- Home

- »

- Electronic & Electrical

- »

-

Smart Bathroom Market Size, Share & Growth Report, 2030GVR Report cover

![Smart Bathroom Market Size, Share & Trends Report]()

Smart Bathroom Market Size, Share & Trends Analysis Report by Product (Smart Toilet, Smart Soap Dispenser, Smart Faucets, Showers, Smart Bathroom Mirrors, Smart Bathtubs), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-972-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

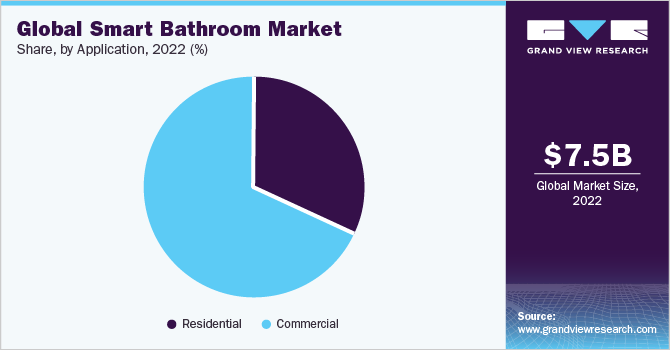

The global smart bathroom market size was estimated at USD 7.52 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.1% from 2023 to 2030. The rising adoption of smart homes, both in developing and developed countries worldwide, is fueling the demand for smart bathrooms. This trend is particularly prominent in Western countries, where there is a growing emphasis on home improvement projects and bathroom renovations. As homeowners seek to enhance their living spaces, the demand for various smart bathroom solutions is on the rise in both residential and commercial sectors. The increasing expenditure on home improvement projects and remodeling is driving the demand for these products, propelled by rising home and mortgage prices.

The rising average number of bathrooms in homes has led to increased popularity and usage of modern and intelligent bathroom products. Over the past 50 years, the number of bathrooms per person in the United States has doubled. Additionally, according to a blog post by The Atlantic in January 2020, the proportion of houses with 10 or more bathrooms has also doubled in the last decade. According to the U.S. Census Bureau, out of the 970,000 single-family homes completed in 2021, 27,000 homes had one and a half bathrooms or fewer, while 320,000 homes had three or more bathrooms.

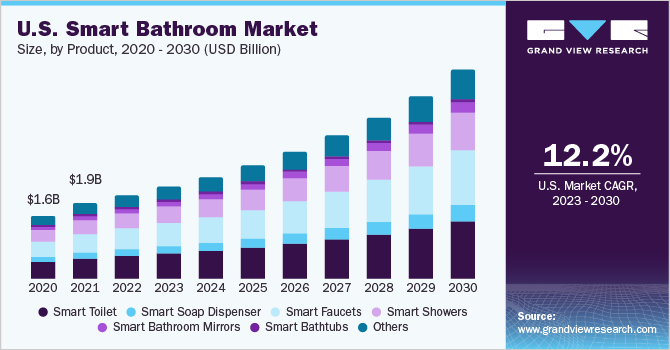

The U.S. has witnessed a considerable increase in demand for smart bathroom products in recent years. Product features such as adjustable water temperature, lighting, voice control, automation, personalized settings, and remote control through smartphone apps help create a more tailored and enjoyable bathroom experience.

The growing consumer preference for connected homes and energy-efficient solutions can also be regarded as a major factor driving the demand in the U.S. smart bathroom market. Our U.S. smart bathroom products consumer insights report offers a deep-dive into the consumers of smart bathroom products in the U.S., analyzing them based on consumer demographics, the influence of marketing, factors influencing their purchase decisions, and consumer brand awareness & preferences.

The prompt enlargement of the real estate sector is creating an increased need for plumbing fixtures, indicating growth prospects for the smart shower market. In addition, flourishing commercial construction, particularly in the hospitality sector, which includes hotels, resorts, and hospitals, is enhancing the need for smart bathroom accessories.

Manufacturers in the industry are continuously expanding their product portfolios by incorporating a wide range of combinations involving materials, technologies, and designs. They are also placing a strong emphasis on developing innovative smart bathroom products. This trend has led to increased adoption of advanced technologies and the introduction of intelligent concepts that cater to consumer needs.

A notable example of this is Moen Incorporated, which showcased various innovations at the Kitchen & Bath Industry Show (KBIS) in February 2021. Moen highlighted several product innovations that included touchless technology, spa-like showers, and other cutting-edge advancements.

One of the highlighted products was the U by Moen Smart Faucet, which offers a hands-free and convenient experience. Another innovation presented was the NEW! Cia Bathroom Faucet with MotionSense Wave, providing users with touchless operation through motion-sensing technology. Additionally, Moen introduced the Moen Aromatherapy Shower with INLY, combining the luxury of a spa-like experience with the therapeutic benefits of aromatherapy.

Product Insights

In terms of revenue, smart toilets held a market share of 35.7% in 2022. This is attributed to advanced properties of the product such as self-cleaning and self-deodorizing, which make it an environmentally friendly and popular product in the smart bathroom industry. High-tech or smart toilets are widely being used among households and commercial properties owing to various features incorporated in the fixture, such as hands-free flushing, heated seats, motion-activated seats, and built-in night lights.

In the realm of technological advancements, several manufacturers are introducing groundbreaking smart toilets capable of collecting and analyzing users' data. One notable example is Casana, a U.S.-based start-up that recently secured funding of USD 30 million to advance its smart toilet seat technology. Their innovative product, the Heart Seat, is set to make its debut and is equipped with an array of sensors embedded within the toilet seat. These sensors are designed to gather comprehensive health data related to the mechanical and electrical functioning of the heart, as well as blood oxygenation levels.

The smart faucets category is expected to grow at a CAGR of 13.0% from 2023 to 2030. The emerging concepts of smart bathrooms are increasing the prominence of smart faucets across industries. The increasing inclination toward convenience has led to the development of hands-free faucets, especially in the commercial sector. COVID-19 has also fueled the demand for hands-free faucets. In the post-COVID-19 era, the demand is expected to rise for smart faucets, especially in commercial buildings like offices, hotels and restaurants, and malls. The change in consumer perception, especially during the COVID-19 outbreak, will drive the demand for smart faucets, such as sensor faucets, over the forecast period.

Application Insights

The commercial application segment dominated the market in 2022, accounting for 68.3% of the revenue share. The demand for smart bathrooms is expected to witness substantial growth in the coming years, driven by the expanding hotel industry and the growing number of restaurants and eateries worldwide. Additionally, the development and expansion of commercial infrastructure in emerging economies are contributing to the market's growth prospects.

Government initiatives aimed at advanced and sustainable infrastructure in emerging economies like China, India, Brazil, and Mexico are also expected to propel the construction industry. Rapid expansion in the commercial sector in Canada is also expected to contribute significantly to the future demand for the installation of smart bathroom fixtures across hotels.

The residential application segment is expected to grow at a CAGR of 11.6% from 2023 to 2030. This is attributed to increasing urbanization and expenditure on home remodeling. Modern urban lifestyle, along with smart, upgraded, and visually appealing product innovation with the help of IoT, is increasing the adoption rate of smart bathroom fixtures among consumers. The growing trend of home remodeling is driving the demand for various smart bathroom products, such as high-tech toilets, smart showerheads, and smart mirrors.

Regional Insights

North America dominated the market with a share of 32.4% in 2022. This is attributed to increasing spending on renovations and remodeling in the commercial sector. An increasing number of commercial buildings in the region owing to the growth of the tourism industry is expected to boost the demand for smart bathrooms. The commercial sector, which includes hotels, restaurants, and malls, has been investing in remodeling projects to enhance the consumer experience. This process also includes improving public restrooms. This is likely to boost the demand for smart bathroom accessories, such as smart soap dispensers and digital faucets.

As per The Ambient, the U.S. has the highest number of smart home devices, with a penetration rate of 32.4% and an estimated total of 41.3 million smart homes. Additionally, it is estimated that the U.S. will have over 63 million smart homes by 2022. This, in turn, is creating new growth opportunities for the regional players to gain market shares by offering technologically advanced products to consumers.

Asia Pacific, on the other hand, is expected to grow at a CAGR of 12.4% from 2023 to 2030. As per a study published by Google and Accenture, in 2020, the household penetration of connected home devices in Australia was 22%, South Korea was 21%, and Japan was 13%. However, countries such as India, Indonesia, and Thailand each had a penetration rate of 2%. The rising spending power of consumers coupled with the increasing penetration of smart homes is acting as a major catalyst for the smart bathroom market growth in the region.

According to the China Smart Home Industry Alliance, in 2020, there were 300,000 to 500,000 smart homes in China, accounting for only 1% of newly developed real estate. The penetration of smart homes in China is estimated to grow over the forecast period, owing to the low-cost smart home products and the increasing number of tech-savvy consumers in the country. This scenario will bode well for the smart bathroom market over the forecast period.

Europe is expected to witness a steady CAGR of 11.7% over the forecast period. The market for smart home technology in Europe is experiencing significant growth, primarily driven by the increasing adoption of the smart home concept in the region. A recent study conducted by IoT analyst firm Berg Insight reveals that by the end of 2021, there were approximately 53.7 million smart homes in Europe. Projections indicate that the installed base of smart homes is expected to reach around 100 million by the end of 2026, resulting in a market penetration rate of 42%. This trend presents substantial opportunities for manufacturers in the market to expand their market shares.

The growing trend of home renovation in the UK is accelerating the smart bathroom market growth. In addition, homeowners have been investing in lifestyle-enhancing projects as against merely necessary maintenance activities.

For instance, according to the 2022 UK Houzz & Home Renovation Trends Study, the rates of home renovation activity have reached the highest levels recorded since 2018. In 2021, over 53% of homeowners undertook renovation projects, marking a 4% increase from the previous year's figure of 49%. Moreover, a notable 21% of homeowners specifically focused on renovating their bathrooms in 2021. This upward trend in renovation endeavors is anticipated to propel market growth throughout the projected period.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In March 2023, Roca introduced the In-Wash Insignia shower toilet, which incorporates Roca Connect technology to provide unparalleled comfort and hygiene. Through the accompanying mobile app, called In-Wash Insignia, users can conveniently customize and regulate various operational modes and daily functionalities. Additionally, the app provides valuable insights into water usage and toilet utilization, empowering users with informative data.

-

In 2023 January, Kohler launched the Sprig Shower Infusion System, during the CES 2023 event. This groundbreaking aromatherapy shower infusion system introduces the Sprig Shower Pods, which have the ability to infuse the water stream with an array of delightful scents such as lavender and eucalyptus. These pods also contain skin-friendly ingredients, ensuring a rejuvenating and luxurious spa-like experience that can be enjoyed on a daily basis.

Some prominent players in the global smart bathroom market include:

-

Jacuzzi Brands, LLC

-

Villeroy & Boch AG

-

Signature Hardware (Ferguson Enterprises, LLC)

-

Pfister (Spectrum Brands, Inc.)

-

Kraus USA Plumbing LLC

-

Delta Faucet Company

-

GROHE AMERICA, INC. (LIXIL Corporation)

-

American Standard (LIXIL Corporation)

-

Moen Incorporated

-

Kohler Co.

-

Duravit AG

-

Roca Sanitario, S.A

-

TOTO LTD.

-

Aqualisa

-

GetHai, Inc.

-

WaterHawk

-

Dornbracht AG & Co. KG

Smart Bathroom Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.31 billion

Revenue forecast in 2030

USD 18.76 billion

Growth rate

CAGR of 12.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

Jacuzzi Brands, LLC; Villeroy & Boch AG; Signature Hardware (Ferguson Enterprises, LLC); Pfister (Spectrum Brands, Inc.); Kraus USA Plumbing LLC; Delta Faucet Company; GROHE AMERICA, INC. (LIXIL Corporation); American Standard (LIXIL Corporation); Moen Incorporated; Kohler Co.; Duravit AG; Roca Sanitario, S.A; TOTO LTD.; Aqualisa; GetHai, Inc.; WaterHawk; Dornbracht AG & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Bathroom Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global smart bathroom market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Smart Toilet

-

Smart Soap Dispenser

-

Smart Faucets

-

Smart Showers

-

Smart Bathroom Mirrors

-

Smart Bathtubs

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Residential

-

Commercial

-

Hotels & Restaurants

-

Gyms

-

Spa & Wellness Centers

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global smart bathroom size was estimated at USD 7.52 billion in 2022 and is expected to reach USD 8.31 billion in 2023.

b. The global smart bathroom is expected to grow at a compounded growth rate of 12.1% from 2023 to 2030 to reach USD 18.76 billion by 2030.

b. In terms of revenue, smart toilets held a market share of 35.7% in 2022. This is attributed to its advanced properties of self-cleaning and self-deodorizing, which makes it an environmentally friendly and popular product in the smart bathroom.

b. Some key players operating in smart bathroom market are Jacuzzi Brands, LLC, Villeroy & Boch AG, Signature Hardware , (Ferguson Enterprises, LLC), Pfister, (Spectrum Brands, Inc.), Kraus USA Plumbing LLC, Delta Faucet Company, GROHE AMERICA, INC. (LIXIL Corporation), American Standard (LIXIL Corporation), Moen Incorporated, Kohler Co., Duravit AG, Roca Sanitario, S.A, TOTO LTD., Aqualisa, GetHai, Inc., WaterHawk, Dornbracht AG & Co. KG

b. Key factors that are driving the market growth include the rising adoption of smart homes, both in developing and developed countries worldwide, is fueling the market demand for smart bathrooms. This trend is particularly prominent in western nations, where there is a growing emphasis on home improvement projects and bathroom renovations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."