- Home

- »

- Next Generation Technologies

- »

-

Saudi Arabia Artificial Intelligence Market, Industry Report, 2030GVR Report cover

![Saudi Arabia Artificial Intelligence Market Size, Share & Trends Report]()

Saudi Arabia Artificial Intelligence Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (Hardware, Software, Services), By Technology (Deep Learning, Machine Learning, NLP), By Function, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-250-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

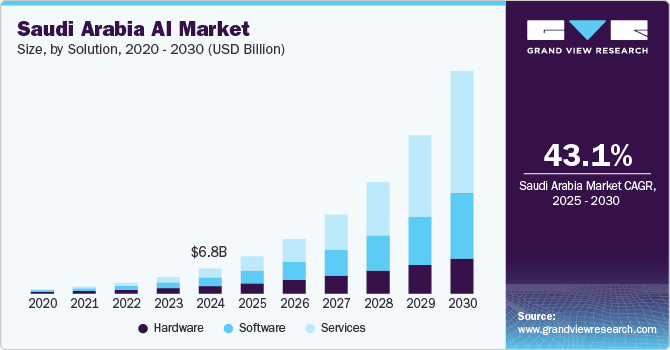

The Saudi Arabia AI market was valued at USD 6.76 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 43.1% between 2025 and 2030. An influx of investments in developing AI solutions and technology adoption across the financial, healthcare, manufacturing, and automotive sectors will bring a paradigm shift in the regional landscape. The penetration of the 4th Industrial Revolution and robust policies from governments and businesses have encouraged stakeholders to inject funds into the GCC country.

The rising penetration of 5G networks across the end-use industries has boded well for the industry outlook. Moreover, the trend for data-based AI solutions has put the Middle Eastern country in a favorable position. Predominantly, the Saudi Arabian government has injected funds into the technology, combining AI and data into major domains. Amidst rapid urbanization, investments in technology could be pronounced in the ensuing period.

Labor-intensive sectors, including healthcare and retail, are likely to depict strong demand for automation. Predominantly, investments in non-oil sectors could position the GCC country in a lucrative position. For instance, retail companies have sought AI to gain consumer insights and inform about promotions and pricing. As the world moves towards AI, stakeholders are likely to unravel opportunities to gain a competitive edge.

Saudi Arabia’s Vision 2030 encourages local manufacturing and assembly of tech hardware. The government aims to reduce dependence on imports by fostering local production of AI hardware, which can eventually reduce costs and increase accessibility for local AI projects. Given the growing need for public safety in urban projects and across critical sectors, AI-powered surveillance requires powerful processing units. This demand for high-quality AI hardware in security sectors is projected to grow as smart cities like NEOM advance.

Market Concentration & Characteristics

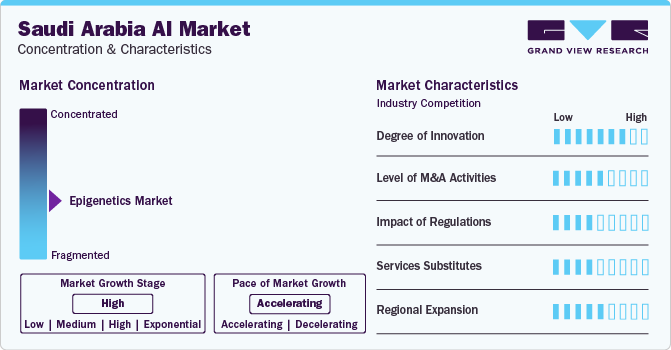

The market is likely to witness innovation with profound investments in NLP-powered chatbots. The applications of NLP in Google Assistants and Amazon’s Alexa have helped the stakeholders boost communications. With AI gaining further traction across the Middle East, Saudi Arabia is poised to exhibit increased traction for state-of-the-art technology.

Stakeholders expect mergers & acquisitions to be noticeable as market companies strive to gain a competitive edge. Predominantly, the democratization of AI has leveraged businesses to explore new ways and invest in mergers & acquisitions activities. M&A activities will further receive an impetus as the country's privatization initiatives and economic diversification. The Kingdom of Saudi Arabia will continue to observe a similar trend following the rapidly expanding economy and surging foreign investments.

Regulation on AI has garnered headlines as the Saudi Authority for Data and Artificial Intelligence has strengthened its efforts to oversee and manage the use and development of AI in the region. With robust smart city projects, including NEOM, the need for AI regulation has become prominent in managing transportation systems and homes. Regulation of AI, intellectual property rights on AI, and privacy control will redefine the business forecast.

The number of substitutes could be less pronounced on the back of soaring penetration of AI across end-use industries. Meanwhile, automation, expert systems, and rule-based systems will continue to contribute to Saudi Arabia's economic growth. However, Saudi Arabia, along with UAE and Qatar, has exhibited a strong commitment toward AI implementation.

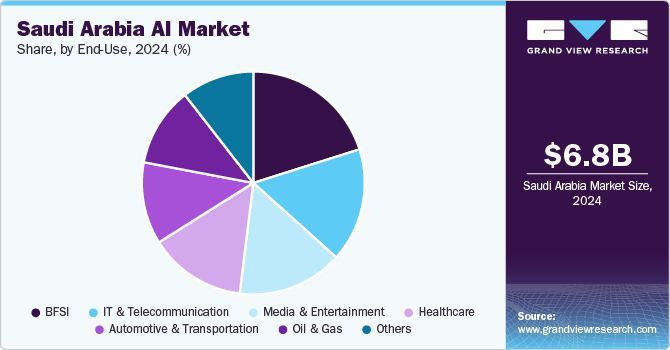

End-users, such as BFSI, healthcare, retail, automotive & transportation, oil & gas, advertising & media, and manufacturing, are slated to depict strong demand for AI tools and technologies. Besides, IT & telecommunication, cybersecurity, aerospace & defense, and education sectors are expected to inject funds into machine learning and deep learning. In essence, the Saudi Arabian government is slated to spur spending on AI and its research in defense and intelligence.

Solution Insights

The software segment spearheaded the Saudi Arabia AI market, accounting for 35.1% of revenue share in 2024. The segment will continue to gain traction to offer real-time insights, create smart applications and propel deep learning and machine learning. For instance, software deployment through the cloud has become pronounced while customizable AI and pre-trained models continue to gain ground.

The service segment is likely to depict a heightened demand, partly due to the penetration of managed services and consulting services. Besides, the trend for virtual assistants that manage facial-recognition programs and homes will encourage stakeholders to inject funds into the service portfolio. The implementation of AI services for predictive maintenance, planning and forecasting has boded well for the regional outlook.

Technology Insights

The deep learning segment is expected to depict robust growth on the back of surging demand from the automotive sector. Predominantly, the trend for autonomous vehicles has fueled the need for neural networks for object detection, decision-making processes and road mapping. For instance, generative adversarial networks, convolutional neural networks, and recurrent neural networks have garnered immense popularity to foster deep learning.

The machine learning segment will grow on the back of demand for supervised learning, reinforcement learning and deep learning. Machine learning tools have become sought-after to boost customer service, helping take proactive action to boost user retention strategies. In essence, an influx of data has spurred the advancements in machine learning models. Embedded analytics with machine learning models will gain ground across the region.

End-use Insights

The BFSI segment will showcase an increased penetration in the Saudi Arabia market, largely due to the adoption of AI and machine learning models to make better lending decisions, assess borrowers’ creditworthiness (more accurately) and minimize the risk of default. An unprecedented rise in transaction data has fueled the demand for AI systems to boost security measures. AI is likely to be a vital proposition in bolstering operational efficiencies and customer experience in the banking and financial sectors. Moreover, financial institutions are poised to emphasize generative AI, exhibiting promising opportunities AI service providers hold in the region.

The healthcare segment will depict a notable rise on the heels of the AI application in assessing clinical trial data, enhancing data connectivity and customer experience, and providing actionable insights. AI solutions have provided a fillip in patient care, diagnosis and treatment. AI algorithms will be instrumental in boosting the accuracy of diagnosis and minimizing the burden on healthcare providers. AI implementation will lead to increased accuracy, data management and predictive modeling, helping provide better patient outcomes.

Key Saudi Arabia Artificial Intelligence Company Insights

Some of the leading players operating in the market include IBM, Google LLC, Amazon, Advanced Micro Devices and Baidu, Inc. They are likely to focus on organic and inorganic strategies to underpin their strategies in the regional landscape.

-

In August 2024, Oracle expanded its cloud infrastructure in Saudi Arabia by launching a new public cloud region in Riyadh. This expansion benefits Oracle by meeting the growing demand for AI and cloud services in the region, while supporting Saudi Arabia’s Vision 2030 goals by enabling public and private organizations to modernize applications and drive innovation through Oracle Cloud Infrastructure (OCI). This new cloud region is part of Oracle’s planned USD 1.5 billion investment to enhance cloud capacity in the Kingdom.

-

In March 2024, Amazon’s AWS announced plans to inject USD 5.3 billion into data centers in Saudi Arabia by 2026, alongside Microsoft and Google-parent Alphabet.

-

In November 2022, Google Cloud rolled out the center of excellence in Saudi Arabia to boost in-demand skills. The training courses would include AI and ML, while the center will provide various cohorts throughout the year.

Some emerging companies are slated to expand their portfolios to bolster their value propositions. Some of the prevailing dynamics are delineated below:

-

In March 2024, the Ministry of Investment of Saudi Arabia (MISA) joined forces with Rezolve AI Limited to establish an AI center of excellence. The latter plans to introduce at least five AI ventures, leveraging Rezolve's AI Large Language Model.

-

In February 2024, Nybl announced a merger with Basserah to create a vertically integrated data-AI pipeline.

Key Saudi Arabia Artificial Intelligence Companies:

- Advanced Micro Devices

- Omdena Inc.

- Google LLC

- IBM

- Intel Corporation

- Intelmatix

- Digital Energy

- Gleac

- Nybl

- Amazon

Recent Developments

-

In January 2024, Intel collaborated with Aramco Digital to establish Saudi Arabia’s inaugural Open RAN (radio access network) Development Center. The two behemoths are developing private 5G (for the industrial sector) to foster digital transformation in the Kingdom.

-

In November 2023, Microsoft CEO Satya Nadella asserted that Saudi companies’ efforts toward AI had fueled innovation, bolstered their productivity, and created new economic opportunities. The Chairman exhorted that speech-to-text solutions have been helping clinicians at King Faisal Hospital to minimize documentation errors, bolster their productivity, and spend more time with patients.

Saudi Arabia Artificial Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.08 billion

Revenue Forecast in 2030

USD 60.57 billion

Growth rate

CAGR of 44.1% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Solution; Technology; End-use

Key Companies Profiled

Advanced Micro Devices, Omdena Inc., Google LLC, IBM, Intel Corporation, Intelmatix, Digital Energy, Gleac, Nybl, Amazon

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Saudi Arabia Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Saudi Arabia artificial intelligence market on the basis of solution, technology and end-use:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Deep Learning

-

Machine Learning

-

Natural Language Processing (NLP)

-

Machine Vision

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Media & Entertainment

-

BFSI

-

IT & Telecommunication

-

Healthcare

-

Automotive & Transportation

-

Oil & Gas

-

Others

-

Frequently Asked Questions About This Report

b. The global Saudi Arabia artificial intelligence market size was estimated at USD 4.46 billion in 2024 and is expected to reach USD 6.76 billion in 2025.

b. The global Saudi Arabia artificial intelligence market is expected to grow at a compound annual growth rate of 43.1% from 2025 to 2030 to reach USD 60.57 billion by 2030.

b. BFSI segment dominated the Saudi Arabia AI market with a share of 20.1% in 2024. This is attributable to the adoption of AI and machine learning models to make better lending decisions, assess borrowers’ creditworthiness (more accurately), and minimize the risk of default

b. Some key players operating in the Saudi Arabia AI market include Advanced Micro Devices, Omdena Inc., Google LLC, IBM, Intel Corporation, Intelmatix, Digital Energy, Gleac, Nybl, Amazon Web Services Inc.

b. Key factors that are driving the market growth include an influx of investments in developing AI solutions, the rising penetration of 5G networks across the end-use industries, and lucrative opportunities from investments in non-oil sectors

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.