Sensitive Toothpaste Market Summary

The global sensitive toothpaste market size was estimated at USD 1.0 billion in 2019 and is expected to reach USD 1.5 billion by 2027, growing at a CAGR of 5.4% from 2020 to 2027. The industry is expected to be driven by the growing awareness of personal health and dental hygiene.

Key Market Trends & Insights

- Asia Pacific accounted for the largest share of 41.7% in terms of revenue in 2019.

- By product type, the whitening segment held the largest market share of 55.7% in 2019.

- By distribution channel, the supermarkets/ hypermarkets segment accounted for the largest market share of 66.3% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 1.0 Billion

- 2027 Projected Market Size: USD 1.5 Billion

- CAGR (2020-2027): 5.4%

- Asia Pacific: Largest market in 2019

In addition, rising demand for natural and organic products for oral care will lead to a surge in the demand for sensitive toothpaste. Market players are coming up with sensitive kinds of toothpaste offering multiple benefits such as deep clean, whitening, repair and protection, herbal multi-care, and fresh mint flavor. The growing adoption of whitening toothpaste due to its multiple benefits is driving the market. In addition, the implementation of innovative marketing strategies by major vendors is anticipated to propel the growth of the market for sensitive toothpaste.

Rapidly changing lifestyles and increasing consumption of alcohol and tobacco are resulting in the rise of oral diseases and teeth sensitivity problems. People across the globe are immensely paying attention to maintain adequate oral care, which will positively impact the growth of the market for sensitive toothpaste in the coming years. In addition, increased dental problems among adults and children due to unhealthy eating habits are majorly driving the consumption of sensitive toothpaste.

Consumers are looking for advanced and rapid oral care solutions such as whitening and rapid relief toothpaste, which is anticipated to fuel market growth in the coming years. Brand image also plays an important role in product marketing. Sensodyne and Colgate-Palmolive are the two major brands that create awareness about oral sensitivity and increase the adoption of sensitive toothpaste among consumers.

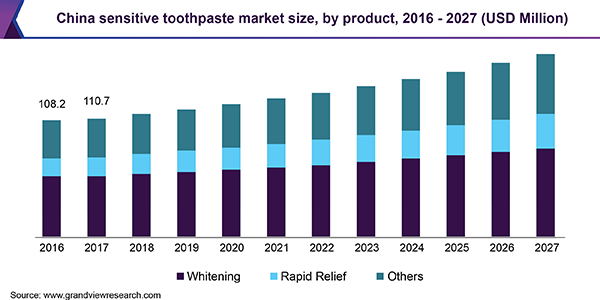

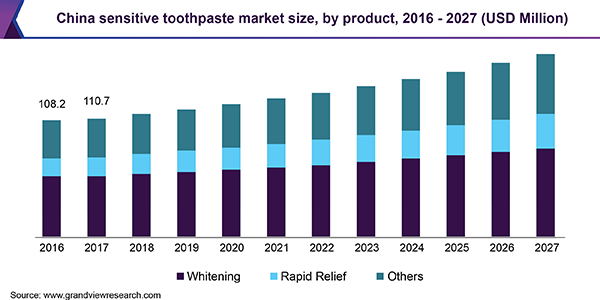

Product Type Insights

By product type, the sensitive toothpaste market is segmented into whitening, rapid relief, and others. The whitening segment held the largest market share of 55.7% in 2019 due to multiple advantages such as lightening of teeth stains, calm tooth nerves, and protection from harmful effects of dietary acid erosion. The rapid relief segment will witness the highest CAGR of 7.2% as it relieves sensitivity pain in just 60 seconds coupled with benefits including cavity protection and refreshing breath.

Growing adoption of natural and organic consumer products has encouraged many companies to add natural content in toothpaste, which will lead to an increase in demand for herbal toothpaste. Repair and protect sensitive toothpaste gives sensitivity protection by building a layer of stannous fluoride.

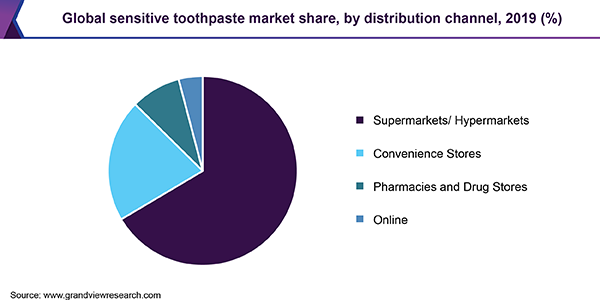

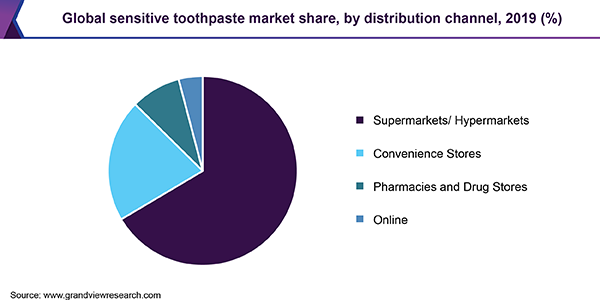

Distribution Channel Insights

The supermarkets/ hypermarkets segment accounted for the largest market share of 66.3% in 2019 owing to the availability of a wide range of products. The pharmacies and drug stores segment will witness a significant growth rate in the coming years. Increasing prescription of the toothpaste by doctors and physicians for sensitivity problems and advanced innovation in medical care will drive demand for sensitivity toothpaste in drug stores and pharmacies. Furthermore, increasing awareness about oral care and teeth sensitivity through company organized campaigns will trigger the growth of the market. For instance, GSK organized tooth sensitivity campaign to create sensitivity awareness among consumer and distributed samples to corporate offices, trains, and also carried out door to door selling. Hence, the wholesale market and campaigning will play a significant role in driving demand for sensitive toothpaste in the coming years.

Online channel is projected to witness the fastest CAGR of 7.1% due to growing penetration of e-commerce sites and several discount offers available on online platforms across the globe. A wide range of personal care products available and time-saving aspect on online sites is expected to contribute a positive impact on the online retail channel market. In addition, the rising penetration of smart gadgets is paving the growth of online sales of sensitive toothpastes.

Regional Insights

Asia Pacific accounted for the largest share of 41.7% in terms of revenue in 2019 due to the increasing demand for oral care products among consumers in China and India. Growing disposable income and awareness about dental hygiene are majorly driving the growth of the market for sensitive toothpaste in this region. Oral care products in India are majorly produced from natural and ayurvedic ingredients. According to WHO, more than 34% of people in India are suffering from oral sensitivity problems. Rising demand for herbal and natural care toothpaste for sensitive teeth problem will drive the market for sensitive toothpaste in India.

According to Oral Health Epidemiological Investigation, the major population of China has been suffering from oral problems. Government support for the development of the oral health sector in China is driving the growth of this market for sensitive toothpaste. For instance, in 2016-2017, the China government has introduced several policies to increase awareness about oral hygiene and cover large dental hospitals and clinics. This will result in a shift towards sensitive toothpastes among consumers.

Sensitive Toothpaste Market Share Insights

Key players operating in the market for sensitive toothpaste are Colgate-Palmolive Company; GlaxoSmithKline plc; Church and Dwight Co., Inc.; Procter and Gamble; Unilever; and Tom's of Maine. Major players operating in the market are investing in the promotion of new products. For instance, GSK brand Sensodyne is focusing on oral care with the help of chatbot and Google Assistant. GlaxoSmithKline plc, Procter and Gamble, and Colgate-Palmolive Company are dominating the market.

Report Scope

|

Attribute

|

Details

|

|

Base year for estimation

|

2019

|

|

Actual estimates/Historical data

|

2016 - 2018

|

|

Forecast period

|

2020 - 2027

|

|

Market representation

|

Revenue in USD Million and CAGR from 2020 to 2027

|

|

Regional scope

|

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

|

|

Country scope

|

U.S., Germany, U.K., China, India, Brazil, South Africa

|

|

Report coverage

|

Revenue forecast, competitive landscape, growth factors and trends

|

|

15% free customization scope (equivalent to 5 analysts working days)

|

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

|

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global sensitive toothpaste market report on the basis of product type, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Whitening

-

Rapid Relief

-

Others

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

Europe

-

Asia Pacific

-

Central & South America

-

Middle East & Africa