- Home

- »

- Biotechnology

- »

-

Small-scale Bioreactors Market Size, Industry Report, 2033GVR Report cover

![Small-scale Bioreactors Market Size, Share & Trends Report]()

Small-scale Bioreactors Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Reusable Bioreactors, Single-use Bioreactors), By Capacity (5 ML-100 ML, 100 ML-250 ML, 250 ML-500 ML), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-046-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Small-Scale Bioreactors Market Summary

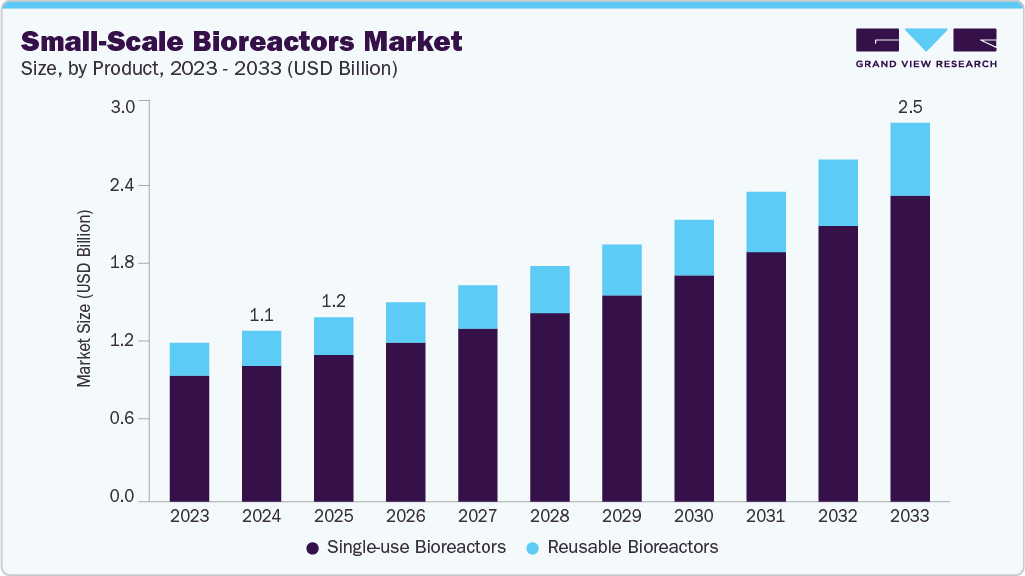

The global small-scale bioreactors market size was estimated at USD 1.12 billion in 2024 and is projected to reach USD 2.49 billion by 2033, growing at a CAGR of 9.4% from 2025 to 2033. This growth is primarily driven by the increasing use of small-scale bioreactors in the pharmaceutical industry and continuous portfolio expansion by major industry players.

Key Market Trends & Insights

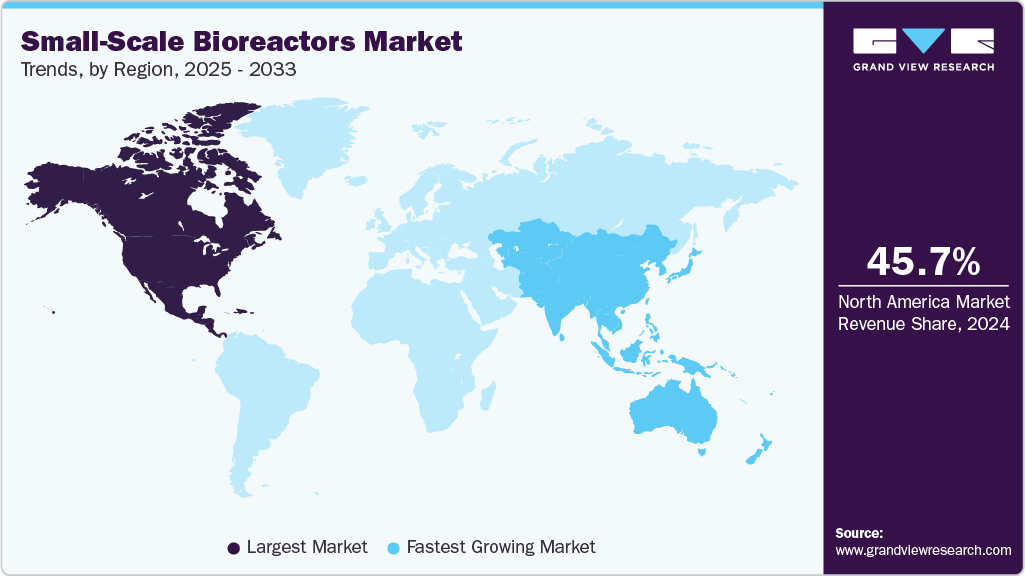

- North America small-scale bioreactors market held the largest share of 45.73% of the global market in 2024.

- The small-scale bioreactors industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the single-use bioreactors segment held the highest market share of 79.59% in 2024.

- Based on capacity, the 1L-3L segment held the highest market share in 2024.

- By end user, the CROs & CMOs companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.12 Billion

- 2033 Projected Market Size: USD 2.49 Billion

- CAGR (2025-2033): 9.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Small-scale bioreactors are critical in process development and optimization, making them essential in modern bioproduction and research workflows.

Rising Biopharmaceutical Innovation and Academic Investment

The rapid expansion of the biopharmaceutical industry has significantly boosted the demand for small-scale bioreactors. For instance, in June 2025, Belgian early-stage investor Biotope raised funding to support up to 30 international biotech startups, strengthening its commitment to fostering innovation across the European biotechnology sector. This trend highlights the expanding ecosystem and continued growth potential for small-scale bioreactor technologies worldwide. As companies focus on developing innovative biologics such as monoclonal antibodies, vaccines, and gene therapies, small-scale bioreactors precisely control critical parameters like temperature, pH, and oxygen levels, enabling efficient early-stage research and process development. Their flexibility, cost-effectiveness, and ability to support high-throughput screening make them essential tools for preclinical trials, small-batch production, and process optimization, helping streamline scale-up to commercial manufacturing.

Latest Biotechnology Funding in 2025

Company

Technology

Therapeutic area

Funding Amount in USD Million

SpliceBio

Gene therapy

Ophthalmology, Genetic and Genomic Medicine

135.0

Mosanna Therapeutics

Small molecules

Psychiatry

80.0

Citius Pharmaceuticals

Fusion protein

Oncology

15.8

QureBio

Bispecific antibody

Oncology

14.0

Merus

Bispecific antibody

Oncology

300.0

Alvotech

Monoclonal antibody

Inflammatory Diseases

78.0

Source: Labiotech, Secondary Research, Grand View Research

Moreover, growing investment in biotechnology education and academic research drives the adoption of small-scale bioreactors in universities and research institutes worldwide. These systems offer a compact, affordable, and versatile platform ideal for hands-on training, prototype development, and a wide range of bioprocess experiments, even in budget-constrained environments. The ability to conduct parallel experiments and quickly adjust process parameters enhances research flexibility and innovation, making small-scale bioreactors indispensable for advancing scientific knowledge and supporting the next generation of biotechnologists.

Cost Efficiency and Accessibility

Cost efficiency is one of the most significant factors driving the demand for small-scale bioreactors across various sectors. Compared to large-scale systems, small-scale bioreactors require substantially lower volumes of culture media, reagents, and other consumables, translating into considerable savings on raw materials. For instance, in February 2025, researchers at SMART CAMP and MIT advanced microbioreactor technology, enhancing small-scale biomanufacturing for biologics. These innovations aim to reduce costs and improve scalability in therapeutics production. This reduction in resource consumption decreases operational expenses and minimizes waste generation, aligning with increasing sustainability goals within the biotechnology industry. Moreover, small bioreactors demand less physical space and infrastructure, which is especially advantageous for laboratories and organizations operating in space-constrained environments.

The affordability and cost-effectiveness of small-scale bioreactors make them particularly appealing to startups, academic institutions, and contract research organizations (CROs) that often have limited budgets but require reliable and precise bioprocessing capabilities. These users benefit from the ability to conduct multiple experiments simultaneously without incurring the high costs associated with large-scale equipment. Moreover, the reduced scale lowers financial risk when experimenting with new processes or products, encouraging innovation and rapid development.

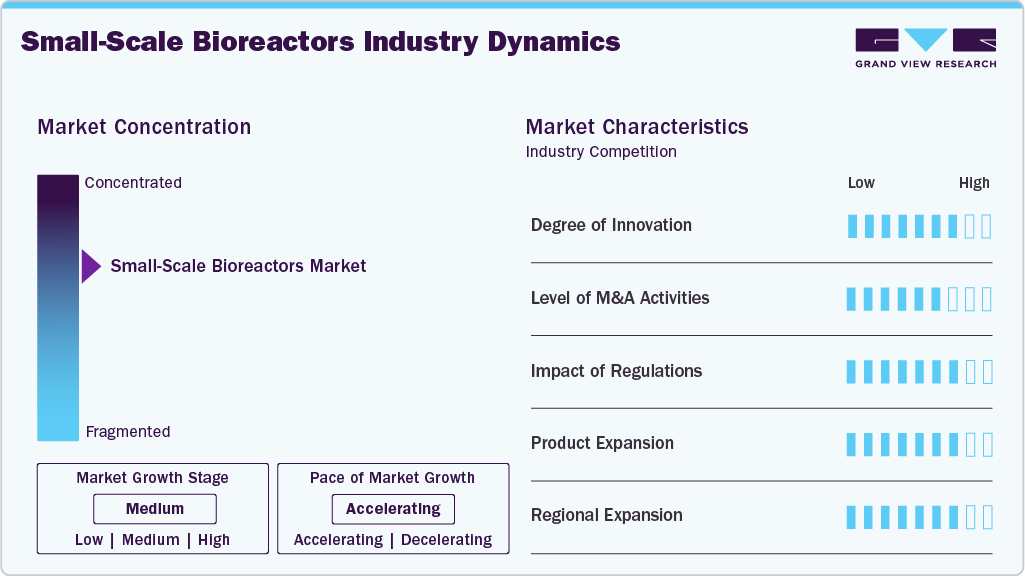

Market Concentration & Characteristics

The degree of innovation in the small-scale bioreactors industry is significant. Innovations such as enhanced automation, real-time sensor integration, and digital process control enable precise monitoring and optimization of culture conditions, improving reproducibility and efficiency. For instance, in October 2024, Univercells Technologies by Donaldson launched the scale-X nexo bioreactor in Belgium. This miniaturized, fixed-bed bioreactor features a 0.5 m² growth surface to streamline cell culture process development across various modalities. The scale-X Nexo bioreactor reduces process development timelines and costs, providing a cost-effective solution for early-stage development and making these innovative small-scale systems indispensable for accelerating biopharmaceutical development and research.

Increasing mergers and acquisitions within the biotech and biopharma industries stimulate demand for small-scale bioreactors by consolidating R&D efforts and expanding product pipelines. For instance, in December 2022, MilliporeSigma acquired Erbi Biosystems, enhancing its upstream portfolio with Breez micro-bioreactor technology to accelerate scalability and automated continuous bioprocessing. Such consolidations often require flexible, scalable bioprocessing platforms to harmonize workflows, optimize process development, and manage multiple parallel projects efficiently. Integrating newly acquired technologies also drives companies to invest in adaptable small-scale systems that support innovation and operational synergy.

Stringent regulatory requirements imposed by global agencies compel biopharmaceutical companies to adopt small-scale bioreactors for precise process control and validation during early-stage development. These systems help ensure consistent, reproducible results that comply with quality and safety standards, reducing risks during scale-up and facilitating smoother regulatory approvals. Enhanced real-time monitoring features in modern bioreactors align with evolving guidelines, further increasing their adoption.

Manufacturers' continuous efforts to expand and innovate their small-scale bioreactor product lines drive market growth by offering advanced features like modular designs, single-use compatibility, and automation. For instance, in January 2025, Biosphere, a California-based startup, unveiled a UV-sterilized bioreactor to reduce biomanufacturing costs. The company secured USD 8.8 million in seed funding and a USD 1.5 million U.S. Department of Defense contract to scale its technology. By replacing traditional steam-based sterilization with UV light, Biosphere's system aims to lower capital expenditures and simplify bioreactor design, potentially enhancing the scalability of bioproduction processes. These product enhancements improve usability, scalability, and application range from microbial fermentation to complex mammalian cell cultures, making small-scale bioreactors more attractive to a wider user base, including startups, research institutes, and biopharmaceutical firms.

The growth of biotechnology hubs and increasing investments in emerging markets, particularly in Asia-Pacific and Latin America, contribute to the regional expansion of the small-scale bioreactors industry. Rising government funding for biotech research, improved infrastructure, and growing local startups fuel demand in these regions. This geographic diversification broadens market opportunities and drives global adoption of small-scale bioreactor technologies.

Product Insights

The single-use bioreactors product segment dominated the industry in 2024, as these have recently been used more frequently in novel biotech processes. For instance, in March 2022, Cellexus International, based in Dundee, UK, introduced the CellMaker single-use airlift bioreactor. This system utilizes gas percolation for gentle mixing, reducing shear stress on delicate cell cultures. The bioreactor's disposable bags eliminate the need for sterilization, cutting downtime and chemical use. This is mainly due to their exceptional ability to improve flexibility, lower investment, and reduce operational expenses. The advantages of single-use products over other small-scale bioreactors are expected to drive segment growth.

The reusable bioreactors segment is expected to grow significantly during the forecast period. Reusable bioreactors are needed more in the pharmaceutical and biopharmaceutical industries because they can produce larger quantities of products. Due to their rigid design, reusable bioreactors have several other benefits, such as low costs, a long lifespan, flexible accessory configuration, and simple handling.

Capacity Insights

The 1L-3L capacity segment dominated the global industry in 2024 and accounted for the maximum share of 29.91% of the overall revenue. The segment is projected to expand further at the fastest growth rate, retaining its dominant position throughout the forecast period. This is due to the wide-scale availability of bioreactors with a working volume capacity of 1L-3L. Due to the advantages of these laboratory systems, most key players also offer these products and contribute to the expansion of the small-scale reactor industry.

The 3L-5L capacity segment is estimated to register a significant growth rate during the forecast period. Products with 3-5L capacity offer numerous benefits for R&D fermentation process development, including quick system implementation, increased size and turnaround flexibility, reduced infrastructure, decreased risk of cross-contamination, and minimal maintenance requirements.

End-use Insights

The CROs & CMOs segment accounted for the largest revenue share of 45.23% in 2024. CMOs and CROs constantly search for improved single-use systems for their clients to improve their service offerings. These companies have adopted novel single-use bioreactors much more quickly than therapeutic manufacturers. CMOs and CROs remain competitive when they create biologics more successfully and affordably, especially for R&D and clinical trials.

The academic & research institutes segment is also estimated to grow significantly during the forecast period since small-scale bioreactors are adopted for different procedures at a higher rate in academic and research institutes. Furthermore, the strong government support and high extent of research funding available in developed countries boost segment growth. The high market penetration of small-scale bioreactors among established academic research institutions will contribute to segment growth.

Regional Insights

North America dominated the small-scale bioreactors industry in 2024 with a share of 45.73% owing to key players in manufacturing advanced small-scale and single-use bioreactors. The rising investments in biopharmaceutical research, owing to the growing incidences of chronic disease & increased demand for novel biologic drugs as well as advanced equipment, including small-scale bioreactors, will drive the industry growth. For instance, in January 2022, Erbi Biosystems, based in Cambridge, Massachusetts, secured USD 4 million in funding to advance its Breez micro-bioreactor platform. The Breez system offers online sensing and control of pH, cell density, dissolved oxygen, and CO₂, facilitating sophisticated feeding strategies and media exchanges. Its compact design and high-performance capabilities make it suitable for cell therapy development and GMP manufacturing applications, further driving demand in the small-scale bioreactors industry.

U.S Small-Scale Bioreactors Market Trends

The small-scale bioreactors market in the U.S. is expected to grow over the forecast period, benefiting from extensive biotech research funding, a large network of academic and clinical research centers, and a thriving biopharmaceutical industry. Ongoing advancements in cell culture, fermentation, and regenerative medicine drive the demand for customizable and scalable bioreactor solutions.

Europe Small-Scale Bioreactors Market Trends

The small-scale bioreactors market in Europe is significant, with countries like the UK and Germany leading due to their advanced biotech industries and robust research infrastructure. Increased funding for life sciences education and startups, coupled with strong collaborations between academia and industry, supports the growing adoption of bioreactor technologies. The region’s focus on sustainable bioprocessing also encourages innovation in bioreactor design and applications.

The UK small-scale bioreactors market held a significant share in 2024. The UK’s well-established life sciences sector and government-backed innovation programs foster a strong demand for small-scale bioreactors. For instance, in April 2025, Project Nexus, a UK-based collaboration, launched to develop sustainable 3D-printed micro bioreactors using bio-based resins. The initiative aims to reduce plastic waste in biopharmaceutical manufacturing. Partners include Photocentric, Sartorius, Metamorphic, CPI, the University of Sheffield, and Imperial College London. Moreover, the country’s focus on personalized medicine and bioprocess optimization has led to increased adoption of advanced bioreactor systems in academic and industrial research.

The small-scale bioreactors market in Germany is expected to grow significantly due to the strong industrial biotechnology sector, supported by world-class research institutions, which propels demand for small-scale bioreactors. Emphasis on sustainable manufacturing and bio-based products has spurred innovation in bioreactor technologies tailored to various bioprocesses.

Asia Pacific Small-Scale Bioreactors Market Trends

The small-scale bioreactors market in Asia Pacific is expected to register the fastest CAGR of 15.15% during the forecast period because it is home to some of the world's most rapidly expanding biotechnological industries and economies. For instance, in June 2024, researchers from the Singapore-MIT Alliance for Research and Technology (SMART) developed a high-density microfluidic bioreactor for CAR T-cell production. This 2 mL automated closed-system chip enables efficient, scalable manufacturing with reduced reagent use and shorter production times, potentially facilitating point-of-care applications. Such innovations, combined with increasing government support and investment in biotechnology infrastructure, are expected to drive robust growth and widespread adoption of small-scale bioreactor technologies across the region.

China small-scale bioreactors market is expected to grow over the forecast period. The country’s rapidly growing biotechnology industry, supported by extensive government initiatives and increasing R&D expenditure, fuels market growth for small-scale bioreactors. The country’s expanding biopharmaceutical manufacturing capabilities and startup ecosystem further boost adoption.

The small-scale bioreactors market in Japan is witnessing significant growth over the forecast period, owing to key market players' investments in biotechnology and pharmaceutical research. For instance, in January 2024, AGC Biologics announced a new 20,000 m² cell therapy facility in Yokohama, Japan, set to operate by 2026 with single-use bioreactors. Such strategic investments underscore the growing demand for small-scale bioreactors in Japan, driven by the country's focus on innovation in biopharmaceutical development and regenerative medicine.

MEA Small-Scale Bioreactors Market Trends

The small-scale bioreactors market in the MEA is in the early stages of development, driven by rising investments in biotechnology infrastructure and research activities. While the market is still evolving relative to more established regions, increasing government initiatives and growing public and private sector interest are anticipated to accelerate adoption and open up promising opportunities in the future.

Kuwait small-scale bioreactors market is anticipated to experience steady growth over the forecast period, driven by increasing investments in biotechnology research and the development of supportive infrastructure, which suggests promising potential for small-scale bioreactor market expansion.

Key Small-scale Bioreactors Company Insights

The global market is highly competitive, with key players accounting for most of the market share. Companies involved in the market are adopting various strategies, such as the launch of innovative products, partnerships & collaborations, and mergers & acquisitions to maintain their market presence.

Leading companies such as Sartorius AG, Thermo Fisher Scientific Inc., Merck KGaA, and Danaher Corporation have gained significant market share due to their advanced bioprocessing platforms, scalable bioreactor technologies, and end-to-end service offerings. These companies support various applications, including process development, academic research, and clinical manufacturing, helping biopharmaceutical organizations accelerate development timelines.

Eppendorf AG, Solida Biotech GmbH, and others also play a critical role in shaping the market by focusing on high-quality, user-centric solutions tailored for cell and gene therapy, regenerative medicine, and vaccine production. Their integrated offerings often include compact, modular systems and automation tools designed to meet the evolving demands of both research and commercial environments.

With the ongoing shift toward precision medicine, decentralized manufacturing, and sustainable bioprocessing, companies that can deliver intelligent, scalable, and cost-effective solutions are well-positioned to lead. A synergy of technological advancement, regulatory alignment, and responsiveness to the fast-paced needs of modern bioproduction will shape the future of the small-scale bioreactors industry.

Key Small-scale Bioreactors Companies:

The following are the leading companies in the small-scale bioreactors market. These companies collectively hold the largest market share and dictate industry trends.

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Danaher Corporation

- Solida Biotech GmbH

- Eppendorf AG

- Getinge AB

- DONALDSON ITALIA S.R.L. (Solaris Biotechnology Srl)

- Infors AG

- LAMBDA Instruments GmbH

Recent Developments

-

In April 2025, Thermo Fisher Scientific introduced the 5L DynaDrive Single-Use Bioreactor, a benchtop solution to improve scalability and efficiency in bioprocess development. Designed for use by large biopharmaceutical companies, CDMOs, and emerging biotech firms, the system enables seamless scale-up from 1 to 5,000 liters, facilitating cost-effective progression from laboratories to commercial manufacturing. The DynaDrive bioreactor offers a 27% boost in productivity over conventional glass systems. It incorporates sustainable features, including biobased Aegis films and BioTitan Retention Devices, to reduce environmental impact and minimize product loss.

-

In November 2024, Lonza completed its first GMP-compliant product batch at its mammalian manufacturing facility in Portsmouth, New Hampshire. Featuring a 2,000L single-use bioreactor system, the facility is designed to support small- to mid-scale biologics production, particularly for treatments targeting rare diseases. This new capacity complements the site's existing 6,000L and 20,000L production capabilities, strengthening Lonza's ability to meet the increasing demand for biologics during early commercial launches. The facility integrates cutting-edge process analytical technologies and streamlined production workflows to ensure a dependable and efficient path to market for a wide range of molecule types.

-

In November 2021, Donaldson Company acquired Solaris Biotechnology Srl, a bioprocessing equipment manufacturer in Porto Mantovano, Italy. This acquisition strengthens Donaldson’s position in the life sciences sector, with a focus on biotechnology, food and beverage, and related industries. Solaris offers a broad range of products, from benchtop systems for R&D to pilot and commercial-scale manufacturing equipment.

Small-scale Bioreactors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.21 billion

Revenue forecast in 2033

USD 2.49 billion

Growth rate

CAGR of 9.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, capacity, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Sartorius AG; Thermo Fisher Scientific Inc.; Merck KGaA; Danaher; LAMBDA Instruments GmbH; Eppendorf AG; Solida Biotech GmbH; Getinge AB; DONALDSON ITALIA S.R.L. (Solaris Biotechnology Srl); Infors AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small-scale Bioreactors Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global small-scale bioreactors market report based on product, capacity, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Reusable Bioreactors

-

Stainless Steel Bioreactors

-

Glass Bioreactors

-

-

Single-use Bioreactors

-

-

Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

5 ML-100 ML

-

100 ML-250 ML

-

250 ML-500 ML

-

500 ML-1 L

-

1L-3L

-

3L-5L

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biopharmaceutical Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global small-scale bioreactors market size was estimated at USD 1.12 billion in 2024 and is expected to reach USD 1.21 billion in 2025.

b. The global small-scale bioreactors market is expected to grow at a compound annual growth rate of 9.44% from 2025 to 2033 to reach USD 2.49 billion by 2033.

b. North America dominated the small-scale bioreactors market with a share of 45.73% in 2024. This is attributable to the rising investments in biopharmaceutical research, owing to the growing incidences of chronic disease & increased demand for novel biologic drugs as well as advanced equipment, including small-scale bioreactors, will drive the industry growth.

b. Some key players operating in the small-scale bioreactors market include Sartorius AG, Thermo Fisher Scientific Inc., Merck KGaA, Danaher, LAMBDA Instruments GmbH, Eppendorf AG, Solida Biotech GmBH, Getinge AB, DONALDSON ITALIA S.R.L. (Solaris Biotechnology Srl), Infors AG

b. Key factors that are driving the market growth include increasing investments for biotech based research along with increasing demand for single-use bioreactors

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.