- Home

- »

- Next Generation Technologies

- »

-

Silicon Carbide Semiconductor Devices Market Report, 2030GVR Report cover

![Silicon Carbide Semiconductor Devices Market Size, Share, & Trends Report]()

Silicon Carbide Semiconductor Devices Market (2022 - 2030) Size, Share, & Trends Analysis Report By Component, By Product, By Wafer Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-024-1

- Number of Report Pages: 238

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicon Carbide Semiconductor Devices Market Summary

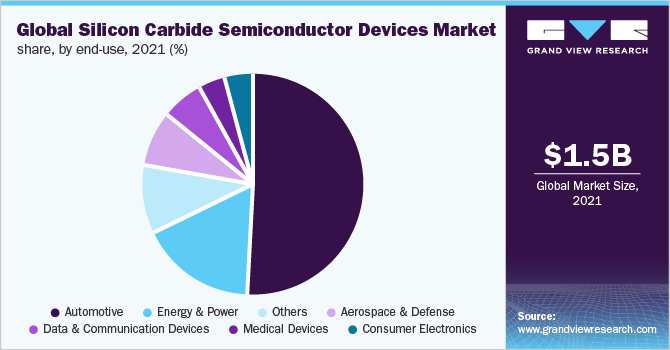

The global silicon carbide semiconductor devices market was valued at USD 1.52 billion in 2021 and is projected to reach USD 10.39 billion by 2030, growing at a CAGR of 23.8% from 2022 to 2030. Silicon Carbide (SiC) semiconductor devices have emerged as the most viable devices for next-generation, low-cost semiconductors due to their superior material properties.

Key Market Trends & Insights

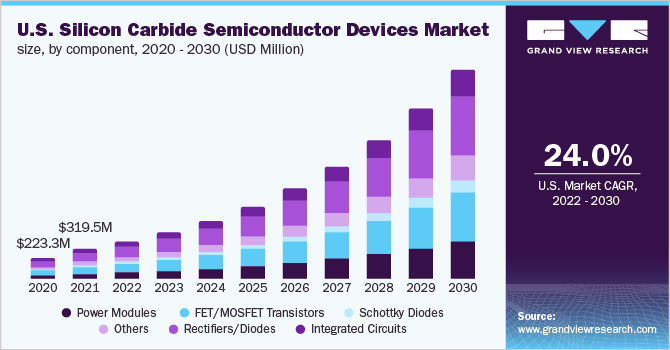

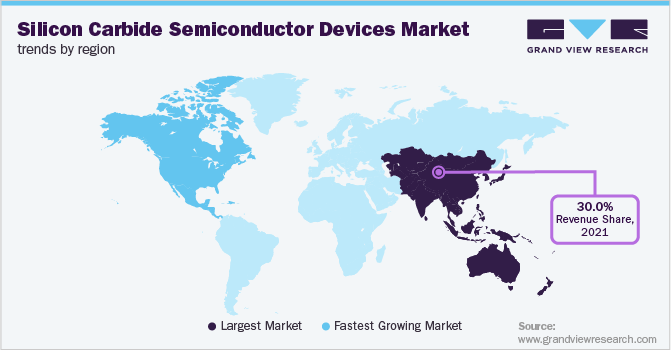

- Asia Pacific dominated the SiC semiconductor devices market in 2021 and accounted for a revenue share of more than 30.0%.

- North America is anticipated to register significant growth during the forecast period.

- By component, the power modules segment dominated the market in 2021 and accounted for a revenue share of more than 27.0%.

- By product, the power semiconductors segment dominated the market in 2021 and accounted for a revenue share of more than 75.0%.

- By wafer size, the 1-inch to 4 inches segment dominated the market in 2021 and accounted for a revenue share of more than 45.0%.

Market Size & Forecast

- 2024 Market Size: USD 1.52 Billion

- 2030 Projected Market Size: USD 10.39 Billion

- CAGR (2022-2030): 23.8%

- Asia Pacific: Largest market in 2021

Their fundamental properties include low ON resistance, high temperature, high frequency, and high voltage performance which makes them superior compared to silicon. Additionally, the increasing adoption of SiC semiconductor devices in power electronics and a wide range of applications offered by SiC semiconductor devices in electric vehicle charging infrastructure is driving the market’s growth.

Silicon is considered to be reaching its limits in terms of operation at higher temperatures, voltages, and frequencies. In comparison with silicon, silicon carbide devices provide higher temperature, voltage, and frequency thresholds. Over the years, developments in materials such as silicon carbide and gallium nitride have been receiving increased attention.

SiC semiconductor devices have various applications in converters, inverters, power supplies, battery chargers, and motor control systems. Due to their material properties, SiC semiconductor devices are well suited to fulfill increased demand for sustainability and electrification, thereby driving the market’s growth.

Silicon carbide has been considered the potential replacement for silicon due to its material properties, and these advantages are driving the use of silicon carbide in power electronics. Some of the important applications of silicon carbide semiconductor devices are in electric vehicle battery chargers, on-board chargers, DC-DC converters, hybrid electric vehicle powertrains, energy recovery, photovoltaic inverters, wind turbines, MRI power supply, X-ray power supply, air conditioning, auxiliary power suppliers, integrated vehicle systems, and power distribution.

Due to its wide range of applications in power electronics, the use of SiC is expected to increase significantly. The growing end-uses of silicon carbide semiconductor devices in emerging industries, such as the electric vehicle and power electronics industries are expected to drive the market growth during the forecast period.

The growing adoption of SiC semiconductor devices in electric vehicle charging infrastructure is creating a significant growth opportunity for the market. With the continued pressure on governments worldwide to reduce carbon emissions, the electric vehicle industry has witnessed many innovations and investments during the past few years.

With the evolution of the electric vehicle industry, SiC semiconductor devices are playing a crucial role in electric vehicle charging infrastructure. According to a study published by the China Association of Automobile Manufacturers; IT Juzi; and Quanzhan Industrial Research Institute, SiC investments are largely correlated with China’s EV production, and they increase with the increase in EV production. The growing demand for SiC semiconductor chips in the EV charging infrastructure proposes promising opportunities for the market’s growth.

However, the SiC semiconductor devices market faces a few challenges in fabricating the SiC. The main defects that can occur during the manufacturing process of SiC are scratches, micro pipes, crystalline stacking faults, stains, and surface particles. All these factors are potentially adversely affecting the performance of SiC devices.

However, the market players are expected to overcome these challenges in the near future through aggressive investments in the research & development of SiC semiconductor devices. For instance, in March 2022, II-VI, a semiconductor manufacturer, increased its investment in 150 mm and 200 mm SiC epitaxial and wafer substrate manufacturing with large-scale factory expansions in Kista (Sweden) and Easton (U.S.). Such initiatives are expected to propel innovations in the SiC semiconductor devices industry and reduce design challenges.

COVID-19 Impact Analysis

The outbreak of COVID-19, along with the subsequent lockdowns and restrictions on the movement of people and goods imposed across the globe, took a severe toll on the demand for electronic devices and power electronics that use SiC semiconductor devices. The global economy plunged into a deep contraction, affecting consumers' purchasing power and constraining their ability to borrow.

The overall decline in consumer purchasing power led to a decreased demand for many technology products, adversely affecting the Silicon Carbide (SiC) semiconductor devices market. Moreover, the imbalance between demand and supply for SiC semiconductor devices has led to a demand-supply gap in the semiconductor industry, adversely affecting the SiC semiconductor devices market during the pandemic.

Moreover, the global shutdown has impacted semiconductor manufacturing companies worldwide, ultimately halting wafer production. This also affected the market adversely, resulting in a delay in SiC semiconductor device manufacturing.

Component Insights

The power modules segment dominated the market in 2021 and accounted for a revenue share of more than 27.0%. Silicon carbide power modules enable using silicon carbide as a switch for power conversion and have wide applications in energy, e-mobility, and industrial applications. They help improve power consumption efficiency and reduce operational costs.

Additionally, the integration of the silicon carbide power modules with the Schottky Barrier Diode and (metal–oxide–semiconductor field-effect transistor)MOSFET enables significantly lesser switching loss compared to silicon, which is expected to contribute to segment growth during the forecast period.

The increasing application of silicon carbide power modules also encourages companies to launch new products, thereby driving the segment’s growth. For instance, ON SEMICONDUCTOR CORPORATION (on semi) has launched the APM32 power module series for high voltage DC-DC conversion in electric vehicles.

The FET/MOSFET Transistors segment is anticipated to register significant growth during the forecast period. The primary benefits of silicon carbide FET/MOSFET include higher thermal conductivity, higher critical breakdown field, and a wide band gap, resulting in a high current density, reduction in device thickness and on-state resistance, and lower leakages/power loss at high operating temperatures, respectively.

Several companies are launching silicon carbide-based FET/MOSFETs to benefit from a potential increase in demand from several industries. For instance, in August 2022, Toshiba Corporation introduced its 3rd generation 650V and 1200V silicon carbide MOSFETs, which reduced switching losses in industrial equipment by 20%. A wide range of benefits offered by the FET/MOSFET transistors is expected to fuel the segment’s growth throughout the forecast period.

Product Insights

The power semiconductors segment dominated the market in 2021 and accounted for a revenue share of more than 75.0%. SiC semiconductor devices have a wide range of fundamental characteristics, such as wide band gap, which makes them highly suitable for power semiconductors. The wide band gap of silicon carbide also helps reduce the equipment's size and makes it more reliable at higher voltages and switching frequencies.

For instance, electric vehicle manufacturers are incorporating silicon carbide components to achieve cost and energy efficiency in inverters, chargers, and auxiliary loads along with reducing the battery size, leading to new product launches by the companies.

For instance, in July 2020, Infineon Technologies AG introduced a 1200V Easy PACK half-bridge module that leverages Cool Sic MOSFET technology to enhance electric vehicle charging efficiency and reduce battery costs. Power semiconductors' material properties and beneficial characteristics bode well for the segment's growth.

The optoelectronic devices segment is anticipated to register significant growth during the forecast period. The growth of optoelectronic devices can be attributed to the rising prevalence of silicon carbide in high-energy laser and lighting applications. Due to its high thermal stability, silicon carbide is increasingly being incorporated in optoelectronic devices such as Light-Emitting Diodes (LED), solar cells, photodetectors, and telescopes.

Several optoelectronic device companies are witnessing organic and inorganic growth. For instance, II-VI Coherent Corp., an optoelectronics and materials specialist company, recorded revenue of more than USD 3.0 billion in the fiscal year ending 2021 after II-VI Incorporated acquired Coherent Corp.

Additionally, companies such as Cree, Inc. (now WOLFSPEED, INC.) leverage silicon carbide technology (150mm silicon carbide substrates) to develop a broad range of lighting solutions, including residential, indoor, and outdoor lighting.

Wafer Size Insights

The 1-inch to 4 inches segment dominated the market in 2021 and accounted for a revenue share of more than 45.0%. The 1- 4 inches silicon carbide wafers have a thickness of 350 ± 25 micrometers. They are available in N-type and P-type variants. The P-type substrate of silicon carbide wafers is used in the production of power devices such as Insulated Gate Bipolar Transistor (IGBT).

In contrast, the N-type substrates are coated with nitrogen to improve conductivity in power devices. In addition to the beneficial mechanical characteristics, the variants are compatible with existing device fabrication processes. Moreover, the 1 to 4 inches of silicon carbide wafers can be mass-produced, making them cost-effective, and the demand is expected to stem mainly from industrial applications. They also help reduce the size of the equipment, which is an additional benefit for their adoption during the forecast period.

The 10 inches & above segment is anticipated to register the fastest growth during the forecast period. The growth of the 10 inches & above segment can be attributed to the commercial-scale production of silicon carbide wafers. These wafers also enable the fabrication of Gallium Nitride (GaN) devices, including power devices and Light Emitting Diodes (LED).

Additionally, silicon carbide film prevents the diffusion of silicon into GaN and adds no more than USD 25.0 to USD 35.0 to the costs of silicon wafers. The higher cost-effectiveness and power efficiency offered by silicon carbide wafers compared to standard silicon are expected to contribute to the segment's growth during the forecast period.

End-use Insights

The automotive segment dominated the market in 2021 and accounted for a revenue share of above 50.0%. The automotive segment is further sub-segmented into electric vehicles and IC automobiles. The growth of the automotive segment can be attributed to the growing adoption of SiC semiconductors in electric vehicles and IC automobiles. Silicon Carbide (SiC) semiconductors offer characteristics such as durability for high-frequency switches and low energy losses, making them ideal for application in converters, chargers, and inverters.

Moreover, SiC semiconductors help improve energy efficiency and reduce the weight of the electronics, thus increasing the overall power density and efficiency. The benefits above bode well for the automotive segment’s growth throughout the forecast period.

The energy & power segment is anticipated to register significant growth during the forecast period. The energy & power segment is further sub-segmented into EV infrastructure and power distribution & utilities. SiC semiconductor devices offer a wide range of benefits in the energy & power segment. For instance, silicon carbide (SiC) semiconductor devices such as diodes and MOSFETs reduce system costs, minimize component size, and enhance power efficiency in electric vehicle charging.

Whereas the features of silicon carbide, such as a wide band gap, improved energy efficiency, and reduced cooling requirements, make it ideal for the application in power distribution & utility systems such as distribution grids, transmission systems, and renewable energy infrastructure to ensure cost-effectiveness. The material properties and unique characteristic features offered by SiC semiconductor devices in the energy & power segment are expected to contribute towards the segment’s growth during the forecast period.

Regional Insights

Asia Pacific dominated the SiC semiconductor devices market in 2021 and accounted for a revenue share of more than 30.0%. The presence of leading market players is expected to drive the market's growth in Asia Pacific. The increasing investments in development and manufacturing across the region also contribute to the market growth in Asia Pacific. For instance, in March 2022, Toshiba Electronic Components and Storage Co., Ltd. announced an investment worth JPY 100 billion (USD 839 million) in capacity expansion of power components.

Such initiatives are strengthening the region’s position in the market. Moreover, the rising demand for higher efficiency, smaller size, and lower weight of SiC semiconductors among various end-use manufacturers in the Asia Pacific region is driving the market’s growth.

North America is anticipated to register significant growth during the forecast period. The region's growth can be attributed to the presence and concentration of prominent players such as Gene Sic Semiconductor and ON SEMICONDUCTOR CORPORATION (on semi), which have an extensive customer base, driving the market growth in North America.

Furthermore, the concentration of these prominent players in this region encourages power electronics manufacturers to adopt innovative SiC semiconductor devices for better efficiency. Moreover, leading regional players are taking strategic initiatives, driving the region's growth.

For instance, in August 2021, ON SEMICONDUCTOR CORPORATION (on semi) announced the agreement to acquire SiC and sapphire materials manufacturer GT Advance Technologies Inc. With this acquisition, the company is expected to expand the supply of SiC to meet the rapidly increasing customer demand for SiC-based solutions.

Key Companies & Market Share Insights

The silicon carbide (SiC) semiconductor devices market can be described as a consolidated market. The key players in the SiC semiconductor devices market are focusing on developing novel products to cater to the growing demand. The demand is attributed to the ability of the newly introduced products to adapt to specific requirements catering to power conversion, quick charging, and operational efficiency.

Additionally, companies collaborated to leverage particular expertise and resources around semiconductors and battery management systems. Partnerships often were focused on developing innovative solutions for electric vehicles, with increased efficiency in usage and features.

Vendors are focusing on expanding their production capabilities to cater to the increased demand. For instance, in September 2022, ON SEMICONDUCTOR CORPORATION (on semi) expanded into the Czech Republic with the launch of its extended silicon carbide fabrication facility.

The expanded facility is expected to increase the wafer production of on semi by 16 times during the next two years and cater to the rising demand for microchips. Such initiatives are fueling the SiC semiconductor devices market’s growth. Some of the prominent players in the global silicon carbide semiconductor devices market include:

-

ALLEGRO MICROSYSTEMS, INC.

-

Infineon Technologies AG

-

ROHM Co., Ltd.

-

STMicroelectronics N.V.

-

ON SEMICONDUCTOR CORPORATION (on semi)

-

WOLFSPEED, INC.

-

Gene Sic Semiconductor

-

TT Electronics plc.

-

Mitsubishi Electric Corporation

-

Powerex Inc.

-

Toshiba Corporation

-

FUJI ELECTRIC CO., LTD.

Silicon Carbide Semiconductor Devices Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.89 billion

Revenue forecast in 2030

USD 10.39 billion

Growth rate

CAGR of 23.8% from 2022 to 2030

Base year of estimation

2021

Historical data

2018 - 2021

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Component, product, wafer size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Belgium; China; India; Taiwan; Southeast Asia; Brazil; UAE

Key companies profiled

ALLEGRO MICROSYSTEMS, INC.; Infineon Technologies AG; ROHM Co., Ltd.; STMicroelectronics N.V.; ON SEMICONDUCTOR CORPORATION (on semi); WOLFSPEED, INC.; Gene Sic Semiconductor; TT Electronics plc.; Mitsubishi Electric Corporation; Powerex Inc.; Toshiba Corporation; FUJI ELECTRIC CO., LTD.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicon Carbide Semiconductor Devices Market Segmentation

The report forecasts revenue growth at global, regional, and country levels in addition to providing an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Silicon Carbide (SiC) Semiconductor Devices Market report based on the component, product, wafer size, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Schottky Diodes

-

FET/MOSFET Transistors

-

Integrated Circuits

-

Rectifiers/Diodes

-

Power Modules

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Optoelectronic Devices

-

Power Semiconductors

-

Frequency Devices

-

-

Wafer Size Outlook (Revenue, USD Million, 2018 - 2030)

-

1 inch to 4 inches

-

6 inches

-

8 inches

-

10 inches & above

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electric Vehicles

-

IC Automobiles

-

-

Consumer Electronics

-

Aerospace & Defense

-

Medical Devices

-

Data & Communication Devices

-

Energy & Power

-

EV Infrastructure

-

Power Distribution & Utilities

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Taiwan

-

Southeast Asia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global silicon carbide semiconductor devices market size was estimated at USD 1.52 billion in 2021 and is expected to reach USD 1.89 billion in 2022.

b. The global silicon carbide semiconductor devices market is expected to grow at a compound annual growth rate of 23.8% from 2022 to 2030 to reach USD 10.39 billion by 2030.

b. Asia Pacific dominated the silicon carbide semiconductor devices market with a share of 30.07% in 2021. The region's growth can be attributed to the rising demand for high-efficiency, small-size, and lightweight Silicon Carbide semiconductors from the incumbents of various end-use industries.

b. Some key players operating in the SiC semiconductor devices market include Allegro Microsystems, Inc., Infineon Technologies AG, ROHM Co. Ltd., STMicroelectronics N.V., ON SEMICONDUCTOR CORPORATION (Onsemi), Wolfspeed, Inc., GeneSic Semiconductor, TT Electronics PLC, Mitsubishi Electric Corporation, Powerex Inc, Toshiba Corporation, Fuji Electric Co. Ltd.

b. Key factors that are driving the market growth include evolution of semiconductors and superior material properties offered by SiC semiconductors and increasing adoption of silicon carbide semiconductor devices in power electronics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.