- Home

- »

- Next Generation Technologies

- »

-

Security Guard Management Software Market Report, 2033GVR Report cover

![Security Guard Management Software Market Size, Share & Trends Report]()

Security Guard Management Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Application (Patrol Management), By Enterprise Size, By Deployment, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-654-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Security Guard Management Software Market Summary

The global security guard management software market size was estimated at USD 1.63 billion in 2024, and is projected to reach USD 4.46 billion by 2033, growing at a CAGR of 11.8% from 2025 to 2033. This growth is driven by the growing need for real-time security operations management, digital incident reporting, and workforce automation across various sectors.

Key Market Trends & Insights

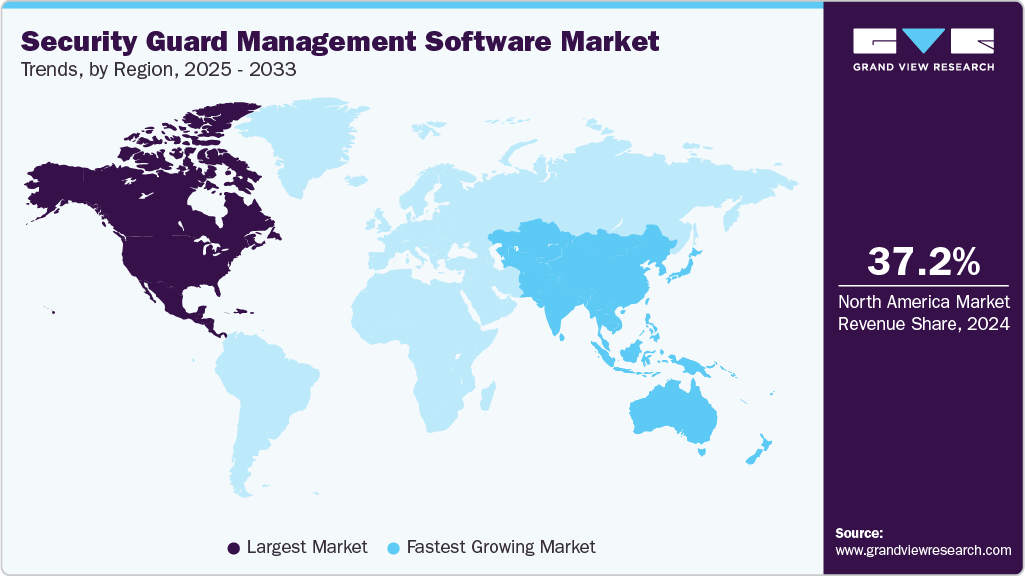

- North America dominated the global security guard management software market with the largest revenue share of 37.2% in 2024.

- The security guard management software industry in the U.S. is expected to grow significantly over the forecast period.

- By component, the software segment led the market, holding the largest revenue share of 69.6% in 2024.

- By application, the patrol management segment led the market, holding the largest revenue share in 2024.

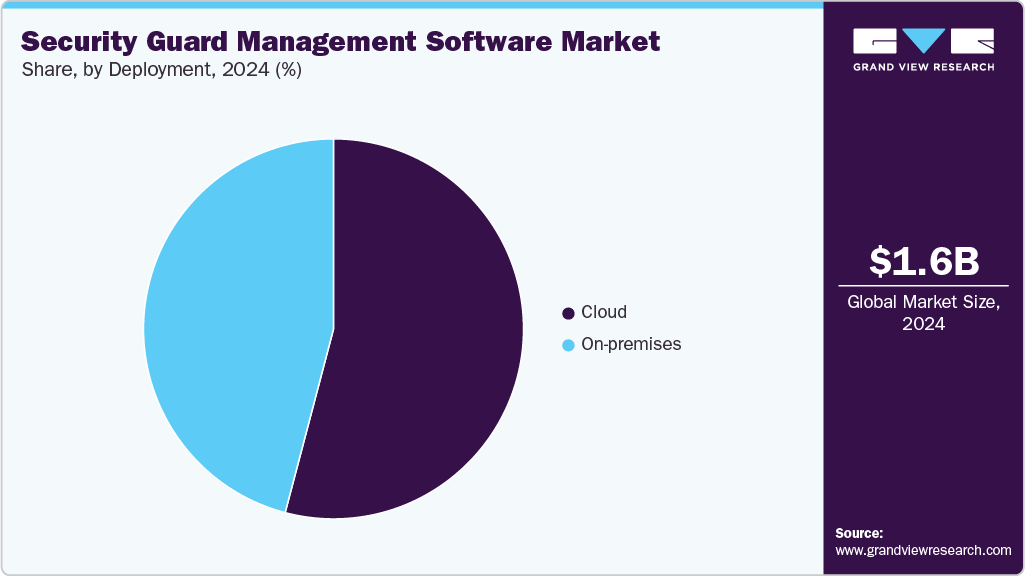

- By deployment, the cloud segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.63 Billion

- 2033 Projected Market Size: USD 4.46 Billion

- CAGR (2025-2033): 11.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing security threats, thefts, and vandalism across commercial, residential, industrial, and governmental sectors create a pressing need for advanced security solutions. Organizations emphasize streamlined security functions, workforce management, and regulatory compliance, which encourage the adoption of software systems that manage personnel, schedules, tasks, and reporting efficiently. Technological innovations such as cloud computing, AI, and the IoT enable real-time surveillance, biometric verification, GPS tracking, and predictive analytics, enhancing operational effectiveness and decision-making processes.In addition, market expansion is influenced by the continuous integration of emerging technologies and the growing complexity of security challenges. AI and machine learning facilitate the automation of routine tasks, enabling security teams to focus on complex activities while reducing operational costs. Mobile applications provide security personnel instant communication and updates, improving responsiveness and coordination. Cloud-based systems offer flexibility and scalability, allowing organizations to adapt to changing security demands. Moreover, evolving regulations related to data protection and security compliance drive organizations to invest in software solutions that meet these requirements across diverse industries.

Furthermore, the increasing emphasis on operational efficiency and comprehensive risk management supports ongoing market development. Organizations recognize the importance of leveraging data insights to optimize resource allocation and enhance decision-making. Integration of IoT devices into security frameworks enhances monitoring capabilities and accelerates incident response. These trends contribute to sustained growth in the security guard management software market, reflecting a continuous shift towards innovative, efficient, and adaptable security solutions.

Component Insights

The software segment led the market, accounting for over 68% of global revenue share in 2024, as organizations are increasingly prioritizing digital transformation and automation in their security operations. Businesses across sectors seek comprehensive platforms that streamline scheduling, incident reporting, and workforce management, driving strong demand for software solutions. These platforms offer real-time data analytics, integration with surveillance systems, and automated compliance tracking, which enhances operational efficiency and decision-making. The ability to centralize and digitize security operations reduces manual errors and administrative burdens, making software adoption a strategic priority. As a result, the software segment continues to capture a significant share of global revenue, reflecting its essential role in modern security management.

The services segment is predicted to experience the fastest growth in the forecast years as companies recognize the need for expert support in deploying, customizing, and maintaining security guard management systems. The increasing complexity of software platforms and the rapid pace of technological change prompt organizations to seek professional services for seamless integration and user training. Consulting, technical support, and managed services help businesses maximize the value of their software investments and ensure ongoing compliance with industry standards. As new features and updates become available, service providers play a vital role in helping clients adapt and optimize their security processes. This growing reliance on specialized expertise positions the services segment for accelerated expansion in the coming years.

Application Insights

The patrol management segment accounted for the largest revenue share in 2024 due to its fundamental importance in security operations. Organizations depend on patrol management systems to ensure that guards follow assigned routes, complete required checks, and respond promptly to incidents. Digital patrol management tools provide real-time visibility into guard activities, automate reporting, and generate actionable insights for supervisors. These capabilities support accountability, improve incident response times, and enhance overall security coverage. By replacing manual logbooks with automated systems, organizations achieve greater transparency and efficiency, making patrol management a core component of their security strategies.

The GPS tracking & route optimization segment is expected to grow at the fastest CAGR during the forecast period as organizations increasingly leverage real-time location data to enhance guard performance and resource allocation. GPS-enabled solutions allow supervisors to monitor guard movements, verify patrol completion, and quickly address deviations from planned routes. Route optimization features help minimize travel time, reduce operational costs, and ensure thorough coverage of large or complex facilities. These technologies also support rapid incident response by directing guards to the nearest location, improving safety outcomes. As demand for location-based intelligence rises, GPS tracking and route optimization become integral to effective security management.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share in 2024 as they operate extensive facilities and require scalable, integrated security solutions. These organizations face complex security challenges, including managing large teams, multiple sites, and diverse regulatory requirements. Advanced security guard management software supports centralized control, detailed analytics, and seamless integration with existing IT infrastructure. Large enterprises also prioritize data security and compliance, driving adoption of robust platforms that offer customizable features and comprehensive reporting. Their significant budgets and focus on operational efficiency further reinforce their leadership in market share.

The SMEs segment is expected to experience the fastest CAGR during the forecast period as SMEs increasingly adopt digital security solutions to enhance competitiveness and meet regulatory expectations. Cloud-based platforms and subscription models lower the barriers to entry, making advanced security management accessible without substantial upfront investment. SMEs benefit from automation, real-time alerts, and streamlined reporting, which help them manage limited resources more effectively. As awareness of security threats grows, SMEs prioritize solutions that provide flexibility, scalability, and ease of use. This shift in approach drives rapid adoption and positions the SMEs segment for strong expansion.

Deployment Insights

The cloud segment accounted for the prominent revenue share in 2024 as organizations seek scalable, flexible, and cost-efficient deployment options. Cloud-based security guard management platforms support remote access, real-time updates, and seamless integration with other business systems. These solutions simplify software maintenance, enable automatic updates, and facilitate disaster recovery, reducing the burden on internal IT teams. The ability to access security data from any location enhances operational agility and supports hybrid or distributed work environments. As digital transformation accelerates, cloud deployment emerges as the preferred choice for businesses of all sizes.

The on-premises segment is expected to grow significantly during the forecast period. Sectors such as government and finance often mandate direct control over sensitive information and system infrastructure. On-premises solutions enable organizations to customize security protocols, restrict external access, and comply with specific industry standards. This approach aligns with businesses seeking greater autonomy and assurance over their data environment. As concerns about cybersecurity and regulatory compliance intensify, demand for on-premises deployment continues to rise in industries such as government, BFSI, and healthcare.

Vertical Insights

The commercial buildings segment accounted for the largest revenue share in 2024 due to their high security needs and complex operational environments. Office complexes, shopping malls, and mixed-use developments require comprehensive guard management to monitor access points, protect assets, and ensure occupant safety. Digital solutions enable property managers to coordinate security teams, automate visitor management, and respond swiftly to incidents. Integrating surveillance, access control, and reporting tools enhances situational awareness and supports regulatory compliance. As urbanization and commercial development accelerate, demand for advanced security solutions in commercial buildings remains strong.

The BFSI segment is anticipated to grow at the fastest CAGR during the forecast period due to the sector’s increasing reliance on advanced security solutions to safeguard sensitive financial data, assets, and infrastructure. The BFSI industries face heightened risks from cyber threats, fraud, and physical security breaches, which drive the adoption of integrated software platforms that combine personnel management with real-time monitoring and incident reporting. Regulatory compliance and stringent data protection requirements further compel BFSI organizations to implement comprehensive security guard management systems. In addition, the sector’s ongoing digital transformation, including the rise of online banking and automated financial services, creates complexity that necessitates the efficient coordination of security personnel and technology. These factors contribute to the rapid expansion of security guard management software usage within the BFSI industry.

Regional Insights

North America security guard management software market dominated the market with a revenue share of over 37.2% in 2024, driven by advanced technological infrastructure, high digital adoption rates, and a mature security services market. The region’s focus on regulatory compliance, risk management, and innovation drives widespread adoption of digital security solutions. The presence of technology vendors and a large base of security-conscious enterprises further accelerates market growth. North American organizations prioritize automation, analytics, and integration, reinforcing the region’s leadership position in the industry.

U.S. Security Guard Management Software Market Trends

The U.S. security guard management software market is expected to grow significantly in 2024 as businesses and public institutions prioritize upgrading their security operations to tackle evolving threats and enhance overall safety. The country’s diverse economic landscape and strong emphasis on technological innovation drive the demand for advanced security solutions. Organizations focus on scalable platforms that provide real-time monitoring and seamless integration with existing infrastructure, enabling more efficient management of security personnel and resources. This commitment to modernization and operational efficiency fuels continuous expansion within the U.S. market.

Europe Security Guard Management Software Market Trends

The security guard management software market in Europe is expected to grow significantly over the forecast period, driven by the region’s diverse industrial sectors and increasing adoption of cloud-based technologies. European organizations seek solutions that accommodate multilingual operations and enable smooth integration with existing legacy systems, addressing the complexity of managing security across multiple countries. The ongoing digital transformation across industries encourages investment in advanced security management platforms that enhance operational efficiency and coordination. These factors contribute to the expanding demand for security guard management software throughout Europe.

Asia Pacific Security Guard Management Software Market Trends

The security guard management software market in the Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period, driven by rapid urbanization, expanding commercial infrastructure, and rising security awareness. Governments and businesses in the region invest in smart city projects, digital transformation, and advanced surveillance technologies. The increasing adoption of cloud-based solutions and mobile applications supports efficient security operations in diverse and dynamic environments. As economic development accelerates, organizations across Asia Pacific prioritize scalable, innovative security solutions to address evolving risks and regulatory requirements.

Key Security Guard Management Software Company Insights

Some key companies in the security guard management software industry are GuardsPro LLC, Celayix, Connecteam, and Trackforce.

-

Celayix is a security guard management software provider specializing in advanced scheduling, time and attendance tracking, and workforce communication for security operations. Its platform offers geofencing, guard touring, shift bidding, and automated replacement management, enabling organizations to efficiently manage guard deployment, monitor real-time activity, and reduce no-shows.

-

Trackforce delivers comprehensive security workforce management solutions through its GuardTek and TrackTik platforms. These platforms are designed to optimize security guard operations with real-time tracking, automated incident reporting, and mobile access for field teams. The software enables efficient patrol management, centralized command center oversight, and detailed analytics for operational visibility.

Key Security Guard Management Software Companies:

The following are the leading companies in the security guard management software market. These companies collectively hold the largest market share and dictate industry trends.

- GuardsPro LLC

- Motics Corporation

- American Software Solutions, Inc.

- OfficerReports

- Celayix

- Connecteam

- DESTINY SOFTWARE

- Novagems.com Inc.

- Trackforce

- Condo Control

Recent Developments

-

In May 2025, Trackforce, a provider of security workforce management software, announced a partnership with SCYLLA TECHNOLOGIES INC., an AI video surveillance company. This collaboration integrates AI-powered threat detection directly into security workforce workflows, enabling security providers to identify, dispatch, and resolve incidents more efficiently. The solution also streamlines incident billing and reporting, providing a fully integrated platform that enhances real-time situational awareness and operational response.

-

In January 2025, the SPOT consortium, comprising Patria and Solita, secured the Finnish Border Guard’s tender for developing user applications for its operational information system (RAVALU). This initiative aims to deliver flexible and user-friendly solutions tailored to the complex requirements of security authorities. The modernization of the Finnish Border Guard’s operational information system is scheduled between 2025 and 2027 to enhance situational awareness, operational efficiency, and the overall effectiveness of border security operations.

-

In May 2024, Siemens introduced SINEC Security Guard, a new cybersecurity software-as-a-service (SaaS) solution designed to identify vulnerabilities within industrial shop floor environments rapidly. This service aims to enhance the security posture of manufacturing and industrial operations by providing real-time monitoring and threat detection, enabling organizations to address cyber risks and ensure operational continuity proactively.

Security Guard Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.82 billion

Revenue forecast in 2033

USD 4.46 billion

Growth rate

CAGR of 11.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, vertical, enterprise size, component, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

GuardsPro LLC; Motics Corporation; American Software Solutions, Inc.; OfficerReports; Celayix; Connecteam; DESTINY SOFTWARE; Novagems.com Inc.; Trackforce; Condo Control

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Security Guard Management Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global security guard management software market report based on component, application, enterprise size, deployment, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Patrol Management

-

Task Scheduling

-

GPS Tracking & Route Optimization

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premises

-

Cloud

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Commercial Buildings

-

Industrial

-

Residential Complexes

-

Healthcare

-

Government & Public Sector

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global security guard management software market size was estimated at USD 1.63 billion in 2024 and is expected to reach USD 1.82 billion in 2025

b. The global security guard management software market is expected to grow at a compound annual growth rate of 11.8% from 2025 to 2033 to reach USD 4.46 billion by 2033

b. North America dominated the security guard management software market with a share of 36% in 2024, driven by advanced technological infrastructure, high digital adoption rates, and a mature security services market.

b. Some key players operating in the security guard management software market include Key companies profiled GuardsPro LLC; Motics Corporation; American Software Solutions, Inc.; OfficerReports; Celayix; Connecteam; DESTINY SOFTWARE; Novagems.com Inc.; Trackforce; Condo Control

b. Key factors that are driving the market growth include the growing need for real-time security operations management, digital incident reporting, and workforce automation across various sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.