- Home

- »

- Sensors & Controls

- »

-

Shock Sensor Market Size, Share & Growth Report, 2030GVR Report cover

![Shock Sensor Market Size, Share & Trends Report]()

Shock Sensor Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Piezoelectric, Piezoresistive), By End-use (Automotive, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-376-8

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shock Sensor Market Summary

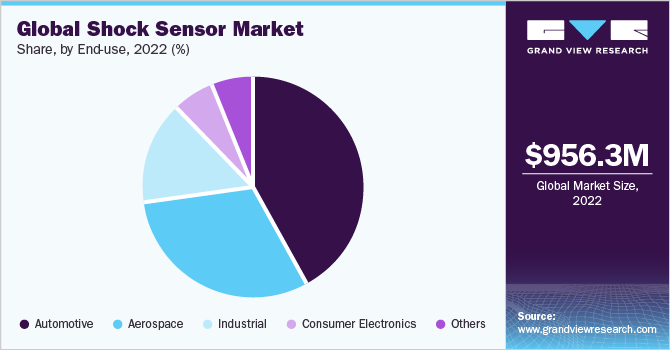

The global shock sensor market size was valued at USD 956.3 million in 2022 and is projected to reach USD 4,216.6 million by 2030, growing at a CAGR of 21.0% from 2023 to 2030. A shock sensor, alternatively called a vibration or impact sensor, is a specialized device designed to gauge and identify sudden vibrational impacts or collisions.

Key Market Trends & Insights

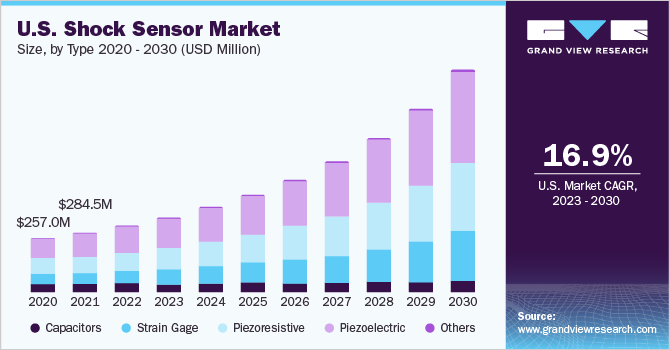

- North America dominated the shock sensors market in 2022 and accounted for a more than 34.0% revenue share.

- Asia Pacific is anticipated to register significant growth over the forecast period.

- By type, the piezoelectric segment dominated the market in 2022 and accounted for a revenue share of more than 36.0%.

- By end-use, the automotive segment dominated the market in 2022 and accounted for a revenue share of more than 42.0%.

Market Size & Forecast

- 2022 Market Size: USD 956.3 Million

- 2030 Projected Market Size: USD 4,216.6 Million

- CAGR (2023-2030): 21.0%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

These sensors find applications across a spectrum of end-use, including automotive, aerospace, industrial, and consumer electronics industries, among other areas. The escalating requirement for these sensors across diverse industries, aimed at avoiding harm, amplifying safety measures, and delivering instantaneous insights, is driving the market’s growth. IoT (Internet of Things) technology has significantly enhanced the functionality of shock sensors. Integrating IoT with shock sensors allows real-time data on impacts, vibrations, and movements to be efficiently collected and transmitted. This data is then analyzed to provide insights into the condition and handling of goods during transportation. Additionally, IoT-enabled shock sensors often come with features like GPS tracking, enabling precise location monitoring and allowing for immediate responses to incidents. This convergence of IoT and shock sensor has revolutionized shipping, logistics, and manufacturing industries by enabling proactive monitoring, data-driven decision-making, and improved overall operational efficiency.Various industries are leveraging the benefits provided by shock sensor. For instance, the shipping industry has adopted shock sensors for cargo monitoring and protection. These shock sensors are strategically placed within containers and packaging to detect impacts, vibrations, and movements that could harm fragile goods. Further, key market players are integrating the Internet of Things (IoT) with shock sensor. For instance, Trusted A/S, an IoT data monitoring solution provider, offers a data tracking IoT solution for the shipping industry, which provides high-precision data on handling with data graphs, shock detection, and GPS positions on location for incidents. Such solutions are helping logistics managers manage the high risk of damage during transport and shipment, thus driving the demand for shock sensors.

With the growing technological advancements, shock sensors are anticipated to decrease in size to fit multiple application areas. In addition to the miniaturization of shock sensor, their integration into various devices enhanced IoT integration for real-time monitoring and analytics, and the use of AI for predictive maintenance is anticipated to shape the market's future growth. Moreover, shock sensors are expected to play a crucial role in autonomous vehicles, healthcare, retail, and consumer electronics, among other applications. As industries become more regulated, shock sensors' adherence to evolving standards will be essential, and innovative uses like smart packaging integration will further define the market's future landscape.

Shock sensor play a crucial role in many applications. However, achieving optimal sensitivity and accuracy is challenging for market players. Designing sensors that can accurately differentiate between harmless vibrations and potentially damaging impacts can be complex. Lack of inaccuracy can lead to false alarms or can overlook genuine threats. To avoid these threats, market players need to strike the right balance between the sensitivity and reliability of the sensor. To achieve this, incorporating advanced sensor technology adds to the production cost, which can present as a barrier to adoption, particularly in price-sensitive industries, thus adversely affecting their widespread adoption. Thus, high production costs and achieving the utmost accuracy are a challenge in the market.

COVID-19 Impact Analysis

The COVID-19 pandemic had adverse impacts on the market. Supply chain disruptions and manufacturing slowdowns led to reduced production and delayed product launches. Additionally, with industries such as automotive and consumer electronics being affected, demand for shock sensor experienced a temporary decline. However, the pandemic also highlighted the importance of remote monitoring and predictive maintenance, potentially driving future demand for shock sensors in sectors such as healthcare. The market is expected to recover as industries recover and gain growth momentum gradually.

Type Insights

The piezoelectric segment dominated the market in 2022 and accounted for a revenue share of more than 36.0%. Piezoelectric shock sensors detect structural movement in terms of acceleration and generate a charge when physically accelerated. In short, piezoelectric shock sensor generate electric charge in response to mechanical stress, making them highly sensitive to vibrations and shocks. The growing demand for precise impact detection is driving the segment’s growth. With advancements in sensor technology, piezoelectric shock sensors have become smaller and more cost-effective, thus being suitable for integrating various devices and structures. These factors are anticipated to drive the segment’s growth over the forecast period.

The piezoresistive segment is anticipated to grow significantly over the forecast period. Piezoresistive shock sensors detect changes in internal resistive elements when subjected to mechanical stress. This change provides quantifiable output, thus making it useful for shock detection in critical applications. For instance, in October 2021, Endevco announced the launch of the 7274A Triaxial Piezoresistive Accelerometer for high g shock applications such as train crash testing, rocket shed testing, and weapons testing. Such product launches are driving the market’s growth over the forecast period.

End-use Insights

The automotive segment dominated the market in 2022 and accounted for a revenue share of more than 42.0%. Shock sensor play a vital role in enhancing safety and functionality in the automotive industry. They are essential components in airbag systems, detecting rapid acceleration and triggering timely airbag deployment for enhanced safety. Furthermore, shock sensors are used in vehicle testing and research to assess impact performance, contributing to automobiles' overall safety and reliability and their components. These applications are contributing to the segment’s growth and are anticipated to fuel the demand for shock sensor from the automotive sector over the forecast period.

The industrial segment is anticipated to register significant growth over the forecast period. Shock sensors have crucial applications for equipment safety and maintenance. They detect sudden impacts or vibrations that might harm machines or structures. By spotting these disturbances, they help prevent damage and costly breakdowns. These sensors also play a role in ensuring safe shipping of fragile goods. In manufacturing, they monitor the efficiency of machines and the quality of products by detecting irregular vibrations. Benefits offered by shock sensor, such as avoiding accidents, maintaining machinery, ensuring product quality, and making operations smoother and more reliable, are driving the segment's growth.

Regional Insights

North America dominated the shock sensors market in 2022 and accounted for a more than 34.0% revenue share. The regional market’s growth is accounted to the growing demand for security solutions in various sectors. Industries in the North American region emphasize asset protection and surveillance, where shock sensor have crucial applications. Technological advancements and integration with IoT devices further propel the growth. In addition, the region's stringent safety regulations and the need to prevent theft and damage contribute to the regional market’s growth.

Asia Pacific is anticipated to register significant growth over the forecast period. This region is witnessing increased adoption of shock sensor across industries like automotive, electronics, and security. Rising concerns about asset protection and safety drive the demand. As companies seek to prevent damage during transportation and enhance security measures, the market for shock sensors is expanding. Technological advancements and the growing manufacturing sector also contribute to the market's growth. With a focus on preventing losses and ensuring product integrity, businesses increasingly recognize the value of shock sensors, further fueling their demand in Asia Pacific.

Key Companies & Market Share Insights

The market can be considered a moderately fragmented market with the presence of several small players. Key players in the market are launching innovative solutions to cater to various end-use industries. In addition, these players are integrating various features such as IoT, device tracking/GPS tracking, and real-time monitoring capabilities with shock sensors. The innovation in the market is anticipated to harness the market’s growth over the forecast period.

Key vendors in the market are leveraging new technology to improve their shock sensor offerings. For instance, in February 2023, Texecom, a security company, launched a Grade 3 shock sensor known as the Impaq S G3. The shock sensor has a viber accelerometer technology and meets the design demanded for high-end commercial and residential properties. The product is designed to provide a high level of accuracy for vibration detection. Such initiatives are propelling the market’s growth. Some of the prominent players in the global shock sensor market include:

-

TE Connectivity

-

PCB Piezotronics, Inc.

-

Honeywell International Inc.

-

DYTRAN INSTRUMENTS INCORPORATED

-

Murata Manufacturing Co., Ltd.

-

Mobitron AB

-

Meggitt PLC

-

SpotSee

-

SignalQuest, LLC

-

Climax Technology, Co. Ltd

Shock Sensor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,107.4 million

Revenue forecast in 2030

USD 4,216.6 million

Growth rate

CAGR of 21.0% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, UK, Germany, France, China, India, Japan, South Korea, Australia, Brazil, Mexico, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

TE Connectivity; PCB Piezotronics, Inc.; Honeywell International Inc.; DYTRAN INSTRUMENTS INCORPORATED; Murata Manufacturing Co., Ltd.; Mobitron AB; Meggitt PLC; SpotSee; SignalQuest, LLC; Climax Technology, Co. Ltd

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

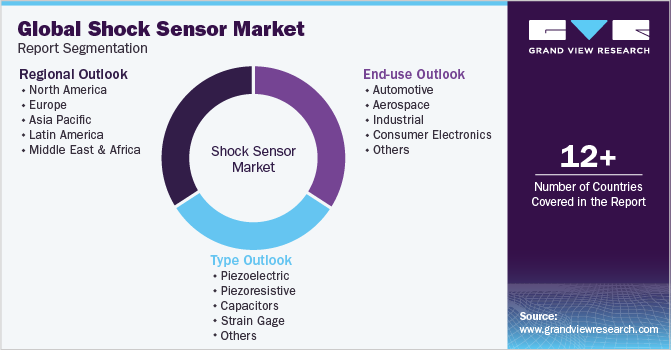

Global Shock Sensor Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global shock sensor market report based on type, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Piezoelectric

-

Piezoresistive

-

Capacitors

-

Strain Gage

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace

-

Industrial

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shock sensor market size was estimated at USD 956.3 million in 2022 and is expected to reach USD 1,107.4 million in 2023.

b. The global shock sensor market is expected to grow at a compound annual growth rate of 21.0% from 2023 to 2030 to reach USD 4,216.6 million by 2030.

b. North America dominated the market in 2022. The regional market’s growth is accounted to the growing demand for security solutions in various sectors. Industries in the North American region emphasize asset protection and surveillance, where shock sensors have crucial applications.

b. North America dominated the market in 2022. The regional market’s growth is accounted to the growing demand for security solutions in various sectors. Industries in the North American region emphasize asset protection and surveillance, where shock sensors have crucial applications.

b. Shock sensor enables operators to choose hardware and software solutions from various The escalating requirement for these sensors across diverse industries, aimed at avoiding harm, amplifying safety measures, and delivering instantaneous insights, is the driving the market’s growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.