- Home

- »

- Medical Devices

- »

-

Saudi Arabia Wearable Medical Devices Market, Industry Report, 2030GVR Report cover

![Saudi Arabia Wearable Medical Devices Market Size, Share & Trends Report]()

Saudi Arabia Wearable Medical Devices Market Size, Share & Trends Analysis Report By Product (Diagnostic, Therapeutic), By Site, By Application, By Grade Type, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-239-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

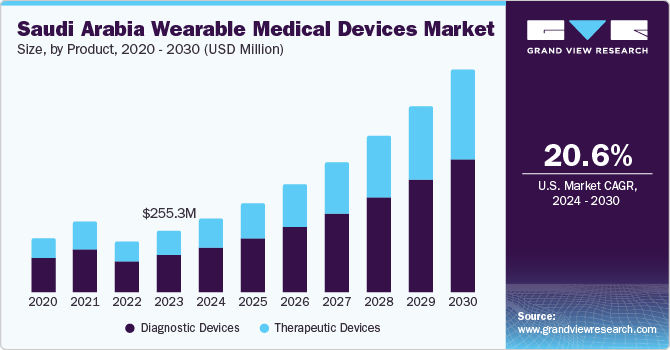

The Saudi Arabia wearable medical devices market size was estimated at USD 255.34 million in 2023 and is projected to grow at a CAGR of 20.6% from 2024 to 2030. The anticipated growth in industries like remote patient monitoring and home healthcare will impact the market. The increased focus on healthy lifestyle and fitness contribute to the increased demand for fitness trackers. Technological advancements, increase in clinical trials, and awareness of personal health monitoring and round-the-clock monitoring is expected to drive the market.

An increase in lifestyle-associated diseases is a major threat to the health of Saudi Arabia’s population. An increase in obesity, a reflection of a hampered healthy lifestyle, is associated with majority of non-communicable diseases like hypertension, type 2 diabetes, and dyslipidemia, leading to cardiovascular disorders is a serious concern. In 2020 and 2021, obesity prevalence in Saudi Arabia was found to be highest across the globe with an average of 35%. This necessitates continuous monitoring of physiological parameters.

The Vision 2030 project of the Saudi Government plans to invest USD 65 million in the country’s healthcare sector aiding research and development (R&D) in healthcare infrastructure such as telemedicine and remote patient monitoring. Leading wearable medical device companies are influencing the market tremendously by bringing in innovative technologies. New developments like artificial intelligence integration, continuous monitoring features, and sophisticated wearable medical device sensors are changing the game. In November 2023, Koninklijke Philips N.V. launched ultra-lightweight and flexible magnetic resonance Smart Fit coils optimized with Philips’ SmartSpeed AI solution, enabling improved image quality resolution and contributing to improved diagnosis.

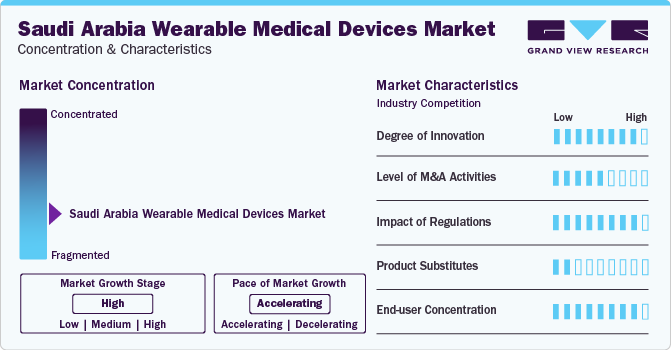

Market Concentration & Characteristics

The market growth stage is high, and pace of the growth is accelerating. Increase in prevalence of lifestyle diseases reflecting the increase in health awareness is expected to harness technological innovations, with devices offering enhanced features in personal health monitoring. The market observes high level of competition due to the launch of innovative and diversified portfolios.

The global wearable medical device market is highly fragmented. Numerous businesses that provide a wide variety of cutting-edge devices define the market and foster competition. Continuous technical improvements propel this fragmentation and encourage the creation of diverse wearable medical solutions. As a result, the market is dynamic and diverse, and a wide range of firms are involved in developing and expanding wearable medical devices.

The rapid advancements in wearable medical technology render new gadgets that offer enhanced monitoring, diagnostics, and treatment capabilities. The industry is marked by a boom in innovative solutions to revolutionize patient care and enable individuals to take control of their health. These solutions range from smartwatches that measure vital signs to implantable devices that provide real-time health data. For instance, in September 2023, Apple Inc. launched Apple Watch Series 9, providing new features to track physical and mental health along with logging health data privately and securely. This noteworthy level of innovation highlights the industry's dedication to using wearable medical devices that are both smart and accessible to address changing healthcare requirements. The advent of smart textiles embedded with sensor technology is likely to replace the traditional wearables seamlessly integrating monitoring capabilities into everyday fashion.

Through alliances and acquisitions, industry participants are strategically aligning to acquire a competitive edge, grow their product ranges, and improve their technological capabilities. The market for wearable medical devices is dynamic, and firms are looking for strategic partnerships to promote innovation, meet changing healthcare demands, and strengthen their positions in this quickly expanding industry. For instance, in May 2023, Medtronic announced the acquisition of EOFlow Co. Ltd. which helps with personal management of diabetes regarding insulin delivery.

The Saudi Arabia Food and Drug Authority (SFDA) regulates the manufacturing, imports, and distribution of medical devices. The Kingdom of Saudi Arabia recognizes U.S. FDA, EU, and Japan approvals, enabling international manufacturers to utilize their existing technical documentation for new ventures in the Saudi market.

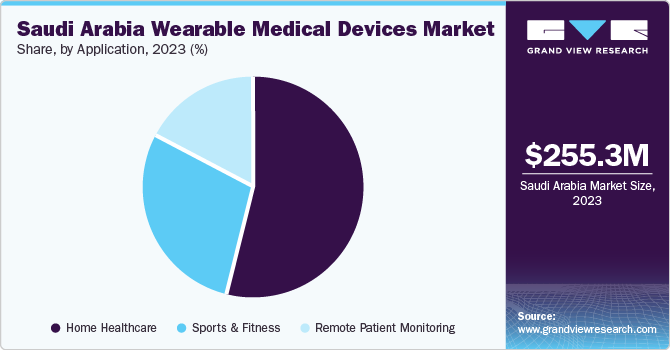

Application Insights

The application segment is further categorized into sports and fitness, remote patient monitoring, and home healthcare. Home healthcare held a maximum share of 53.80% in 2023. Increasing prevalence of lifestyle associated diseases, and rising demand for remote patient monitoring are some factors driving market growth.

The remote patient monitoring segment is expected to grow at the fastest CAGR over the forecast period. Remote patient monitoring proved to be a successful practice in the country during the COVID-19 pandemic. In 2021, the National Health Information Center under the Ministry of Health launched Saudi Telehealth Network to bridge the gap between healthcare facilities and primary health centres and hospitals in remote areas via telemedicine. Saudi Arabia is identified as the first country in the Middle East to provide e-health via SEHA Virtual Hospital.

Product Insights

The diagnostics device segment dominated the market with the largest share 60.92% in 2023. The life expectancy at birth increased from 71 years in 2000 to 76 years in 2021 and with the aging population comes challenges of dealing with chronic illnesses such as cancer, diabetes and cardio vascular diseases (CVDs).

Ischaemic heart disease is the highest on the list of top 10 causes of death in Saudi Arabia. This cause requires the need for early diagnosis of CVDs including coronary heart disease, rheumatic heart disease, cerebrovascular disease, and other conditions. Additionally, increasing awareness among the population about the capability of cardiovascular wearables to continuously assess heart rate, and pulse rate during everyday activities is expected to drive the segment further.

The therapeutic device segment is expected to grow at the fastest CAGR over the forecast period. A strong pipeline of therapeutic devices, such as wearable pain relievers, insulin management devices, and intelligent asthma management products, is anticipated to propel the market.

Site Insights

Based on site, the wearable medical devices market is categorized into handheld, headband, strap/clap/bracelet, shoe sensors, and others. The strap/clap/bracelet site segment dominated with the largest revenue share of 51.51% in 2023. Advancements in technology, including ECG tracking features along with pulse rate, and respiratory monitoring featured with Bluetooth and cloud connectivity, smartwatches are further expected to drive the market. For instance, the Polar Electro’s Elixir sensor offers features that measure mechanical parameters along with physiological parameters like body temperature, cardiovascular activity, and autonomic nervous system.

Grade Type Insights

The consumer grade wearable medical devices segment accounted for the largest revenue share of 77.55% in 2023. The user-friendly functionality, affordability, convenience contribute in the market growth. Technological advancements in clinical applications are expected to drive the growth. Use of artificial intelligence (AI), internet of things (IoT), and cloud computing help physicians and healthcare providers in disease diagnosis and treatment. In May 2023, Medtronic’s AccuRhythm AI algorithm technology was awarded as the “Best New Monitoring Solution” at 7th annual MedTech Breakthrough Awards program.

Distribution Channel Insights

The pharmacy segment dominated the market with the largest revenue share in 2023, owing to the availability and widespread accessibility of pharmacies, providing customers with an easy way to buy these devices. The significant revenue share that pharmacies have in the wearable medical device market results from their function as health and wellness centers and their capacity to offer knowledgeable guidance.

The growing preference of consumers for online shopping is the driving force behind the segment's growth. The variety, accessibility, and ease of use of e-commerce platforms support this trend. The market for wearable medical devices is anticipated to grow due to increased demand brought about by the easy and effective online shopping experience as the online retail industry continues to flourish.

Key Saudi Arabia Wearable Medical Devices Company Insights

Some of the key players operating in the market include Koninklijke Philips N.V., Garmin, Covidien (Medtronic), Polar Electro, and Omron Healthcare Co., Ltd, Sotera Wireless, Huawei Device Co.,Ltd., and Apple Inc.

- Polar Electro offers wearable biosensor technology, developing healthcare through continuous monitoring solutions. Their innovative products enable real-time tracking of vital signs such as heart rate, respiratory rate, and skin temperature with a focus on accuracy, reliability, and user-friendliness.

Key Saudi Arabia Wearable Medical Devices Companies:

- Koninklijke Philips N.V.

- Garmin

- Covidien (Medtronic)

- Omron Corp.

- Polar Electro

- Sotera Wireless

- Huawei Device Co., Ltd.

- Apple Inc.

Recent Developments

-

The launching of a new project by Saudi Health on February 15th, 2024, provides tele-electroencephalogram (EEG) services through the SEHA Virtual Hospital (SVH), facilitating medical officers to monitor the recordings round-the-clock as the EEG devices are directly connected to the SEHA Virtual Hospital.

-

In January 2024, Garmin International, Inc. launched its HRM-Fit, a heart rate monitor for women which captures real-time heart rate and health data.

-

In October 2023, Garmin International, Inc. expanded its ECG App to record heart rhythms and signs of atrial fibrillation from their smart watches.

-

In September 2023, Huawei Device Co., Ltd. launched its GT4 watch encompassing TruSeen 5.5+ technology for improved health tracking along with the TruSleep 3.0 technology for detection of sleep interruptions and changes in blood oxygen levels.

Saudi Arabia Wearable Medical Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 956.43 million

Growth rate

CAGR of 20.6% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, site, application, grade type, distribution channel

Country scope

Saudi Arabia

Key companies profiled

Koninklijke Philips N.V.; Garmin; Covidien (Medtronic); Polar Electro; Sotera Wireless; Huawei Device Co.,Ltd.; Omron Healthcare Co., Ltd; Apple Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Saudi Arabia Wearable Medical Devices Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Saudi Arabia wearable medical devices market report based on product, site, application, grade, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep Trackers

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal and Obstetric Devices

-

Neuromonitoring devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

Therapeutic Devices

-

Pain Management Devices

-

Neurostimulation Devices

-

Others

-

-

Insulin/Glucose Monitoring Devices

-

Insulin Pumps

-

Others

-

-

Rehabilitation Devices

-

Accelometers

-

Sensing Devices

-

Ultrasound Platform

-

Others

-

-

Respiratory Therapy Devices

-

Ventilators

-

Positive Airway Pressure (PAP) Devices

-

Portable Oxygen Concentrators

-

Others

-

-

-

-

Site Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Headband

-

Strap/Clip/Bracelet

-

Shoe Sensors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports and Fitness

-

Remote Patient Monitoring

-

Home Healthcare

-

-

Grade Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer-Grade Wearable Medical Devices

-

Clinical Wearable Medical Devices

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacies

-

Online Channel

-

Hypermarkets

-

Frequently Asked Questions About This Report

b. The Saudi Arabia wearable medical devices market size was estimated at USD 255.34 million in 2023.

b. The Saudi Arabia wearable medical devices market is expected to grow at a compound annual growth rate (CAGR) of 20.6 from 2024 to 2030 to reach USD 956.43 million by 2030.

b. The consumer-grade wearable medical devices segment dominated the market, with the largest market share of 77.6% in 2023. This high share is attributable to the user-friendly functionality, affordability, and operational convenience.

b. Some of the key players operating in the Saudi Arabia wearable medical devices market include Koninklijke Philips N.V., Garmin, Covidien (Medtronic), Omron Corp., Polar Electro, Sotera Wireless, Huwei Device Co.,Ltd., Apple Inc., among others.

b. Key factors driving the market growth include remote patient monitoring and home healthcare, increased focus on healthy lifestyle and fitness, and rising demand for round-the-clock monitoring.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."