- Home

- »

- Electronic & Electrical

- »

-

Smart Shower Market Size & Share Analysis Report, 2030GVR Report cover

![Smart Shower Market Size, Share & Trends Report]()

Smart Shower Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Commercial, Residential/Domestic), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-019-7

- Number of Report Pages: 139

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

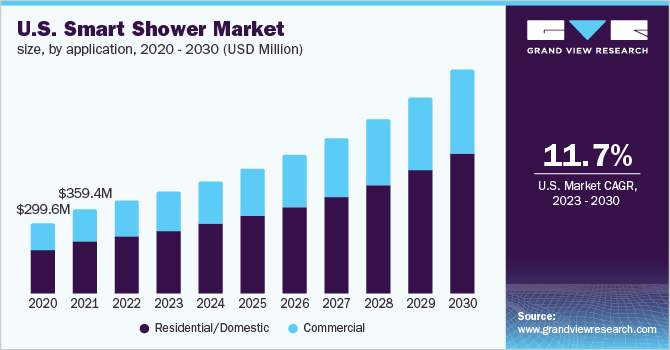

The global smart shower market size was valued at USD 1.11 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.8% from 2023 to 2030. The growing penetration of smart bathroom products in developing as well as developed countries across the globe is augmenting the demand for the smart shower.

The smart shower market was negatively impacted by the COVID-19 pandemic owing to disruptions in the supply chain, restrictions on the construction sector, travel restrictions, and the shutting down of offline retail channels across the globe. According to the NKBA (National Kitchen & Bath Association), the average benchmark rating of COVID-19’s impact on the plumbing business is 7.4 on a scale of 1 to 10, with 1 being no impact and 10 being the highest during 2020. In addition, nearly 60% of NKBA members reported experiencing supply chain disruptions, including long lead times, slowing production, and shipping delays. Businesses in the flooring, appliance and cabinet sectors were most impacted by these disruptions.

The growing penetration of smart homes in developing and developed countries across the globe is driving the demand for smart technology products like a smart shower. According to the CE Pro Smart Home Deep Dive Study, in 2019, 61% of integrators and manufacturers believed their smart home installation business would grow that year. In addition, increasing home improvement projects and bathroom renovations, particularly in western countries, are paving the way for different smart bathroom products such as smart showers for the residential as well as commercial sectors.

Manufacturers in the industry are including a variety of combinations pertaining to material, technology, and designs in their portfolios, as well as focusing on developing innovative smart showers. This, in turn, is upping the adoption of products with advanced technologies, resulting in the introduction of smart concepts catering to consumer needs. For instance, in February 2021, Moen Incorporated highlighted the touchless technology, spa-like shower, and many other innovations at the Kitchen & Bath Industry Show (KBIS) 2021. Some of the product innovations the company highlighted were U by Moen Smart Faucet; NEW! Cia Bathroom Faucet with MotionSense Wave; Moen Aromatherapy Shower with INLY; and Nebia by Moen Spa Shower.

Application Insights

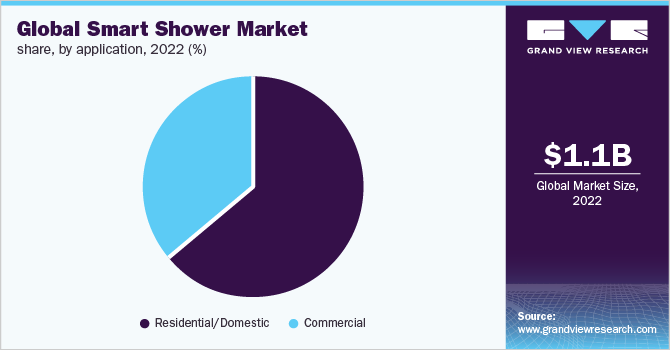

Based on application, residential/domestic accounted for the largest share of 63.9% in 2022. Tech-savvy homeowners choose products integrated with smart technologies primarily for their efficiency and convenience. Emphasis is also laid on the aesthetics of these smart solutions. Innovative offerings in smart household products, which save time and energy, will boost the consumption rate among households. Manufacturers are playing a key role by offering tech-loaded products to increase the mass adoption rate across such settings. For instance, in August 2020, Aqualisa, a leading U.K.-based shower manufacturer, launched the Quartz Smart Collection. The collection brings internet connectivity and control through thermostatic digital valves Aqualisa SmartValve and caters to the increasing demand for smart technology in the bathroom.

The commercial segment is anticipated to hold the leading market share due to the significant demand for smart bathroom fixtures in hotels and airports. Additionally, restaurant chains around the world are likely to adopt such products in line with evolving customer tastes. Commercial places prioritize the comfort and convenience of their guests and strive to offer a luxurious living experience through smart solutions. In August 2022, Sunway Resort, a fully-integrated premier hospitality destination in Asia, unveiled eight brand-new rooms and suites. The in-room amenities differ for each of the rooms and suites and the ‘Sunway Grand Suite’ can accommodate four persons. The spa-inspired bathrooms of the suite are integrated with different smart amenities such as a walk-in chromotherapy shower that use multiple colors to refresh the body and stimulate the senses.

Regional Insights

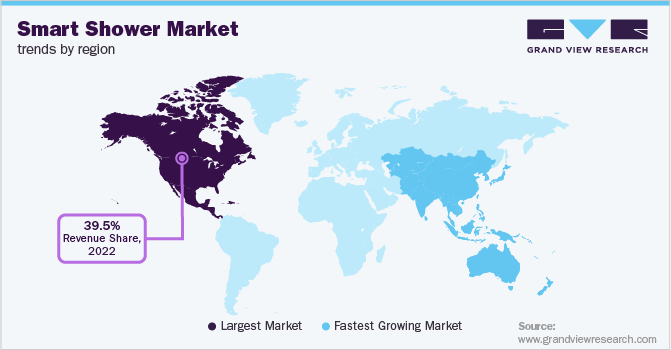

Based on region, North America accounted for the largest revenue share of 39.5% of the global smart shower market in 2022 and is expected to continue its dominance over the forecast period. The increasing penetration of smart homes and commercial properties in the U.S. and Canada is acting as a major catalyst for market growth in the region. The advanced technologies aimed at energy conservation and maintaining hygiene are majorly driving the North American smart shower market. The increased presence of old houses across North America promotes the need for home remodeling, which will propel the demand for new and smart bathroom fittings and fixtures. For instance, according to Improving America’s Housing 2019 report in July 2019, 80% of the 137 million homes in the U.S. were at least 20 years old, while 40% were at least 50 years old.

Asia Pacific is expected to attain the fastest CAGR of 12.5% during the forecast period 2023-2030. The growth of the hospitality industry, which includes hotels, resorts, and hospitals, on a global scale over the past few years has provided enormous growth potential for the technologies of the smart bathroom market. The rapid growth of the Asia Pacific business sector is also anticipated to substantially impact the demand for installing smart bathroom fixtures in hotels. According to TOPHOTELPROJECTS, in 2019, 521 new hotels were opened in the Asia Pacific region. China, Australia, and India were leading countries in terms of expected openings in 2021. According to a blog post by Travel Pulse in January 2021, Marriott International announced to open of 100 properties in Asia Pacific in 2021.

The increasing adoption of smart showers across Europe to reduce water and energy consumption is expected to drive market growth. For instance, in September 2020, The SmartShower project, run by Flow Loop in Denmark, launched the Eco Loop, an innovative shower panel that recycles water and energy using standard off-the-shelf components.

Key Companies & Market Share Insights

The smart shower market is characterized by the presence of various well-established players such as Kohler Co, Moen Incorporated, Roca Sanitario, S.A, and TOTO Ltd, as well as several small- and medium-sized players. These market players face intense competition from each other, as some of them operate at several locations and have large customer bases.

Additionally, the market is consolidated with a small number of large-scale vendors controlling a majority of the market. Leading companies have been investing significant funds in comprehensive research and development, primarily to develop more cutting-edge products.

-

In June 2021, Roca Group, a leader in the design, production, and marketing of bathroom products, acquired German manufacturer Sanit, which specializes in sanitaryware installation systems. The acquisition was aimed at setting up specialized competence centers for different bathroom product categories and strengthening the company’s position as a global operator

-

In March 2022, Jaquar-owned Artize launched its flagship retail space Atelier luxury bath gallery to display its retail bath ware. Through this initiative, visitors are encouraged to touch, feel, and experience the Artize bath ware products

Some of the prominent players in the global smart shower market are as follows:

-

Roca Sanitario, S.A.

-

TOTO LTD.

-

Moen Incorporated

-

LIXIL Corporation

-

Kohler Co.

-

Jaquar

-

Aqualisa

-

GetHai, Inc.

-

Dornbracht AG & Co. KG

-

WaterHawk (LTE Water Products)

Smart Shower Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.22 billion

Revenue forecast in 2030

USD 2.71 billion

Growth rate (Revenue)

CAGR of 11.8% from 2022 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; Thailand; Indonesia; China; Japan; India; Australia; Brazil; Argentina; South Africa; and UAE

Key companies profiled

Roca Sanitario S.A.; TOTO LTD.; Moen Incorporated; LIXIL Corporation; Kohler Co.; Jaquar; Aqualisa; GetHai, Inc.; Dornbracht AG & Co. KG; WaterHawk (LTE Water Products)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Smart Shower Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart shower market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Hotels & Restaurants

-

Gyms

-

Spas and Wellness

-

Others

-

-

Residential/Domestic

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

Thailand

-

Indonesia

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart shower market size was estimated at USD 1,113.2 million in 2022 and is expected to reach USD 1,225.9 million in 2023

b. The global smart shower market is expected to grow at a compound annual growth rate of 11.5% from 2023 to 2030 to reach USD 2.71 billion by 2030.

b. Based on region, North America accounted for the largest revenue share of 39.49% of the global smart shower market in 2022 and is expected to continue its dominance over the forecast period. The increasing penetration of smart homes and commercial properties in the U.S. and Canada is acting as a major catalyst for market growth in the region.

b. Some key players operating in the global smart shower market include Roca Sanitario, S.A., TOTO LTD., Moen Incorporated, LIXIL Corporation, Kohler Co., Jaquar, Aqualisa, GetHai, Inc., Dornbracht AG & Co. KG, and WaterHawk (LTE Water Products).

b. Key factors that are driving the smart shower market growth include the growing penetration of smart bathroom products in developing as well as developed countries across the globe is augmenting the demand for the smart showers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.