- Home

- »

- Clothing, Footwear & Accessories

- »

-

Skateboard Market Size & Share, Industry Report, 2033GVR Report cover

![Skateboard Market Size, Share & Trends Report]()

Skateboard Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Street Board, Cruiser Board), By End Use (Kids (0-9), Teenagers (12-17)), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-213-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Skateboard Market Summary

The global skateboard market size was estimated at USD 3.56 billion in 2024 and is projected to reach USD 4.63 billion by 2033, growing at a CAGR of 2.6% from 2025 to 2033. The market growth is drivenby rising youth participation in action sports and the growing influence of street culture and social media.

Key Market Trends & Insights

- North America dominated the global skateboard market with the largest revenue share of 41.0% in 2024.

- The skateboard market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By product, the street board market led the market with the largest revenue share of 44.2% in 2024.

- By product, the electric board segment is anticipated to grow at the fastest CAGR of 3.5% during the forecast period.

- By end use, the teenagers segment led the market with the largest revenue share of 43.5% in 2024.

Market Size

- 2024 Market Size: USD 3.56 Billion

- 2033 Projected Market Size: USD 4.63 Billion

- CAGR (2025-2033): 2.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The skateboard industry is driven by increasing youth engagement in outdoor and adventure sports, supported by the growing popularity of street culture and skate boarding’s inclusion in global events like the Olympics. Social media platforms and influencer marketing have amplified the sport’s visibility and aspirational appeal.In addition, advancements in board design, the use of sustainable materials, and urban infrastructure development are further boosting market growth worldwide. In February 2024, Mondi, a renowned sustainable packaging company, unveiled the world’s first skateboard half-pipe constructed entirely from containerboard, demonstrating the material’s durability for high-stress uses. The project, co-developed with Olympian skateboarder Julia Brückler, aims to engage younger audiences around sustainable packaging and material innovation.

The skateboard industry is propelled by rising disposable incomes and lifestyle shifts toward fitness-oriented recreational activities. Expanding retail networks, including online platforms, have made skateboards and accessories more accessible to a global audience. Moreover, collaborations between skateboard brands and the fashion or entertainment industries are enhancing brand appeal and attracting new consumer segments. For instance, in July 2024, Welcome Skateboards formed an exclusive collaboration with Britney Spears, producing skate decks, hoodies, and tees featuring her signature iconography and nostalgic aesthetic.

The skateboard industry is gaining momentum due to increasing urbanization and the development of dedicated skate parks in cities worldwide. Government initiatives promoting sports participation among youth are also encouraging the adoption of skateboarding. Furthermore, technological innovations such as electric and smart skateboards are attracting both enthusiasts and commuters, expanding the market’s reach. Companies such as RADBOARDS offer innovative products such as the Zeus Pro Electric skateboard with a top speed of 60km/h and a maximum mileage of 70 km.

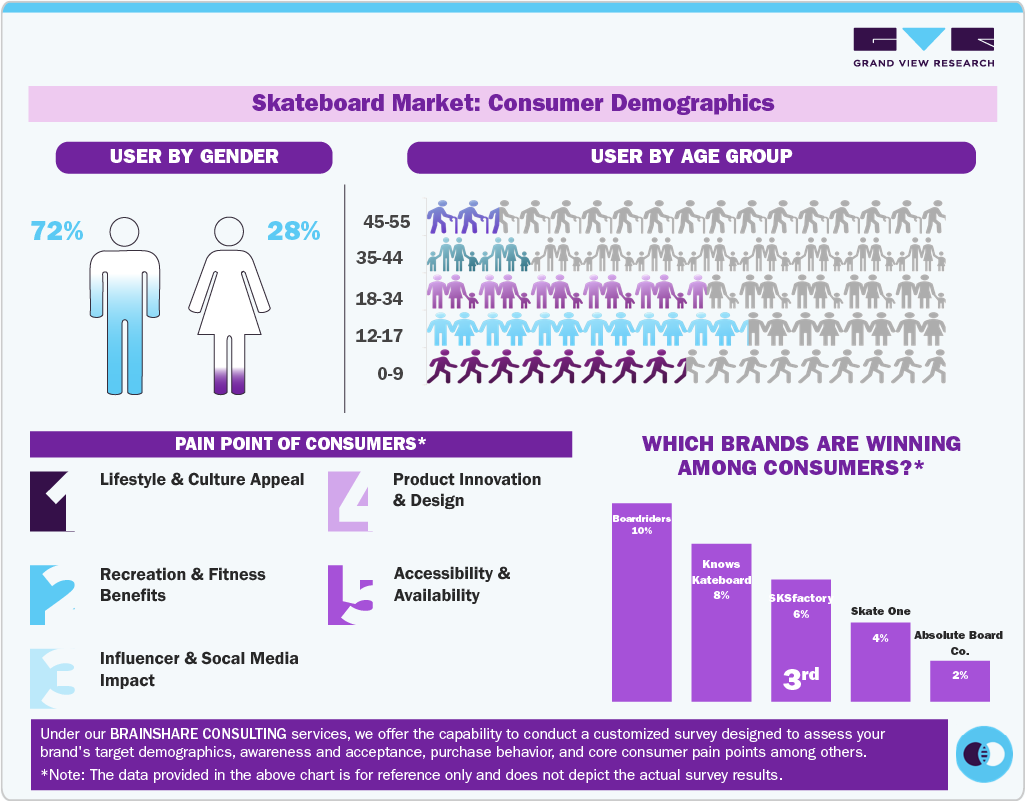

Consumer Insights for Skateboard

Product Insights

The street board segment led the market with the largest revenue share of 44.2% in 2024. The street board industry is driven by the rising popularity of urban sports and lifestyle activities among younger demographics. Growing exposure through digital media, video-sharing platforms, and global sporting events has significantly increased participation and awareness. The emergence of streetwear fashion and brand collaborations with athletes and influencers are further enhancing market appeal. Technological advancements in materials, such as lightweight and durable decks, are improving performance and safety. In addition, the expansion of e-commerce channels and easy product availability are fueling steady market growth across regions.

The electric segment is projected to grow at the fastest CAGR of 3.5% from 2025 to 2033. The electric board market is driven by the growing demand for eco-friendly and convenient personal transportation solutions in urban areas. Rising fuel prices and increasing environmental awareness are pushing consumers toward electric mobility options. Technological advancements in battery efficiency, motor performance, and lightweight materials are enhancing the usability and range of electric boards. The popularity of last-mile commuting solutions and the integration of smart features, such as Bluetooth connectivity and mobile app controls, are further boosting adoption. In July 2024, Future Motion Inc. (Onewheel) introduced a new high‑performance electric board model- “GT‑S Series Rally Edition” that features a 6‑inch central hub motor, larger tire, and Recurve Rails geometry for serious off‑road capability, and can be controlled via the Onewheel mobile application.

End Use Insights

The teenagers segment led the market with the largest revenue share of 43.5% in 2024. The skateboard industry for teenagers is driven by the growing appeal of skateboarding as a lifestyle and recreational activity among youth. Social media platforms and influencer content showcasing tricks and urban skate culture significantly influence teenage adoption. Participation in school clubs, local competitions, and global events like the X Games further encourages engagement. Innovative designs, colorful graphics, and customizable boards make skateboarding more attractive to teenagers. In addition, easy availability through online stores and retail outlets, along with affordable pricing, is expanding access and fueling market growth.

The kids segment is projected to grow at the fastest CAGR of 3.2% from 2025 to 2033. The skateboard industry for kids is driven by increasing parental focus on outdoor physical activities and skill development. Fun, safe, and beginner-friendly designs with protective features make skateboarding appealing to younger age groups. Marketing campaigns that target children through cartoons, toys, and educational content effectively boost interest and awareness. Growth in community programs, sports camps, and kid-friendly skate parks provides opportunities for practice and social interaction. In addition, rising disposable income among families allows for greater spending on recreational products, including skateboards and related gear.

Regional Insights

North America dominated the global skateboard market with the largest revenue share of 41.0% in 2024. The North American market is driven by a strong youth culture and widespread popularity of extreme sports. High media exposure through skateboarding events, movies, and social media campaigns fuels consumer interest. Availability of well-established retail chains and specialized skate shops enhances product accessibility. Investment in urban infrastructure, including skate parks and recreational zones, encourages participation. In addition, collaborations between skateboard brands and entertainment or fashion sectors strengthen brand visibility and adoption.

U.S. Skateboard Market Trends

The skateboard market in the U.S. accounted for the largest market revenue share of 86.4% in North America in 2024. In the U.S., the skateboard industry benefits from government and private initiatives promoting youth sports and outdoor activities. The inclusion of skateboarding in the Olympics has significantly boosted mainstream appeal. Technological advancements in board materials and safety equipment attract both beginners and enthusiasts. Community-driven events, competitions, and skateboarding clubs foster a supportive environment for growth. Rising interest in sustainable and eco-friendly boards also drives consumer preference.

Europe Skateboard Market Trends

The skateboard market in Europe held a significant market share of 2.8% in the global market. Europe’s skateboard market is propelled by increasing urbanization and the development of city-based recreational spaces. Strong cultural acceptance of skateboarding as both a sport and a lifestyle encourages participation across age groups. E-commerce platforms and cross-border retail networks improve product reach and availability. Festivals, exhibitions, and street sports competitions showcase skateboarding, attracting new audiences. In June 2024, Santa Cruz Skateboards and Jägermeister, a German herbal liqueur brand, collaborated to launch a strictly limited three‑piece skateboard and apparel capsule collection, centred on a re‑issue of the “Kendall Deck”.

Asia Pacific Skateboard Market Trends

The skateboard market in Asia Pacific is projected to grow at the fastest CAGR of 3.3% from 2025 to 2033. The Asia Pacific skateboard industry is driven by rapid urban development and growing youth populations in countries. Rising disposable incomes and the adoption of Western lifestyle trends increase demand for recreational sports products. Social media and digital campaigns targeting teenagers are fueling awareness and aspiration. Expansion of skate parks and urban sports infrastructure supports active participation. Collaborations with local influencers and celebrity endorsements enhance brand penetration and popularity.

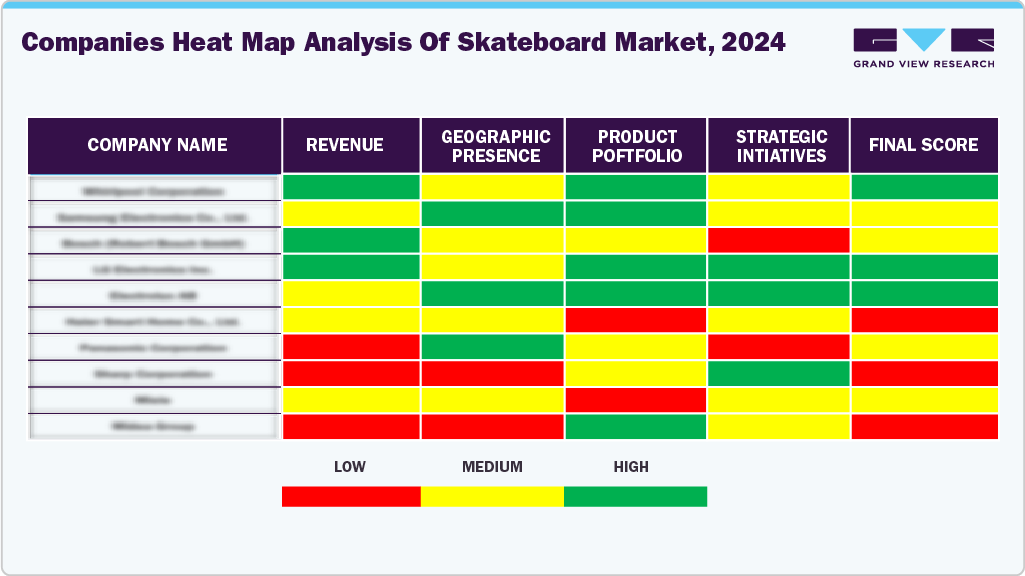

Key Skateboard Company Insights

Brands in the global skateboard industry are tapping into untapped opportunities by introducing innovative designs, offering greater customization, and aligning marketing strategies with evolving consumer preferences. By catering to niche segments and emerging trends, they aim to boost market share and enhance their global competitive positioning.

Key Skateboard Companies:

The following are the leading companies in the global skateboard market. These companies collectively hold the largest market share and dictate industry trends.

- Boardriders

- Krown Skateboards

- Sk8factory

- Skate One

- Absolute Board Co.

- Alien Workshop

- Zero Skateboards

- CONTROL SKATEBOARDS INC.

- Razor USA LLC

- Almost Skateboards

Recent Developments

-

In September 2024, UDITER launched the Pixel Rider, which is claimed to be the world’s first electric skateboard featuring a deck with a fully customizable LED screen for personal expression.

-

In June 2024, Santa Cruz Skateboards and Jägermeister, a German herbal liqueur brand, collaborated to launch a strictly limited three‑piece skateboard and apparel capsule collection, centred on a re‑issue of the “Kendall Deck”.

-

In June 2024, the Canadian national skateboarding body Canada Skateboard partnered with OVO (the lifestyle brand founded by Drake) to design limited-edition uniforms and apparel for Canadian skateboarders heading to the Paris 2024 Olympics.

Skateboard Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 3.76 billion

Revenue Forecast in 2033

USD 4.63 billion

Growth rate

CAGR of 2.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; Brazil; UAE; South Africa

Key companies profiled

Boardriders; Krown Skateboards; Sk8factory; Skate One; Absolute Board Co.; Alien Workshop; Zero Skateboards; CONTROL SKATEBOARDS INC.; Razor USA LLC; Almost Skateboards

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Skateboard Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global skateboard market report based on the product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Street Board

-

Cruiser Board

-

Long Board

-

Electric Board

-

Others (Classic, Roll Away, Old School) (Classic, Roll Away, Old School)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Kids (0-9)

-

Teenagers (12-17)

-

Adults (18 & above)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The street board market accounted for a revenue share of 44.2% in 2024, driven by rising youth participation in action sports and the growing influence of social media culture, the street board (skateboard) market is seeing strong momentum.

b. Some key players operating in the skateboard market include Boardriders, Krown Skateboards, Sk8factory, Skate One, Absolute Board Co., Alien Workshop, Zero Skateboards, CONTROL SKATEBOARDS INC., Razor USA LLC, and Almost Skateboards.

b. Key factors driving growth in the skateboard market include increasing youth engagement in action and adventure sports and the rising popularity of skateboarding as a mainstream recreational activity. Expanding urban skate parks, supportive government initiatives promoting outdoor sports, and stronger representation in global events such as the Olympics are further boosting demand.

b. The global skateboard market size was estimated at USD 3.56 billion in 2024 and is expected to reach USD 3.76 billion in 2025.

b. The global skateboard market is expected to grow at a compound annual growth rate (CAGR) of 2.6 % from 2025 to 2033 to reach USD 4.63 billion by 2033.

b. The U.K. skateboard market is expected to grow at a compound annual growth rate of 2.9% from 2025 to 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.