- Home

- »

- Medical Devices

- »

-

Renal Denervation Catheter Market, Industry Report, 2033GVR Report cover

![Renal Denervation Catheter Market Size, Share & Trends Report]()

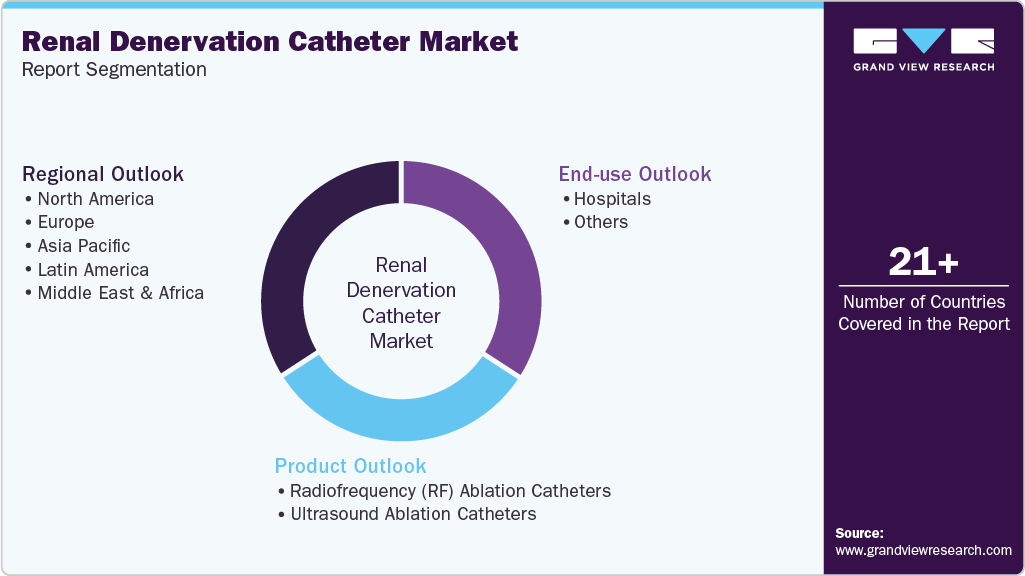

Renal Denervation Catheter Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Product (Radiofrequency Ablation Catheters, Ultrasound Ablation Catheters), By End-use (Hospital), By Region (North America, Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-680-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range:

- Forecast Period: 1 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Renal Denervation Catheter Market Summary

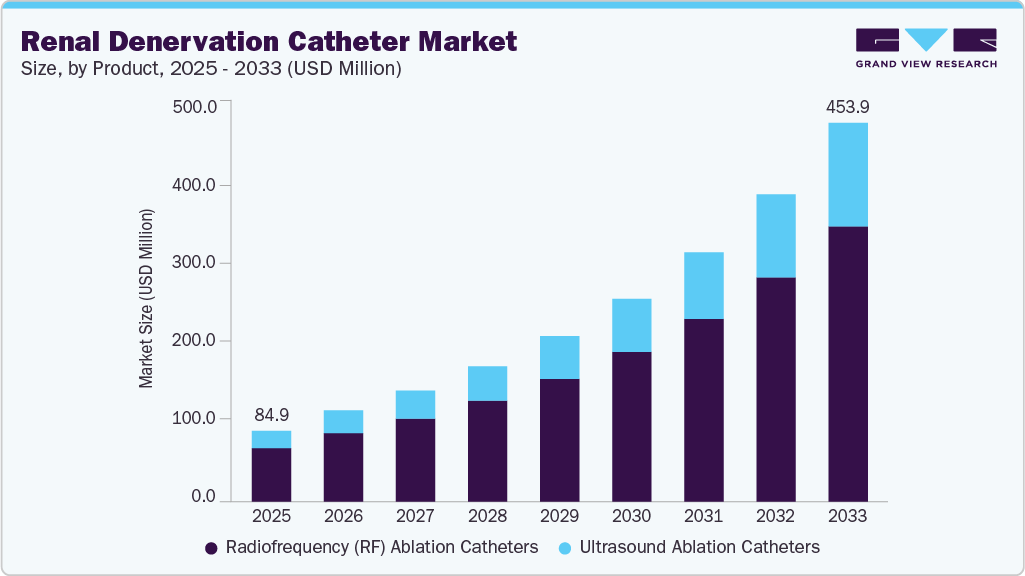

The global renal denervation catheter market size was estimated at USD 84.91 million in 2025 and is projected to reach USD 453.97 million by 2033, growing at a CAGR of 23.31% from 2025 to 2033. This growth is primarily driven by the increasing global burden of hypertension, particularly treatment-resistant hypertension, which affects a significant proportion of patients who do not respond adequately to pharmacological therapy.

Key Market Trends & Insights

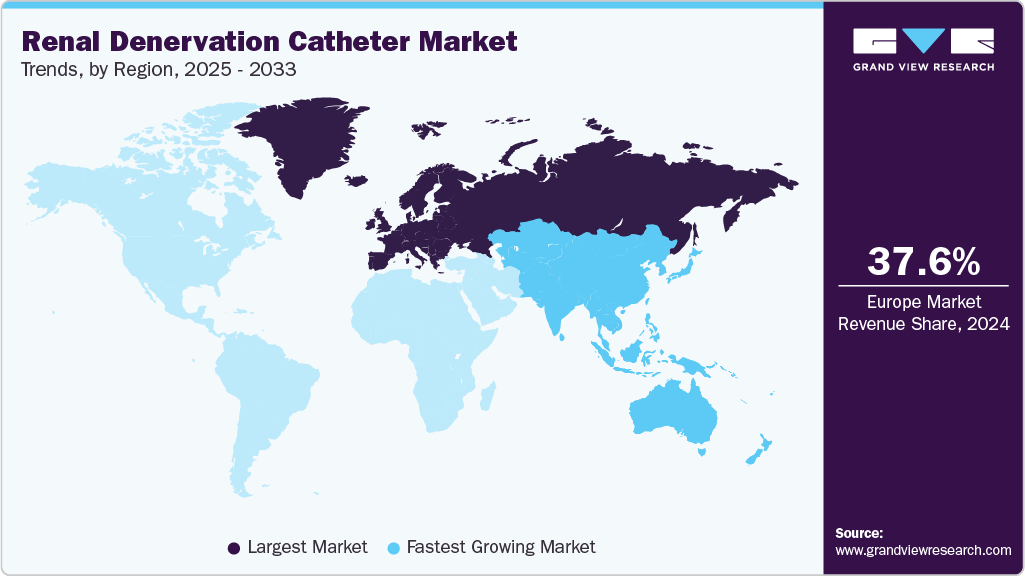

- Europe dominated the renal denervation catheter market with the largest revenue share of 37.62% in 2025.

- The renal denervation catheter market in the UK is expected to grow significantly in the forecast period.

- By product, the radiofrequency ablation catheters segment led the market with the largest revenue share in 2025.

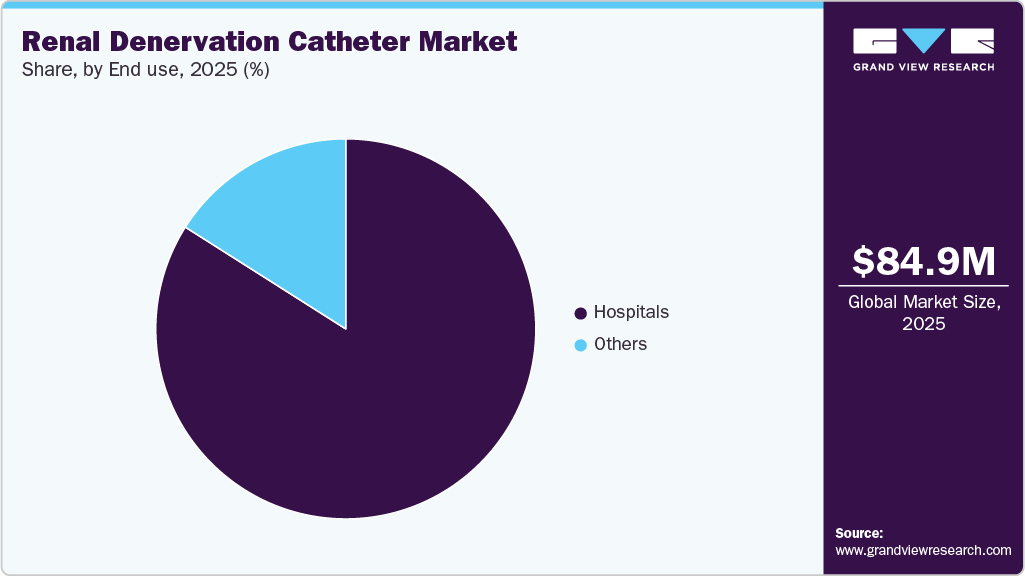

- Based on end use, the hospital segment led the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 84.91 Million

- 2033 Projected Market Size: USD 453.97 Million

- CAGR (2025-2033): 23.31%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

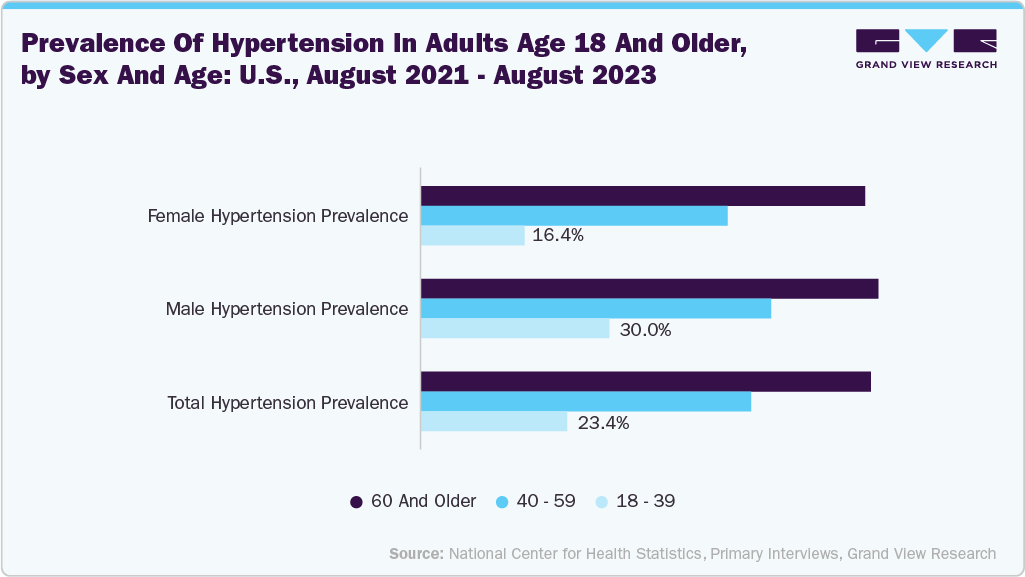

As a minimally invasive procedure, renal denervation (RDN) offers a promising alternative for patients seeking long-term blood pressure control with fewer medications. According to the NIH, hypertension is a critical public health issue and a leading cause of cardiovascular disease, morbidity, and premature mortality worldwide. About 1.13 billion people - one in six globally - are affected by high blood pressure, which is projected to increase to 1.5 billion by 2025.The rising global prevalence of hypertension is a significant factor fueling the growth of the renal denervation catheter market. Hypertension remains one of the most significant modifiable risk factors for cardiovascular disease, stroke, and kidney failure, and its incidence continues to escalate due to factors such as aging populations, unhealthy lifestyles, obesity, high salt intake, and increasing levels of stress. According to the WHO, as of March 2023, approximately 1.28 billion adults aged 30 to 79 years are affected by hypertension, with two-thirds of them living in low- and middle-income countries. Particularly concerning the subset of this population is those with resistant hypertension-patients who fail to achieve target blood pressure levels despite using three or more antihypertensive medications, including a diuretic. This group represents a key renal denervation therapy target population.

As awareness of the limitations of pharmacologic treatments grows and the demand for more effective, longer-lasting interventions increases, renal denervation is gaining attention as a minimally invasive option to reduce sympathetic nerve activity and achieve sustained blood pressure control. The increasing clinical and real-world evidence supporting RDN’s efficacy and safety in lowering blood pressure, especially in resistant hypertension, is driving its acceptance among physicians and patients, significantly contributing to the expansion of the renal denervation catheter market.

“Current control rates for hypertension are dismal, and this technology offers a new option for many patients with resistant or difficult-to-control hypertension. Ultrasound renal denervation has been proven safe and effective in rigorous studies. When lifestyle changes and medications are not enough, ultrasound renal denervation holds great promise as an adjunctive therapy to help patients reach their goal BP.” - Naomi D.L. Fisher, MD, director of hypertension services and the hypertension specialty clinic at Brigham and Women’s Hospital.

The growing awareness about hypertension management is expected to drive market growth in the forecast years. Industry players, industry stakeholders, healthcare organizations, and government agencies are actively launching initiatives to educate the public on the importance of regular blood pressure monitoring and early intervention. For instance,

-

World Hypertension Day was observed on May 17, 2025, with the theme “Measure Your Blood Pressure Accurately, Control It, Live Longer!”. This global campaign emphasized the critical role of accurate blood pressure measurement, timely diagnosis, and effective treatment in preventing hypertension-related complications.

-

In addition, in February 2025, the American Heart Association, with support from Providence, launched the “Love Your Heart. Lower the Pressure.” campaign. This initiative encourages individuals to “know their numbers” and collaborate with healthcare providers to manage their blood pressure and lower their risk of cardiovascular diseases, including heart attacks and strokes.

"At Providence, we are deeply committed to advancing health equity and addressing the critical health disparities that impact our communities. By supporting the American Heart Association with this hypertension awareness campaign, we aim to equip communities with the knowledge and resources they need to take control of their heart health. This initiative is not just about raising awareness-it's about creating tangible change and ensuring that everyone, regardless of their background, has access to the care and support necessary to lead a healthy life,” - Whitney Haggerson, Vice President of Health Equity and Medicaid, Providence.

Some of the recently launched campaigns for hypertension awareness

Organization

Campaign Name

Date of Launch

Aim/Goal

Indian Stroke Association (ISA)

Indian Red Cross Society

Rotary Club of Guntur

Check BP - Stop Stroke

April 2025

To raise awareness about the importance of monitoring blood pressure, to prevent major health issues like brain stroke, heart attack and kidney failures.

The Association of Physicians of India (API)

Glenmark Pharmaceuticals

Take charge at 18 - BP Screening Day

September 2024

Emphasizes the critical importance of early blood pressure monitoring beginning at age 18.

Source: Grand View Research Analysis

The increasing number of clinical trials focused on renal denervation catheters is a key driver of market growth. These trials are essential for validating the efficacy, safety, and long-term benefits of RDN as a treatment for resistant and uncontrolled hypertension. The growing body of positive clinical evidence enhances physician confidence, encourages guideline revisions, and prompts regulatory approvals in major markets. Moreover, ongoing multicenter and real-world studies are expanding the understanding of RDNs’ therapeutic scope, including their potential applications in heart failure, chronic kidney disease, and atrial fibrillation management.

Study Title

Conditions

Interventions

Sponsor

Enrollment

Primary Completion Date

REDUCED 1 - Renal Denervation Using Ultrasonic Catheter EmitteD Energy Study /

Uncontrolled Stage 2 Hypertension

DEVICE: Renal denervation

SoniVie Inc.

25

2025-12

Ultrasound-Based Renal Sympathetic Denervation as Adjunctive Upstream Therapy During Atrial Fibrillation Ablation

Atrial Fibrillation

DEVICE: renal denervation|DEVICE: Catheter ablation

Vivek Reddy

160

2/26/2025

ULTRA-HFIB-Redo: Ultrasound-based Renal Sympathetic Denervation Vs Control in Redo Ablation Patients

Paroxysmal Atrial Fibrillation|Persistent Atrial Fibrillation

DEVICE: Renal Denervation|DEVICE: Catheter Ablation

Vivek Reddy

250

2027-12

Source: ClinicalTrials.Gov, Grand View Research Analysis

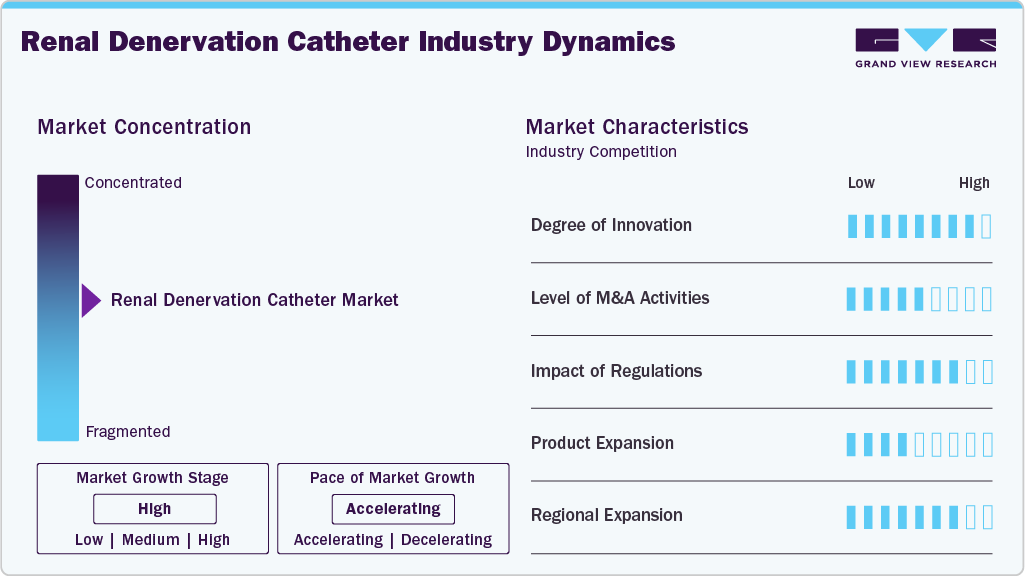

Market Concentration & Characteristics

The renal denervation catheter industry is in a high-growth stage, driven by the increasing global burden of hypertension-particularly treatment-resistant cases-along with growing clinical evidence supporting the safety and efficacy of renal denervation procedures.

The industry is highly innovative, marked by continuous technological advancements and evolving therapeutic approaches. Notable innovations include multi-electrode catheters, automated energy delivery, and real-time temperature and impedance monitoring, all of which enhance procedural consistency and outcomes. Medtronic (Symplicity Spyral) and Recor Medical (Paradise Ultrasound RDN System) lead innovation through stringent clinical trials and regulatory engagement.

The industry has witnessed moderate but strategically significant mergers and acquisitions (M&A) activity in recent years. Although not characterized by a high volume of transactions, the deals that have occurred reflect focused consolidation, strategic entry, and technology acquisition by major medtech companies. As the market matures and clinical evidence supporting renal denervation becomes more potent, the level of M&A activity is expected to rise, particularly as large medtech players seek to diversify their hypertension treatment offerings and capitalize on emerging therapeutic segments. For instance, in March 2025, Boston Scientific Corporation entered into a definitive agreement to acquire SoniVie Ltd., a privately held medical device company. SoniVie has developed the TIVUS Intravascular Ultrasound System, an investigational technology designed to denervate nerves surrounding blood vessels to address various hypertensive conditions, including renal artery denervation for hypertension.

Regulations play a critical and developing role in shaping the growth of the renal denervation catheter market. RDN systems are subject to stringent safety and efficacy assessments by regulatory authorities such as the U.S. FDA, European Medicines Agency (EMA), Japan’s PMDA, and China’s NMPA. Approval delays in some regions, particularly those with more conservative evidence thresholds, may limit market access temporarily. However, the increasing alignment between clinical trial outcomes and regulatory expectations drives a more supportive environment for innovation, commercialization, and global expansion of renal denervation technologies.

Product expansion in the industry is a key growth driver, as manufacturers diversify and upgrade their product offerings to meet evolving clinical needs. Companies are launching next-generation systems incorporating advanced features such as multi-electrode configurations, real-time imaging capabilities, and dual-access compatibility to enhance procedural precision and safety. These innovations improve treatment efficacy, reduce procedure time, and broaden the applicability of renal denervation in complex patient populations, including those with resistant hypertension or chronic kidney disease.

Regional expansion is playing a pivotal role in driving the global growth of the renal denervation catheter industry, as manufacturers and stakeholders actively seek to penetrate emerging and underdeveloped healthcare markets. While early adoption was primarily concentrated in Europe, where CE-marked RDN systems have been in clinical use for several years, recent U.S. FDA approvals have opened one of the largest potential markets globally.

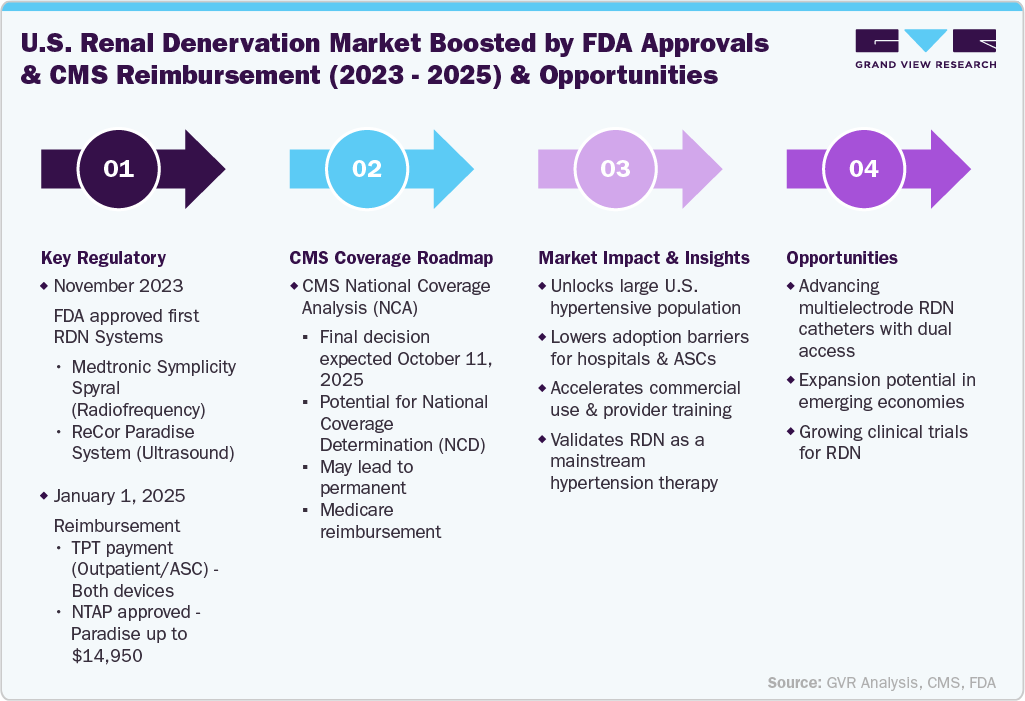

Product Insights

The radiofrequency ablation catheter segment dominated the market in 2025, driven by its established clinical efficacy, procedural precision, and widespread adoption in clinical trials and commercial settings. For instance, in November 2023, the U.S. FDA approved Medtronic's Symplicity Spyral RDN system. This minimally invasive device utilizes radiofrequency energy to target overactive renal nerves contributing to high blood pressure. Furthermore, in January 2025, the Centers for Medicare & Medicaid Services (CMS) initiated a national coverage analysis (NCA) for renal denervation procedures. This was prompted by Medtronic's request to support Medicare coverage for the Symplicity Spyral system to improve access for hypertensive patients. Furthermore, the familiarity of healthcare providers with RF-based systems, streamlined procedural workflows, and ongoing product enhancements continues to support the segment's dominance. As regulatory approvals and reimbursement support increase globally, the RF ablation catheter segment is expected to maintain a strong lead in the market.

The ultrasound ablation catheter segment is expected to witness the fastest growth in the forecast period due to its innovative, non-contact energy delivery mechanism. This mechanism allows for circumferential ablation of renal nerves with greater consistency and reduced procedural variability. Multiple clinical studies have validated the efficacy of ultrasound-based systems. For instance, the RADIANCE-HTN SOLO trial, published in October 2023, evaluated the ReCor Medical Paradise System in patients with mild to moderate hypertension. The results showed that renal denervation using the Paradise endovascular ultrasound system led to a significantly greater reduction in systolic and diastolic blood pressure at two months post-procedure compared to the sham control group. These positive findings support the rapid clinical growth of the ultrasound ablation catheter segment.

End Use Insights

The hospitals segment held the largest market share in 2025, driven by the widespread adoption of RDN procedures in hospital settings. Hospitals have the necessary infrastructure and specialist expertise to perform these minimally invasive interventions. For instance, in 2024, Houston Methodist became the first hospital in Houston to perform the renal denervation procedure, highlighting its role in adopting this non-pharmacologic treatment for hypertension. Such early clinical adoption by healthcare institutions continues to support the dominance of hospitals in the market.Moreover, manufacturers are collaborating with hospitals to train about renal denervation technologies and expand clinical adoption. For instance, in April 2025, Medtronic partnered with KIMS-Sunshine Hospital to establish a specialized renal denervation center.

“This is an important milestone and hopefully the beginning of a new era marked by more innovative, durable and diverse treatment options for a condition that affects so many and contributes to so much of the global burden of disease. Prescription drugs are effective, widely available and affordable, but they don't work for everyone, and adherence is an enormous problem." - Dr. Alpesh Shah, director of Coronary Interventions at Houston Methodist.

The other segment is expected to grow at the fastest CAGR during the forecast period. The other segment of the renal denervation catheter market encompasses a variety of healthcare settings, including ambulatory surgery centers, specialty clinics, research centers, and academic institutions, among others. This segment is experiencing growth driven by the rising number of clinical studies and research initiatives to develop and evaluate RDN technologies. Several academic centers have already adopted these procedures. For instance, in July 2022, the Kaplan Medical Center in Israel-affiliated with the Hebrew University Medical School-treated its first patient using Tivus therapeutic intravascular ultrasound technology.

Regional Insights

Europe renal denervation catheter marketheld the largest share of 37.62% in 2024. This dominance is primarily driven by the early adoption of renal denervation technologies, favorable regulatory environment, and strong clinical research infrastructure across the region. European countries such as Germany, France, and the UK have been at the forefront of conducting pivotal RDN clinical trials, including the SPYRAL HTN and RADIANCE-HTN series, which have significantly contributed to the evidence base for RDN’s efficacy and safety.

The European Society of Cardiology (ESC), in collaboration with the European Society of Endocrinology (ESE) and the European Stroke Organization (ESO), has recognized catheter-based renal denervation (RDN) as a potential therapy for certain patients with hypertension, as per their latest guidelines.

The recommendations below reflect the growing clinical acceptance of RDN as a complementary therapy for managing difficult-to-control hypertension, while emphasizing patient preference and individualized risk-benefit evaluation.

Recommendations

Class

Level

To reduce BP, and if performed at a medium-to-high volume center, catheter-based renal denervation may be considered for resistant hypertension patients who have BP that is uncontrolled despite a three BP-lowering drug combination (including a thiazide or thiazide-like diuretic), and who express a preference to undergo renal denervation after a shared risk-benefit discussion and multidisciplinary assessment.

IIb

B

To reduce BP, and if performed at a medium-to-high volume center, catheter-based renal denervation may be considered for patients with both increased CVD risk and uncontrolled hypertension on fewer than three drugs, if they express a preference to undergo renal denervation after a shared risk-benefit discussion and multidisciplinary assessment.

IIb

A

Due to a lack of adequately powered outcomes trials demonstrating its safety and CVD benefit to renal denervation is not recommended as a first-line BP-lowering intervention for hypertension.

III

C

Source: European Society of Cardiology, 2024

The renal denervation catheter market in the UK is expected to grow significantly in the forecast period. The rising prevalence of hypertension and resistant hypertension is a significant driver of the renal denervation catheter market in the UK. Hypertension affects nearly 30% of adults in the country, and a considerable proportion of these individuals struggle to achieve adequate blood pressure control despite the use of multiple antihypertensive medications. This condition, known as resistant hypertension, poses serious cardiovascular risks and increases the healthcare burden. As per the NHS update in September 2024, 32% of adults have high blood pressure. In the Southeast, 70 per cent of people with high blood pressure have their condition under control, but it’s estimated there are around 400,000 people with uncontrolled high blood pressure - many of whom do not know that they have high blood pressure.

Germany renal denervation catheter market is growing. Germany has a large and aging population, with a high prevalence of hypertension, particularly resistant hypertension-a condition where blood pressure remains uncontrolled despite the use of three or more antihypertensive medications. This growing patient pool strongly demands alternative, device-based therapies like renal denervation. Based on the WHO 2023 Hypertension Profile for Germany, hypertension remains a significant public health challenge, with an estimated 19.8 million adults aged 30-79 years affected.

Product launches in Germany significantly accelerate the growth of the renal denervation catheter market, positioning the country as a strategic hub for adoption and innovation. Germany's healthcare system is among the most advanced in Europe, and it plays a pioneering role in introducing and evaluating novel medical technologies. In October 2021, ReCor Medical, Inc., a wholly owned subsidiary of Otsuka Medical Devices Co., Ltd., initiated the commercial launch of its Paradise ultrasound renal denervation system in Europe, with Germany being the first country where the system is available for the treatment of uncontrolled hypertension. The initial commercial procedures were successfully performed at two leading institutions-Heart Center Leipzig and Saarland University Hospital in Homburg/Saar.

"Despite the availability of antihypertensive medications, many patients fail to control their hypertension, a dangerous condition that can lead to heart attack and death. Clinical data from the ACHIEVE, RADIOSOUND, RADIANCE-HTN SOLO, and TRIO trials show that ultrasound renal denervation with the Paradise System can lower blood pressure and is a new treatment option for physicians to help their selected patients. We are pleased to be one of the first hospitals in Europe to offer renal denervation with ultrasound."- Professor Felix Mahfoud, MD, with Saarland University Hospital

North America Renal Denervation Catheter Market Trends

North America renal denervation catheter market is witnessing significant growth, driven by the rising prevalence of treatment-resistant hypertension. The U.S. leads the regional market, supported by the recent FDA approvals of major RDN systems such as Medtronic’s Symplicity Spyral and Recor Medical’s Paradise system. These regulations have catalyzed clinical adoption and spurred investment in RDN technologies.

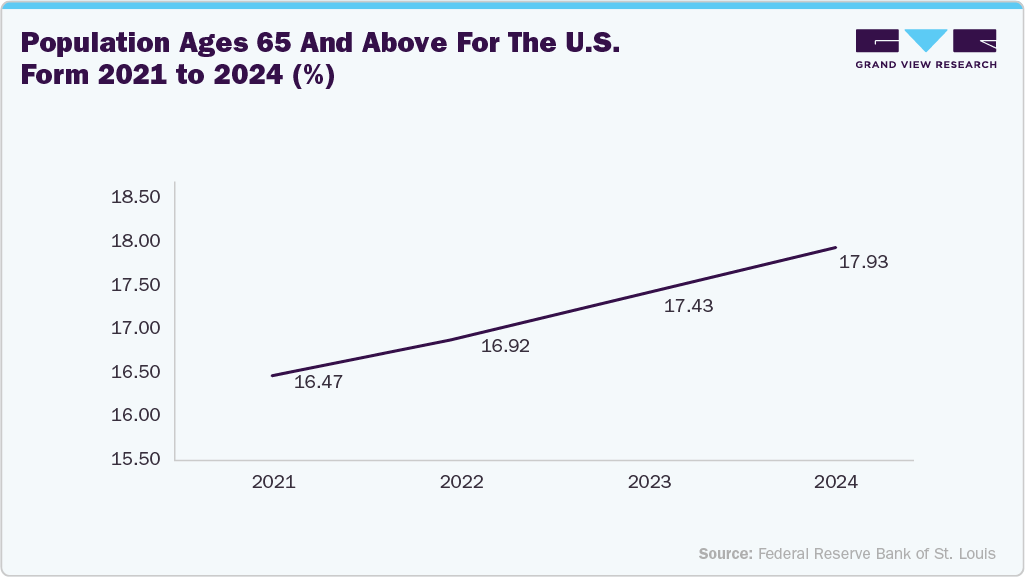

The renal denervation catheter market in the U.S. held the largest share in North America in 2025.The rising prevalence of hypertension in the U.S. is a significant factor driving the growth of the renal denervation catheter market. According to the CDC, nearly half of U.S. adults have hypertension, and a significant proportion of them struggle to maintain adequate blood pressure control despite taking multiple medications. This growing patient population represents the core target for renal denervation, which offers a non-pharmacologic, minimally invasive solution to long-term blood pressure management. As the burden of hypertension continues to rise-driven by aging demographics, sedentary lifestyles, obesity, and dietary habits- the demand for innovative, device-based interventions like RDN is increasing.

According to CDC update in January 2025:

-

In 2022, high blood pressure was a primary or contributing cause of 685,875 deaths in the U.S.

-

About 1 in 5 deaths related to COVID-19 occurred in people with a history of hypertensive disease.

“There are many patients with hypertension refractory to multiple medications, and with multiple hospitalizations and even prior CV events due to uncontrollable BP. To at least have some hope that we may be able to control their BP better is so gratifying. There are so many patients with BP that is uncontrolled despite the best efforts at lifestyle modification and medications. The approval of a renal denervation device offers clinicians the ability to offer a device-based adjunct to their care that may help them be better controlled.”- Ajay J. Kirtane, MD, SM, director of Columbia Interventional Cardiovascular Care.

The U.S. market is driven by key regulatory and reimbursement achievements between 2023 and 2025. In November 2023, the U.S. FDA approved the first renal denervation systems: Medtronic’s Symplicity Spyral, which uses radiofrequency, and ReCor Medical’s Paradise System, which utilizes ultrasound energy.

Asia Pacific Renal Denervation Catheter Market Trends

The renal denervation catheter market in Asia Pacific is experiencing the fastest growth globally, fueled by the rising prevalence of hypertension, increasing awareness about treatment-resistant cases, and expansion of healthcare access across emerging economies. Countries such as China, India, Japan, South Korea, and Australia are leading the adoption, driven by large hypertensive populations and a growing burden of cardiovascular disease. According to WHO estimates, countries in the region are seeing high rates of uncontrolled hypertension, with treatment adherence remaining a significant challenge. This has created a strong demand for alternative therapies like renal denervation, particularly in patients who are non-compliant or unresponsive to medication.

India renal denervation catheter marketis anticipated to witness significant growth over the forecast period. India has a rapidly increasing prevalence of hypertension. A significant portion of these individuals experience uncontrolled or resistant hypertension, defined as high blood pressure that remains elevated despite treatment with three or more antihypertensive drugs. This clinical gap has led to a growing demand for alternative therapies like RDN, which provides a non-pharmacological intervention for blood pressure control. As per the WHO, cardiovascular diseases, including heart attacks and strokes, are the leading cause of death and illness globally and account for nearly one-third of all deaths in India. Uncontrolled hypertension is a major contributing risk factor for CVD. Among the approximately 220 million people in India affected by high blood pressure, only about 12% have their condition adequately controlled.

Strategic partnerships and training initiatives in India drive the renal denervation catheter market by expanding clinical expertise and procedural adoption. In addition, the launch of advanced technologies like next-generation renal denervation systems is improving treatment outcomes and boosting physician acceptance.

- In April 2025, KIMS‑Sunshine Hospital in Hyderabad has partnered with Medtronic to establish a specialized Renal Denervation Therapy Center to treat patients with resistant or uncontrolled hypertension. As part of the collaboration, Medtronic will provide extensive training programs and workshops for healthcare professionals, ensuring they have the latest expertise in patient selection, procedural techniques, and post‑operation management.

“With the Symplicity blood pressure procedure, we aim to empower healthcare professionals and offer a comprehensive approach to managing uncontrolled hypertension that supports our patient-centered approach to care. The recently announced U.S. FDA approval for the RDN system and an update earlier this year of the European Hypertension Society guidelines highlight the role of RDN as part of the hypertension care pathway. We are excited to offer this therapy to all eligible patients in India. As leaders in cardiovascular therapies, Medtronic remains committed to providing innovative solutions that improve patients’ lives.” - Michael Blackwell, Vice President and Managing Director, Medtronic India.

The renal denervation catheter market in China is growing, due to the high prevalence of hypertension in China, which is among the highest globally. According to the National Center for Cardiovascular Diseases, over 270 million people in China suffer from hypertension, with poor control rates despite widespread availability of pharmacological treatments. This has created an urgent need for alternative treatment options such as RDN.

Furthermore, the Chinese government's focus on healthcare reform and domestic medical innovation has enabled a supportive regulatory environment. The National Medical Products Administration (NMPA) has accelerated approval pathways for innovative Class III devices, including RDN catheters, promoting quicker market access for local and international players. The investment of major global and domestic MedTech companies in strategic collaborations, clinical trials, and product rollouts has boosted market awareness and confidence among healthcare professionals. These drivers are positioning China as a rapidly growing and strategically important market for renal denervation technologies.

Some of the key approvals in China by NMPA

Month & Year

Company

Product Name

Device Type

Regulatory Status

Aug-24

SyMap Medical

msRDN Selective Renal Denervation System

Selective Renal Denervation (Class III device)

Class III Medical Device Approval

May-24

Medtronic

Symplicity Spyral Renal Denervation System

Radio Frequency Renal Ablation System

Approved for marketing

Source: NMPA, GVR, Medtronic

“As the leader in renal denervation, we are looking forward to bringing the Symplicity blood pressure procedure to China, where high blood pressure rates continue to increase. As these rates continue to climb, the need for innovative, alternative treatments is strong. The Symplicity procedure can provide people in China with another potential option when seeking high blood pressure solutions, complementing lifestyle modifications and medication.”- Jason Weidman, senior vice president and president of the Coronary and Renal Denervation business within the Cardiovascular Portfolio at Medtronic.

Middle East & Africa Renal Denervation Catheter Market Trends

The renal denervation catheter market in the Middle East and Africa is witnessing gradual growth, driven by the rising prevalence of hypertension and the increasing need for effective treatment options for resistant cases. Lifestyle-related factors such as high obesity rates, sedentary behavior, and excessive salt intake are fueling the hypertension burden, particularly in Gulf countries like Saudi Arabia, the UAE, and Kuwait. At the same time, growing investments in healthcare infrastructure and the expansion of specialized cardiac care centers are creating favorable conditions for the adoption of advanced interventional therapies like renal denervation. As awareness and infrastructure continue to improve, especially in urban centers, the MEA region is expected to become a promising growth area for renal denervation technologies over the forecast years.

Key Renal Denervation Catheter Company Insights

Key players operating in the renal denervation catheter market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Renal Denervation Catheter Companies:

The following are the leading companies in the renal denervation catheter market. These companies collectively hold the largest market share and dictate industry trends.

- Recor Medical, Inc. (Otsuka Medical Devices Co., Ltd.)

- Medtronic

- Boston Scientific Corporation

- Shanghai Bio-heart Biological Technology Co., Ltd.

- MicroPort Scientific Corporation

- EnligHTN, ST. JUDE MEDICAL (Abbott Laboratories)

- Suzhou Xinmai Medical Technology Co., Ltd.

- Ablative Solutions, Inc.

Recent Developments

-

In March 2025, Boston Scientific Corporation announced a definitive agreement to acquire SoniVie Ltd., a privately held medical device company. SoniVie has developed the TIVUS Intravascular Ultrasound System, an investigational technology designed to denervate nerves surrounding blood vessels to address various hypertensive conditions, including renal artery denervation (RDN) for hypertension.

-

In January 2025, Medtronic announced that the Centers for Medicare & Medicaid Services (CMS) has initiated a national coverage analysis (NCA) for renal denervation. This process will enable CMS to review and establish a nationwide Medicare coverage policy for renal denervation procedures in patients with hypertension.

Renal Denervation Catheter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 84.91 million

Revenue forecast in 2033

USD 453.97 million

Growth rate

CAGR of 23.31% from 2025 to 2033

Actual data

2025

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Recor Medical, Inc. (Otsuka Medical Devices Co., Ltd.); Medtronic; Boston Scientific Corporation; Shanghai Bio-heart Biological Technology Co., Ltd.;

MicroPort Scientific Corporation; EnligHTN, ST. JUDE MEDICAL (Abbott Laboratories); Suzhou Xinmai Medical Technology Co., Ltd.; Ablative Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Renal Denervation Catheter Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2025 to 2033. For this study, Grand View Research has segmented the global renal denervation catheter market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2025 - 2033)

-

Radiofrequency (RF) Ablation Catheters

-

Ultrasound Ablation Catheters

-

-

End Use Outlook (Revenue, USD Million, 2025 - 2033)

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2025 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global renal denervation catheter market size was estimated at USD 84.91 million in 2025.

b. The global renal denervation catheter market is expected to grow at a compound annual growth rate of 23.31% from 2025 to 2033 to reach USD 453.97 million by 2033.

b. Europe dominated the renal denervation catheter market with the largest revenue share of 37.62% in 2025.

b. Some key players operating in the renal denervation catheter market include Recor Medical, Inc. (Otsuka Medical Devices Co., Ltd.), Medtronic, Boston Scientific Corporation, Shanghai Bio-heart Biological Technology Co., Ltd., MicroPort Scientific Corporation, EnligHTN, ST. JUDE MEDICAL (Abbott Laboratories), Suzhou Xinmai Medical Technology Co., Ltd., Ablative Solutions, Inc.

b. The renal denervation catheter market is driven by the growing burden of treatment-resistant hypertension, technological advancements in catheter design and energy delivery systems such as radiofrequency and ultrasound.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.