- Home

- »

- Next Generation Technologies

- »

-

Smart Home Market Size, Share And Trends Report, 2030GVR Report cover

![Smart Home Market Size, Share & Trends Report]()

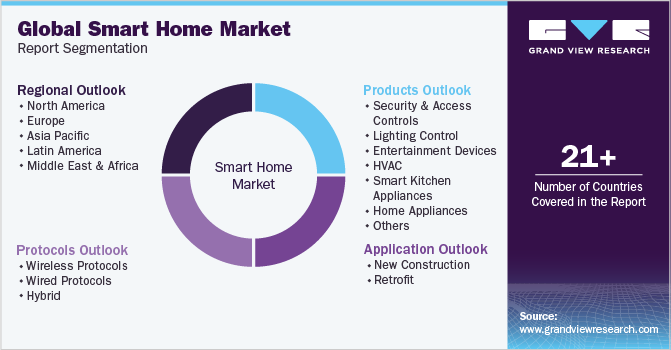

Smart Home Market Size, Share & Trends Analysis Report By Products (Lighting Control, Security & Access Controls), By Application (New Construction, Retrofit), By Protocols (Wireless, Wired), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-041-5

- Number of Pages: 148

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Smart Home Market Size & Trends

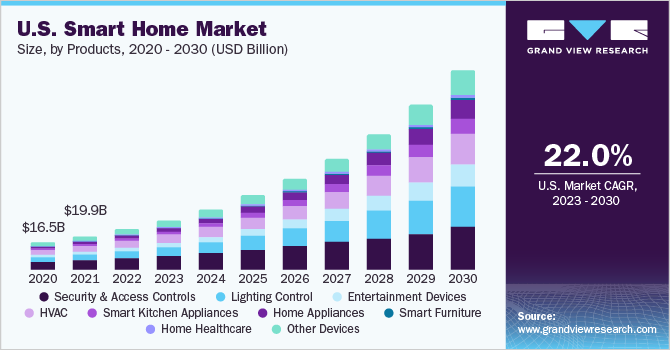

The global smart home market size was valued at USD 79.16 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 27.07% from 2023 to 2030. Smart home products are available in the form of cameras, smart lights, streaming devices, dishwashers, and more. Growing trend of integrating Artificial Intelligence (AI) in smart home products for smart features is expected to increase product demand. Moreover, high penetration rate of smartphones and the internet globally is driving the demand for connected smart home products. Digital assistance integrated with AI is offering users a hands-free and more user-friendly deployment of smart devices, significantly impacting the buyers’ preferences.

Growing use of virtual assistants, such as Siri, Google Assistant, and Alexa, enables users to use voice commands for task automation. The emerging features of these digital assistants, such as Bluetooth speakers and hands-free channel surfing, among others are driving the demand for smart home devices. For instance, in October 2022, Google updated its assistant to support voice-input message typing along with emoji support for convenience in messaging for users. Rapid adoption of modern technologies, such as Internet of Things (IoT), blockchain, smart voice recognition, and AI, is significantly impacting the market growth.

For instance, smart voice recognition technology enables smart home products with a mic to recognize users’ voices and give them personalized responses. Similarly, an increased adoption rate of IoT in developing and developed regions has also contributed to the growth of this market. The capability of technologies to allow connectivity between devices has helped in generating demand for smart home market. The COVID-19 pandemic shut down industries and affected the manufacturing of smart home devices. However, due to stringent lockdowns around the world, people were forced to stay at home.

As a result, people turned towards entertainment in the form of TV shows and movies, which caused a surge in demand for smart TVs and entertainment centres. In addition, there was a rise in the trend for smart homes as they offered automation in tasks following social distancing regulations. Although supply chain disruptions were present, the pandemic and its impacts also revealed significant shortcomings in the digital device and internet infrastructure sectors. As supplies decreased and production lagged, there were not enough semiconductors available to support smart products. This impacted the companies that manufacture smart home products.

Market Dynamics

GROWING DEMAND FOR SMART SECURITY & ACCESS SYSTEMS

One of the major concerns in every household across the globe is the fear of theft and burglary. According to the Federal Bureau of Investigation (FBI) statistics, a burglary occurs every 30 seconds across the U.S, adding up to over 3,000 burglar strikes per day. This has brought up significant installation of Closed-Circuit Televisions (CCTVs) around the premises of the properties, including household, office areas, driveways, and others. However, the various challenges associated with CCTVs, such as the ability of these cameras to only record footage and not prevent intrusions, requirement of high bandwidth and connectivity for remote monitoring, and others, is resulting in the growing demand for smart surveillance systems to ensure safety by detecting, deterring, and reporting intrusions. Smart surveillance system deploys sensors and computer vision to detect the actions and report real-time. It also enables the user to keep a backup of valuable footage on the cloud safely and allows connecting and controlling the entire location remotely.

INCREASING PENETRATION FOR GREEN AND ENERGY EFFICIENT SOLUTIONS

Increased human needs and wants to carry out day-to-day activities lead to a substantial amount of carbon emission into the atmosphere, resulting in global warming. The careless and over deployment of electricity is one of the major causes of global warming. With the introduction of smart technology and smart systems, several innovative devices have been developed to reduce energy usage and consumption in households, making them greener and more sustainable. Smart home devices, including smart thermostats, smart sprinkler systems, smart bulbs, smart meters, smart composters, and smart power strips, allow individuals to control and monitor power consumption, save energy, and help to reduce carbon emissions footprint. The ability of smart devices to be an energy-efficient solution offering sustainable solutions for environment is driving the growth of smart home automation market.

Products Insights

Security & access control segment dominated the industry in 2022 and accounted for the highest share of more than 30.40% of the overall revenue. This growth is attributed to the increasing demand for smart security solutions and the need to allow authorized access to safes or rooms with valuable items. Smart locks and security cameras help monitor and authorize access only for permitted individuals by incorporating live feed playback, custom PINs, fingerprint scanners, and more. For instance, in September 2022, Amazon.com, Inc. unveiled Ring Spotlight Cam Plus, Ring Spotlight Cam Pro, and 2nd Gen Ring Alarm Panic Button for security and access control purposes using radar and 3D motion detection features.

The home healthcare segment is projected to grow at the highest CAGR during the forecast period. This growth can be attributed to the trend of consumers preferring smart home healthcare products to self-diagnose, owing to rising healthcare and insurance costs. The trend of fitness and health consciousness among people is also driving the segment’s growth. For instance, consumers are using home healthcare products to monitor their key vitals, such as oxygen and blood pressure levels. Earlier, this was possible only after visiting a hospital or a clinic; however, smart home healthcare products have enabled consumers to conduct basic testing at home.

Protocols Insights

Wireless protocols segment is expected to grow at the highest CAGR of 27.75% over the forecast period. The segment also recorded the largest market share in 2022. This strong growth is attributed to the capabilities and features offered, such as mobile connectivity, connectivity regardless of location, and more by protocols namely, ZigBee, Wi-Fi, Bluetooth, Z Wave, and others. Manufacturers prefer protocols, which offer smooth communication, with less to no impact on battery life and range.

For instance, ZigBee protocol provides longer battery life as it operates on lower latency and a low-duty cycle for instant device-to-device communication. The wired protocols segment is expected to grow at a significant CAGR from 2023 to 2030 as a result of the traditional products with built-in Ethernet or cable ports. Wired protocols often connect and help operate a hub of smart home devices at a central location. The secureness of wires laid behind walls and fewer connectivity issues is a driving trends for wired protocols. The rising demand for low-latency smart home products is expected to push the segment growth over the forecast period.

Application Insights

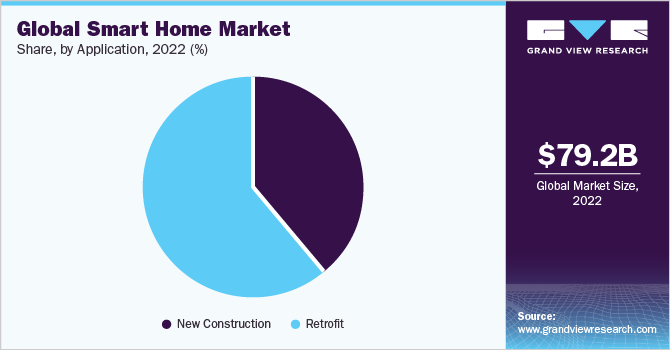

On the basis of applications, the global industry has been bifurcated into new construction and retrofit. The new construction segment is expected to register the fastest growth rate of more than 28.55% over the forecast period. This is mainly due to the convenience and ease of installing smart home devices at ongoing construction projects. Moreover, an increasing number of new residential construction projects around the world is expected to augment the demand for smart homes following the trend of smart security and access features.

Owners of new construction projects are also likely to install multiple smart home products as a result of ease of logistics involved in fixing the devices. The retrofit segment dominated the global industry in 2022 and accounted for the highest share of the overall revenue in the same year. Many homeowners retrofit their existing homes by installing one or multiple smart products based on logistics and budget. Due to easy product availability, there is a rise in trend of smart homes, which drives the growth of this segment.

Regional Insights

Asia Pacific region will account for the fastest CAGR of 32.21% over the forecast period. This growth is attributed to the improved standard of living and rise in disposable income among individuals in the region. Penetration of smartphones, the internet, and other digitally advanced equipment is expected to drive market growth in the region. Furthermore, the trend of using AI-based digital assistance for daily tasks, such as Siri and Alexa, significantly impacts market growth.

Europe region is expected to grow at a steady CAGR from 2023 to 2030. The region recorded a significant market share in 2022. This growth can be attributed to the presence of key players in the region, including ABB, Legrand, Schneider Electric SE, Siemens, Robert Bosch GmbH, and others. Also, increased standard of living, high Gross Domestic Product (GDP), technologically friendly population, and favourable government initiatives support the growth of smart home devices and technologies, which is expected to drive the regional market.

Key Companies & Market Share Insights

Key players use strategies, such as partnerships, acquisitions, ventures, innovations, R&D, and geographical expansions, to solidify their industry position. Companies are also focusing on improving their product offerings to better suit the changing needs of users to stay competitive. For instance, in August 2022, Amazon.com, Inc. launched its wall echo, sound bot, wall echo, and home robot as part of the company’s yearly model upgrade. Launch is expected to be in line with the company’s aim to counter upcoming competitive companies. Key companies are investing substantial capital in ventures, development, and research in modern technologies.

For instance, in January 2022, Samsung Electronics Co., Ltd. partnered with Oracle Corp. to develop smart energy solutions for its customers and combine Oracle’s contextual and behavioural energy insights with Samsung’s SmartThings products and automation services. This partnership is aimed at providing new and valuable features in their product offerings. Key players are also developing additional capabilities for smart home products to support their use in new construction homes as well as retrofit home fitments. Some prominent players in the global smart home market include:

-

LG Electronics, Inc.

-

Siemens AG

-

Amazon.com, Inc.

-

Google Nest (Google LLC)

-

Samsung Electronics Co., Ltd.

-

Schneider Electric SE

-

Legrand S.A.

-

Robert Bosch GmbH

-

Assa Abloy AB

-

Sony Group Corp.

-

ABB, Ltd.

-

Philips Lighting B.V.

-

Honeywell International, Inc.

Recent Development

-

In January 2023, Schneider Electric acquired AVEVA plc to use AVEVA plc’s advanced software capabilities to introduce modern automation solutions for residential, commercial, and building complexes. The acquisition is expected to grow Schneider Electric’s home automation offering.

-

In April 2022, ABB Ltd. launched a collaboration with Samsung Electronics Co., Ltd. to expand its home automation portfolio. The collaboration will make it easier for new customers to reduce costs and create a positive impact on the environment.

-

In September 2022, Lutron Electronics Co., Inc. launched its Diva Smart Dimmer and Claro Smart Switch for smart lighting automation in homes which also has a wireless option.

Smart Home Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 100.42 billion

Revenue forecast in 2030

USD 537.01 billion

Growth rate

CAGR of 27.07% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, protocols, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Benelux; Nordic Countries; Russia; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; Egypt; South Africa; Nigeria

Key companies profiled

LG Electronics, Inc.; Siemens AG; Amazon.com, Inc.; Google Nest (Google LLC); Samsung Electronics Co., Ltd.; Schneider Electric SE; Legrand SA; Robert Bosch GmbH; Assa Abloy AB; Sony Group Corp.; ABB, Ltd.; Philips Lighting B.V.; Honeywell International, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Home Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the smart home market based on products, protocols, application, and region:

-

Products Outlook (Revenue, USD Million, 2018 - 2030)

-

Security & Access Controls

-

Security Cameras

-

Video Door Phones

-

Smart Locks

-

Remote Monitoring Software & Services

-

Others

-

-

Lighting Control

-

Smart Lights

-

Relays & Switches

-

Occupancy Sensors

-

Dimmers

-

Other Products

-

-

Entertainment Devices

-

Smart Displays/TV

-

Streaming Devices

-

Sound Bars & Speakers

-

-

HVAC

-

Smart Thermostats

-

Sensors

-

Smart Vents

-

Others

-

-

Smart Kitchen Appliances

-

Refrigerators

-

Dish Washers

-

Cooktops

-

Microwave/Ovens

-

-

Home Appliances

-

Smart Washing Machines

-

Smart Water Heaters

-

Smart Vacuum Cleaners

-

-

Smart Furniture

-

Home Healthcare

-

Other Devices

-

-

Protocols Outlook (Revenue, USD Million, 2018 - 2030)

-

Wireless Protocols

-

ZigBee

-

Wi-Fi

-

Bluetooth

-

Z Wave

-

Others

-

-

Wired Protocols

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Retrofit

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Benelux

-

Nordic Countries

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Egypt

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global smart home market size was estimated at USD 79.16 billion in 2022 and is expected to reach USD 100.42 billion in 2023.

b. The global smart home market is expected to grow at a compound annual growth rate of 27.07% from 2023 to 2030 to reach USD 537.01 billion by 2030.

b. North America dominated the smart home market with a share of 26.9% in 2022. This is attributable to the increasing adoption of smart devices in the residential vertical to improve the standard of living.

b. Some key players operating in the smart home market include LG, Electronics, Inc., Siemens AG, Amazon .com, Google Nest (Google LLC), Samsung Electronics Co.,Ltd., Schneider Electric SE, Legrand S.A., Robert Bosch GmbH, Assa Abloy AB, Sony Group Corporation, ABB Ltd., Philips Lighting B.V., Honeywell International, Inc.

b. Key factors that are driving the market growth include the growing need for smart security & surveillance systems, and increasing demand for low carbon emission-oriented and energy-saving solutions.

Table of Contents

Chapter 1 Smart Home Market: Methodology and Scope

1.1 Market Segmentation & Scope

1.2 Market Definitions

1.3 Information Procurement

1.3.1 Information analysis

1.3.2 Market formulation & data visualization

1.3.3 Data validation & publishing

1.4 Research Scope and Assumptions

1.4.1 List to data sources

Chapter 2 Smart Home Market: Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Smart Home Market: Industry Outlook

3.1 Market Lineage

3.2 Industry Value Chain Analysis

3.3 Market Dynamics

3.3.1 Market driver analysis

3.3.1.1 Growing need for smart security & surveillance systems

3.3.1.2 Increasing disposable income and inclination for smart and luxurious lifestyle in developing countries

3.3.1.3 Increasing demand for low carbon emission-oriented and energy-saving solutions

3.3.2 Market restraint analysis

3.3.2.1 High installation and maintenance charges

3.3.2.2 Compatibility issues of smart devices from various manufacturers or vendors

3.4 Industry Opportunities & Challenges

3.5 Industry Analysis Tools

3.5.1 Porter’s analysis

3.5.2 Macroeconomic analysis

3.6 Impact of Semiconductor Shortage on Smart Home Supply Chain

3.7 Key Trends

3.7.1 Technological trends

3.7.2 Economic trends

3.8 Consumer Buying Behavior Analysis

3.8.1 Consumer trends & preferences

3.8.2 Factors affecting buying decision

3.8.3 Consumer product adoption

3.8.4 Observations & recommendations

3.9 Emergence of AI in Smart Home Ecosystem

3.10 COVID-19 Impact on the Smart Home Market

Chapter 4 Smart Home Market Product Outlook

4.1 Smart Home Market Share By Product, 2018 - 2030 (USD Million)

4.2 Product Movement Analysis & Market Share, 2022 & 2030

4.3 Smart Home Market Estimates & Forecast, By Product (USD Million)

4.3.1 Security & Access Control

4.3.1.1 Security Cameras

4.3.1.2 Video Door Phones

4.3.1.3 Smart Locks

4.3.1.4 Remote Monitoring Software & Services

4.3.1.5 Others

4.3.2 Lighting Control

4.3.2.1 Smart Lights

4.3.2.2 Relays & Switches

4.3.2.3 Occupancy Sensors

4.3.2.4 Dimmers

4.3.2.5 Other Products

4.3.3 Entertainment Devices

4.3.3.1 Smart Displays/TV

4.3.3.2 Streaming Devices

4.3.3.3 Sound bars and Speakers

4.3.4 HVAC

4.3.4.1 Smart Thermostats

4.3.4.2 Sensors

4.3.4.3 Smart Vents

4.3.4.4 Others

4.3.5 Smart Kitchen Appliances

4.3.5.1 Refrigerators

4.3.5.2 Dish Washers

4.3.5.3 Cooktops

4.3.5.4 Microwave/ovens

4.3.6 Home Appliances

4.3.6.1 Smart Washing Machines

4.3.6.2 Smart Water Heaters

4.3.6.3 Smart Vacuum Cleaners

4.3.7 Smart Furniture

4.3.8 Home Healthcare

4.3.9 Other Devices

Chapter 5 Smart Home Market Protocol Outlook

5.1 Smart Home Market Share By Protocol, 2018 - 2030 (USD Million)

5.2 Protocol Movement Analysis & Market Share, 2022 & 2030

5.3 Smart Home Market Estimates & Forecast, By Protocol (USD Million)

5.3.1 Wireless Protocols

5.3.1.1 ZigBee

5.3.1.2 Wi-Fi

5.3.1.3 Bluetooth

5.3.1.4 Z Waves

5.3.1.5 Others

5.3.2 Wired Protocols

5.3.3 Hybrid

Chapter 6 Smart Home Market Application Outlook

6.1 Smart Home Market Share By Application, 2018 - 2030 (USD Million)

6.2 Application Movement Analysis & Market Share, 2022 & 2030

6.3 Smart Home Market Estimates & Forecast, By Application (USD Million)

6.3.1 New Construction

6.3.2 Retrofit

Chapter 7 Smart Home Regional Outlook

7.1 Smart Home Market Share By Region, 2022 & 2030

7.2 North America

7.2.1 North America smart home market, 2018 - 2030

7.2.2 U.S.

7.2.2.1 U.S. smart home market, 2018 - 2030 (USD Million)

7.2.3 Canada

7.2.3.1 Canada smart home market, 2018 - 2030 (USD Million)

7.3 Europe

7.3.1 Europe smart home market, 2018 - 2030

7.3.2 U.K.

7.3.2.1 U.K. smart home market, 2018 - 2030 (USD Million)

7.3.3 Germany

7.3.3.1 Germany smart home market, 2018 - 2030 (USD Million)

7.3.4 Italy

7.3.4.1 Italy smart home market, 2018 - 2030 (USD Million)

7.3.5 France

7.3.5.1 France smart home market, 2018 - 2030 (USD Million)

7.3.6 Spain

7.3.6.1 Spain smart home market 2018 - 2030 (USD Million)

7.3.7 Benelux

7.3.7.1 Benelux smart home market, 2018 - 2030 (USD Million)

7.3.8 Nordic Countries

7.3.8.1 Nordic Countries smart home market, 2018 - 2030 (USD Million)

7.3.9 Russia

7.3.9.1 Russia smart home market 2018 - 2030 (USD Million)

7.4 Asia Pacific

7.4.1 Asia Pacific smart home market, 2018 - 2030

7.4.2 China

7.4.2.1 China smart home market, 2018 - 2030 (USD Million)

7.4.3 Japan

7.4.3.1 Japan smart home market, 2018 - 2030 (USD Million)

7.4.4 South Korea

7.4.4.1 South Korea smart home market, 2018 - 2030 (USD Million)

7.4.5 India

7.4.5.1 India smart home market, 2018 - 2030 (USD Million)

7.4.6 Australia

7.4.6.1 Australia smart home market, 2018 - 2030 (USD Million)

7.4.7 Indonesia

7.4.7.1 Indonesia smart home market, 2018 - 2030 (USD Million)

7.4.8 Thailand

7.4.8.1 Thailand smart home market, 2018 - 2030 (USD Million)

7.5 Latin America

7.5.1 South America smart home market, 2018 - 2030

7.5.2 Brazil

7.5.2.1 Brazil smart home market, 2018 - 2030 (USD Million)

7.5.3 Mexico

7.5.3.1 Mexico smart home market, 2018 - 2030 (USD Million)

7.5.4 Argentina

7.5.4.1 Argentina smart home market, 2018 - 2030 (USD Million)

7.6 MEA

7.6.1 MEA smart home market, 2018 - 2030

7.6.2 Saudi Arabia

7.6.2.1 Saudi Arabia smart home market, 2018 - 2030 (USD Million)

7.6.3 UAE

7.6.3.1 UAE smart home market, 2018 - 2030 (USD Million)

7.6.4 Egypt

7.6.4.1 Egypt smart home market, 2018 - 2030 (USD Million)

7.6.5 South Africa

7.6.5.1 South Africa smart home market, 2018 - 2030 (USD Million)

7.6.6 Nigeria

7.6.6.1 Nigeria smart home market, 2018 - 2030 (USD Million)

Chapter 8 Competitive Landscape

8.1 Key Market Participants

8.1.1 LG Electronics

8.1.2 Siemens AG

8.1.3 Amazon.com, Inc.

8.1.4 Google Nest (Google LLC)

8.1.5 Samsung Electronics Co., Ltd.

8.1.6 Schneider Electric SE

8.1.7 Legrand SA

8.1.8 Robert Bosch GmbH

8.1.9 Assa Abloy AB

8.1.10 Sony Group Corporation

8.1.11 ABB Ltd.

8.1.12 Philips Lighting B.V.

8.1.13 Honeywell International, Inc.

8.2 Recent Developments & Impact Analysis, By Key Market Participants

8.3 Company Categorization

8.4 Participant’s Overview

8.5 Financial Performance

8.6 Product Benchmarking

8.7 Company Heat Map Analysis

8.8 Company Market Share Analysis, 2022

8.9 Strategy Mapping

8.9.1 Expansion

8.9.2 Mergers & acquisitions

8.9.3 Collaborations

8.9.4 New product launches

8.9.5 Research & development

List of Tables

TABLE 1 Smart home market - key market driver impact

TABLE 2 Key market restraint/challenges impact

TABLE 3 Global smart market revenue estimates and forecast, by product, 2018 - 2030 (USD Million)

TABLE 4 Global smart home market revenue estimates and forecast, by protocol, 2018 - 2030 (USD Million)

TABLE 5 Global smart home market revenue estimates and forecast, by application, 2018 - 2030 (USD Million)

TABLE 6 Company heat map analysis

TABLE 7 Key companies undergoing expansion

TABLE 8 Key companies involved in mergers & acquisitions

TABLE 9 Key companies involved in collaborations

TABLE 10 Key companies new product launches

TABLE 11 Key companies research & development

List of Figures

FIG. 1 Market snapshot

FIG. 2 Information procurement

FIG. 3 Data analysis models

FIG. 4 Market formulation and validation

FIG. 5 Data validating & publishing

FIG. 6 Market snapshot

FIG. 7 Segment snapshot

FIG. 8 Competitive landscape snapshot

FIG. 9 Smart home market value, 2022 & 2030 (USD Million)

FIG. 10 Key opportunity analysis

FIG. 11 Industry value chain analysis

FIG. 12 Market dynamics

FIG. 13 Porter’s analysis

FIG. 14 PESTEL analysis

FIG. 15 Smart home market, by product, key takeaways

FIG. 16 Smart home market, by product, market share, 2022 & 2030

FIG. 17 Security & access controls market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 18 Lighting control market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 19 Entertainment devices market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 20 HVAC market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 21 Smart kitchen appliances market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 22 Home appliances market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 23 Smart furniture market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 24 Home healthcare market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 25 Other devices market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 26 Smart home market, by protocol, key takeaways

FIG. 27 Smart home market, by protocol, market share, 2022 & 2030

FIG. 28 Wireless protocols market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 29 Wired protocols market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 30 Hybrid market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 31 Smart home market, by application, key takeaways

FIG. 32 Smart home market, by application, market share, 2022 & 2030

FIG. 33 New construction market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 34 Retrofit market estimates & forecasts, 2018 - 2030 (USD Million)

FIG. 35 Smart home market revenue, by region, 2022 & 2030, (USD Million)

FIG. 36 North America smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 37 U.S. smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 38 Canada smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 39 Europe smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 40 U.K. smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 41 Germany smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 42 Italy smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 43 France smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 44 Spain smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 45 Benelux smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 46 Nordic countries smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 47 Russia smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 48 Asia Pacific smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 49 China smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 50 Japan smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 51 South Korea smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 52 India smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 53 Australia smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 54 Indonesia smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 55 Thailand smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 56 Latin America smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 57 Brazil smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 58 Mexico smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 59 Argentina smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 60 MEA smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 61 Saudi Arabia smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 62 UAE smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 63 Egypt smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 64 South Africa smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 65 Nigeria smart home market estimates & forecast, 2018 - 2030 (USD Million)

FIG. 66 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Smart Home Products Outlook (Revenue, USD Million, 2018 - 2030)

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/Ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Smart Home Protocols Outlook (Revenue, USD Million, 2018 - 2030)

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Smart Home Application Outlook (Revenue, USD Million, 2018 - 2030)

- New Construction

- Retrofit

- Smart Home Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- North America Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- North America Smart Home Market, by Application

- New Construction

- Retrofit

- U.S.

- U.S. Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- U.S. Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- U.S. Smart Home Market, by Application

- New Construction

- Retrofit

- U.S. Smart Home Market, by Products Type

- Canada

- Canada Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Canada Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Canada Smart Home Market, by Application

- New Construction

- Retrofit

- Canada Smart Home Market, by Products Type

- North America Smart Home Market, by Products Type

- Europe

- Europe Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Europe Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Europe Smart Home Market, by Application

- New Construction

- Retrofit

- U.K.

- U.K. Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- U.K. Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- U.K. Smart Home Market, by Application

- New Construction

- Retrofit

- U.K. Smart Home Market, by Products Type

- Germany

- Germany Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Germany Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Germany Smart Home Market, by Application

- New Construction

- Retrofit

- Germany Smart Home Market, by Products Type

- France

- France Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- France Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- France Smart Home Market, by Application

- New Construction

- Retrofit

- France Smart Home Market, by Products Type

- Italy

- Italy Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Italy Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Italy Smart Home Market, by Application

- New Construction

- Retrofit

- Italy Smart Home Market, by Products Type

- Spain

- Spain Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Spain Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Spain Smart Home Market, by Application

- New Construction

- Retrofit

- Spain Smart Home Market, by Products Type

- Benelux

- Benelux Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Benelux Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Benelux Smart Home Market, by Application

- New Construction

- Retrofit

- Benelux Smart Home Market, by Products Type

- Nordic Countries

- Nordic Countries Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Nordic Countries Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Nordic Countries Smart Home Market, by Application

- New Construction

- Retrofit

- Nordic Countries Smart Home Market, by Products Type

- Russia

- Russia Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Russia Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Russia Smart Home Market, by Application

- New Construction

- Retrofit

- Russia Smart Home Market, by Products Type

- Europe Smart Home Market, by Products Type

- Asia Pacific

- Asia Pacific Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Asia Pacific Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Asia Pacific Smart Home Market, by Application

- New Construction

- Retrofit

- China

- China Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- China Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- China Smart Home Market, by Application

- New Construction

- Retrofit

- China Smart Home Market, by Products Type

- India

- India Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- India Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- India Smart Home Market, by Application

- New Construction

- Retrofit

- India Smart Home Market, by Products Type

- Japan

- Japan Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Japan Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Japan Smart Home Market, by Application

- New Construction

- Retrofit

- Japan Smart Home Market, by Products Type

- South Korea

- South Korea Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- South Korea Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- South Korea Smart Home Market, by Application

- New Construction

- Retrofit

- South Korea Smart Home Market, by Products Type

- Australia

- Australia Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Australia Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Australia Smart Home Market, by Application

- New Construction

- Retrofit

- Australia Smart Home Market, by Products Type

- Indonesia

- Indonesia Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Indonesia Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Indonesia Smart Home Market, by Application

- New Construction

- Retrofit

- Indonesia Smart Home Market, by Products Type

- Thailand

- Thailand Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Thailand Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Thailand Smart Home Market, by Application

- New Construction

- Retrofit

- Thailand Smart Home Market, by Products Type

- Asia Pacific Smart Home Market, by Products Type

- Latin America

- Latin America Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- New Construction

- Retrofit

- Security & Access Controls

- Latin America Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Latin America Smart Home Market, by Application

- New Construction

- Retrofit

- Brazil

- Brazil Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Brazil Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Brazil Smart Home Market, by Application

- New Construction

- Retrofit

- Brazil Smart Home Market, by Products Type

- Mexico

- Mexico Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Mexico Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Mexico Smart Home Market, by Application

- New Construction

- Retrofit

- Mexico Smart Home Market, by Products Type

- Argentina

- Argentina Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Argentina Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Argentina Smart Home Market, by Application

- New Construction

- Retrofit

- Argentina Smart Home Market, by Products Type

- Latin America Smart Home Market, by Products Type

- RetrofitMEA

- MEA Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Wireless Protocols

- MEA Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- MEA Smart Home Market, by Application

- New Construction

- Retrofit

- Saudi Arabia

- Saudi Arabia Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Saudi Arabia Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Saudi Arabia Smart Home Market, by Application

- New Construction

- Retrofit

- Saudi Arabia Smart Home Market, by Products Type

- UAE

- UAE Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- UAE Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- UAE Smart Home Market, by Application

- New Construction

- Retrofit

- UAE Smart Home Market, by Products Type

- Egypt

- Egypt Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Egypt Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Egypt Smart Home Market, by Application

- New Construction

- Retrofit

- Egypt Smart Home Market, by Products Type

- South Africa

- South Africa Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- South Africa Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- South Africa Smart Home Market, by Application

- New Construction

- Retrofit

- South Africa Smart Home Market, by Products Type

- Nigeria

- Nigeria Smart Home Market, by Products Type

- Security & Access Controls

- Security Cameras

- Video Door Phones

- Smart Locks

- Remote Monitoring Software & Services

- Others

- Lighting Control

- Smart Lights

- Relays & Switches

- Occupancy Sensors

- Dimmers

- Other Products

- Entertainment Devices

- Smart Displays/TV

- Streaming Devices

- Sound bars and Speakers

- HVAC

- Smart Thermostats

- Sensors

- Smart Vents

- Others

- Smart Kitchen Appliances

- Refrigerators

- Dish Washers

- Cooktops

- Microwave/ovens

- Home Appliances

- Smart Washing Machines

- Smart Water Heaters

- Smart Vacuum Cleaners

- Smart Furniture

- Home Healthcare

- Other Devices

- Security & Access Controls

- Nigeria Smart Home Market, by Protocols

- Wireless Protocols

- ZigBee

- Wi-Fi

- Bluetooth

- Z Wave

- Others

- Wired Protocols

- Hybrid

- Wireless Protocols

- Nigeria Smart Home Market, by Application

- New Construction

- Retrofit

- Nigeria Smart Home Market, by Products Type

- MEA Smart Home Market, by Products Type

- North America

Smart Home Market Dynamics

Driver: Growing need for smart security & surveillance systems

The major concerns in every household across the globe is the fear of theft and burglary. According to the Federal Bureau of Investigation (FBI) statistics, a burglary occurs every 30 seconds across the U.S, adding up to over 3,000 burglar strikes per day. This has brought about the significant installation of Closed-Circuit Televisions (CCTVs) around the premises of the properties, including household, office areas, driveways, and others. However, the various challenges associated with CCTVs, such as the ability of these cameras to only record footage and not prevent intrusions, constant monitoring, remote monitoring necessitates high bandwidth and connectivity, and others, is resulting in the growing demand for smart surveillance systems to ensure safety by detecting, deterring, and reporting intrusions when they are about to happen. The smart surveillance system deploys sensors and computer vision to detect the actions and report real-time. It also enables the user to keep a backup of valuable footage on the cloud safely and allows connecting and controlling the entire location remotely.

Driver: Increasing demand for low carbon emission-oriented and energy-saving solutions

Increased human needs and wants to carry out day-to-day activities lead to a substantial amount of carbon emission into the atmosphere, resulting in global warming. The careless and over deployment of electricity is one of the major causes of global warming. With the introduction of smart technology and smart systems, several innovative devices have been developed to reduce energy usage and consumption in households, making them greener and more sustainable. Smart home devices, including smart thermostats, smart sprinkler systems, smart bulbs, smart meters, smart composters, and smart power strips, allow individuals to control and monitor power consumption, save energy, and help to reduce carbon emissions footprint. The ability of smart devices to be an energy-efficient solution offering sustainable solutions for the environment is driving the growth of the smart home market.

Restraint: High installation and maintenance chargers

The initial cost of installing and setting up smart home devices is high, resulting in resistance to market growth. Installing advanced features and integrated technologies, including IoT, AI, machine language, block down, and others, inside a home lead to an expensive set-up, majorly affordable by the upper-middle cast and upper-class families in a society. Also, the continuous advancements in these technologies are bringing the prices relatively high due to the advanced features they offer. Home automation can manage entertainment systems, security locks, lighting, and appliances like lights, curtains, and others. It also comprises home security systems, including alarm systems and access control systems. When these home devices are connected to the internet, they become an imperative constituent of the Internet of Things (IoT). The user can deploy Wi-Fi connectivity to control and manage the device from any corner of the world. The system connects controlled devices to a central server. Hence, the entire set-up for converting an ordinary home to a smart home and maintenance incurs a high cost due to the complex set-up and integration of technologies.

What Does This Report Include?

This section will provide insights into the contents included in this smart home market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Smart home market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Smart home market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the smart home market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for smart home market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of smart home market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-