Smart Grid Security Market Size & Trends

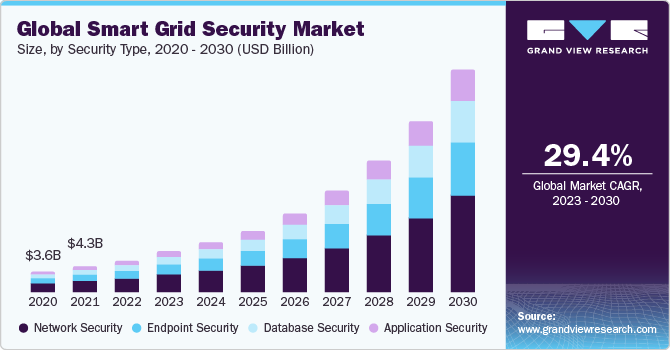

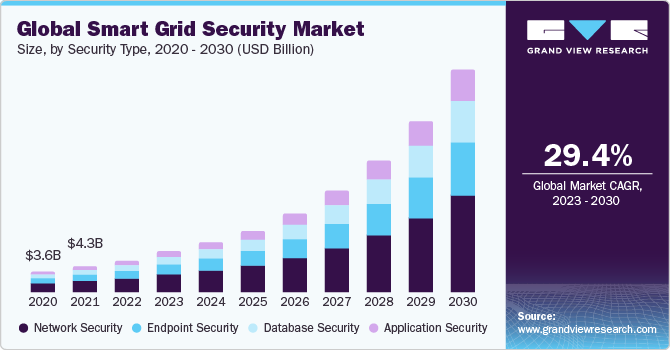

The global smart grid security market size was valued at USD 5.28 billion in 2022 and is expected to grow at a CAGR of 29.4% over the forecast period. Smart grids capture and communicate massive volumes of data, which includes real-time network status, consumer data, and device statistics. It is vital to safeguard data against unwanted access, misuse, or data breaches to ensure the confidentiality of information and grid security.

With the development of remote employment, there has been a greater focus on cyber security. Cyber threats posed major dangers to smart grid operations, including attacks involving ransomware and fraud initiatives. To safeguard smart grid assets and data, utilities are required to strengthen their cybersecurity procedures. Utilities are increasingly using remote management and monitoring systems to ensure the grid's continuing operation and security. These methods allowed smart grid operators to evaluate and manage grid operations remotely, reducing the requirement for on-site employees. Due to the pandemic, there has been a surge in interest in cloud-based safety measures for smart grids. These technologies provided flexibility and adaptability for remote surveillance, data analysis, and data protection.

The post-pandemic era witnessed an increase in complex cyber threats. Threat actors such as nation-states, criminal organizations, and hackers pose ongoing threats to utilities. As a result, sophisticated security solutions are required to protect grid resources and activities. Blockchain technology, artificial intelligence (AI), and neural networks are among the emerging technologies being used to improve smart grid security. These technologies enable better identification of threats, incident handling, and automation. Furthermore, public-private partnerships will be crucial in improving smart grid security. Government departments, services, and industry organizations working together will give assistance and advice on security procedures and standards.

Security Type Insights

On the basis of security type, the market is segmented into application security, endpoint security, database security, and network security. Network security held the largest market share in 2022. Network security contributes to the confidentiality of data by limiting unauthorized changes or manipulation. It is essential in ensuring grid information and instruction accuracy. Remote monitoring and administration of smart grid components are rendered feasible by network security, which can increase efficiency in operation and reduce the cost of maintenance. Improved network security, on the other hand, can create assurance for shareholders, rendering it easier for them to contribute to the growth and extension of smart grid proposals.

Service Insights

On the basis of services, the market is segmented into professional services and managed services. Professional services held the largest market share in 2022. The protection of smart grid communication networks is essential. Professionals provide network security services such as evaluations of vulnerabilities, safety inspections, and safety measures installation. The smart grid depends heavily on data analytics. Professional services organizations provide data analytics and IoT integration services to assist utilities in making sense of the massive amounts of data generated by smart grid devices. Professional services will aid in incorporating IoT devices and edge computing facilities, offering data security, and managing devices as the Internet of Things (IoT) and edge computing evolve increasingly prevalent in the smart grid.

Deployment Insights

On the basis of deployment, the market is segmented into on-premises and cloud. Cloud held the largest market share in 2022. Cloud computing reduces the demand for large capital investments in data centers and infrastructure upfront. Organizations can substitute paying for the resources they use via subscription or paying-as-you-go, resulting in cost reductions over conventional in-house infrastructure. Major cloud providers make substantial investments in security, including industry standards and licenses. They employ trained security teams who constantly upgrade security procedures, which can improve the safety position of smart grid projects. Cloud services often automatically update their operating systems and security features, ensuring that enterprises are safeguarded against the latest threats without any requirement for manual action.

Enterprise Size Insights

On the basis of enterprise size, the market is segmented into small and large enterprises. Large enterprises held the largest market share in 2022. On-premises security systems have significance for the protection of grid assets and information. To protect against cyber threats, firewalls, intrusion detection systems, and security information and event management (SIEM) solutions are often employed within the utility's infrastructure. On-premises solutions are ideal for handling information supplied by IoT sensors and grid equipment. Local processing enables immediate decision-making and lowers grid delay. On-premises solutions can be built to combat issues and power outages, hence improving grid stability. The process relies heavily on server rooms with electricity backups and backup systems such as data centers.

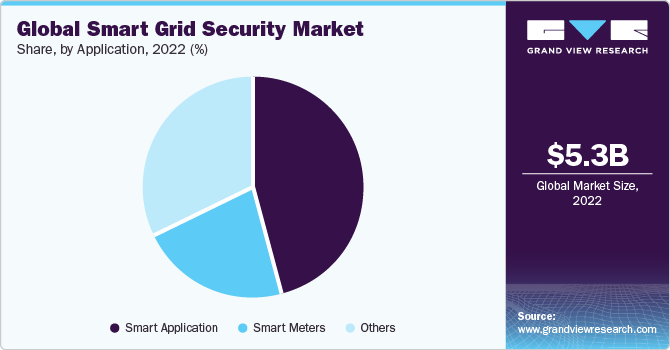

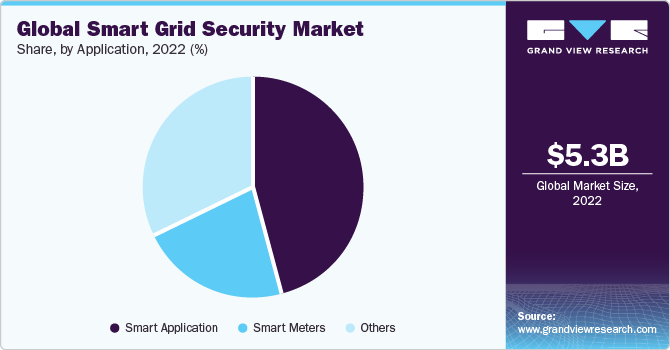

Application Insights

On the basis of application, the market is segmented into smart meters, and smart applications among others. Smart applications held the largest market share in 2022. Smart grid applications serve to safeguard the grid from cyber-attacks by adopting security measures, such as intrusion detection systems, and identifying anomalies. Smart applications forecast demand for power and generation using past data and predictive models, allowing utilities to plan more effectively. Furthermore, smart applications use data analytics to enhance the functioning of grid assets and reduce maintenance costs.

Regional Insights

Asia Pacific dominated the market in 2022. The growth of the region can be attributed to the presence of prominent players such as Intel Corporation, Cisco Systems, Inc., and IBM Corporations, among others. With the rising digitization of energy structures, there is an increasing awareness of vulnerabilities in cybersecurity. APAC organizations are making investments in cybersecurity security technologies for smart grids. Furthermore, the expanding population in APAC countries such as China, India, and Japan, requires enhanced energy planning and distribution, making smart grids and their safety elements highly significant.

Key Companies Market Share Insights

Key players operating in the market are BAE Systems, Cisco Systems, Inc., Duke Energy Corporation, Dimension Solutions, Fortinet, IBM Corporation, Intel Corporation, Leidos, Palo Alto Networks., and Siemens, among others among others among others. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives:

-

In November 2022, Duke Energy Corporation collaborated with Amazon Web Services, Inc. on smart grid technologies. This collaboration will take advantage of Amazon Web Services, Inc.'s cloud capabilities to enhance distribution of energy, enhance relations with consumers, and aid Duke Energy Corporation in its shift to renewable energy sources.

-

In March 2022, Analog Devices, Inc. and Gridspertise collaborated to enhance smart grid technologies, with an emphasis on distribution grid administration and control. The collaboration aims at using Analog Devices, Inc.’s semiconductors capabilities, and Gridspertise's power software to create innovative technologies that will improve the productivity and dependability of smart grids.