- Home

- »

- Alcohol & Tobacco

- »

-

Rum Market Size, Share And Trends, Industry Report, 2030GVR Report cover

![Rum Market Size, Share & Trends Report]()

Rum Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dark & Golden Rum, White Rum), By Distribution Channel (Off-Trade, On-Trade), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68039-924-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rum Market Size & Trends

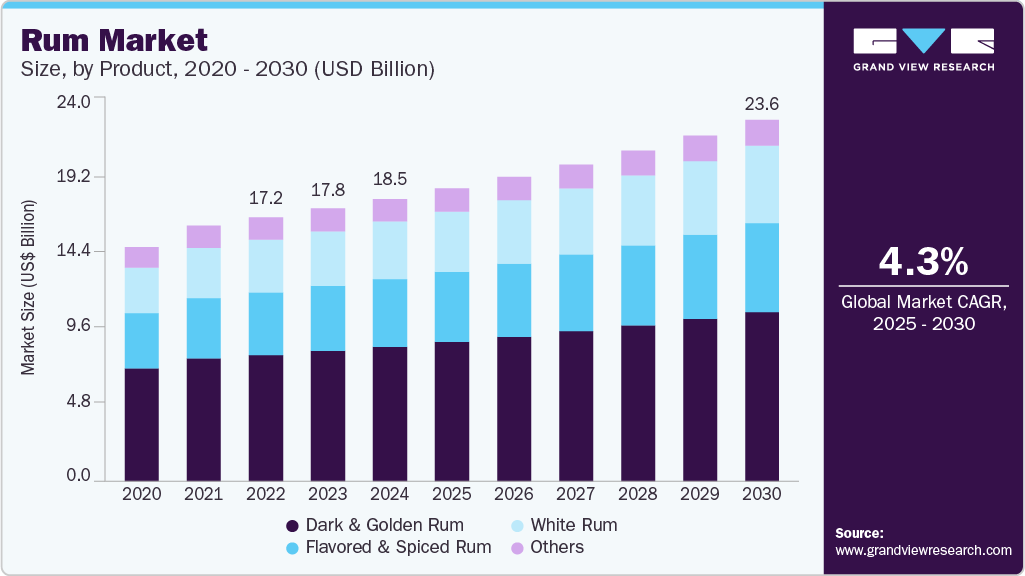

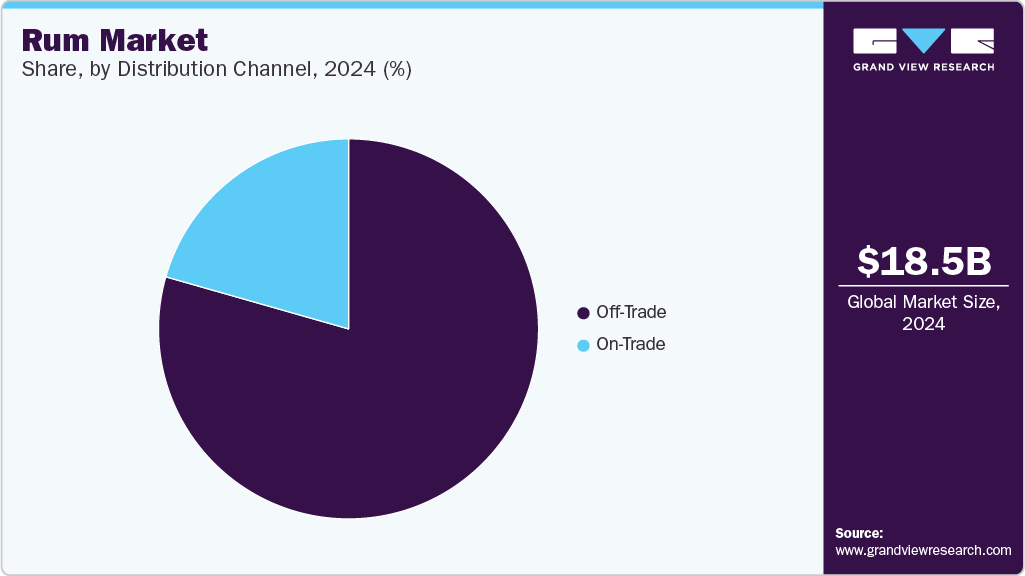

The global rum market size was estimated at USD 18.47 billion in 2024 and is expected to grow at a CAGR of 4.3% from 2025 to 2030. The global market is experiencing robust growth fueled by rising demand for distilled liquor among millennials, who are increasingly drawn to spirits with distinctive character and cultural heritage.

Key Highlights:

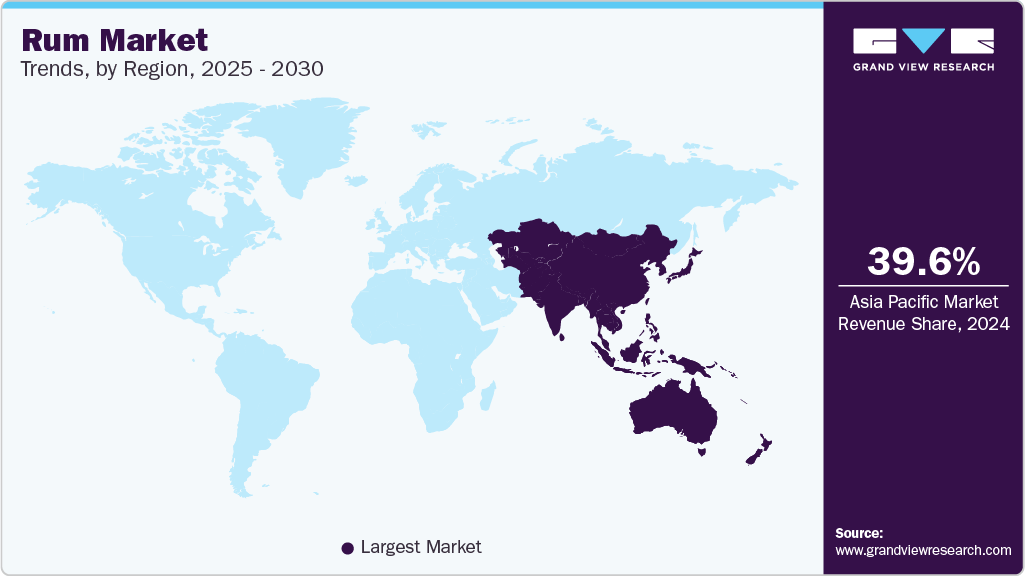

- The Asia Pacific rum market accounted for a share of 39.59% of the global market

- The North America rum market is projected to grow at a CAGR of 4.8% from 2025 to 2030

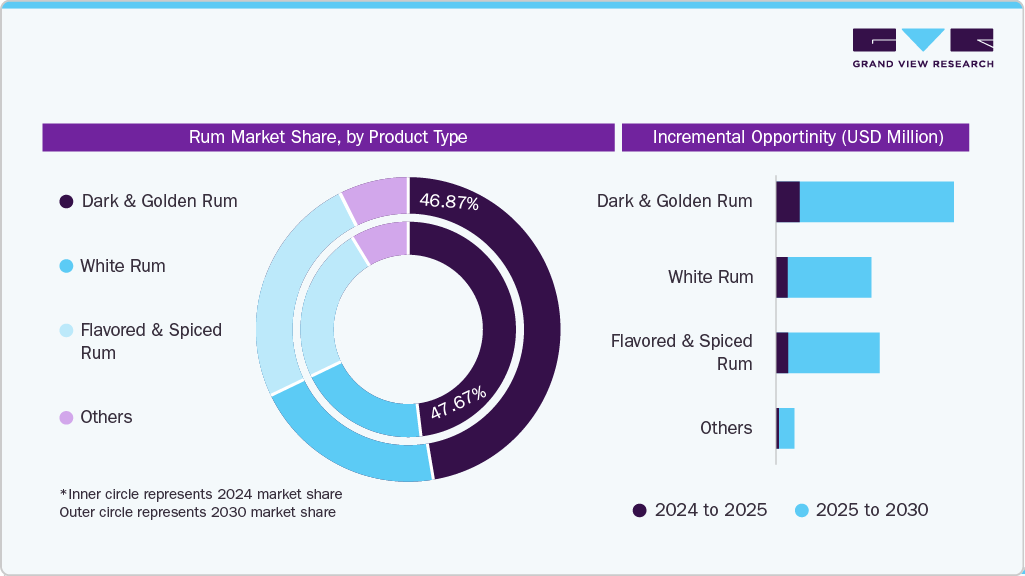

- In terms of product segment, dark and golden rum accounted for a 47.67% share of the global revenue in 2024

- In terms of product segment, Flavored and spiced rum is expected to grow at a CAGR of 4.7% from 2025 to 2030

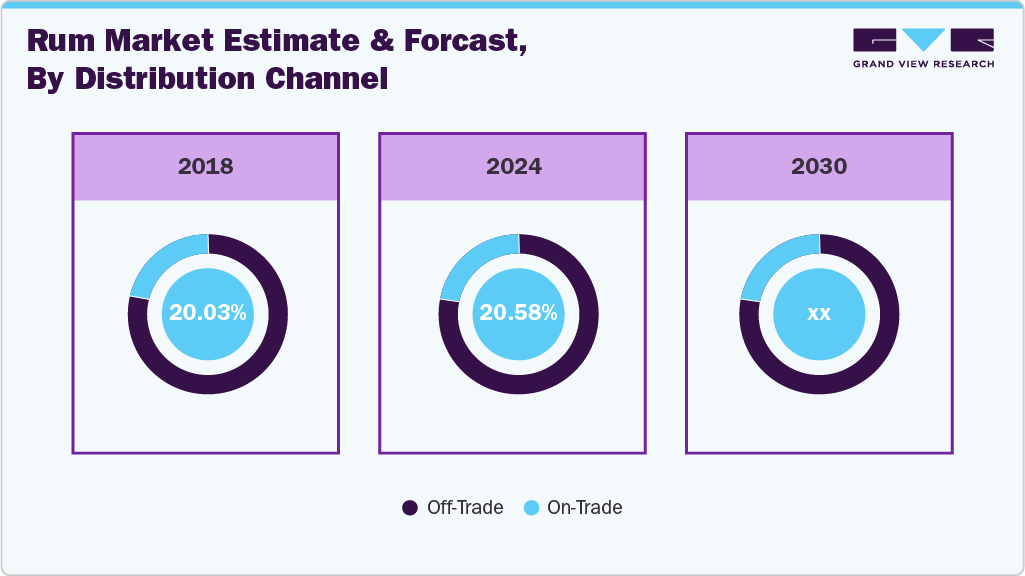

- In terms of distribution channel segment, the sales of rum through off-trade distribution channels accounted for a share of 79.42% in 2024

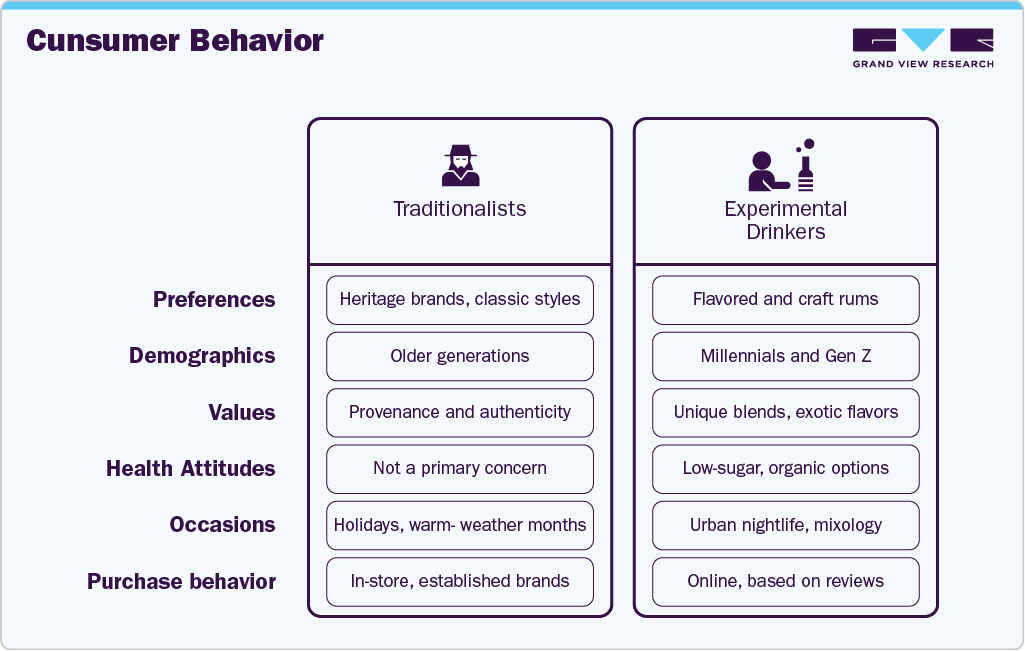

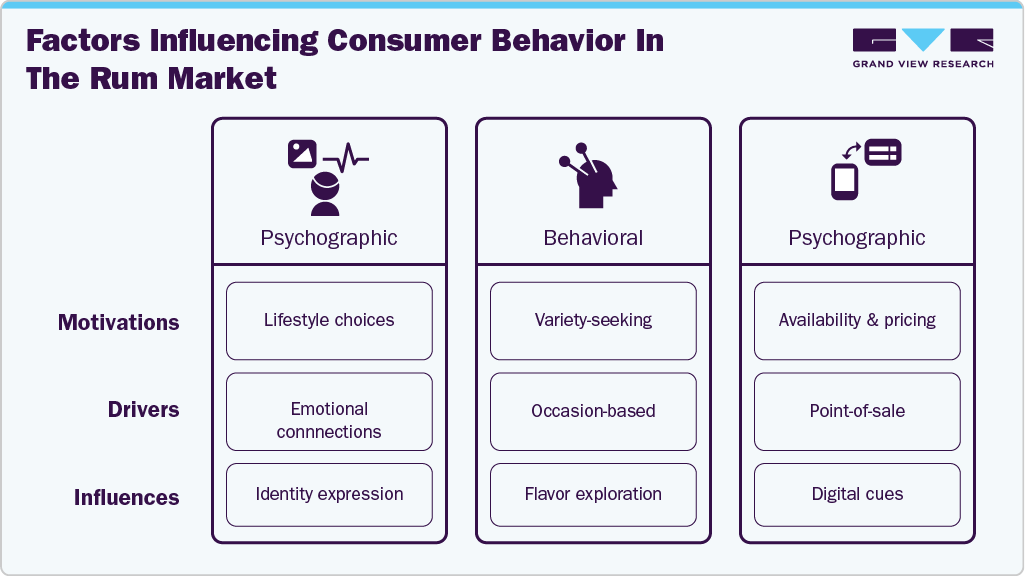

The premiumization of alcoholic beverages has further accelerated this trend, as consumers seek higher-quality, craft, and small-batch rums with refined taste profiles. Additionally, the introduction of new and exotic flavors, such as tropical fruits, spices, and dessert-inspired variants, has broadened rum’s appeal, especially among younger and experimental drinkers, driving both on-trade and off-trade sales worldwide.

The alcohol industry is witnessing some major shifts in consumer behavior and drinking patterns, especially among Gen Z and millennials. Nowadays, consumers have become more experimental and are ready to spend more on premium products. They express a keen interest in substituting their regular beverages for extravagant premium alcohol drinks.

The shift in consumption habits, coupled with a notable surge in the beverage premiumization trend, has significantly contributed to this transformation. According to an article published by Park Street Imports, LLC. in October 2024, rum’s perception has shifted as producers move away from the nautical branding once popular with brands like Sailor Jerry, Captain Morgan, and Kraken. New premium brands such as Ten to One Rum, Foursquare, and Diplomático now emphasize production techniques and the rich history of the spirit. This shift has attracted younger drinkers, with those aged 25-34 accounting for the largest share (20.7%) of rum consumers. Brands are focusing on educating consumers and using quality cues to position rum as a premium spirit.

According to an article published by Ground Signal, a company specializing in AI-powered solutions for the beverage alcohol industry, in March 2024, premium rum sales were 42% higher than average in accounts within Ground Signal’s proprietary Multicultural High Energy Dining segment.

Moreover, due to consumers' changing consumption patterns, manufacturers of premium alcoholic drinks are focusing on strategies like mergers and acquisitions to gain traction and expand their market shares. For instance, in January 2023, Brown‑Forman Corporation acquired the Diplomático Rum brand and related assets from Destillers United Group S.L. (Russia). This acquisition marked Brown‑Forman’s entry into the growing super-premium rum category.

A key factor driving the rum industry is the expansion of product portfolios by manufacturers worldwide, particularly with new flavored dark rum offerings and premium-designed rum to attract a broader consumer base. For instance, in March 2025, Brugal Rum launched the Andrés Brugal Edition 02, the second limited edition in its ultra-premium range, with only 416 bottles available globally. Retailing at USD 3,000 per bottle, it features a blend of four single casks aged in American oak, showcasing flavors of coconut, vanilla, and gentle spice.

According to the Distilled Spirits Council of the United States, in 2024, nearly 21 million 9-liter cases of rum were sold in the U.S., further highlighting the growing demand and the industry's response to evolving consumer preferences.

Furthermore, Rum's popularity in cocktails is a key factor driving its market growth. Its versatility in drinks like the Mojito, Daiquiri, and Piña Colada has made it particularly appealing to younger consumers. As cocktail culture continues to expand globally, rum’s ability to blend with a variety of flavors—from tropical fruits to spices—has made it a preferred choice for both bartenders and home mixologists. This trend, coupled with the rise of craft cocktails and innovative flavored rums, has strengthened rum’s presence in bars and restaurants, driving both casual and premium sales. According to the 2024 Cocktail Trends Report published by Bacardi, rum is considered an essential spirit for on-premise programs, as four of the ten best-selling cocktails identified in the report are rum-based drinks.

Consumer Insights

Product Insights

Dark and golden rum accounted for a 47.67% share of the global revenue in 2024, owing to their rich, aged profiles that align with the premiumization trend, growing cocktail culture, and consumer preference for authenticity and heritage. Their versatility in both sipping and mixology, combined with strong appeal among connoisseurs and casual drinkers alike, made them the dominant choice across markets.

Rum makers are increasingly producing new and improved formulations for dark and golden rum. For instance, in March 2023, Goslings Rum of Bermuda introduced Spirited Seas, marking its venture into ocean-aged rum. This unique offering, with an alcohol by volume (ABV) of 44%, is valued at USD 60 for 750 ml. Goslings Rum Spirited Seas has been introduced in various markets across the U.S.

Flavored and spiced rum is expected to grow at a CAGR of 4.7% from 2025 to 2030, due to its strong appeal among younger consumers seeking sweeter, more approachable profiles and novelty-driven experiences. The rise of ready-to-drink (RTD) cocktails, experimentation in mixology, and demand for seasonal or exotic flavor infusions have made this category highly versatile and trend-responsive. Its lower entry barrier compared to traditional aged rums also supports broader consumption in casual settings, social occasions, and festivals, especially in North America and parts of Europe.

In April 2025, The Kraken Gold Spiced Rum launched a new 50-milliliter travel-friendly bottle format, priced at USD 1.49, which maintains the same 35% ABV and flavor profile that includes caramel, oak, and banana bread notes. This smaller size caters to consumer demand for portable and lower-alcohol options without compromising on quality or taste. The introduction aligns with trends showing that gold and spiced rums account for 41% of total rum consumption in the U.S.

Distribution Channel Insights

The sales of rum through off-trade distribution channels accounted for a share of 79.42% in 2024, due to shifting consumer habits favoring convenience, affordability, and at-home consumption. Post-pandemic lifestyles, including remote work and increased socializing at home, led consumers to purchase rum more frequently from supermarkets, liquor stores, and online platforms rather than bars or restaurants. Off-trade channels also offer a wider range of price points and promotional deals, making them more attractive for routine or bulk purchases. Additionally, the rise of e-commerce and organized retail in both mature and emerging markets has further boosted accessibility, making off-trade the preferred choice for a broader base of casual and cost-conscious consumers.

According to an article published in Food Dive in May 2023, it was found that 23% of consumers consumed more alcohol at home over the past 12 months compared to 16% who consumed more alcohol on the premises. It has been observed that since the COVID-19 pandemic, consumers prefer staying home and drinking rather than going out. This has significantly boosted the off-trade consumption of rum.

The sales of rum through the on-trade distribution channel are projected to grow at a CAGR of 4.8% from 2025 to 2030, due to the resurgence of social and experiential drinking in bars, restaurants, clubs, and resorts as global hospitality sectors continue to recover and expand post-pandemic. Rising consumer demand for premium and craft cocktails, increasing tourism, and a growing interest in curated drinking experiences are encouraging on-premise establishments to diversify and elevate their rum offerings. Furthermore, the popularity of rum-based signature drinks and mixology trends is enhancing its appeal in upscale and themed venues, driving higher per-serving margins and boosting volume growth in on-trade environments worldwide.

According to a survey administered by the U.S. Substance Abuse and Mental Health Services Administration (SAMHSA), there are approximately 69,485 registered bars in the U.S. as of 2023 and this number has grown by 1.3% from 2022. Milwaukee, Wisconsin is the “drunkest city,” with the maximum number of bars, breweries, and wine bars in 2023.

Regional Insights

The Asia Pacific rum market accounted for a share of 39.59% of the global market. It held a market size of USD 7.31 billion in 2024, majorly driven by its large and youthful population, rising disposable incomes, and evolving drinking culture across key markets such as India, the Philippines, Thailand, and Australia. In particular, India, one of the world’s largest rum-consuming countries, continues to drive volume through both mass-market and premium segments, fueled by domestic production, growing urbanization, and increasing social acceptance of alcohol. For instance, in March 2025, Khukri Rum, produced by Nepal's first distillery, MCKT Beverages Pvt. Ltd., entered the Indian market with its three premium expressions: Khukri XXX Rum, Khukri Spiced Rum, and Khukri White Rum.

North America Rum Market Trends

The North America rum market is projected to grow at a CAGR of 4.8% from 2025 to 2030. The rum industry is experiencing rapid growth due to rising consumer interest in premiumization, craft spirits, and diverse flavor profiles, particularly among millennials and Gen Z consumers. The growing popularity of rum-based cocktails, such as mojitos and dark 'n' stormies, in bars and at-home settings is fueling demand, while innovation in flavored and aged rum varieties is attracting new consumers seeking unique experiences. Additionally, the expanding presence of craft distilleries, increased marketing around Caribbean heritage and authenticity, and the broader shift toward spirits over beer are contributing to sustained growth. In April 2025, The North Saanich distiller, a 99-year-old farm in British Columbia, launched Canada’s first limited edition agricole rum, marking a significant milestone in the country's distilling history. This unique rum is crafted from freshly pressed sugarcane juice, distinguishing it from traditional rums made from molasses. The distillation process emphasizes the natural flavors of the sugarcane, resulting in a product that reflects the terroir of the region.

The U.S. rum market is experiencing robust growth, driven by factors such as the increasing popularity of rum-based cocktails, such as mojitos and piña coladas, among consumers. The growing trend toward premiumization is fueling demand for high-quality aged and craft rums, particularly in the cocktail and spirits connoisseur segments. The continued expansion of e-commerce and online alcohol sales is also making rum more accessible to a broader audience. In November 2024, Oxbow Rum Distillery broadened its reach by launching an e-commerce platform, enabling customers in more than 30 states to purchase its premium, additive-free Oxbow Estate Rum and False River Rums directly from the brand's website, hosted by Flaviar.com.

Europe Rum Market Trends

The Europe rum market is projected to grow at a CAGR of 4.4% from 2025 to 2030. This can be attributed to the rising demand for premium and craft rum in key markets like the UK, France, and Germany. In the UK, rum is gaining popularity as a cocktail base, while France is seeing growth in aged and spiced rum due to its ties with Caribbean territories. Germany’s strong retail network and interest in exotic flavors are also fueling off-trade sales, supported by e-commerce and evolving drinking habits. In April 2025, BACARDÍ launched passionfruit-flavored rum across European markets. This new product, BACARDÍ Passionfruit, combines the brand's signature white rum with bold passionfruit flavor, offering a sweet, tangy, and vibrant taste experience.

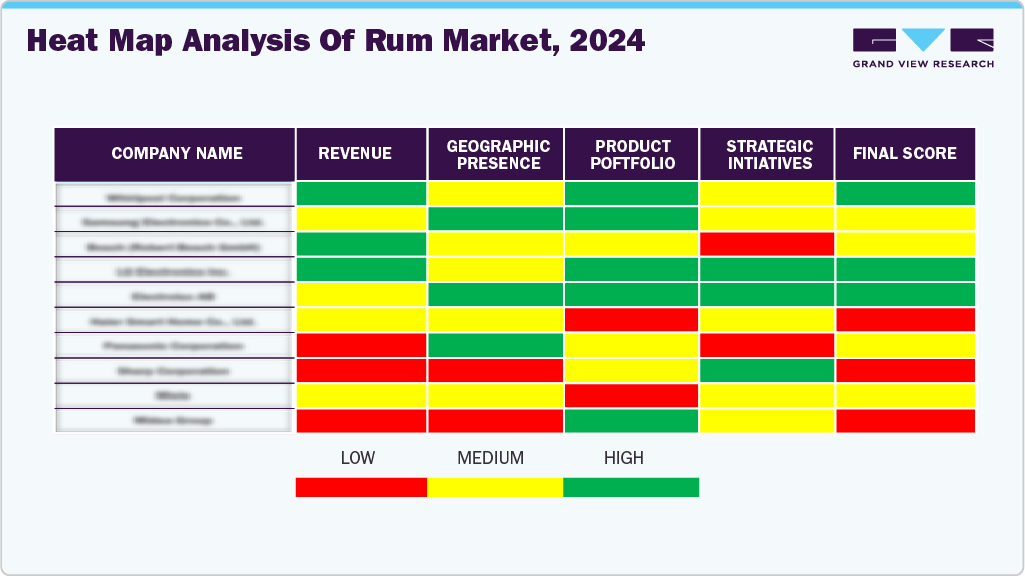

Key Rum Company Insights

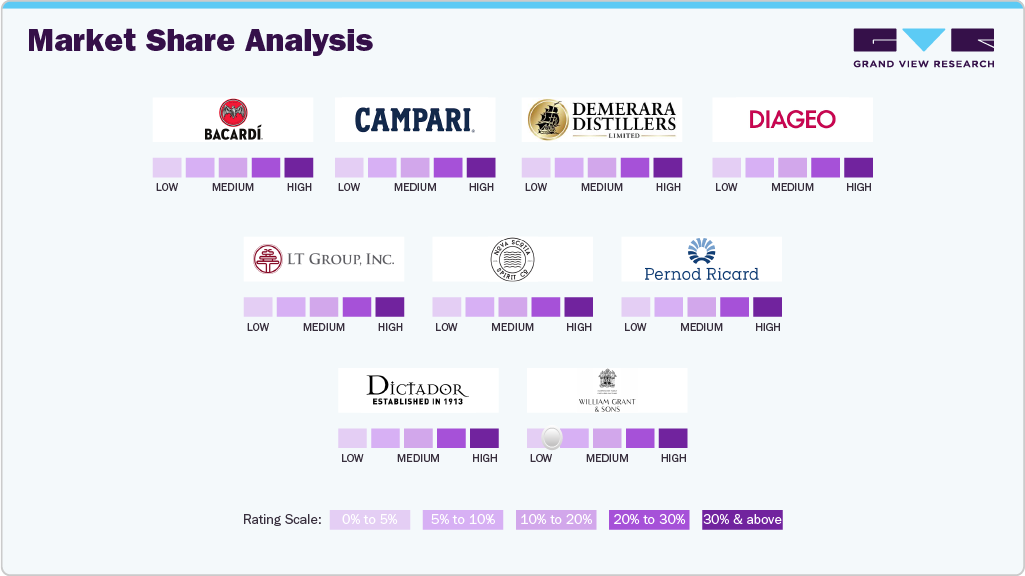

The rum market is highly competitive, with both local and international players vying for market share. Major international brands like Bacardi, Havana Club, and Captain Morgan dominate the global landscape, while regional distilleries such as Mount Gay in the Caribbean and Oxbow Rum Distillery in the U.S. continue to carve out their niches. Local players benefit from a strong connection to the heritage of their regions, offering authentic products that resonate with consumers.

The market is relatively fragmented, with a wide range of brands, from large-scale producers to small craft distilleries. This fragmentation is driven by consumer demand for variety, with a growing preference for premium, artisanal, and flavored rums. While international brands maintain a significant share, smaller producers are gaining traction by offering unique products and tapping into niche segments.

Analyzing market competition is crucial for understanding the competitive dynamics and identifying growth opportunities. It helps companies assess their position relative to key competitors, enabling them to develop targeted strategies, such as expanding distribution, enhancing product offerings, or pursuing mergers and acquisitions.

Key Rum Companies:

The following are the leading companies in the rum market. These companies collectively hold the largest market share and dictate industry trends.

- Bacardi Limited

- Davide Campari-Milano N.V.

- Demerara Distillers Ltd. (DDL)

- Diageo Plc

- LT Group Inc.

- Nova Scotia Spirit Co.

- Pernod Ricard SA

- Dictador Europe Sp. z o.o.

- William Grant & Sons Ltd.

- Mohan Meakin Limited

Recent Developments

-

In March 2025, Brugal Rum launched the Andrés Brugal Edition 02, the second limited edition in its ultra-premium range, with only 416 bottles available globally. Retailing at USD 3,000 per bottle, it features a blend of four single casks aged in American oak, showcasing flavors of coconut, vanilla, and gentle spice.

-

In March 2025, Wray & Nephew launched Wray’s 43, a new UK-exclusive white Jamaican rum with an ABV of 43%, designed to cater to the growing demand for flavorful, easy-to-mix spirits. This limited edition rum is a blend of unaged Jamaican white rums, featuring notes of rich fruits, charred pineapple, and molasses.

Rum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.17 billion

Revenue forecast in 2030

USD 23.62 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/ billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Russia; China; Japan; Australia; Philippines; India Brazil; Argentina and South Africa

Key companies profiled

Bacardi Limited; Davide Campari-Milano N.V.; Demerara Distillers Ltd. (DDL); Diageo Plc; LT Group Inc.; Nova Scotia Spirit Co.; Pernod Ricard SA; Dictador Europe Sp. z o.o.; William Grant & Sons Ltd.; and Mohan Meakin Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rum Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global rum market report on the basis of product, distribution channel and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dark and Golden Rum

-

White Rum

-

Flavored and Spiced Rum

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-Trade

-

On-Trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Philippines

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rum market size was estimated at USD 18.47 billion in 2024 and is expected to reach USD 19.17 billion in 2025.

b. The global rum market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2030 to reach USD 23.62 billion by 2030

b. The dark and golden rum dominated the market with a share of 47.67% in 2024 owing to consumer preference and production. Dark and golden rums tend to undergo an extended aging process compared to other rum varieties. This aging duration contributes to the development of enhanced flavors, intricate profiles, and a velvety texture in the rum, making it more appealing to many consumers

b. Some of the key market players in the rum market are Bacardi Limited; Davide Campari-Milano N.V.; Demerara Distillers Ltd. (DDL); Diageo Plc; LT Group Inc.; Nova Scotia Spirit Co.; Pernod Ricard SA; Dictador Europe Sp. z o.o.; William Grant & Sons Ltd.; and Mohan Meakin Limited

b. Factors such as increasing consumer interest and expanding cocktail culture are expected to drive the industry growth globally. Product innovation and diversification have attracted new consumers and provided existing consumers with a wider range of options to choose from. Furthermore, there has been a shift in consumer preferences toward spirits with natural and authentic qualities. Rum, as a product with a rich history and often produced from natural ingredients like sugarcane, appeals to consumers seeking authentic and artisanal products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.