- Home

- »

- Pharmaceuticals

- »

-

Sciatica Treatment Market Size, Share, Industry Report, 2033GVR Report cover

![Sciatica Treatment Market Size, Share & Trends Report]()

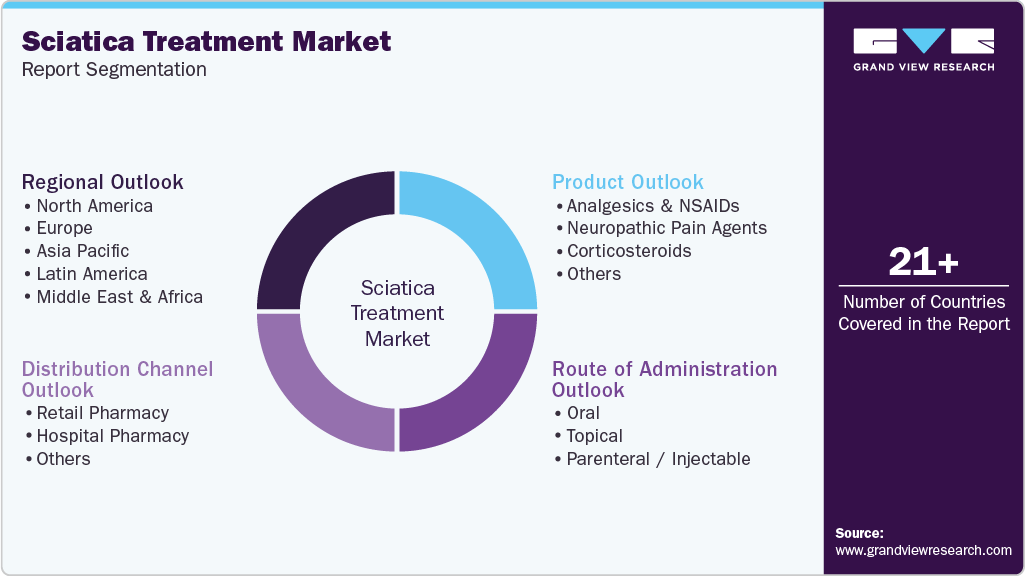

Sciatica Treatment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Analgesics & NSAIDs, Neuropathic Pain Agents, Corticosteroids), By Route of Administration (Oral, Topical, Parenteral / Injectable), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-769-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - NULL

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sciatica Treatment Market Summary

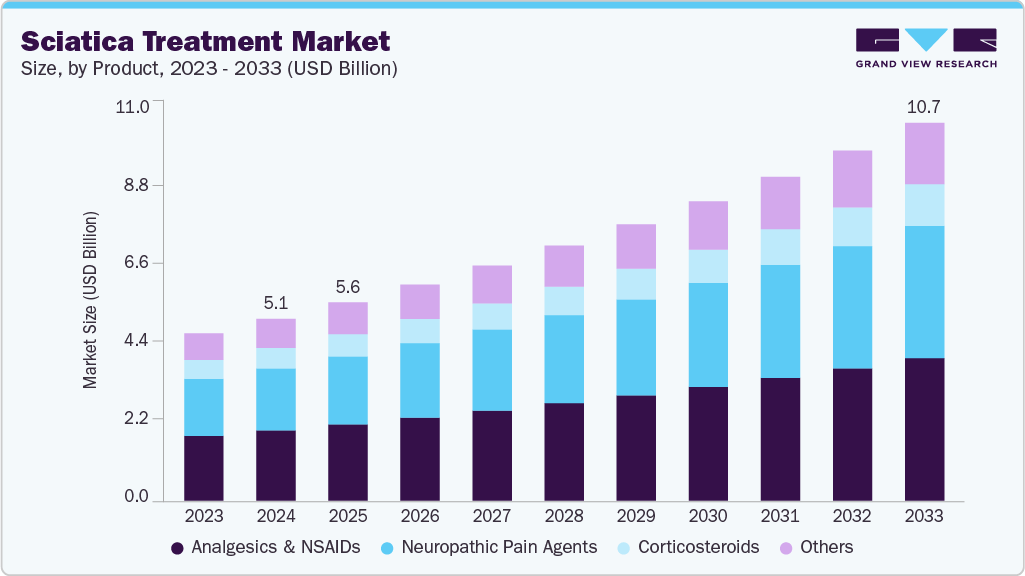

The global sciatica treatment market size was estimated at USD 5.15 billion in 2024 and is projected to reach USD 10.71 billion by 2033, growing at a CAGR of 8.40% from 2025 to 2033. This growth is attributed to several key factors, including the rising global prevalence of sciatica, aging populations, and advancements in treatment modalities.

Key Market Trends & Insights

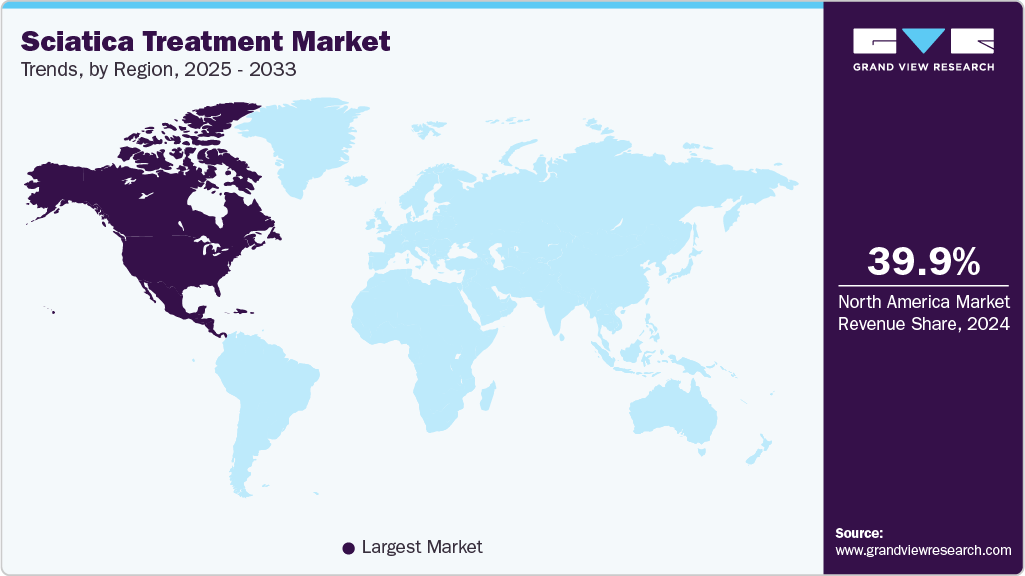

- The Asia Pacific region is projected to grow at a CAGR of 10.73% over the forecast period.

- North America held the largest revenue share of 39.91% in 2024.

- Based on product category, the analgesics & NSAIDs segment dominated the market with a share of 38.61% in 2024.

- Based on route of administration, the oral segment dominated the market with a share of 68.91% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.15 Billion

- 2033 Projected Market Size: USD 10.71 Billion

- CAGR (2025-2033): 8.40%

The sciatica treatment market is experiencing significant growth, driven by several key factors that reflect broader trends in healthcare, patient care, and technological advancements. One of the primary drivers is the aging global population. As people live longer, the incidence of musculoskeletal conditions like sciatica increases. According to the World Health Organization, October 2024, By 2030, 1 in 6 people in the world will be aged 60 years or over. At this time, the share of the population aged 60 years and over will increase from 1 billion in 2020 to 1.4 billion. By 2050, the world’s population of people aged 60 years and older will double (2.1 billion). The number of persons aged 80 years or older is expected to triple between 2020 and 2050 to reach 426 million, with a significant rise in chronic conditions such as sciatica. This demographic is particularly vulnerable to chronic conditions like sciatica.

As the number of older adults rises, so does the demand for effective treatment options to address the chronic pain and mobility issues associated with sciatica. This trend is especially noticeable in regions like North America and Europe, where a significant proportion of the population is aging. The Centers for Disease Control and Prevention (CDC) has identified musculoskeletal disorders (MSDs) as a leading cause of disability among U.S. adults. These disorders encompass conditions such as back pain, joint injuries, tendinitis, and repetitive strain. They can cause temporary or even permanent disability, leaving some individuals unable to move around easily. Work-related MSDs are particularly prevalent among people during their working years, contributing to a rise in demand for sciatica treatments. Consequently, healthcare systems in these regions are focusing on developing and providing specialized treatment options for older patients, thus contributing to market expansion.

Furthermore, the development of biologic treatments, such as stem cell therapy and platelet-rich plasma (PRP) injections, offers potential for more targeted and effective management of sciatica, especially in cases involving disc degeneration or nerve damage. Given the rise in research on PRP’s potential benefits for conditions like chronic lower back pain, it is plausible that treatments like these could be explored for sciatica in the future. In the same period, Mayo Clinic continued to offer more conventional treatments for sciatica, such as physical therapy, medications, and injections (like epidural steroids), which have been well-established as effective for managing sciatica-related pain. As new technologies continue to emerge, treatment options will diversify, creating opportunities for market growth and innovation.

Another important driver is the increasing awareness of sciatica and its available treatment options. As public awareness around chronic pain conditions and musculoskeletal disorders rises, more patients are seeking diagnosis and management for sciatica symptoms. According to the Centers for Disease Control and Prevention (CDC), data from the National Health Interview Survey in 2023 revealed that 24.3% of U.S. adults had chronic pain, and 8.5% had high-impact chronic pain that frequently limited life or work activities. Chronic pain and high-impact chronic pain are among the most common reasons adults seek medical care. Healthcare providers are also increasingly emphasizing early intervention, which helps reduce long-term disability and improves overall patient outcomes.

In addition to growing awareness, there is a greater focus on improving access to treatment, especially in developing regions. The expansion of healthcare infrastructure in regions like Asia Pacific and Latin America is facilitating greater access to both traditional and modern treatment options. For example, in March 2023, the World Bank approved funding to improve healthcare infrastructure in India, including the expansion of spine care services. This is expected to support a greater demand for sciatica treatments in the region.

Furthermore, the increasing availability of telemedicine services and home care options is also allowing for broader access to treatment, particularly for patients in remote or underserved areas. This growing accessibility, combined with higher awareness and advancements in treatment methods, positions the sciatica treatment market for continued expansion in the coming years.

Pipeline Analysis

Pipeline for sciatica treatment is seeing steady progress, with several new therapies advancing through clinical trials. These therapies are primarily focused on addressing the unmet need for non-opioid analgesics and targeted treatments for sciatica-related pain. One of the key candidates in development is SP-102 (SEMDEXA™), a non-opioid injectable formulation of semisynthetic hydrocodone bitartrate. In June 2024, Scilex Holding Company announced positive results from Phase 3 trials, which showed that SP-102 provided significant relief in pain intensity and improved disability scores. This product is positioned to offer a potential alternative to opioid-based treatments, particularly in managing chronic pain conditions such as sciatica. The safety profile observed in the trials was comparable to placebo, which could make it an attractive option for patients seeking alternatives to traditional pain management strategies.

Another development, In December 2024, Vertex Pharmaceuticals announced the results of a Phase 2 clinical trial evaluating suzetrigine (VX-548), an oral NaV1.8 sodium channel inhibitor, for the treatment of painful lumbosacral radiculopathy (LSR), commonly known as sciatica. The study aimed to assess the efficacy of suzetrigine in reducing pain intensity in patients with LSR. However, Vertex Pharmaceuticals intends to proceed with Phase 3 trials to further explore its efficacy in broader neuropathic pain indications. Despite the challenges faced in the Phase 2 trial, the continued development of suzetrigine reflects the ongoing effort to find effective alternatives to traditional pain management in sciatica.

The pharmaceutical pipeline for sciatica treatment continues to evolve, with several promising candidates advancing through clinical trials. While some therapies face challenges in demonstrating clinical efficacy, ongoing research and strategic partnerships are likely to play a significant role in shaping the future of sciatica treatment. The focus on non-opioid analgesics and targeted pain modulation highlights the market’s shift towards safer and more effective treatment options for patients suffering from sciatica. As these therapies progress, they could offer significant opportunities for companies to capture market share in a growing segment of the healthcare industry.

Market Concentration & Characteristics

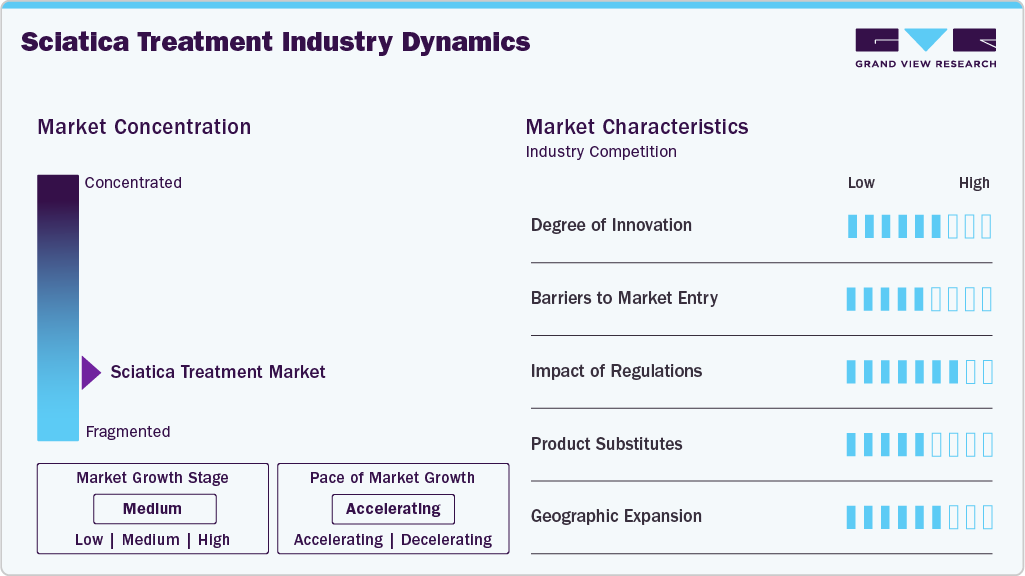

The sciatica treatment market is moderately concentrated, with several major pharmaceutical and medical device companies holding significant shares. Key players include Medtronic, Johnson & Johnson, Abbott Laboratories, and Boston Scientific, which are well-established in the global healthcare landscape. These companies focus on both surgical interventions and non-invasive therapies, including spinal injections and physical therapy solutions. In addition to these industry leaders, smaller biotechnology firms are contributing to the market by developing targeted biologic treatments and novel analgesics aimed at addressing sciatica-related pain. The market is characterized by a competitive landscape where innovation and strategic partnerships play crucial roles. Furthermore, there is an increasing emphasis on minimally invasive procedures, which are gaining traction due to their lower risk profiles and shorter recovery times compared to conventional surgical options.

The sciatica treatment market is witnessing notable innovation, particularly in the development of non-opioid analgesics and minimally invasive procedures. For instance, SP-102 (SEMDEXA™), a viscous gel formulation of dexamethasone sodium phosphate, has demonstrated significant efficacy in Phase 3 trials, offering a potential alternative to traditional opioid treatments. Additionally, biologic therapies such as platelet-rich plasma (PRP) injections are gaining traction as non-invasive options for managing sciatica-related pain. These advancements aim to address the growing demand for safer and more effective treatment modalities in the management of sciatica.

New entrants in the sciatica treatment market face several barriers, including high research and development costs, stringent regulatory requirements, and the need for extensive clinical trial data to demonstrate safety and efficacy. Established companies with existing market presence and distribution networks hold a competitive advantage. For example, Medtronic and Boston Scientific have well-established portfolios in spinal interventions, making it challenging for new companies to penetrate the market without significant investment and strategic partnerships.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a crucial role in shaping the sciatica treatment market. The approval process for new treatments involves rigorous clinical trials to ensure safety and efficacy, which can delay time-to-market. For instance, SP-102 (SEMDEXA™) received Fast Track designation from the FDA in 2017, expediting its development process. However, the overall regulatory landscape remains complex, and compliance with these regulations is essential for market entry and success.

The sciatica treatment market is characterized by the availability of various product substitutes, including traditional pain medications such as non-steroidal anti-inflammatory drugs (NSAIDs), opioids, and physical therapy. Additionally, emerging therapies like spinal cord stimulation and acupuncture offer alternative treatment options. The presence of these substitutes intensifies competition, requiring new treatments to demonstrate clear advantages in efficacy, safety, and cost-effectiveness to gain market acceptance.

Geographical expansion presents significant opportunities for growth in the sciatica treatment market, particularly in emerging economies where healthcare infrastructure is improving. Countries in the Asia-Pacific region, such as India and China, have large populations with increasing incidences of sciatica, driven by aging demographics and lifestyle factors. For example, the World Bank approved funding in March 2023 to improve healthcare infrastructure in India, including the expansion of spine care services. This development is expected to enhance access to advanced treatments and drive market growth in these regions.

Product Insights

The Analgesics & NSAIDs segment held the largest revenue share of 38.61% in 2024 due to their established efficacy, accessibility, and cost-effectiveness. These medications are commonly recommended as first-line treatments for sciatica, effectively reducing inflammation and alleviating pain. Their widespread availability over-the-counter and through prescriptions contributes to their dominance. The FDA has been actively working to expand non-opioid options for chronic pain management. In September 2025, the FDA issued draft guidance titled "Development of Non-Opioid Analgesics for Chronic Pain," aiming to accelerate the development of safe and effective non-opioid treatments to reduce reliance on opioids, reflecting the ongoing development and acceptance of NSAIDs in treating conditions like sciatica. This approval underscores the continued reliance on NSAIDs as a primary therapeutic option in managing sciatica-related pain.

The Neuropathic Pain Agents segment is experiencing rapid growth in the sciatica treatment market due to several key factors. The increasing prevalence of conditions such as diabetic neuropathy, chemotherapy-induced peripheral neuropathy, and spinal cord injuries is driving demand for effective pain management solutions. Advancements in drug development, including the introduction of non-opioid analgesics, are contributing to the market's expansion. For instance, in July 2024, the FDA accepted Vertex's new drug application for suzetrigine, a non-opioid analgesic, highlighting the regulatory support for alternative pain management options. Additionally, the growing emphasis on non-opioid pain management, driven by concerns over opioid misuse, is further propelling the demand for neuropathic pain agents. This trend reflects a shift towards safer and more targeted treatments for sciatica and related conditions.

Route of Administration Insights

The oral route of administration holds the largest revenue share of 68.91% in 2024, primarily due to its convenience, patient preference, and cost-effectiveness. Oral medications, including nonsteroidal anti-inflammatory drugs (NSAIDs) and oral steroids, are commonly used as first-line treatments for sciatica. These treatments are widely accessible, both over-the-counter and through prescriptions, making them easy for patients to obtain and use. The preference for oral medications is further driven by better patient compliance, as they are non-invasive and more comfortable compared to injectable treatments. In January 2025, the U.S. Food and Drug Administration (FDA) approved Journavx (suzetrigine), an oral non-opioid analgesic developed by Vertex Pharmaceuticals. This approval marks the first new class of pain medication in over two decades, offering a novel approach to managing moderate-to-severe acute pain without the addiction risks associated with opioids.

The topical drug segment is the fastest-growing in the sciatica treatment market in 2024 due to several factors. Topical analgesics offer localized pain relief, reducing systemic side effects associated with oral medications. This localized application enhances patient compliance, particularly among those with chronic conditions. Additionally, the increasing prevalence of chronic pain disorders, such as arthritis and neuropathy, has driven demand for effective pain management solutions. For instance, in September 2023, Kenvue Inc. launched a new line of topical analgesic products aimed at providing targeted relief for musculoskeletal pain, reflecting the industry's response to growing consumer preference for non-invasive treatments. Furthermore, advancements in formulation technologies have improved the efficacy and user experience of topical drugs, contributing to their rising adoption in sciatica management.

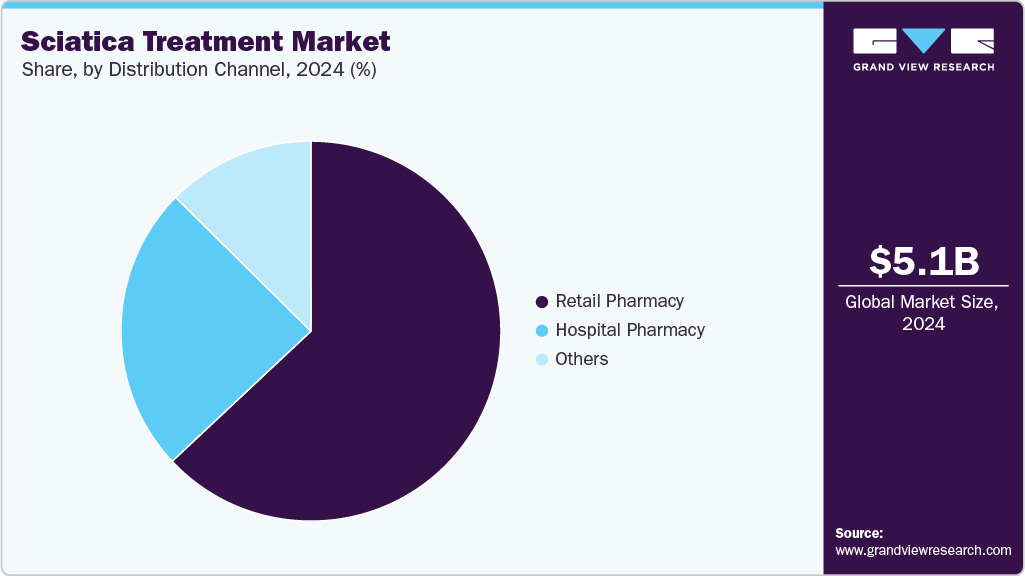

Distribution Channel Insights

The retail pharmacy segment held the largest revenue share of 63.00% in 2024, driven by factors such as widespread accessibility, patient preference for over-the-counter options, and the convenience of obtaining medications without the need for a prescription. Retail pharmacies offer a range of sciatica treatments, including nonsteroidal anti-inflammatory drugs (NSAIDs), topical analgesics, and muscle relaxants, which are commonly used as first-line therapies for sciatica. The ease of access to these medications in retail settings contributes to their popularity among patients seeking immediate relief. Additionally, the expansion of retail pharmacy chains and the increasing number of outlets globally have further facilitated the availability of sciatica treatments, supporting the segment's dominance in the market. This trend reflects the ongoing preference for accessible and non-invasive treatment options among sciatica patients.

The Others segment in the sciatica treatment market is projected to be the fastest-growing distribution channel from 2025 to 2033. This growth is primarily driven by the increasing adoption of digital health solutions, including telemedicine platforms and online consultations, which provide patients with convenient access to healthcare services. These platforms often offer integrated care options, such as virtual consultations, remote monitoring, and digital prescriptions, enhancing patient engagement and adherence to treatment plans. For instance, Spine examined patient satisfaction with telemedicine in spine care. The study found that 96.8% of patients reported being satisfied or very satisfied with their telemedicine visits, highlighting the effectiveness of telemedicine in managing spine-related conditions. Additionally, the expansion of home-based care models and the increasing availability of home-use medical devices contribute to the growth of this segment. These developments reflect a shift towards more accessible and patient-centered care options in the management of sciatica.

Regional Insights

North America sciatica treatment market remains the dominant region with market share of 39.91% in 2024, driven by a combination of factors, including high healthcare expenditure, advanced medical infrastructure, and a significant prevalence of chronic pain conditions. The U.S. accounts for a large portion of the demand, where the Centers for Disease Control and Prevention (CDC) reported that nearly 24.3% of adults suffer from chronic pain, with sciatica being one of the most common conditions. The healthcare system in North America is well-equipped to provide timely diagnoses and comprehensive treatments, including both pharmaceutical and surgical interventions. Additionally, the widespread availability of pain management options through insurance coverage contributes to the market’s strong performance.

The North America sciatica treatment market, in particular, benefits from significant investment in healthcare research and development, which fosters the adoption of innovative sciatica treatments. Pharmaceuticals and minimally invasive surgical procedures dominate, and the increasing reliance on non-opioid pain management therapies is a notable trend. Regulatory agencies like the FDA continue to approve new treatments, such as biologic therapies and spinal injections, which further drive the market’s growth. For instance, In December 2024, the U.S. Food and Drug Administration (FDA) approved Journavx (suzetrigine), a first-in-class non-opioid analgesic, for the treatment of moderate to severe acute pain in adults. This approval is part of the FDA's efforts to encourage the development of non-opioid analgesics for acute pain. Additionally, the availability of online healthcare services and telemedicine platforms in North America is improving patient access to diagnosis and treatment, broadening the market for sciatica care.

U.S. Sciatica Treatment Market Trends

U.S. sciatica treatment market is expected to see significant advancements driven by high healthcare expenditure, advanced medical infrastructure, and the increasing prevalence of chronic pain, particularly sciatica. With approximately 24.3% of U.S. adults experiencing chronic pain, sciatica remains a leading condition contributing to disability. In response, the U.S. market offers a wide range of treatment options, from pharmacological therapies such as NSAIDs and corticosteroids to surgical interventions like spinal decompression. Additionally, the increasing preference for non-opioid pain management strategies aligns with ongoing regulatory efforts to mitigate opioid dependence, fostering growth in alternative therapies.

The treatment landscape in the U.S. is evolving, with a growing emphasis on telemedicine and home-based care, enhancing patient access to diagnosis and management. New treatments like Suzetrigine, marketed under the brand name Journavx, was approved by the U.S. Food and Drug Administration (FDA) on January 2025. It is the first non-opioid analgesic in over 20 years to be approved for the treatment of moderate-to-severe acute pain in adults. As healthcare systems continue to evolve, this dynamic market is positioned for continued growth, with innovations in both pharmacological and non-pharmacological treatments.

Europe Sciatica Treatment Market Trends

Europe sciatica treatment market in 2024 is characterized by an aging population and a high burden of musculoskeletal disorders, with sciatica being a leading cause of disability in older adults. A study found that the point prevalence of back pain among German adults was 37.1%, with a one-year prevalence of 76.0% and a lifetime prevalence of 85.5%. Disabling back pain was reported in 11.2% of the population, with lower educational levels being a significant predictor of increased prevalence. This demographic shift is driving the demand for sciatica treatments, particularly non-surgical options such as physical therapy, pain management medications, and spinal injections. Additionally, the European Union’s healthcare initiatives, aimed at reducing the burden of chronic pain, are fostering greater access to advanced sciatica treatment options.

The market is also supported by well-established healthcare systems across Europe, which allow for broad access to a range of treatments. Countries with robust healthcare infrastructure, such as France, Germany, and the UK, are experiencing increased adoption of innovative therapies. The region’s strong emphasis on preventive care, along with growing awareness campaigns about musculoskeletal health, contributes to higher patient engagement and treatment adherence. Furthermore, the increasing focus on minimally invasive procedures is helping to shift the treatment paradigm towards more effective and less invasive methods for managing sciatica, adding to the market's growth prospects.

The UK sciatica treatment market is primarily shaped by the National Health Service (NHS) and its structured approach to managing musculoskeletal disorders. With increasing awareness and demand for comprehensive care for sciatica, treatment protocols are centered around a stepped-care approach, ranging from physical therapy and pain medications to more advanced interventions, including spinal injections. The UK’s publicly funded healthcare system provides access to these treatments, though there is increasing reliance on private healthcare options due to waiting times in public services.

Despite challenges in healthcare accessibility, the UK sciatica treatment market benefits from continued investments in improving the NHS and promoting multidisciplinary care. The integration of exercise and psychological therapies into treatment plans, as well as expanding use of evidence-based practices, is expected to drive market growth. Furthermore, the introduction of digital health solutions, such as telehealth consultations, is increasing access to timely care for sciatica patients across the country.

The Germany sciatica treatment market is driven by a high prevalence of back pain, with nearly 61.3% of adults affected. This has led to growing demand for sciatica management solutions, ranging from conservative treatments like physical therapy and NSAIDs to surgical options. The German healthcare system, known for its comprehensive coverage and focus on evidence-based medicine, ensures that patients have access to timely and effective care. The integration of rehabilitation services and specialized clinics has further enhanced the management of chronic pain and musculoskeletal conditions like sciatica.

Germany’s strong healthcare infrastructure, combined with ongoing research in the field of musculoskeletal treatments, positions the market for continued growth. The country’s emphasis on preventive care and patient-centered treatment plans, is expected to drive further advancements in sciatica treatment options. Innovations in both pharmaceutical treatments will continue to shape the market’s trajectory.

The France sciatica treatment market is shaped by the country’s healthcare system, which offers coverage for a wide range of treatments. This includes pharmacological interventions such as NSAIDs and corticosteroids. Sciatica is a significant cause of disability in France, with many patients seeking both traditional and alternative therapies for relief. France's integrated healthcare system allows for early intervention and multidisciplinary care, ensuring that patients receive the appropriate treatment based on the severity of their condition.

The growing integration of alternative treatments like osteopathy and acupuncture alongside conventional medical care is expanding treatment options in the country. The French healthcare system’s focus on patient-centered care, combined with increasing government investment in medical infrastructure, is likely to drive further growth in the sciatica treatment market. Additionally, public awareness campaigns and the inclusion of sciatica in national healthcare guidelines will continue to contribute to market expansion.

Asia-Pacific Sciatica Treatment Market Trends

Asia Pacific is one of the fastest-growing regions in the sciatica treatment market, with the increasing incidence of sciatica linked to lifestyle changes, aging populations, and rising levels of sedentary behavior in countries like China, India, and Japan. The growing awareness of chronic pain and musculoskeletal disorders, coupled with expanding healthcare infrastructure, is contributing to increased demand for sciatica treatment solutions. In countries like China and India, there is a significant rise in musculoskeletal conditions due to lifestyle factors such as poor posture, obesity, and lack of physical activity. This has led to a greater need for both preventive and therapeutic interventions.

The region is also seeing an increase in healthcare investments, with government initiatives aimed at improving access to medical care. Advancements in medical technology and treatment options, including physical therapy and injectable treatments, are becoming more accessible in major urban centers. Additionally, the growing adoption of digital health solutions, including telemedicine for sciatica diagnosis and management, is expanding the market in rural and underserved areas. While private healthcare facilities dominate advanced treatment offerings, public healthcare systems in countries like India are gradually improving access to effective sciatica treatments, making them more widely available to a broader population.

The Japan sciatica treatment market is influenced by a rapidly aging population and a rising incidence of lifestyle-related diseases such as obesity and physical inactivity, which contribute to musculoskeletal disorders like sciatica. In Japan, sciatica treatments are often approached with a combination of conservative methods, including physical therapy, acupuncture, and pharmacological treatments like NSAIDs. Given the country’s advanced healthcare system, patients have access to a wide range of treatments, including minimally invasive spinal procedures. Advancements in robotic assistance have also improved the accuracy of spinal injections, such as epidural steroid injections, which are commonly used to treat sciatica. Research into robotic-assisted spinal injections is ongoing, aiming to enhance treatment efficacy and patient outcomes. Japan’s strong focus on preventive healthcare, along with increasing public awareness of musculoskeletal health, is expected to drive demand for sciatica treatments.

Japan’s healthcare system emphasizes early intervention and a holistic approach to chronic pain management, which supports the use of non-surgical treatments. The country's advancements in medical technology also enable the adoption of innovative treatments, such as spinal injections and robotic-assisted surgeries. This market will likely continue to expand as Japan's elderly population increases, along with continued investments in healthcare infrastructure and innovations in pain management.

The China sciatica treatment market is growing rapidly due to the country’s large population, aging demographic, and rising prevalence of lifestyle-related diseases. As urbanization increases and sedentary lifestyles become more common, musculoskeletal disorders such as sciatica are becoming more prevalent. The market is driven by the adoption of both traditional and modern treatment methods, including oral medications, physical therapy, and increasingly, surgical options. Healthcare reforms and government initiatives aimed at improving access to care are also driving the expansion of sciatica treatment options across the country.

China's healthcare system is undergoing modernization, with substantial investments in medical infrastructure and the expansion of private healthcare facilities. The introduction of innovative treatments, including minimally invasive spinal procedures and biologic therapies, is helping address the growing demand for effective sciatica management. Additionally, the growing awareness of chronic pain management in China’s urban areas, along with improved access to medical services in rural regions, positions the country for continued growth in the sciatica treatment market. For instance, In March 2024, China launched a national community pain management program in Beijing, aiming to create a community pain management ecosystem by integrating resources from various sectors. This initiative seeks to raise awareness and improve access to pain management services across the country.

Latin America Sciatica Treatment Market Trends

In Latin America, the sciatica treatment market is expanding, driven by factors such as an aging population, increasing prevalence of lifestyle-related diseases, and growing healthcare awareness. Countries like Brazil and Mexico are experiencing a rise in musculoskeletal disorders, including sciatica, due to longer life expectancies and shifts in lifestyle patterns, such as sedentary behavior and poor diet. The middle class in these regions is also growing, leading to greater demand for advanced treatment options. However, the region still faces challenges in terms of healthcare access, particularly in rural areas where healthcare infrastructure is less developed. Additionally, In May 2025, it was reported that the federal budget allocation for SUS was expected to increase by 6.2% compared to 2024, and by 27% over 2023. This increase in funding reflects the government's commitment to enhancing public healthcare infrastructure.

The market in Latin America is characterized by a mix of public and private healthcare providers. While public healthcare systems offer basic treatment options, private healthcare facilities provide more specialized and advanced therapies, including spinal injections, minimally invasive surgeries, and rehabilitation programs. The rising adoption of private healthcare and the growing number of private hospitals and clinics are driving the market forward. Furthermore, increased government focus on healthcare reforms and accessibility in countries like Brazil and Argentina is helping to address gaps in treatment availability and improve overall access to sciatica care.

The Brazil sciatica treatment market is expanding, driven by the country's large, aging population and increasing prevalence of musculoskeletal disorders. Factors such as poor posture, obesity, and long working hours contribute to the rising cases of sciatica. In Brazil, sciatica treatments range from over-the-counter NSAIDs and muscle relaxants to more advanced options, including spinal injections and surgery. The public healthcare system offers basic treatments, while private healthcare providers cater to those seeking more specialized care. Access to sciatica treatment is growing as Brazil’s private healthcare sector continues to expand, particularly in urban centers.Brazil’s ongoing healthcare reforms are expected to foster continued growth in the sciatica treatment market.

Middle East & Africa Sciatica Treatment Market Trends

Middle East and Africa sciatica treatment market is evolving, with key drivers including urbanization, lifestyle changes, and healthcare infrastructure improvements. Countries in the Gulf Cooperation Council (GCC), including the UAE and Saudi Arabia, are seeing a rise in musculoskeletal disorders due to sedentary lifestyles, increased obesity rates, and an aging population. The demand for sciatica treatment is therefore increasing, particularly in urban areas with better access to medical care. While healthcare access remains a challenge in rural parts of Africa, urban centers are witnessing significant improvements in the availability of advanced treatment options.

The Saudi Arabia sciatica treatment market is benefiting from a combination of demographic trends, such as an aging population, and an increasing incidence of lifestyle-related conditions. Saudi Arabia is witnessing an increase in musculoskeletal disorders, including sciatica, due to an aging population and rising obesity rates. The prevalence of obesity has been steadily increasing, contributing to various health issues, including sciatica. The country’s growing obesity rate and sedentary lifestyle have contributed to a rise in musculoskeletal disorders, including sciatica. Saudi Arabia’s healthcare system provides access to both conservative treatments (such as physical therapy and NSAIDs) and advanced medical procedures (such as spinal injections and surgeries). The government’s focus on improving healthcare infrastructure and expanding access to specialized services is supporting the growth of the sciatica treatment market.

Key Sciatica Treatment Company Insights

The sciatica treatment market is highly competitive, with major pharmaceutical companies like AbbVie, Teva, Sun Pharma, Pfizer, and Sorrento Therapeutics leading the development of pain management drugs, including NSAIDs, gabapentin, and biologics. These companies are focused on expanding their portfolios through innovative therapies, such as biologics and minimally invasive treatments, to meet the growing demand for effective sciatica management. Key players are investing in research and development to improve existing drugs and introduce new options that offer better efficacy, reduced side effects, and shorter recovery times. Partnerships and collaborations with healthcare providers and research institutions are crucial to advancing treatment options, particularly as non-invasive solutions gain traction in the market.

Key Sciatica Treatment Companies:

The following are the leading companies in the sciatica treatment market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Glenmark Pharmaceuticals Ltd.

- Sorrento Therapeutics Inc.

- Medtronic plc

- Boston Scientific Corporation

- Pfizer Inc.

- Johnson & Johnson

- Abbott Laboratories

Recent Developments

-

In June 2024, Scilex Holding Company, a subsidiary of Sorrento Therapeutics, announced the publication of Phase 3 clinical trial results for SP-102 (SEMDEXA™) in the PAIN® Journal. The study demonstrated that a single epidural injection of SP-102 provided significant and sustained pain relief for patients with sciatica due to herniated discs, supporting its potential as a first-to-market, non-opioid treatment option.

-

In January 2025, the FDA approved Journavx (suzetrigine), a first-in-class non-opioid analgesic for moderate-to-severe acute pain. While effective for acute pain, its efficacy in chronic conditions like sciatica was limited in trials. Vertex Pharmaceuticals is exploring its use for diabetic nerve pain and lumbosacral radiculopathy.

-

In July 2024, Semnur Pharmaceuticals, a subsidiary of Scilex Holding, announced plans to go public through a merger with Denali Capital Acquisition Corp., valuing the deal at up to $2 billion. The company aims to fund the development of its lead drug candidate, SP-102 (SEMDEXA™), currently in late-stage trials for moderate-to-severe chronic radicular pain or sciatica.

Sciatica Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.62 billion

Revenue forecast in 2033

USD 10.71 billion

Growth rate

CAGR of 8.40% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

AbbVie Inc.; Teva Pharmaceutical Industries Ltd.; Sun Pharmaceutical Industries Ltd.; Glenmark Pharmaceuticals Ltd.; Sorrento Therapeutics Inc.; Medtronic plc; Boston Scientific Corporation; Pfizer Inc.; Johnson & Johnson; Abbott Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sciatica Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global sciatica treatment market report based on product, route of administration, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Analgesics & NSAIDs

-

Neuropathic Pain Agents

-

Corticosteroids

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Topical

-

Parenteral / Injectable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Pharmacy

-

Hospital Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.