- Home

- »

- Biotechnology

- »

-

Single-cell Analysis Market Size, Share, Growth Report, 2030GVR Report cover

![Single-cell Report]()

Single-cell Analysis Market Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Application (Cancer, Stem Cell), By Workflow (Downstream Analysis, Data Analysis), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-930-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Single-cell Analysis Market Size & Trends

The global single-cell analysis market size was estimated at USD 4.34 billion in 2023 and is projected to grow at a CAGR of 18.7% from 2024 to 2030. This growth can be attributed to the expanding application scope in disease diagnosis and drug discovery & development, lucrative growth of sequencing technology, technological innovations in single-cell analysis & cell isolation, and rising incidence of cancer.

Rapid technological advancements have enabled comprehensive transcriptome and genome analysis in an individual cell. Studies focusing on single cells reveal that each cell type exhibits distinct functions and lineage, which result in each cell responding differently toward changing the physiology of the host environment. Single-cell technology helps in assessing cellular heterogeneity and aids in the analysis of pathways & processes at the molecular level. Single-cell analysis is evolving rapidly with applications in oncology, immunology, and others. Currently, there are 22 phase-II clinical trials listed on Clinicaltrials.gov tagged with single-cell sequencing technology.

Single-cell analysis plays a key role in precision medicine, where treatments are tailored to the individual characteristics of each patient. By understanding the cellular heterogeneity in diseases such as cancer, clinicians can make informed decisions about the most effective treatment strategies for each patient. According to a new research published in April 2024, scientists used single-cell analyzing tools to develop a fundamental approach for classifying head and neck squamous cell carcinoma (HNSCC) based on B cells. This study is significant for researchers to predict patient prognosis and patient response to immunotherapy. Moreover, single-cell analysis enables researchers to understand the variability in drug responses across different cell types within the same tissue or organ.

The rapid advancement and lucrative growth in sequencing technology have significantly propelled the market growth. Single-cell analysis, a method used to study the genomic, transcriptomic, proteomic, and metabolomic profiles of individual cells, has become important in understanding the complexities of biology. Modern sequencing technologies offer much higher throughput, enabling the analysis of thousands to millions of individual cells in a single experiment. This scale has opened new avenues in research and diagnostics, contributing to the industry's growth.

Technological innovations in single-cell analysis and cell isolation have significantly driven the market growth. New technologies improve the resolution & sensitivity of single-cell analysis, allowing for the detection of rare cell types and low-abundance molecules. The technological innovations in single-cell analysis and cell isolation have expanded the range of applications, from basic research to clinical diagnostics and therapeutic development. Furthermore, the integration of artificial intelligence in single-cell research leverages the study of cell biology. For instance, In January 2024, Deepcell, Inc. announced a collaboration with NVIDIA to accelerate the use of generative artificial intelligence in single-cell research.

The rising incidence of cancer globally is a significant driver for the expansion and growth of the industry. WHO predicts that there will be over 35 million new cancer cases by 2050, a 77% surge from the approximately 20 million cases estimated in 2022. Single-cell analysis technologies allow for the detailed examination of cellular heterogeneity, providing insights into unique genetic and phenotypic characteristics of individual cells within a tumor. Single-cell analysis technologies, such as single-cell RNA Sequencing (scRNA-seq), allow researchers to study this complexity by profiling the gene expression of individual cells.

Market Concentration & Characteristics

The industry is characterized by a high degree of innovation driven by technological advancements. The growing demand for analytical tools for innovative research and subsequent funding has led to the introduction of high-throughput equipment within the industry. Multiple innovations have led this equipment to involve features such as automation, high sensitivity, and accuracy, which ultimately help in analyzing scarce samples. Also, increasing R&D investments by key companies is opportunistic for industry growth. For instance, in October 2023, Pixelgen Technologies, a Sweden-based single-cell spatial proteomics company, announced the completion of Series A funding of nearly USD 7.3 million.

The industry is characterized by a moderate level of merger & acquisition and collaboration activities undertaken by several industry players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. For instance, in January 2024, Parse Biosciences acquired data analysis software company Biomage. This acquisition helped Parse to combine its single-cell sequencing technology with Biomage’s RNA sequencing data analysis platform.

The regulatory framework for single-cell analysis varies across different countries, with each nation having its own set of guidelines and regulations to govern the ethical and legal aspects of this technology. These regulations often address issues such as patient consent, data privacy, sample collection, storage, and sharing, as well as using single-cell data for research purposes.

Key players adopt this strategy to increase the production capacity and reach of their products in the market and improve their availability in diverse geographic areas. Moreover, the rising demand for precision medicine in treating chronic diseases expedites the research and development in cellular and molecular biology, fostering companies’ product portfolios.

Product Insights

The consumables segment dominated the market with the largest revenue share of 54.8% in 2023. The segment growth is attributable to the growing demand for personalized medicine, advancements in biotechnology, and the increasing need for more precise & detailed cellular analysis in research and clinical diagnostics. The market for consumables used in single-cell analysis encompasses a range of products designed to facilitate the study of individual cells. This includes items such as reagents, kits, microplates, and other tools that are essential for conducting detailed examinations of cellular functions, genetic expression, and other critical aspects of cell biology at the single-cell level.

The instruments segment is anticipated to grow at a significant CAGR over the forecast period. The incorporation of smart technology has enhanced the effectiveness of patient assessment, driving the demand for single-cell technologies such as NGS and PCR. Moreover, the introduction of integrated devices, such as in-patient monitoring & management tools, and laboratory equipment is aiding in improved assessment & management of research laboratories and clinical trials, which is expected to propel the market growth.

Application Insights

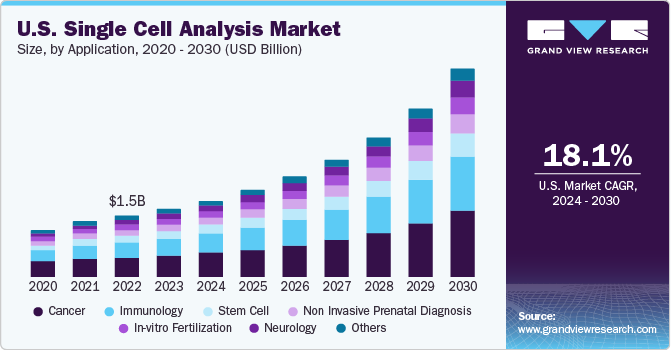

The cancer segment dominated the market with the largest share of 32.1% in 2023. This segment is a major driver of growth due to the potential of these technologies to significantly impact the diagnosis and treatment of cancer. Single-cell analysis has proved to be effective for the diagnosis of cancer cells. Genetic variation via cell proliferation conditions, mutation rates, and cell types can be easily identified using these techniques.

The immunology segment is poised to exhibit the fastest CAGR during the forecast period. Single-cell analysis techniques enable researchers to characterize the heterogeneity of immune cell populations in detail. By profiling gene expression, epigenetic modifications, and protein expression at the single-cell level, researchers study the molecular mechanisms underlying immune cell fate decisions, such as T-cell lineage commitment or B-cell maturation. In addition, single-cell analysis techniques are instrumental in studying immune responses to various stimuli, including pathogens, vaccines, and cancer cells.

Workflow Insights

The data analysis segment dominated the market with the largest market share of 38.5% in 2023. The complexity and volume of data generated from single-cell analysis require robust computational tools and algorithms for accurate interpretation. This necessity drives the demand for advanced data analysis solutions. Single-cell analysis technologies have advanced and similar developments in bioinformatics and computational methods to handle the data. Collaboration in the data analysis workflow segment is expected to drive market growth. For instance, in June 2023, Honeycomb and Revvity collaborated to launch a new set of tools for single-cell analysis. This set includes HIVE CLX Single-Cell RNAseq Solution, BeeNetPLUS analysis workflow, and HIVE CLX Service (U.S. only).

The downstream analysis segment is expected to witness the fastest growth from 2024 to 2030. As single-cell sequencing technologies continue to evolve, they generate a volume of high-resolution data. Downstream analysis tools & software are essential for interpreting and extracting meaningful insights from this complex data, driving the demand for sophisticated bioinformatics solutions. Downstream analysis tools that seamlessly integrate with upstream sample preparation and data acquisition technologies are in high demand, propelling the growth of this segment.

End-use Insights

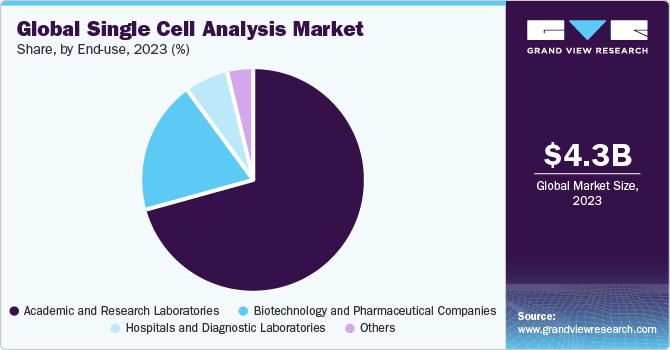

In 2023, the academic & research laboratories segment held the largest revenue share of 70.8%. The segment includes government organizations, universities, laboratories, and research institutions that carry out experimental work in the field of life sciences. The growth of this segment is propelled by the presence of a large number of biotechnology institutes that explore novel technologies for the analysis of single cells for genomics and research focusing on infectious diseases.

Some government organizations, including National Institutes of Health (NIH) provide funding to genome analysis and sequencing centers that focus on the interpretation of the genomic bases of rare and common human diseases. Moreover, the application of NGS solutions in research projects carried out in universities also propels market growth. The provision of onsite bioinformatics courses that include workshops on the practical implementation of NGS sequencing and data analysis is also expected to boost the revenue of the academic research segment in the coming years.

Regional Insights

North America single-cell analysis market is expected to grow at a lucrative rate owing to an increase in the adoption of genomic medicines, biopharmaceuticals, and novel technologies such as next-generation sequencing in the U.S. and Canada for diagnosing & treating clinical disorders. In addition, the increasing use of genomic, proteomic, and cell biology-based platforms in the region is boosting the uptake of single-cell analysis tools.

U.S. Single-cell Analysis Market Trends

The U.S. accounts for the most clinical development in life sciences technologies for applications in oncology and infectious diseases. The successful completion of the Human Genome Project has contributed to the development of personalized medicine approaches. Research, development, and commercialization of customized medicine services and products occur faster in the U.S. than in other countries. The FDA, Environmental Protection Agency (EPA), and Department of Agriculture (USDA) are the primary regulatory bodies for the market.

Europe Single-cell Analysis Market Trends

Europe has witnessed several developments in stem cell research, cell therapy, personalized medicine, biopharmaceutical development, and proteomics. This is due to several initiatives undertaken by the government and non-government organizations to boost the biotechnology sector growth in the region.

The UK single-cell analysis market is expected to exhibit substantial growth. The growing support from the UK ecosystem and NHS by providing appropriate platforms for developing innovative therapies propels the market growth in the country. According to the National Institute for Biological Standards and Control (NIBSC), the global human Pluripotent Stem Cell line registry (hPSCreg) operates closely with the UK Stem Cell Bank. The European Commission funds hPSCreg is a publicly accessible platform to facilitate coordination and collaboration in human pluripotent stem cell research and applications. The establishment of various organizations that support the development of stem cell-based therapies is expected to accelerate the progress of regenerative medicine in the UK, which is expected to boost the growth of market.

The single-cell analysis market in Germany accounted for a substantial revenue share in the European market. The close cooperation between research institutes, pharmaceutical & biotechnology companies, technology parks, and the government is a significant factor contributing to the market growth in Germany. The country is home to major global biotechnology companies, such as Merck KGaA, Eppendorf AG, Sartorius AG, and CellGenix GmbH, which are expected to witness significant growth in the coming years.

The France single-cell analysis market is witnessing growing demand for single-cell analyzing instruments in research activities, drug testing, and diagnostic labs. Many companies are involved in the R&D of single-cell instruments and strategic collaborations/acquisitions to meet this demand. Moreover, the market observes continuous growth owing to the emergence of start-up companies across the country, along with the increasing government and private sector funding.

Asia Pacific Single-cell Analysis Market Trends

Asia Pacific is the fastest-growing region, owing to the rapidly developing economy, increasing geriatric population, and growing investments in the biotechnology sector. Key factors driving the market include increasing demand for biotech tools in R&D activities, improving adoption of laboratory automation, and growing government attention on biotech & healthcare sectors.

Japan single-cell analysis market captured the largest revenue share in the Asia Pacific region due to its rapid technological advancements and strategic initiatives to maximize return on investments. In addition, several foreign companies are entering the market. In May 2021, Chugai launched a cryo-electron microscopy system in Japan to accelerate drug discovery.

The single-cell analysis market in China is projected to grow at the fastest rate during the forecast period. According to Novotech in September 2023, China emerged as a hub for cell and gene therapy, securing the second position globally in patent applications and registered clinical trials, following the U.S. A surge in cancer cases is seen across the country harnessing the focus on cancer immunotherapy-based products in China.

India single-cell analysis market has shown tremendous growth and potential in last few years. In the biotechnology sector, India is currently ranked 12th in the world and 3rd in the Asia Pacific region, and it is the world's largest manufacturer of vaccines. In addition, under the Pradhan Mantri Aatmanirbhar Swasth Bharat Yojana, in March 2021, the government planned to establish nine biosafety-level-3 laboratories. The Department of Biotechnology set up biotech parks and incubators nationwide to provide infrastructure support while converting research into products.

Middle East and Africa Single-cell Analysis Market Trends

Cancer cases are expected to significantly increase in the Middle East and Africa (MEA) in the coming years. The need for efficient cancer care has increased due to unmet medical needs, which has increased market potential. Stem cell-based oncology space in African nations is expected to be driven by the growing demand for efficient cancer treatment.

The single-cell analysis market in Saudi Arabia is aided by extensive research studies involving sequencing that are likely to expand the usage rate of advanced DNA sequencing techniques. The Saudi Food and Drug Authority (SFDA) is primarily responsible for regulating food and healthcare products, including devices & medicines, in Saudi Arabia. Moreover, the Saudi Human Genome Program aims to study the genetic base of diseases in the population. Hence, the King Abdulaziz City for Science and Technology (KACST) and Life Technologies together formed a program to improve healthcare in Saudi Arabia.

The UAE single-cell analysis market is projected to grow at the fastest rate during the forecast period. In recent years, the UAE has made significant investments in genomic medicine. Identifying and screening people at risk for genetic disorders to implement preventative measures & individualized treatment plans are among the main areas of focus for genomics medicine in the country. These factors are contributing to the market growth.

Key Single-Cell Analysis Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Single-Cell Analysis Companies:

The following are the leading companies in the single-cell analysis market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc

- QIAGEN NV

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Merck KGaA

- Becton, Dickinson & Company (BD)

- Fluidigm Corporation (Standard BioTools Inc.)

- 10x Genomics, Inc.

- BGI

- Novogene Co, Ltd.

Recent Developments

-

In February 2024, 10X Genomics announced the launch of GEM-X, comprising two single-cell gene assays-Chromium Single Cell Gene Expression 3'v4 and Chromium Single Cell Immune Profiling 5'v3, helping 10X Genomics to expand its single-cell technology products portfolio.

-

In February 2024, Takara Bio USA, Inc announced the launch of two single-cell solutions, Shasta Total RNA-Seq Kit and Shasta Whole-Genome Amplification Kit.

-

In February 2024, Singleron Biotechnologies announced the opening of its labs in Ann Arbor, Michigan, U.S. The company planned to offer single-cell analysis service, comprehensive solutions from tissue dissociation, single-cell multi-omic analysis, single cell reagent kits, automation instruments, to bioinformatics support.

-

In January 2024, BD announced a collaboration with Hamilton Ink, a robotics developer organization, to support the creation of automated solutions for single-cell multiomics research purposes.

-

In January 2024, Singleron Biotechnologies launched AccuraSCOPE Single Cell Transcriptome and Genome Library Kit at the Festival of Genomics meeting in the UK. This innovative kit can simultaneously profile full genome and full-length transcriptome, offering researchers a valuable tool for their studies.

-

In September 2023, Illumina, Inc. collaborated with Singleron Biotechnologies for an optimized workflow that automatically initiates DRAGEN single cell RNA sequencing analysis following the sequencing of a Singleron GEXSCOPE single-cell library using an Illumina NextSeq 2000 system.

-

In April 2023, Fluidigm Corporation (Standard BioTools Inc.) launched the Hyperion XTi Imaging System. The XTi delivers high-precision imaging and quantification of complex biological information at the single-cell level.

Single-cell Analysis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.89 billion

Revenue forecast in 2030

USD 13.69 billion

Growth rate

CAGR of 18.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, workflow, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc; QIAGEN NV; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Merck KGaA; Becton, Dickinson & Company (BD); Fluidigm Corporation (Standard BioTools Inc.); 10x Genomics, Inc.; BGI; Novogene Co, Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Single-cell Analysis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global single cells analysis market report based on product, application, workflow, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Reagents

-

Assay Kits

-

-

Instruments

-

Microscopes

-

Hemocytometers

-

Flow Cytometers

-

Next Generation Sequencing

-

PCR Systems

-

High-content Screening System

-

Cell Microarrays

-

Single Live Cell Imaging

-

Automated Cell Counters

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Immunology

-

Neurology

-

Stem cell

-

Non-invasive prenatal diagnosis

-

In-vitro fertilization

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Single cell isolation & library preparation

-

Downstream Analysis

-

Data Analysis

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic and Research Laboratories

-

Biotechnology and Pharmaceutical Companies

-

Hospitals and Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global single-cell analysis market size was estimated at USD 4.34 billion in 2023 and is expected to reach USD 4.89 billion in 2024.

b. The global single-cell analysis market is expected to grow at a compound annual growth rate of 18.7% from 2024 to 2030 to reach USD 13.69 billion by 2030.

b. The Consumables segment dominated the single-cell analysis market with a share of 54.8% in 2023. This is attributable to the high penetration of reagents & kits in the market coupled with their high usage and purchase rate.

b. Some key players operating in the single-cell analysis market include Thermo Fisher Scientific, Inc., QIAGEN NV, Bio-Rad Laboratories, Inc., Illumina, Inc., Merck KGaA, Becton, Dickinson & Company (BD), Fluidigm Corporation (Standard BioTools Inc.),10x Genomics, Inc., and BGI, and Novogene Co, Ltd.

b. Key factors that are driving the single-cell analysis market growth include increasing implementation of single-cell assessment within the diagnostics and pharmaceutical manufacturing industry, and declining prices of sequencing technology that accelerate single-cell genome sequencing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."