- Home

- »

- Medical Devices

- »

-

Respiratory Syncytial Virus Diagnostics Market Report, 2030GVR Report cover

![Respiratory Syncytial Virus Diagnostics Market Size, Share & Trends Report]()

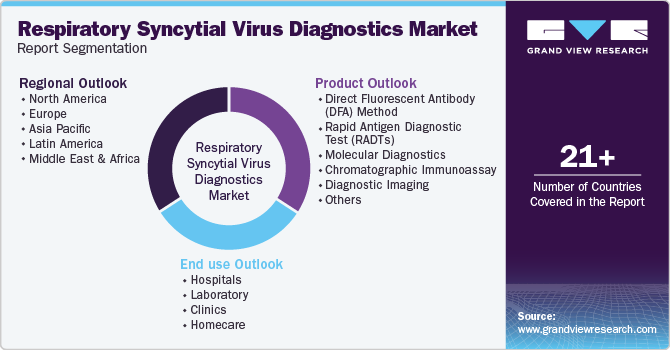

Respiratory Syncytial Virus Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (DFA, RADT, Molecular Diagnostics, Chromatographic Immunoassay), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-680-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

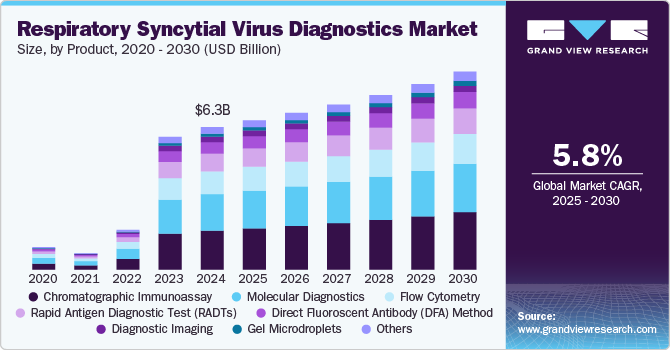

The global respiratory syncytial virus diagnostics market size was estimated at USD 6.27 billion in 2024 and is projected to grow at a CAGR of 5.81% from 2025 to 2030. The growth of the market is attributed to the increasing incidence of respiratory infections, rising neonatal population base, and high demand for in-vitro diagnostics & point of care facilities. Advances in diagnostic technologies, including molecular assays and point-of-care (POC) testing, have enhanced the speed and precision of RSV detection, creating lucrative opportunities for market players. Moreover, government initiatives and funding to combat infectious diseases are further fueling the market's growth.

Respiratory syncytial virus (RSV) is a highly prevalent viral infection, particularly impacting infants, young children, and older adults. Globally, RSV is estimated to cause approximately 33 million acute lower respiratory tract infections annually in children under five years, with over 3 million cases requiring hospitalization. In the U.S., RSV leads to 58,000-80,000 hospitalizations and 100-300 deaths among children under five each year, as well as 60,000-160,000 hospitalizations and 6,000-10,000 deaths among adults aged 65 and older. Seasonal outbreaks typically occur during fall and winter, significantly impacting healthcare systems, and highlighting the critical need for effective diagnostic and preventive measures.

Technological advancements are another critical driver of market growth, as manufacturers focus on developing more sensitive and specific diagnostic tests. Molecular diagnostic methods, such as reverse transcription polymerase chain reaction (RT-PCR), have gained importance for their high accuracy and ability to detect low viral loads. These innovations have boosted RSV diagnostic’s reliability, making them indispensable tools in clinical and research settings. The integration of artificial intelligence (AI) and automation in diagnostics is also expected to streamline workflows and enhance the efficiency of RSV detection.

Growing awareness about the severity and impact of respiratory syncytial virus (RSV) infections, coupled with increasing healthcare spending, is a major driver of market growth. Public health campaigns, educational initiatives, and media coverage have highlighted the risks associated with RSV, particularly for vulnerable populations such as infants and the elderly, prompting a surge in demand for timely diagnostic solutions. Rising healthcare expenditure, especially in developed and emerging economies, has enabled the adoption of advanced diagnostic technologies and infrastructure improvements. Governments and private organizations are investing in research, screening programs, and preventive strategies, further accelerating the integration of RSV diagnostics into routine healthcare practices. This heightened focus on early diagnosis and treatment aligns with the broader shift towards patient-centric and value-based care, boosting the market's growth.

However, the high cost associated with advanced diagnostic technologies, such as molecular assays and point-of-care devices, which can limit their accessibility, particularly in low- and middle-income regions, is one of the major factors restraining the growth of the market. In addition, the lack of standardized testing protocols and inconsistent reimbursement policies in some regions pose challenges to market adoption. Awareness about RSV diagnostics remains low in certain populations, further restricting demand. Moreover, the seasonal nature of RSV outbreaks creates fluctuating demand, making it difficult for manufacturers and healthcare providers to maintain consistent supply chains and resources throughout the year.

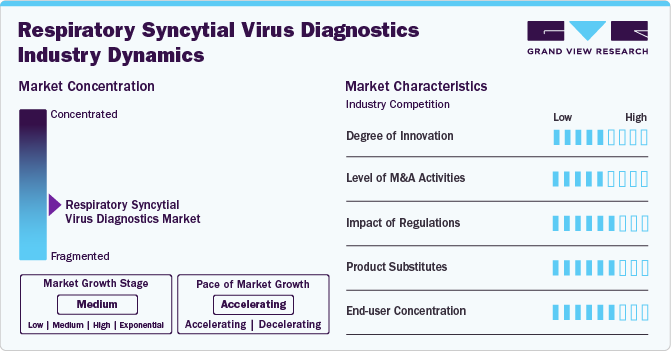

Market Concentration & Characteristics

The degree of innovation in the market is high, as companies continuously develop and introduce more advanced, sensitive, and rapid diagnostic technologies. For example, the use of molecular diagnostics like RT-PCR has significantly improved detection accuracy, while rapid antigen tests and point-of-care (POC) devices enable faster results for timely patient management. Furthermore, the integration of AI and automation into diagnostic workflows has further enhanced the efficiency and accuracy of RSV testing, indicating a strong push for innovation in this space.

The level of mergers and acquisitions (M&A) activities in market is medium. While there have been some strategic acquisitions by major diagnostic companies to strengthen their product portfolios and expand market reach, such as Abbott's acquisition of Alere, the market is not experiencing a high volume of M&A activity. Companies are primarily focusing on organic growth through research and development or partnerships to innovate and capture market share.

The impact of regulation is high, as regulatory bodies such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) play a critical role in ensuring the safety and effectiveness of diagnostic tests. Stringent regulatory requirements can both encourage innovation, by setting high standards, and delay the introduction of new products due to the lengthy approval process.

The threat of product substitutes in the market is low. While other diagnostic tools such as clinical assessment and chest X-rays may assist in diagnosing RSV, they do not provide the same level of specificity and sensitivity as molecular or antigen-based tests. As the demand for accurate and rapid diagnostics continues to grow, specialized RSV tests are unlikely to be easily substituted by other products, making this market relatively shielded from substitute threats.

End user concentration is medium, with hospitals and diagnostic laboratories being the primary users of these diagnostic tests. While these institutions account for the majority of the demand, an increasing number of point-of-care testing devices are being used in clinics and even at home, broadening the customer base. The growing focus on personalized healthcare and at-home diagnostics may slightly reduce the concentration of End users in hospitals, but healthcare institutions will continue to dominate overall demand.

Product Insights

Chromatographic immunoassay segment dominated the market with a share of 27.38% in 2024 and is anticipated to grow at fastest growth rate over the forecast period driven by the widespread adoption for rapid, cost-effective, and reliable testing. These assays, which include lateral flow immunoassays (LFIA), are popular in both clinical and point-of-care settings due to their simplicity, quick turnaround time, and ease of use. Chromatographic immunoassays offer high sensitivity and specificity for detecting RSV antigens, making them particularly valuable for the rapid diagnosis of acute respiratory infections, especially in pediatric and geriatric populations. These tests detect RSV antigens in patient samples, providing results in as little as 15-30 minutes, which is crucial for the timely management of patients. Products such as the BinaxNOW RSV test from Abbott and the Sofia RSV FIA from Quidel are examples of successful chromatographic immunoassay-based diagnostics. These tests have contributed significantly to the market due to their cost-effectiveness compared to molecular assays, making them accessible to a broader range of healthcare providers.

Gel microdroplets segment is expected to register fastest CAGR during the forecast period. The growth of the segment is expected to be driven by their potential to enhance diagnostic sensitivity, accuracy, and scalability. This innovative technology allows for the encapsulation of biological samples in small gel droplets, which can then be analyzed using advanced techniques such as fluorescence or imaging-based detection. The use of gel microdroplets in RSV diagnostics allows for high-throughput screening and multiplexing, enabling the detection of multiple pathogens simultaneously. This capability is particularly valuable in environments with high patient volumes, such as hospitals and diagnostic laboratories.

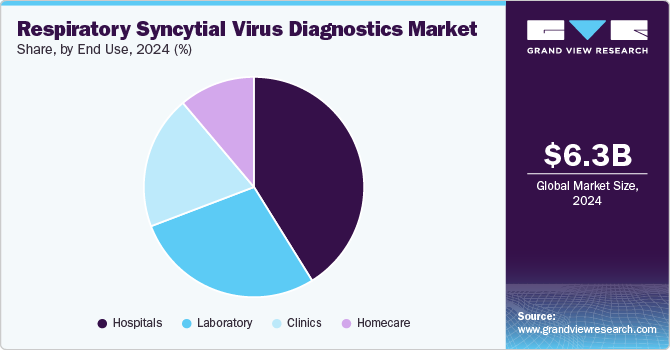

End use Insights

Hospitals segment dominated the market with a share of 41.09% in 2024 and is anticipated to grow at fastest growth rate over the forecast period. The critical role of hospitals in diagnosing and managing severe cases of RSV, especially in vulnerable populations such as infants, the elderly, and immunocompromised individuals, is driving the growth of the segment. Hospitals require high-accuracy and rapid diagnostic tools to ensure timely intervention, often relying on advanced molecular tests and immunoassays to confirm RSV infections and guide treatment decisions. As a result, hospitals continue to represent the bulk of RSV diagnostic revenue, with a strong focus on molecular diagnostics, point-of-care tests, and laboratory-based assays to handle the large volume of cases during seasonal outbreaks.

Homecare segment is expected to grow significantly over the forecast period driven by the increasing availability of over-the-counter (OTC) diagnostic tests and the rising demand for at-home healthcare solutions. With more patients seeking convenient and accessible ways to monitor their health, home testing kits for RSV, often based on rapid antigen testing or simple nasal swabs, are becoming more popular. This trend is particularly evident as parents of young children, who are at higher risk for severe RSV infections, are increasingly opting for home diagnostics to monitor symptoms early. The convenience, affordability, and speed of these at-home testing options are driving significant growth in this segment, contributing to its rapid expansion in the RSV diagnostics market.

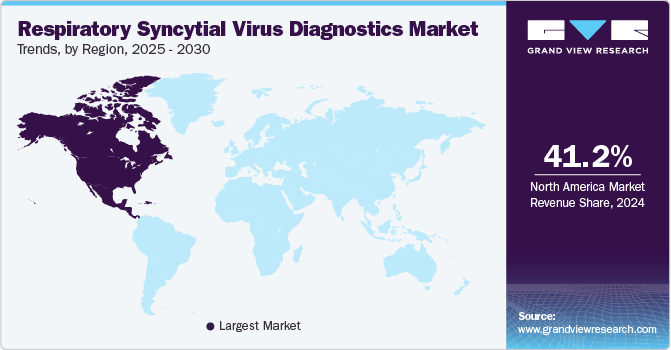

Regional Insights

North America respiratory syncytial virus diagnostics market dominated the market with largest revenue share of 41.18% in 2024. The dominance of the region is attributed to the advanced healthcare infrastructure, high adoption of cutting-edge diagnostic technologies, and significant government and private sector investments in healthcare. Moreover, increasing awareness of the severity of RSV infections, especially in high-risk populations such as infants and the elderly, has led to greater demand for early detection tools, fueling market growth. The growing emphasis on preventive healthcare and the shift toward patient-centric care further contribute to the rising adoption of RSV diagnostics.

U.S. Respiratory Syncytial Virus Diagnostics Market Trends

U.S. RSV diagnostics market is expected to grow over the forecast period due to the increasing incidence of RSV infections, particularly among high-risk populations such as infants and the elderly. The adoption of advanced diagnostic technologies, such as rapid antigen tests and molecular assays, is expanding in hospitals, clinics, and point-of-care settings.

Europe Respiratory Syncytial Virus Diagnostics Market Trends

Europe accounted for a significant share of the market. This can be attributed to the rising awareness of RSV’s impact on vulnerable populations, such as infants and the elderly. Increasing adoption of rapid, cost-effective diagnostic solutions in hospitals and outpatient settings is driving demand.

UK RSV diagnostics market is growing as healthcare providers focus on improving early detection and management of RSV infections, particularly in children and older adults. The adoption of rapid diagnostic tests and point-of-care solutions is increasing in hospitals and clinics.

The France respiratory syncytial virus diagnostics market is expected to grow over the forecast period due to increasing efforts to improve early diagnosis and treatment of RSV infections, especially among infants and the elderly. The adoption of rapid and accurate diagnostic tests, including antigen-based and molecular assays, is expanding in hospitals and healthcare settings.

Germany respiratory syncytial virus diagnostics market in is expected to witness substantial growth supported by a strong healthcare system and increasing awareness of RSV’s impact on vulnerable populations such as infants and the elderly. The demand for advanced diagnostic technologies, including rapid antigen tests and molecular assays, is rising in hospitals and diagnostic labs.

Asia Pacific Respiratory Syncytial Virus Diagnostics Market Trends

The Asia Pacific market is expected to witness the fastest CAGR of over the projected period driven by increasing healthcare investments, rising awareness of RSV infections, and improving diagnostic capabilities. Growing populations, especially in countries such as China and India, are contributing to higher demand for diagnostic solutions in both urban and rural areas. In addition, the adoption of affordable, rapid diagnostic tests and the expansion of healthcare infrastructure are accelerating market growth in the region.

The respiratory syncytial virus diagnostics market in China is expected to grow over the forecast period due to rising healthcare awareness, increasing urbanization, and improving healthcare infrastructure. The demand for rapid, cost-effective diagnostic solutions is expanding, especially in hospitals and clinics.

The respiratory syncytial virus diagnostics market in Japan is expected to grow over the forecast period driven by a strong healthcare system and a focus on early diagnosis of respiratory infections in vulnerable populations.

Latin America Respiratory Syncytial Virus Diagnostics Market Trends

Latin America respiratory syncytial virus diagnostics market was identified as a lucrative region in this industry owing to improving healthcare infrastructure and increasing awareness of RSV infections, particularly in vulnerable populations. As governments invest more in healthcare and diagnostic technologies, demand for affordable and accessible RSV testing is rising.

The respiratory syncytial virus diagnostics market in Brazil is expected to grow over the forecast period. The market has observed high growth in awareness of the virus's impact on vulnerable populations increases, driving demand for accurate diagnostic solutions.

MEA Respiratory Syncytial Virus Diagnostics Market Trends

MEA respiratory syncytial virus diagnostics market was identified as a lucrative region in this industry, fueled by increasing healthcare investments and rising awareness of respiratory infections. Improvements in healthcare infrastructure, particularly in countries such as Saudi Arabia and the UAE, are driving the adoption of advanced diagnostic technologies.

The respiratory syncytial virus diagnostics market in Saudi Arabia is expected to grow over the forecast period, attributed to the increasing healthcare investments and advancements in diagnostic technologies. Rising awareness of respiratory infections, particularly among vulnerable populations like children and the elderly, is driving demand for rapid and accurate RSV testing.

Key Respiratory Syncytial Virus Diagnostics Company Insights

Some of the leading players operating in the market include Abbott Laboratories, Thermo Fisher Scientific, and Quidel Corporation, who are known for their advanced diagnostic solutions and strong market presence. These companies offer a wide range of RSV testing products, from molecular assays to rapid antigen tests, catering to hospitals, diagnostic labs, and point-of-care settings. Abbott’s BinaxNOW and Quidel’s Sofia RSV tests are examples of highly adopted products in the market.

Companies such as BioMérieux, LumiraDx, and Cepheid are gaining traction with their novel diagnostic approaches and point-of-care technologies. BioMérieux’s molecular diagnostics and Cepheid’s GeneXpert system are examples of cutting-edge technologies that offer rapid and accurate RSV detection. These emerging players are leveraging advances in artificial intelligence, automation, and microfluidics to create next-generation diagnostic tools that promise enhanced sensitivity and convenience.

Key Respiratory Syncytial Virus Diagnostics Companies:

The following are the leading companies in the RSV diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- BD (Becton, Dickinson, and Company)

- Novartis AG

- Abbott

- QuidelOrtho Corporation

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- BIOMÉRIEUX

- DiaSorin S.p.A.

- Merck KGaA

- Coris BioConcept

- Siemens Healthcare S.A.

- Quest Diagnostics Incorporated

Recent Developments

-

In October 2024, QIAGEN announced the FDA approval of the QIAstat-Dx Respiratory Panel Mini test, specifically designed to aid clinical decision-making in diagnosing upper respiratory infections in outpatient settings. The test covers five prevalent viral pathogens: influenza A, influenza B, human rhinovirus, respiratory syncytial virus (RSV), and SARS-CoV-2, providing a comprehensive diagnostic solution.

-

In September 2024, Roche Diagnostics received Emergency Use Authorization (EUA) for its cobas Liat SARS-CoV-2, Influenza A/B, and RSV nucleic acid test. This automated multiplex real-time PCR (RT-PCR) assay, designed for use on the cobas Liat system, enables precise and efficient detection of multiple respiratory pathogens.

-

In May 2023, Hologic Inc. announced the FDA approval for its Panther Fusion SARS-CoV-2/Flu A/B/RSV assay, a molecular diagnostic test capable of detecting and differentiating four common respiratory viruses: SARS-CoV-2, influenza A, influenza B, and respiratory syncytial virus (RSV). This assay addresses the challenge of similar clinical symptoms across these viruses, enabling more precise diagnosis and treatment decisions.

Respiratory Syncytial Virus Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.56 billion

Revenue forecast in 2030

USD 8.70 billion

Growth rate

CAGR of 5.81% from 2025 to 2030

Actual data

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

BD (Becton, Dickinson, and Company); Novartis AG; Abbott; QuidelOrtho Corporation; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd.; BIOMÉRIEUX; DiaSorin S.p.A.; Merck KGaA; Coris BioConcept; Siemens Healthcare S.A.; Quest Diagnostics Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Respiratory Syncytial Virus Diagnostics Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global respiratory syncytial virus diagnostics market report based on product, end use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Fluorescent Antibody (DFA) Method

-

Rapid Antigen Diagnostic Test (RADTs)

-

Molecular Diagnostics

-

Chromatographic Immunoassay

-

Gravity Driven Test

-

Oligochromatography (OC)

-

-

Diagnostic Imaging

-

Gel Microdroplets

-

Flow Cytometry

-

Others

-

-

End use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Laboratory

-

Clinics

-

Homecare

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global respiratory syncytial virus diagnostics market size was estimated at USD 6.27 billion in 2024 and is expected to reach USD 6.56 billion in 2025.

b. The global respiratory syncytial virus diagnostics market is expected to grow at a compound annual growth rate of 5.81% from 2025 to 2030 to reach USD 8.70 billion by 2030.

b. Chromatographic immunoassay dominated the respiratory syncytial virus diagnostics market with a share of 27.38% in 2024. This is attributable to the widespread adoption for rapid, cost-effective, and reliable testing.

b. Some key players operating in the respiratory syncytial virus diagnostics market BD (Becton, Dickinson, and Company), Novartis AG, Abbott, QuidelOrtho Corporation, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., BIOMÉRIEUX, DiaSorin S.p.A., Merck KGaA, Coris BioConcept, Siemens Healthcare S.A., Quest Diagnostics Incorporated.

b. Key factors that are driving the respiratory syncytial virus diagnostics market growth include increasing incidence of respiratory infections, rising neonatal population base, and high demand for in-vitro diagnostics & point of care facilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.