- Home

- »

- Homecare & Decor

- »

-

Smart Faucets Market Size & Share, Industry Report, 2030GVR Report cover

![Smart Faucets Market Size, Share & Trends Report]()

Smart Faucets Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ball, Disc, Cartridge, Compression), By Application (Bathroom, Kitchen), By End-use, By Material, By Finish, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-271-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Faucets Market Summary

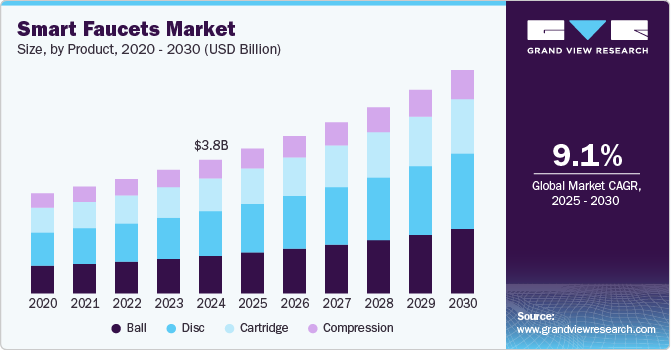

The global smart faucets market size was estimated at USD 3,804.2 million in 2024 and is projected to reach USD 6,368.2 million by 2030, growing at a CAGR of 9.1% from 2025 to 2030. The increasing consumer preference for smart home technologies is a major driver. As more individuals seek convenience, efficiency, and automation in their daily lives, smart faucets, which offer features such as touchless operation, water temperature control, and usage monitoring, are gaining popularity.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- In terms of segment, ball accounted for a revenue of USD 4,128.5 million in 2024.

- Ball is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,804.2 million

- 2030 Projected Market Size: USD 6,368.2 million

- CAGR (2025-2030): 9.1%

- North America: Largest market in 2024

The growing awareness of water conservation and energy efficiency further supports this trend, as smart faucets are designed to optimize resource usage.

Smart faucets integrate motion sensors and touchless technology, optimizing water usage by automatically controlling flow and temperature. For instance, in the hospitality sector, leading hotel chains such as Marriott and Hilton have begun incorporating smart faucets to enhance operational efficiency and sustainability compliance. Similarly, urban households, particularly in North America and Europe, are adopting smart faucets as part of their broader home automation ecosystems.

Moreover, regulatory frameworks mandating water efficiency are further accelerating adoption. Governments worldwide impose stringent water conservation policies and encourage the installation of smart plumbing solutions. For example, California’s stringent water efficiency standards have led to increased adoption of sensor-based faucets in residential and commercial settings.

In addition, rising concerns over hygiene, particularly post-pandemic, have fueled demand for touchless and voice-activated faucets. Public infrastructure, including airports, hospitals, and corporate offices, is increasingly integrating these systems to mitigate the spread of germs while improving user convenience.

Rising disposable income and urbanization worldwide have led to higher spending capacities, and consumers are willing to invest in advanced home fixtures that enhance their living standards. Rapid urban development has led to the demand for modern infrastructure, including smart kitchens and bathrooms equipped with innovative technologies like smart faucets.

Technological advancements also play a crucial role in driving this market. Integrating Internet of Things (IoT) capabilities in smart faucets enables seamless connectivity and remote control via smartphones or voice assistants. Continuous innovation in materials, designs, and functionalities makes these products increasingly appealing to diverse demographics, including tech-savvy individuals and environmentally conscious consumers.

The hospitality and commercial sectors are adopting smart faucets on a larger scale due to their ability to provide hygiene, aesthetic appeal, and cost-saving benefits. Hotels, restaurants, and other establishments are integrating these faucets to enhance customer experiences and align with sustainability goals.

Key manufacturers are incorporating new technologies to increase the connectivity and convenience of bathroom and kitchen faucets. Moreover, industry participants focus on expanding their product portfolio by offering innovative products incorporating artificial intelligence (AI). Key sanitary ware manufacturers, including GROHE AG and Kohler Co., have developed a wide range of faucets with multiple color choices, innovative designs, and smart connectivity.

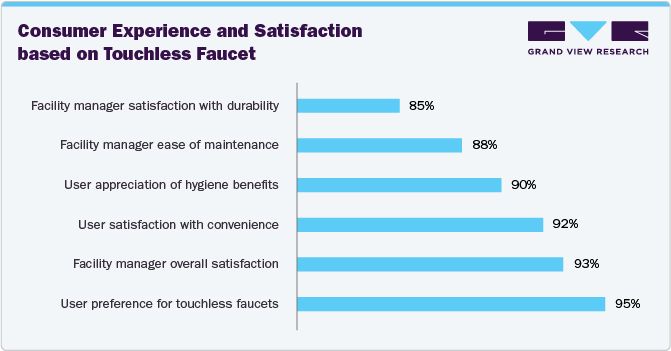

Consumer Survey & Insights

The 2021 survey conducted by FontanaShowers evaluated user experiences and satisfaction with touchless faucets in various commercial settings, including office buildings, shopping malls, hospitals, schools, and airports. The study aimed to assess user perceptions regarding convenience and hygiene and facility managers’ insights on maintenance and durability.

Responses were collected over three months from 500 users and 50 facility managers through online and paper-based questionnaires. The findings demonstrated a high level of satisfaction among both user groups. From a user perspective, 92% reported high satisfaction with the convenience of touchless faucets, and 90% appreciated the hygiene benefits, emphasizing the reduced need to touch surfaces. Moreover, 95% of users preferred touchless faucets over traditional manual ones in public restrooms.

Facility managers echoed these positive sentiments, with 88% acknowledging ease of maintenance and 85% expressing satisfaction with faucet durability, translating to fewer repairs. Moreover, 93% of facility managers affirmed that these faucets significantly improved restroom cleanliness and maintenance efficiency. The results collectively highlight the effectiveness of touchless faucets in enhancing user experience, promoting hygiene, and ensuring operational ease for facility management in commercial environments. This reinforces their growing preference for high-traffic public spaces.

Product Insights

Disc smart faucets accounted for a revenue share of 33.5% in the overall smart faucet industry in 2024. Technological advancements, particularly ceramic disc technology, have made these faucets highly durable and precise in controlling water flow, appealing to quality-conscious consumers. Their water conservation features, which align with the increasing focus on environmental sustainability, have also driven demand. Furthermore, the sleek, modern designs of disc faucets enhance the aesthetic appeal of kitchens and bathrooms, making them a preferred choice among homeowners. Integration with smart home systems, such as voice-activated controls and IoT connectivity, further boosts their popularity, especially among tech-savvy users. Features like touchless operation ensure hygiene and convenience, which are particularly valued in both residential and commercial settings.

Demand for smart ball faucets is expected to grow at a CAGR of 9.5% from 2025 to 2030. Ball faucets are a common choice for kitchen sinks and were the first washerless faucets. They are easily identifiable by their single handle, which moves over a rounded, ball-shaped cap located just above the faucet base. Inside, a metal or plastic ball with chambers or slots works with rubber O-rings and spring-loaded seals to control water flow and temperature. Based on the handle's position, the ball and lever assembly adjusts the hot and cold water mix. This innovative design made ball faucets popular, offering a sleek, single-handle operation and affordability.

Application Insights

Smart faucets in bathrooms accounted for a revenue share of 59.2% in the overall smart faucet in 2024. Bathrooms are a key area where hygiene is paramount, and smart faucets with touchless or sensor-enabled features offer hands-free operation, reducing the spread of germs. These faucets also provide water-saving capabilities, aligning with the growing emphasis on sustainability and efficient resource usage. Integrating smart technologies, such as voice control and IoT connectivity, enhances convenience and user experience, making them appealing to tech-savvy consumers. In addition, the aesthetic appeal of modern smart faucets complements contemporary bathroom designs, driving their adoption in both residential and commercial spaces. Rising urbanization and increasing disposable incomes have further fueled the demand for premium bathroom fixtures, solidifying this segment's market performance of smart faucets.

Demand for smart faucets in kitchen applications is set to grow at a CAGR of 9.2% from 2025 to 2030. Increasing consumer focus on convenience and efficiency has driven interest in smart kitchen solutions, where features like touchless operation, voice control, and precise temperature adjustment provided by smart faucets play a significant role. The growing adoption of connected home technologies and IoT devices makes smart faucets an integral part of modern kitchens. Furthermore, their water-saving capabilities align with global sustainability efforts and appeal to environmentally conscious consumers. Rising disposable incomes, urbanization, and evolving kitchen aesthetics also contribute to the growing demand as homeowners increasingly invest in premium, technologically advanced kitchen fixtures.

End-use Insights

Smart faucet sales in residential settings accounted for 71.7% of the overall smart faucet industry in 2024, primarily driven by the continuous growth in housing construction, home renovations, and remodeling activities. Homeowners are increasingly investing in upgrading kitchens and bathrooms with modern, efficient, smart, and aesthetically appealing faucets that align with current design trends. Moreover, the increasing trend of smart home technology integration has boosted the adoption of automatic home faucets.

Smart faucet sales in commercial areas are expected to grow at a CAGR of 9.3% from 2025 to 2030. Expanding commercial infrastructure across developing economies supports this segment’s growth. The increasing demand for touchless and sensor-enabled faucets in commercial spaces, such as hotels, restaurants, offices, and healthcare facilities, is spurred by the focus on hygiene and convenience. The water-saving features of smart faucets also align with sustainability goals, appealing to businesses aiming to reduce operational costs and meet environmental standards. Furthermore, rising urbanization and globalization are increasing the number of commercial establishments, further boosting the demand for technologically advanced and aesthetically appealing faucets.

Material Insights

Smart faucets made of brass & bronze accounted for a revenue share of 39.9% in 2024 due to their superior durability, corrosion resistance, and aesthetic appeal. These materials are highly valued for their longevity and ability to withstand varying water conditions, making them ideal for residential and commercial applications. Brass and bronze faucets also offer a premium look, complementing modern and traditional interior designs, which appeals to consumers looking for high-quality, stylish fixtures.

Demand for smart faucets made of stainless steel is expected to grow at a CAGR of 10.0% from 2025 to 2030. Stainless steel is a popular material for kitchen faucets, especially when paired with matching stainless steel sinks. Known for its strength and higher melting point, stainless steel is harder to cast and machine than brass. However, it contains no lead, aligning with modern regulatory requirements. Its strength allows for thinner castings, reducing material usage. Moreover, durability and safety are derived from its composition, which includes 18% chromium and 8-10% nickel. Chromium enhances corrosion resistance, while nickel strengthens the material and improves malleability. Some 316 steel alloys also contain molybdenum for added resistance to acidic environments.

Finish Insights

Smart faucets with a chrome finish accounted for a revenue share of 42.5% in 2024. This is attributed to their widespread popularity for their sleek, shiny appearance, which complements a wide range of interior styles, from modern to traditional. Chrome finishes are also highly durable, corrosion-resistant, and easy to clean, making them a practical choice for consumers. Furthermore, chrome faucets are typically more affordable than other finishes, making them accessible to a broad range of consumers.

Smart faucets with a matt black finish are expected to grow at a CAGR of 9.2% from 2025 to 2030. Matte black smart faucets are a practical and stylish addition to modern kitchens and bathrooms. Their bold, neutral finish pairs well with a wide range of design styles, from sleek contemporary interiors to warm, nature-inspired aesthetics. The matte surface provides a clean, understated appearance, striking contrast against lighter countertops or blending seamlessly with darker tones. Their adaptability makes them popular for homeowners seeking a functional yet visually appealing upgrade. Matte black smart faucets work equally well as a focal point or a complement to other design elements.

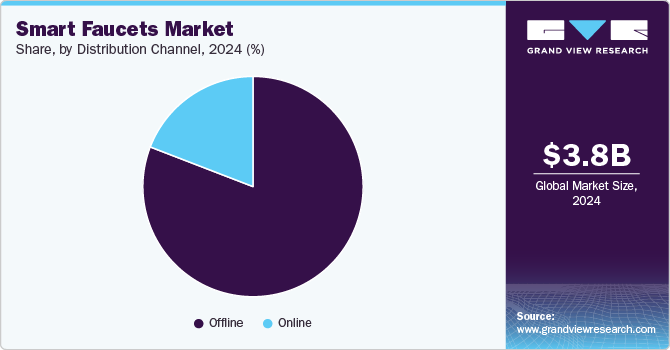

Distribution Channel Insights

Smart faucet sales through offline channels accounted for a share of 80.9% in 2024, driven by consumer preference for in-person shopping when selecting high-involvement products like faucets. Many consumers prefer to physically examine faucets in retail stores, such as home improvement centers and specialty bath and plumbing stores, to assess their design, finish, and quality before purchasing.

Smart faucet sales through online channels are expected to grow at a CAGR of 8.8% from 2025 to 2030. Offline distribution channels for smart faucets provide customers with quick access to products, allowing them to evaluate the quality, colors, measurements, and patterns visually. Customers can also take precise measurements and discuss them with sales representatives to ensure optimal fit and customization. Through this distribution channel, customers can also seek in-person assistance for installation services and post-purchase support.

Regional Insights

The smart faucet industry in North America accounted for a revenue share of 25.1% in 2024, owing to the region's strong adoption of advanced home technologies driven by tech-savvy consumers, which has played a significant role in boosting the market. High awareness of water conservation and sustainability efforts has increased demand for faucets with smart water-saving features. Moreover, modern home remodeling trends and premium fixtures in North America have fueled interest in smart faucets, particularly among homeowners seeking functionality and aesthetic appeal.

U.S. Smart Faucet Market Trends

The U.S. smart faucet market witnessed significant growth in 2024, owing to the developed commercial infrastructure, including hospitality, healthcare, and office spaces, that supports adopting smart faucet solutions. Moreover, integrating IoT technologies into smart faucets aligns well with the growing penetration of smart home ecosystems in the U.S.

Europe Smart Faucet Market Trends

The smart faucet industry in Europe is expected to grow at a CAGR of 7.9% from 2025 to 2030. Growing awareness of water conservation and sustainability leads consumers and businesses to adopt water-saving smart faucets. Increasing investments in modernizing residential and commercial spaces, particularly in urban areas, also contribute to this market expansion. The integration of smart home technologies, a trend gaining momentum across Europe, aligns with the features offered by smart faucets, such as voice control and IoT connectivity. Furthermore, the rising demand for hygiene-focused solutions, like touchless faucets, has fueled the adoption of smart faucets in sectors such as hospitality, healthcare, and public infrastructure.

Asia Pacific Smart Faucet Market Trends

The smart faucet market in Asia Pacific accounted for a revenue share of 38.7% of the global smart faucet industry in 2024. Rapid urbanization and infrastructure development in countries like China, India, and Southeast Asian nations have driven the adoption of modern home and commercial fixtures, including smart faucets. Increasing disposable incomes and the growing middle-class population in these countries have fueled the demand for premium and technologically advanced products. In addition, the emphasis on water conservation and environmental sustainability has prompted consumers and businesses in the region to invest in smart faucets with water-saving features. Integrating smart home technologies and a rising preference for touchless and hygienic solutions in residential, hospitality, and healthcare settings has further boosted this region's growth.

Middle East & Africa Smart Faucet Market Trends

The smart faucet market in the Middle East & Africa is expected to grow at a CAGR of 8.6% from 2025 to 2030, driven by rapid urbanization, increasing infrastructure development, rising disposable incomes, and changing consumer preferences. In particular, Gulf Cooperation Council (GCC) countries such as the UAE, Saudi Arabia, Qatar, and Kuwait are witnessing a surge in demand for smart and convenient faucets due to technological advancements, increasing water conservation efforts, and a preference for luxury and modern interiors. As urban populations expand and real estate developments flourish, there is a rising need for high-quality and technologically advanced bathroom and kitchen fixtures, making smart faucets popular among homeowners, businesses, and hospitality sectors.

Key Smart Faucets Company Insights

The market is fragmented primarily due to several globally recognized and regional players. Some key companies in the market include Kohler Co., Kraus, USA, American Standard Brands, Grohe America Inc., Pfister, Delta Faucet Company, and others.

-

Kohler Co. manufactures kitchen and bath appliances, engines & power generation systems, furniture & decorative products, and home interiors & tiles. Under the kitchen and bath segment, the company offers sinks & faucets, toilet seating, bathing products, mirrors & vanities, kitchen faucets, shower doors, and lighting products. Its product portfolio comprises furniture and decorative items, including ceramics, wood tiles, beds, tables, and other accessories.

-

Kraus USA Plumbing LLC is a prominent manufacturer specializing in kitchen and bathroom fixtures, particularly known for their high-quality faucets. Kraus places a strong emphasis on quality throughout its manufacturing process. They utilize advanced technology combined with top-quality materials to ensure that every product meets rigorous durability and reliability standards. Their product line includes a wide range of sinks, faucets, and aesthetically pleasing accessories engineered for exceptional performance.

Key Smart Faucets Companies:

The following are the leading companies in the smart faucets market. These companies collectively hold the largest market share and dictate industry trends.

- Kohler Co.

- Kraus, USA

- American Standard Brands

- Grohe America Inc.

- Pfister

- Delta Faucet Company

- Moen Incorporated

- Aqua Source Faucet

- Danze Inc.

- Masko Corporation

Recent Developments

-

In February 2025, Brondell, a San Francisco-based innovator, launched its Jema Kitchen Faucet Collection at KBIS 2025 in Las Vegas. The Jema faucet, Brondell's flagship product in its new faucet category, integrates patented Nebia spray technology for superior performance and water conservation. With four spray modes, including the efficient RapidRinse and GentleClean, Jema delivers exceptional cleaning power at just 0.8 gpm. Its sleek, high-arch design maximizes sink space, while features like the Accelerate Installation System ensure hassle-free setup.

-

In December 2024, VitrA, a global leader in bathroom solutions, unveiled Root Sensor Faucets, a cutting-edge innovation for sustainable and smart bathrooms. Featuring advanced sensor technology, these faucets enable hands-free operation, reducing water wastage while ensuring convenience. With a sleek, modern design, they seamlessly complement diverse bathroom styles. Prioritizing water conservation and hygiene, the faucets activate only when needed, providing a touchless and efficient experience. Root Sensor Faucets embody VitrA's commitment to sustainability, making them ideal for residential and commercial applications.

-

In July 2024, Studio McGee and Kohler teamed up to create a collection of kitchen and bathroom products that blend timeless design with modern functionality. The collaboration includes six curated collections, each offering a unique aesthetic. The Edalyn Kitchen Faucet Collection features elegantly arched faucets and a wall-mounted pot filler, while the Castia Bathroom Faucet Collection provides sleek yet classic bath fixtures in multiple finishes.

-

In May 2024, Delta Faucet Company announced the launch of its new Touch₂O with Touchless Technology. This faucet enhances kitchen convenience by offering multiple ways to control water flow. Users can activate the faucet through motion sensing, a simple tap, or manual operation using the handle.

-

In February 2024, at KBIS 2024, Delta Faucet introduced a range of innovative kitchen and bathroom products designed for convenience and modern living. Their Touch₂O with Touchless Technology allows users to control water flow through motion, touch, or manual operation, and it features a TempSense Indicator that changes color based on water temperature.

Smart Faucet Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 4.13 billion

Revenue forecast in 2030

USD 6.37 billion

Growth rate

CAGR of 9.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, finish, end-use, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Kohler Co; Kraus USA; American Standard Brands; Grohe America Inc.; Pfister; Delta Faucet Company; Moen Incorporated; Aqua Source Faucet; Danze Inc.; Masco Corporation

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Faucets Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart faucet market report based on product, application, material, finish, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ball

-

Disc

-

Cartridge

-

Compression

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automatic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bathroom

-

Kitchen

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Copper

-

Brass & Bronze

-

Zinc & Zinc Alloys

-

Plastic

-

Others

-

-

Finish Outlook (Revenue, USD Million, 2018 - 2030)

-

Nickel

-

Chrome

-

Stainless Steel

-

Matte Black

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart faucets market was estimated at USD 3.80 billion in 2024 and is expected to reach USD 4.13 billion in 2025.

b. The global smart faucets market is expected to grow at a compound annual growth rate of 9.1% from 2025 to 2030 to reach USD 6.37 billion by 2030.

b. Asia Pacific dominated the smart faucet market, with a share of 38.7% in 2024. Regional growth is driven by rapid urbanization, increasing construction activities, and rising infrastructure development in emerging economies such as China, India, and Southeast Asia.

b. Some of the key players operating in the smart faucet market include Kohler Co., Kraus USA, American Standard Brands, Grohe America Inc., Pfister, Delta Faucet Company, Moen Incorporated, Aqua Source Faucet, Danze Inc., and Masco Corporation.

b. Growth of the global smart faucet market is majorly driven by the growing awareness of water conservation and energy efficiency, which further supports this trend, as smart faucets are designed to optimize resource usage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.