- Home

- »

- Communication Services

- »

-

Satellite Internet Market Size & Share, Industry Report, 2030GVR Report cover

![Satellite Internet Market Size, Share & Trends Report]()

Satellite Internet Market (2025 - 2030) Size, Share & Trends Analysis Report By Frequency Band (L-band, C-band, K-band, And X-band), By Industry, By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-003-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Satellite Internet Market Summary

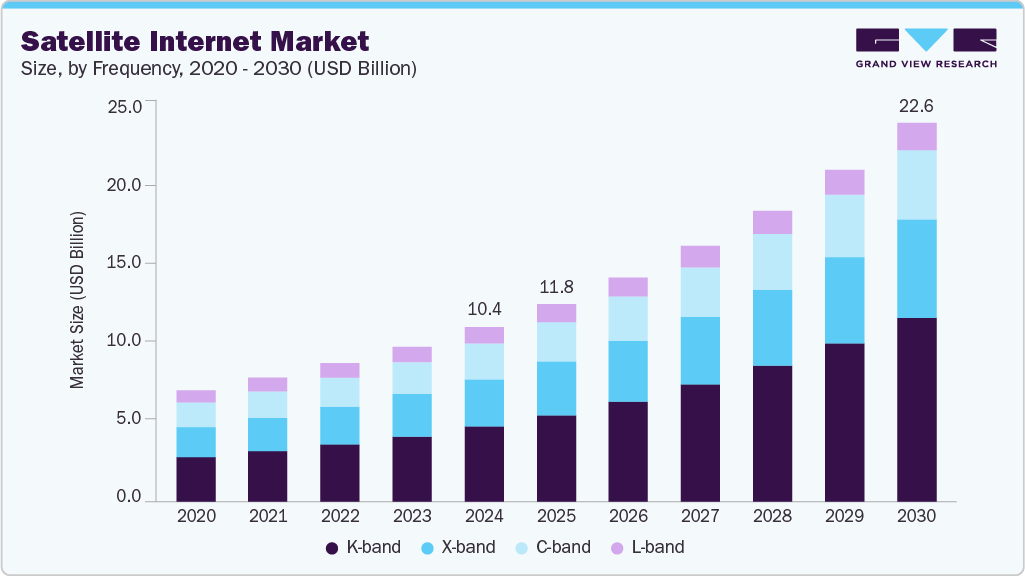

The global satellite internet market size is estimated at USD 10.4 billion in 2024 and is projected to reach USD 22.6 billion by 2030, growing at a CAGR of 13.9% from 2025 to 2030. Satellite communication provides a land-based interface with voice, video, and information that can be accessed anywhere on the planet.

Key Market Trends & Insights

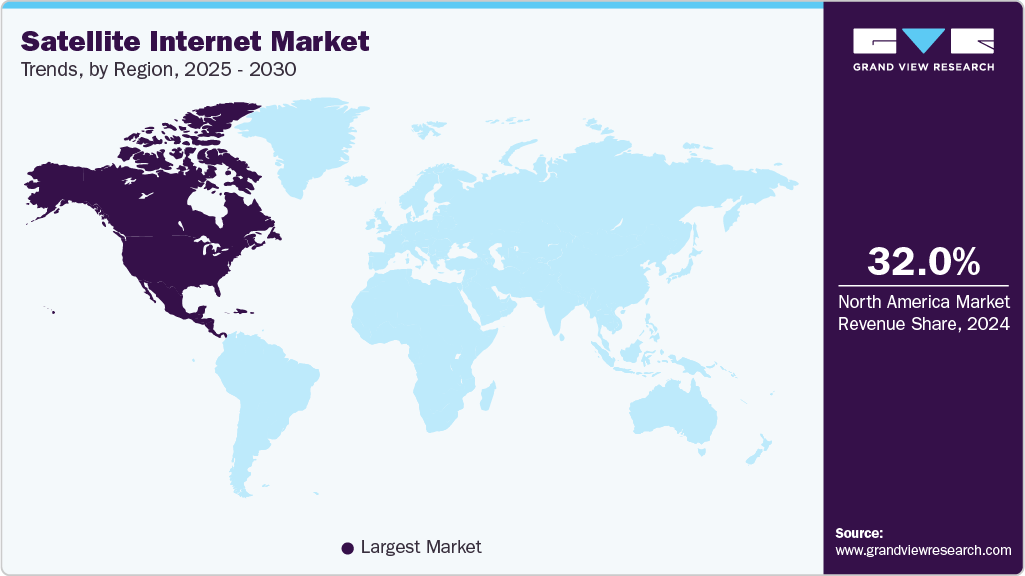

- North America dominated the satellite internet market with the largest market revenue share of 32.0% in 2024.

- The satellite internet market in the U.S. held a dominant position in 2024.

- By frequency band, the K-band segment led the market with the largest revenue share of 42.9% in 2024.

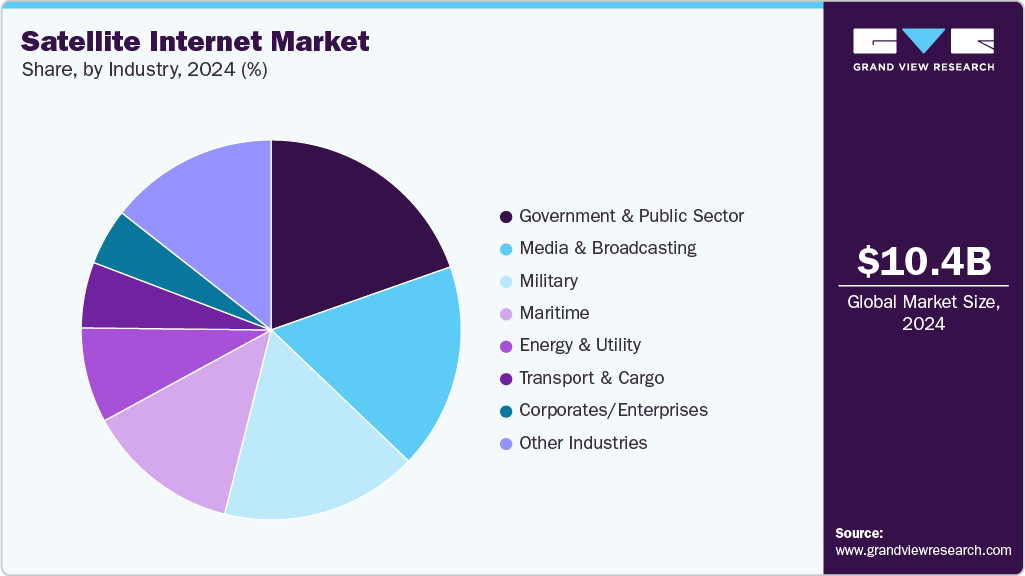

- By industry, the government and public segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.4 Billion

- 2030 Projected Market Size: USD 22.6 Billion

- CAGR (2025-2030): 13.9%

- North America: Largest market in 2024

The satellite internet industry is gaining momentum, driven by expanding rural connectivity needs, surging demand for high-speed broadband in remote areas, and the growing reliance on digital services across industries. Governments and private players are increasingly investing in low Earth orbit (LEO) satellite constellations to bridge the digital divide and support nationwide broadband coverage. However, challenges such as high initial deployment costs, signal latency, and spectrum management persist. The integration of advanced technologies like beamforming, AI-based traffic management, and hybrid satellite-terrestrial networks presents a major growth opportunity for the market.One of the primary advantages of satellite internet for businesses is its ability to deliver high-speed connectivity, measured in multiple megabits per second, even in remote or geographically challenging regions such as oceans, deserts, and mountainous areas. This capability is particularly valuable for establishing secure and private links across widely dispersed locations where traditional broadband infrastructure is unavailable.

The lack of viable broadband alternatives in rural and underserved areas has significantly contributed to the growing demand for satellite internet services. Moreover, the technology’s ability to offer reliable speed and data performance further enhances its appeal. Emerging economies such as India, Vietnam, and Malaysia are increasingly adopting satellite internet solutions to address connectivity gaps, which is expected to drive substantial market growth.

The expansion of satellite internet services continues to be bolstered by significant government initiatives aimed at promoting digital economies and enhancing public safety. In October 2023, the U.S. Federal Communications Commission (FCC) authorized over USD 18 billion in funding through the Enhanced Alternative Connect America Cost Model (Enhanced A-CAM) program. This initiative supports 368 companies across 44 states, with the goal of deploying broadband services of at least 100/20 Mbps to more than 700,000 unserved locations and maintaining or improving service to approximately 2 million existing locations over 15 years. Such substantial investments underscore the critical role of satellite internet in bridging the digital divide, particularly in remote and underserved areas. As governments continue to prioritize broadband expansion, the satellite internet industry is poised for significant growth, driven by the need for reliable, high-speed connectivity in regions where traditional infrastructure is lacking.

Satellite internet technology has seen increased adoption across various industries, particularly in healthcare. Satellite-based telehealth services have proven essential in providing broadband access to remote and underserved regions, where traditional telecommunications infrastructure is often lacking. For instance, SES S.A., a satellite telecommunications provider, leveraged its global satellite fleet to connect hospitals in countries such as Bangladesh, Sierra Leone, Mexico, and Italy, supporting medical operations and expanding access to digital healthcare.

In the United States, Viasat Inc. implemented optimization and web acceleration techniques to manage broadband traffic more effectively. These efforts prioritized critical applications, including health and education services, to ensure consistent connectivity for users in areas with limited access to conventional internet networks. These initiatives highlight the growing importance of satellite internet in supporting essential services in remote and underserved areas.

Investments in low Earth orbit (LEO) satellite constellations are accelerating as governments aim to expand high-speed internet access in remote regions. In February 2025, the UK Space Agency awarded approximately USD 20.3 million (£16 million) to two projects under its Connectivity in Low Earth Orbit (C-LEO) program, part of a larger USD 203 million (£160 million) initiative over four years. This funding supports companies like EnSilica and Excelerate Technology to develop next-generation terminals compatible with systems like OneWeb. As global mega-constellations are projected to account for ~75% of 18,000 satellite launches between 2021 and 2031, such investments are pivotal to bridging the digital divide and driving market expansion.

High initial deployment costs pose a significant challenge to the satellite internet industry, often ranging from hundreds of millions to several billion USD. For example, launching a single satellite can cost between ~USD 50 million and USD 400 million, depending on the satellite’s size and technology. Building and deploying large constellations, such as those with hundreds or thousands of satellites, can push total investments into the multi-billion-dollar range. In addition, expenses related to ground infrastructure, user terminals, and ongoing maintenance add to the financial burden. These substantial upfront costs can delay project timelines and limit entry for smaller players, posing a barrier to faster market expansion.

Frequency Band Insights

The K-band segment led the market with the largest revenue share of 42.9% in 2024. The K-band frequency is increasingly utilized in defense, broadcasting, and security radar systems. K-band monolithic microwave integrated circuit (MMIC) technology is an emerging trend that enables the implementation of K-band power amplifiers and low-noise amplifiers with lower costs, ease of large-scale production, and high durability, which is expected to drive the growth of the market in the forecasted period. In addition, K-band frequency is also used for providing wireless broadband access in remote locations and is used in fixed satellites, local-multipoint distribution systems (LMDS), and digital point-to-point radio services.

The X-band segment is expected to register at the fastest CAGR from 2025 to 2030. The X-band has been explicitly allocated for marine, military, and government missions. The demand for X-band is increasing owing to the growing adoption in marine rescue operations due to the capability to explore and track a specific target. Furthermore, it offers communication antenna systems that support rescue efforts by providing broadband service and email access for operation and personnel usage, boosting the market in this category. The International Telecommunications Union and the United Nations body in command of the wireless spectrum have allocated X-band SATCOM for use by military missions. The X-band frequency band has become increasingly popular as more governments seek X-band SATCOM for their military mission; this was especially noticeable during combat operations in Iraq and Afghanistan.

Industry Insights

The government and public segment accounted for the largest market revenue share in 2024. Governments across the globe have been investing in satellite broadband technology to provide broadband services in every region of their nations and rely only on cutting-edge technology to connect rural areas to the broadband network. For instance, In September 2022, Hughes Communications India announced the commercial release of the HTS internet service. The service combines ground-based Hughes Jupiter Platform technology with the K-band satellite frequency on GSAT-29 and GSAT-11, operated by the Indian Space Research Organization (ISRO), to provide countrywide high-speed internet connectivity. This includes the most distant regions in the northeastern and the densely forested regions, such as Jharkhand, Odisha, Chhattisgarh, Maharashtra, and others.

Governments all over the world are implementing satellite internet to operate smart cities. Smart cities are brimming with devices that automatically alert concerned authorities and constantly monitor the water and electricity supply and the level of air quality in specific areas. There must be a broadband connection for these sensors to communicate with one another and a centralized computer that turns sensor readings data into valuable insights. Although optical fibers reach urban areas, satellite internet can be used in an emergency.

The media and broadcasting segment is expected to register at the fastest CAGR from 2025 to 2030. The development of the media and broadcasting sector is due to an increase in demand for TV and radio applications. In addition, the growing popularity of over-the-top (OTT) services is fueling market growth. Internet services have grown in popularity over the last few decades as network coverage has expanded and societal lives have changed. This increased demand for content distribution via the internet among broadcasting service providers, fueling the media and broadcasting segment. For instance, The AIBROINFRA project is a crucial step towards a worldwide mobile solution for optimizing high-quality audio/video connectivity even from remote areas where there is no terrestrial network. The key objective of this project is to address the growing demand in the broadcast business for more program development of high quality while simultaneously lowering operating expenses.

Regional Insights

North America dominated the satellite internet market with the largest market revenue share of 32.0% in 2024. The North America market is being driven by the growing demand for high-speed connectivity in rural and underserved areas, increasing reliance on satellite-based solutions for precision agriculture, and rising public and private investments in space-based broadband infrastructure. This growth reflects a broader push to extend reliable internet access beyond the limitations of terrestrial networks, especially in areas where fiber or cable infrastructure is economically unviable. For instance, in January 2024, John Deere partnered with SpaceX to provide satellite internet connectivity for farmers via Starlink. This solution supports precision agriculture by enabling real-time data sharing, remote diagnostics, and machine-to-machine communication, targeting rural areas with limited cellular coverage in the U.S. and Brazil starting in late 2024.

U.S. Satellite Internet Market Trends

The satellite internet market in the U.S. held a dominant position in 2024. The U.S. market is witnessing significant transformation, driven by increased private-sector investments in LEO (Low Earth Orbit) constellations, rising demand for connectivity in mobility sectors such as aviation and maritime, and regulatory support for bridging the rural-urban digital divide. These trends are accelerating large-scale satellite deployments and enhancing competitive dynamics in the broadband space. For instance, in April 2025, Amazon launched the first 27 satellites for its Kuiper broadband constellation, initiating a global internet-from-space network. The company aims to deploy 3,236 satellites under its USD 10 billion Project Kuiper, intensifying competition with SpaceX’s Starlink in the satellite internet sector.

The Canada satellite internet market is being driven by government-backed initiatives to bridge the digital divide in remote regions, partnerships with global satellite providers, and increased demand for broadband connectivity in northern and rural areas. In November 2024, the Ontario government announced the Ontario Satellite Internet (ONSAT) program, a partnership with Starlink to provide high-speed satellite internet to 15,000 underserved and remote homes and businesses starting June 2025. This initiative is part of Ontario’s broader plan to ensure universal, reliable internet access by the end of 2025, backed by nearly USD 3 billion in investments across fiber, fixed wireless, and satellite technologies.

The satellite internet market in Mexico is supported by rising demand for rural broadband, federal efforts to connect underserved regions, and growing private-sector collaboration with satellite operators to improve digital inclusion. The government has prioritized connectivity through programs including CFE Telecommunications Internet para Todos, and partnerships with satellite firms are increasingly being used to expand coverage where terrestrial infrastructure is lacking.

Asia Pacific Satellite Internet Market Trends

The satellite internet market in Asia Pacific was identified as a lucrative region in 2024, driven by growing government-backed rural connectivity programs, rising demand for digital inclusion across emerging economies, and increased public-private partnerships focused on LEO satellite deployment. These factors are enabling wider adoption of satellite broadband solutions in remote and underserved areas across the region. For instance, in January 2025, Airtel announced the completion of two satellite internet ground stations in India, pending final spectrum allocation. With 635 satellites already launched, Airtel is set to challenge global players by expanding broadband access in underserved regions, amid ongoing regulatory debates over spectrum allocation. Also, in March 2025, Airtel signed an agreement with SpaceX to introduce Starlink’s high-speed satellite internet services in India. The collaboration aims to expand Airtel’s connectivity reach by combining Starlink’s advanced satellite network with Airtel’s ground infrastructure and retail presence, targeting rural communities, schools, and small businesses.

The China satellite internet market held a substantial share in 2024. The Chinese market is experiencing rapid growth, driven by strong government support through national initiatives such as the Digital Silk Road, which aims to expand global digital infrastructure using satellite technology. The integration of satellite internet with China’s rapidly expanding 5G networks further enhances connectivity in remote and rural areas, supporting applications such as smart cities and the Internet of Things (IoT). In addition, China’s advanced domestic satellite manufacturing capabilities enable cost-effective deployment of large satellite constellations, accelerating market growth. For instance, on April 1, 2025, China launched a test satellite aboard a Long March-2D rocket to verify mobile-to-satellite broadband connections and space-ground network integration, marking a significant step in advancing its satellite internet technology.

The satellite internet market in Japan held a significant share in 2024. In Japan, the satellite internet industry is influenced by steady government investments aimed at strengthening disaster preparedness and ensuring resilient communications infrastructure, particularly in rural and remote areas prone to natural disasters. In addition, Japan’s advanced technological ecosystem promotes the integration of satellite internet with emerging technologies, including AI, IoT, and 5G, enabling innovative applications in sectors such as remote manufacturing, smart cities, and emergency response. The country’s focus on enhancing digital inclusivity further drives the adoption of satellite connectivity in underserved regions. For instance, in November 2023, Amazon’s Project Kuiper partnered with NTT and SKY Perfect JSAT to provide advanced LEO satellite broadband services targeting enterprises and government bodies. Also, in April 2025, Japan’s KDDI launched au Starlink Direct, a direct-to-cell satellite service that allows smartphones to connect directly to Starlink satellites, expanding mobile coverage to remote areas and strengthening emergency communication capabilities nationwide.

Europe Satellite Internet Market Industry Trends

The satellite internet market in Europe was identified as a lucrative region in 2024. The European market is witnessing significant transformation, driven by increasing demand for connectivity in rural and remote areas, strong regulatory support promoting digital inclusion, and substantial investments in next-generation satellite technologies such as High Throughput Satellites (HTS) and Low Earth Orbit (LEO) constellations. In addition, the rise of IoT applications across industries like agriculture, transportation, and energy is fueling the need for reliable satellite communication networks. For instance, in March 2025, Orange S.A. (Orange Africa and Middle East) partnered with Eutelsat to expand satellite internet access via the EUTELSAT KONNECT satellite, targeting underserved regions in countries including Jordan, Côte d'Ivoire, Senegal, and the Democratic Republic of Congo, with a focus on delivering secure, high-speed connectivity adapted to local requirements.

The Germany satellite internet market is being shaped by increasing demand for reliable connectivity in remote and rural regions, growing adoption of Internet of Things (IoT) applications in industries such as manufacturing and logistics, and supportive government initiatives promoting digital infrastructure expansion. Also, advances in hybrid satellite-terrestrial technologies are enabling more seamless and efficient network coverage in the country. For instance, Telefónica Germany (O2) partnered with Skylo to launch a hybrid satellite-terrestrial IoT service in early 2024. Utilizing iSIM technology combined with Skylo’s non-terrestrial network profile, the service connects devices in remote areas lacking terrestrial NB-IoT coverage. Initially targeting Europe and North America, this collaboration significantly expands Telefónica’s IoT connectivity capabilities on a global scale.

The satellite internet market in the UK is driven by increasing government support for expanding digital infrastructure to rural and underserved areas, growing demand for reliable broadband connectivity among businesses and remote communities, and strong innovation in satellite technology, fostering competitive services. In addition, the UK's strategic positioning as a hub for satellite development and space technology investment further accelerates market growth. For instance, in March 2023, OneWeb launched its final 36 satellites aboard an Indian LVM3 rocket, completing its initial 618-satellite constellation. This milestone enables the UK-based firm to offer global broadband coverage primarily through telecom partners, while planning further satellite advancements to compete with major players like Starlink in the global connectivity market.

The growing demand for enhanced mobile connectivity and emergency communication services in rural and underserved areas is driving innovation in the UK satellite internet industry. In January 2025, Amazon announced plans to launch its Project Kuiper satellite broadband service in the UK within two years. The initiative aims to deploy 3,000 low-Earth orbit satellites to rival Starlink and explore direct-to-device connectivity, which will enhance mobile and emergency communications in remote and underserved areas across the country.

Key Satellite Internet Company Insights

Some of the key players operating in the market include Singtel Group, EchoStar Corporation (HughesNet), Freedomsat, and Thuraya Telecommunications Company.

-

Founded in 1879 and headquartered in Singapore, Singtel Group is a prominent telecommunications company in Asia. It provides a wide range of services including satellite internet, mobile, fixed-line, and digital solutions across consumer, enterprise, and government sectors. Singtel leverages extensive regional infrastructure and strategic partnerships to deliver broadband connectivity, cloud services, and cybersecurity solutions, aiming to enhance digital transformation across Asia-Pacific.

-

Founded in 1980 and headquartered in Colorado, U.S., EchoStar Corporation is a global provider of satellite communication solutions. Through its HughesNet division, EchoStar delivers high-speed satellite internet services primarily to residential and business customers in North America and Latin America. The company leverages advanced satellite technology and a robust network infrastructure to offer reliable broadband access in rural and remote areas, supporting digital inclusion and enhancing connectivity where traditional internet options are limited.

Key Satellite Internet Companies:

The following are the leading companies in the satellite internet market. These companies collectively hold the largest market share and dictate industry trends.

- Singtel Group

- Thuraya Telecommunications Company

- Eutelsat Communications SA / OneWeb

- OneWeb.net

- Axess

- Freedomsat

- SpaceX (Starlink)

- Viasat, Inc.

- EchoStar Corporation (HughesNet)

- DSL Telecom

Recent Developments

-

In May 2025, Starlink secured preliminary regulatory approval to begin operations in India, offering plans starting at USD 10 (₹850) per month. With a 10 million user target, this move underscores satellite internet’s potential to deliver affordable, high-speed connectivity across underserved regions in developing economies.

-

In May 2025, Safaricom announced plans to collaborate with satellite internet firms to boost broadband in underserved Kenyan regions. This move responds to Starlink’s rapid growth, which doubled its market share in three months, prompting Safaricom to urge regulators to require satellite providers to partner with local operators.

-

In April 2025, Amazon's Project Kuiper successfully launched its KA-01 mission, deploying 27 LEO satellites as part of a 3,200-satellite constellation plan. This marks the beginning of full-scale operations, with service expected to begin later this year, enhancing global broadband coverage and competition.

-

In March 2025, Jio Platforms and Bharti Airtel partnered with SpaceX’s Starlink to launch satellite internet services in India. This collaboration addresses challenges in spectrum allocation and aims to provide high-speed connectivity to rural regions where traditional networks face limitations.

-

In November 2024, BSNL, in collaboration with Viasat, launched India’s first satellite-to-device service using L-band geostationary satellites. This two-way communication system enables connectivity in remote areas without cellular or Wi-Fi. It supports emergency calls, messaging, and digital payments, advancing India’s non-terrestrial network capabilities.

-

In June 2024, Orbit Connect India, a joint venture between Jio Platforms and Luxembourg-based SES, secured satellite operation approvals from IN-SPACe. These clearances position Reliance to enter India’s growing satellite internet space, joining a competitive field that includes Starlink, Kuiper, and OneWeb.

-

In September 2023, Reliance Jio unveiled JioSpaceFiber at India Mobile Congress 2023. This satellite broadband service aims to deliver high-speed, reliable internet across India, especially to underserved rural regions. By bypassing ground infrastructure limits, it promises to enhance digital access, boosting education, healthcare, and economic growth nationwide.

-

In May 2022, Singtel launched iSHIP, an all-in-one platform providing satellite-enabled digital services and connectivity for the maritime industry. This service of iSHIP gave ship owners and ship managers substantial visibility and flexibility of their operations and resources

-

In July 2022, Eutelsat Communications collaborated with OneWeb to combine Eutelsat’s 36 GEO satellites with OneWeb’s constellation of 648 low Earth orbit satellites. This enabled both entities to capture the satellite connectivity market and take on SpaceX (Starlink)'s satellite internet dominance.

Satellite Internet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.8 billion

Revenue Forecast in 2030

USD 22.6 billion

Growth rate

CAGR of 13.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Frequency band, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Singtel Group; Freedomsat; EchoStar Corporation; Thuraya Telecommunications Company; Eutelsat Communications SA; OneWeb.net; SpaceX; Viasat, Inc.; Axess; DSL Telecom

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Satellite Internet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global satellite internet market report based on frequency band, industry, and region.

-

Frequency Band Outlook (Revenue, USD Million, 2018 - 2030)

-

L-band

-

C-band

-

K-band

-

X-band

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy & Utility

-

Government and Public Sector

-

Transport & Cargo

-

Maritime

-

Military

-

Corporates/Enterprises

-

Media & Broadcasting

-

Other Industries

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global satellite internet market size was estimated at USD 10.4 billion in 2024 and is expected to reach USD 22.6 billion in 2030.

b. The global satellite internet market is expected to grow at a compound annual growth rate of 13.9% from 2025 to 2030 to reach USD 22.6 billion by 2030.

b. The North America satellite internet market accounted for 32.0% of the global share in 2024. The satellite internet market in North America is being driven by the growing demand for high-speed connectivity in rural and underserved areas, increasing reliance on satellite-based solutions for precision agriculture, and rising public and private investments in space-based broadband infrastructure.

b. Some key players operating in the satellite internet market include Singtel Group; Freedomsat; EchoStar Corporation; Thuraya Telecommunications Company; Eutelsat Communications SA; OneWeb.net; SpaceX; Viasat, Inc.; Axess; DSL Telecom

b. Key factors that are driving the growth of the satellite internet market include expanding rural connectivity needs, surging demand for high-speed broadband in remote areas, and the growing reliance on digital services across industries. Governments and private players are increasingly investing in low Earth orbit (LEO) satellite constellations to bridge the digital divide and support nationwide broadband coverage

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.