategy and regulatory compliance at the early stages of product development can be critical to product approval. Failure to address regulatory compliance in the early development stages often leads to delays in the approval process owing to inappropriately designed studies, manufacturing oversights, omitted studies, and other failures to meet the regulatory requirements.

Globalization of biopharmaceuticals and medical device companies is likely to be one of the major market drivers. Emerging markets from Asia Pacific, Latin America, and MEA regions offer low product development & manufacturing costs, tax benefits, and availability of skilled labor at relatively low costs with supportive regulations. The abovementioned factors have made the regional markets attractive prospects in terms of outsourcing and expansion for biopharmaceutical & medical device companies, thus stimulating the demand for regulatory services. Further, rising adoption of decentralized clinical trials, fast track approvals, and global harmonization in new product development are few other factors bolstering overall market demand.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of market growth is accelerating. The regulatory affairs outsourcing market is characterized by a high degree of innovation, level of merger and acquisition strategies, impact of regulations, service expansion and regional expansion of market participants. Continuous advancements or upgradation in regulatory guidelines for better safety and efficacy, accelerating market demand.

Degree of Innovation

- The global regulatory affairs outsourcing market is characterized by a high degree of innovation. Growing integration of several advanced technologies such as Artificial Intelligence (AI), machine learning, Internet of Things (IoT), big data and analytics for regulatory affairs is likely to enhance overall market growth potential.

Level of M&A activities

- The level of M&A activities is expected to be at moderate level. Several market players, such as ICON Plc., Pharmalex GmbH, VCLS and IQVIA Inc., are involved in several merger and acquisition activities. M&A activities by major players aid in expanding their geographic reach and strengthening their market position.

Impact of Regulations

- The impact of Regulations is expected to be significant due to highly stringent regulatory compliance requirements. Rigorous regulatory standards are established to ensure that drugs and therapies undergoing testing are safe and effective. Changing regulatory guidelines for pharmaceutical and medical device products in different countries will boost market growth.

Service Expansion

- The key companies are implementing diverse strategic initiatives such as new service launches, expansions and partnerships to expand their service portfolio and gain a strong market foothold. Strong presence of skilled professionals to cater a wide range of services for precise outcomes and approvals is a key factor driving market demand.

Regional Expansion

- Growing initiatives by key market participants such as new facility expansions, partnership with local players to broaden their footprints in the emerging market. Rising need for regulatory compliance services and growing clinical trial services in the emerging regions such as Latin America and MEA offer expansion opportunities to the market players.

Service Insights

On the basis of service, the market is categorized into regulatory consulting, legal representation, regulatory writing & publishing, product registration & clinical trial applications, regulatory submissions, regulatory operations, and others. The product registration and clinical trial applications segment dominated the market and accounted for the largest revenue share of over 26.0% of the global revenue. The increasing number of clinical trials across the globe, stringent regulations in developed markets, and legal/regulatory reforms in emerging markets such as Asia Pacific are driving the outsourcing trend for clinical trial applications.

The legal representation services segment is anticipated to witness the fastest growth rate of 9.0% over the forecast period. The segment growth is owing to increasing demand for legal representatives worldwide on account of the globalization of medical devices and pharmaceutical companies. The regulations are very complex and ever-changing. The changing regulatory landscape in regions such as Asia Pacific, MEA, and Latin America increases the demand for local experts for legal representation for obtaining regulatory approvals and custom clearance. These factors are promoting the demand for legal representation services across the world.

Company Size Insights

On the basis of company sizes, the market has been divided into small, medium, and large. The medium-sized companies segment accounted for 46.7% of the revenue share in 2023 and is estimated to expand further, retaining the leading position over the forecast period. The presence of several mid-sized established providers, especially privately-held ones, is anticipated to contribute to this segment share. Moreover, medium-sized pharmaceutical and medical device companies do not have enough capital to develop an in-house regulatory affairs team, which is further driving the demand for regulatory affairs outsourcing among these companies.

The large companies’ segment is projected to register a significant growth rate of 7.7% over the forecast period. Large companies generally prefer to establish long-term relations with their service providers to avoid sudden disruption in their operations and thus, prefer a service provider that can meet their regulatory needs to support their various cross-scale and ramp-up operations. Apart from this, according to an article published by GEP (2020), large-scale pharma companies generally outsource about 50% of their regulatory affairs needs. These factors are contributing to the growth of this segment.

Category Insights

The category segment is subdivided into drugs, biologics, and medical devices. Drugs segment dominated the market and accounted for the largest share of 39.7% in 2023. The segment is currently leading the regulatory affairs outsourcing market due to the increasing demand for regulatory support services in the pharmaceutical industry. With the growing number of new drug applications and the increasing complexity of regulatory requirements, pharmaceutical companies are increasingly outsourcing their regulatory affairs functions to specialized service providers. Outsourcing enables these companies to access the expertise of regulatory professionals and reduce costs associated with maintaining an in-house regulatory affairs team. Additionally, the pharmaceutical segment is also witnessing growth due to the increasing focus on drug safety, efficacy, and quality, which requires extensive regulatory support.

However, the medical device segment is projected to register a considerable CAGR of 7.9% over the forecast period, which can be attributed to the fact that medical devices companies are now focusing on their core competencies and outsourcing noncore functions to increase their productivity and operational efficiency. The growing demand for advanced medical devices and new technological advancements in medical devices are further contributing to the growth of the segment.

Indication Insights

The oncology segment dominated the market and accounted for the largest share of more than 33.3% in 2023. The recent advances in the biology of cancer and the emergence of new tools for genome analysis have opened a clinical perspective in oncology, which has led to the development of personalized medicines. Scientific progress is driving an increase in the number of personalized medicine products and services, subject to regulatory review, hence contributing to market growth. Other indications included in the scope of the study are neurology, cardiology, immunology, and others.

The immunology segment is expected to expand at the fastest CAGR of 9.8% over the forecast period. This is owing to its potential in facilitating the treatment of various cardiovascular, neurological, oncological, and inflammatory diseases. The strategic initiatives undertaken by market players for immunology are anticipated to facilitate segment growth. For instance, in September 2021, Boehringer Ingelheim acquired Abexxa Biologics. This has broadened company’s cancer immunology and immunotherapeutics portfolio market. In addition, the COVID-19 pandemic created an urgent need for vaccines. Thus, the development of vaccines for COVID-19 is likely to have a positive impact on segment growth.

Product Stage Insights

The clinical studies segment dominated the market and accounted for the largest revenue share of 46.8% in 2023. This can be attributed to the increasing number of clinical trial registrations over the past few years. According to ClinicalTrials.gov, nearly 33,613 new trials were registered in 2023, as compared to around 32,540 in 2020. Moreover, this rise in the number of biologics, high demand for advanced technologies, and a requirement for personalized orphan drugs & medicines are other factors likely to fuel segment growth during the forecast period.

The preclinical segment is anticipated to expand at the fastest CAGR of 9.0% over the forecast period of 2024 - 2030. The rising demand for novel disease treatments, such as COVID-19, Zika virus, and Ebola, and the increasing prevalence of existing diseases, such as CVDs, cancer, and neurological diseases are the key factors contributing to the preclinical segment’s growth. Moreover, stringent regulations related to preclinical studies, laid down by global regulatory bodies, such as International Conference on Harmonization (ICH), WHO, FDA, EMEA (Europe), PMDA (Japan), ANVISA (Brazil), MHRA (UK), & ROEB (Canada), are further driving the demand for regulatory affairs outsourcing agencies for preclinical studies.

End-use Insights

The pharmaceutical companies segment dominated the market and accounted for the largest share of more than 40.3% in 2023. This segment growth is owing to the growth in evolving areas, such as biosimilar, orphan drugs, and personalized medicines, which are creating more demand for regulatory services, thereby boosting segment growth. In addition, the significant number of new drugs entering the pharmaceutical industry has further improved segment growth.

The medical device and biotechnology companies’ segments both have registered a substantial share in the market in 2023. This can be attributed to the increased demand for biopharmaceuticals, vaccines, advanced medical devices, and other products. The growing demand for wearable technologies, along with recent epidemic events, is further contributing to the substantial share of these segments. Furthermore, the increasing number of launches pertaining to medical devices is another significant factor boosting demand for regulatory affairs services, thus supporting segmental growth.

Regional Insights

The Asia Pacific region dominated the regulatory affairs outsourcing market and accounted for the largest revenue share of more than 39.9% in 2023. The region is also projected to witness the fastest CAGR over the forecast period. This can be attributed to the increasing number of clinical trials and the rising number of companies trying to enter markets in developing countries, such as India and China. Furthermore, the availability of a skilled workforce in the region at lower costs compared to the U.S. is another factor expected to propel the regional market growth.

China is one of the most attractive markets for the biopharmaceutical industry. Growing geriatric population and presence of a large population belonging to the middle-income group are further increasing the demand for innovative and cost-effective medicines, which is expected to attract major biopharmaceutical and medical devices companies in this region. Seeking approval for new drugs is a primary challenge faced by biopharmaceutical companies as a clinical trial application process requires 12 to 24 months while approval process may require more than six years. Along with national approvals, the new drug requires approval at both provincial and city levels, which may require additional 4 to 5 years. Reforms in the healthcare sector in recent times are expected to streamline the approval process. Further, recent pricing reforms are expected to attract multinational companies, contributing to the demand for regulatory services. For instance, in January 2023, GenScript, which provides contract services to help other companies develop and manufacture biologic drugs, secured USD 224 million in funding from investors. This new investment can help GenScript's subsidiary, ProBio, expand its production capacity for biologic drugs, which are made using living cells and are often used to treat complex diseases including cancer & autoimmune disorders. ProBio's expansion plans include building new manufacturing facilities in China and overseas. Such initiatives are expected to propel the demand for regulatory affairs services in China.

The North America regional market also reported a significant share in the global industry. The presence of key pharmaceutical and medical device companies and the rise in R&D spending in the region are some of the key factors driving the market in North America. North America and Europe are expected to be the key markets for regulatory affairs outsourcing, owing to the presence of two major international regulatory agencies, the European Medicines Agency (EMA) and the U.S. FDA, which regulate more than half of the medical devices worldwide.

The U.S. accounts for a major share of clinical trial applications across the globe. Along with branded and patented products, there is a strong demand for cost-effective generic and biosimilar products in this region. For instance, in January 2022, around 33 FDA-approved biosimilars were available in the U.S., 21 of which were commercially available in the market. Thus, increasing development and approval of novel biosimilars is expected to propel the demand for regulatory services in the U.S., driving the market.

Key Regulatory Affairs Outsourcing Company Insights

The major players operating across the regulatory affairs outsourcing market are focused on the adoption of several strategic initiatives such as mergers, partnerships, acquisitions, etc. Companies such as Labcorp Drug Development, Charles River Laboratories, ICON plc, Genpact, WuXi AppTec, and Parexel International Corporation hold a notable share of the market. This is owing to their comprehensive service portfolio covering a wide range of regulatory affairs outsourcing services. Moreover, these companies are continuously investing in cutting-edge technologies for regulatory affairs to offer more accurate and efficient services. This technological advantage helps attract clients and contribute to a larger market share. The multinational presence of these companies coupled with implementation of strategic initiatives such as partnerships, mergers & acquisitions contribute to the company’s market presence.

Key Regulatory Affairs Outsourcing Companies:

The following are the leading companies in the regulatory affairs outsourcing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these regulatory affairs outsourcing companies are analyzed to map the supply network.

- Accell Clinical Research, LLC

- Genpact

- CRITERIUM, INC

- Promedica International

- WuXi AppTec

- Medpace

- Charles River Laboratories

- ICON plc

- Labcorp Drug Development

- Parexel International Corporation

- Freyr

- PHARMALEX GMBH

- NDA Group AB

- Pharmexon

- Qvigilance

- BlueReg

- Cambridge Regulatory Services

- APCER Life Sciences, Inc.

- Real Regulatory Ltd

- VCLS

- PrimeVigilance

- ProPharma Group MIS Limited

- Regulatory Pharma Net srl

- ZEINCRO

- BioMapas

- REGENOLD GMBH

Recent Developments

-

In January 2023, AmerisourceBergen Corporation acquired PharmaLex Holding GmbH, a prominent service provider including regulatory affairs in the life sciences industry. This has broadened company’s service portfolio in a significant market.

-

In April 2022, VCLS collaborated with EC Innovations, a Chinese company that offers translation services globally and has vast experience translating highly regulated life sciences and medical content. The strategy helped to strengthen company’s offerings and operational capabilities.

Regulatory Affairs Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.03 billion

Revenue forecast in 2030

USD 11.31 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, company size, category, indication, product stage, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Turkey; Netherlands; Switzerland; Sweden; Europe CIS Countries; Japan; China; India; Australia; South Korea; Indonesia; Malaysia; Singapore; Thailand; Taiwan; CIS Countries; Brazil; Mexico; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Egypt; Israel; Kuwait

Key companies profiled

Accell Clinical Research; LLC; Genpact; CRITERIUM, INC; Promedica International; WuXi AppTec; Medpace; Charles River Laboratories; ICON plc; Covance, Inc. (Labcorp Drug Development); Parexel International Corporation; Freyr; PHARMALEX GMBH; NDA Group AB; Pharmexon; Qvigilance; BlueReg; Cambridge Regulatory Services; APCER Life Sciences, Inc.; Real Regulatory Ltd; VCLS; PrimeVigilance; ProPharma Group MIS Limited; Regulatory Pharma Net srl; ZEINCRO; BioMapas; Regenold GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Regulatory Affairs Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global regulatory affairs outsourcing market report based on services, company size, category, indication, stage, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Regulatory Consulting

-

Strategy & Development Planning

-

QA Consulting

-

Others

-

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submission

-

Regulatory Operations

-

Other Services

-

-

Company Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Regulatory Consulting

-

Strategy & Development Planning

-

QA consulting

-

Others

-

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

Medical Device

-

Regulatory Consulting

-

Strategy & Development Planning

-

QA Consulting

-

Others

-

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Others

-

-

Product Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical

-

PMA (Post Market Authorization)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Pharmaceutical Companies

-

Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Turkey

-

Netherlands

-

Switzerland

-

Sweden

-

Europe CIS Countries

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Malaysia

-

Singapore

-

Thailand

-

Taiwan

-

CIS Countries

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Israel

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global regulatory affairs outsourcing market size was estimated at USD 7.0 billion in 2022 and is expected to reach USD 7.5 billion in 2023.

b. The global regulatory affairs outsourcing market is expected to witness a compound annual growth rate of 8.0% from 2023 to 2030 to, reach USD 12.82 billion by 2030.

b. Product registration & clinical trial applications held the largest share of 25.9% in 2022. The increasing number of clinical trials across the globe, stringent regulations in developed markets, and legal/regulatory reforms in emerging markets such as Asia Pacific is driving the outsourcing trend for clinical trial applications.

b. Some of the players operating in the regulatory affairs outsourcing market are Accell Clinical Research, LLC.; Genpact Ltd.; Criterium, Inc.; PRA Health Sciences; Promedica International; WuXi AppTec, Inc.; Medpace; Pharmaceutical Product Development, LLC (PPD); Charles River Laboratories International, Inc.; ICON plc; Covance, Parexel International Corporation; Inc.; and Freyr.

b. Key factors that are driving the regulatory affairs outsourcing market growth include an increase in geographical expansion activities by companies, an increase in the R&D activities, and rising clinical trial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.