- Home

- »

- Biotechnology

- »

-

Single-use Bioreactors Market Size, Industry Report, 2033GVR Report cover

![Single-use Bioreactors Market Size, Share & Trends Report]()

Single-use Bioreactors Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Type, By Type Of Cell, By Molecule Type, By Application, By End Use, By Usage Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-694-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Single-use Bioreactors Market Summary

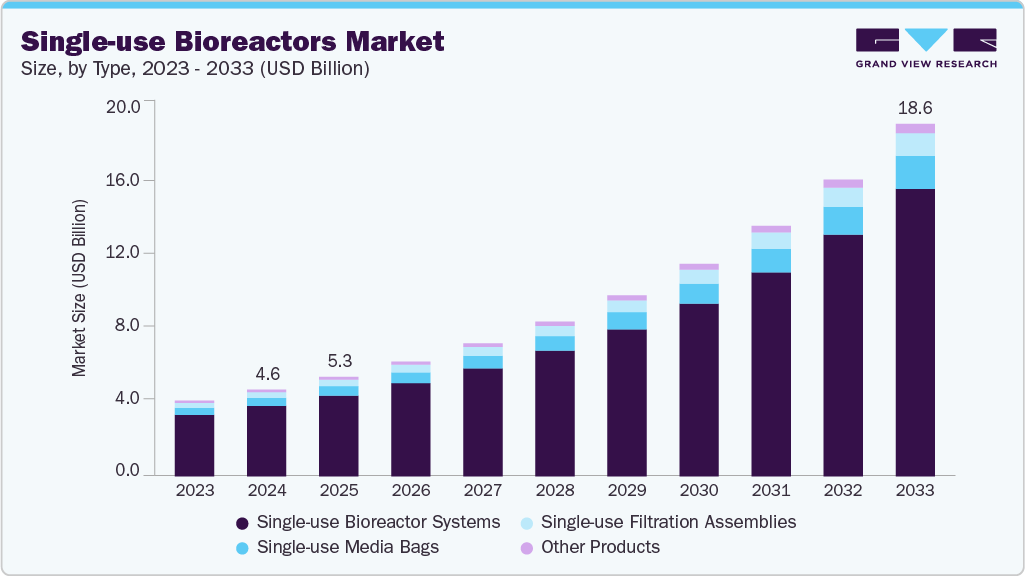

The global single-use bioreactors market size was estimated at USD 4.58 billion in 2024 and is projected to reach USD 18.65 billion by 2033, growing at a CAGR of 17.12% from 2025 to 2033. Single-use systems are emerging as an important technology for pharmaceutical and mammalian cell culture applications.

Key Market Trends & Insights

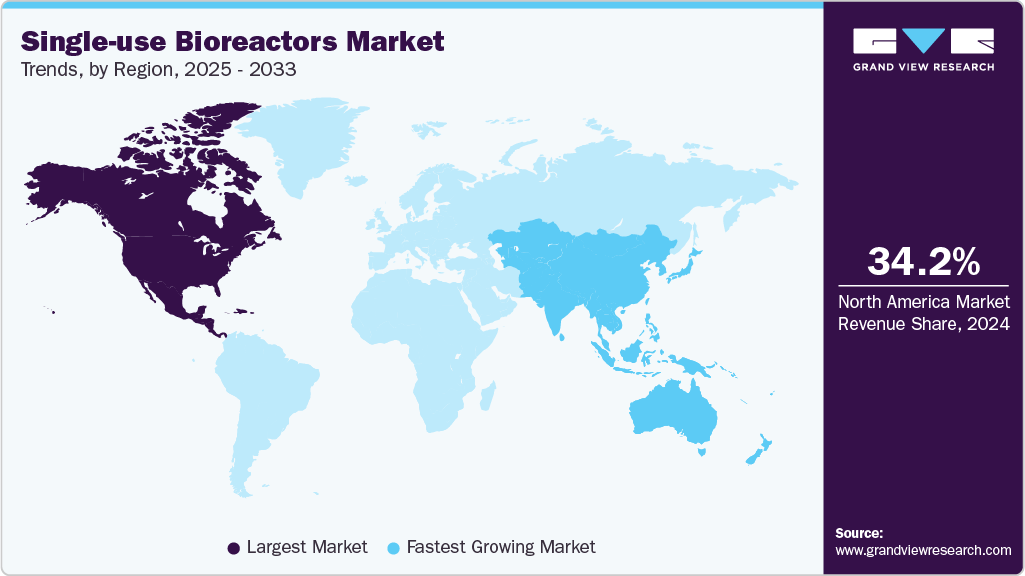

- The North America single-use bioreactors market held the largest revenue share of 34.24% of the global market in 2024.

- The single-use bioreactors industry in the U.S. is expected to grow from 2025 to 2033.

- By product, the single-use bioreactor systems segment held the highest market share of 81.19% in 2024.

- By type, the stirred-tank SUBs segment held the highest market share in 2024.

- By type of cell, the mammalian cells segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.58 Billion

- 2033 Projected Market Size: USD 18.65 Billion

- CAGR (2025-2033): 17.12%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

They are particularly well-suited for biopharmaceutical production, where prevailing market trends call for quick, easy, and flexible deployment. In addition, with comprehensive qualification and validation procedures, the use of single-use bioreactors lowers the possibility of cross-contamination and improves process safety in highly potent biopharmaceutical compounds. These factors are anticipated to drive the market growth.

In addition, some of the manufacturers are using bioreactors to culture suitable host cells for the coronavirus, in order to study the viral pathogenesis in humans. Moreover, in the past few months, the single-use bioreactor manufacturers have undertaken numerous collaborative initiatives to develop biologics/vaccines as potential therapeutics against the COVID-19. For instance, ABEC has focused on customizing the process services and solutions throughout the manufacturing and development of the entire range of biopharmaceutical products, with the aid of its single-use solutions.

The range of stainless-steel bioreactors and associated high capital costs have become a challenge due to the changing demand for biopharmaceuticals. SUBs' versatility to meet the rising demand for biopharmaceuticals has enabled them to successfully address the issues related to traditional bioreactors. Flexibility offered by single-use bioreactors is one of the main encouraging factors for investing in technology that further drives the growth of the single-use bioreactors industry.

Additionally, it is projected that in the upcoming years, the use of disposable bioreactors will pick up steam due to the increased demand for biopharmaceuticals across the globe. Small-scale, bench-top SUBs reduce the requirement for assembling, cleaning, and autoclaving, which leads to quicker turnaround times. The advantages offered by SUBs motivate their use for the manufacturing of biopharmaceuticals.

SUBs also have the potential to be less expensive than traditional bioreactors. They typically have lower implementation costs than traditional stainless-steel bioreactor systems. Therefore, the cost-saving benefits of these items in terms of construction, operation, and cleaning can be primarily attributable to their adoption. Cost, desired operating volume, reaction size, temperature control, and capacity are deciding factors when choosing single-use bioreactors.

Increasing investment flow by key players in the production of advanced & effective equipment is likely to support market growth throughout the projected timeframe. For instance, in March 2022, Dundee-based Cellexus International introduced a single-use airlift bioreactor that helps scientists to grow fragile cell cultures for their study more quickly and affordably. Instead of employing harsher mixing methods, the CellMaker single-use airlift bioreactors produce bubbles that percolate through the mixture, generating a gentle mixing action for even the most fragile cell cultures. Such initiatives by companies are likely to supplement the single-use bioreactors industry growth in the coming years.

Rising Biologics Demand & Technological Advancements Driving Market

The single-use bioreactors market is experiencing robust growth, driven by several key factors. The increasing demand for biologics, including monoclonal antibodies, vaccines, and gene therapies, has led to a surge in the adoption of single-use technologies. These systems offer flexibility, scalability, and reduced risk of cross-contamination, making them ideal for the production of personalized medicines and small-batch runs. Contract Development and Manufacturing Organizations (CDMOs) and Contract Manufacturing Organizations (CMOs) are increasingly adopting single-use bioreactors due to their cost-effectiveness and efficiency in meeting the growing production demands.

Technological developments have also fueled the single-use bioreactors industry’s growth. Innovations that have improved productivity and process control include the creation of high-capacity single-use systems and the incorporation of automation and digitization in bioprocessing. For instance, in April 2024, Cytiva unveiled the Xcellerex magnetic mixer. It is a one-time use mixing device intended for large-scale production operations. These developments boost the industry's transition to more flexible and sustainable manufacturing methods while also increasing operational efficiency.

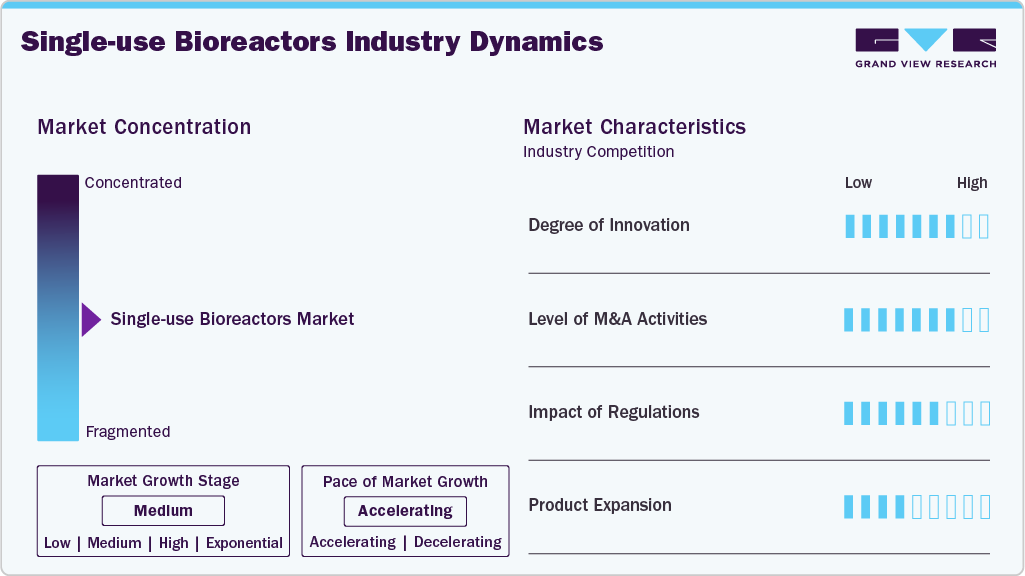

Market Concentration & Characteristics

The single-use bioreactors market is highly innovative, driven by the need for more efficient, flexible, and scalable bioprocessing solutions. Companies continuously develop advanced materials, sensors, and automation systems to enhance process control, reduce contamination risks, and enable rapid scale-up. The focus on personalized medicine and complex biologics has further accelerated technological innovation in this space.

Mergers and acquisitions are relatively active in the market, as larger bioprocessing companies seek to expand their product portfolios, acquire specialized technologies, or strengthen their position in emerging markets. Strategic collaborations and acquisitions are commonly aimed at integrating innovative single-use solutions with existing bioprocessing platforms to enhance competitiveness.

Regulatory compliance is a significant factor influencing the single-use bioreactors industry. Stringent guidelines from agencies like the FDA and EMA ensure product safety, sterility, and quality in biologics manufacturing. Companies must invest in validation, documentation, and quality control to meet these standards, which can slow down product introduction but ultimately ensures reliability and market trust.

Product expansion is a prominent strategy in the industry, with manufacturers diversifying offerings to include larger-capacity systems, integrated monitoring solutions, and hybrid platforms combining single-use and traditional technologies. This allows companies to cater to a wide range of applications from small-scale R&D to commercial manufacturing.

Geographical expansion is a key focus, with companies targeting high-growth regions like Asia-Pacific and Latin America due to increasing biologics production and emerging biopharmaceutical hubs. Efforts often include setting up local manufacturing facilities, forming distribution partnerships, and adapting products to regional regulatory requirements to strengthen market presence.

Product Insights

The single-use bioreactor systems segment captured the largest market share of over 81.19% in 2024 and is expected to grow at the fastest CAGR during the forecast period.Single-use bioreactor systems are widely used in biopharmaceutical manufacturing processes that require high product yield. The versatility, cost-effectiveness, and high mass production capability of single-use bioreactors would increase demand for the products, leading to rapid market growth. Furthermore, the rising demand for quick development, greater production of new bio-therapeutics, including vaccines, antibodies, enzymes, and hormones, and an increase in the product quantities that can be produced in these bioreactors, contribute to the market's ongoing expansion. In addition, an increase in focus of key manufacturers on offering small-scale bioreactors will fuel segment growth over the next years.

The single-use media bags segment is expected to experience significant growth during the forecast period. These bags are integral to the biopharmaceutical industry, offering advantages such as reduced capital investment, lower risk of cross-contamination, and enhanced scalability in production processes. Their widespread adoption is particularly evident in contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs), where the need for flexible and cost-effective solutions is paramount. The increasing demand for biologics, including monoclonal antibodies and vaccines, further propels the need for efficient media storage and handling solutions, positioning single-use media bags as a critical component in modern bioprocessing.

Type Insights

The stirred tank bioreactors segment led the single-use bioreactors market with the largest revenue share of 80.16% in 2024. The benefits offered by these bioreactors include good oxygen transfer and fluid mixing ability, easy scale-up, low operating costs, compliance with cGMP requirements, and alternative impellers have led to the highest penetration of stirred tank bioreactors in the market.

The wave-induced SUBs segment is expected to experience significant growth over the forecast period.Wave-induced single-use bioreactors (SUBs) are increasingly recognized for their gentle mixing capabilities, making them ideal for cultivating shear-sensitive cell lines such as mammalian cells. Unlike traditional stirred-tank systems, these bioreactors employ a rocking motion to facilitate mixing, which reduces mechanical stress on cells and enhances oxygen transfer efficiency. This characteristic is particularly advantageous in the production of biologics and gene therapies, where maintaining cell viability is crucial.

Type of Cell Insights

The mammalian cells segment led the single-use bioreactors industry with the largest revenue share in 2024. This can be attributed to the significant penetration of this cell type in the creation of biopharmaceutical therapies and the commercial success of recombinant proteins made from mammalian cells. As per BioProcess International, 85% of biopharmaceutical candidates in clinical development are made using mammalian cell cultures.

The yeast cells segment is expected to grow at a significant CAGR during the forecast period.Yeasts are a dependable eukaryotic host for the synthesis of heterologous proteins and offer special benefits in the generation of therapeutic recombinants. Growing attention given by several scientists and research organizations to the use of yeast cells in clinical or therapeutic settings will drive market expansion during the projected timeframe. For instance, research published by NCBI in June 2021 examined cutting-edge techniques and approaches for synthesizing heterologous medicinal proteins from yeast genes.

Molecule Type Insights

The vaccines segment accounted for the largest share of 27.62% in 2024. This is majorly attributed to the COVID-19 outbreak, which has resulted in an urgent need for the development of a virus vaccine. According to Bioplan Associates, use of single-use systems in commercial manufacturing of vaccines is anticipated to rise sharply. Many biopharmaceutical companies are actively engaged in the quick development of COVID-19 vaccines in response to the COVID-19 pandemic.

Additionally, gene gene-modified cells segment is expected to grow at the fastest CAGR of 17.88% during the forecast period. The growing field of cell and gene therapies is anticipated to accelerate the uptake of SUBs in this market. For instance, in January 2021, Sartorius and RoosterBio, Inc. teamed up to improve the production capabilities for gene and cell therapies. The partnership aims to increase the manufacturing of regenerative medicine. Such an ongoing and continuous increase in the adoption of single-use systems is anticipated to drive market growth.

Application Insights

In 2024, the research and development (R&D)/process development segment accounted for the largest share. Single-use bioreactor utilization in process development is a driving force behind the market expansion. Furthermore, due to their adaptability, ease of setup, and lower risk of cross-contamination, single-use bioreactors (SUBs) are increasingly used in research and development (R&D) and process development. In addition, every component of the bioprocessing sector uses single-use systems. According to the American Pharmaceutical Review, single-use system devices are used for clinical or process development in about 85% of operations. This exhibits the majority of single-use bioreactors in both clinical manufacturing and R&D.

The bioproduction sector is expected to grow at the fastest CAGR of 17.67% and is anticipated to see significant use of single-use bioreactors in the near future due to the numerous benefits they provide. The widespread use of disposable reactors, from the lab to the industrial, has increased as a result of significant developments in bioreactor designs, sensor systems, and stirring motors.

Usage Insights

The lab-scale production segment led the single-use bioreactors market and captured the largest revenue share of 35.62% in 2024. In the biopharmaceutical business, disposable bioreactors are frequently employed in preclinical & clinical research. It is anticipated that growing single-use technology acceptance would have a substantial impact on segment growth in cell-based therapy research and vaccine production.

The large-scale production segment is expected to grow at the fastest CAGR of 18.18% during the forecast period. This is due to the quickly expanding market demand for the commercial production of biopharmaceutical goods and the growth of manufacturing capacity to accommodate these demands. For instance, Wuxi Biologics introduced a 36,000L biomanufacturing line in February 2021, employing nine 4,000L single-use bioreactors. In addition, to enable the scale-up, companies such as Thermo Fisher Scientific and ABEC launched the large-volume single-use bioreactors on the market. In recent years, Thermo Fisher introduced its 5000-L single-use bioreactor, and ABEC launched its 4000-L and 6000-L single-use bioreactors.

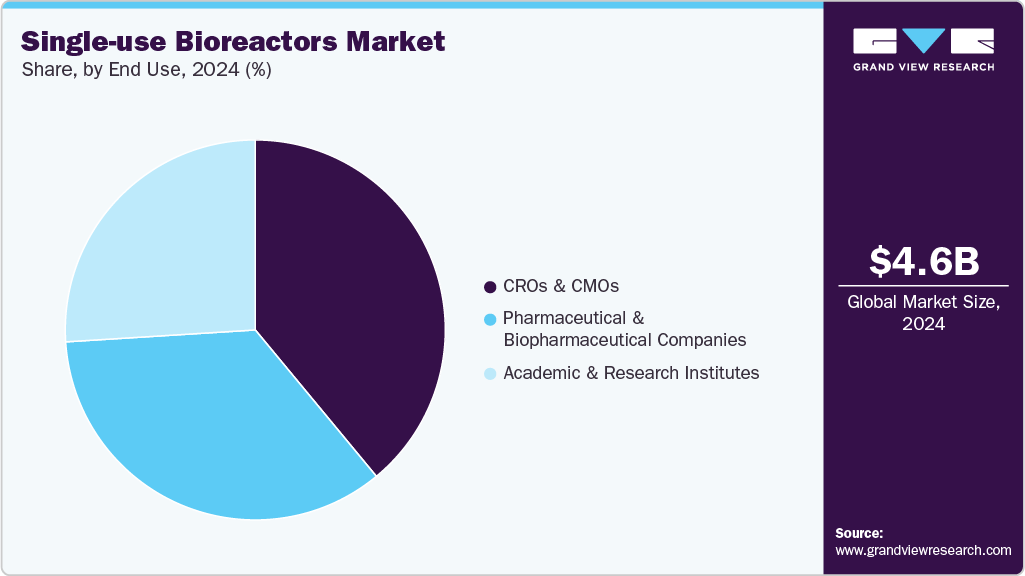

End Use Insights

The CMOs & CROs segment accounted for a significant share of 38.65% in 2024, and it is also expected to be the fastest-growing segment during the study period. The demand for supply production capacity, as well as quick awareness campaign change-overs, is more among CMOs. As a result, they use a broader range of single-use components and systems. With the increasing trend of outsourcing, CROs & CMOs are more likely to adopt single-use bioreactors.

On the other hand, the pharmaceutical and biopharmaceutical companies segment is estimated to witness significant growth over the forecast period. According to the estimates, 66% of biopharmaceutical companies use disposable bioreactors in their routine operations. Furthermore, strategic activities by key market players offer lucrative opportunities in the review period. For instance, BioCentriq and Pall Corporation worked together in July 2021 to clinically manufacture Zolgensma, an FDA-approved gene therapy, utilizing an iCELLis fixed-bed bioreactor.

Regional Insights

North America dominated the single-use bioreactors market with a revenue share of 34.24% in 2024. This is explained by the fact that the region has well-established biopharmaceutical companies and key operating players. Additionally, the region's increased production capacity has added to the market expansion. For instance, Thermo Fisher Scientific stated in September 2021 that it would build a new manufacturing facility specifically for single-use bioprocessing products.

U.S Single-use Bioreactors Market Trends

The U.S. leads the single-use bioreactors industry, driven by substantial investments in biopharmaceutical R&D, a robust regulatory framework supporting innovation, and a high concentration of contract development and manufacturing organizations (CDMOs). Government initiatives, such as the National Institutes of Health (NIH) funding, further bolster growth in this sector.

Europe Single-use Bioreactors Market Trends

Europe's single-use bioreactors industry’s expansion is fueled by increasing approvals of biosimilars and monoclonal antibodies, coupled with the rising prevalence of chronic diseases. The region's strong emphasis on biologics R&D and supportive government policies contributes to the growing adoption of single-use bioreactors.

The UK's single-use bioreactors market is propelled by its thriving pharmaceutical sector, significant investments in biosimilars, and a favorable regulatory environment. The government's support for biopharmaceutical innovation and the presence of leading contract manufacturing organizations enhance the country's position in the global market.

The single-use bioreactors market in Germany is expected to grow over the forecast period. Germany benefits from its strong industrial base and advanced healthcare infrastructure, promoting the adoption of single-use bioreactors. The country's focus on sustainable manufacturing practices and efficient bioprocessing solutions drives the demand for flexible and cost-effective bioreactor systems.

Asia Pacific Single-use Bioreactors Market Trends

The Asia Pacific single-use bioreactors industry is projected to witness the fastest CAGR of 17.47% throughout the forecast period. According to estimates, Asian businesses, including both domestic contenders and global behemoths, are building approximately half of all new bioprocessing facilities worldwide. In the near future, this is anticipated to significantly fuel the regional market expansion.

The China single-use bioreactors market is expected to grow over the forecast period. China's rapid growth in the biopharmaceutical industry, coupled with increasing investments in biosimilars and biologics, accelerates the adoption of single-use bioreactors. The government's initiatives to enhance domestic manufacturing capabilities and reduce reliance on imports further stimulate market expansion.

The single-use bioreactors market in Japan is projected to witness growth over the forecast period. Japan's aging population and high demand for biologics and vaccines drive the need for efficient and scalable biomanufacturing solutions. The country's emphasis on technological innovation and regulatory support fosters the market growth.

MEA Single-use Bioreactors Market Trends

The MEA region is witnessing a surge in biopharmaceutical investments, particularly in countries like Saudi Arabia and the UAE. The establishment of advanced manufacturing facilities and increasing healthcare infrastructure development contribute to the rising adoption of single-use bioreactor technologies.

The Kuwait single-use bioreactors market is expected to grow over the forecast period. Kuwait's growing healthcare sector and strategic initiatives to diversify its economy promote the adoption of advanced biomanufacturing technologies. The country's investments in healthcare infrastructure and emphasis on self-sufficiency in pharmaceutical production drive the demand for single-use bioreactors.

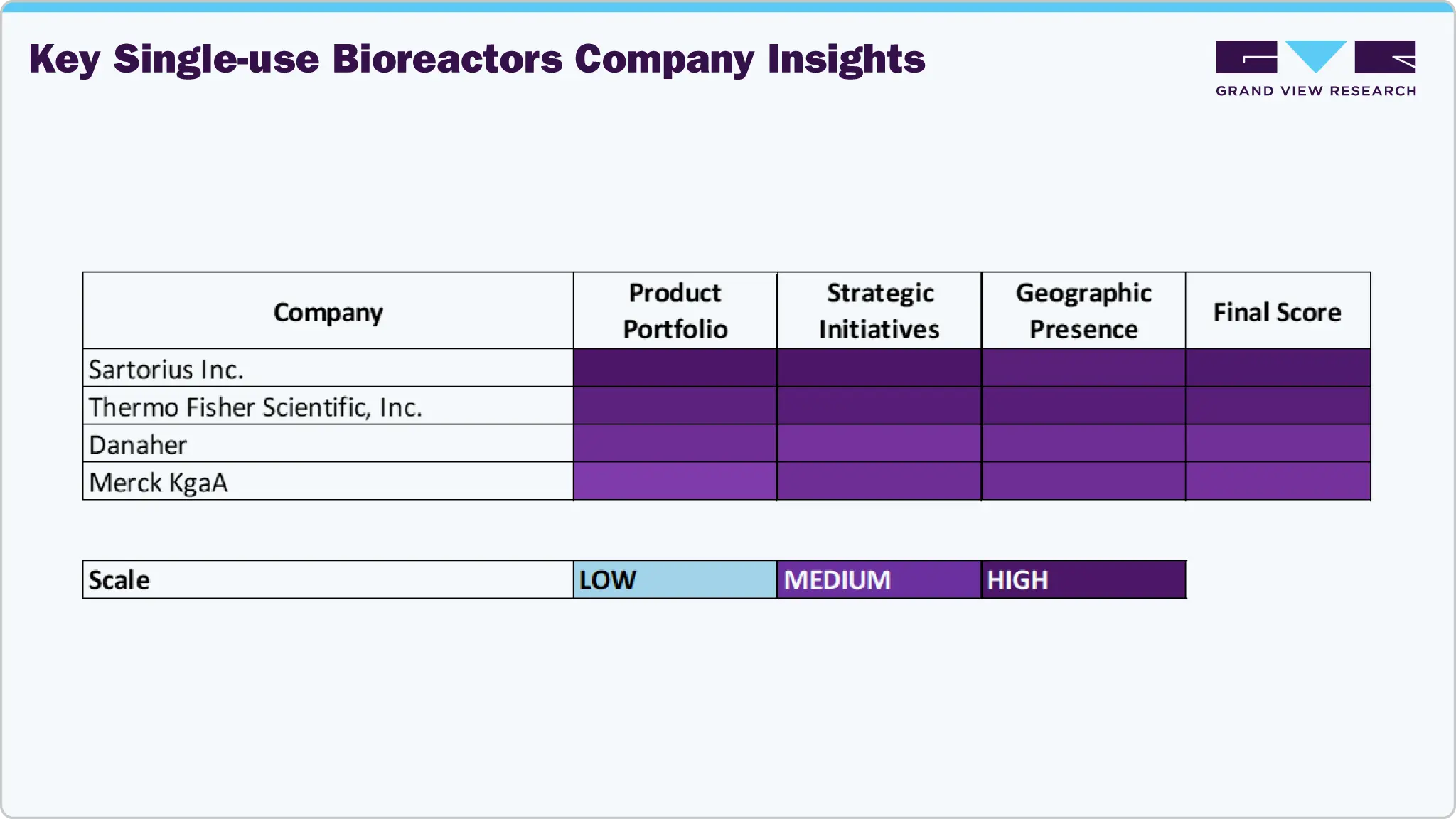

Key Single-use Bioreactors Company Insights

The market for single-use bioreactors is characterized by the presence of multiple major players, each of which uses innovation and strategic initiatives to support the industry's expansion. Prominent companies such as Thermo Fisher Scientific, Sartorius AG, and Merck KGaA provide a variety of single-use bioreactor systems, such as stirred-tank and wave-induced types, to meet the needs of different cell culture and biopharmaceutical production applications. Through partnerships and acquisitions, these businesses have increased the range of products they offer, strengthening their position in the bioprocessing solutions market. For example, the purchase of Patheon by Thermo Fisher Scientific has strengthened its position in the manufacturing and contract development industry. On the other hand, Sartorius AG's cell analysis products have been enhanced by the acquisition of Essen Bioscience.

Key Single-use Bioreactors Companies:

The following are the leading companies in the single-use bioreactors market. These companies collectively hold the largest market share and dictate industry trends.

- Sartorius Inc.

- Thermo Fisher Scientific, Inc.

- Danaher

- Merck KgaA

- Celltainer Biotech BV

- Getinge AB

- Eppendorf AG

- Cellexus

- Lonza

- PBS Biotech Inc.

Recent Developments

-

In April 2025, AGC Biologics revealed an investment strategy regarding the large-scale single-use technology it will employ at its new facility in Yokohama, Japan. With the addition of two 5,000 L Thermo Scientific DynaDrive Single-Use Bioreactors (S.U.B.), the CDMO will have one of the most sophisticated facilities in Japan to produce large-scale mammalian-based biologics.

-

In April 2025, at its MFG20 facility in Hangzhou, China, WuXi Biologics finished the first commercial project Process Performance Qualification (PPQ) campaign for its three sets of 5,000 L single-use bioreactors (SUBs) in the second drug substance line.

-

In June 2022, Exothera SA partnered with LogicBio Therapeutics and Polyplus-transfection SA to produce a highly scalable AAV manufacturing platform. The Allegro stirred tank single-use bioreactors manufactured by Pall Corporation have been selected for this project.

Single-use Bioreactors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.27 billion

Revenue forecast in 2033

USD 18.65 billion

Growth rate

CAGR of 17.12% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, type of cell, molecule type, application, end use, usage type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Sartorius Stedim Biotech; Thermo Fisher Scientific; Danaher; Merck KGaA; Celltainer Biotech BV; Getinge AB; Eppendorf AG; Cellexus; PBS Biotech Inc.; Lonza.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Single-use Bioreactors Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the single-use bioreactors market on the basis of product, type, type of cell, molecule type, application, end use, usage type, and region:

-

Product Scope Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-use bioreactor systems

-

Up to 10L

-

11-100L

-

101-500L

-

501-1500L

-

Above 1500L

-

-

Single-use media bags

-

2D Bags

-

3D Bags

-

Others

-

-

Single-use Filtration Assemblies

-

Other Products

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Stirred-tank SUBs

-

Wave-induced SUBs

-

Bubble-column SUBs

-

Other SUBs

-

-

Type of Cell Outlook (Revenue, USD Million, 2021 - 2033)

-

Mammalian Cells

-

Bacterial Cells

-

Yeast Cells

-

Other Cells

-

- Molecule Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Monoclonal Antibodies

-

Vaccines

-

Gene Modified Cells

-

Stem Cells

-

Other Molecules

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Research and Development (R&D) or Process Development

-

Bioproduction

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biopharmaceutical Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

-

Usage Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Lab-scale Production

-

Pilot-scale Production

-

Large-scale Production

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global single-use bioreactors market size was estimated at USD 4.58 billion in 2024 and is expected to reach USD 5.27 billion in 2025.

b. The global single-use bioreactors market is expected to grow at a compound annual growth rate of 17.12% from 2025 to 2033 to reach USD 18.65 billion by 2033.

b. Single-use bioreactor systems dominated the single-use bioreactors market with a share of 81.19% in 2024. This is attributed to the various commercial advantages offered by their systems coupled with increasing adoption by end-users in the market.

b. Some key players operating in the single-use bioreactors market include Sartorius Stedim Biotech; Thermo Fisher Scientific; Danaher; Merck KgaA; Celltainer Biotech BV; Getinge AB; Eppendorf AG; Cellexus; PBS Biotech Inc.; Lonza.

b. Key factors that are driving the single-use bioreactors market growth include increasing adoption of SUBs among small companies and startups, reduction in automation complexity, reduction in energy and water consumption, rising research in the biopharmaceutical market, and technological advancements in SUBs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.