- Home

- »

- Next Generation Technologies

- »

-

Satellite Servicing Market Size & Share, Industry Report 2033GVR Report cover

![Satellite Servicing Market Size, Share & Trends Report]()

Satellite Servicing Market (2025 - 2033) Size, Share & Trends Analysis Report By Orbit (Low Earth Orbit (LEO)), Medium Earth Orbit (MEO), Geostationary Orbit (GEO)), By Service (Robotic Servicing, Refueling, Assembly), By Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-652-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Satellite Servicing Market Summary

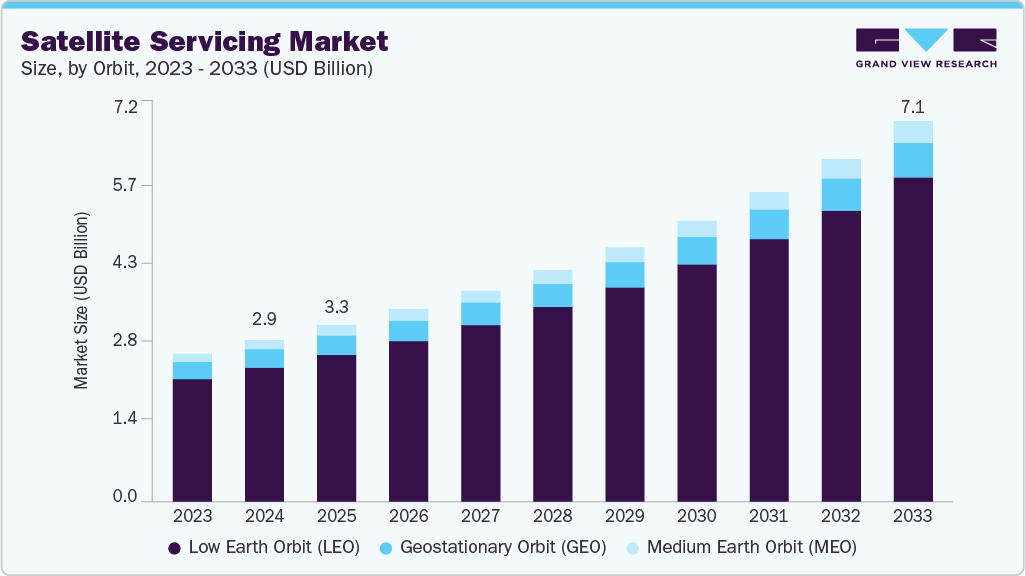

The global satellite servicing market size was estimated at USD 2,996.1 million in 2024 and is projected to reach USD 7,061.9 million by 2033, growing at a CAGR of 10.1% from 2025 to 2033. Market growth is primarily driven by the rising demand for extending satellite lifespans, the increasing number of aging satellites in orbit, higher investments in space infrastructure, advances in robotic servicing technologies, and the development of on-orbit servicing solutions.

Key Market Trends & Insights

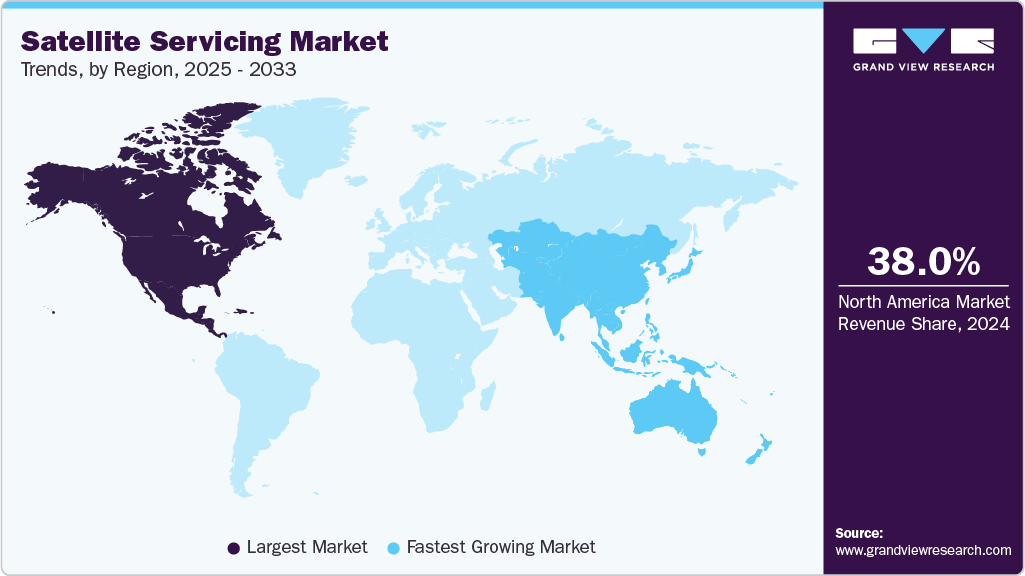

- North America dominated the global satellite servicing market with the largest revenue share of over 38% in 2024.

- The satellite servicing market in the U.S. led the North America market and held the largest revenue share in 2024.

- By orbit, the low Earth orbit (LEO) segment led the market and held the largest revenue share of over 83% in 2024.

- By service, the robotic servicing segment led the market and held the largest revenue share of over 44% in 2024.

- By type, the large satellites (>1000 Kg) segment dominates the market and holds the largest revenue share of over 47% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,996.1 Million

- 2033 Projected Market Size: USD 7,061.9 Million

- CAGR (2025-2033): 10.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market.

The market growth is primarily driven by the increasing need for extending the lifespan and operational efficiency of existing satellites through in-orbit servicing, refueling, and repairs. The rising demand for cost-effective space operations, especially by commercial satellite operators and defense agencies, is fueling the development of autonomous and robotic servicing technologies. Modular satellite designs and standardized servicing interfaces are further improving the scalability and feasibility of satellite maintenance missions, which is expected to drive the satellite servicing industry expansion.The rising demand for extending the operational life of satellites is significantly fueling the growth of the satellite servicing market. With the increasing number of satellites being launched for communication, Earth observation, and defense applications, there is a growing need to maintain, refuel, and upgrade these assets in orbit. Satellite servicing technologies enable operators to extend satellite lifespans, reduce mission costs, and improve return on investment. This trend is attracting both government and commercial space stakeholders, thereby driving continuous innovation in the market.

Additionally, the increasing focus on space sustainability and debris mitigation is becoming a major growth driver for the market. The orbital environment becomes increasingly congested, and there is a growing emphasis on in-orbit servicing solutions such as de-orbiting defunct satellites, repositioning assets, and clearing space debris. The satellite servicing industry is evolving to offer robotic arms, autonomous docking, and debris collection capabilities. These solutions ensure safer space operations align with global sustainability goals, boosting adoption across the satellite servicing industry.

Furthermore, the integration of autonomous robotics and AI-based navigation systems is revolutionizing the capabilities of satellite servicing missions. These advanced technologies allow precise, real-time operations such as autonomous refueling, part replacement, and inspection tasks without human intervention. Automating these complex maneuvers enhances mission success rates and reduces operational risks, thereby accelerating the adoption of satellite servicing solutions across both government and commercial space programs.

Moreover, increasing collaboration between satellite manufacturers, servicing technology providers, and space agencies is enhancing the development of standardized servicing architectures. These partnerships lead to interoperable spacecraft designs, modular servicing interfaces, and open-system protocols that streamline servicing operations. The alignment of technical standards across stakeholders is fostering a more integrated and scalable satellite servicing ecosystem, ultimately fueling robust market growth.

Orbit Insights

The low Earth orbit (LEO) segment dominated the satellite servicing market with a share of over 83% in 2024, driven by the rapid expansion of LEO satellite constellations for broadband, Earth observation, and IoT applications. The shorter distances in LEO allow for lower latency and easier access for servicing missions, making it a cost-effective and technically feasible orbit for refueling, inspection, and repair. Growing investments from private players and increasing demand for servicing solutions to support mega-constellations like Starlink and OneWeb further reinforce the segment’s leadership in the satellite servicing industry.

The medium Earth orbit (MEO) segment is expected to witness a significant CAGR of over 9% from 2025 to 2033. This growth is primarily driven by the rising deployment of navigation and communication satellite constellations in MEO, such as those supporting global positioning systems (e.g., GPS, Galileo). The increasing need for life-extension, orbital adjustments, and in-orbit repairs of these critical satellites is fueling demand for advanced servicing solutions. Advancements in autonomous servicing vehicles and standardized refueling interfaces are enabling efficient operations in the MEO environment, further accelerating segment growth.

Service Insights

The robotic servicing segment accounted for the largest share of the satellite servicing industry in 2024, driven by increasing demand for in-orbit satellite maintenance, refueling, and life-extension services. Advancements in autonomous robotics, AI-powered navigation, and precision docking technologies are enabling complex tasks such as part replacement, inspection, and repositioning without human intervention. Growing investments by government space agencies and commercial satellite operators in robotic servicing missions are enhancing operational efficiency and reducing satellite replacement costs. The ability to perform multi-function servicing tasks with high reliability is positioning robotic systems as the preferred solution in the evolving satellite servicing landscape.

The active debris removal (ADR) and orbit adjustment segment is expected to witness the fastest CAGR from 2025 to 2033. This growth is fueled by the increasing congestion in low Earth orbit (LEO) and geostationary orbit (GEO), prompting urgent demand for technologies that can remove defunct satellites and mitigate collision risks. Rising global concerns over space sustainability, along with regulatory pressure from space agencies and international organizations, are accelerating investment in ADR capabilities. Additionally, advancements in autonomous robotics and AI-driven navigation systems are enhancing the precision and efficiency of orbit correction and debris capture missions, driving widespread adoption across commercial and defense sectors.

Type Insights

The large satellites (>1000 Kg) segment accounted for the largest market share in 2024, owing to their critical role in high-value applications such as defense surveillance, global communications, and Earth observation. These heavy satellites represent significant capital investment, making in-orbit services such as refueling, repositioning, and life-extension an attractive option to maximize operational lifespan and ROI. The growing demand for maintaining uninterrupted services, especially in geostationary orbit, is prompting satellite operators to adopt servicing solutions tailored for large spacecraft. Additionally, advancements in robotic servicing technologies and standardized docking interfaces are further driving the dominance of this segment in the satellite servicing market.

The small satellites (< 500 Kg) segment is expected to witness the fastest CAGR from 2025 to 2033, driven by the rapid increase in the deployment of small satellite constellations for communication and scientific missions. Their shorter lifecycles and limited onboard fuel capacity make them ideal candidates for in-orbit servicing solutions such as refueling, repositioning, and inspection. The growing demand for cost-effective, scalable space operations and the rise of commercial space startups further support servicing needs for small satellites. Advancements in miniaturized robotics and autonomous servicing vehicles are making it technically and economically feasible to support this rapidly expanding segment.

End Use Insights

The commercial segment accounted for the largest market share in 2024, driven by the growing demand from satellite operators for cost-effective solutions to extend the operational life of high-value communication and earth observation. The number of private space ventures and satellite constellations increases, and commercial entities are investing in satellite servicing technologies such as in-orbit refueling, robotic repairs, and relocation services to maximize asset utilization and reduce replacement costs. The rising competition among satellite operators to maintain uptime and orbital slots is further accelerating the adoption of autonomous and scalable servicing solutions, positioning the commercial sector as a dominant force in the satellite servicing market.

The military & government segment is expected to witness the highest CAGR from 2025 to 2033. This growth is driven by the rising need to extend the operational life of high-value defense satellites and ensure mission continuity in contested space environments. Governments are increasingly investing in in-orbit refueling, relocation, and inspection capabilities to maintain real-time surveillance, secure communications, and national security assets. Advancements in autonomous servicing technologies and strategic collaborations with private players are further accelerating adoption. The emphasis on space resilience and operational agility is prompting significant funding in satellite servicing programs across global defense sectors.

Regional Insights

The North America satellite servicing market accounted for the largest market share of over 38% in 2024, driven by the region’s advanced space infrastructure, strong government support, and significant investments by private aerospace companies. Rising demand for satellite life extension, active debris removal, and in-orbit inspection is propelling the development and deployment of sophisticated servicing missions. Government-backed initiatives are further accelerating market growth by fostering public-private partnerships and driving R&D investments across the North American satellite servicing industry.

U.S. Satellite Servicing Market Trends

The U.S. satellite servicing industry is expected to grow at a significant CAGR of over 9% from 2025 to 2033, driven by the country’s robust space infrastructure and private sector investment. The increasing frequency of satellite launches and the growing need to extend satellite lifespans are accelerating demand. The U.S. government's emphasis on space sustainability and debris mitigation, including initiatives like the OSAM (On-orbit Servicing, Assembly, and Manufacturing) program, is further contributing to market expansion, fueling the growth of the satellite servicing industry in the U.S.

Europe Satellite Servicing Market Trends

The Europe satellite servicing industry held a significant revenue share of over 27% in 2024. In Europe, the growth is driven by increasing government and ESA-led initiatives focused on in-orbit servicing and satellite life extension. The region’s strong emphasis on space sustainability and compliance with emerging space traffic management regulations is further boosting demand for advanced servicing capabilities. The growing need for infrastructure to support satellite constellations also contributes to the rising momentum in the regional market.

The UK satellite servicing market is expected to grow at a significant CAGR in the forthcoming years. The country benefits from its advanced space infrastructure, strong government backing through agencies like the UK Space Agency. Increasing investments in in-orbit servicing technologies, such as life extension, debris removal, and satellite inspection, are driving market adoption. The UK’s focus on space sustainability and its leadership in regulatory frameworks are creating a favorable environment for innovation and private sector involvement in satellite servicing solutions.

The growth of the satellite servicing market in Germany is driven by the country’s strong aerospace engineering capabilities and robust investment in space research. Germany’s focus on space sustainability is fostering the development of in-orbit servicing technologies, including refueling, repair, and de-orbiting solutions. Government support through agencies like DLR and collaborations with domestic and international space companies are further accelerating innovation. The country’s push for technological sovereignty is creating new growth avenues for the satellite servicing industry.

Asia Pacific Satellite Servicing Market Trends

The Asia Pacific satellite servicing industry is expected to grow at the fastest CAGR of over 12% from 2025 to 2033, driven by increasing satellite launches, expanding national space programs, and rising demand for in-orbit maintenance and life extension. The emergence of private space startups and government-backed initiatives, such as ISRO's in-orbit servicing plans, is fostering innovation. Regional focus on space sustainability and orbital debris mitigation is further accelerating the adoption of satellite servicing.

The Japan satellite servicing market is gaining momentum, driven by the country's advanced space infrastructure, strong government support, and leadership in robotics and automation. Japan's commitment to space sustainability, exemplified by initiatives from JAXA and partnerships with private firms, is fostering the development. The nation’s expertise in precision engineering and autonomous systems supports innovations in satellite repair, refueling, and debris removal. Japan's growing participation in international space collaborations is expanding opportunities and accelerating the adoption of the satellite servicing industry.

The satellite servicing market in China is rapidly expanding, driven by the country’s strategic investments in space technology and in-orbit infrastructure. China’s space program, led by organizations like CNSA, is emphasizing satellite life extension, orbital refueling, and debris removal as key priorities to support its growing constellation of satellites. Government support through national space initiatives and favorable policy frameworks is fostering innovation and private sector participation. China's increasing demand for secure communication, Earth observation, and navigation capabilities is accelerating the adoption of satellite servicing solutions, fueling robust market growth.

Key Satellite Servicing Company Insights

Some of the key players operating in the market include Northrop Grumman and Maxar Technologies.

-

Northrop Grumman is a leading aerospace and defense company recognized for pioneering satellite servicing missions through its subsidiary, Space Logistics. It developed and launched the Mission Extension Vehicle (MEV), the world’s first commercial satellite servicing spacecraft, successfully extending the life of aging satellites in geostationary orbit. Northrop Grumman’s proven on-orbit servicing capabilities, including docking, relocation, and refueling, position it at the forefront of the global satellite servicing market.

-

Maxar Technologies is a major force in space infrastructure and satellite servicing, particularly known for its work in robotic arms and in-space assembly. Maxar is developing technologies that enable satellites to be refueled, repaired, and upgraded in orbit. The company’s high-precision robotics and servicing platforms are designed to extend satellite lifespans, reduce operational costs, and increase space mission flexibility. Maxar’s advanced capabilities in in-orbit servicing are making it a key enabler of next-generation satellite operations.

Orbit Fab, Inc. and Starfish Space are some of the emerging participants in the satellite servicing market.

-

Orbit Fab, Inc. is an innovative startup transforming the future of space logistics with its “Gas Stations in Space” concept. The company is building a network of in-orbit propellant depots to support satellite servicing, refueling, and maneuverability. With several demonstration missions and contracts with government and private sector clients, Orbit Fab aims to establish a sustainable orbital economy. Its pioneering focus on in-space refueling makes it one of the most promising emerging players in the satellite servicing ecosystem.

-

Starfish Space is a fast-growing startup specializing in autonomous satellite servicing and docking solutions. Its flagship product, the Otter servicing vehicle, is designed to capture, relocate, and extend the life of satellites in both LEO and GEO. By leveraging cutting-edge guidance, navigation, and control (GNC) technologies, Starfish is developing cost-effective and scalable servicing platforms. The company’s focus on autonomous, robotic operations positions it as a rising star in the evolving satellite servicing market.

Key Satellite Servicing Companies:

The following are the leading companies in the satellite servicing market. These companies collectively hold the largest market share and dictate industry trends.

- Northrop Grumman

- Maxar Technologies

- Astroscale

- Orbit Fab, Inc.

- Thales Alenia Space

- AIRBUS

- Lockheed Martin Corporation.

- ClearSpace

- Altius Space Machines

- Starfish Space.

Recent Developments

-

In June 2025, Northrop Grumman announced the integration of a new robotics payload onto its Mission Robotic Vehicle (MRV) under DARPA’s Robotic Servicing of Geosynchronous Satellites (RSGS) program. The update enables advanced capabilities such as autonomous inspection, in-orbit repair, and repositioning of satellites in geostationary orbit. Designed to support commercial and government operators, this development represents a major step toward operationalizing robotic satellite servicing and extending the life and functionality of high-value orbital assets, accelerating the growth of the satellite servicing industry.

-

In May 2025, Starfish Space announced the upcoming Otter Pup 2 mission, which aims to perform the first-ever commercial docking with an unprepared satellite in low Earth orbit. This mission marks Starfish Space’s transition from technology demonstration to a fully operational satellite servicing industry. Designed to enable autonomous rendezvous and docking without pre-installed client interfaces, the Otter Pup 2 represents a major advancement in scalable in-orbit servicing solutions. The mission supports the growing need for flexible satellite life extension and orbital asset management, reinforcing Starfish’s role in the evolving satellite servicing market.

-

In April 2025, Astroscale announced a landmark mission to perform the first-ever hydrazine refueling of a U.S. Space Force satellite in geostationary orbit (GEO). The operation will utilize Orbit Fab’s proprietary refueling interface, marking a significant breakthrough in commercial military satellite servicing. This mission introduces a new era of in-orbit refueling capabilities, enhancing the longevity, flexibility, and operational readiness of defense satellite assets and further solidifying the strategic role of satellite servicing in modern space infrastructure.

Satellite Servicing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,269.0 million

Revenue forecast in 2033

USD 7,061.9 million

Growth rate

CAGR of 10.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Orbit, service, type, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Northrop Grumman; Maxar Technologies; Astroscale; Orbit Fab, Inc.; Thales Alenia Space; AIRBUS; Lockheed Martin Corporation.; ClearSpace; Altius Space Machines; Starfish Space

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Satellite Servicing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the satellite servicingmarket report based on orbit, service, type, end use, and region:

-

Orbit Outlook (Revenue, USD Million, 2021 - 2033)

-

Low Earth Orbit (LEO)

-

Medium Earth Orbit (MEO)

-

Geostationary Orbit (GEO)

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Active Debris Removal (ADR) and Orbit Adjustment

-

Robotic Servicing

-

Refueling

-

Assembly

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Satellites (< 500 Kg)

-

Medium Satellites (501- 1000 Kg)

-

Large Satellites (>1000 Kg)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Military & Government

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global satellite servicing market was estimated at USD 2,996.1 Million in 2024 and is expected to reach USD 3,269.0 Million in 2025.

b. The global satellite servicing market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2033 to reach USD 7,061.9 Million by 2033.

b. The Asia Pacific satellite servicing is expected to grow at the highest CAGR of over 12% from 2025 to 2033, driven by increasing satellite launches, expanding national space programs, and rising demand for in-orbit maintenance and life extension. The emergence of private space startups and government-backed initiatives such as ISRO's in-orbit servicing plans are fostering innovation. Regional focus on space sustainability and orbital debris mitigation is further accelerating the adoption of satellite servicing market.

b. The key players in the satellite servicing market are Northrop Grumman, Maxar Technologies, Astroscale, Orbit Fab, Inc., Thales Alenia Space, AIRBUS, Lockheed Martin Corporation., ClearSpace, Altius Space Machines, Starfish Space.

b. Key drivers of satellite servicing market include by the increasing demand for extending satellite lifespans, rising number of aging satellites in orbit, growing investments in space infrastructure, advancements in robotic servicing technologies, and the emergence of on-orbit servicing solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.