- Home

- »

- Biotechnology

- »

-

Serum-free Media Market Size, Share, Industry Report, 2030GVR Report cover

![Serum-free Media Market Size, Share & Trends Report]()

Serum-free Media Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution, By Product, By Application (Biopharmaceutical Production, Tissue Engineering), By End-use, By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-070-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Serum-free Media Market Summary

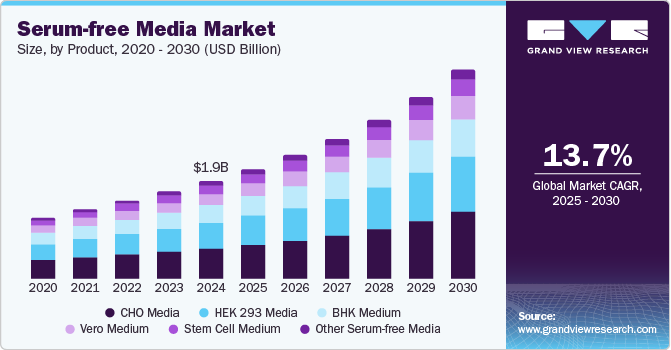

The global serum-free media market size was estimated at USD 1.90 billion in 2024 and is projected to grow at a CAGR of 13.7% from 2025 to 2030. Market growth is primarily driven by the burgeoning biopharmaceutical industry, characterized by an increasing demand for biologics encompassing monoclonal antibodies and recombinant proteins.

Key Market Trends & Insights

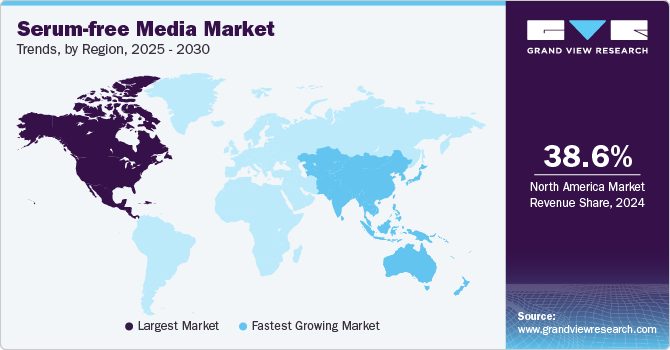

- North America serum-free media market dominated the global market with a revenue share of 38.6% in 2024.

- By application, biopharmaceutical production led the market with a revenue share of 73.7% in 2024.

- By end use, pharmaceutical & biotechnology companies held the largest revenue share of 57.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.90 Billion

- 2030 Projected Market Size: USD 4.05 Billion

- CAGR (2025-2030): 13.7%

- North America: Largest market in 2024

This spike in demand can be attributed to significant advancements in cell-based therapies and the ongoing development of novel therapeutics to address chronic and infectious diseases. As market players strive to meet therapeutic demands, the transition towards serum-free media aligns with their operational goals and enhances product quality and consistency, which is vital for meeting regulatory standards.

Regulatory support has emerged as a pivotal driver for the serum-free media market, particularly in Europe and the U.S. The European Medicines Agency (EMA) has advocated using defined, animal-origin-free components. This regulatory emphasis pushes manufacturers towards serum-free formulations to ensure compliance and product safety. Concurrently, updated guidelines from the U.S. Food and Drug Administration (FDA) mandate stringent controls over raw materials used in cell therapies, promoting an increased reliance on serum-free options. As adherence to these regulations becomes paramount, the adoption of serum-free media is rapidly accelerating.

Innovations in formulations, including chemically defined media and recombinant growth factors, have markedly improved cell culture performance and reproducibility. Such enhancements afford researchers and manufacturers greater control over physiological responses and facilitate superior detection of cellular mediators. As a result, serum-free media have become the preferred choice in research and industrial applications, thereby significantly boosting their market presence.

Heightened investments in R&D, particularly within the context of life-threatening diseases, are fostering a landscape ripe for innovation. Initiatives by companies and substantial governmental funding for biotechnology research are expected to drive demand for serum-free media. Strategic collaborations and the continued focus on cell-based therapeutics will undeniably create lucrative opportunities, positioning the serum-free media market for sustained growth in the coming years.

Product Insights

CHO media dominated the market and accounted for a share of 30.9% in 2024, driven by their essential role in biopharmaceutical production. Their chemically defined, animal component-free nature facilitates the development of biologics, including monoclonal antibodies and recombinant proteins. Increased emphasis on cell-based therapeutics and enhanced cell culture performance drive demand further.

HEK 293 media is expected to grow rapidly over the forecast period, fueled by its crucial role in producing viral vectors for gene therapy and vaccine development. Their high yield of recombinant proteins and enhanced cell productivity, alongside increasing demand from gene therapy research and COVID-19 vaccine candidates, underscore their importance in biopharmaceutical applications.

Application Insights

Biopharmaceutical production led the market with a revenue share of 73.7% in 2024, owing to the need for efficient, consistent cell culture systems in drug development. Serum-free media reduce contamination risks and variability, which is essential for regulatory compliance and product quality, while the shift towards cell-based therapies and personalized medicine drives their adoption.

Tissue engineering and regenerative medicine are expected to register the fastest CAGR of 5.6% over the forecast period. Serum-free media eliminate variability, ensuring reproducibility and consistency in cell behavior, which is crucial for tissue engineering. Advances in formulations have enabled the successful culture of various stem cells and primary cells, enhancing viability and functionality.

End-use Insights

Pharmaceutical & biotechnology companies held the largest revenue share of 57.9% in 2024. These companies need serum-free media to maintain a controlled, defined environment for cell culture, thereby enhancing product quality and consistency. Regulatory agencies advocate for defined media to reduce contamination risks from animal-derived components, while increased clinical trials and R&D investments in innovative therapies fuel this demand.

Research & academic institutes are projected to grow significantly over the forecast period. These institutions employ serum-free media to ensure reproducibility and experiment consistency, eliminating variability from serum-derived components. The growing focus on stem cell research, regenerative medicine, and biopharmaceutical development drives demand for defined environments, while increased funding allows for the adoption of advanced serum-free media in academic studies.

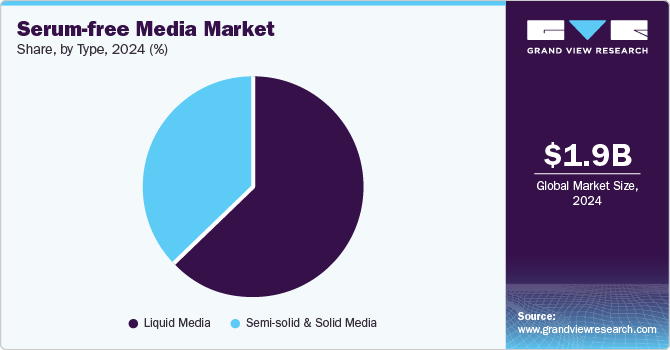

Type Insights

Liquid media dominated the market with a revenue share of 63.1% in 2024, attributed to their significant advantages in cell culture applications. They ensure a controlled environment for reproducibility, reduce contamination risks from animal-derived components, and facilitate easier purification, enhancing safety and product quality in large-scale biologics production and cell-based therapies.

The semi-solid and solid media segment is expected to grow rapidly over the forecast period. Semi-solid media enhance the cloning of hybridomas and CHO cells by enabling individual cells to form discrete colonies, thereby improving efficiency in monoclonal antibody production. Solid media offer a stable environment for isolating specific cell types, crucial for tissue engineering and regenerative medicine while minimizing contamination risks.

Regional Insights

North America serum-free media market dominated the global market with a revenue share of 38.6% in 2024. North America features a robust healthcare infrastructure, substantial biopharmaceutical investments, and a concentration of industry leaders. The region’s strong R&D capabilities and conducive regulatory environment foster innovation in serum-free technologies, driven by the growing prevalence of chronic diseases and increased funding for research initiatives in drug development and biomanufacturing.

U.S. Serum-free Media Market Trends

The U.S. serum-free media market dominated in North America in terms of revenue share in 2024. The country has a significant presence of leading biopharmaceutical companies and contract research organizations (CROs) that increasingly utilize serum-free media for improved efficiency and consistency in cell culture. Moreover, government support through research grants promotes innovation in therapeutic development and enhances the focus on personalized medicine and high-quality biologics.

Europe Serum-free Media Market Trends

Europe serum-free media market held a substantial market share in 2024. The region’s dedication to minimizing dependence on animal-derived components aligns with ethical standards and enhances product safety. Moreover, significant R&D investments across European nations are advancing cell culture technologies, increasing the demand for serum-free media, driven by the rise of chronic diseases and the growth of clinical trials.

The Germany serum-free media market is expected to grow rapidly over the forecast period. The country hosts several prominent biopharmaceutical companies emphasizing innovative cell culture methods, such as serum-free media, to improve product quality and consistency. Germany’s robust regulatory framework promotes the adoption of defined culture systems, coinciding with global ethical research trends and driving demand for serum-free media through heightened R&D investments.

Asia Pacific Serum-free Media Market Trends

Asia Pacific serum-free media market is expected to register the fastest CAGR of 16.9% over the forecast period. Countries in the region prioritize developing innovative therapies and vaccines to tackle escalating healthcare challenges, including chronic diseases. The increase in clinical trials and research initiatives in the region heightens the demand for dependable serum-free media solutions, supporting the global shift toward animal component-free culture systems.

The China serum-free media market is expected to grow at the fastest CAGR over the forecast period. The Chinese government has classified biotechnology as a strategic sector, resulting in heightened funding and support for innovative therapies. Moreover, the expanding pharmaceutical industry drives the demand for high-quality serum-free media solutions. China’s focus on advanced treatments for chronic diseases positions it as a key contributor to the region.

Key Serum-free Media Company Insights

Some key companies operating in the market include Thermo Fisher Scientific Inc., Sartorius AG, and Merck KGaA. Key players are emphasizing innovation and strategic partnerships, investing in R&D for advanced serum-free formulations, and expanding their portfolios to address the growing demand for biopharmaceuticals and regenerative medicine.

-

Sartorius AG specializes in bioprocess solutions, developing serum-free media for cell culture applications. The company enhances biopharmaceutical manufacturing efficiencies and cost-effectiveness through innovative technologies, particularly in cell and gene therapy development.

-

Lonza offers the TheraPEAK T-VIVO Cell Culture Medium for CAR T-cell manufacturing, prioritizing chemically defined, animal component-free media to enhance consistency and regulatory compliance.

Key Serum-free Media Companies:

The following are the leading companies in the serum-free media market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Merck KGaA

- Lonza

- Danaher Corporation

- FUJIFILM Holdings Corporation

- MP BIOMEDICALS

- Corning Incorporated

- PAN-Biotech

- R&D Systems, Inc

Recent Developments

-

In November 2024, Sartorius Stedim Biotech opened a Center for Bioprocess Innovation in Marlborough, Massachusetts. The center facilitates collaborative research and process development for enhanced efficiency in biopharmaceutical manufacturing.

-

In April 2024, Thermo Fisher Scientific launched the Gibco CTS OpTmizer One Serum-Free Medium for enhanced scalability in cell therapy manufacturing.

Serum-free Media Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.13 billion

Revenue forecast in 2030

USD 4.05 billion

Growth rate

CAGR of 13.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Sartorius AG; Merck KGaA; Lonza; Danaher Corporation; FUJIFILM Holdings Corporation; MP BIOMEDICALS; Corning Incorporated; PAN-Biotech; R&D Systems, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Serum-free Media Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global serum-free media market report based on product, application, end-use, type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

CHO Media

-

HEK 293 Media

-

BHK Medium

-

Vero Medium

-

Stem Cell Medium

-

Other Serum-free Media

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Production

-

Monoclonal Antibodies

-

Vaccines Production

-

Other Therapeutic Proteins

-

-

Tissue Engineering & Regenerative Medicine

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Research & Academic Institutes

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Media

-

Semi-solid & Solid Media

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.