- Home

- »

- Advanced Interior Materials

- »

-

Residential Elevators Market Size, Industry Report, 2033GVR Report cover

![Residential Elevators Market Size, Share & Trends Report]()

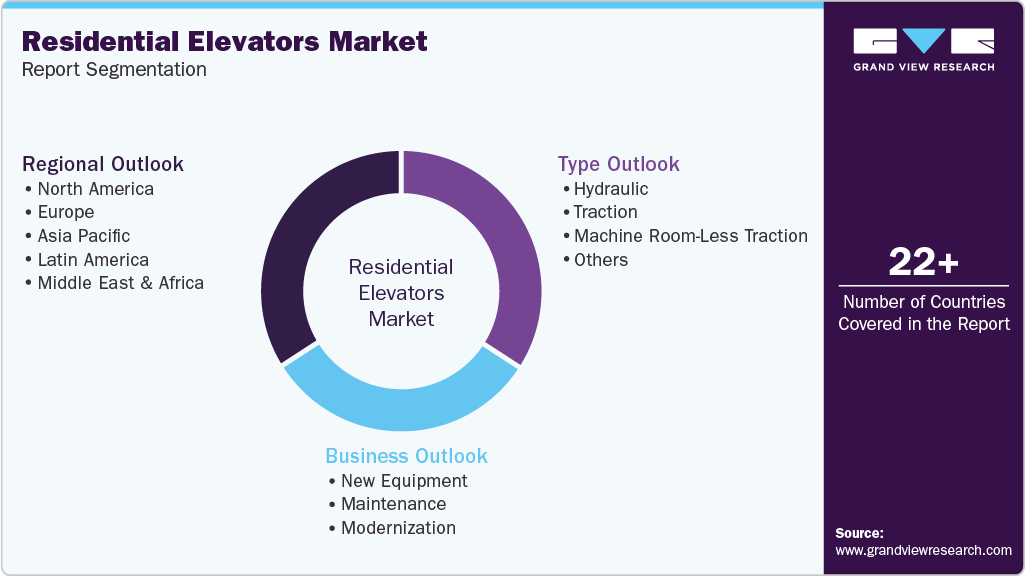

Residential Elevators Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Hydraulic, Traction, Machine Room-Less Traction), By Business (New Equipment, Maintenance, Modernization), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-783-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Residential Elevators Market Summary

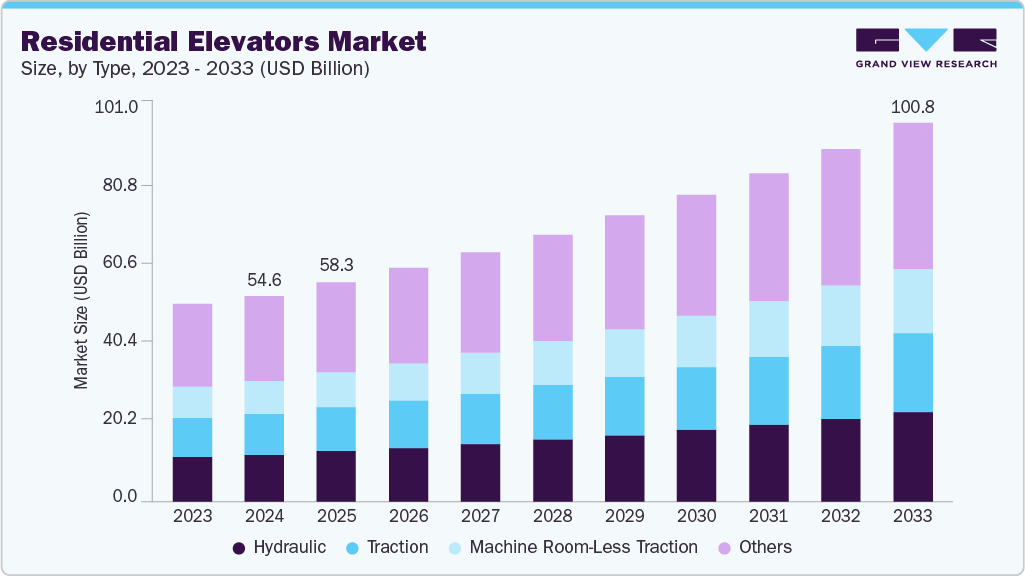

The global residential elevators market size was estimated at USD 54.61 billion in 2024 and is projected to reach USD 100.79 billion by 2033, growing at a CAGR of 7.1% from 2025 to 2033. Rising urbanization and the increasing construction of multi-story residential buildings are boosting demand for residential elevators.

Key Market Trends & Insights

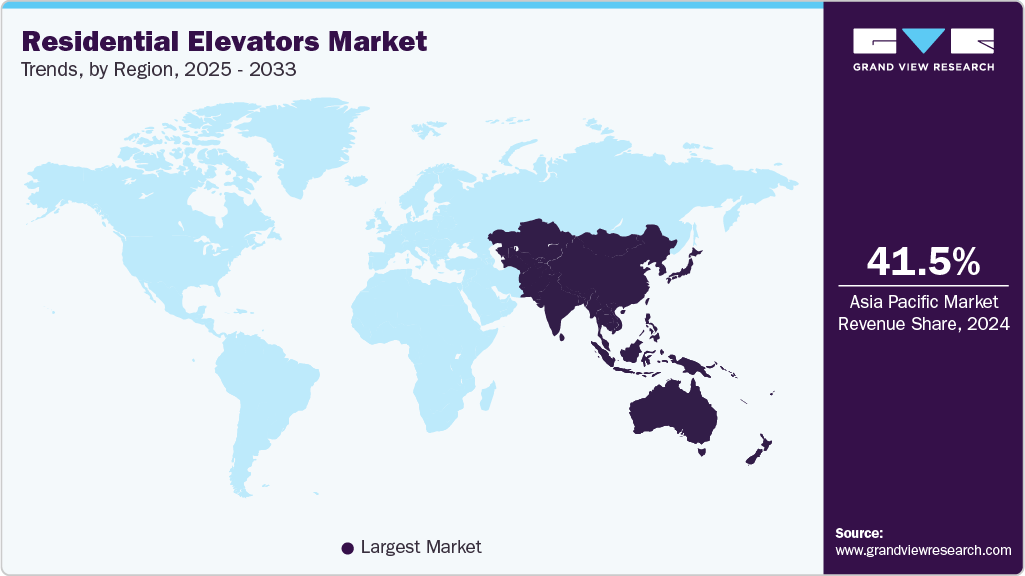

- Asia Pacific dominated the residential elevators market with the largest revenue share of 41.5% in 2024.

- The residential elevators market in the U.S. is expected to grow at a substantial CAGR of 5.8% from 2025 to 2033.

- By type, machine room-less traction segment is expected to grow at a considerable CAGR of 8.0% from 2025 to 2033 in terms of revenue.

- By business, maintenance segment is expected to grow at a considerable CAGR of 7.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 54.61 Billion

- 2033 Projected Market Size: USD 100.79 Billion

- CAGR (2025-2033): 7.1%

- Asia Pacific: Largest market in 2024

Aging populations in developed regions are also driving adoption, as elevators enhance mobility and convenience at home. Consumers increasingly prefer luxury and smart home features, encouraging manufacturers to innovate. Technological advancements, such as energy-efficient and space-saving elevator designs, are attracting more residential buyers. Government regulations promoting accessibility in housing further support market growth. The trend of integrating smart elevators with home automation systems is gaining traction. Moreover, rising real estate development in emerging economies is expanding the residential elevator market globally.

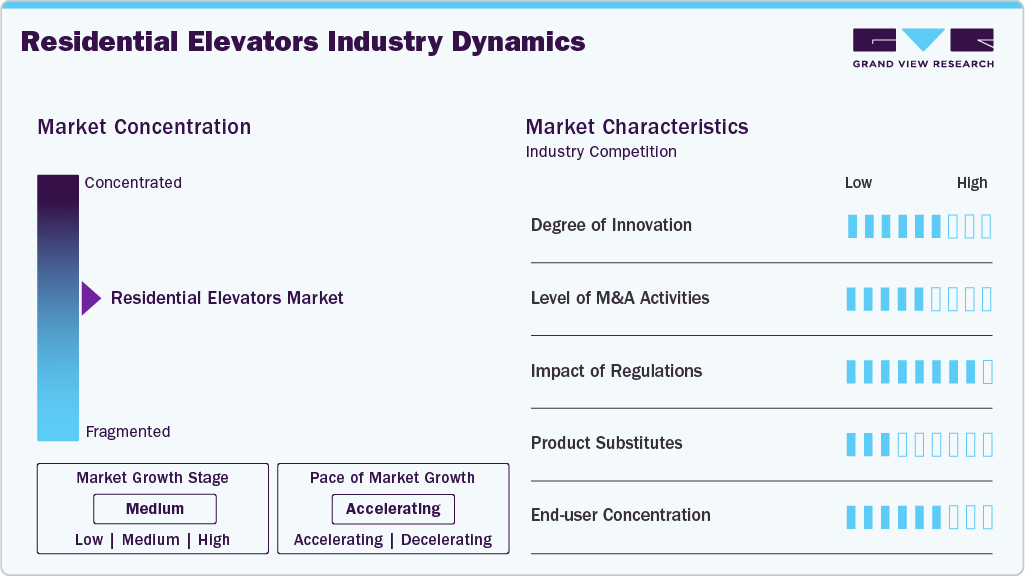

Market Concentration & Characteristics

The global residential elevators market is moderately concentrated, with a few leading players dominating key regions through strong brand presence and advanced product offerings. Major manufacturers leverage innovation, smart home integration, and energy-efficient designs to maintain market share. At the same time, numerous regional and local players cater to niche demands, especially in emerging markets. This balance of global leaders and smaller competitors shapes a competitive yet evolving industry landscape.

The residential elevator industry is marked by continuous innovation, focusing on compact designs, energy efficiency, and smart home integration. Companies are investing in IoT-enabled systems and advanced safety features to differentiate their products. Customization options for luxury homes and space-constrained apartments are increasingly popular. This innovation-driven approach helps manufacturers attract premium customers and maintain a competitive edge.

Regulatory standards for safety, accessibility, and energy efficiency significantly influence product design and installation practices. Governments in developed regions mandate compliance with building codes, affecting both cost and timelines for residential elevators. Certification and adherence to safety norms are critical for market credibility. These regulations also encourage manufacturers to adopt sustainable and technologically advanced solutions.

The market primarily serves urban homeowners, luxury residences, and aging populations seeking convenience and mobility. Demand is concentrated in metropolitan areas with high-rise buildings and premium real estate developments. Emerging markets show growing interest, driven by rising income levels and modern housing projects. End-user preferences for comfort, safety, and technology integration strongly shape product offerings.

Drivers, Opportunities & Restraints

Rising urbanization and the proliferation of multi-story residential buildings are fueling demand for home elevators. Aging populations in developed countries are driving adoption for improved mobility and safety. Increasing consumer preference for luxury and smart home features encourages manufacturers to innovate. In addition, higher disposable incomes enable homeowners to invest in comfort and convenience solutions.

Emerging markets present significant growth potential due to rapid real estate development and rising middle-class income. Integration of IoT and smart home automation in residential elevators opens avenues for advanced product offerings. Energy-efficient and space-saving designs cater to sustainability-conscious consumers. Strategic partnerships and regional expansions offer manufacturers opportunities to capture untapped markets.

High installation and maintenance costs limit adoption among price-sensitive buyers, especially in developing regions. Complex regulatory requirements and varying building codes can delay project implementation. Limited awareness about the benefits of home elevators restricts penetration in non-metro areas. Competition from alternative mobility solutions, such as stair lifts, may also slow market growth.

Type Insights

Hydraulic residential elevators continue to dominate the market and accounted for 22.9% share in 2024 due to their reliability, smooth operation, and cost-effectiveness. They are well-suited for low- to mid-rise buildings, making them popular among homeowners. Easy installation and lower maintenance requirements enhance their appeal. In addition, hydraulic systems provide robust lifting capacity, supporting a variety of residential applications.

Machine Room-Less (MRL) traction elevators are witnessing rapid growth due to their space-saving design and energy efficiency. Eliminating the need for a separate machine room makes them ideal for modern, compact residential buildings. Rising adoption in luxury homes and high-rise apartments fuels market expansion. Advanced features such as smart controls and reduced power consumption further drive their popularity.

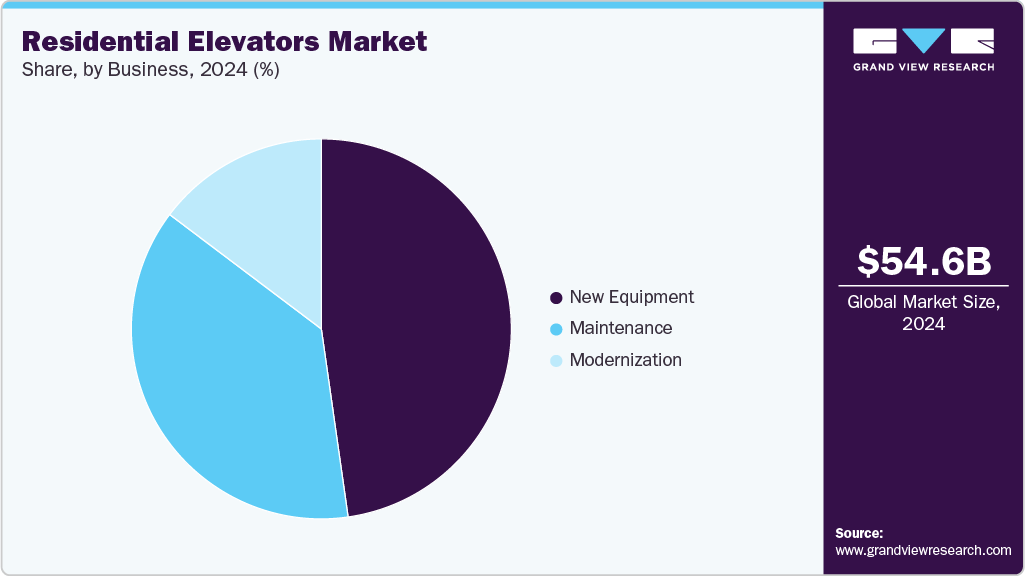

Business Insights

The new equipment segment dominates the residential elevator market and accounted for 47.7% share in 2024 as developers and homeowners invest in modern, customized installations. Growing construction of multi-story and luxury residences drives strong demand. Advanced technologies and design flexibility make new elevators attractive to end users. In addition, favorable financing options and government incentives for accessibility boost new equipment adoption.

The maintenance segment is the fastest growing due to increasing installations and the need for regular servicing to ensure safety and longevity. Rising awareness of compliance with safety regulations fuels demand for professional maintenance services. Predictive maintenance and IoT-enabled monitoring are becoming key trends. Recurring revenue models make maintenance an attractive business opportunity for service providers.

Regional Insights

North America is witnessing steady growth at CAGR of 6.0%, driven by aging populations and a focus on accessibility in residential buildings. Homeowners increasingly prefer energy-efficient and technologically advanced elevators. Renovation and retrofit projects in existing homes further contribute to growth. Strong regulatory standards ensure high safety and quality, boosting consumer confidence.

U.S. Residential Elevators Market Trends

The U.S. dominates the North American residential elevator market due to a large number of multi-story homes and luxury residences. Aging populations and increased focus on accessibility drive adoption. High disposable incomes enable homeowners to invest in premium and smart elevator solutions. In addition, strict safety regulations ensure widespread trust in new installations.

Canada’s residential elevator market is growing steadily due to urbanization and rising high-rise residential developments. Demand is fueled by aging demographics seeking mobility solutions at home. Government incentives and building codes promoting accessibility encourage installations. Emerging smart home trends and energy-efficient designs further accelerate market growth.

Europe Residential Elevators Market Trends

Europe shows steady growth driven by urban redevelopment and rising demand for smart and sustainable residential solutions. Aging demographics increase the need for mobility-enhancing elevators. Countries such as Germany, France, and the UK are investing in premium residential projects. Energy efficiency and compliance with strict building codes support market adoption.

Germany dominates the European residential elevator market due to its advanced construction sector and high demand for multi-story homes. Aging populations drive the need for mobility and accessibility solutions. Consumers prefer energy-efficient and technologically advanced elevators, boosting adoption. Strong regulatory standards ensure safety and quality, supporting market growth.

The UK market is growing as urban redevelopment and high-rise residential projects increase. Rising awareness of smart home integration and sustainable solutions encourages elevator adoption. Aging demographics further support demand for home mobility solutions. Renovation and retrofit projects in existing homes provide additional market opportunities.

Asia Pacific Residential Elevators Market Trends

Asia Pacific leads the residential elevators market and accounted for 41.5% share, due to rapid urbanization and extensive high-rise residential construction. Rising disposable incomes and increasing adoption of smart home solutions drive demand. Countries such as China and India are witnessing significant infrastructure investments. In addition, the growing middle class prefers home elevators for convenience and luxury.

China dominates the Asia Pacific residential elevator market due to rapid urbanization and large-scale high-rise residential developments. Rising disposable incomes and preference for luxury home amenities drive demand. Homeowners increasingly adopt smart home integration and energy-efficient designs. Government initiatives promoting modern housing further support market expansion.

India’s residential elevator market is growing steadily due to increasing urban population and multi-story residential construction. Rising middle-class income and awareness of home convenience solutions fuel adoption. Developers are incorporating elevators to enhance property value in premium housing projects. In addition, government policies encouraging accessibility in residential buildings boost market growth.

Latin America Residential Elevators Market Trends

The residential elevator market in Latin America is growing due to rapid urbanization and new multi-story residential projects. Rising middle-class income and demand for modern housing fuel adoption. Local developers increasingly incorporate elevators to enhance property value. Limited competition in certain regions provides opportunities for international manufacturers.

Brazil’s residential elevator market is expanding due to increasing urbanization and the development of multi-story residential buildings. Rising middle-class income levels drive demand for convenience and modern home features. Developers are incorporating elevators to enhance property value and attract buyers. In addition, limited competition in certain regions creates opportunities for new market entrants.

Middle East & Africa Residential Elevators Market Trends

Growth in the Middle East and Africa is driven by luxury residential construction and urban expansion in metropolitan areas. High disposable incomes and demand for modern home amenities support market adoption. Large-scale real estate and infrastructure projects create new opportunities. In addition, regional governments are encouraging accessibility solutions in housing developments.

Saudi Arabia’s residential elevator market is growing due to rapid urbanization and expansion of luxury residential projects. Rising disposable incomes and demand for modern home amenities drive adoption. Developers increasingly include elevators to enhance property value and convenience. In addition, government initiatives promoting smart and accessible housing support market growth.

Key Residential Elevators Company Insights

Some of the key players operating in the market include Otis Worldwide Corporation, Schindler, KONE Corporation

-

Otis Worldwide Corporation is a global leader in the design, manufacturing, and service of elevators, escalators, and moving walkways. The company focuses on advanced technologies, including smart elevators and predictive maintenance systems. It maintains a strong presence in both new installations and aftermarket services across commercial and residential sectors. Otis leverages digital solutions to enhance operational efficiency and passenger safety. Its extensive global network ensures rapid deployment and consistent support in key markets.

-

Schindler specializes in manufacturing and servicing elevators, escalators, and moving walkways, emphasizing energy-efficient and innovative solutions. The company integrates IoT and smart building technologies to improve performance and user experience. Schindler operates across diverse regions, providing both new equipment and comprehensive maintenance services. Its focus on reliability, sustainability, and safety strengthens its position in urban residential and commercial projects. Continuous investment in R&D enables Schindler to adapt to evolving infrastructure and mobility trends worldwide.

Key Residential Elevators Companies:

The following are the leading companies in the residential elevators market. These companies collectively hold the largest market share and dictate industry trends.

- Otis Worldwide Corporation

- Schindler

- KONE Corporation

- Hitachi Ltd.

- HYUNDAIELEVATOR CO.,LTD.

- Mitsubishi Electric Corporation

- Toshiba Group

- FUJITEC CO., LTD.

- Aritco Lift AB

- EMAK

- TK Elevator

- Schindler Group

- ESCON Elevators Pvt Limited

- Electra Elevators

- CANNY ELEVATOR CO, LTD.

Recent Developments

-

In October 2025, Otis Korea will acquire Schindler Elevator Company in South Korea to strengthen its local market presence. The move supports Otis’s goal to expand service and modernization offerings in the region. The acquisition is expected to finalize in the fourth quarter of 2025, pending regulatory approval. This strategic step aims to enhance customer service and operational capabilities in South Korea.

-

In August 2025, Otis Worldwide has been awarded a contract to install 76 elevators in a luxury high-rise residential project in Dubai. The project includes Skyrise, Arise, and Gen2 machine-roomless elevators across six towers. Each tower has 71 floors, with elevators reaching speeds up to 6 meters per second. The EMS Panorama™ 2.0 system will enhance efficiency and passenger experience.

Residential Elevators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 58.29 billion

Revenue forecast in 2033

USD 100.79 billion

Growth rate

CAGR of 7.1% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, business, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; Japan; India; Australia; South Africa; Argentina; Brazil; Saudi Arabia; South Africa; UAE

Key companies profiled

Otis Worldwide Corporation; Schindler; KONE Corporation; Hitachi Ltd.; Hyundai Elevator Co., Ltd.; Mitsubishi Electric Corporation; Toshiba Group; FUJITEC Co., Ltd.; Aritco Lift AB; EMAK; TK Elevator; Schindler Group; ESCON Elevators Pvt Limited; Electra Elevators; CANNY Elevator Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Residential Elevators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global residential elevators market report based on type, business, and region.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hydraulic

-

Traction

-

Machine Room-Less Traction

-

Others

-

-

Business Outlook (Revenue, USD Billion, 2021 - 2033)

-

New Equipment

-

Maintenance

-

Modernization

-

-

Region Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global residential elevators market size was estimated at USD 54.61 billion in 2024 and is expected to be USD 58.29 billion in 2025.

b. The global residential elevators market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2033 to reach USD 100.79 billion by 2033.

b. The new equipment segment dominates the residential elevator market and accounted for 47.7% share in 2024 as developers and homeowners invest in modern, customized installations. Growing construction of multi-story and luxury residences drives strong demand. Advanced technologies and design flexibility make new elevators attractive to end users.

b. Some of the key players operating in the residential elevators market include Otis Worldwide Corporation, Schindler, KONE Corporation, Hitachi Ltd., Hyundai Elevator Co., Ltd., Mitsubishi Electric Corporation, Toshiba Group, FUJITEC Co., Ltd., Aritco Lift AB, EMAK, TK Elevator, Schindler Group, ESCON Elevators Pvt Limited, Electra Elevators, and CANNY Elevator Co., Ltd.

b. The residential elevators market is driven by rising urbanization, increasing high-rise and luxury home construction, and growing demand for mobility solutions among aging populations. Advanced technologies and smart home integration further boost adoption. Additionally, higher disposable incomes enable homeowners to invest in comfort and convenience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.