- Home

- »

- Animal Health

- »

-

Ruminant Vaccines Market Size, Share, Industry Report 2030GVR Report cover

![Ruminant Vaccines Market Size, Share & Trends Report]()

Ruminant Vaccines Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Cattle, Sheep & Goats), By Vaccine Type, By Indication, By Route Of Administration, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-117-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ruminant Vaccines Market Summary

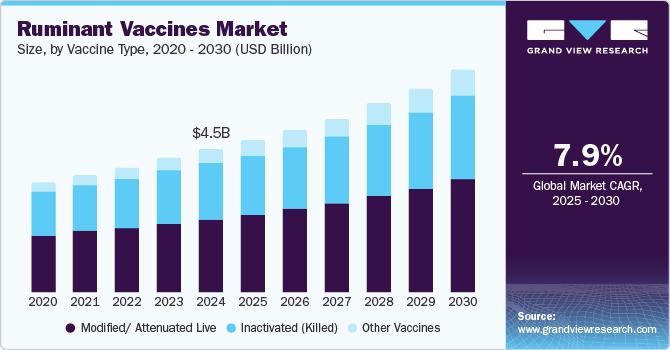

The global ruminant vaccines market size was estimated at USD 4.52 billion in 2024 and is projected to reach USD 7.2 billion by 2030, growing at a CAGR of 7.9% from 2025 to 2030. The ruminant vaccines industry is witnessing growth due to the emergence of various new diseases in cattle, sheep, and goats.

Key Market Trends & Insights

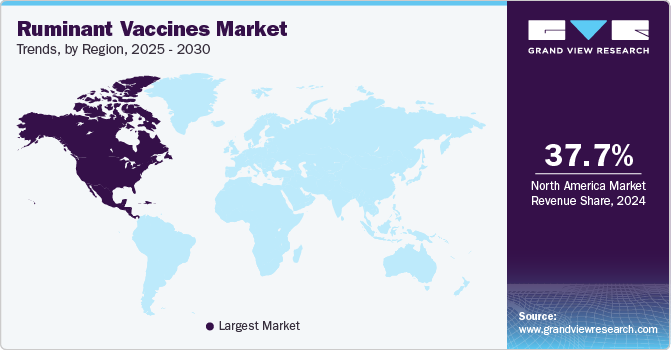

- The North America ruminant vaccines market accounted for 37.74% of revenue share in 2024.

- The ruminant vaccines market in the U.S. held a significant share of the North America market in 2024.

- By animal type, cattle segment dominated the market in 2024.

- By vaccine type, modified/attenuated live segment dominated the market in 2024 with a share of 51.7%.

- By indication, bovine respiratory diseases (BRD) segment dominated the market in 2024 with a share of 34.3%.

Market Size & Forecast

- 2024 Market Size: USD 4.52 Billion

- 2030 Projected Market Size: USD 7.2 Billion

- CAGR (2025-2030): 7.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, according to the news published by the World Organization of Animal Health in August 2024, the contagious virus named “Peste des Petits Ruminants (PPR)” was detected in two European countries- Greece and Romania for the first time. Both countries were free from this virus before, but with this finding, the ruminants in these countries are a significant threat, with morbidity as high as 100% and a mortality of 80%. These new diseases among ruminants increase the need for new vaccines to prevent the animals from health deterioration and livestock owners from economic loss. Research and development (R&D) plays a pivotal role in the growth of the ruminant vaccines industry by driving innovation and improving vaccine efficacy. For instance, according to the data published by Curators of the University of Missouri in April 2024, Roman Ganta, a professor in Mizzou’s College of Veterinary Medicine, along with a researcher from Bond Life Sciences Center, has worked on a vaccine to prevent Bovine anaplasmosis. It is the first proven vaccine to immunize cattle and protect them from this tick-borne disease. This vaccine's successful launch and availability would save Missouri’s USD 1.6 billion cattle industry, which is vital to the nation’s economy. Similar advances in biotechnology, genomics, and molecular biology have enabled the development of next-generation vaccines, such as DNA-based, mRNA, and subunit vaccines. These offer better protection and fewer side effects, resulting in increased adoption.

In addition, several initiatives undertaken by market participants and government organizations increase awareness about ruminant diseases and prevention methods. For instance, in November 2024, the International Veterinary Vaccinology Network Conference 2024 was hosted in collaboration with the Biotechnology Center at Ho Chi Minh City in Vietnam to provide an open ground for the global veterinary community associated with vaccines. This helped professionals worldwide come together and share knowledge on vaccinology and foster international collaborations necessary for innovation, development, and distribution of vaccines used for livestock and zoonotic diseases in low and middle-income countries.

Animal Type Insights

Cattle dominated the market in 2024 and is expected to grow significantly during the forecast period. This growth is due to the increasing prevalence of cattle diseases and the need to develop preventive measures. Many researchers, veterinarians, and organizations are developing new vaccines to meet the increasing demand. For instance, as per the news published by Louisiana State University in March 2024, a researcher at the university has developed a vaccine against bovine respiratory disease (BRD) in cattle and has claimed to be better than the vaccine cocktail, which many veterinarians currently use. This new vaccine offers potential benefits such as cost-effectiveness and also does not cause abortion. The researcher has applied for a patent for this vaccine, which, on approval, can be a groundbreaking step in the cattle industry to contribute to segment growth.

The sheep & goats segment is poised to grow at the fastest CAGR of 10.0% during the forecast period. Sheep and goats are a primary source of meat in several regions of the world. They also serve as a crucial source of milk and livelihood in developing countries, especially in low and middle-income countries, which increases the need to look after the health of these animals. In addition, rising awareness among farmers about the economic benefits of vaccination and government-led vaccination programs is boosting the demand for ruminant vaccines. For instance, according to the news published by THG PUBLISHING PVT LTD. in October 2024, the state animal husbandry department in Kerala, India, launched a vaccination drive against Peste des Petits Ruminants (PPR) for goats and sheep. With this vaccination drive, 13.5 lakh goats and 1,500 sheep across the state are expected to get vaccinated.

Vaccine Type Insights

Modified/attenuated live dominated the market in 2024 with a share of 51.7%. These high numbers are attributed to its superior efficacy in stimulating strong and long-lasting immunity in animals. In addition, the advancements in vaccine development have enhanced the safety and stability of attenuated live vaccines, expanding their use for various diseases. For instance, Boehringer Ingelheim International GmbH launched BULTAVO 3, which protects ruminants from bluetongue virus serotype 3 (BTV-3) in May 2024. It is the first BTV-3 vaccine that potentially prevents mortality and other clinical signs of the disease. Launching new vaccines in the industry increases revenue generation, contributing to segment growth.

Other vaccines segment is anticipated to grow at the fastest CAGR of 10.33% during the forecast period. This growth is attributed to the rising adoption of next-generation vaccines, including DNA-based, mRNA, and recombinant vaccines. These innovative solutions address the limitations of traditional vaccines by offering enhanced safety, targeted efficacy, and the ability to combat emerging and complex diseases. Growing investments in research and development and advancements in biotechnology have led to the creation of customizable vaccines tailored to specific regional or herd needs. For instance, according to the news published in May 2024, U.S. scientists are developing a next-generation mRNA vaccine to protect cows against bird flu and be prepared for any pandemic. Such developments in other vaccine segments are expected to fuel market growth in the coming years.

Indication Insights

Bovine Respiratory Diseases (BRD) segment dominated the market in 2024 with a share of 34.3%. These high numbers are due to rising prevalence of the condition and obvious increase in the demand for the vaccines against BRD. For instance, in October 2024, Merck & Co., Inc. mentioned that the morbidity rate of bovine respiratory disease lies between 35% and 50%, and the mortality is observed at 5-10%, which also depends on other risk factors present in the affected animal. Also, as per the data published in February 2024, the prevalence of subclinical BRD can reach up to 67%. These increasing cases of BRD contribute to the segment growth.

Other Indications are expected to grow with the fastest CAGR of 10.1% during the forecast period. This growth is attributed to the increasing incidences of several ruminant diseases, such as Bluetongue, Johne’s disease, Pinkeye/ IBK, Peste des Petits Ruminants, Foot and Mouth Disease, scabby mouth disease, etc. In addition, government initiatives to vaccinate cattle, sheep, and goats further boost the adoption of ruminant vaccines. For instance, according to the data published in September 2024, the Department of Agriculture of Africa declared a Foot and Mouth Disease (FMD) Disease Management Area. In the Eastern Cape, more than 96,906 cattle and 635 sheep were vaccinated for FMD under this project. Various organizations' vaccination drives and preventive measures contribute to the segment’s growth.

Route of Administration Insights

The injectable segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The injectable route has numerous advantages, such as direct delivery to the bloodstream, dosage control, and better immune response, making it a widely adopted route of administration in the ruminant vaccines sector. For example, Boehringer Ingelheim's Pyramid/ Presponse family of vaccines is a lineup of injectable cattle vaccines effective against various bacteria and viruses.

The intranasal segment is expected to grow at the fastest CAGR over the forecast period. The intranasal route is a non-invasive route of administration that offers ease of administration. INFORCE 3 from Zoetis, for instance, is an intranasal cattle vaccine for vaccination against respiratory disease caused by bovine respiratory syncytial virus (BRSV), parainfluenza 3 (PI3) virus, and infectious bovine rhinotracheitis (IBR) virus. It is intended for use in beef and dairy cattle. BOVILIS NASALGEN 3-PMH is another example of an intranasal vaccine provided by Merck- a leading market player.

Distribution Channel Insights

Hospital/Clinic Pharmacies dominated the market with the largest share of 47.4% in 2024 due to their critical role in ensuring the safe and reliable delivery of vaccines. These pharmacies serve as trusted points of access for veterinarians and livestock owners, offering professional guidance on vaccine selection, storage, and administration. Their ability to maintain stringent cold chain protocols ensures the efficacy of vaccines, making them a preferred choice for disease prevention programs. Moreover, expansion in the network of hospitals and clinical pharmacies, especially in developed countries, boosts the segment's growth.

E-commerce is the fastest-growing segment and is expected to grow at a CAGR of 10.5% over the forecast period. This surge is driven by the increasing adoption of online platforms by veterinarians, farmers, and livestock owners due to their convenience, competitive pricing, and availability of wide product selection. The rise of digital marketplaces specializing in veterinary supplies has streamlined access to vaccines, particularly in remote areas. Many companies, such as Zoetis, have their online platforms to sell vaccines. Moreover, advancements in logistics and cold chain technologies ensure the safe and timely delivery of temperature-sensitive vaccines, further bolstering confidence in e-commerce platforms as a reliable distribution channel.

Regional Insights

The North America ruminant vaccines market dominated the global market and accounted for 37.74% of revenue share in 2024. This is owing to factors such as the presence of leading market players, increasing consumption of animal protein, and technological advancements. Key companies, including Zoetis Services LLC, Merck & Co., Inc., and Elanco, are headquartered in the U.S., thus contributing to the regional share. For instance, in September 2024, Medgene collaborated with Iowa State University to develop and expand its vaccine offerings. USDA Animal & Plant Health Inspection Service provided a two-year grant for this project. Such regional strategic collaborations are expected to maintain North America’s market position.

U.S. Ruminant Vaccines Market Trends

The ruminant vaccines market in the U.S. held a significant share of the North America market in 2024. This growth is attributed to the advanced veterinary infrastructure and government support in researching and developing new ruminant vaccines. For instance, according to the data published in October 2024, the U.S. Department of Health and Human Services approved two vaccine field safety trials to protect dairy cows from H5N1 and support ruminant vaccine development.

Europe Ruminant Vaccines Market Trends

The ruminant vaccines market in Europe is driven by the increasing prevalence of diseases among cattle, sheep, goats, and other animals in the ruminant category. For instance, as of August 2024, 47 outbreaks of Peste des Petits Ruminants (PPR) were reported in Greece, and 56 outbreaks were reported in Romania, notifying over 2000 and 5000 cases, respectively, in both European regions. Situations like these increase the demand for efficient vaccines and boost their adoption. Such factors in the region are expected to drive the market growth.

The UK ruminant vaccines market is expected to grow significantly due to robust research, initiatives, and the launch of ruminant vaccines in the region. Advances in vaccine development targeting emerging diseases and government support for livestock health are fostering innovation and enhancing market expansion. For instance, Zoetis launched Protivity in October 2024, which is the World’s first UK-authorized vaccine for Mycoplasma bovis in cattle. It is a modified live vaccine for this widespread bacterial disease.

The ruminant vaccines market in Germany is experiencing significant growth, mainly due to various strategic initiatives undertaken by the government and other regional key players. Moreover, the prevalence of diseases among cattle increases the demand for these vaccines. For instance, according to the report published in September 2024, several European countries encountered the spread of BTV-3, including Germany. Germany and other countries approved three vaccines for emergency use: BULTAVO 3, BLUEVAC-3, and Syvazul. Such regional scenarios are anticipated to increase product approvals and fuel market growth in the coming years.

Asia Pacific Ruminant Vaccines Market Trends

The ruminant vaccines market in Asia Pacific is expected to grow at the fastest CAGR of 9.8% over the forecast period. The market growth in the region is due to the several vaccination programs organized by the countries' governments. Increased awareness about zoonotic diseases and the need for preventive measures such as vaccinations have significantly boosted the market growth. For instance, in September 2024, the Department of Animal Husbandry and Dairying in India successfully vaccinated ruminants for various diseases that include, including 5.09 Crore-FMD vaccinations, 16.00 lakh Brucellosis vaccinations, 80.00 Lakh PPR vaccinations in July 2024. Such vaccination programs fuel the demand for ruminant vaccines and propel the market growth.

China ruminant vaccines market is growing at a lucrative rate and will hold a significant share in 2024. The increasing demand for animal protein in the country, government funding for vaccination drives, and the rising prevalence of diseases among cattle, sheep, and goats are some of the major factors driving market growth in the country. For instance, according to the data published in October 2024, a survey was conducted to understand the prevalence of bovine brucellosis in China, and a conclusion was drawn on the regions that need vaccination for the same disease. The Animal Husbandry and Veterinary Bureau of the Ministry of Agriculture and Rural Affairs announced a notice according to which the Brucella vaccination program was implemented in 17 regions in 2024. These countries have mandatory vaccination policies for bovine brucellosis to monitor and eradicate the disease from the country and further increase market growth.

Latin America Ruminant Vaccines Market Trends

The ruminant vaccines market in Latin Americaexhibits high growth potential, driven by the region's large and expanding livestock population and increasing emphasis on disease prevention. For instance, Argentina had 54,242,595 cattle in 2022, while Brazil had a count of 234,352,649 cattle, the highest among any other country in the world. In addition, governments and industry stakeholders are prioritizing vaccination programs to combat endemic diseases and boost livestock productivity, supporting the economic significance of the agricultural sector in the region.

Brazil ruminant vaccines market exhibits high growth potential due to the country’s extensive livestock population coupled with several government initiatives undertaken for livestock health. For instance, in May 2024, Brazil declared itself free from foot-and-mouth disease (FMD) after a vaccination cycle that began around 50 years ago. The country’s minister of Agriculture and Livestock, Carlos Fávaro, announced this announcement.

Middle East and Africa Ruminant Vaccines Market Trends

The ruminant vaccines market in MEA growth is driven particularly by the increasing focus on livestock health, government investments, and multiple vaccination drives to prevent the ruminants from diseases and support the regional economy. For instance, in July 2024, the African Development Bank funded the Technologies for African Agricultural Transformation (TAAT) Livestock Compact program to introduce a thermotolerant vaccine against Mali's peste des petits ruminants (PPR) disease. This drive had targeted 1 million PPR vaccine doses for 35,000 small ruminant animals in Mali, Africa.

UAE ruminant vaccines market growth is anticipated to grow at the fastest CAGR during the forecast period in the MEA region. This growth is attributed to the country's advanced veterinary infrastructure, product launches, and regulatory approvals. For instance, UAE approved Kyoto Biken Laboratories, Inc.’s KYOTOBIKEN bovine vaccine in November 2024, and the company also launched this vaccine in the same month. Such developments in the country are expected to drive market growth during the coming years.

Key Ruminant Vaccines Company Insights

The market is highly competitive due to several strategic initiatives, such as new product launches, mergers and acquisitions, and regional expansion, undertaken by key market players to increase their global footprints. Companies are diversifying their product portfolios to address a broader range of applications.

Key Ruminant Vaccines Companies:

The following are the leading companies in the ruminant vaccines market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- Zoetis Services LLC

- Vaxxinova International BV

- Merck & Co., Inc.

- Bimeda Animal Health Ltd.

- Indian Immunologicals Ltd.

- Elanco

- Virbac

- Ceva Santé Animale

- CZ Vaccines S.A.U. (Zendal Group)

Recent Developments

-

In October 2024, Merck & Co., Inc. received an expanded indication for subcutaneous administration of BOVILIS ROTAVEC CORONA vaccines, first administered intramuscular routes.

-

In August 2023, Moredun Research Institute and Ceva Sante Animale received an award of USD 9.5 Lakh to develop new vaccines against bovine respiratory disease.

Ruminant Vaccines Report Scope

Report Attribute

Details

The market size value in 2025

USD 4.81 billion

The revenue forecast for 2030

USD 7.02 billion

Growth rate

CAGR of 7.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, vaccine type, indication, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boehringer Ingelheim International GmbH; Zoetis Services LLC; Vaxxinova International BV; Merck & Co., Inc.; Bimeda Animal Health Ltd.; Indian Immunologicals Ltd.; Elanco; Virbac; Ceva Santé Animale; CZ Vaccines; S.A.U. (Zendal Group)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Ruminant Vaccines Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global ruminant vaccines market based on animal type, vaccine type, indication, route of administration, distribution channel, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cattle

-

Sheep & Goats

-

-

Vaccine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

BVD Infection

-

Bovine Respiratory Diseases (BRD)

-

Leptospirosis

-

Clostridial diseases

-

Diarrhea/ Scours

-

FMD

-

Other Indications

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectable

-

Intranasal

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/Clinic Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ruminant vaccines market size was estimated at USD 4.52 billion in 2024 and is expected to reach USD 4.80 billion in 2025.

b. The global ruminant vaccines market is expected to grow at a compound annual growth rate of 7.87% from 2025 to 2030 to reach USD 7.01 billion by 2030.

b. North America dominated the ruminant vaccines market with a share of 37.74% in 2024. This is attributable to factors such as the presence of leading market players, increasing consumption of animal protein, and technological advancements.

b. Some key players operating in the ruminant vaccines market include Boehringer Ingelheim International GmbH, Zoetis Services LLC, Vaxxinova International BV, Merck & Co., Inc., Bimeda Animal Health Ltd. , Indian Immunologicals Ltd., Elanco, Virbac, Ceva Santé Animale, CZ Vaccines, S.A.U. (Zendal Group)

b. The growing need for animal protein, strategies initiatives by key players, increased R&D activities, rising disease prevalence, and increasing demand for animal protein are some of the major drivers driving this market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.