- Home

- »

- Biotechnology

- »

-

Sequencing Market Size, Share And Growth Report, 2030GVR Report cover

![Sequencing Market Size, Share & Trends Report]()

Sequencing Market (2024 - 2030) Size, Share & Trends Analysis Report By Product & Services (Platform, Software), By Application (Oncology, Clinical Investigation), By Workflow, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-195-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sequencing Market Summary

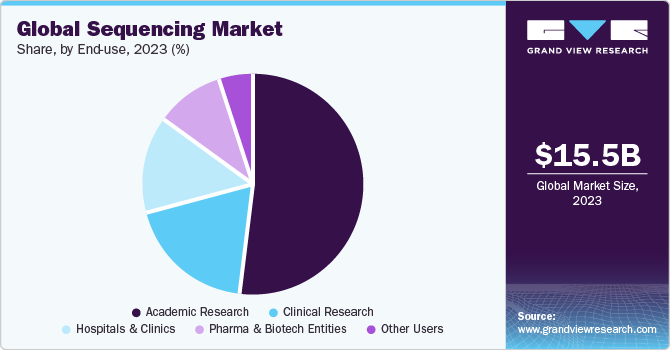

The global sequencing market size was estimated at USD 15,540.0 million in 2023 and is projected to reach USD 62,478.8 million by 2030, growing at a CAGR of 22.2% from 2024 to 2030. The market growth is attributed to factors such as growing demand for gene therapy, personalized medicine, drug discovery, increasing cancer incidence, and a significant increase in demand for consumer genomics in recent years.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Mexico is expected to register the highest CAGR from 2024 to 2030.

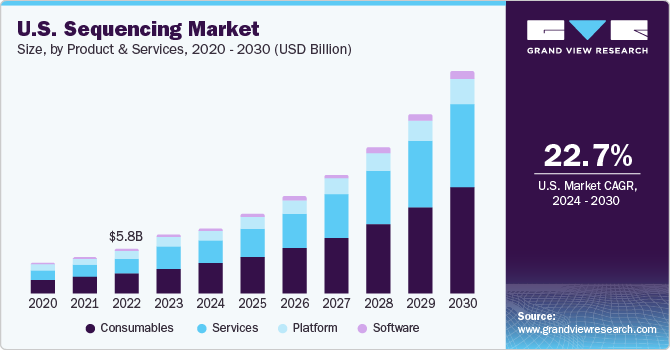

- In terms of segment, consumables accounted for a revenue of USD 6,913.2 million in 2023.

- Services is the most lucrative product & services segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 15,540.0 Million

- 2030 Projected Market Size: USD 62,478.8 Million

- CAGR (2024-2030): 22.2%

- North America: Largest market in 2023

Moreover, the increasing number of joint ventures and partnerships amongst market players is also expected to positively impact market growth. For instance, in June 2022, Illumina, Inc., and Allegheny Health Network signed a collaboration for effective evaluation of the impact of in-house Comprehensive Genomic Profiling (CGP) to leverage patient care.

Furthermore, major companies worldwide have increased their research and development capabilities. This strong concentration on COVID-19 vaccine research created a lucrative opportunity to use of these technologies during the pandemic. For example, a group of Chinese researchers used MinION Mk1C, a product from Oxford Nanopore Technologies (UK) to sequence COVID-19 samples. Furthermore, factors such as widespread implementation of NGS technologies in clinical diagnostics due to faster results and processing are expected to provide a favorable environment for market expansion over the forecast period.

Many genomic surveillance programs were launched country-wide to understand the dynamics of pandemic situation and to implement effective preventive measures. For instance, in December 2020, the Indian SARS-CoV-2 Genomics Consortium (INSACOG) was launched by the joint efforts of the Department of Biotechnology (DBT), the Ministry of Health, and ICMR to screen the genomic variations in the SARS-CoV-2 by sequencing technologies. Furthermore, country-specific companies are providing consumer genomics services which are also expected to fuel the market size in coming years. One such company, Mapmygenome, one of the pioneers in India, offers DTC genomics services.

The increasing prevalence of inherited cancers is expected to create a demand for cancer genomics. The substantial understanding of human genome has focused on using various gene therapies for treatment of cancers by modern gene editing techniques such as CRISPR-Cas gene technology. For instance, in September 2022, a group of researchers at the University of California introduced the applications of precision genome editing agents for management of inherited retinal diseases (IRDs).

Developing high-throughput sequencing technologies such as NGS and microarrays has generated massive amounts of genomic data. However, the rapid accumulation of this data from DNA sequencing and Electronic Health Records (EHRs) poses significant challenges and opportunities for extracting biologically or clinically relevant information. Phenome-wide association study (PheWAS) & genome-wide association study (GWAS) are helping researchers to study correlations between genotype and phenotype.

The market players are working extensively towards collaborations, expansions, acquisitions, and substantial capital investments to advance research to understand rare diseases and to aid drug discovery. For instance, in December 2023, CCM Biosciences announced that they would launch a new business unit named 5Prime, focusing on next-generation DNA sequencing and more. The unit will focus on molecular diagnostics and DNA-based biotechnology for enzyme-based engineering.

Market Concentration & Characteristics

The market has witnessed a remarkable degree of innovation in recent years. Advancements in technologies have led to the development of high-throughput sequencing platforms, which can generate extensive amounts of data in a short amount of time. These platforms have enabled researchers to sequence entire genomes and transcriptomes at a fraction of the cost and time required by previous methods. In addition, introducing new chemistries and library preparation methods has improved the accuracy, sensitivity, and speed of sequencing, expanding the range of applications in which sequencing can be used.

In recent years, there has been a significant increase in the level of M&A (mergers and acquisitions) activities in the market. This trend is driven by the growing demand for these technologies in various fields such as healthcare, agriculture, and environmental research. Many companies in the industry have been acquiring smaller companies or merging with larger ones to expand their offerings and gain a competitive edge. Some market acquisitions include Illumina's acquisition of Pacific Biosciences and Roche's acquired Stratos Genomics.

The impact of regulations on the market can be significant. Regulations help ensure that sequencing technologies are safe and effective for various applications, such as clinical diagnosis and drug development. However, regulations can also increase the cost and complexity of developing and commercializing sequencing products. This can create barriers to entry for smaller companies and limit innovation in the market. In addition, regulations can vary by country and region, which can further complicate the development and distribution of sequencing products on a global scale.

There are diverse technologies and alternative approaches; the lack of a single universal substitute for all sequencing needs can be attributed to the complexity and diversity of genomic research applications, the evolving nature of sequencing technologies, and the importance of using complementary techniques based on specific research requirements. Researchers choose the sequencing method that aligns with the goals of their study, considering factors such as accuracy, read length, cost, and throughput.

The concentration of end-users in the market can vary by region, and it is influenced by factors such as research funding, healthcare policies, and the level of technological adoption in different sectors. Market dynamics also shift based on emerging applications and advancements in sequencing technologies.

Product & Service Insights

The consumables segment dominated the overall market with the largest revenue share of 44.5% in 2023. The dominance of the consumables segment can be attributed to the fact that sequencing is a continuous process and requires a constant supply of consumables. In addition, advancements in technologies such as shotgun and denovo sequencing and the increasing demand for high-throughput sequencing have led to higher consumption of consumables. As a result, the consumables segment is expected to continue to dominate the market from 2024 to 2030.

The services segment is expected to grow at the highest CAGR during the forecast period. This is due to the increasing demand for sequencing services, particularly in the healthcare and pharmaceutical industries. The services segment includes sequencing services, data analysis services, and other related services. The increasing adoption of these technologies, rising demand for personalized medicine, and the growing focus on drug discovery and development are expected to boost the market.

Application Insights

The oncology segment dominated the market with the largest revenue share of 28.0% in 2023. This is attributed to sequencing technology playing a critical role in the diagnosis and treatment of cancer. By sequencing a patient's DNA, researchers can identify specific genetic mutations linked to specific types of cancer. This information helps doctors plan individual patients' treatment, increasing the possibility of successful outcomes.

In addition, this technology is also used in cancer research to identify new drug targets and develop more effective therapies. As a result, the demand for this technology in the field of oncology is expected to continue to grow in the coming years. Furthermore, key players in the market are launching new products and services, and it is expected to support market growth. For instance, in March 2023, Illumina, Inc. launched new cloud-based software, Connected Insights, to enable analysis for oncology applications and rare diseases.

The consumer genomics segment is expected to grow at the highest CAGR rate in the market. This growth is driven by increasing popularity of direct-to-consumer genetic testing, allowing individuals to learn about their ancestry, understand potential health risks, and personalize their healthcare. The availability of affordable technologies and the rise of personalized medicine are contributing to the growth of this market segment. As a result, many companies are focusing on developing sequencing platforms that can be used for consumer genomics applications. For instance, in January 2023, Complete Genomics Incorporated, a subsidiary of MGI Tech Co., Ltd., launched a full sequencing platform at Biotech Showcase during the JP Morgan Healthcare Conference Week 2023.

Workflow Insights

In 2023, sequencing workflow held the largest market share of 56.4% due to the increasing demand for NGS technologies and rising number of genome mapping programs. The NGS technologies provide faster and cost-effective sequencing solutions, which have increased the adoption of sequencing workflows in various research applications. In addition, the increasing focus on precision medicine and the growing application of sequencing in oncology and genetic disease diagnosis is also expected to drive the growth of sequencing workflow segment in the coming years.

Data analysis segment is expected to grow at the highest CAGR from 2024 to 2030. This is primarily due to increasing demand for high-throughput sequencing technologies and need for efficient data management and analysis. As the volume of sequencing data grows, there is a greater need for advanced software and analytical tools to process and analyze this information accurately. The data analysis segment is expected to play a crucial role in enabling researchers to derive meaningful insights from sequencing data, leading to a surge in demand for these services.

End-use Insights

In 2023, academic research held the largest market share of 51.9% in the end-use segment. This growth is attributed to sequencing technology that has revolutionized how researchers study complex biological systems and diseases. By sequencing the DNA or RNA of organisms, researchers can better understand their genetic makeup and identify potential targets for drug development. In addition, this technology has become more accessible and affordable in recent years, making it a valuable tool for academic researchers studying a wide range of topics, from evolutionary biology to cancer genetics.

Furthermore, academic institutions frequently collaborate on large-scale genomic projects, pooling resources, and expertise to tackle complex research questions. This collaborative approach enhances the impact of sequencing technologies in academic research. For instance, in August 2023, PacBio and GeneDx, LLC partnered with the University of Washington to explore the potential of HiFi long-read whole genome sequencing (WGS) in improving diagnostic rates among pediatric patients with genetic disorders.

Clinical research segment is expected to grow at the highest CAGR in the market. Sequencing plays a crucial role in clinical research by providing insights into the genetic basis of diseases and aiding in the development of targeted therapies. As a result, demand for sequencing in clinical research is expected to increase, which will drive market growth in this segment. This growth can be attributed to the increasing prevalence of chronic diseases, technological advancements, and rising investments in genomics research.

Regional Insights

North America sequencing market accounted for 49.42% of the global market in 2023. This is attributed to the support of research institutes and pharmaceutical giants. Genomics is now an integral part of any disease research and drug discovery due to the implications of genetic expression on human health. There are emerging advancements in the region for the utility of genomics with collaborative efforts. For instance, in January 2022, Illumina, Inc. collaborated with Nashville Biosciences, LLC (part of Vanderbilt University Medical Center at Tennessee) for drug development by using genomics and establishing a preeminent clinical genomic resource.

U.S. Sequencing Market Trends

The U.S. sequencing market is expected to grow over the forecast period due to the rise of cancer cases in the country. According to the American Cancer Society, Inc., approximately 611,720 deaths from cancer are expected in the U.S. in 2024, and over 2 million new cancer cases are expected to be diagnosed. With the increasing need for precision medicine in oncology, sequencing technology can provide valuable insights into an individual's genetic makeup and help identify specific mutations that may be causing the cancer. By analyzing the genetic profile of a tumor, doctors can develop personalized treatments tailored to the patient's specific needs. This has led to increased demand for sequencing technology in clinical and diagnostic settings and is expected to continue to drive growth in the market.

Europe's sequencing market is expected to witness significant growth due to the increasing prevalence of chronic diseases, such as cancer, mental health disorders, and diabetes. Sequencing technology can help in the early detection and diagnosis of these diseases, leading to better treatment outcomes. In addition, the growing demand for personalized medicine is expected to drive the market growth, as sequencing technology plays a crucial role in developing targeted therapies.

UK Sequencing Market Trends

The UK sequencing market is expected to grow exponentially over the forecast period. The UK government's support for genomics research is expected to drive growth in the sequencing market. The UK government has been investing in genomics research through initiatives such as Genomics England and the UK Biobank. These projects aim to sequence the genomes of large populations to understand the genetic basis of diseases better and inform personalized medicine approaches. For instance, in December 2022, the UK government allocated USD 133.08 million in funding for a research initiative by Genomics England in collaboration with the NHS. This program aims to investigate the effectiveness of employing whole genome sequencing to speed up the diagnosis and treatment of rare genetic diseases in newborns.

France Sequencing Market Trends

France sequencing market is expected to show rapid growth during the forecast period. The rising prevalence of chronic diseases, advancements in sequencing technologies, and increasing government support for genomics research are driving the sequencing market in France. In addition, there are growing collaborations among academic and research institutions supporting market growth in the country. For instance, in February 2022, Illumina entered a partnership with the Jean Perrin Center in France to propel forward a precision medicine strategy for individuals with late-stage cancer. The collaborative initiative, CELIA (Comprehensive Genomic Profiling Impact), will evaluate the clinical significance of comprehensive genomic profiling in guiding cancer treatment choices for patients with advanced conditions, countering it with the utilization of the prevailing standard of care, which includes small panel tests.

Germany Sequencing Market Trends

Germany sequencing market is expected to exhibit exponential growth over the forecast period. The country has a strong research infrastructure and support for innovation, which has led to a high demand for sequencing services across various fields, such as biotech and healthcare. The increasing prevalence of genetic disorders and diseases has led to a greater focus on precision medicine and personalized treatments. In addition, the availability of advanced sequencing technologies and the presence of significant sequencing companies in Germany, such as GATC Biotech AG, Qiagen, Eurofins Genomics Germany, and BioVariance GmbH, have also contributed to the market’s growth.

The Asia Pacific sequencing market is expected to exhibit the fastest growth over the forecast period. The region has significantly increased in research and development activities across various scientific domains, including genomics. Government initiatives, academic institutions, and private organizations in countries such as China, Japan, South Korea, and India have been investing in genomics research, driving the adoption of sequencing technologies. In addition, the prevalence of genetic disorders and chronic diseases in the Asia Pacific region is driving the need for genomic studies and personalized medicine. These technologies play a crucial role in understanding the genetic basis of diseases and developing targeted therapies, contributing to market growth.

China Sequencing Market Trends

China sequencing market is expected to grow significantly over the forecast period. China has a large population, and there is a growing prevalence of genetic diseases in the country. Sequencing technologies are used to diagnose these diseases and identify potential treatments, which is expected to drive demand for sequencing services. In addition, collaboration with international companies and research institutions allows China to access advanced sequencing technologies, expertise, and resources. International partnerships contribute to the growth of the sequencing market by facilitating technology transfer, knowledge exchange, and collaborative research projects. For instance, in January 2024, Illumina, Inc. entered into an agreement with Janssen Research & Development, LLC (Janssen). This partnership marks the inaugural collaboration concerning the advancement of Illumina's innovative molecular residual disease assay, which utilizes whole-genome sequencing technology as a comprehensive solution for multi-cancer research. The assay aims to identify circulating tumor DNA (ctDNA) to enhance the comprehension of disease persistence or recurrence after medical intervention.

Japan Sequencing Market Trends

Japan sequencing market is the largest market in the Asia Pacific region. The growing aging population in Japan has been one of the key drivers of the sequencing market in the country. According to data from the Ministry of Internal Affairs and Communications, as of September 2023, people aged 65 or over stood at 36.2 million. As the number of seniors aged 65 or over continues to increase, there is a higher demand for precision medicine, personalized healthcare, and advanced diagnostics, which can be facilitated by genomic sequencing. Next-generation sequencing (NGS) technologies can help in the early detection and diagnosis of various diseases, including cancer, genetic disorders, and infectious diseases, which are more prevalent among the elderly population.

Moreover, with the government initiatives to promote genomics research and precision medicine, there is a significant opportunity for the sequencing market to grow in Japan. In June 2023, Japan government enacted the Genome Medicine Promotion Act. The act aims to streamline regulations for genome-based medical products, potentially speeding up market approval for sequencing-based diagnostics and therapies.

Saudi Arabia Sequencing Market Trends

Saudi Arabia sequencing market is expected to grow positively over the forecast period. Increasing public awareness of the benefits of genomics and personalized medicine contributes to the country’s demand for consumer genomics and related services. In addition, The Saudi government's ambitious Vision 2030plan prioritizes diversifying the economy beyond oil and gas, with healthcare being a key focus area. This includes investments in genomics research and development, which are expected to fuel sequencing market growth.

Kuwait Sequencing Market Trends

Kuwait sequencing market is expected to grow over the forecast period. Kuwait is emerging as one of the fastest-growing nations, propelled by increasing exports and a growing economy. With substantial developments in its healthcare infrastructure, the country is addressing the rising incidence of infectious diseases, chronic ailments, and lifestyle-related health issues. Kuwait has been increasing its healthcare spending to improve the quality of healthcare services. According to the International Trade Administration, over 80% of healthcare spending in Kuwait is allocated to the public healthcare sector. This led to investments in advanced technologies like sequencing for better disease diagnosis, treatment, and management.

Key Sequencing Market Company Insights

The market players operating in the sequencing market are adopting product approval to increase the reach of their products in the market and improve the availability of their products & services in diverse geographical areas, along with expansion to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Sequencing Companies:

The following are the leading companies in the sequencing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these sequencing companies are analyzed to map the supply network.

- Illumina, Inc.

- F. Hoffman-La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

- Eurofins GATC Biotech GmbH

- BGI.

Recent Development

-

In December 2023, Illumina Inc. partnered with HaploX to provide locally manufactured sequencing instruments in China.

-

In March 2023, Illumina Inc. launched the Illumina Complete Long Read technology. This technology marks a significant step forward in the field of NGS by providing the ability to generate long and short reads on the same instrument.

-

In July 2023, QIAGEN launched the QIAseq Normalizer Kits for research use. It is a convenient, fast, and cost-effective technique for different DNA libraries for best-quality results from NGS runs.

Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.80 billion

Revenue forecast in 2030

USD 62.48 billion

Growth rate

CAGR of 22.2% from 2024 to 2030

Base year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, application, workflow, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Illumina, Inc.; F. Hoffman-La Roche Ltd.; QIAGEN; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Oxford Nanopore Technologies; PierianDx; Genomatix GmbH; DNASTAR, Inc.; Perkin Elmer, Inc.; Eurofins GATC Biotech GmbH; BGI

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Sequencing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global sequencing market based on product & services, application, workflow, end-use, and region.

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Platform

-

1st Generation of sequencing device

-

2nd Generation of sequencing device

-

3rd Generation of sequencing device

-

-

Consumables

-

Kits

-

DNA Library Preparation

-

RNA Library Preparation

-

Target enrichment Library quantification

-

Purification & quality control

-

Others

-

-

Reagents

-

Sample Prep

-

Library preparation and amplification

-

Sequencing

-

-

Accessories

-

Collection tubes

-

Plates

-

Others

-

-

-

Services

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Diagnostics and Screening

-

Oncology Screening

-

Sporadic Cancer

-

Inherited Cancer

-

-

Companion Diagnostics

-

Other Diagnostics

-

Research Studies

-

-

Clinical Investigation

-

Infectious Diseases

-

Inherited Diseases

-

Idiopathic Diseases

-

Non-Communicable/Other Diseases

-

-

Reproductive Health

-

NIPT

-

Aneuploidy

-

Microdeletions

-

-

PGT

-

Newborn Genetic Screening

-

Single Gene Analysis

-

-

HLA Typing/Immune System Monitoring

-

Metagenomics, Epidemiology & Drug Development

-

Agrigenomics & Forensics

-

Consumer Genomics

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-Sequencing

-

Sequencing

-

Data Analysis

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Other Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sequencing market size was estimated at USD 15.54 billion in 2023 and is expected to reach USD 18.80 billion in 2024.

b. The global sequencing market is expected to grow at a compound annual growth rate of 22.2% from 2024 to 2030 to reach USD 62.48 billion by 2030.

b. North America dominated the sequencing market with a share of 49.42% in 2023. This is attributed to the support provided by research institutes and pharmaceutical giants, along with technological advancements in the genomics and NGS market space.

b. Some key players operating in the sequencing market include Illumina; QIAGEN; Thermo Fisher Scientific, Inc.; F. Hoffman-La Roche Ltd.; Oxford Nanopore Technologies; Genomatix GmbH; PierianDx; DNASTAR, Inc.; Eurofins GATC Biotech GmbH; Perkin Elmer, Inc.; BGI; Bio-Rad Laboratories, Inc.

b. Key factors that are driving the sequencing market growth include decreasing costs for genetic sequencing, development of companion diagnostics and personalized medicine, rise in competition amongst prominent market entities, a rising clinical opportunity for NGS technology, technological advancements in cloud computing and data integration, growing healthcare expenditure, and increasing prevalence of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.