- Home

- »

- Medical Devices

- »

-

Small Molecule Drug Discovery Outsourcing Market Report, 2033GVR Report cover

![Small Molecule Drug Discovery Outsourcing Market Size, Share & Trends Report]()

Small Molecule Drug Discovery Outsourcing Market (2025 - 2033) Size, Share & Trends Analysis Report By Workflow (Target Identification & Screening, Preclinical Development), By Service, By Therapeutics Area, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-672-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Molecule Drug Discovery Outsourcing Market Summary

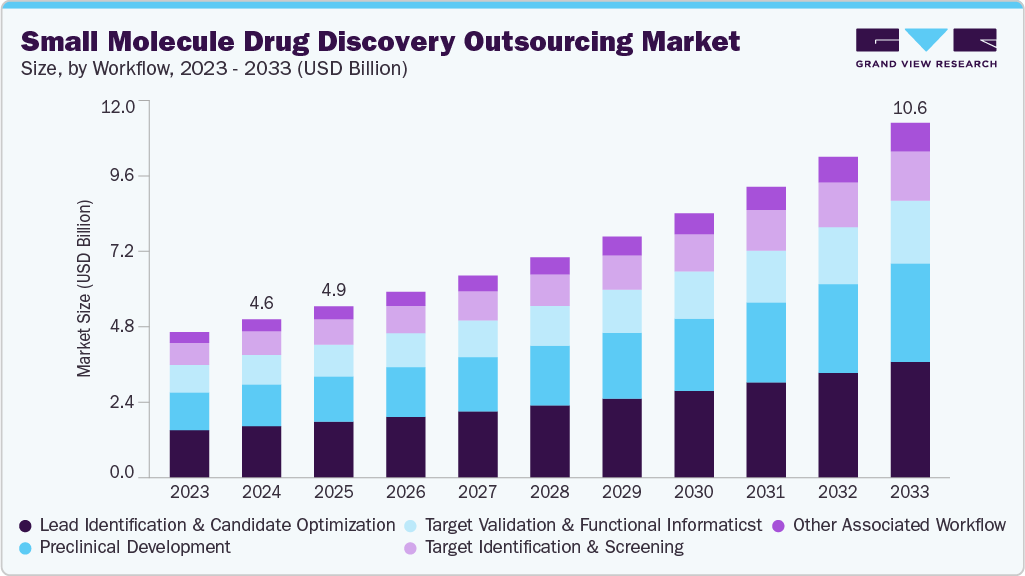

The global small molecule drug discovery outsourcing market size was estimated at USD 4.55 billion in 2024, and is projected to reach USD 10.62 billion by 2033, growing at a CAGR of 10.03% from 2025 to 2033. Rising research and development expenses, an increasing need for drug development, and a transition toward virtual pharmaceutical models drive the market.

Key Market Trends & Insights

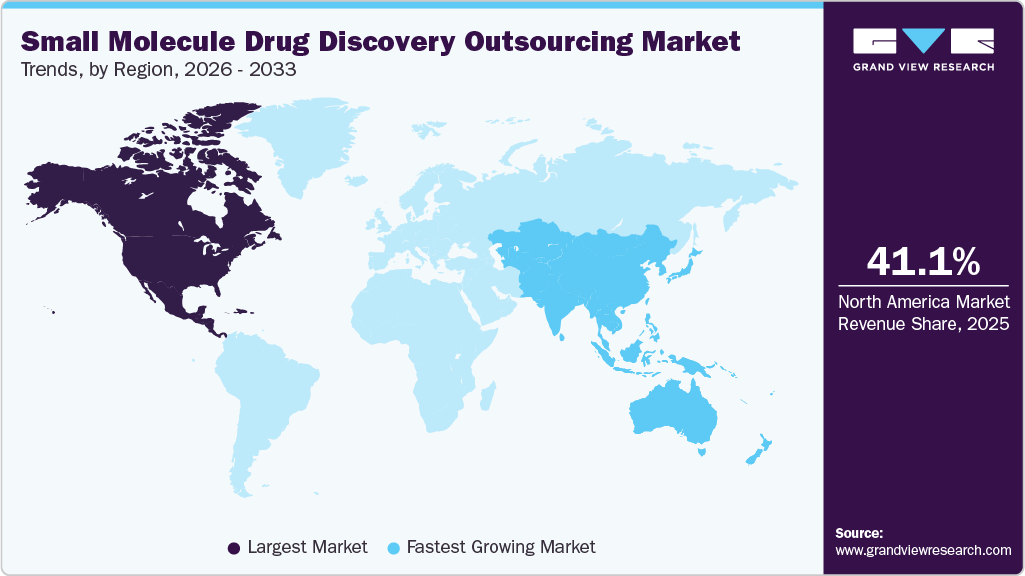

- North America small molecule drug discovery outsourcing market held the largest share of 41.16% of the global market in 2024.

- The small molecule drug discovery outsourcing in the U.S. is expected to grow significantly over the forecast period.

- Based on workflow, the lead identification & candidate optimization segment held the highest market share of 32.19% in 2024.

- Based on service, the chemistry services segment held the highest market share in 2024.

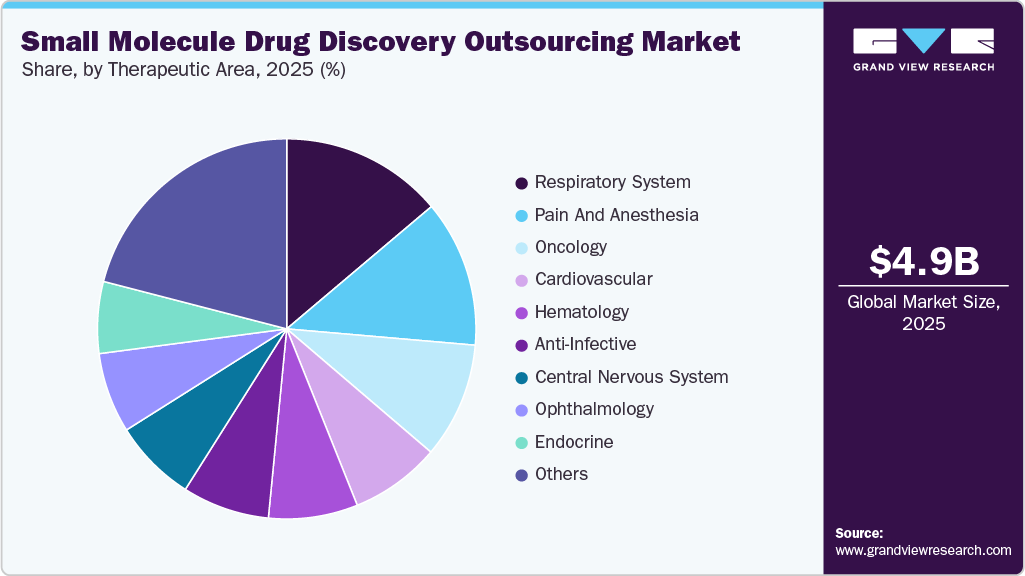

- By therapeutics area, the respiratory system segment held the highest market share in 2024.

- Based on end use, the pharmaceutical & biotechnology companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.55 Billion

- 2033 Projected Market Size: USD 10.62 Billion

- CAGR (2025-2033): 10.03%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Some other factors contributing to market growth are a rising number of registered studies, growing approval of small molecule drugs, advancements in medical technology, an upsurge in diseases under investigation, and the imperative for novel treatments. Currently, small molecule drugs have been the cornerstone of the pharmaceutical industry. These organic compounds, characterized by their low molecular weight, offer several advantages as therapeutic agents. These molecules provide advantages such as high oral bioavailability, adaptable dosing regimens, and the capability to engage intracellular pathways, making them applicable to a broad spectrum of diseases, particularly in areas like cancer, infections, and neurological disorders.

Besides, drug discovery plays a crucial role in developing these small molecule drugs, encompassing complex stages and cutting-edge technologies to formulate effective therapies and accelerate R&D pipelines. Thus, many pharmaceutical and biopharmaceutical companies are increasingly partnering with outsourcing companies specializing in the expertise to manage early discovery phases, including target identification, hit-to-lead processes, lead optimization, and the approval process. For instance, in 2024, the U.S. FDA Center for Drug Evaluation and Research approved 50 new molecular entities, consisting of 32 chemical entities & 18 biologic entities. Besides, of the NCEs, small molecules gained major attention and share, making up 91% (31 drugs), with the remaining drugs comprising peptides and nucleic acids.

Moreover, outsourcing in the pharmaceutical industry is gaining momentum as companies recognize the benefits of acquiring additional competencies essential for successful drug development and commercialization. Outsourcing provides specialized expertise, helps improve cash flow management, and offers significant manufacturing advantages, including reducing investment risks. Besides, developing costly in-house capabilities for early-stage technologies and products involves considerable risks throughout development. These factors have led to outsourcing as an emerging risk-averse alternative for product innovations. Moreover, companies often face challenges in determining the necessary scale for current and future product offerings or market penetration, complicating the design and scaling of in-house manufacturing. As a result, outsourcing has become a preferred option for product innovation.

Furthermore, innovative technologies, the rising prevalence of chronic and infectious diseases, and the growing need for new therapies support market growth. Advances such as artificial intelligence, machine learning, and high-throughput screening are streamlining the hit identification and lead optimization processes, supporting the market growth. Also, the advancement of precision medicine and AI-driven screening methods has further enhanced the efficiency of the discovery process. Similarly, advancements in drug design, predictive modeling, and precision medicine are enhancing the contributions of outsourcing partners in the early stages of drug discovery and development. Such factors are expected to drive the market growth over the estimated time period.

Opportunity Analysis

The small molecule drug discovery outsourcing industry is experiencing significant growth opportunities driven by the increasing complexity of drug research, a rising demand for cost-effective innovations, and a shift towards virtual pharmaceutical models. As global drug pipelines expand, more companies outsource early-stage activities such as target validation, hit identification, and lead optimization to specialized contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs). This strategy aims to accelerate development timelines and reduce fixed costs. Moreover, the market has a major opportunity to apply AI-powered drug discovery platforms, which enhance the efficiency of candidate screening and selection.

Besides, the growing focus on rare diseases, oncology, and central nervous system (CNS) disorders drives demand for high-throughput and personalized discovery methods, creating new growth opportunities for specialized CROs. Furthermore, emerging regions like India, China, and Eastern Europe are becoming attractive outsourcing destinations due to their skilled workforce and cost advantages. In addition, regulatory harmonization fuels the collaboration across borders. Also, mid-sized biotech firms lacking internal capabilities increasingly turn to comprehensive outsourcing solutions. Similarly, a rise in venture capital investment and strategic partnerships between CROs and pharmaceutical companies is accelerating innovation in the market. Integrating digital tools, predictive modeling, and rapid synthesis techniques positions outsourcing as a pivotal element in the future landscape of small molecule drug discovery.

Impact of U.S. Tariffs on the Global Small Molecule Drug Discovery Outsourcing Market

The implementation of U.S. tariffs on imported goods, notably from countries like China, has affected the global small molecule drug discovery outsourcing industry in various ways. Many pharmaceutical and biotech companies in the U.S. depend on CROs in China and India for early-stage drug discovery due to their cost advantages and technical proficiency. However, introducing tariffs has increased costs for raw materials, reagents, and laboratory equipment obtained from these regions, thereby increasing operational expenses for both U.S. companies and their overseas partners. This factor has led companies to reassess their supply chain strategies and consider diversifying their outsourcing options to avoid regions impacted by tariffs.

However, in response to U.S. tariffs, many organizations are relocating parts of their discovery operations to countries such as India, Eastern Europe, and Southeast Asia, which remain unaffected by U.S. tariffs. In addition, domestic CROs are finding a slight competitive edge as pharmaceutical clients look to decrease their exposure to international trade uncertainties. Thus, this trend has not completely alleviated the financial strain caused by higher import duties and logistics delays. Overall, the tariffs have accelerated the strategic evaluations of outsourcing models, encouraging the development of regional partnerships, dual sourcing strategies, and nearshoring alternatives to enhance resilience in global early-stage drug discovery operations.

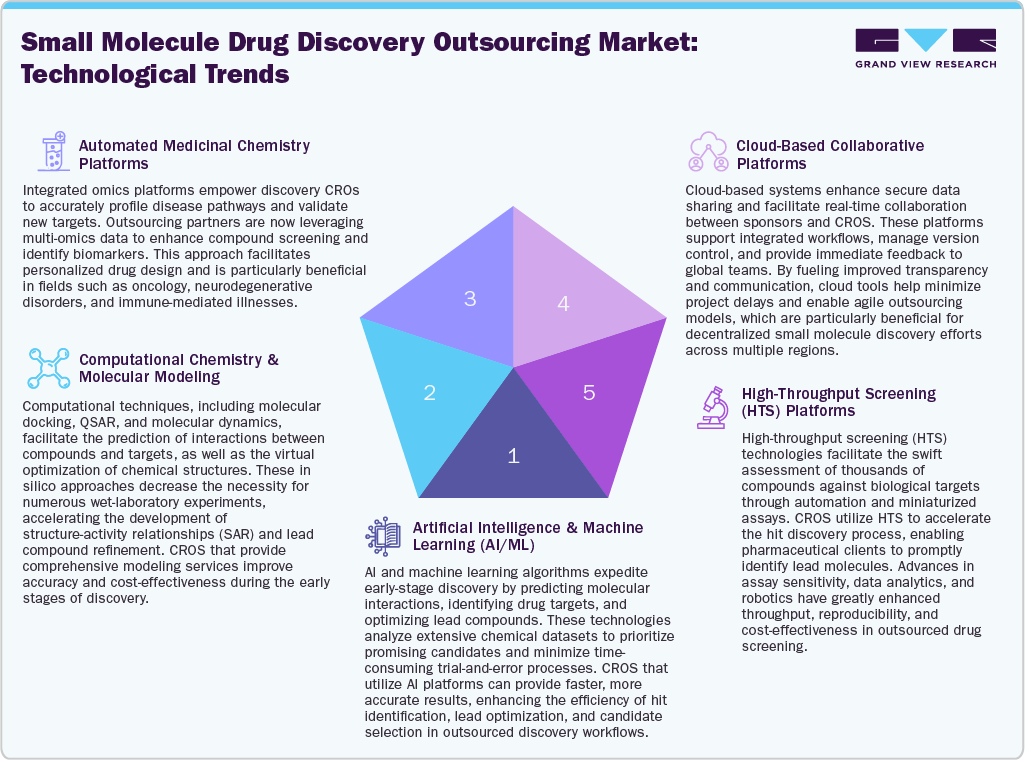

Technological Advancements

Technological advancements are revolutionizing small molecule drug discovery outsourcing, making research faster, more efficient, and cost-effective. Key innovations in Artificial Intelligence and Machine Learning (AI/ML) are pivotal, as they enhance the prediction of target-ligand interactions, analyze intricate datasets, and optimize compound libraries. This significantly speeds up hit identification and lead optimization processes. Besides, high-throughput screening (HTS) is another critical factor allowing CROs to assess compounds using automated, miniaturized assays, thereby improving the success rates of hit discovery. Moreover, cloud-based collaborative platforms facilitate real-time data sharing, project tracking, and communication between sponsors and CROs, which promotes transparency & accelerates decision-making across global teams.

In addition, computational chemistry and molecular modeling tools assist in virtual screening and lead refinement by predicting how compounds behave, reducing reliance on lengthy lab procedures. Moreover, automated medicinal chemistry platforms streamline the process by optimizing compound synthesis and reaction processes through robotics and AI-driven systems, enabling rapid Structure-Activity Relationship (SAR) cycles. For instance, in October 2024, AION Labs announced the launch of ProPhet, a startup leveraging artificial intelligence to improve small molecule identification in drug discovery. The company aims to streamline and advance early-stage drug development by targeting proteins while significantly reducing the time and cost associated with identifying potential drug candidates for these targets.

Thus, these technologies empower outsourcing providers to produce high-quality results, shorten development timelines, and offer scalable solutions to pharmaceutical and biotech clients seeking innovation in small molecule discovery. They facilitate agile, data-driven strategies, positioning CROs as essential partners in expediting preclinical pipelines and enhancing overall R&D productivity.

Pricing Model Analysis

The market offers a variety of pricing models designed to suit project scope, risk-sharing requirements, and service complexity. Milestone-based pricing links payments to specific R&D milestones such as target validation or lead optimization. This model supports accountability and aligns the incentives of Contract Research Organizations (CROs) with sponsors' objectives. The fixed-fee model is suitable for tasks such as compound synthesis, providing budget certainty; however, it offers limited flexibility for any changes in the project. While less prevalent, value-based pricing connects compensation to measurable scientific or commercial outcomes, promoting high performance and innovation, especially in high-value therapeutic areas. However, it requires effective performance metrics and a high level of trust between partners.

Moreover, the subscription or retainer model allows sponsors to pay a recurring fee for ongoing access to CRO expertise and infrastructure, which is particularly beneficial for virtual pharma companies and biotechs that seek flexible, long-term collaboration. Thus, sponsors are increasingly adopting a blend of these pricing models to effectively balance cost, performance, and risk throughout the drug discovery process.

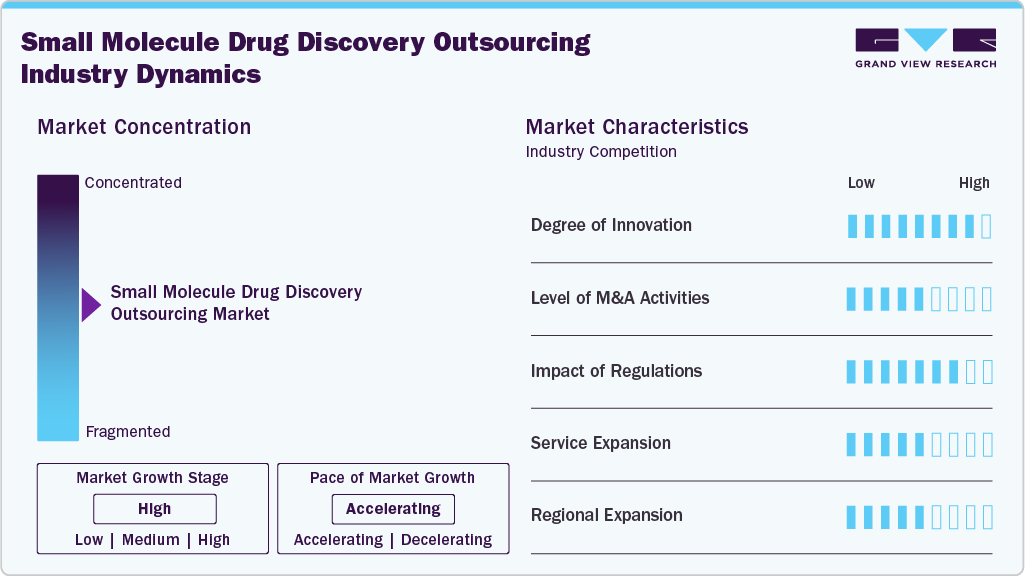

Market Concentration & Characteristics

The small molecule drug discovery outsourcing industry is in a moderate growth stage, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

The landscape of small molecule drug discovery outsourcing is evolving, driven by advancements in AI-powered screening, structure-based design, and predictive analytics. Contract Research Organizations (CROs) increasingly use digital platforms, machine learning, and automation to improve the processes of hit identification and lead optimization. In addition, by incorporating multi-omics data and computational chemistry techniques, the discovery of new compounds is accelerated, resulting in shorter time-to-market and enhanced quality and success rates of drug candidates.

The number of mergers and acquisitions is increasing as Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) seek to broaden their discovery capabilities and expand their geographical reach. Larger companies are acquiring specialized companies that provide AI technologies, early-stage discovery assets, or significant therapeutic knowledge. These factors further improve service offerings, optimize operations, and enhance relationships with clients, fueling comprehensive outsourcing solutions and boosting market competitiveness in discovery, development, and regulatory services.

Global regulatory bodies such as the FDA, EMA, and PMDA strongly focus on data integrity, reproducibility, and adherence to compliance standards in early-stage discovery efforts. As a result, CROs are increasingly investing in robust quality systems, validated platforms, and secure data management practices. The alignment of ICH and GxP guidelines enhances transparency, promotes cross-border collaborations, and allows for quicker regulatory approvals for outsourced preclinical discovery initiatives.

CROs are broadening their service offerings from fundamental medicinal chemistry to comprehensive drug discovery, which now encompasses AI modeling, in silico ADMET, bioassays, and studies that facilitate Investigational New Drug (IND) applications. Incorporating platform technologies such as high-throughput screening and synthetic biology enables sponsors to utilize a range of capabilities in a single location. This extensive service expansion improves operational efficiency and accommodates intricate discovery processes in therapeutic fields like oncology and central nervous system disorders.

Outsourcing providers are increasingly expanding into Asia Pacific, Eastern Europe, and Latin America to address growing demand and reduce geopolitical risks. In addition, countries such as India and China are at the forefront regarding capacity and cost-effectiveness, while Eastern Europe provides advantageous access to EU markets. At the same time, CROs based in the U.S. and EU are enhancing their domestic operations to align with reshoring trends. This regional expansion further enhances global presence and supply chain resilience.

Workflow Insights

On the basis of workflow segment, in 2024, the lead identification & candidate optimization segment dominated the market, accounting for a revenue share of 32.19%. The segment growth is driven by higher R&D costs, demand for faster timelines, the growing adoption of AI technology, complex therapies, and the rising demand for high-quality preclinical candidates. Besides, this stage plays a major role for contract research organizations (CROs) in assisting pharmaceutical companies in identifying and improving promising compounds, further supporting market growth. Moreover, the growing need for therapies in oncology, CNS disorders, and infectious diseases is driving the market. In addition, CROs utilize lead identification and candidate optimization, high-throughput screening, and computational chemistry to identify active molecules and improve their drug-like characteristics. Thus, the rising drug targets and the requirement for faster preclinical development are expected to drive the market over the estimated time period.

On the other hand, the preclinical development segment is expected to grow at a CAGR of 10.69% over the forecast period. Preclinical development plays a crucial role in outsourcing small molecule drug discovery, focusing on assessing safety, toxicity, and pharmacokinetics before clinical trials. This phase is increasingly outsourced due to the rising complexity of regulatory requirements, cost constraints, and the need for expedited Investigational New Drug (IND) submissions. Besides, pharmaceutical and biotech companies collaborate with Contract Research Organizations (CROs) to leverage specialized expertise, access advanced in vivo models, and utilize GLP-compliant facilities. Moreover, factors such as increased pipeline activity, an emphasis on rare and complex diseases, and the transition toward virtual R&D models are expected to support the market growth. Thus, by outsourcing pre-clinical development, companies can achieve greater flexibility, reduce risk, and accelerate the progression of drug candidates into human trials. Such factors are expected to drive market growth.

Service Insights

On the basis of service segment, the market is segmented into chemistry services and biology services. In 2024, the chemistry services segment dominated the market, attributed to the increasing complexity of drug design and the need for rapid synthesis of diverse chemical libraries. Chemistry services play a vital role in small molecule drug discovery outsourcing, encompassing hit synthesis, lead optimization, and custom compound development. By outsourcing, pharmaceutical and biotech companies can leverage the expertise of skilled chemists, access scalable infrastructure, and utilize specialized technologies, all without making significant internal investments. Moreover, cost efficiency, shorter development timelines, and a growing emphasis on complex therapeutic areas such as oncology are expected to support market growth. Furthermore, with the growing number of virtual pharma models, the chemistry outsourcing services are expected to support market growth.

On the other hand, the biology services segment is expected to grow significantly during the forecast period. Biology services in small molecule drug discovery outsourcing encompass target validation, assay development, mechanism-of-action studies, and both in vitro and in vivo efficacy testing. These services are widely used to assess the biological relevance and understanding of the nature of drugs. Besides, the growing demand for specialized disease models, the increasing complexity of therapeutic targets, and the necessity for preclinical decisions propel the trend towards outsourcing companies. Moreover, pharmaceutical and biopharmaceutical companies are turning to contract research organizations (CROs) to gain access to advanced bioassays, cell-based platforms, and translational models, particularly in fields such as oncology and central nervous system disorders. This strategy facilitates cost-effective, flexible, and data-driven drug discovery processes, further supporting the market growth.

Therapeutics Area Insights

Based on therapeutics area segment, the respiratory system segment accounted for the largest market share in 2024. The respiratory therapeutic area in small molecule drug discovery outsourcing is expanding due to rising cases of asthma, COPD, pulmonary hypertension, and post-COVID complications. Chronic Respiratory Diseases (CRDs) have increased globally, which has led pharmaceutical and biopharmaceutical companies to rely on CROs and CDMOs for expertise in pulmonary models, inhalation delivery, and biomarker-based screening. Moreover, factors such as the rising need for targeted therapies, faster development timelines, and regulatory demands for safety are expected to support the market over the estimated time period. Technological advancements and novel drug development approaches are further enabling faster, more effective discovery of respiratory treatments, supporting efficiently addressing the growing global burden of respiratory diseases.

The oncology segment is expected to grow significantly during the forecast period. Oncology continues to be a major area of focus in small molecule drug discovery outsourcing, driven by the significant global cancer burden and the pressing demand for targeted therapies. Pharmaceutical companies often outsource to leverage specialized cancer biology platforms, biomarker-driven screening processes, and innovative compound libraries. Key factors motivating this trend include increasing R&D costs, the complexities of tumor biology, and the growing need for personalized treatment options. Contract Research Organizations (CROs) provide advanced in vitro and in vivo oncology models, facilitating quicker lead identification and optimization while mitigating risks in the early stages of drug development. Moreover, private players provide biochemical, biophysical, and cellular assay systems for oncology targets, which include tumor microenvironment, tumor metabolism, cancer immunology, and other assays. For instance, the U.S. FDA mentioned that as of 2023, the worldwide oncology pipeline mentioned 16 oral medications & 6 injectable drugs, with 6 drugs dedicated to breast cancer and 3 aimed for non-small cell lung cancer.

End Use Insights

On the basis of the end use segment, the pharmaceutical & biotechnology companies segment accounted for the largest market share in 2024. Pharmaceutical and biotechnology firms increasingly opt for small molecule drug discovery outsourcing to speed up research and development, lower expenses, and tap into specialized expertise. As the demand for innovative therapies grows, outsourcing allows for more flexible resource management and access to cutting-edge technologies such as artificial intelligence, high-throughput screening, and computational modeling. Biotech companies, typically working with limited in-house resources, depend on Contract Research Organizations (CROs) for comprehensive discovery support. Similarly, pharmaceutical companies leverage outsourcing to broaden their pipelines, mitigate risks, and prioritize internal resources for critical or advanced-stage projects. Thus, such factors are expected to drive the market over the estimated time period.

The academic institute’s segment is expected to grow significantly during the forecast period. Academic institutes are increasingly shifting towards outsourcing small molecule drug discovery, offering early-stage research, novel targets, and innovative screening methods. Besides, limited infrastructure and funding often compel these institutes to collaborate with Contract Research Organizations (CROs) for medicinal chemistry, ADMET profiling, and lead optimization. Besides, the rising trend towards translational research funding, government-backed innovation initiatives, and collaborative models with industry are expected to support the market. By outsourcing, academic teams can expedite discovery timelines, bridge the commercialization gap, and amplify the influence of basic research on therapeutic development.

Regional Insights

In 2024, North America dominated the market with a share of 41.16%. The market is driven by a strong pharmaceutical and biotechnology landscape, cutting-edge research and development infrastructure, and the widespread integration of innovative technologies such as artificial intelligence and high-throughput screening. In addition, countries such as the U.S., Canada, and Mexico are at the forefront of outsourcing demand, driven by expanding R&D expenditures, a robust pipeline of small molecule therapeutics, and a growing dependence on external contract research organizations (CROs) for early-stage discovery capabilities. Besides, there is an increasing trend in strategic partnerships between pharmaceutical firms and specialized CROs, especially in oncology and rare diseases. Moreover, rising venture capital investments and the rise of virtual biotech models are further propelling outsourcing practices throughout the preclinical phases of drug discovery.

U.S. Small Molecule Drug Discovery Outsourcing Market Trends

The small molecule drug discovery outsourcing market in the U.S. held the largest share in 2024. The country’s growth is driven by rising research and development budgets, an emerging landscape of biotech startups, and robust capabilities among contract research organizations (CROs). Besides, outsourcing facilitates cost-efficient early-stage services such as target validation, hit screening, and lead optimization. Moreover, advancements in artificial intelligence and automation are streamlining timelines significantly. U.S.-based CROs gain an advantage through their familiarity with regulatory requirements, strong domestic collaborations with pharmaceutical companies, and a wide-ranging global client base, particularly in areas like oncology, neurology, and pipelines for rare diseases.

Canada small molecule drug discovery outsourcing market is driven by strong collaborations between academia and industry, as well as government support for biotech innovation. Mid-sized contract research organizations (CROs) provide specialized early research services, including medicinal chemistry, bioassays, and computational modeling. Besides, the proximity to U.S. clients and aligned regulatory standards foster cross-border partnerships. The country's emphasis on oncology, infectious diseases, and central nervous system (CNS) disorders is driving demand. Furthermore, outsourcing enables Canadian biotech firms to access high-quality discovery services, while international clients gain the advantage of competitive costs and a pool of skilled scientific expertise.

Europe Small Molecule Drug Discovery Outsourcing Market Trends

The small molecule drug discovery outsourcing market in Europe is driven by rising CRO hubs in the UK, Germany, France, and Eastern Europe. Besides, sponsors gaining comprehensive drug discovery services, cutting-edge technologies, and streamlined regulatory frameworks is expected to support the market. CROs provide a range of services, including AI-driven hit screening, medicinal chemistry, ADMET profiling, and translational biology tailored for oncology, metabolic disorders, and neurological diseases. Also, collaborative efforts between industry and academic innovators significantly enhance innovation. Moreover, the emergence of virtual biotech models and supportive EU research funding further promotes outsourcing, delivering cost-effective and compliant solutions for global clients.

Germany small molecule drug discovery outsourcing market held the highest share in 2024. Germany is a pivotal outsourcing hub in Europe, recognized for its precision, scientific expertise, and GMP-compliant infrastructure. The country's contract research organizations (CROs) focus on medicinal chemistry, computational modeling, ADMET assessment, and bioassays. Robust partnerships with academic institutions and government support drive innovation, particularly in oncology and central nervous system (CNS) research. Moreover, regulatory alignment with the European Medicines Agency (EMA) and global standards attracts multinational clients, further contributing to market growth. Germany's outsourcing market is characterized by high-quality services and cutting-edge technologies, providing dependable and efficient drug discovery support throughout Europe and beyond.

The small molecule drug discovery outsourcing market in the UK is expected to grow significantly over the forecast period. The UK's outsourcing market comprises top-tier research capabilities, experienced contract research organizations (CROs), and a highly skilled workforce. The services offered include hit identification, medicinal chemistry, bioanalytics, and preclinical biology, particularly in oncology, immunology, and infectious diseases. Besides, integrating AI and translation platforms enhances productivity within the sector. Strong collaborations with academic institutions and a well-supported biotech ecosystem improve service quality. With its regulatory alignment and infrastructure, the country is a preferred outsourcing destination for European and global pharmaceutical companies.

Asia Pacific Small Molecule Drug Discovery Outsourcing Market Trends

The small molecule drug discovery outsourcing market in Asia Pacific is expected to grow significantly over the forecast period. This growth can be attributed to various factors, such as cost-effectiveness and high-skilled outsourcing destinations within countries such as India, China, and Southeast Asia. Contract research organizations (CROs) in this area provide integrated services, including medicinal chemistry, high-throughput screening (HTS), ADMET analysis, and bioassays, supported by a talented workforce and state-of-the-art laboratories. Strong government incentives and regulatory harmonization are key factors driving this growth. The region is increasingly adopting artificial intelligence and automation technologies. As a result, it attracts global pharmaceutical and biotech companies looking to minimize costs while maintaining high-quality standards, particularly in early-stage discovery for oncology, central nervous system (CNS) disorders, and metabolic diseases.

China small molecule drug discovery outsourcing market is driven by extensive chemistry expertise, increasing investment in biotechnology, and supportive government R&D incentives. Contract research organizations (CROs) provide a wide range of early-phase services, including hit discovery, medicinal chemistry, and preclinical biology. The adoption of artificial intelligence and high-throughput systems is on the rise. Strong local pipelines in oncology and infectious diseases align well with global client needs. In addition, ongoing regulatory reforms and international collaborations are enhancing quality and trust, positioning China as a significant global player in affordable and scalable discovery services.

The small molecule drug discovery outsourcing market in Japan is driven by rising innovation within contract research organizations (CROs) providing top-tier services in chemistry, biology, and computational fields. There is a strong collaboration between pharmaceutical and biotechnology companies, bolstered by regulatory alignment with the International Council for Harmonisation (ICH) and accelerated approval processes. CROs in Japan focus on oncology, central nervous system (CNS) disorders, and rare diseases, utilizing cutting-edge technologies and AI platforms. With high operational standards, a professional talent pool, and a dedication to quality, Japan has become a trusted outsourcing destination, particularly for domestic sponsors and select international clients.

India small molecule drug discovery outsourcing market has established itself as a leading global destination for small molecule discovery outsourcing, providing a wide range of services, including medicinal chemistry, ADMET, high-throughput screening (HTS), and bioanalytics, all at competitive prices. Contract research organizations (CROs) benefit from a pool of skilled scientists, robust technical expertise, and expanding laboratory infrastructure. The increasing adoption of AI and automation further enhances efficiency. In addition, regulatory convergence and government support for R&D contribute to market growth, making the country an ideal choice for global pharmaceutical and biotech companies seeking cost-effective, high-volume discovery operations, particularly in early-stage programs.

Latin America Small Molecule Drug Discovery Outsourcing Market Trends

The small molecule drug discovery outsourcing market in Latin America is emerging as a value-driven outsourcing region, with significant biomedical hubs in Brazil, Mexico, and Argentina. Local CROs provide services in medicinal chemistry, bioassays, and ADMET profiling. Lower labor costs, coupled with improving scientific infrastructure, attract both domestic and international sponsors. Collaborations with regional academic institutions promote translational research. The adoption of outsourcing is on the rise, fueled by the cost advantages and strategic diversification pursued by pharmaceutical and biotech companies operating across Latin America is expected to support the market growth.

Brazil small molecule drug discovery outsourcing market is driven by a growing biotech ecosystem and strong academic collaboration. CROs offer services in medicinal chemistry, screening, and ADMET evaluation, with an increasing focus on oncology and infectious disease research. Government-sponsored research funding and regulatory alignment enhance the quality of services. Moreover, the country has gained increased attention from sponsors due to its competitive pricing, regional expertise, and expanding scientific capacity, particularly appealing to Latin American and smaller global biotech companies.

Middle East & Africa Small Molecule Drug Discovery Outsourcing Market Trends

The small molecule drug discovery outsourcing market in the Middle East & Africa is evolving, with emerging CRO capabilities in South Africa, Saudi Arabia, UAE, and Kuwait. Besides, medicinal chemistry and basic biology services are expanding the market growth. In addition, investments in biotech infrastructure and government-led innovation initiatives drive the market. Regulatory frameworks are aligning with international standards, fueling confidence among sponsors. The diversification allows outsourcing options that allow both global and regional clients to access cost-effective discovery services while supporting the rise of emerging virtual drug discovery initiatives.

South Africa small molecule drug discovery outsourcing market is driven by strong translational research and the emergence of biotech clusters. CROs in the region provide services in medicinal chemistry, molecular modeling, and early bioassay development. Government R&D investments in health and infectious disease are further driving growth. While current capabilities are relatively small-scale, regulatory alignment and partnerships with academic institutions support the delivery of high-quality outputs. The country offers affordable discovery services backed by regional expertise, making it an attractive option for local and global biotech sponsors. Such factors are expected to support the market growth.

Key Small Molecule Drug Discovery Outsourcing Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge. For instance, in January 2025, Iktos and Cube Biotech have partnered to identify new small molecule agonists for the Amylin Receptor. This collaboration leverages Iktos' innovative AI-based drug discovery and robotic synthesis capabilities alongside Cube Biotech's cutting-edge native membrane protein technology, NativeMPTM, and their proficiency in purification & biophysical assays.

Key Small Molecule Drug Discovery Outsourcing Companies:

The following are the leading companies in the small molecule drug discovery Outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- WuXi AppTec

- Pharmaceutical Product Development, LLC

- Charles River Laboratories

- Laboratory Corporation of America Holdings (Covance)

- Eurofins

- Evotec

- Albany Molecular Research (Curia)

- GenScript Biotech

- Pharmaron

- Syngene International

- Dalton Pharma Services

- Oncodesign

- Jubilant Biosys

- Domainex

- GenScript Biotech

- Merck & Co., Inc.

- QIAGEN

- Dr. Reddy Laboratories Ltd.

- Pharmaron Beijing Co., Ltd.

- TCG Lifesciences Pvt Ltd.

Recent Developments

-

In May 2025, Peptone announced a partnership with Evotec to accelerate & scale the development of small molecule treatments targeting intrinsically disordered proteins (IDPs) across various therapeutic fields. This collaboration will enhance the Evotec drug discovery toolbox, encompassing drug discovery resources, which include specialized knowledge in oncology and immunology, advanced assay development skills, and cutting-edge screening technologies. This integration will complement Peptone's innovative, physics-based methods for analyzing the structural dynamics of IDPs.

-

In April 2025, the Icahn School of Medicine at Mount Sinai announced the launch of the AI Small Molecule Drug Discovery Center, which aims to transform the drug development process through artificial intelligence. This new center will blend artificial intelligence techniques with conventional drug discovery approaches to efficiently and accurately identify and design innovative small-molecule therapeutics.

-

In March 2025, Curia Global, Inc. announced plans to expand its facility in Glasgow, UK, along with ongoing expansion efforts in Albuquerque, NM. This development in Glasgow is part of a multi-year expansion project at Curia’s Albuquerque site, which includes an investment of USD 200 million. The Albuquerque site will introduce two filling lines, adding over 70,000 sq ft. to the extensive 200,000 sq ft. manufacturing area to enhance the phase III clinical & commercial capacity for clients. In addition, the VarioSys Flex Line, designed for small-scale biologics & non-potent small molecules, can process syringes, cartridges, and vials. The company also indicated that the new high-speed vial line will begin commissioning in the third quarter of 2025. This high-speed line will feature two autoloaded freeze dryers and automated vial inspection & labeling/packaging capabilities for vials ranging from 2R to 30R.

Small Molecule Drug Discovery Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.94 billion

Revenue forecast in 2033

USD 10.62 billion

Growth Rate

CAGR of 10.03% from 2025 to 2033

Historical Year

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Workflow, service, therapeutics area, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

WuXi AppTec; Pharmaceutical Product Development, LLC; Charles River Laboratories; Laboratory Corporation of America Holdings (Covance); Eurofins; Evotec; Albany Molecular Research (Curia); GenScript Biotech; Pharmaron; Syngene International; Dalton Pharma Services; Oncodesign; Jubilant Biosys; Domainex; GenScript Biotech; Merck & Co., Inc.; QIAGEN; Dr. Reddy Laboratories Ltd.; Pharmaron Beijing Co., Ltd.; TCG Lifesciences Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Molecule Drug Discovery Outsourcing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global small molecule drug discovery outsourcing market report based on workflow, service, therapeutics area, end use, and region:

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Target Identification & Screening

-

Target Validation & Functional Informatics

-

Lead Identification & Candidate Optimization

-

Preclinical Development

-

Others

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemistry Services

-

Biology Services

-

-

Therapeutics Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Respiratory system

-

Pain and Anesthesia

-

Oncology

-

Ophthalmology

-

Hematology

-

Cardiovascular

-

Endocrine

-

Gastrointestinal

-

Immunomodulation

-

Anti-infective

-

Central Nervous System

-

Dermatology

-

Genitourinary System

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology companies

-

Academic Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Argentina

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global small molecule drug discovery outsourcing market size was estimated at USD 4.55 billion in 2024 and is expected to reach USD 4.94 billion in 2025.

b. The global small molecule drug discovery outsourcing market is expected to grow at a compound annual growth rate of 10.03% from 2025 to 2033 to reach USD 10.62 billion by 2033.

b. The lead identification & candidate optimization segment dominated the market, with a share of 32.19% in 2024. The segment growth is driven by higher R&D costs, demand for faster timelines, the growing adoption of AI technology, complex therapies, and the rising demand for high-quality preclinical candidates.

b. Some key players operating in the small molecule drug discovery outsourcing market include WuXi AppTec, Pharmaceutical Product Development, LLC, Charles River Laboratories, Laboratory Corporation of America Holdings (Covance), Eurofins, Evotec, Albany Molecular Research (Curia), GenScript Biotech, Pharmaron, Syngene International, Dalton Pharma Services, Oncodesign, Jubilant Biosys, Domainex, GenScript Biotech, Merck & Co., Inc., QIAGEN, Dr. Reddy Laboratories Ltd., Pharmaron Beijing Co., Ltd., and TCG Lifesciences Pvt Ltd. among others

b. Factors such as the rising R&D expenses, an increasing need for drug development, transition toward virtual pharmaceutical models, rising number of registered studies, growing approval of small molecule drug, and advancements in medical technology are expected to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.