Singapore Kombucha Market Summary

The Singapore kombucha market size was estimated at USD 35.8 million in 2024 and is projected to reach USD 117.8 million by 2033, growing at a CAGR of 14.2% from 2025 to 2033. The growing health consciousness among Singapore’s population is driving the demand for healthier and functional beverages, such as kombucha, as consumers actively seek alternatives to sugary carbonated beverages.

Key Market Trends & Insights

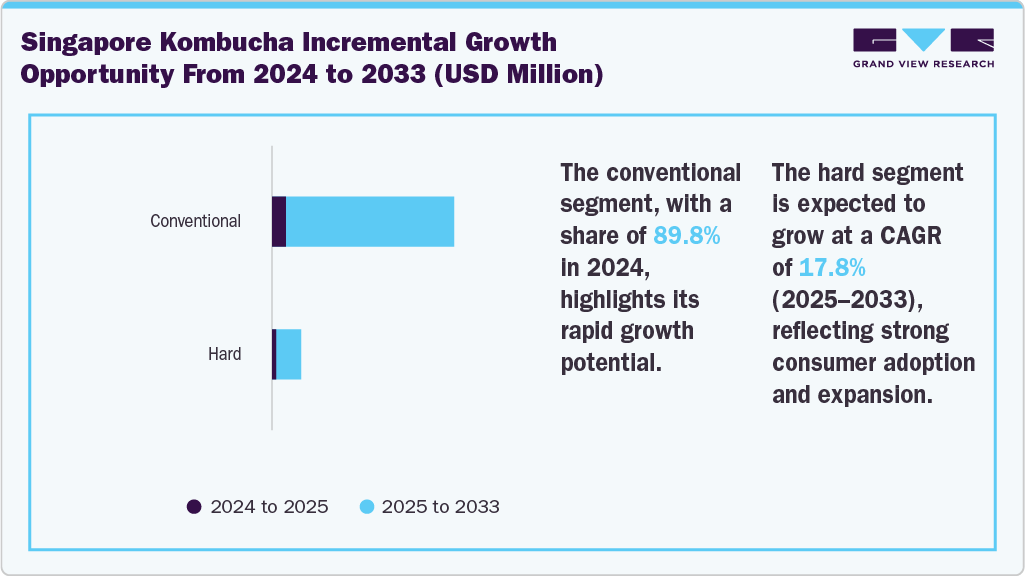

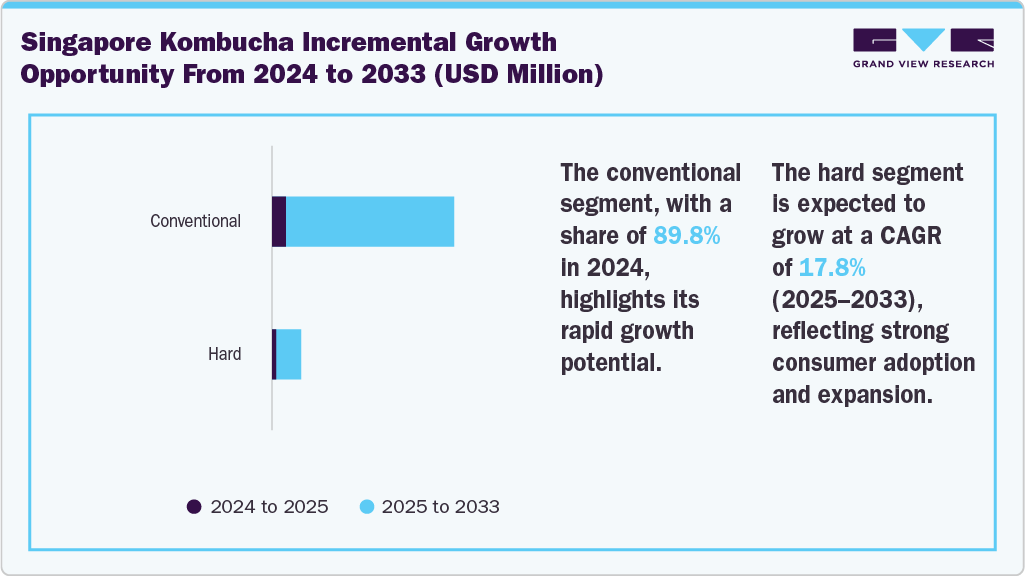

- By product, the conventional segment held the highest market share of 89.8% in 2024.

- By distribution channel, the on-trade segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 35.8 Million

- 2033 Projected Market Size: USD 117.8 Million

- CAGR (2025-2033): 14.2%

This shift is attributed to its gut health benefits, immune-boosting properties, and natural ingredients. Rising focus of consumers on maintaining gut health and immunity is projected to boost the demand for probiotics-rich beverages. An increasing number of local entrepreneurs engaging in innovation and expansion is expected to positively impact the market growth. In 2023, Sembawang-based kombucha company Pourabucha received a two‑star rating at the Great Taste Awards for its cocoa‑raspberry kombucha. Moreover, in May 2023, Singapore-based kombucha brand Wild Boocha adopted stainless steel vat brewing and introduced a unique keg retail format to strengthen its appeal among local consumers. These factors are positively influencing the growth of the Singapore kombucha market and leading to a surge in the consumption of kombucha across the country.

Seamless integration of kombucha into the country's fast-paced lifestyle is fueling the market growth. Its convenient packaging and widespread availability make it an accessible, on-the-go choice for health-conscious consumers, fitting perfectly into daily routines and post-workout or social gatherings.

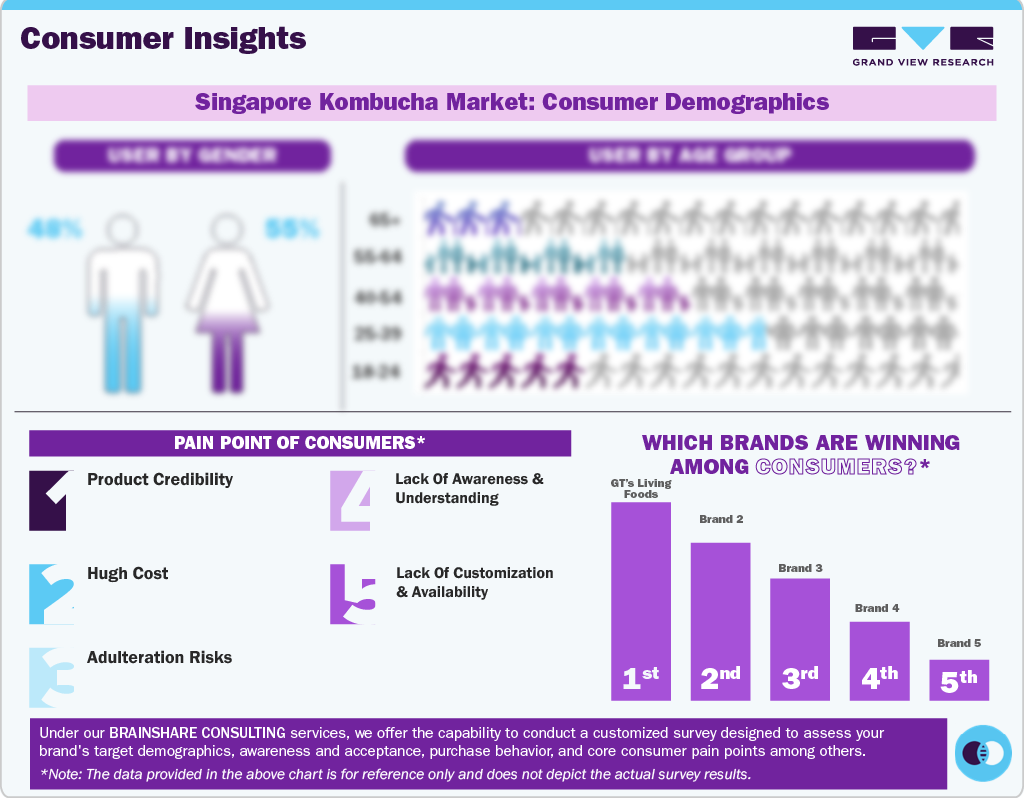

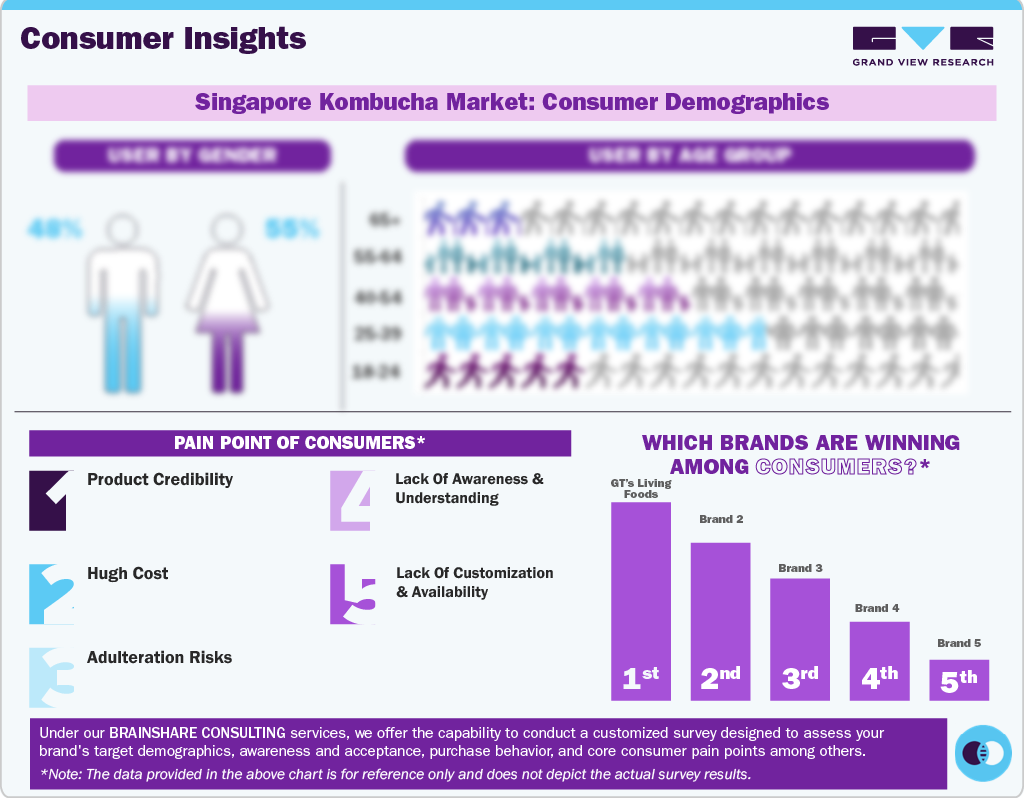

Consumer Insights

In Singapore, kombucha consumption trends exhibit clear demographic patterns and lifestyle drivers, indicating a market deeply attuned to wellness and evolving beverage preferences. A core segment of consumers includes individuals aged 20-40, drawn to kombucha as a functional wellness drink that supports gut health, energy, and immunity. This demographic is particularly engaged with the sober-curious movement, opting for non-alcoholic alternatives that align with their health goals. Younger consumers under 20, frequently attracted by fruit-based, low-sugar flavors and strong social media visibility, also account for significant consumption of kombucha. Online trends and content by influencers often shape their purchasing decisions.

Consumers increasingly explore kombucha as a non-alcoholic, health-conscious alternative, reflecting a broader shift toward inclusive wellness practices. Complementing these demographic shifts, flavor innovation and convenience are crucial drivers. Key market players focus on introducing diverse options like herb-and-spice variants and floral blends to cater to wellness-focused individuals alongside premium canned formats targeting on-the-go urban consumers. These trends are further reinforced by regulatory initiatives such as the Nutri-Grade labeling regime, effective since January 2022, which is a scoring system that mandates specifying the amount of sugar, saturated fats, proteins, etc. for pre-packaged, non-alcoholic beverages. Such trends and mandates are further expected to strengthen kombucha's appeal across all age groups and genders.

Product Insights

Based on product, the conventional segment dominated the market with a revenue share of 89.8% in 2024. The growth is driven by rising health consciousness and strong government support. As consumers increasingly seek functional beverages with gut health, detoxification, and energy-boosting benefits, traditional non-alcoholic kombucha has gained widespread popularity. Enhanced with tropical fruits, herbs, and spices, these drinks are now commonly found in supermarkets, convenience stores, health food outlets, and online platforms. The government’s Nutri-Grade labeling system, implemented by the Health Promotion Board, has been instrumental in prompting kombucha brands to offer low or zero-sugar variants that meet “A” or “B” health grades.

The hard segment in Singapore is expected to register the fastest CAGR of 17.8% from 2025 to 2033. Hard kombucha is showcased as a better-for-you alcoholic beverage, appealing to health-conscious consumers. It attracts consumer groups moderating their alcohol intake or seeking products with perceived benefits, such as low in calories, low sugar content, and options containing probiotics. This aligns with the growing trend in Singapore toward mindful drinking and the rising popularity of low-alcohol beverages.

Distribution Channel Insights

In 2024, on-trade distribution remained the leading sales channel in Singapore's kombucha market. In Singapore, kombucha is increasingly embraced as a premium, health‑minded alternative to traditional alcoholic and non‑alcoholic beverages across bars, restaurants, hotels, cafés, and event venues. Venues like Analogue Initiative have introduced cocktails featuring house‑fermented kombucha, appealing to mindful drinkers and trending wellness‑focused consumers. In May 2023, kombucha producer Wild Boocha innovatively tapped into the on‑trade channel by supplying draft kombucha via mini‑kegs, enabling bars and cafés to serve fresh‑on‑tap kombucha, a format that enhances customer experience and brand visibility.

The off-trade segment is expected to register the fastest CAGR from 2025 to 2033, fueled by diverse distribution channels. Supermarkets are among the key players, stocking various local and international kombucha brands with popular flavors such as peach, mango, and lemon to attract a broad consumer base. Simultaneously, the growing focus of specialty health food retailers on expanding their presence through on-site kitchens and public workshops is expected to fuel the growth of this segment. This caters to the growing demand for artisanal products, functional health benefits, and ingredient transparency. E-commerce platforms are also vital distribution channels, with brands like Yocha available on FairPrice Online and RedMart, and Remedy Kombucha maintaining a strong presence on Shopee. This blend of wider retail options, increased online accessibility, and a supportive regulatory environment continues to drive significant growth in Singapore's off-trade kombucha market.

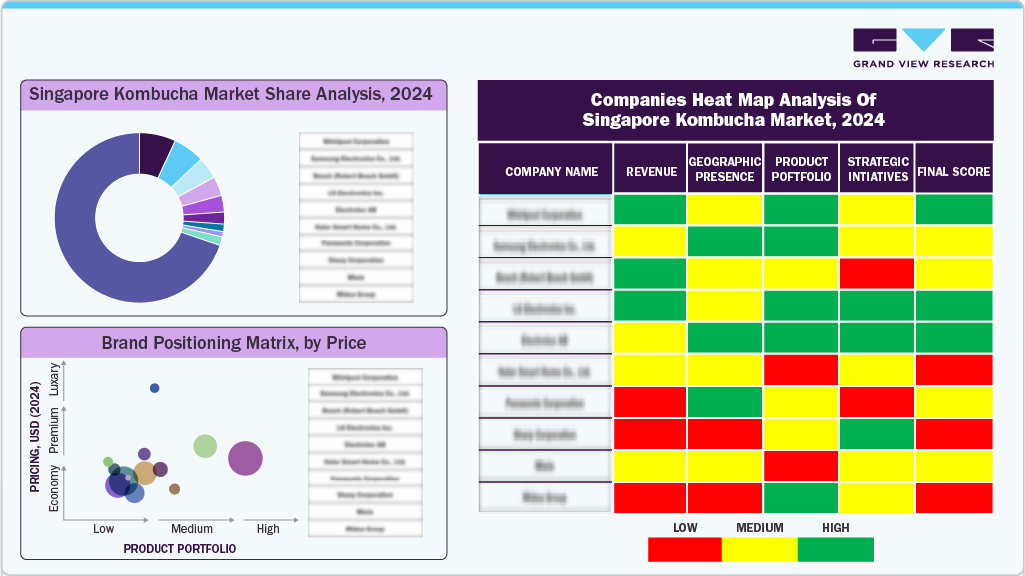

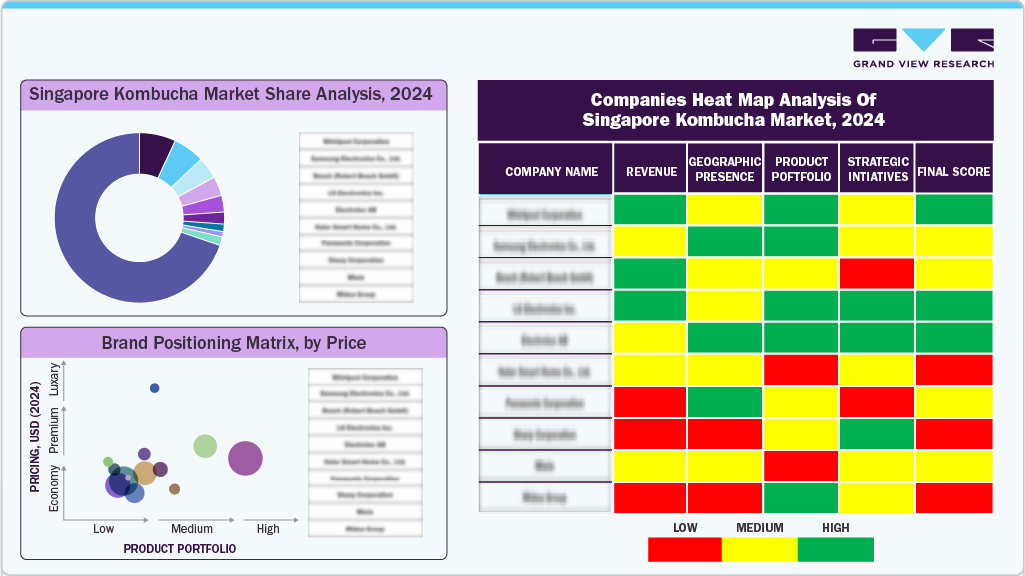

Key Singapore Kombucha Company Insights

Some key players in the Singapore kombucha market include Craft & Culture, Fizzicle Kombucha & Kefir, Yocha, Aboocha, and chateaux.sg. Major players embrace innovative strategies, new product development, distribution partnerships, and more to address changing consumer preferences and growing demand for extensive product portfolios by diverse consumer groups.

-

Craft & Culture is a leading fermentory in Singapore, specializing in fermented foods, kombucha, milk kefir, and water kefir. It is known for its small-batch, handcrafted approach, offering diverse flavors and even expanding into probiotic skincare. The company is focused on quality and health and is known as Singapore’s premier choice for live cultured beverages and fermented foods.

-

Fizzicle is a prominent Singaporean brand renowned for its hand-brewed kombucha, kefir, and Junboocha. Fizzicle focuses on creating naturally fermented, gut-healthy beverages with diverse and innovative flavors, including non-caffeinated options.

Key Singapore Kombucha Companies:

- Craft & Culture

- Fizzicle Kombucha & Kefir

- Yocha

- Aboocha

- chateaux.sg

- Pourabucha

- KIMI KOMBUCHA PTE LTD

- MOON JUICE KOMBUCHA

- Kombucha Works

- Tea Pulse

- Remedy Drinks

- GT's Living Foods

- Tropicana Brands Group (KeVita)

Singapore Kombucha Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2033

|

USD 117.8 million

|

|

Growth rate

|

CAGR of 14.2% from 2025 to 2033

|

|

Actual data

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, distribution channel

|

|

Key companies profiled

|

Craft & Culture; Fizzicle Kombucha & Kefir; Yocha; Aboocha; chateaux.sg; Pourabucha; KIMI KOMBUCHA PTE LTD; MOON JUICE KOMBUCHA; Kombucha Works; Tea Pulse; Remedy Drinks; GT's Living Foods; Tropicana Brands Group (KeVita);

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Singapore Kombucha Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Singapore kombucha market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)