- Home

- »

- Medical Devices

- »

-

Regulatory Affairs Outsourcing Market Size Report, 2030GVR Report cover

![Regulatory Affairs Outsourcing Market Size, Share & Trends Report]()

Regulatory Affairs Outsourcing Market Size, Share & Trends Analysis Report By Services, By Category (Pharmaceuticals, Medical Devices), By Company Size, By Indication, By Product Stage, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-556-4

- Number of Report Pages: 275

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Regulatory Affairs Outsourcing Market Trends

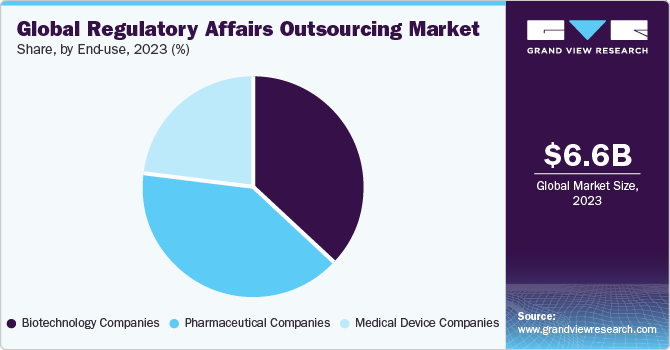

The global regulatory affairs outsourcing market size was accounted for USD 6.63 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030. Outsourcing regulatory affairs has become an increasingly important practice in the healthcare industry. An increase in geographical expansion activities by companies that aim for speedy approvals in local markets is expected to contribute to the adoption of outsourcing models for regulatory services. The outsourcing market for regulatory affairs is expanding rapidly due to increased R&D activities, rising preference for personalized medicine and biologics augmenting the volume of clinical trial applications and product registrations.

Further, healthcare companies are under constant pressure to procure timely clinical approvals from regulators in different nations. Such actions further promote the demand for regulatory affairs services, thus contributing to market growth. Also, increasing demand to obtain approval for new products while maintaining compliance, driving market progression. According to a survey sponsored by Genpact, 72.0% of executives from the life sciences industry consider regulatory compliance as one of the top three challenges life sciences companies face. Regulatory departments often face the burden of handling multiple tasks simultaneously and must ensure compliance with stringent regulatory standards. An increase in efforts by companies to expand their geographical reach and gain rapid approvals in global markets is expected to further contribute to the adoption of outsourcing models for regulatory services. High pressure on life sciences companies to reduce development costs further propels market growth opportunities. Growing usage of generics and demand for drugs & medical devices at affordable prices is expected to reduce healthcare costs, thereby boosting preference for regulatory affairs outsourcing.

Rising out-of-pocket expenditure among developed and developing countries, uneven economic growth, and measures taken by several governments to reduce the cost of drugs are a few factors contributing to the economic and competitive pressure, which, in turn, is expected to drive the demand for regulatory affairs outsourcing among life science companies. Product-specific clinical advice & strategy and regulatory compliance at the early stages of product development can be critical to product approval. Failure to address regulatory compliance in the early development stages often leads to delays in the approval process owing to inappropriately designed studies, manufacturing oversights, omitted studies, and other failures to meet the regulatory requirements.

Globalization of biopharmaceuticals and medical device companies is likely to be one of the major market drivers. Emerging markets from Asia Pacific, Latin America, and MEA regions offer low product development & manufacturing costs, tax benefits, and availability of skilled labor at relatively low costs with supportive regulations. The abovementioned factors have made the regional markets attractive prospects in terms of outsourcing and expansion for biopharmaceutical & medical device companies, thus stimulating the demand for regulatory services. Further, rising adoption of decentralized clinical trials, fast track approvals, and global harmonization in new product development are few other factors bolstering overall market demand.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of market growth is accelerating. The regulatory affairs outsourcing market is characterized by a high degree of innovation, level of merger and acquisition strategies, impact of regulations, service expansion and regional expansion of market participants. Continuous advancements or upgradation in regulatory guidelines for better safety and efficacy, accelerating market demand.

Degree of Innovation

- The global regulatory affairs outsourcing market is characterized by a high degree of innovation. Growing integration of several advanced technologies such as Artificial Intelligence (AI), machine learning, Internet of Things (IoT), big data and analytics for regulatory affairs is likely to enhance overall market growth potential.

Level of M&A activities

- The level of M&A activities is expected to be at moderate level. Several market players, such as ICON Plc., Pharmalex GmbH, VCLS and IQVIA Inc., are involved in several merger and acquisition activities. M&A activities by major players aid in expanding their geographic reach and strengthening their market position.

Impact of Regulations

- The impact of Regulations is expected to be significant due to highly stringent regulatory compliance requirements. Rigorous regulatory standards are established to ensure that drugs and therapies undergoing testing are safe and effective. Changing regulatory guidelines for pharmaceutical and medical device products in different countries will boost market growth.

Service Expansion

- The key companies are implementing diverse strategic initiatives such as new service launches, expansions and partnerships to expand their service portfolio and gain a strong market foothold. Strong presence of skilled professionals to cater a wide range of services for precise outcomes and approvals is a key factor driving market demand.

Regional Expansion

- Growing initiatives by key market participants such as new facility expansions, partnership with local players to broaden their footprints in the emerging market. Rising need for regulatory compliance services and growing clinical trial services in the emerging regions such as Latin America and MEA offer expansion opportunities to the market players.

Service Insights

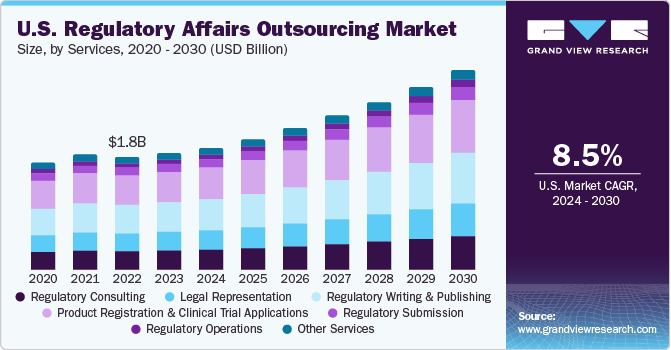

On the basis of service, the market is categorized into regulatory consulting, legal representation, regulatory writing & publishing, product registration & clinical trial applications, regulatory submissions, regulatory operations, and others. The product registration and clinical trial applications segment dominated the market and accounted for the largest revenue share of over 26.0% of the global revenue. The increasing number of clinical trials across the globe, stringent regulations in developed markets, and legal/regulatory reforms in emerging markets such as Asia Pacific are driving the outsourcing trend for clinical trial applications.

The legal representation services segment is anticipated to witness the fastest growth rate of 9.0% over the forecast period. The segment growth is owing to increasing demand for legal representatives worldwide on account of the globalization of medical devices and pharmaceutical companies. The regulations are very complex and ever-changing. The changing regulatory landscape in regions such as Asia Pacific, MEA, and Latin America increases the demand for local experts for legal representation for obtaining regulatory approvals and custom clearance. These factors are promoting the demand for legal representation services across the world.

Company Size Insights

On the basis of company sizes, the market has been divided into small, medium, and large. The medium-sized companies segment accounted for 46.7% of the revenue share in 2023 and is estimated to expand further, retaining the leading position over the forecast period. The presence of several mid-sized established providers, especially privately-held ones, is anticipated to contribute to this segment share. Moreover, medium-sized pharmaceutical and medical device companies do not have enough capital to develop an in-house regulatory affairs team, which is further driving the demand for regulatory affairs outsourcing among these companies.

The large companies’ segment is projected to register a significant growth rate of 7.7% over the forecast period. Large companies generally prefer to establish long-term relations with their service providers to avoid sudden disruption in their operations and thus, prefer a service provider that can meet their regulatory needs to support their various cross-scale and ramp-up operations. Apart from this, according to an article published by GEP (2020), large-scale pharma companies generally outsource about 50% of their regulatory affairs needs. These factors are contributing to the growth of this segment.

Category Insights

The category segment is subdivided into drugs, biologics, and medical devices. Drugs segment dominated the market and accounted for the largest share of 39.7% in 2023. The segment is currently leading the regulatory affairs outsourcing market due to the increasing demand for regulatory support services in the pharmaceutical industry. With the growing number of new drug applications and the increasing complexity of regulatory requirements, pharmaceutical companies are increasingly outsourcing their regulatory affairs functions to specialized service providers. Outsourcing enables these companies to access the expertise of regulatory professionals and reduce costs associated with maintaining an in-house regulatory affairs team. Additionally, the pharmaceutical segment is also witnessing growth due to the increasing focus on drug safety, efficacy, and quality, which requires extensive regulatory support.

However, the medical device segment is projected to register a considerable CAGR of 7.9% over the forecast period, which can be attributed to the fact that medical devices companies are now focusing on their core competencies and outsourcing noncore functions to increase their productivity and operational efficiency. The growing demand for advanced medical devices and new technological advancements in medical devices are further contributing to the growth of the segment.

Indication Insights

The oncology segment dominated the market and accounted for the largest share of more than 33.3% in 2023. The recent advances in the biology of cancer and the emergence of new tools for genome analysis have opened a clinical perspective in oncology, which has led to the development of personalized medicines. Scientific progress is driving an increase in the number of personalized medicine products and services, subject to regulatory review, hence contributing to market growth. Other indications included in the scope of the study are neurology, cardiology, immunology, and others.

The immunology segment is expected to expand at the fastest CAGR of 9.8% over the forecast period. This is owing to its potential in facilitating the treatment of various cardiovascular, neurological, oncological, and inflammatory diseases. The strategic initiatives undertaken by market players for immunology are anticipated to facilitate segment growth. For instance, in September 2021, Boehringer Ingelheim acquired Abexxa Biologics. This has broadened company’s cancer immunology and immunotherapeutics portfolio market. In addition, the COVID-19 pandemic created an urgent need for vaccines. Thus, the development of vaccines for COVID-19 is likely to have a positive impact on segment growth.

Product Stage Insights

The clinical studies segment dominated the market and accounted for the largest revenue share of 46.8% in 2023. This can be attributed to the increasing number of clinical trial registrations over the past few years. According to ClinicalTrials.gov, nearly 33,613 new trials were registered in 2023, as compared to around 32,540 in 2020. Moreover, this rise in the number of biologics, high demand for advanced technologies, and a requirement for personalized orphan drugs & medicines are other factors likely to fuel segment growth during the forecast period.

The preclinical segment is anticipated to expand at the fastest CAGR of 9.0% over the forecast period of 2024 - 2030. The rising demand for novel disease treatments, such as COVID-19, Zika virus, and Ebola, and the increasing prevalence of existing diseases, such as CVDs, cancer, and neurological diseases are the key factors contributing to the preclinical segment’s growth. Moreover, stringent regulations related to preclinical studies, laid down by global regulatory bodies, such as International Conference on Harmonization (ICH), WHO, FDA, EMEA (Europe), PMDA (Japan), ANVISA (Brazil), MHRA (UK), & ROEB (Canada), are further driving the demand for regulatory affairs outsourcing agencies for preclinical studies.

End-use Insights

The pharmaceutical companies segment dominated the market and accounted for the largest share of more than 40.3% in 2023. This segment growth is owing to the growth in evolving areas, such as biosimilar, orphan drugs, and personalized medicines, which are creating more demand for regulatory services, thereby boosting segment growth. In addition, the significant number of new drugs entering the pharmaceutical industry has further improved segment growth.

The medical device and biotechnology companies’ segments both have registered a substantial share in the market in 2023. This can be attributed to the increased demand for biopharmaceuticals, vaccines, advanced medical devices, and other products. The growing demand for wearable technologies, along with recent epidemic events, is further contributing to the substantial share of these segments. Furthermore, the increasing number of launches pertaining to medical devices is another significant factor boosting demand for regulatory affairs services, thus supporting segmental growth.

Regional Insights

The Asia Pacific region dominated the regulatory affairs outsourcing market and accounted for the largest revenue share of more than 39.9% in 2023. The region is also projected to witness the fastest CAGR over the forecast period. This can be attributed to the increasing number of clinical trials and the rising number of companies trying to enter markets in developing countries, such as India and China. Furthermore, the availability of a skilled workforce in the region at lower costs compared to the U.S. is another factor expected to propel the regional market growth.

China is one of the most attractive markets for the biopharmaceutical industry. Growing geriatric population and presence of a large population belonging to the middle-income group are further increasing the demand for innovative and cost-effective medicines, which is expected to attract major biopharmaceutical and medical devices companies in this region. Seeking approval for new drugs is a primary challenge faced by biopharmaceutical companies as a clinical trial application process requires 12 to 24 months while approval process may require more than six years. Along with national approvals, the new drug requires approval at both provincial and city levels, which may require additional 4 to 5 years. Reforms in the healthcare sector in recent times are expected to streamline the approval process. Further, recent pricing reforms are expected to attract multinational companies, contributing to the demand for regulatory services. For instance, in January 2023, GenScript, which provides contract services to help other companies develop and manufacture biologic drugs, secured USD 224 million in funding from investors. This new investment can help GenScript's subsidiary, ProBio, expand its production capacity for biologic drugs, which are made using living cells and are often used to treat complex diseases including cancer & autoimmune disorders. ProBio's expansion plans include building new manufacturing facilities in China and overseas. Such initiatives are expected to propel the demand for regulatory affairs services in China.

The North America regional market also reported a significant share in the global industry. The presence of key pharmaceutical and medical device companies and the rise in R&D spending in the region are some of the key factors driving the market in North America. North America and Europe are expected to be the key markets for regulatory affairs outsourcing, owing to the presence of two major international regulatory agencies, the European Medicines Agency (EMA) and the U.S. FDA, which regulate more than half of the medical devices worldwide.

The U.S. accounts for a major share of clinical trial applications across the globe. Along with branded and patented products, there is a strong demand for cost-effective generic and biosimilar products in this region. For instance, in January 2022, around 33 FDA-approved biosimilars were available in the U.S., 21 of which were commercially available in the market. Thus, increasing development and approval of novel biosimilars is expected to propel the demand for regulatory services in the U.S., driving the market.

Key Regulatory Affairs Outsourcing Company Insights

The major players operating across the regulatory affairs outsourcing market are focused on the adoption of several strategic initiatives such as mergers, partnerships, acquisitions, etc. Companies such as Labcorp Drug Development, Charles River Laboratories, ICON plc, Genpact, WuXi AppTec, and Parexel International Corporation hold a notable share of the market. This is owing to their comprehensive service portfolio covering a wide range of regulatory affairs outsourcing services. Moreover, these companies are continuously investing in cutting-edge technologies for regulatory affairs to offer more accurate and efficient services. This technological advantage helps attract clients and contribute to a larger market share. The multinational presence of these companies coupled with implementation of strategic initiatives such as partnerships, mergers & acquisitions contribute to the company’s market presence.

Key Regulatory Affairs Outsourcing Companies:

The following are the leading companies in the regulatory affairs outsourcing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these regulatory affairs outsourcing companies are analyzed to map the supply network.

- Accell Clinical Research, LLC

- Genpact

- CRITERIUM, INC

- Promedica International

- WuXi AppTec

- Medpace

- Charles River Laboratories

- ICON plc

- Labcorp Drug Development

- Parexel International Corporation

- Freyr

- PHARMALEX GMBH

- NDA Group AB

- Pharmexon

- Qvigilance

- BlueReg

- Cambridge Regulatory Services

- APCER Life Sciences, Inc.

- Real Regulatory Ltd

- VCLS

- PrimeVigilance

- ProPharma Group MIS Limited

- Regulatory Pharma Net srl

- ZEINCRO

- BioMapas

- REGENOLD GMBH

Recent Developments

-

In January 2023, AmerisourceBergen Corporation acquired PharmaLex Holding GmbH, a prominent service provider including regulatory affairs in the life sciences industry. This has broadened company’s service portfolio in a significant market.

-

In April 2022, VCLS collaborated with EC Innovations, a Chinese company that offers translation services globally and has vast experience translating highly regulated life sciences and medical content. The strategy helped to strengthen company’s offerings and operational capabilities.

Regulatory Affairs Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.03 billion

Revenue forecast in 2030

USD 11.31 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, company size, category, indication, product stage, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Turkey; Netherlands; Switzerland; Sweden; Europe CIS Countries; Japan; China; India; Australia; South Korea; Indonesia; Malaysia; Singapore; Thailand; Taiwan; CIS Countries; Brazil; Mexico; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Egypt; Israel; Kuwait

Key companies profiled

Accell Clinical Research; LLC; Genpact; CRITERIUM, INC; Promedica International; WuXi AppTec; Medpace; Charles River Laboratories; ICON plc; Covance, Inc. (Labcorp Drug Development); Parexel International Corporation; Freyr; PHARMALEX GMBH; NDA Group AB; Pharmexon; Qvigilance; BlueReg; Cambridge Regulatory Services; APCER Life Sciences, Inc.; Real Regulatory Ltd; VCLS; PrimeVigilance; ProPharma Group MIS Limited; Regulatory Pharma Net srl; ZEINCRO; BioMapas; Regenold GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Regulatory Affairs Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global regulatory affairs outsourcing market report based on services, company size, category, indication, stage, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Regulatory Consulting

-

Strategy & Development Planning

-

QA Consulting

-

Others

-

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submission

-

Regulatory Operations

-

Other Services

-

-

Company Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Regulatory Consulting

-

Strategy & Development Planning

-

QA consulting

-

Others

-

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

Medical Device

-

Regulatory Consulting

-

Strategy & Development Planning

-

QA Consulting

-

Others

-

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Others

-

-

Product Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical

-

PMA (Post Market Authorization)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Pharmaceutical Companies

-

Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Turkey

-

Netherlands

-

Switzerland

-

Sweden

-

Europe CIS Countries

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Malaysia

-

Singapore

-

Thailand

-

Taiwan

-

CIS Countries

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Israel

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global regulatory affairs outsourcing market size was estimated at USD 7.0 billion in 2022 and is expected to reach USD 7.5 billion in 2023.

b. The global regulatory affairs outsourcing market is expected to witness a compound annual growth rate of 8.0% from 2023 to 2030 to, reach USD 12.82 billion by 2030.

b. Product registration & clinical trial applications held the largest share of 25.9% in 2022. The increasing number of clinical trials across the globe, stringent regulations in developed markets, and legal/regulatory reforms in emerging markets such as Asia Pacific is driving the outsourcing trend for clinical trial applications.

b. Some of the players operating in the regulatory affairs outsourcing market are Accell Clinical Research, LLC.; Genpact Ltd.; Criterium, Inc.; PRA Health Sciences; Promedica International; WuXi AppTec, Inc.; Medpace; Pharmaceutical Product Development, LLC (PPD); Charles River Laboratories International, Inc.; ICON plc; Covance, Parexel International Corporation; Inc.; and Freyr.

b. Key factors that are driving the regulatory affairs outsourcing market growth include an increase in geographical expansion activities by companies, an increase in the R&D activities, and rising clinical trial applications.

Table of Contents

Chapter 1 Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased Database

1.4.2. GVR’s Internal Database

1.5. Details of primary research

1.5.1. Data for primary interviews in North America

1.5.2. Data for primary interviews in Europe

1.5.3. Data for primary interviews in Asia Pacific

1.5.4. Data for primary interviews in Latin America

1.5.5. Data for Primary interviews in MEA

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.1.1. Approach 1: Commodity flow approach

1.7.2. Volume price analysis (Model 2)

1.7.2.1. Approach 2: Volume price analysis

1.8. Research Scope and Assumptions

1.8.1. List of Secondary Sources

1.8.2. List of Primary Sources

1.8.3. Objectives

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Regulatory Affairs Outsourcing Market Variables and Trends

3.1 Market Lineage Outlook

3.2 Market Dynamics

3.2.1 Market Driver Impact Analysis

3.2.1.1 Changing Regulatory Landscape

3.2.1.2 Entry Of Companies In The Global Market

3.2.1.3 Life Science Companies Focusing On Their Core Competencies

3.2.1.4 Economic And Competitive Pressures

3.2.1.5 Demand For Faster Approval Process For Breakthrough Drugs And Devices

3.2.1.6 Growth In Emerging Areas Such As Personalized Medicine, Biosimilars, And Orphan Drugs

3.2.2 Market Restraint Impact Analysis

3.2.2.1 Risk Associated With Data Security

3.2.2.2 Monitoring Issues And Lack Of Standardization

3.3 Industry Challenges

3.3.1 MANAGING RELATIONSHIPS

3.4 Service Mapping, By Drug/Device Lifecycle

3.6 Service Price Analysis

3.5.1 Organization Structure

3.5.2 Price Level Analysis

3.5.2.1 Regulatory Affairs Service Price Analysis By Phase

3.5.2.2 Segment Category Level

3.5.3 Unit Level

3.5.4 Pricing Models

3.6 Technology Landscape

3.6.1 Existing And Emerging Use Of Technology And Preferred Tools

3.6.2 Differentiating In-House Tools Vs Widely Available

3.6.3 Tools That Have Seal Of Approval From Regulatory Authorities

3.6.4 Key Technology Pillars

3.6.4.1 Digital Transformation and Data Integrity

3.6.4.2 Artificial Intelligence, Machine Learning/Automation

3.6.4.2.1 Data Analysis and Predictive Modeling

3.6.4.2.2 Automation of Routine Tasks

3.6.4.2.3 Compliance Monitoring

3.6.4.2.4 Discovery and Development

3.6.4.2.5 Regulatory Guidelines Related to AI/ML:

3.6.4.2.5.1 FDA: Guidelines on AI/ML in Medical Devices

3.6.4.2.5.2 EMA: The Use of Artificial Intelligence (AI) in The Medicinal Product Lifecycle

3.6.4.2.5.3 MHRA: Guidance on Software and AI as a Medical Device

3.6.5 Big Data And Analytics

3.6.6 RTP, Text Processing And Analytics

3.6.7 Speech And Video Analytics

3.6.8 IoT (Internet Of Things)

3.6.8.1 Advanced Supply Chain Monitoring

3.6.9 AI Tools

3.6.9.1 ELICIT (Electronic Literature Control and Information Tracking)

3.6.9.2 HUMATA (Human and Machine Analysis of Texts and Arguments)

3.6.9.3 Chat GPT

3.6.9.4 Scite Assistant

3.6.9.5 Other AI Tools

3.7 Covid-19 Impact On Regulatory Affairs Outsourcing Market

3.7.1 COVID-19 Impact On Clinical Trial Services Market

3.7.2 COVID-19 Impact On Regulatory Services Market

3.7.3 COVID-19 Impact On Key Market Players

3.7.4 Post COVID-19 Impact On The Market

3.8 Top Regional Player Analysis

3.9 Total Number Of Clinical Trials, by Phase & Region (2021-23):

3.10 Average Cost/Price Of Clinical Trials

3.10.1 Average Cost/Price Of Clinical Trials By Phase

3.10.2 Average Cost/Price Of Clinical Trials By Therapeutic Areas

3.10.3 Average Cost/Price Of Clinical Trials By Major Countries/Region

3.11 Cost Breakdown Analysis For CRO's

3.11.1 Percent Of Outsourced Vs In-House Clinical Trial Categories

3.12 Regulatory Affairs: Industry Analysis Tools

3.12.1 PORTER’S Analysis

3.12.2 PESTEL Analysis

Chapter 4 Regulatory Affairs Outsourcing Market: Service Estimates & Trend Analysis

4.1 Service Movement Analysis & Market Share, 2023 & 2030

4.2 Regulatory Affairs Outsourcing Market Estimates & Forecast, By Service (USD Million)

4.2.1 Regulatory Consulting

4.2.1.1 Regulatory Consulting Market, 2018 - 2030 (USD Million)

4.2.1.2 Strategy & Development Planning

4.2.1.2.1 Strategy & Development Planning Market, 2018 - 2030 (USD Million)

4.2.1.3 QA Consulting

4.2.1.3.1 QA Consulting Market, 2018 - 2030 (USD Million)

4.2.1.4 Others

4.2.1.4.1 Others Market, 2018 - 2030 (USD Million)

4.2.2 Legal Representation

4.2.2.1 Legal Representation Market, 2018 - 2030 (USD Million)

4.2.3 Regulatory Writing & Publishing

4.2.3.1 Regulatory Writing & Publishing Market, 2018 - 2030 (USD Million)

4.2.4 Product Registration & Clinical Trial Applications

4.2.4.1 Product registration & clinical trial applications Market, 2018 - 2030 (USD Million)

4.2.5 Regulatory Submissions

4.2.5.1 Regulatory Submissions Market, 2018 - 2030 (USD Million)

4.2.6 Regulatory Operations

4.2.6.1 Regulatory Operations Market, 2018 - 2030 (USD Million)

4.2.7 Other Services

4.2.7.1 Other services Market, 2018 - 2030 (USD Million)

Chapter 5 Regulatory Affairs Outsourcing Market: Category Estimates & Trend Analysis

5.1 Category Movement Analysis & Market Share, 2023 & 2030

5.2 Regulatory Affairs Outsourcing Market Estimates & Forecast, By Category (USD Million)

5.3 Pharmaceuticals

5.3.1 Pharmaceuticals Regulatory Affairs Outsourcing Market, By Regulatory Consulting, 2018 - 2030 (USD Million)

5.3.1.1 Pharmaceutical Regulatory Affairs Outsourcing Market By Strategy & Development Planning, 2018 - 2030 (USD Million)

5.3.1.2 Pharmaceutical Regulatory Affairs Outsourcing Market By QA Consulting, 2018 - 2030 (USD Million)

5.3.1.3 Pharmaceutical Regulatory Affairs Outsourcing Market By Others,2018 - 2030 (USD Million)

5.3.2 Pharmaceuticals Regulatory Affairs Outsourcing Market, By Legal Representation, 2018 - 2030 (USD Million)

5.3.3 Pharmaceuticals Regulatory Affairs Outsourcing Market, By Regulatory Writing & Publishing, 2018 - 2030 (USD Million)

5.3.4 Pharmaceuticals Regulatory Affairs Outsourcing Market, By Product Registration & Clinical Trial Applications, 2018 - 2030 (USD Million)

5.3.5 Pharmaceuticals Regulatory Affairs Outsourcing Market, By Regulatory Submissions, 2018 - 2030 (USD Million)

5.3.6 Pharmaceuticals Regulatory Affairs Outsourcing Market, By Regulatory Operations, 2018 - 2030 (USD Million)

5.3.7 Pharmaceuticals Regulatory Affairs Outsourcing Market, By Other Services, 2018 - 2030 (USD Million)

5.4 Medical Devices

5.4.1 Medical Devices Regulatory Affairs Outsourcing Market By Regulatory Consulting, 2018 - 2030 (USD Million)

5.4.1.1 Medical Devices Regulatory Affairs Outsourcing Market By Strategy & Development Planning, 2018 - 2030 (USD Million)

5.4.1.2 Medical Devices Regulatory Affairs Outsourcing Market By QA Consulting, 2018 - 2030 (USD Million)

5.4.1.3 Medical Devices Regulatory Affairs Outsourcing Market By Others, 2018 - 2030 (USD Million)

5.4.2 Medical Devices Regulatory Affairs Outsourcing Market By Legal Representation, 2018 - 2030 (USD Million)

5.4.3 Medical Devices Regulatory Affairs Outsourcing Market By Regulatory Writing And Publishing, 2018 - 2030 (USD Million)

5.4.4 Medical Devices Regulatory Affairs Outsourcing Market By Product Registration & Clinical Trial Applications, 2018 - 2030 (USD Million)

5.4.5 Medical Devices Regulatory Affairs Outsourcing Market By Regulatory Submissions, 2018 - 2030 (USD Million)

5.4.6 Medical Devices Regulatory Affairs Outsourcing Market By Regulatory Operations, 2018 - 2030 (USD Million)

5.4.7 Medical Devices Regulatory Affairs Outsourcing Market By Other Services, 2018 - 20302018 - 20302018 - 2030 (USD Million)

Chapter 6 Regulatory Affairs Outsourcing Market: Company Size Estimates & Trend Analysis

6.1 Company Size Movement Analysis & Market Share, 2022 & 2030

6.2 Regulatory Affairs Outsourcing Market Estimates & Forecast, By Company Size (USD Million)

6.2.1 Small Companies

6.2.1.1 Small Companies Market, 2018 - 2030 (USD Million)

6.2.2 Medium Companies

6.2.2.1 Medium Companies Market, 2018 - 2030 (USD Million)

6.2.3 Large Companies

6.2.3.1 Large Companies Market, 2018 - 2030 (USD Million)

Chapter 7 Regulatory Affairs Outsourcing Market: Indication Estimates & Trend Analysis

7.1 Indication Movement Analysis & Market Share, 2022 & 2030

7.2 Regulatory Affairs Outsourcing Market Estimates & Forecast, By Indication (USD Million)

7.2.1 Oncology

7.2.1.1 Oncology Market, 2018 - 2030 (USD Million)

7.2.2 Neurology

7.2.2.1 Neurology Market, 2018 - 2030 (USD Million)

7.2.3 Cardiology

7.2.3.1 Cardiology Market, 2018 - 2030 (USD Million)

7.2.4 Immunology

7.2.4.1 Immunology Market, 2018 - 2030 (USD Million)

7.2.5 Other Indications

7.2.5.1 Other Indications Market, 2018 - 2030 (USD Million)

Chapter 8 Regulatory Affairs Outsourcing Market: Product Stage Estimates & Trend Analysis

8.1 Product Stage Movement Analysis & Market Share, 2022 & 2030

8.2 Regulatory Affairs Outsourcing Market Estimates & Forecast, By Product Stage (USD Million)

8.2.1 Preclinical

8.2.1.1 Preclinical Market, 2018 - 2030 (USD Million)

8.2.2 Clinical

8.2.2.1 Clinical Market, 2018 - 2030 (USD Million)

8.2.3 Premarket Approval (PMA)

8.2.3.1 Premarket Approval (PMA) Market, 2018 - 2030 (USD Million)

Chapter 9 Regulatory Affairs Outsourcing Market: End-Use Estimates & Trend Analysis

9.1 End-Use Movement Analysis & Market Share, 2022 & 2030

9.2 Regulatory Affairs Outsourcing Market Estimates & Forecast, By End-Use (USD Million)

9.2.1 Medical Device Companies

9.2.1.1 Medical Device Companies Market, 2018 - 2030 (USD Million)

9.2.2 Pharmaceutical Companies

9.2.2.1 Pharmaceutical Companies Market, 2018 - 2030 (USD Million)

9.2.3 Biotechnology Companies

9.2.3.1 Biotechnology Companies Market, 2018 - 2030 (USD Million)

Chapter 10 Regulatory Affairs Outsourcing Market: Regional Estimates and Trend Analysis

10.1 Regulatory Affairs Outsourcing Market: Regional Outlook

10.2 North America

10.2.1 North America Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.2.2 U.S.

10.2.2.1 Key Country Dynamics

10.2.2.2 Regulatory Landscape/Reimbursement Scenario

10.2.2.3 Competitive Insights

10.2.2.4 U.S. Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.2.3 Canada

10.2.3.1 Key Country Dynamics

10.2.3.2 Regulatory Landscape/Reimbursement Scenario

10.2.3.3 Competitive Insights

10.2.3.4 Canada Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3 Europe

10.3.1 Europe Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.2 UK

10.3.2.1 Key Country Dynamics

10.3.2.2 Regulatory Landscape/Reimbursement Scenario

10.3.2.3 Competitive Insights

10.3.2.4 UK Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.3 Germany

10.3.3.1 Key Country Dynamics

10.3.3.2 Regulatory Landscape/Reimbursement Scenario

10.3.3.3 Competitive Insights

10.3.3.4 Germany Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.4 France

10.3.4.1 Key Country Dynamics

10.3.4.2 Regulatory Landscape/Reimbursement Scenario

10.3.4.3 Competitive Insights

10.3.4.4 France Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.5 Italy

10.3.5.1 Key Country Dynamics

10.3.5.2 Regulatory Landscape/Reimbursement Scenario

10.3.5.3 Competitive Insights

10.3.5.4 Italy Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.6 Spain

10.3.6.1 Key Country Dynamics

10.3.6.2 Regulatory Landscape/Reimbursement Scenario

10.3.6.3 Competitive Insights

10.3.6.4 Spain Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.7 Russia

10.3.7.1 Key Country Dynamics

10.3.7.2 Regulatory Landscape/Reimbursement Scenario

10.3.7.3 Competitive Insights

10.3.7.4 Russia Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.8 Sweden

10.3.8.1 Key Country Dynamics

10.3.8.2 Regulatory Landscape/Reimbursement Scenario

10.3.8.3 Competitive Insights

10.3.8.4 Sweden Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.9 Turkey

10.3.9.1 Key Country Dynamics

10.3.9.2 Regulatory Landscape/Reimbursement Scenario

10.3.9.3 Competitive Insights

10.3.9.4 Turkey Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.10 Netherlands

10.3.10.1 Key Country Dynamics

10.3.10.2 Regulatory Landscape/Reimbursement Scenario

10.3.10.3 Competitive Insights

10.3.10.4 Netherlands Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.11 Switzerland

10.3.11.1 Key Country Dynamics

10.3.11.2 Regulatory Landscape/Reimbursement Scenario

10.3.11.3 Competitive Insights

10.3.11.4 Switzerland Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.3.12 Europe CIS Countries

10.3.12.1 Key Country Dynamics

10.3.12.2 Regulatory Landscape/Reimbursement Scenario

10.3.12.3 Competitive Insights

10.3.12.4 Europe CIS Countries Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4 Asia Pacific

10.4.1 Asia Pacific Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.2 Japan

10.4.2.1 Key Country Dynamics

10.4.2.2 Regulatory Landscape/Reimbursement Scenario

10.4.2.3 Competitive Insights

10.4.2.4 Japan Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.3 China

10.4.3.1 Key Country Dynamics

10.4.3.2 Regulatory Landscape/Reimbursement Scenario

10.4.3.3 Competitive Insights

10.4.3.4 China Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.4 India

10.4.4.1 Key Country Dynamics

10.4.4.2 Regulatory Landscape/Reimbursement Scenario

10.4.4.3 Competitive Insights

10.4.4.4 India Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.5 Australia

10.4.5.1 Key Country Dynamics

10.4.5.2 Regulatory Landscape/Reimbursement Scenario

10.4.5.3 Competitive Insights

10.4.5.4 Australia Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.6 South Korea

10.4.6.1 Key Country Dynamics

10.4.6.2 Regulatory Landscape/Reimbursement Scenario

10.4.6.3 Competitive Insights

10.4.6.4 South Korea Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.7 Thailand

10.4.7.1 Key Country Dynamics

10.4.7.2 Regulatory Landscape/Reimbursement Scenario

10.4.7.3 Competitive Insights

10.4.7.4 Thailand Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.8 Indonesia

10.4.8.1 Key Country Dynamics

10.4.8.2 Regulatory Landscape/Reimbursement Scenario

10.4.8.3 Competitive Insights

10.4.8.4 Indonesia Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.9 Malaysia

10.4.9.1 Key Country Dynamics

10.4.9.2 Regulatory Landscape/Reimbursement Scenario

10.4.9.3 Competitive Insights

10.4.9.4 Malaysia Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.10 Singapore

10.4.10.1 Key Country Dynamics

10.4.10.2 Regulatory Landscape/Reimbursement Scenario

10.4.10.3 Competitive Insights

10.4.10.4 Singapore Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.11 Taiwan

10.4.11.1 Key Country Dynamics

10.4.11.2 Regulatory Landscape/Reimbursement Scenario

10.4.11.3 Competitive Insights

10.4.11.4 Taiwan Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.4.12 CIS Countries

10.4.12.1 Key Country Dynamics

10.4.12.2 Regulatory Landscape/Reimbursement Scenario

10.4.12.3 Competitive Insights

10.4.12.4 Asia Pacific CIS Countries Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.5 Latin America

10.5.1 Latin America Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.5.2 Brazil

10.5.1.1 Key Country Dynamics

10.5.1.2 Regulatory Landscape/Reimbursement Scenario

10.5.1.3 Competitive Insights

10.5.1.4 Brazil Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.5.3 Mexico

10.5.3.1 Key Country Dynamics

10.5.3.2 Regulatory Landscape/Reimbursement Scenario

10.5.3.3 Competitive Insights

10.5.3.4 Mexico Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.5.4 Argentina

10.5.4.1 Key Country Dynamics

10.5.4.2 Regulatory Landscape/Reimbursement Scenario

10.5.4.3 Competitive Insights

10.5.4.4 Argentina Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.5.5 Colombia

10.5.5.1 Key Country Dynamics

10.5.5.2 Regulatory Landscape/Reimbursement Scenario

10.5.5.3 Competitive Insights

10.5.5.4 Colombia Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.5.6 Chile

10.5.6.1 Key Country Dynamics

10.5.6.2 Regulatory Landscape/Reimbursement Scenario

10.5.6.3 Competitive Insights

10.5.6.4 Chile Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.6 Middle East & Africa

10.6.1 Middle East & Africa Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.6.2 South Africa

10.6.2.1 Key Country Dynamics

10.6.2.2 Regulatory Landscape/Reimbursement Scenario

10.6.2.3 Competitive Insights

10.6.2.4 South Africa Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.6.3 Saudi Arabia

10.6.3.1 Key Country Dynamics

10.6.3.2 Regulatory Landscape/Reimbursement Scenario

10.6.3.3 Competitive Insights

10.6.3.4 Saudi Arabia Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.6.4 UAE

10.6.4.1 Key Country Dynamics

10.6.4.2 Regulatory Landscape/Reimbursement Scenario

10.6.4.3 Competitive Insights

10.6.4.4 UAE Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.6.5 Egypt

10.6.5.1 Key Country Dynamics

10.6.5.2 Regulatory Landscape/Reimbursement Scenario

10.6.5.3 Competitive Insights

10.6.5.4 Egypt Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.6.6 Israel

10.6.6.1 Key Country Dynamics

10.6.6.2 Regulatory Landscape/Reimbursement Scenario

10.6.6.3 Competitive Insights

10.6.6.4 Israel Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

10.6.7 Kuwait

10.6.7.1 Key Country Dynamics

10.6.7.2 Regulatory Landscape/Reimbursement Scenario

10.6.7.3 Competitive Insights

10.6.7.4 Kuwait Regulatory Affairs Outsourcing Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 11 Competitive Landscape

11.1 Recent Developments & Impact Analysis by Key Market Participants

11.2 Company Categorization

11.3 Company Market Share Analysis

11.4 Company Heat Map Analysis

11.5. Strategy Mapping

11.5.1 Expansions

11.5.2 Merger & Acquisition

11.5.3 Partnerships & Collaborations

11.5.4 Service Launches

11.5.5 Research And Development

11.6. Company Profiles

11.6.1 Accell Clinical Research, LLC

11.6.1.1 Participant’s Overview

11.6.1.2 Financial Performance

11.6.1.3 Service Benchmarking

11.6.1.4 Strategic Initiatives

11.6.2 Genpact

11.6.2.1 Participant’s Overview

11.6.2.2 Financial Performance

11.6.2.3 Service Benchmarking

11.6.2.4 Strategic Initiatives

11.6.3 CRITERIUM, INC

11.6.3.1 Participant’s Overview

11.6.3.2 Financial Performance

11.6.3.3 Service Benchmarking

11.6.3.4 Strategic Initiatives

11.6.4 Promedica International

11.6.4.1 Participant’s Overview

11.6.4.2 Financial Performance

11.6.4.3 Service Benchmarking

11.6.4.4 Strategic Initiatives

11.6.5 WuXi AppTec

11.6.5.1 Participant’s Overview

11.6.5.2 Financial Performance

11.6.5.3 Service Benchmarking

11.6.5.4 Strategic Initiatives

11.6.6 Medpace

11.6.6.1 Participant’s Overview

11.6.6.2 Financial Performance

11.6.6.3 Service Benchmarking

11.6.6.4 Strategic Initiatives

11.6.7 Charles River Laboratories

11.6.7.1 Participant’s Overview

11.6.7.2 Financial Performance

11.6.7.3 Service Benchmarking

11.6.7.4 Strategic Initiatives

11.6.8 ICN plc

11.6.8.1 Participant’s Overview

11.6.8.2 Financial Performance

11.6.8.3 Service Benchmarking

11.6.8.4 Strategic Initiatives

11.6.9 Labcorp Drug Development

11.6.9.1 Participant’s Overview

11.6.9.2 Financial Performance

11.6.9.3 Service Benchmarking

11.6.9.4 Strategic Initiatives

11.6.10 Parexel International Corporation

11.6.10.1 Participant’s Overview

11.6.10.2 Financial Performance

11.6.10.3 Service Benchmarking

11.6.10.4 Strategic Initiatives

11.6.11 Freyr

11.6.11.1 Participant’s Overview

11.6.11.2 Financial Performance

11.6.11.3 Service Benchmarking

11.6.11.4 Strategic Initiatives

11.6.12 PHARMALEX GMBH

11.6.12.1 Participant’s Overview

11.6.12.2 Financial Performance

11.6.12.3 Service Benchmarking

11.6.12.4 Strategic Initiatives

11.6.13 NDA Group AB

11.6.13.1 Participant’s Overview

11.6.13.2 Financial Performance

11.6.13.3 Service Benchmarking

11.6.13.4 Strategic Initiatives

11.6.14 Pharmexon

11.6.14.1 Participant’s Overview

11.6.14.2 Financial Performance

11.6.14.3 Service Benchmarking

11.6.14.4 Strategic Initiatives

11.6.15 Qvigilance

11.6.15.1 Participant’s Overview

11.6.15.2 Financial Performance

11.6.15.3 Service Benchmarking

11.6.15.4 Strategic Initiatives

11.6.16 BlueReg

11.6.16.1 Participant’s Overview

11.6.16.2 Financial Performance

11.6.16.3 Service Benchmarking

11.6.16.4 Strategic Initiatives

11.6.17 Cambridge Regulatory Services

11.6.17.1 Participant’s Overview

11.6.17.2 Financial Performance

11.6.17.3 Service Benchmarking

11.6.17.4 Strategic Initiatives

11.6.18 APCER Life Sciences, Inc.

11.6.18.1 Participant’s Overview

11.6.18.2 Financial Performance

11.6.18.3 Service Benchmarking

11.6.18.4 Strategic Initiatives

11.6.19 Real Regulatory Ltd

11.6.19.1 Participant’s Overview

11.6.19.2 Financial Performance

11.6.19.3 Service Benchmarking

11.6.19.4 Strategic Initiatives

11.6.20 VCLS

11.6.20.1 Participant’s Overview

11.6.20.2 Financial Performance

11.6.20.3 Service Benchmarking

11.6.20.4 Strategic Initiatives

11.6.21 PrimeVigilance

11.6.21.1 Participant’s Overview

11.6.21.2 Financial Performance

11.6.21.3 Service Benchmarking

11.6.21.4 Strategic Initiatives

11.6.22 ProPharma Group MIS Limited

11.6.22.1 Participant’s Overview

11.6.22.2 Financial Performance

11.6.22.3 Service Benchmarking

11.6.22.4 Strategic Initiatives

11.6.23 Regulatory Pharma Net srl

11.6.23.1 Participant’s Overview

11.6.23.2 Financial Performance

11.6.23.3 Service Benchmarking

11.6.23.4 Strategic Initiatives

11.6.24 ZEINCRO

11.6.24.1 Participant’s Overview

11.6.24.2 Financial Performance

11.6.24.3 Service Benchmarking

11.6.24.4 Strategic Initiatives

11.6.25 BioMapas

11.6.25.1 Participant’s Overview

11.6.25.2 Financial Performance

11.6.25.3 Service Benchmarking

11.6.25.4 Strategic Initiatives

11.6.26 REGENOLD GMBH

11.6.26.1 Participant’s Overview

11.6.26.2 Financial Performance

11.6.26.3 Service Benchmarking

11.6.26.4 Strategic Initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 Global Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 4 Global Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 5 Global Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 6 Global Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 7 Global Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 8 Global Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 9 Global Regulatory Affairs Outsourcing Market, by Region, 2018 - 2030 (USD Million)

Table 10 North America Regulatory Affairs Outsourcing Market, by Country, 2018 - 2030 (USD Million)

Table 11 North America Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 12 North America Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 13 North America Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 14 North America Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 15 North America Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 16 North America Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 17 U.S. Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 18 U.S. Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 19 U.S. Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 20 U.S. Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 21 U.S. Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 22 U.S. Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 23 Canada Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 24 Canada Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 25 Canada Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 26 Canada Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 27 Canada Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 28 Canada Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 29 Europe Regulatory Affairs Outsourcing Market, by Country, 2018 - 2030 (USD Million)

Table 30 Europe Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 31 Europe Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 32 Europe Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 33 Europe Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 34 Europe Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 35 Europe Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 36 Germany Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 37 Germany Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 38 Germany Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 39 Germany Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 40 Germany Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 41 Germany Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 42 UK Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 43 UK Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 44 UK Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 45 UK Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 46 UK Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 47 UK Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 48 France Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 49 France Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 50 France Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 51 France Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 52 France Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 53 France Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 54 Italy Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 55 Italy Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 56 Italy Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 57 Italy Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 58 Italy Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 59 Italy Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 60 Spain Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 61 Spain Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 62 Spain Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 63 Spain Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 64 Spain Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 65 Spain Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 66 Denmark Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 67 Denmark Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 68 Denmark Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 69 Denmark Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 70 Denmark Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 71 Denmark Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 72 Sweden Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 73 Sweden Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 74 Sweden Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 75 Sweden Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 76 Sweden Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 77 Sweden Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 78 Norway Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 79 Norway Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 80 Norway Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 81 Norway Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 82 Norway Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 83 Norway Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 84 Asia Pacific Regulatory Affairs Outsourcing Market, by Country, 2018 - 2030 (USD Million)

Table 85 Asia Pacific Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 86 Asia Pacific Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 87 Asia Pacific Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 88 Asia Pacific Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 89 Asia Pacific Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 90 Asia Pacific Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 91 China Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 92 China Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 93 China Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 94 China Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 95 China Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 96 China Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 97 Japan Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 98 Japan Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 99 Japan Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 100 Japan Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 101 Japan Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 102 Japan Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 103 India Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 104 India Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 105 India Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 106 India Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 107 India Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 108 India Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 109 South Korea Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 110 South Korea Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 111 South Korea Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 112 South Korea Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 113 South Korea Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 114 South Korea Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 115 Australia Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 116 Australia Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 117 Australia Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 118 Australia Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 119 Australia Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 120 Australia Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 121 Thailand Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 122 Thailand Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 123 Thailand Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 124 Thailand Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 125 Thailand Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 126 Thailand Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 127 Latin America Regulatory Affairs Outsourcing Market, by Country, 2018 - 2030 (USD Million)

Table 128 Latin America Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 129 Latin America Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 130 Latin America Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 131 Latin America Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 132 Latin America Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 133 Latin America Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 134 Brazil Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 135 Brazil Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 136 Brazil Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 137 Brazil Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 138 Brazil Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 139 Brazil Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 140 Mexico Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 141 Mexico Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 142 Mexico Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 143 Mexico Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 144 Mexico Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 145 Mexico Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 146 Argentina Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 147 Argentina Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 148 Argentina Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 149 Argentina Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 150 Argentina Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 151 Argentina Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 152 Middle East & Africa Regulatory Affairs Outsourcing Market, by Country, 2018 - 2030 (USD Million)

Table 153 Middle East & Africa Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 154 Middle East & Africa Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 155 Middle East & Africa Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 156 Middle East & Africa Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 157 Middle East & Africa Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 158 Middle East & Africa Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 159 South Africa Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 160 South Africa Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 161 South Africa Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 162 South Africa Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 163 South Africa Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 164 South Africa Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 165 Saudi Arabia Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 166 Saudi Arabia Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 167 Saudi Arabia Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 168 Saudi Arabia Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 169 Saudi Arabia Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 170 Saudi Arabia Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 171 UAE Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 172 UAE Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 173 UAE Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 174 UAE Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 175 UAE Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 176 UAE Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

Table 177 Kuwait Regulatory Affairs Outsourcing Market, by Service, 2018 - 2030 (USD Million)

Table 178 Kuwait Regulatory Affairs Outsourcing Market, by Category, 2018 - 2030 (USD Million)

Table 179 Kuwait Regulatory Affairs Outsourcing Market, by Company Size, 2018 - 2030 (USD Million)

Table 180 Kuwait Regulatory Affairs Outsourcing Market, by Indication, 2018 - 2030 (USD Million)

Table 181 Kuwait Regulatory Affairs Outsourcing Market, by Product Stage, 2018 - 2030 (USD Million)

Table 182 Kuwait Regulatory Affairs Outsourcing Market, by End-Use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Regulatory Affairs Outsourcing Market, Market Segmentation

Fig. 7 Market Driver Relevance Analysis (Current & Future Impact)

Fig. 8 Market Restraint Relevance Analysis (Current & Future Impact)

Fig. 9 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 10 Porter’s Five Forces Analysis

Fig. 11 Regional Marketplace: Key Takeaways

Fig. 12 Global Regulatory Affairs Outsourcing Market, for Regulatory consulting, 2018 - 2030 (USD Million)

Fig. 13 Global Regulatory Affairs Outsourcing Market, for Strategy & Development Planning, 2018 - 2030 (USD Million)

Fig. 14 Global Regulatory Affairs Outsourcing Market, for QA Consulting, 2018 - 2030 (USD Million)

Fig. 15 Global Regulatory Affairs Outsourcing Market, for Agent Services, 2018 - 2030 (USD Million)

Fig. 16 Global Regulatory Affairs Outsourcing Market, for Others, 2018 - 2030 (USD Million)

Fig. 17 Global Regulatory Affairs Outsourcing Market, for Legal representation, 2018 - 2030 (USD Million)

Fig. 18 Global Regulatory Affairs Outsourcing Market, for Regulatory writing & publishing, 2018 - 2030 (USD Million)

Fig. 19 Global Regulatory Affairs Outsourcing Market, for Onsite Monitoring, 2018 - 2030 (USD Million)

Fig. 20 Global Regulatory Affairs Outsourcing Market, for Product registration & clinical trial applications, 2018 - 2030 (USD Million)

Fig. 21 Global Regulatory Affairs Outsourcing Market, for Project Management Services, 2018 - 2030 (USD Million)

Fig. 22 Global Regulatory Affairs Outsourcing Market, for Others, 2018 - 2030 (USD Million)

Fig. 23 Global Regulatory Affairs Outsourcing Market, for Regulatory Submissions, 2018 - 2030 (USD Million)

Fig. 24 Global Regulatory Affairs Outsourcing Market, for Regulatory Operations, 2018 - 2030 (USD Million)

Fig. 25 Global Regulatory Affairs Outsourcing Market, for other services, 2018 - 2030 (USD Million)

Fig. 26 Global Regulatory Affairs Outsourcing Market, for Drugs, 2018 - 2030 (USD Million)

Fig. 27 Global Regulatory Affairs Outsourcing Market, for Innovators, 2018 - 2030 (USD Million)

Fig. 28 Global Regulatory Affairs Outsourcing Market, for Generics, 2018 - 2030 (USD Million)

Fig. 29 Global Regulatory Affairs Outsourcing Market, for Biologics, 2018 - 2030 (USD Million)

Fig. 30 Global Regulatory Affairs Outsourcing Market, for Biotech, 2018 - 2030 (USD Million)

Fig. 31 Global Regulatory Affairs Outsourcing Market, for ATMP, 2018 - 2030 (USD Million)

Fig. 32 Global Regulatory Affairs Outsourcing Market, for Biosimilars, 2018 - 2030 (USD Million)

Fig. 33 Global Regulatory Affairs Outsourcing Market, for Medical Devices, 2018 - 2030 (USD Million)

Fig. 34 Global Regulatory Affairs Outsourcing Market, for Diagnostics, 2018 - 2030 (USD Million)

Fig. 35 Global Regulatory Affairs Outsourcing Market, for Therapeutics, 2018 - 2030 (USD Million)

Fig. 36 Global Regulatory Affairs Outsourcing Market, for Small, 2018 - 2030 (USD Million)

Fig. 37 Global Regulatory Affairs Outsourcing Market, for Small Sized Biotech/biopharmaceutical Companies, 2018 - 2030 (USD Million)

Fig. 38 Global Regulatory Affairs Outsourcing Market, for Small Sized Pharmaceutical Companies, 2018 - 2030 (USD Million)

Fig. 39 Global Regulatory Affairs Outsourcing Market, for Small Sized Medical Device Companies, 2018 - 2030 (USD Million)

Fig. 40 Global Regulatory Affairs Outsourcing Market, for Medium, 2018 - 2030 (USD Million)

Fig. 41 Global Regulatory Affairs Outsourcing Market, for Medium Sized Biotech/biopharmaceutical Companies, 2018 - 2030 (USD Million)

Fig. 42 Global Regulatory Affairs Outsourcing Market, for Medium Sized Pharmaceutical Companies, 2018 - 2030 (USD Million)

Fig. 43 Global Regulatory Affairs Outsourcing Market, for Medium Sized Medical Device Companies, 2018 - 2030 (USD Million)

Fig. 44 Global Regulatory Affairs Outsourcing Market, for Large, 2018 - 2030 (USD Million)

Fig. 45 Global Regulatory Affairs Outsourcing Market, for Large Sized Biotech/biopharmaceutical Companies, 2018 - 2030 (USD Million)

Fig. 46 Global Regulatory Affairs Outsourcing Market, for Large Sized Pharmaceutical Companies, 2018 - 2030 (USD Million)

Fig. 47 Global Regulatory Affairs Outsourcing Market, for Large Sized Medical Device Companies, 2018 - 2030 (USD Million)

Fig. 48 Global Regulatory Affairs Outsourcing Market, for Oncology, 2018 - 2030 (USD Million)

Fig. 49 Global Regulatory Affairs Outsourcing Market, for Neurology, 2018 - 2030 (USD Million)

Fig. 50 Global Regulatory Affairs Outsourcing Market, for Cardiology, 2018 - 2030 (USD Million)

Fig. 51 Global Regulatory Affairs Outsourcing Market, for immunology, 2018 - 2030 (USD Million)

Fig. 52 Global Regulatory Affairs Outsourcing Market, for Others, 2018 - 2030 (USD Million)

Fig. 53 Global Regulatory Affairs Outsourcing Market, for Preclinical, 2018 - 2030 (USD Million)

Fig. 54 Global Regulatory Affairs Outsourcing Market, for Clinical studies, 2018 - 2030 (USD Million)

Fig. 55 Global Regulatory Affairs Outsourcing Market, for PMA, 2018 - 2030 (USD Million)

Fig. 56 Global Regulatory Affairs Outsourcing Market, for Biotechnology Companies, 2018 - 2030 (USD Million)

Fig. 57 Global Regulatory Affairs Outsourcing Market, for Pharmaceutical Companies, 2018 - 2030 (USD Million)

Fig. 58 Global Regulatory Affairs Outsourcing Market, for Medical Device Companies, 2018 - 2030 (USD Million)

Fig. 59 Regional Outlook, 2023 & 2030

Fig. 60 North America Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 61 U.S. Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 62 Canada Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 63 Europe Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 64 Germany Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 65 UK Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 66 France Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 67 Italy Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 68 Spain Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 69 Denmark Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 70 Sweden Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 71 Norway Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 72 Turkey Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 73 Netherlands Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 74 Switzerland Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 75 CIS Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 76 Asia Pacific Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 77 Japan Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 78 China Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 79 India Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 80 Australia Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 81 South Korea Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 82 Thailand Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)

Fig. 83 Indonesia Regulatory Affairs Outsourcing Market, 2018 - 2030 (USD Million)