- Home

- »

- Beauty & Personal Care

- »

-

Self-tanning Products Market Size Report, 2022-2030GVR Report cover

![Self-tanning Products Market Size, Share & Trends Report]()

Self-tanning Products Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Lotions, Gels), By Application (Men, Women), By Distribution Channel (Online, Supermarkets & Hypermarkets), And Segment Forecasts

- Report ID: GVR-3-68038-362-1

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Self-tanning Products Market Summary

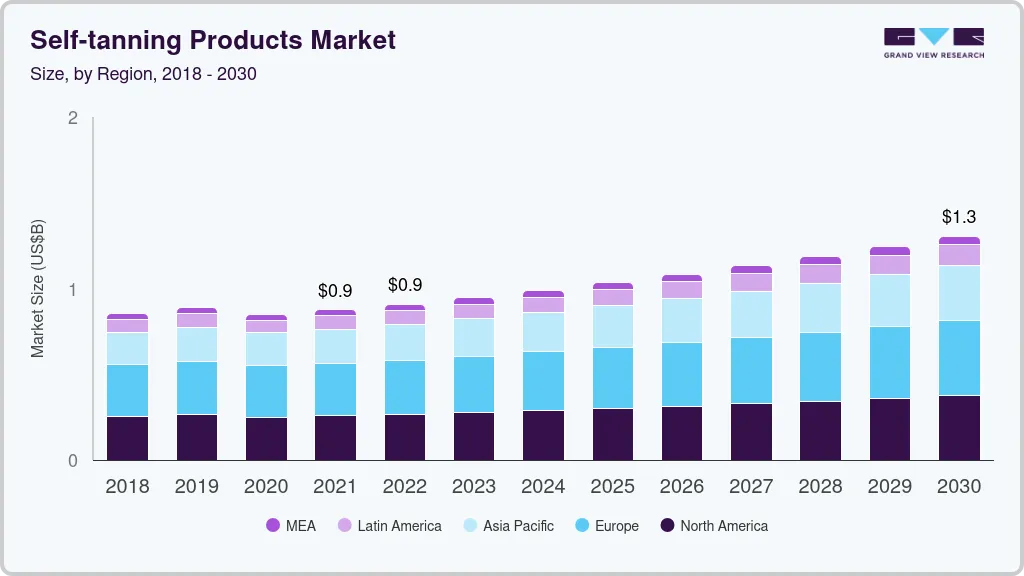

The global self-tanning products market size was estimated at USD 877.0 million in 2021 and is projected to reach USD 1,305.3 million by 2030, growing at a CAGR of 4.5% from 2022 to 2030. Self-tanning products have become increasingly prevalent as consumers have become aware of the health and long-term aesthetic effects of excessive sun exposure.

Key Market Trends & Insights

- The Europe held the largest market share of 35.0% in 2021 and is expected to maintain dominance over the forecast period.

- The Asia Pacific is expected to be the fastest-growing regional market from 2022 to 2030.

- By product, the lotions segment held the largest market share of more than 54.5% in 2021 and is expected to maintain dominance over the forecast period.

- On the basis of applications, the global market has been further segmented into men and women.

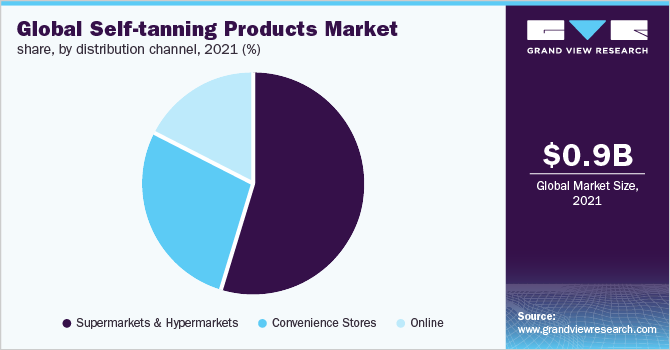

- By distribution channel, the supermarkets & hypermarkets segment held the largest market share of 54.8% in 2021 and is expected to maintain dominance over the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 877.0 million

- 2030 Projected Market Size: USD 1,305.3 million

- CAGR (2022-2030): 4.5%

- Europe: Largest market in 2021

- Asia Pacific: Fastest growing market

Widespread UVA and UVB exposure is constantly increasing skin cancer cases, which has been playing a vital role in driving the adoption of such products. The COVID-19 pandemic has had a devastating impact on the market as a majority of the customer base is in Europe and North America, which have been severely affected by the pandemic.

However, as markets have slowly started opening, the popularity of the online distribution channel is expected to create a steady demand for self-tanning and cosmetic offerings in the foreseeable future. Rising concerns about skin diseases and other health risks associated with sun exposure will boost the demand for such offerings in the upcoming years. Lotions & gels are among the most used products as these are frequently applied. Apart from benefits such as instant hydration, reduced breakouts, and refreshed skin, lotions & gels are also easy-to-use quick solutions for combating dry skin. These products, most commonly known as sunless tanners, provide the skin a tanned look without exposing it to harmful Ultraviolet (UV) rays.

As consumers shift toward safer cosmetic and beauty offerings, manufacturers are launching innovative and advanced self-tanning products to provide a more realistic tanning experience while also being safe and better for the skin. Major compositions include ingredients that hydrate and nourish the skin so that it looks healthier and rejuvenated. These ingredients include vitamins, essential oils, fruit extracts, and antioxidants, and their popularity has been increasing in recent years, especially among health-conscious consumers. Furthermore, major health organizations are supporting the use of self-tan products over other variants.

For instance, The Centers for Disease Control and Prevention (CDC) promoted the use of self-tan products by considering it as a safer alternative to UV-induced tanning. Moreover, the preference for such products has been observed to be higher among U.S. consumers owing to the growing prevalence of skin diseases, such as skin cancers. According to the American Academy of Dermatology, skin cancer is the most common cancer in the U.S. and about one in five Americans will develop the disease in their lifetime.

Product Insights

The lotions segment held the largest market share of more than 54.5% in 2021 and is expected to maintain dominance over the forecast period. The increasing incidences of skin malignancies and disorders due to Ultraviolet (UV) ray exposure are likely to drive the demand for lotions throughout the forecast period. Lotions, as compared to creams, contain less oil or are sometimes completely oil-free. These emulsions frequently use alcohols to prevent the oil and water components from separating, which results in a silky feel when the product is applied. Moreover, lotions are less viscous, making them easier to pour or pump. However, the gels segment is projected to register the fastest CAGR during the forecast period.

Gels are water-based self-tanning solutions that help retain moisture in the skin and prevent dryness. The non-oily product contains glycerin, which leaves skin soft, luminous, and well-moisturized. Gel-based products have water-soluble ingredients that give them a thick texture, which makes them simpler to apply. Gels provide a variety of benefits, including ease of application, excellent moisturization, and hydration, which contribute to the product’s growing popularity. Non-greasy and quick-drying gels melt into the skin without smudging or streaking, preventing any stains on garments. Furthermore, gel moisturizers have fewer emollients and oils than cream moisturizers. Water molecules and capsules of hyaluronic acid in gel-based products allow hydration without leaving greasy residues on the surface of the skin.

Application Insights

On the basis of applications, the global market has been further segmented into men and women. The women application segment held the largest market share of 63.3% in 2021 and is expected to maintain dominance over the forecast period. Women are increasingly adding grooming products to their daily routines to enhance their appearance and confidence. According to an article published by Popsugar Beauty in July 2021, the craving for a sun-kissed glow is especially common among women, as 59% of the college-going females in the U.S. have used self-tanners at least once and prefer using them year-round.

However, the men segment is projected to register the fastest CAGR from 2022 to 2030. Historically, the consumption and demand for men’s skincare have been sluggish owing to the social perception of beauty by-products associated with women. However, significant growth in the awareness of skincare among the male population globally has acted as a crucial driver in recent years. The growing awareness about personal hygiene & regular grooming among men, the rising number of product launches & celebrity endorsements, and increasing disposable income are major factors driving the growth of this segment.

Distribution Channel Insights

The supermarkets & hypermarkets segment held the largest market share of 54.8% in 2021 and is expected to maintain dominance over the forecast period. These are service superstores with the availability of a wide range of products across various categories, ranging from food, household items, and general merchandise to cosmetics and personal care products under a single roof. This attracts consumers toward this distribution channel. According to an Entrepreneur Handbook article published in July 2021, Tesco, Sainsbury’s, Asda, and Morrisons accounted for 63% of the retail sale in the U.K.

However, the online distribution channel segment is projected to register the fastest growth rate during the forecast period. The pandemic has triggered a digital explosion across many sectors. According to data released by Bluecore, there has been an average increase of 127% in the online sale of beauty and skincare products globally in June 2020 compared to the same month the previous year. Similarly, L’Oréal reported that its sales through online channels rose from 15.6% in 2019 to 26.6% in 2020.

Regional Insights

Europe held the largest market share of 35.0% in 2021 and is expected to maintain dominance over the forecast period. With the increased regulations on DHA in self-tan products, owing to the growing awareness regarding its side effects on the skin, consumer preference has been shifting toward organic and natural lotions. For instance, Vita Liberata, a leading brand in organic cosmetics and skincare, offers sunless tanning lotions with natural and organic ingredients, including aloe vera and shea butter that aid in getting a natural tan and glow. The increasing number of product offerings through various brands is anticipated to boost the demand for lotions in the forecast period.

Asia Pacific is expected to be the fastest-growing regional market from 2022 to 2030. The increasing demand for skincare and cosmetic products in the emerging markets of China and India, due to factors such as the growing number of new product launches and rising concerns about skin health, the harmful effects of UV rays, & skin conditions, are likely to positively influence the Asia Pacific market. Central & South America is projected to register significant growth during the forecast period. Manufacturers in this region are engaged in the development of tanning products that contain a mixture of natural and organic ingredients in an attempt to tap into new customer demographics. For instance, Brazilian Tape Tan, a leading natural and organic manufacturer of skincare products, offers a wide range of self-tan products with natural intensifiers.

Key Companies & Market Share Insights

The global market is characterized by the presence of a few well-established players and several small- & medium-scale players. Product launches are one of the key strategic initiatives in the industry to gain a competitive edge. For instance, in August 2021, Cosmopolitan launched CosmoSun - a line of cruelty-free, vegan, and nut-free tan products and other sun-care items, in collaboration with Devoted Creations. The product range includes Sunless Mousse, Instant Body Bronzer, Sun Lotion with Shimmer, Overnight Sunless Lotion and Liquid Sunshine tanning water. In January 2021, BONDI Sands launched an eco-friendly pure fake tan with 100% recyclable packaging.

The product range includes Pure Self Tan Foaming Water, The Pure Gradual Tanning Lotion, Pure Self Tanning Sleep Mask, Pure Self Tanning Face Mist, and Pure Self Tanning Drops. In May 2020, St. Tropez launched its Self Tan Express Bronzing Gel, which is made using hyaluronic acid to help keep the skin moisturized. It is produced using the Intelligent Shade Technology to offer 3 shades in 1 for a more realistic tan, streak-free result, and even color fade. Some of the key players operating in the global self-tanning products market include:

-

The Estée Lauder Companies Inc.

-

L’Oréal

-

Shiseido Co., Ltd.

-

St. Tropez

-

Unilever

-

Kao Corporation

-

Beiersdorf AG

-

Johnson & Johnson Services, Inc.

-

Avon Products, Inc.

-

Clarins

Self-tanning Products Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 909.2 million

Revenue forecast in 2030

USD 1.31 billion

Growth rate

CAGR of 4.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; South Korea; India; Brazil

Key companies profiled

The Estée Lauder Companies Inc.; Beiersdorf AG; Clarins; Avon Products, Inc.; St. Tropez; L’Oréal; Kao Corporation; Unilever; Johnson & Johnson Services Inc.; Shiseido Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global self-tanning products market report on the basis of product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Lotions

-

Gels

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global self-tanning products market size was estimated at USD 877.0 million in 2021 and is expected to reach USD 909.2 million in 2022.

b. The global self-tanning products market is expected to grow at a compound annual growth rate of 4.5% from 2022 to 2030 to reach USD 1.31 billion by 2030.

b. Europe dominated the self-tanning products market with a share of more than 30% in 2021. The increasing number of product offerings through various brands is driving the demand for self-tanning products in the region.

b. Some of the key players in the self-tanning products market are The Estée Lauder Companies Inc.; Beiersdorf AG; Clarins; Avon Products, Inc.; St. Tropez; L'Oréal; Kao Corporation; Unilever; Johnson & Johnson Services Inc.; and Shiseido Co., Ltd.

b. Key factors that are driving the self-tanning products market growth include rising concerns about skin diseases and other health risks associated with sun exposure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.