- Home

- »

- Semiconductors

- »

-

RF Test Equipment Market Size And Share Report, 2030GVR Report cover

![RF Test Equipment Market Size, Share & Trends Report]()

RF Test Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Type Of Equipment (Oscilloscopes, Signal Generators), By Frequency Range, By Form Factor, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-294-2

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

RF Test Equipment Market Summary

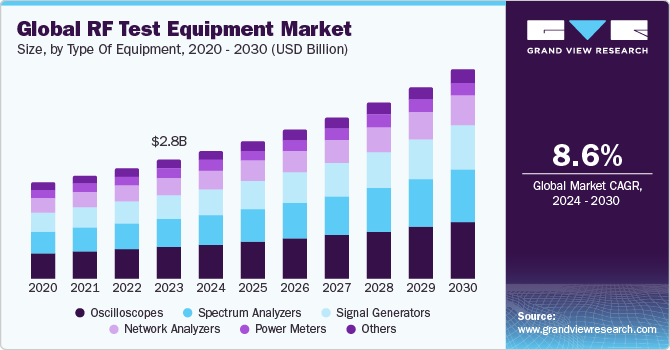

The global RF test equipment market size was estimated at USD 2,763.1 million in 2023 and is projected to reach USD 4,875.5 million by 2030, growing at a CAGR of 8.6% from 2024 to 2030. The market encompasses devices and tools used for testing and measuring radio frequency (RF) signals.

Key Market Trends & Insights

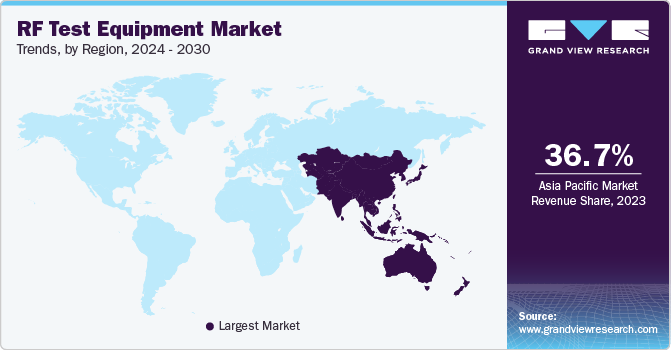

- The Asia Pacific RF test equipment market held the largest revenue share at 36.7% in 2023.

- By type of equipment, the oscilloscopes segment held the largest revenue share of over 27.0% in 2023.

- By frequency, the 1 GHz-6 GHz segment held the largest revenue share of over 29.0% in 2023.

- By form factor, the benchtop segment held the largest revenue share of over 47.0% in 2023.

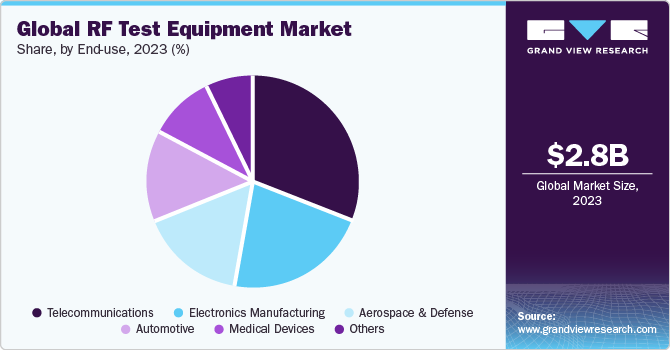

- By end use, the telecommunication segment held the largest revenue share of over 31.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,763.1 Million

- 2030 Projected Market Size: USD 4,875.5 Million

- CAGR (2024-2030): 8.6%

- Asia Pacific: Largest market in 2023

These instruments are critical in the design, manufacturing, and maintenance of various electronic devices that operate within the RF spectrum, including telecommunications equipment, consumer electronics, automotive systems, aerospace, and defense applications.

RF Test Equipment includes oscilloscopes, signal generators, spectrum analyzers, network analyzers, power meters, and frequency counters, each serving specific testing functions to ensure devices meet required specifications and standards.

The market is set to experience significant growth due to several driving factors that are boosting demand and technological advancement in this field. Key contributors include the widespread deployment of 5G technology, the increasing complexity of RF devices, the global expansion of telecommunications networks, and the burgeoning consumer electronics market, among others.

The introduction of 5G networks is a major catalyst for the RF test equipment industry. This new generation of mobile technology offers faster speeds, lower latency, and the capability to connect a higher number of devices simultaneously. Such advancements necessitate comprehensive testing to ensure that both devices and networks perform efficiently across various frequency bands, including sub-6GHz and mmWave frequencies. The intricate requirements and high-performance standards of 5G drive the need for advanced RF testing solutions to effectively manage and optimize network performance, thereby increasing the demand for radio frequency equipment.

The market is poised for substantial growth due to several key driving factors. The deployment of 5G technology is a significant catalyst, requiring comprehensive testing solutions to ensure efficient performance across various frequency bands, including sub-6GHz and mmWave frequencies. This demand is driven by the need for faster speeds, lower latency, and increased connectivity provided by 5G networks.

Increasing complexity in RF devices, spurred by the rise of the Internet of Things (IoT), smart cities, and autonomous vehicles, also necessitates advanced RF testing to ensure reliability and performance in complex environments. In addition, the global expansion of telecommunications networks, including 4G LTE and 5G, further boosts the need for RF test equipment as operators strive to optimize and troubleshoot network performance.

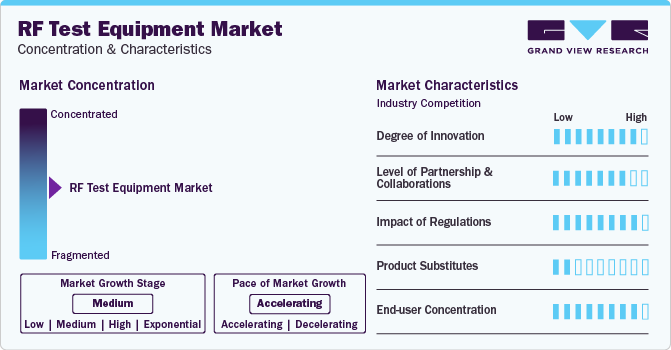

Market Concentration & Characteristics

The market for RF test equipment is characterized by a high degree of innovation. Continuous advancements in wireless communication technologies, such as 5G and beyond, drive the need for more sophisticated testing equipment. Innovations include the development of software-defined radios, automated test solutions, and remote testing capabilities. Companies like Keysight Technologies and Rohde & Schwarz are at the forefront, consistently introducing new products and features that enhance testing precision and efficiency.

The market witnesses a moderate level of partnerships and collaboration activities. Companies often partner with telecommunications providers, research institutions, and component manufacturers to develop integrated solutions that meet evolving industry needs. Collaborations also occur through consortiums and industry standard bodies to ensure interoperability and compliance with new wireless technologies. However, most major players still focus heavily on in-house development and proprietary technologies.

Regulation has a significant impact on the market. Regulatory bodies like the Federal Communications Commission (FCC) in the US and the European Telecommunications Standards Institute (ETSI) have set stringent standards for RF emissions and device performance. Compliance with these regulations is mandatory, driving the need for advanced testing equipment to ensure products maintain required standards. This regulatory environment ensures market stability but also imposes high compliance costs on manufacturers.

The threat of substitutes in the market is low. The specialized nature of RF testing, which requires precise and reliable measurements, means that few alternative products can match the performance of dedicated RF test equipment. While general-purpose test equipment exists, it lacks the specificity and accuracy needed for RF applications, making dedicated RF test solutions indispensable for industries relying on wireless technologies.

The market has a high concentration of end-users, particularly in sectors such as telecommunications, consumer electronics, aerospace, defense, and automotive. These industries rely heavily on RF testing to ensure their products meet stringent performance and safety standards. For instance, the telecommunications sector requires extensive RF testing for network infrastructure and devices, while the defense sector depends on RF test equipment for radar and communication systems. This concentration of end-users underscores the critical importance of RF test equipment across various high-tech industries.

Type of Equipment Insights

The oscilloscopes segment dominated the target market with the largest revenue share of more than 27.0% in 2023. Oscilloscopes dominate the market due to their unparalleled precision and versatility in signal analysis. These devices are essential for visualizing and diagnosing the behavior of electrical signals in various applications. Oscilloscopes can measure voltage over time, detect anomalies, and provide a comprehensive view of signal waveforms, making them indispensable in developing and troubleshooting RF circuits and systems. Their ability to handle a wide range of frequencies and signal types ensures their broad applicability across multiple industries, including telecommunications, automotive, aerospace, and consumer electronics.

Moreover, continuous investments in research and development by major companies ensure that oscilloscopes remain at the forefront of technological innovation. This relentless focus on improving performance and adding new features aligns with the growing complexity of RF systems and the increasing demand for advanced testing solutions. Consequently, oscilloscopes are poised to maintain their dominant position in the market, supported by their critical role in ensuring the reliability and performance of modern electronic systems.

The spectrum analyzers segment is expected to register the fastest CAGR of 9.7% over the forecast period. The demand for spectrum analyzers is projected to grow significantly, driven by the rapid adoption and expansion of wireless communication technologies. With the ongoing rollout of 5G networks and the burgeoning Internet of Things (IoT) ecosystem, there is an increasing need to analyze and optimize the RF spectrum efficiently. Spectrum analyzers are crucial in identifying, characterizing, and mitigating issues related to signal interference, bandwidth allocation, and spectrum efficiency, which are essential for the reliable performance of these advanced wireless systems.

Frequency Insights

The 1 GHz-6 GHz segment dominated the market with a revenue share of more than 29% in 2023. Primarily, the widespread adoption of wireless communication technologies, including 5G, Wi-Fi, and Bluetooth, drives demand for RF test equipment operating within this frequency range. The rollout of 5G networks worldwide further accelerates this trend, as radio frequency test equipment in the 1 GHz-6 GHz spectrum is essential for testing 5G infrastructure and devices. In addition, the rapid expansion of the Internet of Things (IoT) ecosystem and the proliferation of connected devices contribute to the segment's growth, necessitating RF testing across various frequency bands. Moreover, the electronics manufacturing industry relies heavily on RF test equipment within this range to ensure the quality and performance of RF components used in consumer electronics, automotive, aerospace, and defense applications. The 1 GHz-6 GHz segment's dominance is fueled by the convergence of technological advancements, industry trends, and growing market demand for RF testing solutions tailored to modern wireless communication systems and connected devices.

The more than 20 GHz segment is expected to register the fastest CAGR of 10.1% over the forecast period. The proliferation of mmWave technology, especially in 5G networks and automotive radar systems, is propelling demand for RF test equipment capable of operating at higher frequencies. As 5G networks evolve, the importance of mmWave frequencies above 20 GHz for high-speed, low-latency connectivity in urban areas is becoming increasingly evident. Furthermore, applications in automotive, aerospace, and wireless backhaul sectors are driving the need for RF testing at these frequencies. Advanced driver-assistance systems (ADAS) and satellite communications, among others, require precise testing of components operating above 20 GHz. Technological advancements are also playing a crucial role, enabling the development of RF test equipment with enhanced capabilities for high-frequency testing. Market trends such as the demand for high-speed data transmission, IoT expansion, and the deployment of advanced wireless infrastructure further bolster the growth prospects of this segment.

Form Factor Insights

The benchtop segment dominated the market in 2023 with a revenue share of more than 47%. The dominance of the benchtop segment is due to its superior performance, versatility, and reliability. These benchtop instruments offer high accuracy and multifunctionality, integrating signal generation, analysis, and power measurements in a single unit. Their ease of use, seamless integration with other equipment, and durable construction make them ideal for demanding applications in industries like telecommunications and aerospace. Continuous technological advancements, such as improved frequency range and measurement speed, further bolster their dominance. In addition, the growing demand in emerging markets and the ability of manufacturers to offer customized solutions contribute to the segment's growth. Overall, benchtop radio frequency test equipment stands out as a preferred choice for professionals seeking precise, efficient, and comprehensive testing solutions for RF and wireless applications.

The modular segment is expected to register the fastest CAGR of 9.9% over the forecast period due to its customizable, cost-effective, and space-efficient nature. Modular equipment allows users to build flexible test systems tailored to their needs, reducing upfront costs and maximizing space utilization. Continuous technological advancements, such as improved performance and connectivity options, further drive the adoption of modular solutions. Standardization efforts and interoperability initiatives promote seamless integration of modular components from different manufacturers. In addition, the rise of software-defined instruments and the demand for test automation in Industry 4.0 environments contribute to the growth of the modular segment. Overall, modular RF test equipment offers versatile, scalable, and interoperable solutions to meet evolving testing requirements across industries.

End-use Insights

The telecommunication segment dominated the target market with a revenue share of more than 31.0% in 2023. The rapid expansion of telecommunication networks, including the deployment of 5G technology, fuels demand for RF test equipment to ensure network reliability and performance. Increasingly complex telecommunication systems incorporating advanced technologies like MIMO and carrier aggregation necessitate sophisticated RF testing solutions. The proliferation of IoT and connected devices further amplifies the need for RF test equipment to verify RF performance and connectivity. In addition, the COVID-19 pandemic has accelerated the adoption of remote and virtual testing solutions, driving demand for cloud-based and software-defined testing platforms. Collectively, these trends underscore the vital role of radio frequency test equipment in the telecommunication sector and its continued dominance in the market.

The aerospace & defense segment is expected to grow at the fastest CAGR of 9.9% over the forecast period. Rising defense budgets globally are driving investment in modernization efforts and military readiness, fueling demand for radio frequency test equipment for the development, testing, and maintenance of defense systems. In addition, the increasing adoption of electronic warfare systems, advancements in aerospace technologies, and the proliferation of satellite communication systems contribute to the segment's growth. The rapid expansion of unmanned systems and the need for secure communication systems further bolster demand for radio frequency test equipment in aerospace and defense applications. Technological advancements in RF technology continue to drive innovation in radio frequency test solutions, enhancing performance, functionality, and automation capabilities to meet evolving testing requirements. Overall, these trends underscore the critical role of radio frequency test equipment in ensuring the reliability, performance, and security of RF systems in aerospace and defense applications.

Regional Insights

The RF test equipment market in North America is fueled by the region's leadership in technological innovation, particularly in telecommunications, aerospace, and defense. It propels the demand for advanced testing solutions. Expansion of telecommunications infrastructure, defense spending, and electronics manufacturing leadership further bolster market growth. Emerging industries like smart cities and IoT contribute to the increasing demand for RF testing solutions. Regulatory compliance requirements and the push for test automation drive innovation and adoption of RF test equipment. Overall, the regional market benefits from a diverse range of sectors requiring rigorous testing to ensure performance, reliability, and compliance with standards.

U.S. RF Test Equipment Market Trends

The market in the U.S. held the largest revenue share of more than 77% in 2023 and is experiencing substantial growth. Technological innovation across industries such as telecommunications, aerospace, and defense has fueled the demand for advanced testing solutions. The expansion of telecommunications infrastructure and defense spending underscores the need for reliable RF testing equipment. The U.S. leadership in electronics manufacturing drives demand for quality assurance in RF components and devices. Emerging industries like smart cities and IoT contribute to the growing demand for RF testing solutions. Regulatory compliance requirements and the push for test automation further propel market growth. Overall, the U.S. market benefits from a diverse range of sectors requiring rigorous testing to ensure performance, reliability, and compliance with standards.

Asia Pacific RF Test Equipment Market Trends

The RF test equipment market in Asia Pacific asserted its dominance in 2023, capturing the largest revenue share at 36.7%. Rapid growth in telecommunications infrastructure, driven by increasing mobile phone penetration and 5G network deployment, fuels demand for RF testing solutions. The region's prominence in electronics manufacturing, particularly in countries like China, Japan, South Korea, and Taiwan, further boosts demand for RF test equipment to ensure quality control in production processes. The expansion of the automotive electronics market, emerging aerospace and defense sector, and rise of IoT and smart manufacturing initiatives contribute to market growth. In addition, government initiatives, the growing consumer electronics market, and technological advancements bolster the region's competitiveness in the market. Overall, Asia Pacific's leading position is underpinned by its robust industrial base, technological expertise, and strong demand across various industries for RF testing solutions.

The China RF test equipment market is experiencing robust growth, driven by several key factors. Rapid expansion of telecommunications infrastructure and a booming electronics manufacturing industry fuel demand for radio frequency test equipment to ensure quality and compliance. Government initiatives and investments in technological innovation further drive market growth across strategic industries such as telecommunications, aerospace, and defense. Expansion of the automotive electronics market and the rise of IoT and smart manufacturing initiatives contribute to the increasing demand for RF testing solutions. In addition, continuous technological advancements and innovation in RF technology drive the adoption of advanced radio frequency test equipment in China. Overall, the market in China benefits from a strong industrial base, government support, and the country's position as a global leader in technology and manufacturing.

Europe RF Test Equipment Market Trends

The radio frequency test equipment market in Europe is experiencing growth driven by several factors. Continuous investment in telecommunications infrastructure and the automotive industry's expansion contribute significantly to demand. In addition, investments in aerospace and defense sectors, advancements in wireless technologies, and stringent regulatory requirements drive market growth. Europe's focus on research and development further fuels innovation in radio frequency test solutions. Moreover, the adoption of automated testing solutions enhances efficiency and reduces testing costs. The Europe market benefits from a diverse range of sectors requiring rigorous testing to ensure compliance, performance, and reliability.

The UK radio frequency test equipment market is experiencing growth driven by several factors. Investments in telecommunications infrastructure and automotive electronics are key drivers, alongside aerospace and defense investments. The UK's focus on advancing wireless technologies and adherence to stringent regulatory requirements also shape market dynamics. Moreover, research and development efforts contribute to innovation in radio frequency test solutions, while demand for test automation and efficiency drives technological advancements.

Key RF Test Equipment Company Insights

Some of the key companies in the RF test equipment industry include Keysight Technologies Inc. and Anritsu Group.

-

Keysight Technologies is a leading provider of electronic design and test solutions, offering a wide range of radio frequency test equipment and instruments. The company serves various industries, including telecommunications, aerospace, defense, automotive, and electronics manufacturing. Keysight is known for its continuous innovation in redotest solutions, leveraging advanced technologies to meet evolving customer requirements. The company invests heavily in research and development to develop cutting-edge instruments with improved performance, accuracy, and reliability.

-

Anritsu is a leading global provider of test and measurement solutions, offering a wide range of radio frequency equipment and instruments. The company caters to diverse industries, including telecommunications, aerospace, defense, automotive, and semiconductor manufacturing. Anritsu has a strong global presence and serves customers in over 90 countries through a network of subsidiaries, distributors, and representatives. The company's reputation for quality, reliability, and customer support has established it as a trusted provider of radio frequency solutions worldwide.

Tektronix, and Rohde & Schwarz are some of the emerging market companies in the target market.

-

Tektronix is a well-established company known for its expertise in test and measurement solutions. While traditionally recognized for oscilloscopes, Tektronix has expanded its portfolio to include radio frequency equipment catering to various industries. Tektronix's competitive advantage lies in its decades-long experience in the test and measurement industry, combined with a commitment to innovation and customer satisfaction. The company's comprehensive product portfolio and global support network position it as a preferred choice for RF testing needs.

-

Rohde & Schwarz is one of the leading providers of test and measurement solutions, with a strong focus on RF and microwave technologies. The company offers a wide range of radio frequency equipment tailored to meet the needs of various industries.Rohde & Schwarz has a strong presence in key markets worldwide, serving customers in the telecommunications, aerospace, defense, automotive, and semiconductor industries. The company's reputation for quality and innovation has established it as a trusted partner for RF testing solutions.

Key RF Test Equipment Companies:

The following are the leading companies in the rf test equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Keysight Technologies Inc.

- Anritsu Group

- Rohde & Schwarz

- Tektronix

- Teledyne Technologies Incorporated

- National Instruments

- Yokogawa Electric Corporation

- Siemens

- EXFO Inc.

- Giga-Tronics Incorporated

- Cobham PLC

- VIAVI Solutions Inc.

- Fortive

- Chroma ATE Inc.

- Atlantic Microwave Ltd

- B&K Precision Corporation

Recent Developments

-

In February 2024, Anritsu Corporation introduced the latest NR Licensed 6GHz Band Measurement MX800010A-014 software for its MT8000A Radio Communication Test Station. This system now provides support for RF tests in the 6 GHz band (5.925 GHz to 7.125 GHz) intended for 5G FR12 devices. This enhancement comes in response to the extension announced in December 2023, which raised the upper-frequency limit for licensed bands operating on 5G Frequency Range 1 (FR1). Previously, licensed bands were limited to below 6 GHz, but with the introduction of 3GPP Release 17, these bands have been expanded to 7.125 GHz. This adjustment aims to accommodate the increasing volume of mobile, Wi-Fi, and other wireless traffic operating within these bands.

-

In July 2023, Keysight Technologies, Inc. is broadening its FieldFox lineup with the introduction of the latest N9912C FieldFox Handheld Analyzer. This software-defined radio frequency (RF) testing platform presents field engineers with over 20 options for vector network analyzer (VNA), cable and antenna tester (CAT), and spectrum analyzer (SA) capabilities that can be upgraded or downloaded. Field engineers regularly perform maintenance and troubleshoot RF, microwave, and millimeter-wave (mmWave) systems.

-

In June 2023, Keysight Technologies, Inc. unveiled its PathWave Test Executive for Manufacturing Developer Version, which now offers automated RF calibration and verification testing for Autotalks' cellular vehicle-to-everything (LTE V2X) and dedicated short-range communications (DSRC) chipsets. These chipsets are commonly deployed in telematics control units (TCU), which serve as embedded onboard systems managing wireless tracking, diagnostics, and communication for connected vehicles.

RF Test Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,974.8 million

Revenue forecast in 2030

USD 4,875.5 million

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type of equipment, frequency, form factor, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Keysight Technologies Inc., Siemens, EXFO Inc., Giga-Tronics Incorporated, Cobham PLC, VIAVI Solutions Inc., Anritsu Group, Rohde & Schwarz, National Instruments, Fortive, Chroma ATE Inc., Yokogawa Electric Corporation, Atlantic Microwave Ltd, B&K Precision Corporation, Tektronix, Teledyne Technologies Incorporated,

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global RF Test Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global RF test equipment market report based on type of equipment, frequency range, form factor, end-use, and region.

-

Type of Equipment Outlook (Revenue, USD Million, 2017 - 2030)

-

Oscilloscopes

-

Signal Generators

-

Spectrum Analyzers

-

Network Analyzers

-

Power Meters

-

Others

-

-

Frequency Range Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 1 GHz

-

1 GHz-6 GHz

-

7 GHz-20 GHz

-

More than 20 GHz

-

-

Form Factor Outlook (Revenue, USD Million, 2017 - 2030)

-

Bench Top

-

Portable

-

Modular

-

Rackmount

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecommunications

-

Aerospace & Defense

-

Electronics Manufacturing

-

Automotive

-

Medical Devices

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global RF test equipment market size was estimated at USD 2,763.1 million in 2023 and is expected to reach USD 2,974.8 million in 2024

b. The global RF test equipment market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 4,875.5 million by 2030

b. Asia Pacific asserted its dominance in 2023, capturing the largest revenue share at 36.7%. Rapid growth in telecommunications infrastructure, driven by increasing mobile phone penetration and 5G network deployment, fuels demand for RF testing solutions.

b. Some key players operating in the RF test equipment market include Keysight Technologies Inc., Siemens, EXFO Inc., Giga-Tronics Incorporated, Cobham PLC, VIAVI Solutions Inc., Anritsu Group, Rohde & Schwarz, National Instruments, Fortive, Chroma ATE Inc., Yokogawa Electric Corporation, Atlantic Microwave Ltd, B&K Precision Corporation, Tektronix, and Teledyne Technologies Incorporated among others.

b. Factors such as the continuous evolution of wireless technologies such as 5G, Wi-Fi 6, and IoT (Internet of Things), rapid expansion of telecommunication networks, rising complexity of RF designs, and growth in aerospace and defense sector are driving the growth of the RF test equipment market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.