- Home

- »

- Digital Media

- »

-

Skill Gaming Market Size And Share, Industry Report, 2030GVR Report cover

![Skill Gaming Market Size, Share & Trends Report]()

Skill Gaming Market (2025 - 2030) Size, Share & Trends Analysis Report By Game Genre, By Skill Type (Physical, Mental), By Gaming Platform (Desktop, Mobile, Console, VR, AR), By Revenue Model, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-624-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Skill Gaming Market Summary

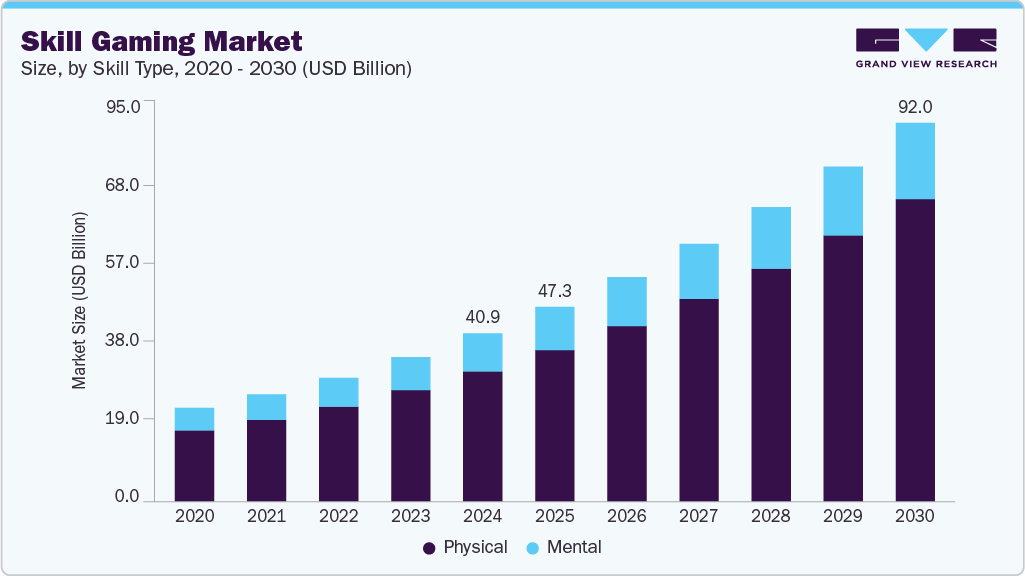

The global skill gaming market size was estimated at USD 40.85 billion in 2024 and is projected to reach USD 92.03 billion by 2030, growing at a CAGR of 14.2% from 2025 to 2030. The market is witnessing rapid growth, driven by the increasing popularity of mobile-based gaming platforms, rising internet penetration, and the growing demand for real-money competitions that emphasize player skill over chance.

Key Market Trends & Insights

- The Asia Pacific skill gaming market accounted for the largest market share of over 52% in 2024.

- U.S. dominated the North America skill gaming market with a share of over 67% in 2024.

- Based on game genre, the card-based segment dominated the market with a market share of over 34% in 2024.

- Based on skill type, the physical segment accounted for the highest market share in 2024.

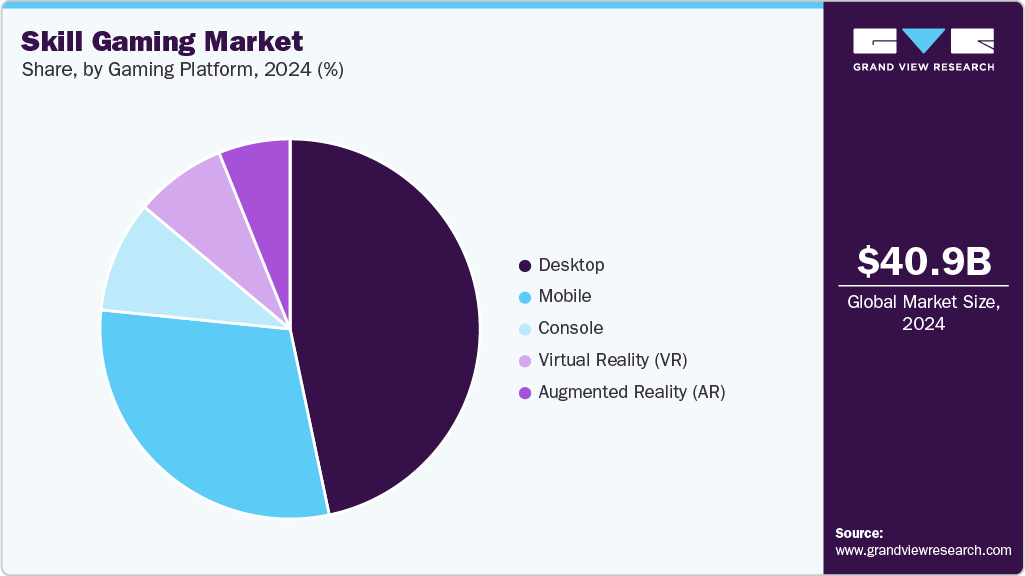

- Based on gaming platform, the desktop segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 40.85 Billion

- 2030 Projected Market Size: USD 92.03 Billion

- CAGR (2025-2030): 14.2%

- Asia Pacific: Largest market in 2024

Key trends shaping the market include the gamification of learning and entertainment, integration of blockchain for secure transactions and transparent gameplay, and the proliferation of esports and skill-based tournaments In addition, technological advancements such as AI-powered matchmaking and real-time analytics are enhancing player experience and engagement across platforms.The skill gaming Industry is rapidly pivoting toward real-money competitions and entry-fee tournaments as a primary revenue model. Secure payment infrastructure and rigorous compliance frameworks are fostering user trust and facilitating higher conversion rates. This monetization strategy significantly boosts user engagement and drives up average revenue per user (ARPU), minimizing dependency on in-app advertising. Financial incentives are strengthening user retention and broadening the monetizable audience base.

Widespread mobile penetration and the rollout of 5G networks are compelling companies in the skill gaming industry to adopt mobile-first development strategies. To meet the expectations of mobile-centric users, platforms are refining game mechanics, interfaces, and graphics for optimal smartphone performance, particularly in regions where mobile dominates digital consumption. Mobile-native platforms outperform traditional web-based models in user acquisition and session engagement. As a result, mobile optimization is now a strategic priority for scaling and maintaining competitiveness in the global skill gaming ecosystem.

The rising demand for personalized engagement is prompting the skill gaming industry to integrate AI-driven recommendation engines across platforms. By analyzing individual behavior, player skill, and gameplay trends, companies are curating tailored experiences that include customized challenges, rewards, and content offerings. This level of personalization increases user satisfaction, extends playtime, and enhances platform stickiness. Firms investing in intelligent matchmaking and adaptive content delivery are securing long-term retention and monetization advantages in the skill gaming market.

Governments in both mature and emerging economies are increasingly distinguishing games of skill from games of chance, creating regulatory clarity that benefits the skill gaming industry. This favorable shift allows operators to scale operations while ensuring compliance with local legal frameworks. Progressive digital gaming policies are attracting institutional investors and unlocking market expansion opportunities. Transparent and skill-based governance is becoming a competitive edge, strengthening industry credibility and enabling sustainable growth trajectories.

Fantasy sports are a major growth vector in the skill gaming industry, with strong traction in countries such as India, the U.S., and various European markets. These platforms combine sports knowledge and strategic decision-making, aligning with legal definitions of skill-based play. Seasonal sports calendars ensure recurring user participation and sustained platform activity. Fantasy formats are diversifying to include basketball, MMA, and eSports, further deepening user engagement.

Game Genre Insights

The card-based segment dominated the market with a market share of over 34% in 2024. The widespread availability of affordable smartphones and faster internet connectivity has enabled seamless access to mobile-based card skill games. Consumers across emerging economies are becoming active participants in digital card gaming ecosystems. This accessibility is encouraging new entrants and startups to develop localized content to tap into regional preferences. As mobile gaming continues to dominate, the card-based skill gaming segment is expected to maintain strong growth momentum globally.

The puzzle games segment is expected to witness the highest CAGR of over 15% from 2025 to 2030, driven by rising demand for brain-training and educational entertainment. Puzzle games emerge as a preferred format for skill development. These games offer value beyond entertainment by enhancing memory, logic, and attention skills in a fun format. Parents, educators, and lifelong learners are adopting puzzle-based platforms as tools for supplementary cognitive training. This shift is encouraging developers to integrate educational content into engaging puzzle frameworks.

Skill Type Insights

The physical segment accounted for the highest market share in 2024, driven by the resurgence of in-person entertainment. Physical skill games are witnessing a strong revival in arcades, malls, and entertainment venues. Consumers are actively seeking interactive, social, and hands-on experiences that extend beyond what digital-only platforms can offer. Family entertainment centers and bar arcades are leveraging this demand by incorporating physical skill games to increase visitor engagement and drive revenue growth. Operators are modernizing classic formats with digital scoring systems and multiplayer capabilities to enhance the competitive appeal and user experience.

The mental segment is expected to witness a significant CAGR from 2025 to 2030. Gamified logic and reasoning platforms are witnessing strong traction among students, professionals, and lifelong learners. These user segments are increasingly favoring cognitively engaging games over passive entertainment. The market is seeing a clear shift toward high-value, time-efficient formats that combine stimulation with measurable outcomes. This trend is accelerating product innovation in mental skill gaming, emphasizing consistency, performance, and user retention.

Gaming Platform Insights

The desktop segment accounted for the largest market share in 2024, driven by the growing demand for structured, professional gaming ecosystems. Desktop platforms remain the top choice for tournaments, ranked matches, and skill-based competitions. Their superior hardware stability and reliable performance appeal strongly to serious and competitive gamers. The rise in organized gaming events and leaderboard-centric gameplay formats is significantly increasing daily active user engagement. This momentum is unlocking new monetization avenues through premium subscriptions and in-game currency transactions.

The virtual reality (VR) segment is expected to witness a significant CAGR from 2025 to 2030. VR skill games are rapidly evolving with real-time multiplayer capabilities that enhance social and competitive interaction. The immersive blend of physical presence and digital gameplay is attracting users seeking differentiated and engaging skill-based experiences. This trend is accelerating the expansion of VR e-sports and collaborative challenge formats. To support this growth, industry players are scaling infrastructure to enable high-volume VR tournaments and league-based ecosystems.

Revenue Model Insights

The entry fees segment accounted for the largest market share in 2024, owing to the growing demand for seamless user experiences, players now expect hassle-free and instant payment options for contest entry fees. Integration of digital wallets, UPI, and multiple payment gateways is no longer optional but a baseline requirement to reduce transaction friction. In response, platforms are prioritizing investments in fraud detection and regulatory compliance to ensure secure, trustworthy transactions. A robust and secure payment infrastructure is critical to support the rapid scaling of entry fee–based skill gaming ecosystems.

The in-game purchases segment is expected to witness the highest CAGR from 2025 to 2030, driven by the growing demand for competitive advantage and enhanced gameplay. In-game purchases for power-ups and performance upgrades are becoming central to user engagement. Players are increasingly willing to invest in items that deliver strategic value without compromising fairness. To meet this expectation, platforms are developing transparent monetization frameworks that maintain game balance and prevent "pay-to-win" perceptions. This is reinforcing the adoption of skill-based matchmaking and ethical in-game purchase models as industry standards.

Regional Insights

The North America skill gaming market accounted for a significant share of 23% in 2024, driven by rising consumer preference for competitive mobile gaming. Platforms are innovating with real-time multiplayer and cash prize tournaments. Increasing legalization and regulation of skill-based games across multiple states are creating a more secure environment for operators. In addition, partnerships between gaming companies and sports leagues enhance user engagement through integrated fantasy and eSports experiences.

U.S. Skill Gaming Market Trends

The U.S. skill gaming market dominated the market with a share of over 67% in 2024, owing to the legalization of online skill-based wagering in several states, the market is witnessing significant monetization opportunities. Advanced AI-driven personalization and fraud detection systems are enhancing player trust and engagement. The growing integration of eSports with traditional skill games is creating hybrid competitive formats that attract sponsorships.

Europe Skill Gaming Market Trends

Europe skill gaming market is expected to grow at a CAGR of over 11% from 2025 to 2030, primarily driven by diverse regulatory environments, companies are tailoring localized product offerings to comply with specific market requirements. The rise of fantasy sports across multiple countries is fueling user acquisition and retention. Investments in blockchain are gaining momentum to ensure transparency and enhance digital asset ownership.

The skill gaming market in UKis expected to grow at a significant rate in the coming years. The rising demand for skill-based social gaming platforms is driving user engagement, particularly among younger demographics seeking community interaction. Enhanced data privacy regulations are prompting operators to invest heavily in secure, transparent user data management systems to maintain compliance and consumer trust.

The Germany skill gaming market is driven by newly implemented licensing frameworks; operators are adapting business models to meet compliance standards. The increasing popularity of educational and cognitive training games reflects rising consumer interest in gamified learning. Corporate adoption of gamification for employee training is opening additional B2B revenue streams.

Asia Pacific Skill Gaming Market Trends

The Asia Pacific skill gaming market accounted for the largest market share of over 52% in 2024 and is expected to grow at the highest CAGR of over 15% from 2025 to 2030, owing to exponential smartphone penetration and expanding internet access in emerging markets, user base growth is robust. Regional operators are focusing on hyper-casual and short-session skill games tailored for mobile users. Regulatory evolution in countries such as India and Southeast Asia is shaping market entry strategies.

The skill gaming market in China is gaining traction, driven by the government’s focus on digital wellness, developers are incorporating features that promote responsible gaming and limit playtime. The rising influence of livestreaming and influencer marketing is accelerating user acquisition and retention through real-time interaction and community-building.

The Japan skill gaming market is rapidly expanding, owing to the strong culture of competitive gaming, skill-based tournaments with significant prize pools are attracting both casual and professional players. The integration of AR (Augmented Reality) technologies is enhancing immersive gameplay, creating new user engagement opportunities across skill-based formats.

Key Skill Gaming Company Insights

Some of the key players operating in the market are Playtika and DraftKings among others.

-

DraftKings is a leader in daily fantasy sports and skill-based sports betting, leveraging users’ knowledge and strategic decision-making. The company has expanded into casino-style and mobile skill games, offering interactive formats with real-money incentives. DraftKings thrives on its ability to combine sports knowledge with gaming to create competitive, skill-driven user experiences.

-

Playtika specializes in mobile-first social and skill-based games, particularly in the puzzle and card segments, such as Solitaire and Bingo Blitz. The company emphasizes player retention and monetization through engaging, competitive formats. It has built a strong presence in the casual skill gaming space with its data-driven development and gamification strategies.

-

Niantic and Scopely are some of the emerging market participants in the skill gaming market.

-

Scopely is rapidly emerging in the mobile gaming space with a growing portfolio of interactive, competitive games like Scrabble GO and Star Trek Fleet Command. The company blends strategic gameplay with social competition, tapping into skill elements that drive user engagement. Scopely is known for acquiring and scaling IP-based games with skill-driven mechanics.

-

Niantic gained global fame with Pokémon GO and continues to innovate with augmented reality and geolocation-based skill games. The company's games emphasize real-world movement and user strategy, bridging physical activity with digital skill-based play. Niantic is pushing the boundaries of skill gaming into immersive and experiential formats.

Key Skill Gaming Companies:

The following are the leading companies in the skill gaming market. These companies collectively hold the largest market share and dictate industry trends.

- Skillz

- DraftKings

- FanDuel

- Playtika

- Zynga (Take-Two Interactive)

- Activision Blizzard

- Ubisoft

- Electronic Arts (EA)

- Supercell

- Tencent Games

- Niantic

- Scopely.

Recent Developments

-

In April 2025, Papaya, a UK-based mobile gaming platform, announced a strategic partnership with the U.S.-based nonprofit National Institute for Play (NIFP) to promote the benefits of play for adult mental and physical wellbeing. Papaya, known for its skill-based mobile games like Bingo and Solitaire, has experienced rapid growth with over 30 million downloads and 15 million daily tournaments. The collaboration aims to raise awareness about the science-backed advantages of play, such as stress reduction and increased optimism, through upcoming campaigns.

-

In April 2025, Caesars Entertainment expanded its strategic partnership with AGS (American Gaming Systems) to bring the popular Triple Coin Treasures slot series to its online casino platforms, marking their exclusive digital debut. The collaboration includes the launch of Shamrock Fortunes, previously available only at Caesars' land-based casinos, and plans for additional releases such as a Caesars-branded version of a classic AGS game and new titles launching simultaneously online and in physical locations. These offerings will be accessible through Caesars Palace Online Casino, Caesars Sportsbook & Casino, and Horseshoe Online Casino, with integrated promotions and loyalty rewards via the Caesars Rewards program.

-

In March 2025, OneVerse, a metaverse and gaming technology company, partnered with online poker platform Poker Dangal to expand its real-money gaming (RMG) portfolio. This collaboration integrates Poker Dangal's services into the OneVerse platform, enabling players to participate in both free and paid online poker tournaments. The partnership aims to enhance game development and player engagement, contributing to the growth of India's online gaming ecosystem.

-

In February 2025, Head Digital Works (HDW), the parent company of gaming platform A23, acquired Deltatech Gaming, the operator of online poker platform Adda52, for USD 57.5 million in a strategic two-phase transaction. The acquisition aims to strengthen HDW’s presence in the online poker market by combining Adda52’s advanced technology and extensive user base with A23’s platform capabilities, thereby enhancing the overall gaming experience. This integration is expected to accelerate the growth of skill gaming in India by providing more robust, technology-driven, and engaging skill-based gaming options to a wider audience.

Skill Gaming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.30 billion

Revenue forecast in 2030

USD 92.03 billion

Growth rate

CAGR of 14.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Game genre, skill type, gaming platform, revenue model, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Skillz; DraftKings; FanDuel; Playtika; Zynga (Take-Two Interactive); Activision Blizzard; Ubisoft; Electronic Arts (EA); Supercell; Tencent Games; Niantic; Scopely.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Skill Gaming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the skill gaming market report based on game genre, skill type, gaming platform, revenue model, and region:

-

Genre Outlook (Revenue, USD Billion, 2018 - 2030)

-

Card-Based

-

Puzzle Games

-

Tile-Based

-

Board-Based

-

Word or Number-Based

-

Dice-Based

-

Others

-

-

Skill Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Physical

-

Mental

-

-

Gaming Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Desktop

-

Mobile

-

Console

-

Virtual Reality (VR)

-

Augmented Reality (AR)

-

-

Revenue Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Entry Fees

-

Subscription Fees

-

In-Game Purchases

-

Advertising

-

Other Revenue Models

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Middle East & Africa

-

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global skill gaming market size was estimated at USD 40.85 billion in 2024 and is expected to reach USD 47.30 billion in 2025.

b. The global skill gaming market is expected to grow at a compound annual growth rate of 14.2% from 2025 to 2030 to reach USD 92.03 billion by 2030.

b. The Asia Pacific skill gaming market accounted for the largest market share of over 52% in 2024 and is expected to grow at the highest CAGR of over 15% from 2025 to 2030, owing to exponential smartphone penetration and expanding internet access in emerging markets, user base growth is robust

b. Some key players operating in the skill gaming market include Skillz, DraftKings, FanDuel, Playtika, Zynga (Take-Two Interactive), Activision Blizzard, Ubisoft, Electronic Arts (EA), Supercell, Tencent Games, Niantic, and Scopely.

b. The key factors driving the skill gaming market include the increasing popularity of mobile-based gaming platforms, rising internet penetration, and the growing demand for real-money competitions that emphasize player skill over chance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.