- Home

- »

- Medical Devices

- »

-

Rigid Laparoscopes Market Size, Industry Report, 2033GVR Report cover

![Rigid Laparoscopes Market Size, Share & Trends Report]()

Rigid Laparoscopes Market (2025 - 2033) Size, Share & Trends Analysis Report By Surgery Type, By Angle of View, By Product Dimension, By Product Length, By Surgical Center Size, By Surgical Center Location, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-763-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - NULL

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rigid Laparoscopes Market Summary

The global rigid laparoscopes market size was estimated at USD 1.67 billion in 2024 and is projected to reach USD 2.46 billion by 2033, growing at a CAGR of 4.35% from 2025 to 2033. The rising acceptance of minimally invasive procedures and patient preferences for quicker recovery and shorter hospital stays are driving the market for rigid laparoscopes.

Key Market Trends & Insights

- North America rigid laparoscopes market dominated global market in 2024 and accounted for the largest revenue share of 44.15%.

- The U.S. dominated the rigid laparoscopes market in North America region in 2024.

- Canada rigid laparoscopes market is anticipated to register the fastest growth rate during the forecast period.

- In terms of surgery type segment, the general surgery segment held the largest revenue share in 2024.

- In terms of angle of view segment, the 30°segment held the largest revenue share in 2024.

- In terms of product dimension segment, the 4-5.9 mm segment held the largest revenue share in 2024.

- In terms of product length segment, the standard/long length scopes (30-35 cm) segment held the largest revenue share in 2024.

- In terms of surgical center size segment, the large (300+ beds) segment held the largest revenue share in 2024.

- In terms of surgical center location segment, the metropolitan segment held the largest revenue share in 2024.

- In terms of end use segment, the hospitals segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.67 Billion

- 2033 Projected Market Size: USD 2.46 Billion

- CAGR (2025-2033): 4.35%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Expanding healthcare infrastructure in emerging markets and government investments in surgical training programs fuel demand, creating strong momentum for global market growth. The primary driver of the rigid laparoscopes market is the increasing preference for minimally invasive procedures. Surgeons and patients favor these techniques due to smaller incisions, reduced post-operative pain, and faster recovery times. This trend is particularly strong in general surgery, gynecology, and urology, where laparoscopic interventions are gradually replacing traditional open procedures. In August 2024, AKTORmed GmbH’s SOLOASSIST IID / DEXTER Endoscope Arm cleared by the FDA, allowing surgeons to use this rigid laparoscope system in minimally invasive procedures such as cholecystectomy, appendectomy, and thoracic or urologic interventions.

The market is growing owing to continuous improvements in optics, digital integration, and ergonomics. The advancement of high-definition imaging, fluorescence-guided visualization, and single-use laparoscopes is increasing surgical precision and patient safety. Integration with digital platforms and robotic-assisted systems is further expanding the clinical utility of rigid laparoscopes, encouraging adoption in advanced healthcare centers. In July 2025, the Surgical Endoscopy journal highlighted advancements in laparoscopic surgery, focusing on robotic-assisted platforms that improve surgeon dexterity, visualization, and precision. These systems integrate 3D optics, multi-arm instruments, and semi-autonomous controls to enhance minimally invasive procedures.

Growing investments in healthcare infrastructure, particularly in Asia-Pacific, Latin America, and the Middle East drive demand for this market. Programs for minimally invasive surgery are being supported by governments through funding, hospital modernization, and surgeon training. This expanding infrastructure, combined with rising surgical volumes, is opening new growth opportunities for both global and regional manufacturers. In September 2024, Munich-based medtech startup Symphera raised USD 2.6 million in seed funding to advance its innovative laparoscopic device, which automates tool-switching at the push of a button, aiming to simplify surgery and improve patient outcomes.

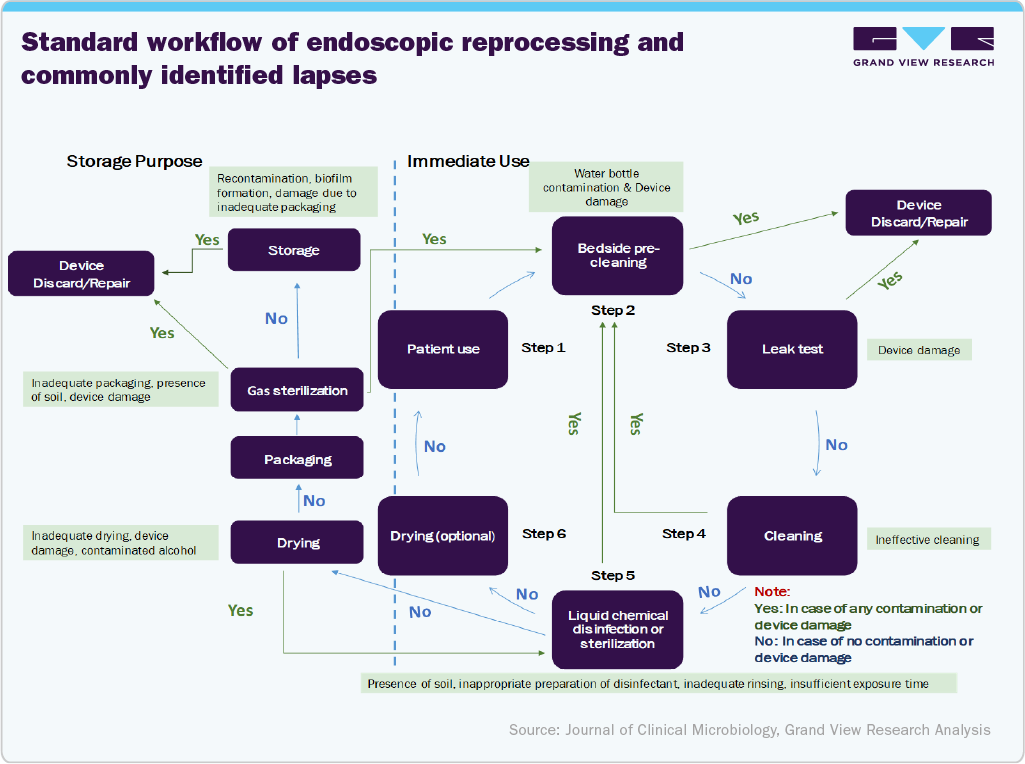

Analysis of Reprocessing Costs of Laporoscopes

Rigid laparoscopes must be reprocessed in order to stop the spread of infections. To preserve device performance and guarantee patient safety, it entails meticulous cleaning, high-level disinfection or sterilization, and appropriate storage. Strict adherence to these procedures also lowers procedural risks and prolongs the instruments' lifespan.

Fluorescence imaging

Fluorescence imaging combines high-definition optics and fluorescent markers that highlight particular tissues or structures. This technology improves surgical visualization in rigid laparoscopes. In laparoscopic operations, this method enables surgeons to more accurately identify lesions, blood vessels, or inflammatory areas, increasing precision, lowering complications, and promoting better patient outcomes.

-

Enhanced Visualization: High-definition and 4K rigid laparoscopes combined with fluorescence provide clearer, more accurate imaging of internal organs during laparoscopic procedures.

-

Wide-Field Imaging: Advanced rigid scopes enable deeper tissue visualization and real-time intraoperative assessment, supporting procedures in bariatric, gynecologic, and general surgery.

-

Molecular Targeting: Fluorescence molecular laparoscopy (FML) uses probes that bind to specific biomarkers, improving detection of (pre)malignant or inflamed tissues.

-

Improved Precision: This technology enhances surgical accuracy compared with conventional white-light laparoscopy.

-

Ongoing Innovation: Research continues on disease-specific probes to increase sensitivity and specificity for targeted surgical applications.

Pricing Analysis

In minimally invasive surgery (MIS), rigid laparoscopes are vital instruments due to they give surgeons precise access to the abdominal and pelvic cavities for high-definition visualization. They are extensively utilized in bariatric procedures, urology, gynecology, and general surgery. To accommodate different surgical procedures, each laparoscope is made with precise lengths, diameters, viewing angles, and working channels. Technical requirements, specific surgical applications, and the expenses of high-precision manufacturing such as optics and German stainless steel components are the main factors influencing pricing.

Price range of Rigid Endoscopes

Pricing Determinants

A. Design Complexity & Procedure-Specific Customization

-

Surgical use-case: The superior German optics, integrated chip-on-tip imaging, and enhanced light intensity found in laparoscopes used for sophisticated procedures such as bariatric, gynecologic, or robotic-assisted abdominal surgeries result in higher costs.

-

Diameter and length: Rigid laparoscopes with a narrow diameter (<3 mm) or extra length (≥35 cm) are more costly because they require precise engineering and optical alignment.

B. Material & Build Quality

-

Optics: High-definition rod lens systems with scratch-resistant sapphire windows increase production costs.

-

Construction: German stainless steel or titanium construction ensures durability and corrosion resistance, adding to the price.

C. Reusability & Sterilization Tolerance

- Laparoscopes that are rigid are made to be used repeatedly. Long-term dependability in surgical settings is ensured by pricing that corresponds to the number of sterilization cycles they can withstand without experiencing mechanical failure or optical degradation.

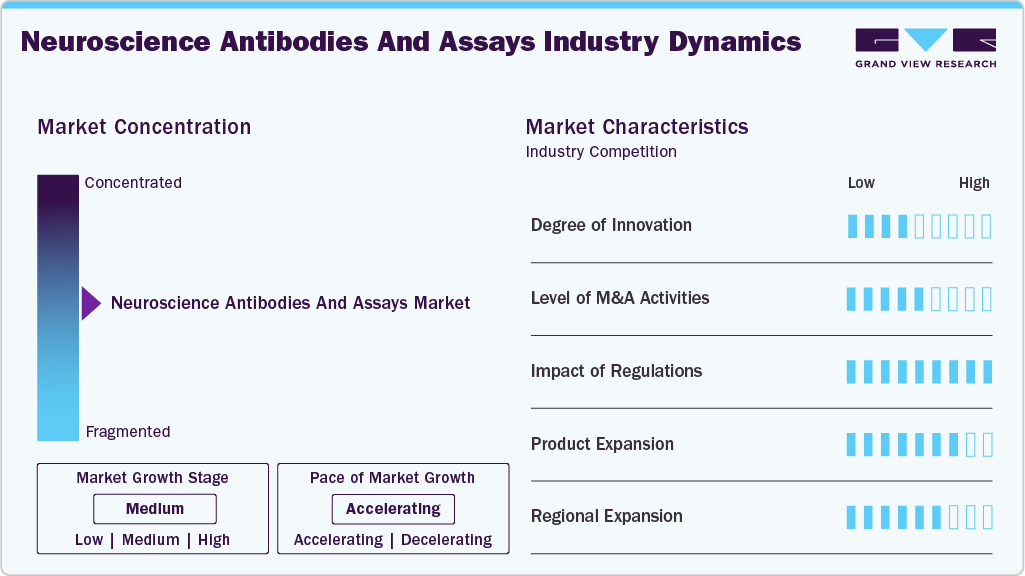

Market Concentration & Characteristics

The degree of innovation in the rigid laparoscopes market is medium. It is driven by small gains in optics, ergonomics, and digital features, seen in HD imaging, fluorescence guidance, and single-use scopes. Clinical precision is being improved through cooperation between software developers and optics experts, although adoption remains constrained by cost sensitivity and workflow integration issues.

Mergers and acquisitions in the rigid laparoscopes industry are at a moderate level. It focuses on specialized innovators who have developed special laparoscopic instruments, imaging tools, or optics. These strategic actions are intended to advance technology and broaden regional reach. Licensing partnerships and co-development agreements complement M&A activity, allowing larger players to test innovations before complete acquisition and maintaining a controlled growth trajectory.

Regulations have a high impact on the rigid laparoscopes market. Sterilization, optical safety, and device durability are governed by strict standards in every region. These frameworks promote both device dependability and patient safety. They create a high barrier to entry by increasing compliance costs and prolonging development timelines. It takes dedicated expertise to navigate complicated regulatory environments, and businesses with a strong global compliance infrastructure have an edge when it comes to product launches and market access.

Product expansion within the rigid laparoscopes market is medium. It is primarily focused on product line enhancements. Manufacturers are improving diameter options, viewing angles, and integration with advanced imaging systems, while bundling with complementary surgical equipment to increase value. In September 2022, a study published in Sensors highlighted a fully insertable, tetherless robotic laparoscopic camera (s-CAM) that enables surgeons to achieve multi-quadrant visualization with 4 degrees of freedom.

Regional expansion in the rigid laparoscopes market is high. Regional expansion in the rigid laparoscopes market is high. It is fueled by rising minimally invasive surgical adoption in Asia-Pacific, Latin America, and the Middle East. Global players are leveraging localized manufacturing, training initiatives, and distribution partnerships to capture emerging demand. The expansion of surgical training initiatives and public investments in the health care system facilitate market acceptance.

Surgery Type Insights

By surgical type, general surgery segment dominated the market with the largest revenue share of 19.36% in 2024. The extensive use of laparoscopic techniques for operations such as cholecystectomy, appendectomy, and hernia repair is what has led to this dominance. Constant demand is still driven by high procedural volumes and well-established clinical protocols. In July 2023, in a review of the uptake and clinical results of novel robotic platforms in general surgery, Medicina (Kaunas) demonstrated their viability for use in a variety of procedures and specialties across the globe.

The bariatric segment is anticipated to grow at the fastest CAGR over the forecast period. Market growth is fueled by increasing obesity rates, greater patient awareness, wider adoption of minimally invasive weight-loss surgeries, and technological advances in imaging and laparoscopic tools that enhance safety and outcomes. In January 2024, a review of developments in bariatric surgery was published in the Journal of Personalized Medicine. It focused on robotic and laparoscopic techniques and using rigid laparoscopes to increase surgical accuracy and results.

Angle of View Insights

By angle of view, the 30°segment dominated the market with the largest revenue share of 38.29% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. It is favored because it can be used for standard laparoscopic procedures and offers clear visualization with simpler instrument manipulation. Due to its widespread surgeon familiarity and compatibility with most laparoscopic instruments, the segment is frequently used as the default option in operating rooms. Devices such as the Olympus 5 mm 30° Rigid Laparoscope are widely used in hospitals and ambulatory centers, supporting general surgery and gynecologic procedures with precise visualization.

The 45°segment is anticipated to grow at the significant CAGR over the forecast period. The primary factors driving its adoption are advanced HD imaging, ergonomic design, angled visualization requirements, and the growing demand for complex surgeries with improved outcomes. With its enhanced light distribution and decreased glare, for example, the Olympus 5 mm 45° Laparoscope allows for dynamic orientation in robotic and thoracoscopic setups without the need for frequent repositioning.

Product Dimension Insights

By product dimension, the 4-5.9 mm segment dominated the market with the largest revenue share of 30.65% in 2024. Its balance of image quality and accessibility supports demand, making it appropriate for a variety of laparoscopic procedures. This size is preferred by hospitals and surgical facilities owing to its adaptable, manageable, and compatible with common laparoscopic tools. For instance, the Olympus 5 mm 30° and 45° rigid laparoscopes and Stryker's autoclavable 5 mm HD scope are a part of this segment. Their broad utility spans various laparoscopic procedures.

The 2-3.9 mm segment is anticipated to grow at the fastest CAGR over the forecast period. Growth is fueled by pediatric and minimally invasive procedures requiring ultra-thin scopes for smaller incisions and faster recovery. Adoption is supported by the rising demand for scarless surgery and procedures in anatomically restricted areas. For instance, The HOPKINS rigid laparoscope 0°, 2 mm, 26 cm from Karl Storz GmbH & Co. KG provides 2D rod-lens imaging and precise visualization for minimally invasive bariatric surgery.

Product Length Insights

By product length, the standard/long length scopes (30-35 cm) segment dominated the market with the largest revenue share of 35.69% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The ease of handling and procedural versatility of this length make it the preferred length for both general and bariatric surgeries. This length is preferred by surgeons as it is stable and can support the majority of abdominal and pelvic procedures without reducing visibility. The Olympus 33 cm 5 mm 30° laparoscope, Karl Storz GmbH & Co. KG 30 cm bariatric telescopes, and Stryker 35 cm HD rigid scopes are used in multi-specialty MIS.

The extra-long scopes (> 35 cm) segment is anticipated to grow at the significant CAGR over the forecast period. Demand is driven by complex procedures requiring extended reach and stability within the abdominal cavity. Growth is further supported by increasing adoption of specialized bariatric and oncologic laparoscopic surgeries that require deeper access. Notable rigid laparoscopes include bariatric and robotically compatible 38-45 cm scopes, with Stryker and Karl Storz GmbH & Co. KG offering models featuring integrated camera heads, fluorescence guidance, and articulated sheaths for longer minimally invasive procedures.

Surgical Center Size Insights

By surgical center size, the large (300+ beds) segment dominated the market with the largest revenue share of 41.84% in 2024. Specialized surgical teams, high procedural volumes, and complex facilities support this dominance in this industry. Higher investment capacity also helps these centers as it enables the integration of advanced imaging systems and the purchase of high-end laparoscopic equipment. These organizations have long-standing equipment partnerships with vendors such as Olympus Corporation, Karl Storz GmbH & Co. KG, and Stryker, who frequently combine scopes with visualization towers and service agreements.

The medium (100-299 beds) segment is anticipated to grow at the fastest CAGR over the forecast period. Rising investments in laparoscopic equipment and expanding facilities that can perform minimally invasive surgery are the main drivers of growth. Government programs, hospital modernization initiatives, and growing surgical awareness in regional cities all support expansion. They generally require 4-5.9 mm autoclavable scopes in standard lengths (30-35 cm), with angled optics (30°, 45°) being the preferred choice across most MIS procedures.

Surgical Center Location Insights

By surgical center location, the metropolitan segment dominated the market with the largest revenue share of 47.77% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Its dominance is supported by the concentration of innovative medical services and the availability of highly qualified surgeons. Higher procedural volumes and ongoing demand are due to patients' preference for complex procedures in urban areas. With the U.S., Germany, and the UK driving growth, metropolitan centers are leaders in rigid laparoscopes across specialties such as bariatrics, gynecology, and urology. These centers have adopted 4K/3D, robotic-integrated, and chip-on-tip systems.

The suburban segment is anticipated to grow at the significant CAGR over the forecast period. Growing use of minimally invasive procedures and better access to healthcare in secondary cities are among the primary drivers of expansion. In these areas, investments in advanced surgical facilities and educational initiatives are speeding up market penetration. These centers prefer standard-diameter (4-5.9 mm) autoclavable scopes with moderate shaft lengths and viewing angles of 30° or 45°.

End Use Insights

By end use, the hospitals segment dominated the market with a revenue share of 42.90% in 2024. Higher procedure volumes, well-appointed operating rooms, and skilled surgical teams are contributing factors for this. In order to maintain their dominant position in the market, hospitals also invest in the latest laparoscopic technologies and training initiatives. Major OEMs such as Olympus Corporation, Karl Storz GmbH & Co. KG, and Stryker often supply hospital chains under capital bundles or service contracts, which include replacement cycles, scope tracking systems, and integrated video towers.

The outpatient facilities segment is expected to grow at the fastest rate during the forecast period. Growth is supported by the rise of ambulatory surgery centers and the shift toward cost-effective, minimally invasive procedures. Increasing patient preference for outpatient care and quicker recovery is driving adoption, especially for routine laparoscopic interventions. Laparoscopic procedures, specifically those involving bariatric, orthopedic, and oncologic surgeries, increasingly incorporate advanced imaging technologies such as 4K, 3D, and fluorescence guidance.

Regional Insights

North America dominated the rigid laparoscopes market with a revenue share of 44.15% in 2024. Established regional R&D competencies, a high utilization rate of minimally invasive surgeries, and an efficient healthcare infrastructure all contribute to this dominance. In addition, the growing awareness of laparoscopic procedures among patients and healthcare providers is leading to the establishment of market leadership. In April 2023, Xenocor, a Utah-based medical device company, raised USD 10 million to launch its Saberscope, a single-use, HD, fog-free, articulating laparoscope cleared by the FDA.

U.S. Rigid Laparoscopes Market Trends

The U.S. dominated the rigid laparoscopes market in North America region in 2024. The presence of leading medical device manufacturers, high surgical volumes, and early adoption of advanced laparoscopic technologies drives it. Favorable reimbursement policies and growing demand for outpatient and minimally invasive surgeries also contribute to growth. In April 2025, a Medical Science Educator article described an inexpensive homemade laparoscope designed for medical education. This allows students to study abdominal anatomy and fundamental laparoscopic procedures without paying for expensive commercial laparoscopic towers.

Europe Rigid Laparoscopes Market Trends

The rigid laparoscopes market in Europe is expected to grow significantly over the forecast period. Increased use of minimally invasive procedures, improvements in imaging technology, and growing hospital infrastructure contribute to growth. The market is further supported by increased funding for surgeon education initiatives and regulatory backing for the latest medical technology. In March 2024, Tonglu Kanger Medical Instrument Co. showcases its German stainless steel rigid endoscopes for laparoscopy, featuring multiple diameters, lengths, and angles to enhance surgical precision and versatility.

The rigid laparoscopes market in the UK is expected to grow significantly during the forecast period. It is supported by the rising demand for laparoscopic and outpatient procedures. Market expansion is driven by government initiatives to modernize healthcare facilities and a growing emphasis on lowering hospital stays. In May 2024, the expansion of Surgical Holdings' (UK) rigid endoscope repair services was emphasized. It focused on quality control and device maintenance to guarantee surgical accuracy and dependability.

The Germany rigid laparoscopes marketis expected to witness growth over the forecast period. High procedure volumes, a well-established healthcare system, and a strong emphasis on using technology in surgical practices are some of the primary driving forces. In September 2025, a political leader visited SCHÖLLY in Germany, exploring its 3D visualization systems and laparoscopes. The discussion focused on reducing bureaucracy, supporting innovation, and strengthening Germany’s role in global medical technology.

Asia Pacific Rigid Laparoscopes Market Trends

The Asia Pacific rigid laparoscopes industry is expected to register the fastest growth rate over the forecast period. The region's growth is fueled by rising surgical volumes, awareness of minimally invasive procedures, and increasing healthcare costs. Government initiatives and the rapid expansion of hospitals in China, South Korea, and India further accelerate demand. In April 2025, to improve minimally invasive surgical capabilities in the area, the Administrator General of Tamil Nadu donated an advanced laparoscopy system with a high-definition camera to Kanniyakumari Government Medical College and Hospital.

China rigid laparoscopes market is anticipated to register considerable growth during the forecast period. Growth is driven by expanding hospital infrastructure, increasing medical tourism, and rising adoption of laparoscopic surgeries across tertiary and secondary care facilities. In December 2022, Researchers at the University of Science and Technology of China and City University of Hong Kong developed a data-driven system to automate laparoscope adjustment in robotic surgery.

The rigid laparoscopes market in Japanis expected to witness rapid growth. An aging population is driving demand, strict procedural guidelines, and the use of the latest laparoscopic technology in medical facilities. In February 2022, a Japanese team developed the world’s first 8K rigid laparoscope, offering unprecedented resolution for laparoscopic procedures. This device makes tiny nerves and blood vessels clearly visible and enables safer, more precise surgeries.

Latin America Rigid Laparoscopes Market Trends

The Latin America rigid laparoscopes industry is anticipated to witness considerable growth over the forecast period. Growth is fueled by rising investments in healthcare infrastructure, increasing minimally invasive surgical procedures, and expanding awareness of laparoscopic benefits. In January 2025, MicroPort MedBot’s Toumai laparoscopic surgical robot received market approval from Brazil’s ANVISA, marking a milestone in robotic-assisted laparoscopic surgery in Latin America.

Brazil rigid laparoscopes marketis anticipated to register considerable growth during the forecast period. Rising procedural volumes, government support for modernizing healthcare facilities, and adopting advanced imaging technologies drive market expansion. In October 2024, Purple Surgical officially launched in Brazil at the 72nd Congress of Coloproctology, introducing its rigid laparoscopes and other advanced laparoscopic instruments, surgical staplers, and trocars to the local market.

Middle East and Africa Rigid Laparoscopes Market Trends

The Middle East and Africa rigid laparoscopes market is anticipated to witness considerable growth over the forecast period. Growing private hospital networks, awareness of minimally invasive surgery, and rising healthcare spending contribute to growth. In August 2022, Robotica published an article reviewing robotic technologies for laparoscopic surgery. The article covered handheld devices, positioning robots, surgeon-console systems, and training platforms, and highlighted surgical precision and dexterity improvements.

Saudi Arabia rigid laparoscopes market is anticipated to register considerable growth during the forecast period. Government programs to enhance surgical results, expanding healthcare infrastructure, and a growing emphasis on minimally invasive procedures in public and private hospitals are some of the driving factors of this industry. In November 2024, Fujifilm Middle East expanded in Saudi Arabia through MoUs with healthcare providers, endoscopy training programs, and AI-driven screening centers aligned with Vision 2030.

Key Rigid Laparoscopes Company Insights:

Key participants in the rigid laparoscopes industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Rigid Laparoscopes Companies:

The following are the leading companies in the rigid laparoscopes market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- Arthrex, Inc.

- Stryker Corporation

- Karl Storz GmbH & Co. KG

- Smith+Nephew

- CONMED Corporation

- Lepu Medical Technology (Beijing) Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Fujifilm Healthcare Americas

- SCHÖLLY FIBEROPTIC GMBH

Recent Developments

-

In September 2025, World Laparoscopy Hospital performed laparoscopic sleeve gastrectomy with endoscopic calibration, enhancing surgical precision and minimizing complications for safer long-term outcomes.

-

In September 2025, SCHÖLLY launched its new 10 mm NIR FI laparoscopes under the FLEXISTAGE program, featuring a newly developed optical system with larger lenses. The devices deliver high-end image performance compatible with 4K | UHD and NIR visualization systems.

-

In August 2023, Huaxin Medical and Yisi Medical formed a strategic alliance to accelerate the development and global commercialization of innovative rigid laparoscopes. The partnership combines Huaxin’s R&D and manufacturing strengths with Yisi’s brand, clinical expertise, and international marketing channels.

Rigid Laparoscopes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.75 billion

Revenue forecast in 2033

USD 2.46 billion

Growth rate

CAGR of 4.35% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion, Procedure Volume in Units Thousands, Unit Volume in Units Thousands and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Surgery Type, Angle of View, Product Dimension, Product Length, Surgical Center Size, Surgical Center Location, End Use, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; Arthrex, Inc.; Stryker Corporation; Karl Storz GmbH & Co. KG; Smith+Nephew; CONMED Corporation; Lepu Medical Technology (Beijing) Co., Ltd.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Fujifilm Healthcare Americas; SCHÖLLY FIBEROPTIC GMBH;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rigid Laparoscopes Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global rigid laparoscopes market report based on surgery type, angle of view, product dimension, product length, surgical center size, surgical center location, end use, and region:

-

Surgery Type Outlook (Revenue USD Million, 2021 - 2033) (Procedure Volume Units Thousands, 2021 - 2033) (Unit Volume Units Thousands, 2021 - 2033)

-

General Surgery

-

Gynecology

-

Colorectal

-

Bariatric

-

Thoracic

-

Urology

-

Other Surgeries

-

-

Angle of View Outlook (Revenue USD Million, 2021 - 2033)

-

0°

-

30°

-

45°

-

Others (70°, 90°, 120°+)

-

-

Product Dimension Outlook (Revenue USD Million, 2021 - 2033)

-

<2 mm

-

2-3.9 mm

-

4-5.9 mm

-

≥6 mm

-

-

Product Length Outlook (Revenue USD Million, 2021 - 2033)

-

Short Length Scopes (< 20 cm)

-

Medium Length Scopes (20-30 cm) [Autoclavable]

-

Standard/Long Length Scopes (30-35 cm)

-

Extra-Long Scopes (> 35 cm) [Draped (Sterile Sheathed)]

-

-

Surgical Center Size Outlook (Revenue USD Million, 2021 - 2033)

-

Small (1-99 beds)

-

Medium (100-299 beds)

-

Large (300+ beds)

-

-

Surgical Center Location Outlook (Revenue USD Million, 2021 - 2033)

-

Metropolitan

-

Suburban

-

Rural

-

-

End Use Outlook (Revenue USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

Ambulatory Surgical Centers

-

Specialty Surgical Centers

-

-

Academic Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033) (Procedure Volume Units Thousands, 2021 - 2033) (Unit Volume Units Thousands, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.