- Home

- »

- Plastics, Polymers & Resins

- »

-

Shipping Container Market Size & Share Report, 2020-2028GVR Report cover

![Shipping Container Market Size, Share & Trends Report]()

Shipping Container Market Size, Share & Trends Analysis Report By Product (ISO, Non-standard), By Type (Dry, Reefer, Tank), By Size (20', 40', High Cube), By Flooring, By Application, By Region, And Segment Forecasts, 2020 - 2028

- Report ID: GVR-4-68039-603-5

- Number of Report Pages: 166

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Bulk Chemicals

Report Overview

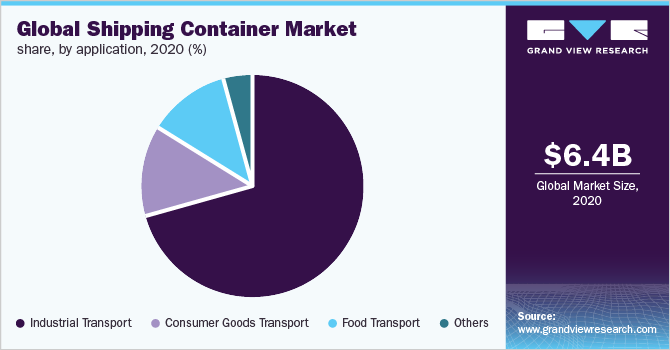

The global shipping container market size was valued at USD 6.41 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 12.0% from 2020 to 2028. The market is witnessing a high growth owing to rising maritime shipping on account of an increase in trade agreements across the nations. Most of the shipping containers are manufactured as per the specifications outlined by International Organization for Standardization (ISO), mainly to enable smooth and hassle-free loading/unloading and also to guarantee that the container will withstand extreme environments and structural integrity during transportation.

The U.S. has one of the largest pharmaceutical markets worldwide and is one of the top 3 importers and exporters of medical products. Large investments in drug development, production of different healthcare products, and their exports are projected to offer opportunities for shipping container vendors in the U.S.

Maritime trade refers to the transportation of goods via sea or other waterways. As per the International Chamber of Shipping, around 11 billion tons of goods are transported via shipping containers each year. Increasing trading activities across the globe are expected to support the industry's growth.

The outbreak of COVID 19 from the beginning of 2020 negatively impacted the growth of the market. The pandemic resulted in lockdown across the countries mainly to contain the disease spread, which led to a contraction in demand for non-essential consumer goods particularly in the second and third quarter of 2020.

Moreover, in the first quarter of 2020, China was the epicenter of COVID 19. Thus, to limit the disease spread several countries halted their trade with China. The U.S.-China trade fell by 20.3% in Q1, 2020 and a similar trade drop was observed among China and European countries.

China being a major exporter of consumer goods across the world, the decline in its export in 2020 owing to COVID 19 significantly impacted the demand for shipping containers. However, rapid vaccination from the beginning of 2021 is expected to result in a rebound in demand for consumer goods, thereby benefitting the market over a shorter period.

Product Insights

ISO container led the market and accounted for more than 98.0% share in the product segment in 2020. ISO is the standard container used for universal cargo transportation. The extensive utilization of ISO containers for international trade is mainly attributed to its higher share in the product segment in 2020.

Typically, ISO containers have a height and width of 2.591 m and 2.438 m, respectively. They come with lengths of 6.058 m (known as 20-ft containers) and 12.192 m (known as 40-ft containers). The rising adoption of automation at container terminals is projected to drive the standardization of containers over the coming years.

Non-standardized ones are not manufactured as per standards set by the International Organization for Standardization (ISO). These are available with sizes of 48 ft and 53 ft., which are larger in sizes compared to ISO-standard. Besides, non-standardized ones are also offered smaller sizes such as 10 ft and 8 ft.

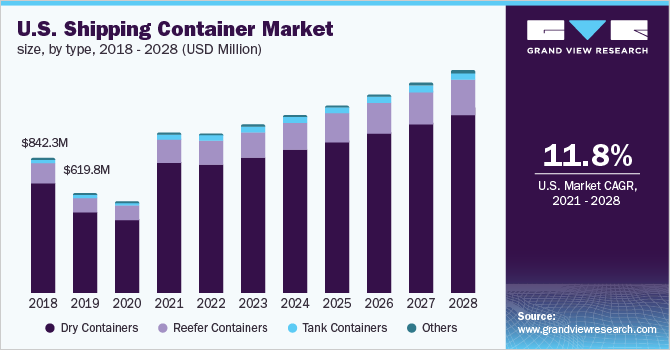

Type Insights

Dry containers dominated the market and accounted for over 80.2% share of global revenue in 2020. Low cost, wide availability, and extensive application of dry containers for shipping of dry materials mainly contributed to its high share in the type segment in 2020.

Dry containers are airtight and effectively prevent damage to inside goods from harsh conditions. Most of the dry containers are made using steel; however, in some cases, aluminum is also used. They are used for most of the movement of dry goods packed in boxes, barrels, sacks, drums, cartons, cases, and pallets at the international and domestic levels.

Reefer is among the popular shipping container, used to transport temperature-critical goods such as vegetables, seafood, fish, meat, fruits, pharmaceutics, flowers, and alcoholic beverages. Reefers are expensive as compared to dry containers owing to added refrigeration mechanism in them.

Apart from dry and refer containers multiple other types of containers including flat rack, tunnel, special-purpose, open-top, and insulated containers are used for shipping goods. The tank container is another popular shipping container type, which is mainly used for the transportation of gas, liquid, or powder products.

Size Insights

Based on size, 40’ containers dominated the industry and accounted for over 48.2% share of global revenue in 2020. Factors such as large space and durability offered by the 40’ container as compared to 20’ mainly attributed to its higher adoption across the application industries.

The dimensions of 20’ containers comply with the international standard, ISO 668:1995. 20’ container typically provides 160 ft sq square of storage space. These are more convenient in terms of handling and less expensive than the 40’ containers. However, lower goods storage capacity as compared to 40’ is expected to hinder the growth of the 20’ segment over the forecast period

High cube is another popular container size, which is similar to 40’ containers in terms of length and breadth; however, their height is 1 foot more than standard 40’ containers. This height results in an additional 344 cubic feet storage capacity in high cube containers owing to which the high cube segment is likely to witness strong growth in the coming years

Flooring Insights

Wood flooring dominated the global shipping container market and accounted for nearly 59.9% of the market share, in terms of volume. The higher inclination towards wood flooring is majorly observed owing to its low cost, adequate strength, aesthetic appeal, and durability.

Bamboo flooring is expected to witness the fastest growth in the global market from 2020 to 2028. Cost-effectiveness, easy availability, and sustainability are key factors augmenting the growth of bamboo flooring. Besides, other factors such as robust scratch resistance and substantial strength offered by bamboo flooring also attracting shipping container manufacturers towards the segment.

Metal-floored shipping containers mainly use steel and aluminum for flooring. Steel flooring is generally used in shipping containers, which are specifically designed for industrial applications. The high cost of metal flooring as compared to wood and bamboo flooring is anticipated to hamper the growth of the metal flooring segment in the market over the forecast period.

Vinyl flooring is typically employed for shipping containers intended to carry liquid cargo containing chemicals, oil, acids, and others. Vinyl flooring is low maintenance, durable, and easy to clean. However, this flooring can be damaged by extreme temperatures and is highly susceptible to gouges and dents.

Application Insights

Industrial transport led the application segment with a share of 56.6% by revenue in the global market in 2020. Extensive use of shipping containers for transportation of industrial raw materials and manufactured goods such as metals, minerals, oil & gases, chemicals, machinery, automobiles, aircraft parts, etc. are attributed to the high share of the industrial transport segment in 2020.

The consumer goods segment is expected to witness significant growth in the market over the forecast period. It primarily includes transportation of electronic devices, furniture, toys, and others through shipping containers. Steady growth in imports of consumer goods in developed regions such as North America and Europe is expected to favor the growth of the segment in the coming years.

Moreover, growing demand for consumer goods especially in developing countries such as India, Indonesia, Brazil, and China on account of the steady rise in disposable income is anticipated to fuel the demand for consumer goods. Additionally, the rising popularity of e-commerce as sales channels in the aforementioned countries is further expected to increase the demand for consumer goods, thereby, benefitting the market.

The food transport application segment mainly comprises the use of shipping containers for the transportation of food items and beverages such as vinegar; alcohols and spirits; food ingredients; pulses; vegetable oils; canned, dried, and frozen fruits; condiments; sauces; jams and jellies; prepared/preserved seafood; and snacks.

Perishable food items and beverages deteriorate quickly if exposed to humidity or extreme temperatures. Therefore, the use of reefer containers plays a key role during the transportation of such food items and beverages. Steady growth in global agricultural and processed food trade is expected to favor the growth of the food transport segment in the market in the coming years.

Regional Insights

The Asia Pacific region dominated the regional market and accounted for over 68.1% share of global revenue in 2020. Strong maritime trade from Asia Pacific countries such as China, Japan, India, South Korea, and others mainly contributed to its leading position in the global market.

China, South Korea, and Japan are the leading producers of ships. These countries together accounted for a share of 95% of the newly built ship deliveries in 2019. Moreover, large volumes of export, intraregional trade activities and expanding manufacturing activities particularly in these countries are expected to further support the market growth.

Developments in ASEAN countries are also projected to remain one of the key contributing factors for the growth of the Asia Pacific shipping container industry. In the last 2 decades, total merchandise trade in ASEAN has increased by 4 times, crossing USD 2.8 trillion in 2019. However, the outbreak of COVID 19 resulted in a slump in trade activities within the region, which led to a decline in demand for shipping containers in 2020.

Europe emerged as the second-largest market for shipping containers and is anticipated to witness considerable growth from 2020 to 2028. Rising maritime trade activities are projected to remain a key growth factor for the European market. The U.S., China, Switzerland, and Russia are the top exporting destinations of the European Union and cumulatively accounted for a share of 45.2% in the overall exports of 2020.

Key Companies & Market Share Insights

The industry is highly fragmented with the presence of large- and medium-sized international companies as well as small-sized domestic players. Increasing investment in building manufacturing plants for shipping containers is fueling the market growth. The leading Chinese companies, namely CIMC, DFIC, and CXIC, have ramped up their container production activities in late 2020

Growing investment in shipping container manufacturing is expected to increase the competitiveness in the market. For instance, in March 2021, Dubai-based Transworld Group signed an agreement worth USD 26.83 million with Indian state-owned Sagarmala Development Company Ltd. to construct a cargo container manufacturing facility in Gujarat. Some of the prominent players operating in the global shipping container market are:

-

Bertschi AG

-

BNH Gas Tanks

-

Bulkhaul Limited

-

Danteco Industries BV

-

NewPort Tank

-

A.P. Moller - Maersk

-

China International Marine Containers (Group) Ltd

-

COSCO SHIPPING Development Co., Ltd.

-

CXIC Group

-

Singamas Container Holdings Limited

-

TLS Offshore Containers/TLS Special Containers

-

W&K Containers, Inc.

-

Thurston Group Limited

-

OEG

-

Sea Box, Inc.

-

IWES LTD.

-

Norcomp Nordic AB

Shipping Container Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 11.33 billion

Revenue forecast in 2028

USD 15.83 billion

Growth rate

CAGR of 12.0% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2020 to 2028

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, size, flooring, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Australia; Brazil; UAE

Key companies profiled

Bertschi AG; BNH Gas Tanks; Bulkhaul Limited; Danteco Industries BV; NewPort Tank; A.P. Moller – Maersk; China International Marine Containers (Group) Ltd.; COSCO SHIPPING Development Co., Ltd.; CXIC Group; Singamas Container Holdings Limited; TLS Offshore Containers/TLS Special Containers; W&K Containers, Inc.; Thurston Group Limited; CARU Containers; OEG; Sea Box, Inc.; IWES LTD; Norcomp Nordic AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global shipping container market report based on product, type, size, flooring, application, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2017 - 2028)

-

ISO Containers

-

Non-standardized Containers

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2017 - 2028)

-

Dry Containers

-

Reefer Containers

-

Tank Containers

-

Others

-

-

Size Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2017 - 2028)

-

20’ Containers

-

40’ Containers

-

High Cube Containers

-

Others

-

-

Flooring Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2017 - 2028)

-

Wood

-

Bamboo

-

Metal

-

Vinyl

-

Others

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2017 - 2028)

-

Consumer Goods Transport

-

Industrial Transport

-

Food Transport

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

MEA

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global shipping container market size was estimated at USD 6.41 billion in 2020 and is expected to reach USD 11.33 billion in 2021.

b. The shipping container market is expected to grow at a compound annual growth rate of 12.0% from 2020 to 2028 to reach USD 15.83 billion by 2028.

b. ISO container was the dominant product segment in terms of revenue, occupying over 98.0% in 2020, and is expected to experience significant growth over the forecast period. The high preference for standard-sized shipping containers as they are used across the globe mainly contributed to the high adoption of ISO containers.

b. Some of the key players in the shipping container market are Bertschi AG, BNH Gas Tanks, Bulkhaul Limited, Danteco Industries BV, NewPort Tank, A.P. Moller – Maersk, China International Marine Containers (Group) Ltd., COSCO SHIPPING Development Co., Ltd., CXIC Group, and Singamas Container Holdings Limited.

b. The key factors that are driving the shipping container include the growing penetration of e-commerce coupled with favorable trade agreements among nations across the globe. Moreover, growing digitization in the shipping container space is also augmenting growth in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."