- Home

- »

- Advanced Interior Materials

- »

-

Selective Catalytic Reduction Market, Industry Report, 2030GVR Report cover

![Selective Catalytic Reduction Market Size, Share & Trends Report]()

Selective Catalytic Reduction Market (2025 - 2030) Size, Share & Trends Analysis Report By End-use (Automotive, Power Generation, Chemical & Petrochemical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-507-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Selective Catalytic Reduction Market Summary

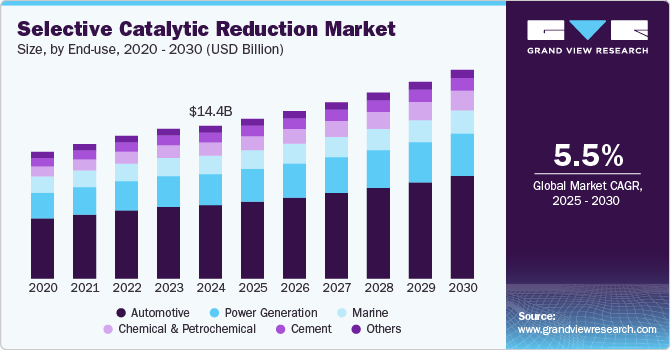

The global selective catalytic reduction (SCR) market size was estimated at USD 14,399.2 million in 2024 and is projected to reach USD 19,707.3 million by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The selective catalytic reduction (SCR) industry is witnessing significant growth driven by stringent government regulations regarding vehicle emissions and the increasing demand for cleaner technologies.

Key Market Trends & Insights

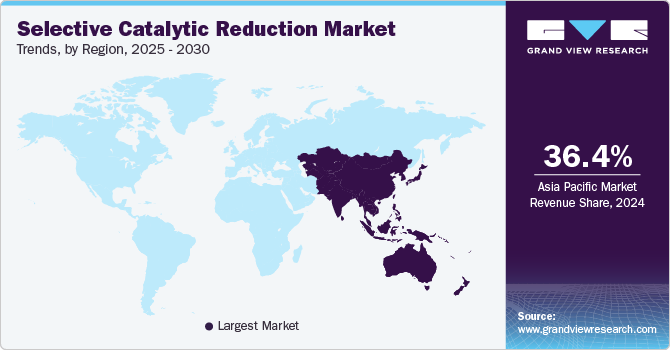

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

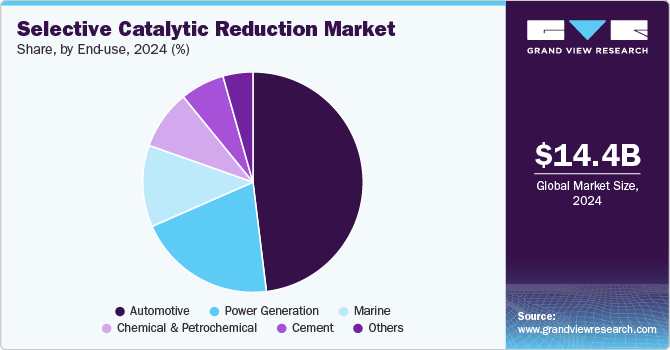

- In terms of segment, automotive accounted for a revenue of USD 7,271.4 million in 2024.

- Chemical & Petrochemical is the most lucrative end use segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 14,399.2 Million

- 2030 Projected Market Size: USD 19,707.3 Million

- CAGR (2025-2030): 5.5%

- Asia Pacific: Largest market in 2024

SCR technology, primarily used in automotive, industrial, and power generation sectors, helps reduce nitrogen oxide (NOx) emissions by injecting a urea-based solution into exhaust gases. As countries around the world implement tighter environmental standards, particularly the Euro 6 and similar norms, SCR systems are becoming essential in meeting emission limits, especially in diesel engines.

Additionally, the growing adoption of electric vehicles (EVs) and hybrid vehicles, which generally produce lower emissions, is pushing automakers to integrate SCR systems into their designs for internal combustion engines. Furthermore, the market is also being influenced by rising environmental awareness and the need for sustainable solutions. The Asia Pacific region, particularly China, is expected to dominate the market due to its heavy industrial activity and large automotive production base. Increasing investments in research and development to enhance the efficiency and cost-effectiveness of SCR systems will likely spur further growth in the coming years.

Market Concentration & Characteristics

The selective catalytic reduction (SCR) industry exhibits moderate to high concentration, with a few key players dominating the market, while smaller players and regional manufacturers also have a presence. Major companies such as BASF, Johnson Matthey, and Umicore lead the SCR catalyst market, particularly in the automotive sector, offering advanced catalyst technologies and urea-based solutions that meet regulatory standards. These established players have extensive research and development (R&D) capabilities, allowing them to innovate and develop more efficient SCR systems. The industry's concentration is further supported by strong intellectual property protection and long-term contracts with original equipment manufacturers (OEMs) and regulatory bodies.

The characteristics of the SCR market are driven by the need for compliance with environmental regulations, especially concerning nitrogen oxide (NOx) emissions. SCR systems are used in diesel-powered vehicles, industrial facilities, and power plants, where their primary function is to reduce NOx emissions to acceptable levels. The market is heavily influenced by the regulatory environment, as stricter emission standards around the world push for the wider adoption of SCR technology. Governments' focus on reducing air pollution and promoting cleaner technologies continues to drive demand for SCR solutions in various sectors, particularly in regions like Europe, North America, and parts of Asia.

In addition to regulatory compliance, the SCR market is characterized by continuous innovation to improve the efficiency, durability, and cost-effectiveness of the systems. Catalysts used in SCR systems have evolved to handle higher temperatures and offer better resistance to degradation, leading to longer lifecycles and reduced maintenance costs. Additionally, there has been a growing emphasis on reducing the cost of SCR technology, both in terms of manufacturing and after-sales services, as consumers and industries demand more affordable, environmentally friendly solutions.

Another key characteristic of the selective catalytic reduction industry is the increasing integration of digitalization and automation, especially within the automotive and industrial sectors. The development of real-time monitoring systems and advanced control technologies has enhanced the overall efficiency of SCR systems, optimizing the urea injection process, and improving emission control. As environmental concerns continue to rise and the push for zero-emission solutions intensifies, the SCR market is expected to experience further diversification with an increasing number of applications in electric power generation, heavy-duty transport, and even maritime and aviation sectors in the long term.

Drivers, Opportunities & Restraints

One of the key drivers for the selective catalytic reduction (SCR) market is the tightening of environmental regulations worldwide, particularly those aimed at reducing harmful nitrogen oxide (NOx) emissions. Governments across regions like Europe, North America, and Asia have set stringent emission standards for vehicles, industrial processes, and power plants. This regulatory pressure forces industries to adopt SCR technology as a reliable solution to meet these standards and avoid penalties. The increasing focus on environmental sustainability and air quality, along with rising public awareness of pollution, further propels the demand for SCR systems.

A major restraint for the selective catalytic reduction market is the high initial cost and maintenance associated with SCR systems, particularly for smaller businesses or less-developed regions. The technology requires the use of urea-based additives (AdBlue), which adds to operational expenses, and the systems themselves can be costly to install and maintain. This could deter some potential customers from adopting SCR technology, especially in industries or regions with lower budget flexibility or less stringent emissions regulations.

The growing trend toward electrification and hybrid vehicles presents a significant opportunity for the SCR market. As automotive manufacturers develop more efficient internal combustion engines (ICE) alongside electric drivetrains, SCR systems are increasingly used in hybrid vehicles to optimize emissions reduction. Additionally, advancements in SCR technology to improve efficiency and lower operating costs open new markets, especially in sectors like heavy-duty transport and marine applications, where NOx emissions remain a challenge. The continued push for cleaner technologies across various industries also offers ample growth potential for SCR adoption in power generation and industrial processes.

End Use Insights

The automotive end use segment accounted for a revenue share of 48.1% in 2024. In the automotive industry, selective catalytic reduction is used to reduce NOx emissions from diesel engines. A urea-based solution, like AdBlue, is injected into the exhaust gases, where it reacts with NOx over a catalyst to convert them into nitrogen and water. This technology helps vehicles comply with stringent emission regulations. SCR is commonly found in modern diesel-powered cars, trucks, and buses.

Selective Catalytic Reduction (SCR) in power generation is used to reduce nitrogen oxide (NOx) emissions from exhaust gases. It involves injecting a reductant, typically urea or ammonia, into the flue gas stream, which reacts with NOx in the presence of a catalyst, converting them into harmless nitrogen and water.

Regional Insights

Asia Pacific is projected to led the selective catalytic reduction industry and accounted for 36.4% of the overall revenue share in 2024. In the Asia Pacific region, SCR technology is increasingly adopted due to rising air pollution concerns and tightening emission regulations. Countries like Japan and South Korea are at the forefront of adopting SCR systems in both commercial and passenger vehicles. SCR is becoming more widespread as countries push toward reducing environmental footprints.

China selective catalytic reduction market held largest market share in the Asia Pacific region. China has been rapidly adopting SCR technology in the automotive and heavy-duty sectors to comply with its stringent emission standards. As the country aims to reduce air pollution, SCR helps cut NOx emissions from diesel engines, playing a key role in the fight against smog in major cities. The government encourages the use of SCR through regulations and incentives.

The selective catalytic reduction market in the India is expected to grow at a CAGR of 7.5% from 2025 to 2030. In India, SCR technology is gaining traction, particularly in commercial vehicles like trucks and buses. The government has implemented tighter emission standards, and SCR is vital for reducing NOx emissions in the face of growing environmental concerns. Many vehicle manufacturers are incorporating SCR systems to comply with Bharat Stage VI (BS VI) emissions norms.

North America Selective Catalytic Reduction Market Trends

Selective Catalytic Reduction (SCR) technology is widely used in North America to meet stringent EPA emission standards for diesel engines. Both passenger vehicles and commercial trucks use SCR with AdBlue to reduce NOx emissions. This technology is crucial for compliance with the Clean Air Act regulations, ensuring cleaner air quality. The U.S. and Canada also have incentives for adopting cleaner technologies.

U.S. Selective Catalytic Reduction Market Trends

The selective catalytic reduction (SCR) industry in the U.S. is expected to grow at a CAGR of 4.4% from 2025 to 2030. In the U.S., SCR systems are essential for meeting the Environmental Protection Agency's (EPA) strict emission standards for diesel-powered vehicles. SCR helps reduce NOx emissions, playing a key role in the country's efforts to combat air pollution and improve air quality. It’s standard in both heavy-duty trucks and passenger vehicles.

The selective catalytic reduction market in Canada is expected to grow at a CAGR of 3.7% from 2025 to 2030. Canada follows similar emission standards to the U.S. and utilizes SCR technology in diesel vehicles to reduce NOx emissions. The technology is key to meeting Canada's national vehicle emissions regulations, ensuring that both light-duty and heavy-duty vehicles comply with stringent environmental standards.

Europe Selective Catalytic Reduction Market Trends

The Europe selective catalytic reduction (SCR) industry is witnessing steady growth, driven by stringent NOₓ emission regulations across industries such as automotive, power generation, chemical & petrochemical, marine, and cement. The EU's Euro 6 and Euro 7 standards, along with the Industrial Emissions Directive (IED) and Maritime IMO Tier III regulations, have accelerated SCR adoption in vehicles, power plants, and industrial facilities.

Germany's selective catalytic reduction market held 22.4% share in the European market. Germany, as a major automobile hub, has integrated SCR technology into its vehicle fleet, particularly in diesel engines. The country’s strict Euro 6 standards make SCR essential for reducing NOx emissions from cars, trucks, and buses. SCR technology supports Germany's commitment to both environmental sustainability and air quality.

UK selective catalytic reduction market’s growth is driven by rising adoption of SCR in diesel vehicles to comply with the Euro 6 emission standards. The technology is crucial for reducing NOx emissions, which contribute to urban air pollution. SCR systems are found in a wide range of vehicles, from passenger cars to heavy-duty trucks.

Middle East & Africa Selective Catalytic Reduction Market Trends

In the Middle East and Africa, SCR technology is slowly being adopted, particularly in commercial vehicles, to address the region's rising pollution concerns. As governments in countries like the UAE and Saudi Arabia introduce stricter emissions standards, SCR systems are becoming more prevalent in reducing NOx emissions.

Saudi Arabia selective catalytic reduction market is anticipated to grow during the forecast period. In Saudi Arabia, SCR technology is becoming more common in diesel-powered vehicles to meet tightening environmental regulations. The technology helps reduce NOx emissions in line with the country's goal to improve air quality and reduce the environmental impact of transportation in urban areas.

Latin America Selective Catalytic Reduction Market Trends

In Latin America, SCR technology is gradually becoming more common as countries like Mexico and Brazil adopt stricter vehicle emission standards. SCR is used in commercial and passenger vehicles to reduce NOx emissions. This shift supports the region's growing focus on improving air quality and aligning with global emission trends.

Brazil selective catalytic reduction market is expected to witness growth over the forecast period. In Brazil, SCR technology is gaining traction in diesel vehicles due to the implementation of stricter emissions regulations. The adoption of SCR is essential for reducing NOx emissions from both passenger cars and commercial vehicles. The Brazilian government encourages cleaner technologies to combat urban air pollution.

Key Selective Catalytic Reduction Company Insights

Some of the key players operating in the market include Faurecia,Johnson Matthey among others.

-

Faurecia is a global leader in automotive technology, specializing in the design and manufacturing of clean mobility solutions, interior systems, and advanced emissions control technologies. Headquartered in France, Faurecia operates across more than 30 countries, providing innovative solutions aimed at reducing the environmental impact of vehicles. The company is a key player in the development of systems that address air quality and sustainability, focusing on reducing CO2 emissions, enhancing fuel efficiency, and improving vehicle safety. Faurecia partners with major automotive manufacturers to meet stringent global regulations on emissions and help accelerate the transition to cleaner, greener transportation.

-

Johnson Matthey is a UK-based global leader in sustainable technologies, with a strong focus on catalysis, precious metals, and battery materials. The company’s operations span industries such as automotive, chemicals, energy, and environmental sustainability. Johnson Matthey is renowned for its expertise in emission control technologies, particularly in selective catalytic reduction (SCR) and other catalytic solutions to reduce harmful pollutants. The company’s innovations are central to advancing cleaner industrial processes and promoting the transition to a low-carbon economy, with a growing emphasis on energy storage and hydrogen technologies to support a sustainable future.

Key Selective Catalytic Reduction Companies:

The following are the leading companies in the selective catalytic reduction market. These companies collectively hold the largest market share and dictate industry trends.

- Cormetech

- Johnson Matthey

- BASF

- Ceram-Ibiden

- BOSCH

- Bosal

- Faurecia

- Haldor Topsoe

- Röchling Group

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- ANDRITZ Clean Air Technologies

- Durr Systems, Inc.

- Cummins Inc.

- SCR Solutions Holding Ltd

- CONCORD Thermal Efficiency

Recent Developments

-

In February 2024, ANDRITZ has secured an order from TPC Group to provide a Selective Catalytic Reduction (SCR) system for reducing nitrogen oxide (NOx) emissions at the power boiler in Houston, TX, U.S.

Selective Catalytic Reduction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.06 billion

Revenue forecast in 2030

USD 19.71 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Cormetech; Johnson Matthey; BASF; Ceram-Ibiden; BOSCH; Bosal; Faurecia; Haldor Topsoe; Röchling Group; MITSUBISHI HEAVY INDUSTRIES, LTD.; ANDRITZ Clean Air Technologies; Durr Systems, Inc.; Cummins Inc.; SCR Solutions Holding Ltd; CONCORD Thermal Efficiency

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Selective Catalytic Reduction Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global selective catalytic reduction market report based on end use, and region:

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Passenger Cars

-

Commercial Vehicles

-

-

Power Generation

-

Marine

-

Chemical & Petrochemical

-

Cement

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global selective catalytic reduction market size was estimated at USD 14.40 billion in 2024 and is expected to reach USD 15.06 billion in 2025.

b. The selective catalytic reduction market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 and reach USD 19.71 billion by 2030.

b. Asia Pacific is expected to lead the market, accounting for 36.4% of the total revenue share in 2024. The region is witnessing a growing adoption of SCR technology, driven by rising air pollution concerns and stricter emission regulations.

b. Some of the key players operating in the SCR market include Cormetech, Johnson Matthey, BASF, Ceram-Ibiden, BOSCH, Bosal, Faurecia, Haldor Topsoe, Röchling Group, MITSUBISHI HEAVY INDUSTRIES, LTD., ANDRITZ Clean Air Technologies, Durr Systems, Inc., Cummins Inc., SCR Solutions Holding Ltd, CONCORD Thermal Efficiency.

b. The selective catalytic reduction market is witnessing significant growth driven by stringent government regulations regarding vehicle emissions and the increasing demand for cleaner technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.