Servo Motor Market Summary

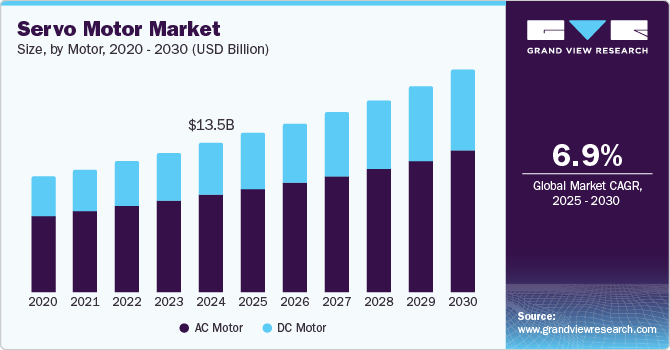

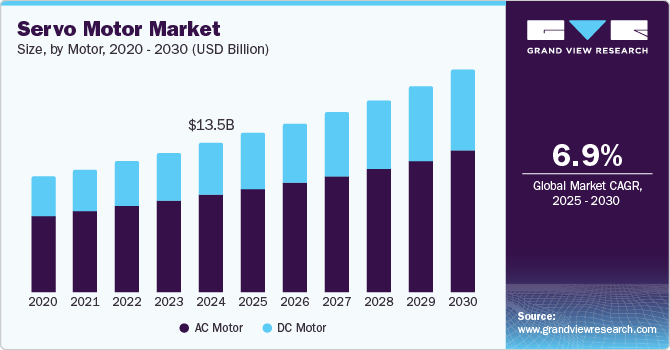

The global servo motor market size was estimated at USD 13.52 billion in 2024 and is projected to reach USD 20.13 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The growth of this market is primarily driven by factors such as the rapid implementation of process automation, the growing focus of multiple industries on adopting energy-efficient processes, and increasing demand for high-performance motors in numerous manufacturing facilities.

Key Market Trends & Insights

- The Asia Pacific servo motors market dominated the global industry with a revenue share of 47.8% in 2024.

- The China servo motors market held the largest revenue share of the regional industry in 2024.

- Based on motor, the AC motor segment dominated the global market with a revenue share of 65.9% from 2025 to 2030.

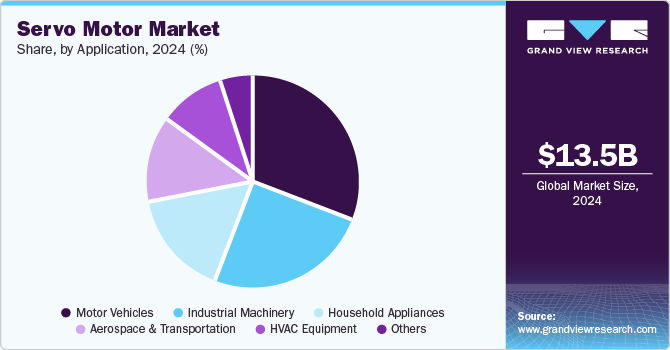

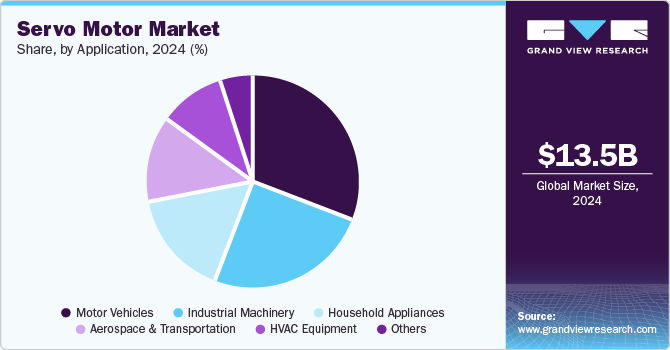

- In terms of application, the motor vehicles segment dominated the global market for servo motors in 2024.

- On the basis of application, the industrial machinery segment is anticipated to experience the fastest CAGR of 8.1% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 13.52 billion

- 2030 Projected Market Size: USD 20.13 billion

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2024

Increasing applications in manufacturing, automotive, consumer electronics, aerospace, and others generate potential growth opportunities for this market. Its abilities, such as precision control, fast response times, and higher torque-to-inertia ratio, have attracted a large customer base from these industries. Unlike stepper motors, servo motors provide higher accuracy in their outcome. The speed of servo motors ranges from 0 to 6000 rpm. Servo motors are extensively used in advanced manufacturing assistance systems such as robotics, CNC machines, and automation.

The servo motors are extensively utilized in robotics applications to ensure coordinated and smooth application of multiple axes. The ability of servo motors to rapidly adjust speed and torque according to feedback is one of its key features, which makes it a significant element in robotic systems. Servo motors are vital in missile guidance systems and flight control surfaces. Its use in other areas, such as the manufacturing of high-end cameras, the renewable energy industry, textile machinery, and others, is anticipated to drive its growth.

Motor Insights

Based on the motor, the AC motor segment dominated the global market with a revenue share of 65.9% from 2025 to 2030. Some of the key features of AC-Motor servo motors include a closed-loop control system, delivery of noteworthy torque even at low speed enabled by a high torque-to-inertia ratio, efficient conversion of electrical energy into mechanical power, and more. Its growing application in areas such as automated manufacturing, CNC machines for milling, cutting, and drilling activities, robotics, the defense sector, the aerospace industry, and others drives growth for this segment.

DC motor segment is projected to experience the fastest CAGR during the forecast period. Precision control is one of its key features. In addition, characteristics such as simpler control through electronics and the ability to generate faster response, ease of use, and rapid readjustments make it suitable for dynamic applications. It’s also considered cost-effective when compared to AC motors. Its common applications include automation, robotics, medical equipment, imaging devices, and more. Its growing utilization in industrial robotics is expected to increase demand in upcoming years.

Application Insights

The motor vehicles segment dominated the global market for servo motors in 2024. The servo motors are extensively utilized in motor vehicles equipped with modern technologies owing to their characteristics such as the ability to generate a faster response, precision, efficiency, and others. It is used in areas such as Electric Power Steering (EPS), robotics in automotive assembly, control systems, adaptive cruise control, and more.

The industrial machinery segment is anticipated to experience the fastest CAGR of 8.1% from 2025 to 2030. As industries gradually advance towards Industry 4.0, multiple businesses and manufacturing units have started adopting automation and modern technologies. Using modern technologies, companies worldwide are upgrading their existing machinery to enhance team performance and reduce operating costs. These aspects are expected to develop growth for this market in the approaching years.

Regional Insights

North America servo motors market is projected to experience substantial growth with CAGR of 6.8% from 2025 to 2030. North America has manufacturing facilities in various industries, including consumer electronics, automotive, food processing, technology, accessories, textiles, and more. These industries have adopted advanced technological solutions such as robotics and process automation for performance enhancements and cost reductions. This has significantly increased the demand for servo motors in the region.

U.S. Servo Motor Market Trends

The U.S. servo motors market dominated the regional industry in 2024 owing to growth in demand empowered by intelligent process automation in the country, the presence of numerous manufacturing facilities, robust production infrastructure, and early adoption trends in terms of technology advancements. In addition, the presence of key companies in the servo motors market has added to the growth opportunities for this market.

Asia Pacific Servo Motor Market Trends

Asia Pacific servo motors market dominated the global industry with a revenue share of 47.8% in 2024 owing to the presence of multiple key players in the region, growing demand for industrial machinery upgrades, the rapid pace of industrial automation, rising acceptance of robotics technology across industries, ease of availability and increasing advancements in manufacturing technology.

The China servo motors market held the largest revenue share of the regional industry in 2024. Robust manufacturing, unprecedented growth in industrial automation, rising demand from industries such as robotics, aerospace, and defense, and multiple companies' focus on equipment upgrades are some of the key growth driving factors for this market.

Europe Servo Motor Market Trends

Europe was identified as one of the key regions for the global servo motors market in 2024. The growing focus of government and organizations on significantly reducing carbon footprint and adopting a zero-emission strategy has fueled the use of automation and robotics in multiple businesses, including manufacturing. This has significantly influenced the demand for servo motors in the region.

Germany servo motors market held significant revenue share of the regional market in 2024. This market is primarily influenced by multiple large-scale enterprises operating in the manufacturing industry, the growing use of servo motors in industrial automation, rising demand from businesses that make consumer electronics, and others.

Key Servo Motor Company Insights

Some of the key companies operating in the servo motors market include ABB, General Electric Company, AMETEK, NIDEC CORPORATION, Siemens AG, among others.

Key Servo Motor Companies:

The following are the leading companies in the servo motor market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Allied Motion, Inc.

- AMETEK

- General Electric Company

- NIDEC CORPORATION

- Rockwell Automation Inc.

- Schneider Electric

- Siemens AG

- WEG

Recent Developments

-

In June 2024, Panasonic Life Solutions India Pvt. Ltd. introduced MINAS A7 with MINAS A6SC series motors. MINAS A6SC series, a new addition to the company’s diverse portfolio, is an AI-equipped servo system designed to deliver high motion performance and precision control. The MINAS A6SC series motors (servo) are specially developed for Original Equipment Manufacturers (OEMs) in the Indian market.

Servo Motor Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 14.44 billion

|

|

Revenue forecast in 2030

|

USD 20.13 billion

|

|

Growth Rate

|

CAGR of 6.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Motor, application, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Brazil, UAE, KSA, South Africa

|

|

Key companies profiled

|

ABB; Allied Motion, Inc.; AMETEK; General Electric Company; NIDEC CORPORATION; Rockwell Automation Inc.; Schneider Electric; Siemens AG; WEG

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

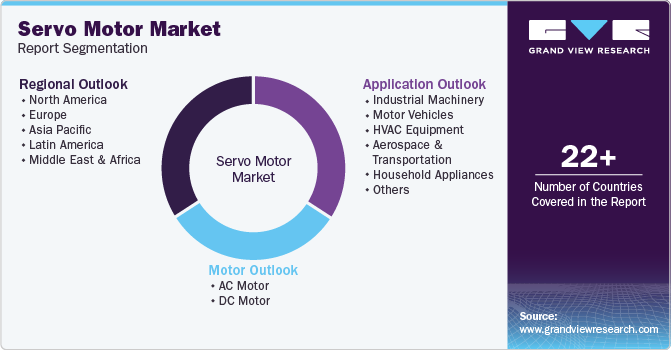

Global Servo Motor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global servo motors market report based on motor, application, and region.

-

Motor Outlook (Revenue, USD Billion, 2018 - 2030)

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

MEA