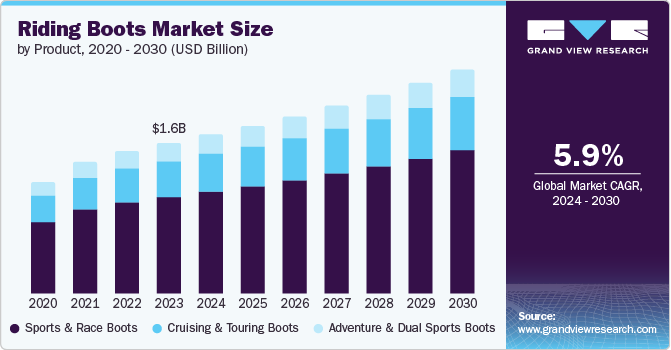

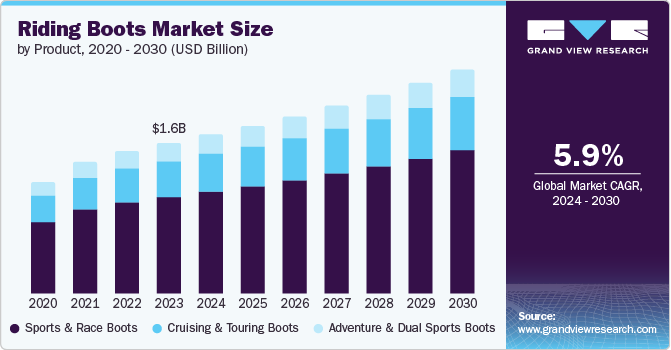

Riding Boots Market Size & Trends

The global riding boots market size was valued at USD 1.62 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. The growth of the riding boots market is expected to be driven by increasing safety awareness among millennials and professional motorcycle riders. The market is projected to expand further due to the rising adoption of riding gear for road trips, adventure touring, and professional championships. Additionally, the increasing concerns about road traffic injuries globally are expected to drive the demand for riding boots in the coming years.

The increasing participation and enthusiasm for motorcycle racing and high-performance riding have fueled the demand for specialized riding boots designed to optimize performance, safety, and agility. Similarly, the expanding demographic of motorcycle enthusiasts, including long-distance riders and touring fans, has driven the demand for comfortable, supportive, all-weather cruising and touring boots.

Riding boots have transcended their utilitarian roots to become fashionable, particularly in urban and suburban settings. Their sleek, sophisticated design and association with equestrian elegance appeal to fashion-forward consumers seeking footwear that blends style with functionality. This trend is evident in the proliferation of riding-inspired boots in high-end fashion collections and the adoption of riding boots as everyday wear by celebrities and influencers.

Product Insights

Sport & race boot dominated the market and accounted for a market revenue share of 64.2% in 2023. Sport bikes and racing motorcycles emphasize speed and performance, with the safety of the rider as the top priority. Sports and racing boots incorporate durable materials, adding advanced elements such as shin guards and ankle protection, and including shock-absorbing soles to safeguard riders in accidents. This emphasis on safety aligns well with increased knowledge of motorcycle safety measures, prompting more riders to focus on wearing appropriate protective equipment.

The cruising & touring boots segment is expected to register the fastest CAGR of 6.2% during the forecast period. Cruising and touring boots address needs such as waterproofing and durable ankle support and are built with insulation for handling various weather conditions. For instance, in September 2021, Royal Enfield collaborated with TCX to launch CE Certified protective riding and lifestyle shoes. The collection includes five products catering to the diverse needs of men and women riders. They combine everyday comfort with high levels of protection, ensuring safety without sacrificing comfort for extended wear. Ultimately, increasing disposable income in certain areas enables riders to purchase specialized gear for their preferred riding style, driving the expansion of the market.

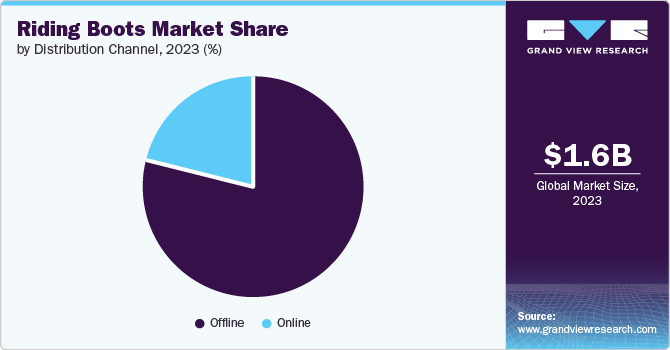

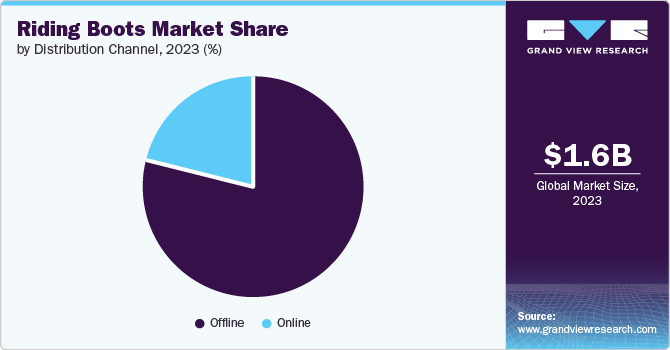

Distribution Channel Insights

The offline segment accounted for the largest market revenue share in 2023. Offline retail allows consumers to try on boots and assess their fit, comfort, and style in person. This hands-on experience is significant for riding boots, where fit and functionality are paramount to ensure safety and performance while riding. The ability to physically inspect and compare different brands and models contributes to consumer confidence and satisfaction, driving sales through offline channels.

The online distribution channel is expected to register the fastest CAGR during the forecast period. The increasing consumer preference for the convenience of online shopping has significantly fueled the growth of the online distribution channel for riding boots. With the rise of e-commerce platforms and the proliferation of online marketplaces, consumers can easily browse and purchase a wide variety of riding boots from the comfort of their homes, eliminating the need to visit physical stores.

Regional Insights

The North America riding boots market held a substantial market revenue share in 2023. Equestrian sports such as show jumping, dressage, eventing, and rodeo enjoy widespread popularity, with many participants ranging from amateurs to professionals. As riders engage in these disciplines, the need for specialized riding boots that offer comfort, durability, and performance-enhancing features becomes essential, thereby driving demand in the market.

U.S. Riding Boots Market Trends

The U.S. riding boots market is anticipated to grow significantly over the forecast period. The growth of the riding boots market in the U.S. is driven by the enduring appeal of equestrian-inspired fashion, the influence of outdoor and adventure lifestyles, the fusion of traditional craftsmanship with modern design, the emphasis on sustainable and ethical footwear choices, and the evolving gender-neutral and unisex fashion trends.

Europe Riding Boots Market Trends

The Europe riding boots market accounted for the largest market revenue share of 33.0% in 2023. Consumers are increasingly seeking versatile and trendy footwear options that can be worn casually and formally. Riding boots, with their classic design and aesthetic appeal, have gained popularity as a fashion statement among consumers, driving the market's growth in the region.

The UK riding boots market is expected to grow rapidly in the coming years. Fashion and lifestyle trends have played a pivotal role in propelling the growth of the riding boots market. The rise of outdoor-inspired fashion has led to a surge in the adoption of riding boots as a stylish and versatile footwear choice. Consumers are increasingly drawn to riding boots' rugged yet sophisticated aesthetic, making them a sought-after fashion staple for both urban and rural settings.

Asia Pacific Riding Boots Market Trends

The Asia Pacific riding boots is anticipated to register the fastest CAGR over the forecast period. The growing affluence and urbanization in the Asia Pacific contribute to expanding the riding boots market. As disposable incomes rise and lifestyles become more Westernized, there is an increasing interest in outdoor recreational activities.

China riding boots market held a substantial market share in 2023. With the expansion of e-commerce platforms and retail networks in China, it has become easier for consumers to access a wider variety of products, including riding boots. This accessibility has made it more convenient for enthusiasts to purchase specialized gear, further driving market growth.

Key Riding Boots Company Insights

Some of the key companies in the global riding boots market include Alpinestars S.p.A, LeMans Corporation, Dainese S.p.A, FOX, FLY Racing, and GAERNE USA. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Alpinestars S.p.A is an Italian manufacturer of safety equipment for motorsports and action sports. They offer a wide range of specialized products for various motorsports and outdoor activities, including MotoGP, motocross, motorcycling, Formula One, World Rally Championship, WEC, V8 Supercars, and NASCAR. Additionally, the company provides custom riding boots for various riders and activities.

-

LeMans Corporation provides a diverse selection of riding boots designed to meet the demands of different riding styles and preferences. Their riding boots are crafted with high-quality materials to ensure durability, comfort, and protection for riders.

Key Riding Boots Companies:

The following are the leading companies in the riding boots market. These companies collectively hold the largest market share and dictate industry trends.

- Alpinestars S.p.A

- LeMans Corporation

- Dainese S.p.A

- FOX

- FLY Racing

- Gaerne Spa

- TCX S.r.l.

- Horze

- Parlanti Roma

- Tattini Boots

Recent Developments

-

In March 2023, Gaerne Spa launched the new Gaerne SG.22 Off-Road boots for the motocross and enduro riding community. These boots boast a range of innovative features and endorsements from top riders and teams. It incorporates the Gaerne Dual Stage Pivot System 1.0, which provides ankle support with two limit switches to effectively limit hyperflexion, hyperextension, and lateral movements.

Riding Boots Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 1.72 billion

|

|

Revenue forecast in 2030

|

USD 2.42 billion

|

|

Growth Rate

|

CAGR of 5.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, distribution channel, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Germany, UK, Italy, China, India, Brazil.

|

|

Key companies profiled

|

Alpinestars S.p.A, LeMans Corporation, Dainese S.p.A, FOX, FLY Racing, Gaerne Spa, TCX S.r.l., Horze, Parlanti Roma, Tattini Boots.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

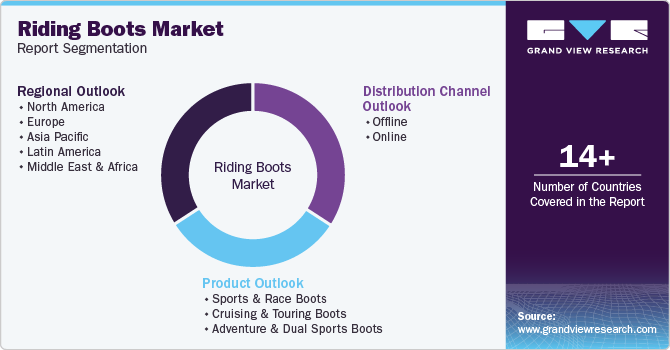

Global Riding Boots Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global riding boots market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)