- Home

- »

- Electronic Devices

- »

-

RF Interconnect Market Size & Share, Industry Report, 2030GVR Report cover

![RF Interconnect Market Size, Share & Trends Report]()

RF Interconnect Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (RF Cable, RF Cable Assembly), By Frequency (Upto 6GHz, Upto 50GHz, Above 50GHz), By End Use (Aerospace & Defense, Medical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-018-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

RF Interconnect Market Summary

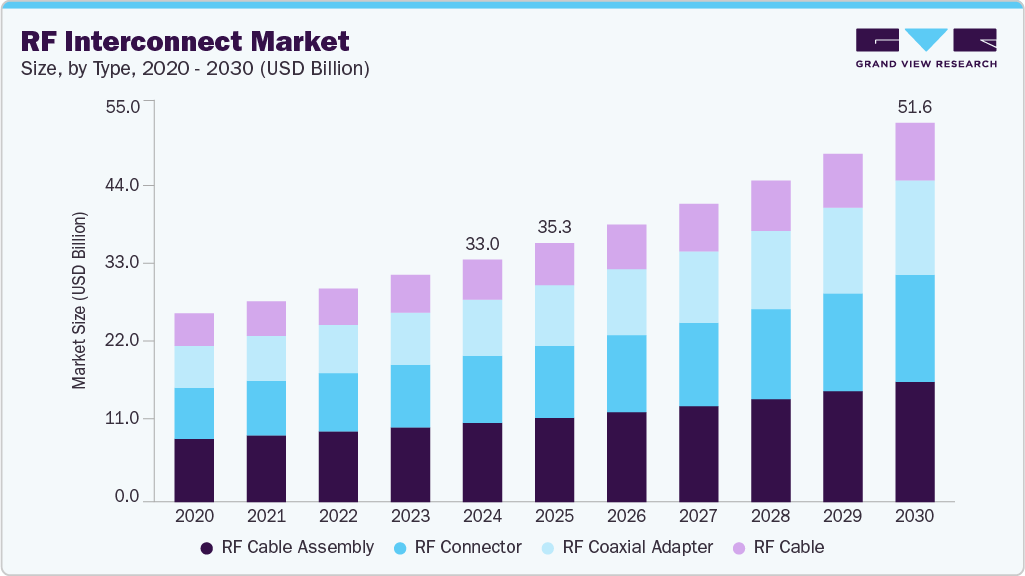

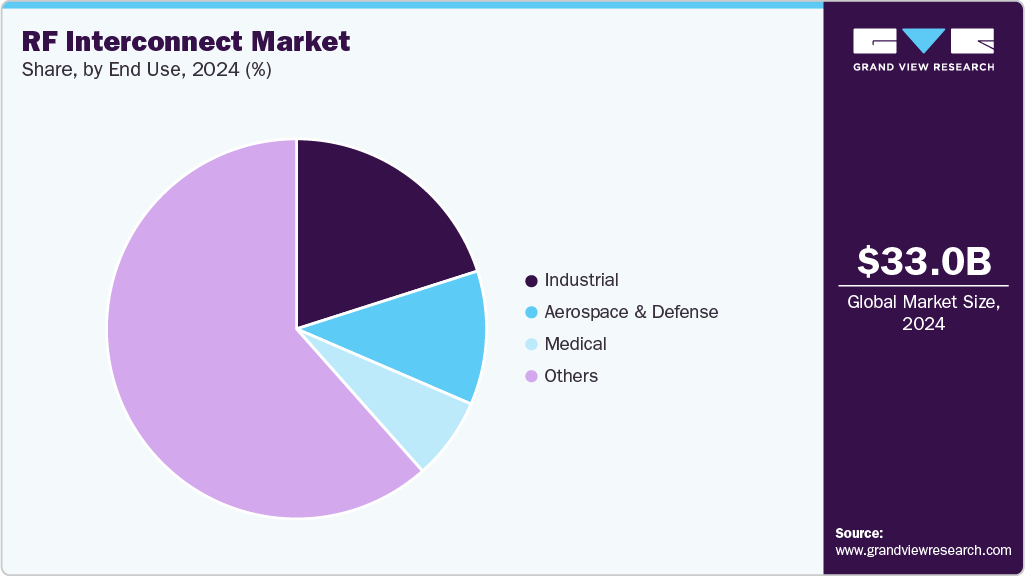

The global RF interconnect market size was valued at USD 33,002.6 million in 2024 and is projected to reach USD 51,640.3 million by 2030, growing at a CAGR of 7.9% from 2025 to 2030. Major factors driving the growth are serving a wide range of industries, including telecommunications, aerospace, defense, medical, and satellite communication.

Key Market Trends & Insights

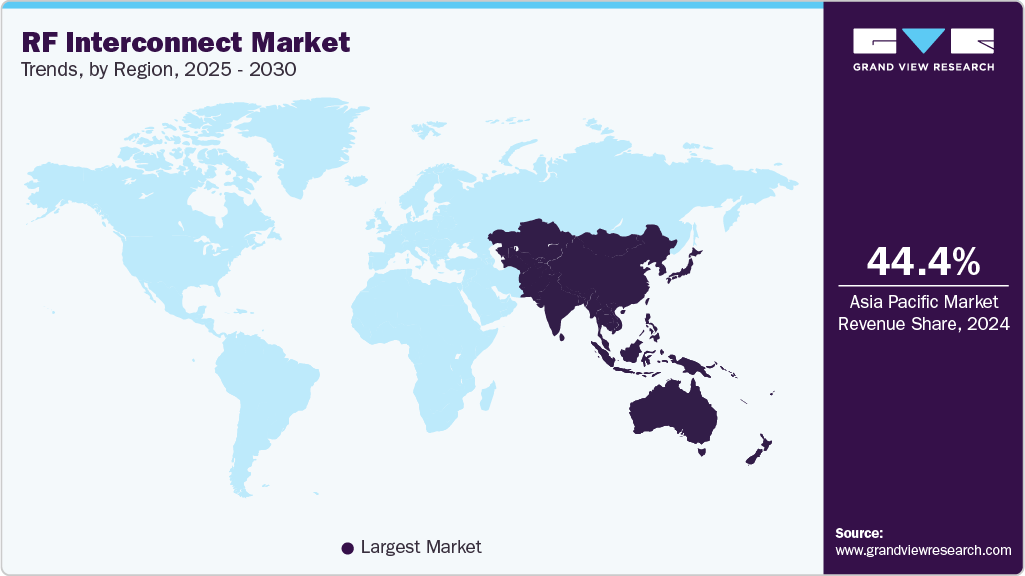

- Asia Pacific dominated the global RF interconnect industry with the largest revenue share of 44.4% in 2024.

- China led the Asia Pacific market and held the largest revenue share in 2024.

- By type, RF cable assembly led the market, holding the largest revenue share of 32.7% in 2024.

- By frequency, up to 50GHz segment held the dominant position in the market and accounted for the leading revenue share of 41.3% in 2024.

- By end use, the industrial segment is expected to grow at the fastest CAGR of 9.1% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 33,002.6 Million

- 2030 Projected Market Size: USD 51,640.3 Million

- CAGR (2025-2030): 7.9%

- Asia Pacific: Largest market in 2024

Their performance is defined by attributes such as low insertion loss, high shielding, mechanical stability, and environmental resistance. As frequency demands increase with the adoption of 5G, interconnect precision efficiency becomes critical. High-power and mission-critical systems often rely on custom-engineered interconnects for secure data transmission.The global RF interconnect market is growing due to the widespread deployment of 5G networks. High-frequency infrastructure requires precise, low-loss signal routing between antennas and radio units. RF interconnects are critical in supporting massive MIMO and beamforming applications in 5G systems. Telecom operators are scaling up small cell installations, boosting demand for compact and high-performance types.

RF interconnects are now required to perform consistently across broader bandwidths and higher data rates. Emerging technologies such as active phased arrays and compact radar systems are increasing system density, which requires smaller, more efficient types. Environmental factors such as vacuum conditions, radiation exposure, and thermal cycling make material selection and mechanical design critical. Regulatory bodies also mandate compliance with standards like MIL-STD, IPC, and RoHS, especially in defense and aerospace. The shift toward modular, software-defined platforms adds pressure to deliver compact, reconfigured interconnect systems.

Furthermore, market participants include global RF type manufacturers, regional suppliers, and specialized contract assemblers. Many companies are investing in R&D to support next-generation telecom, defense, and satellite systems. Strategic collaborations are forming between OEMs and RF specialists to accelerate product development and integration. Government funding for space programs and communication infrastructure continues to drive market expansion. Suppliers are responding by offering localized manufacturing, faster prototyping, and vertically integrated capabilities. Differentiation is shifting toward advanced materials, tighter manufacturing tolerances, and shorter lead times. Companies with diverse products and certifications are preferred for large-scale procurement.

Type Insights

The RF cable assembly segment led the market in 2024, accounting for 32.7% of global revenue, driven by trends for miniaturization and the adoption of advanced materials to address the needs of high-frequency, high-bandwidth applications. The rollout of 5G and the upcoming shift to 6G networks are driving a sharp increase in demand for dependable, high-performance assemblies that can support resilient telecom and IoT infrastructures.To meet these requirements, manufacturers are focusing on innovative designs and material technologies aimed at improving signal integrity, minimizing attenuation, and ensuring compatibility with smaller, next-generation electronic devices. For instance, in June 2024, ConductRF presented its high-performance MIL-STD D38999 and SOSA-compliant VITA 67 cable assemblies at IMS2024 in Washington, DC. These versatile, custom-engineered solutions offer outstanding reliability and signal integrity, making them ideal for military and aerospace applications. With an extensive selection of connectors and cables, ConductRF provides focused assemblies designed to meet stringent environmental and performance demands.

The RF coaxial adapter segment is expected to grow at the fastest CAGR during the forecast period, driven by new technologies that deliver high-frequency, low-loss performance, meeting the escalating demands of 5G, satellite communications, and radar systems. Growing mobile data consumption, the spread of IoT, and the development of smart cities are driving this demand, with miniaturization and high reliability becoming design priorities. The integration of advanced materials such as low-loss dielectrics and high-conductivity metals enhances signal integrity and reduces attenuation, supporting high-performance requirements. Flexibility and customization are increasingly important, enabling cables to adapt to intricate designs and specific industry needs, from robotics to healthcare.

Frequency Insights

The upto 50GHz segment accounted for the largest revenue share in 2024, due to the growth of advanced 5G networks, backhaul communications, radar systems, and the rollout of Wi-Fi 6E/7 technologies operating in the 6 GHz range and beyond. This frequency range is crucial for meeting the higher data rate and bandwidth demands of next-generation wireless and aerospace applications. Industry innovations are centered on creating connectors and cables that deliver low insertion loss and exceptional reliability at these frequencies, as well as automating the production of micro-miniature connectors. Additionally, regulatory initiatives around spectrum sharing and dynamic coordination are influencing adoption, particularly in areas managing the balance between satellite services and unlicensed Wi-Fi use.

The upto 6GHz segment is expected to grow at the fastest CAGR over the forecast period, as it offers unprecedented bandwidth and reduced interference, enabling faster and more reliable wireless connectivity essential for modern high-bandwidth applications. This surge in demand necessitates significant RF interconnect solutions capable of handling higher data rates and supporting advanced Wi-Fi standards like Wi-Fi 6E and Wi-Fi.Prominent initiatives by major players aredriving market expansion. For instance, in February, Anritsu Corporation launched the new software for its Radio Communication Test Station MT8000A, known as NR Licensed 6GHz Band Measurement MX800010A-014, which enables RF testing in the 6 GHz band (5.925 GHz to 7.125 GHz) for 5G Frequency Range 1 (FR1) devices. This enhancement supports the expanded licensed bands introduced in 3GPP Release 17 to address increasing mobile data traffic. Following the World Radio Communication Conference 2023 (WRC-23) agreement, the software facilitates compliance testing in countries deploying 6 GHz licensed bands for 5G FR1.

End Use Insights

The industrial segment is expected to grow at the fastest CAGR as the automation, IoT, and smart manufacturing continue to expand to support dependable wireless communication and sensor networks in demanding environments such as oil and gas, manufacturing, and energy. There is a growing need for strong, high-frequency RF cables and connectors that can endure extreme temperatures, vibration, and corrosive conditions. Moreover, the adoption of Industry 4.0 technologies is driving demand for high-speed, low-latency data transmission, a key advantage of RF interconnects. Market trends are also being influenced by regulatory requirements and the push for scalable, adaptable solutions, positioning industrial applications as a major growth area for RF interconnect technologies.

The medical segment is anticipated to grow at a significant CAGR during the forecast period, driven by the trend of miniaturizing interconnect components for developing more efficient, compact, and reliable medical devices that enhance diagnostics, monitoring, and treatment. Miniaturized connectors play a vital role in improving the performance and patient comfort of various applications, including MRI machines, implantable devices like pacemakers, wearable health monitors, portable diagnostic tools, and minimally invasive surgical instruments. These smaller, high-quality interconnects enable better signal transmission, reduced power consumption, and greater device portability, all of which contribute to improved healthcare outcomes. As medical technology continues to evolve with a focus on safety and precision, the demand for innovative, miniaturized RF interconnect solutions is driving significant growth in this sector.

Regional Insights

North America RF interconnect industry held a revenue share of 23.5% in 2024, driven by the strong focus on expanding high-speed internet infrastructure and rolling out 5G networks, which require RF interconnect solutions capable of handling higher data rates and frequencies. Additionally, new oil and gas projects across North America are expanding the need for strong RF communication systems that can operate in harsh environments. The other drivers for this market are partnership and collaboration between the companies for a strong focus on the RF interconnectors. For instance, in November 2023, Amphenol Corporation acquired Q Microwave, a designer and producer of mission-critical RF components, strengthening its harsh environment solutions segment. Q Microwave is known for its RF filters and subsystems, particularly for military and space applications. This acquisition merges Amphenol’s extensive global presence with Q Microwave’s specialized technical capabilities, aiming to advance RF solutions.

U.S. RF Interconnect Market Trends

The RF interconnect market in the U.S. is expected to grow significantly, driven due to the strong aerospace and defense sectors, as they require dependable, high-performance RF interconnects for critical operations. Moreover, continuous innovation and R&D in wireless technologies and electronics drive the creation of specialized RF solutions to meet emerging connectivity demands. The rising use of satellite communications and the use of IoT devices further demand the need for interconnect technologies.

Europe RF Interconnect Market Trends

The RF interconnect market in Europe is witnessing steady growth over the forecast period,due to the growing need for high-frequency, high-performance connectivity across key sectors like defense, aerospace, and telecommunications.European industries depend on solutions such as GORE Microwave/RF Assemblies, known for their exceptional flexibility, low loss, and consistent phase and amplitude performance up to 70 GHz, which enable dependable long-distance signal transmission while minimizing downtime from cable failures. Furthermore, the rising need for rugged, vapor-sealed, and compact interconnects addresses challenges related to limited installation space, extreme temperatures, vibration, and contamination frequently encountered in European aerospace and defense environments. Together, these factors fuel the demand for advanced RF interconnect products that offer mission-critical reliability, improved system performance, and adherence to strict regional regulations.

Asia Pacific RF Interconnect Market Trends

The RF interconnect market in Asia Pacific is anticipated to register a significant CAGR over the forecast period, driven by the rapid growth of the telecommunications sector in the region. Higher smartphone usage and expanding internet connectivity are substantially increasing the demand for RF interconnect solutions. Additionally, rising investments in manufacturing plants, digital infrastructure, and construction projects are supporting market expansion. The extreme automotive industry, along with the growing use of IoT and wireless communication technologies, is also accelerating the need for dependable RF interconnect components.

For instance, in May 2024, Corning Incorporated, operating in APAC, introduced a gold-plated plastic microwave connector, using Corning Gilbert POLYLINK technology, at IMS 2024. It provides a lightweight, flexible, and cost-effective option for telecommunications and aerospace applications, with reliable performance up to 26.5 GHz. POLYLINK connectors are up to 33% lighter than conventional beryllium copper interconnects and benefit from shorter manufacturing lead times.

Key RF Interconnect Companies Insights

Key players operating in the RF interconnect market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key RF Interconnect Companies:

The following are the leading companies in the RF interconnect market. These companies collectively hold the largest market share and dictate industry trends.

- Amphenol RF

- Corning Incorporated

- Flann Microwave Ltd.

- HUBER+SUHNER

- Radiall

- Samtec

- Rosenberger

- Smith’s Interconnect

- W. L. Gore & Associates, Inc.

- ETL Systems Ltd

Recent Developments

-

In July 2025, Amphenol RF introduced new FAKRA to SMA adapters designed to facilitate seamless integration between automotive FAKRA systems and SMA-based RF devices. These precision-engineered, durable adapters offer a high-performance solution that ensures secure and reliable signal transmission across various demanding applications, thereby enhancing connectivity within automotive and RF environments.

-

In February 2025, Samtec appointed TTI, Inc. Europe, as an authorized global distributor for its full range of cables and connectors. This partnership enables TTI, Inc., to leverage its extensive international supply chain and inventory management expertise to deliver Samtec's high-performance connector, cable, and fiber optic products to electronic manufacturers worldwide.

-

In July 2024, Radiall, a prominent player in the design and manufacture of advanced interconnect solutions, introduced a new SP8T coaxial switch operating at 40 GHz. Available in both terminated and non-terminated configurations, these switches feature SMA 2.9 mm connectors, complementing Radiall’s existing portfolio of 40 GHz switches and addressing high frequency switching requirements in demanding RF and microwave applications.

RF Interconnect Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 35,265.8 million

Revenue forecast in 2030

USD 51,640.3 million

Growth rate

CAGR of 7.9% from 2025 to 2030

Base year for estimation

2024

Actual data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, frequency, end use, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil and Mexico; KSA; UAE; South Africa

Key companies profiled

Amphenol RF; Corning Incorporated; Flann Microwave Ltd.; HUBER+SUHNER; Radiall; Samtec; Rosenberger; Smith’s Interconnect; W. L. Gore & Associates, Inc.; ETL Systems Ltd

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

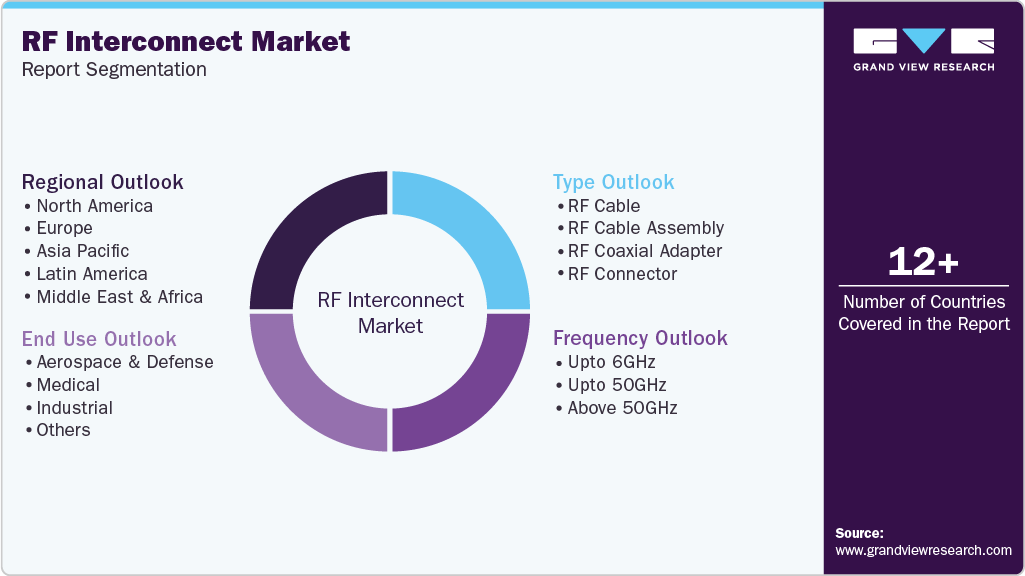

Global RF Interconnect Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global RF interconnect market report based on the type, frequency, end use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

RF Cable

-

RF Cable Assembly

-

RF Coaxial Adapter

-

RF Connector

-

-

Frequency Outlook (Revenue, USD Million, 2017 - 2030)

-

Upto 6GHz

-

Upto 50GHz

-

Above 50GHz

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Aerospace & Defense

-

Medical

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.