- Home

- »

- Distribution & Utilities

- »

-

Shunt Reactor Circuit Market Size And Share Report, 2030GVR Report cover

![Shunt Reactor Circuit Market Size, Share & Trends Report]()

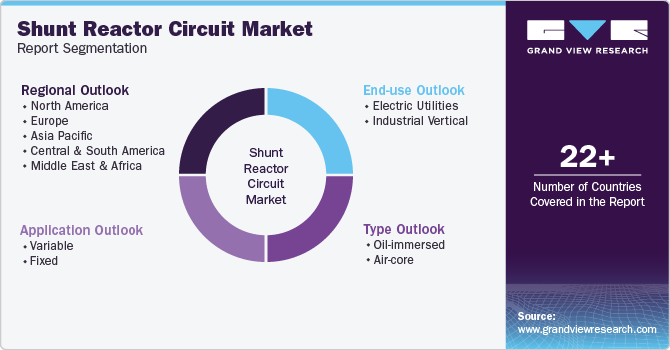

Shunt Reactor Circuit Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Oil-immersed, Air-core), By Application (Variable, Fixed), By End-use (Electric Utilities, Industrial Vertical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-425-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shunt Reactor Circuit Market Summary

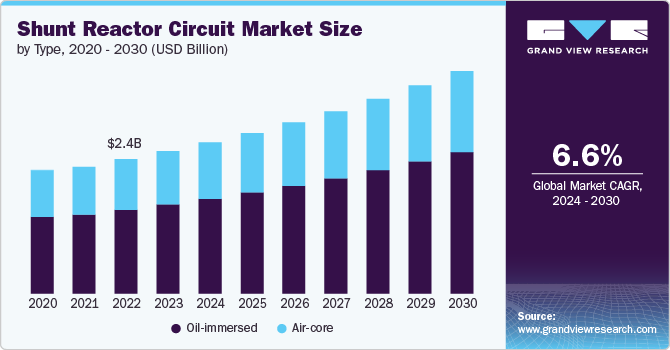

The global shunt reactor circuit market size was estimated at USD 2.52 billion in 2023 and is projected to reach USD 3.94 billion by 2030, growing at a CAGR of 6.63% from 2024 to 2030. Growing renewable energy adoption globally to meet the rising demand from developing countries due to the increased urbanization of rural regions is driving the demand for shunt reactor circuit in the market.

Key Market Trends & Insights

- Asia Pacific dominated global shunt reactor circuit market and accounted for largest revenue share of 39.45% in 2023.

- By type, the oil-immersed segment led the market with the largest revenue share of 62.59% in 2023.

- By application, the variable segment dominated the market with the largest revenue share of 73.35% in 2023.

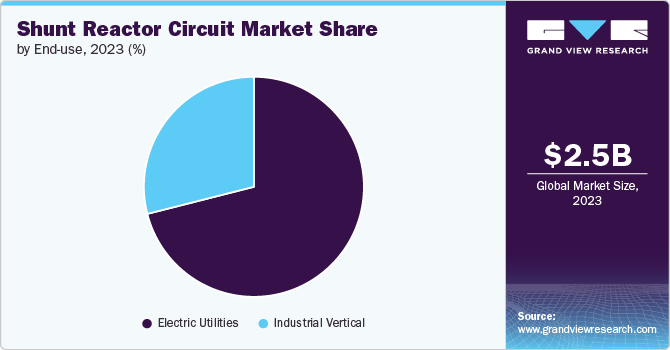

- By end-use, the electric utilities segment led the market with the largest revenue share of 71.04% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.52 Billion

- 2030 Projected Market Size: USD 3.94 Billion

- CAGR (2024-2030): 6.63%

- Asia Pacific: Largest market in 2023

The global shift toward renewable energy sources is driving the demand for shunt reactors, particularly in the integration of wind and solar power plants into the grid. For instance, the European Union's aggressive renewable energy targets, including its plan to achieve 45% of energy from renewables by 2030, are pushing utilities to upgrade their grid infrastructure to accommodate renewable sources. Shunt reactors are crucial in managing the reactive power generated by these renewable sources, helping stabilize voltage levels across the grid. As countries continue to ramp up their renewable energy projects, such as India’s target to reach 450 GW of renewable energy by 2030, the trend toward increased shunt reactor usage is expected to accelerate, solidifying their role in modern energy systems.

Drivers, Opportunities & Restraints

The rapid expansion and modernization of transmission and distribution (T&D) networks globally are significant drivers for the shunt reactor market. As urbanization and industrialization accelerate, especially in developing regions, the demand for electricity is rising. To meet this demand, governments and utility companies are investing heavily in T&D infrastructure to ensure efficient and reliable power delivery. Shunt reactors are essential components in these networks, as they help manage reactive power, reduce transmission losses, and improve the overall efficiency of the grid. This expansion is fueling the growth of the shunt reactor market.

Technological advancements in high-voltage shunt reactors present a substantial opportunity for market growth. Innovations such as digital monitoring, smart grid integration, and improved insulation materials are enhancing the performance and reliability of shunt reactors. These advancements are particularly valuable in high-voltage applications, where the precise management of reactive power is crucial. Companies that invest in R&D to develop cutting-edge shunt reactor technologies stand to gain a competitive edge, as utilities seek more efficient and durable solutions for their power networks.

Despite its potential, the shunt reactor circuit market faces challenges that could hinder its growth. One of the primary restraints in the shunt reactor market is the high initial cost associated with their purchase and installation. Additionally, the maintenance of shunt reactors can be complex and costly, especially in high-voltage applications. These factors can be particularly challenging for smaller utilities or companies operating in regions with limited financial resources. The high upfront investment and ongoing maintenance requirements can deter potential buyers, especially in emerging markets where budget constraints are a significant concern.

Type Insights & Trends

The oil-immersed segment led the market with the largest revenue share of 62.59% in 2023, which can be attributed to the growing demand for reliable grid infrastructure in emerging economies. As countries in regions like Asia-Pacific and Africa continue to expand their power networks to meet rising electricity consumption, the need for robust and durable components becomes critical. Oil-immersed shunt reactors, known for their excellent cooling properties and long operational life, are increasingly favored in these regions where extreme weather conditions and high load demands are common. The ability of oil-immersed shunt reactors to maintain efficiency and stability under such challenging conditions makes them an attractive choice for utilities aiming to enhance grid reliability and reduce maintenance costs. This rising preference is driving growth in the oil-immersed shunt reactor market.

Air-core shunt reactor circuits are gaining significant traction due to the increasing emphasis on eco-friendly and low-maintenance solutions in modern power grids. Unlike oil-immersed reactors, air-core shunt reactors eliminate the need for insulating oil, reducing the risk of environmental contamination and lowering maintenance requirements. This makes them particularly appealing in urban and environmentally sensitive areas where reducing ecological impact is a priority. Additionally, air-core reactors offer high reliability and are less prone to overheating, which is crucial for maintaining consistent performance in high-voltage applications.

Application Insights & Trends

The variable segment dominated the market with the largest revenue share of 73.35% in 2023. The growing need for flexible power management solutions in an increasingly complex energy landscape is promoting the segment. As power grids integrate diverse energy sources, from traditional fossil fuels to renewables such as wind and solar, the demand for versatile components that can adapt to different operating conditions is rising. Shunt reactors, with their ability to manage reactive power and stabilize voltage across a wide range of applications-from industrial plants to renewable energy farms-are becoming essential tools for grid operators. Their adaptability ensures efficient power transmission and distribution, even as energy sources and demands fluctuate, driving their adoption across various sectors.

The fixed segment is expected to grow at the fastest CAGR over the forecast period, owing to the need for consistent and reliable voltage regulation in established high-voltage transmission networks. In fixed applications, where power demand and grid configurations are stable, shunt reactors are crucial for maintaining steady voltage levels and minimizing transmission losses. These reactors help prevent over-voltage issues that can occur due to the inherent capacitive nature of long transmission lines. As utilities focus on ensuring long-term grid stability and efficiency in these fixed networks, the demand for shunt reactors that can provide dependable, ongoing reactive power compensation is increasing, driving market growth in this segment.

End-use Insights & Trends

The electric utilities segment led the market with the largest revenue share of 71.04% in 2023, driven by the ongoing push for grid modernization to handle higher loads and integrate renewable energy sources. As electric utilities upgrade their infrastructure to accommodate growing electricity demands and the variability of renewable energy, shunt reactors are essential for managing reactive power and stabilizing voltage across the grid. These reactors help utilities improve grid efficiency, reduce transmission losses, and prevent voltage fluctuations that could disrupt power delivery. The increasing focus on reliable, resilient power systems in response to rising energy consumption and renewable integration is promoting greater adoption of shunt reactors among electric utilities.

The industrial vertical segment is expected to grow significantly through the forecast period, fueled by the rising need for stable and efficient power supply in energy-intensive industries, such as manufacturing, mining, and petrochemicals. These industries rely heavily on high-voltage power transmission to support their operations, and fluctuations in voltage can lead to equipment damage, production downtime, and increased operational costs. Shunt reactors help industrial facilities maintain consistent voltage levels and manage reactive power, ensuring a smooth and reliable power supply. As industries continue to scale up their operations and require more robust power infrastructure, the demand for shunt reactors to enhance grid stability and efficiency is increasing, propelling the segment.

Regional Insights & Trends

North America is investing heavily in modernizing its aging power grid infrastructure to improve reliability and accommodate new energy sources. As utilities upgrade their systems, they are increasingly incorporating shunt reactors to manage reactive power and stabilize voltage, which is essential for integrating renewable energy sources and maintaining grid performance. This ongoing infrastructure enhancement drives growth in the shunt reactor market across the continent.

U.S. Shunt Reactor Circuit Market Trends

The U.S. is aggressively transitioning to renewable energy sources and increasing electrification across various sectors, including transportation and industrial processes. This shift necessitates significant upgrades to power transmission systems to handle the variable output from renewables and new electrical loads. Shunt reactors play a vital role in stabilizing voltage and managing reactive power, supporting the U.S.’s ambitious energy and infrastructure goals and boosting market demand.

Europe Shunt Reactor Circuit Market Trends

Europe’s strong commitment to reducing carbon emissions and transitioning to green energy is fueling substantial investments in renewable energy and smart grid technologies. Countries across the continent are integrating more wind, solar, and hydroelectric power into their grids, which requires advanced solutions for voltage regulation and reactive power management. Shunt reactors are crucial for maintaining grid stability in this evolving energy landscape, fueling their demand in the European market.

Asia Pacific Shunt Reactor Circuit Market Trends

Asia Pacific dominated global shunt reactor circuit market and accounted for largest revenue share of 39.45% in 2023, driven by rapid urbanization and infrastructure expansion, particularly in countries like China and India. As cities grow and new industrial zones are established, the demand for robust power transmission systems increases. Shunt reactors are critical in these expanding networks to manage reactive power and ensure stable voltage levels, supporting the region’s extensive infrastructure projects and driving market growth.

In the Asia Pacific region, there is a significant push towards renewable energy investments, driven by government policies and environmental goals. As countries such as Japan and South Korea integrate more wind and solar power into their grids, the need for effective reactive power management becomes crucial. Shunt reactors help balance the variable output from these renewable sources, promoting grid stability and efficiency and fueling demand in the region.

Key Shunt Reactor Circuit Company Insights

The shunt reactor circuit market is highly competitive, with several key players dominating the landscape. Major companies include Nissin Electric Co Ltd, ABB India Pvt Ltd, Mitsubishi Corporation, Fuji Electric, HD Hyundai Heavy Industries Co., Ltd., TBEA, Hilkar, Toshiba Corporation, Siemens AG, and GE Grid Solution. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Shunt Reactor Circuit Companies:

The following are the leading companies in the shunt reactor circuit market. These companies collectively hold the largest market share and dictate industry trends.

- Nissin Electric Co Ltd

- ABB India Pvt Ltd

- Mitsubishi Corporation

- Fuji Electric

- HD Hyundai Heavy Industries Co., Ltd.

- TBEA

- Hilkar

- Toshiba Corporation

- Siemens AG

- GE Grid Solution

Recent Developments

-

In February 2024, GE Vernova's Grid Solutions business secured significant multi-million-dollar contracts with the Power Grid Corporation of India (PGCIL) to supply 765 kV Shunt Reactors. These reactors are crucial for enhancing the stability and efficiency of India's electricity transmission system, particularly as the country works to integrate more renewable energy sources into its grid.

-

In April 2022, Hitachi Energy introduced OceaniQ transformers and shunt reactors designed for the offshore environment. This initiative aims to enhance the efficiency and sustainability of offshore operations, particularly in the renewable energy sector. OceaniQ focuses on advanced technologies that improve the management of offshore assets, ensuring better performance and reliability.

Shunt Reactor Circuit Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.68 billion

Revenue forecast in 2030

USD 3.94 billion

Growth rate

CAGR of 6.63% from 2024 to 2030

Base year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Nissin Electric Co Ltd; ABB India Pvt Ltd; Mitsubishi Corporation; Fuji Electric; HD Hyundai Heavy Industries Co.; Ltd.; TBEA; Hilkar; Toshiba Corporation; Siemens Ag; GE Grid Solution

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shunt Reactor Circuit Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global shunt reactor circuit market report on the basis of type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil-immersed

-

Air-core

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Variable

-

Fixed

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Utilities

-

Industrial Vertical

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shunt reactor circuit market size was valued at USD 2.52 billion in 2023 and is expected to reach USD 2.68 billion in 2024.

b. The global shunt reactor circuit market is expected to grow at a CAGR of 6.63% from 2024 to 2030, reaching USD 3.94 billion by 2030.

b. Based on application, the variable segment dominated the market with the largest revenue share of 73.35% in 2023. The growing need for flexible power management solutions in an increasingly complex energy landscape is promoting the segment.

b. Key players operating in the shunt reactor circuit market include Nissin Electric Co Ltd; Abb India Pvt Ltd; Mitsubishi Corporation; Fuji Electric; Hd Hyundai Heavy Industries Co.; Ltd.; Tbea; Hilkar; Toshiba Corporation; Siemens Ag; Ge Grid Solution, among others

b. Growing renewable energy adoption globally to meet the rising demand from developing countries due to the increased urbanization of rural regions is driving the demand for shunt reactor circuit in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.