- Home

- »

- Electronic & Electrical

- »

-

Smart LED Lighting Market Size, Share, Industry Report 2030GVR Report cover

![Smart LED Lighting Market Size, Share & Trends Report]()

Smart LED Lighting Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Wired, Wireless), By Technology (Hybrid, Dali, WiFi, Bluetooth, Zigbee), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-354-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart LED Lighting Market Summary

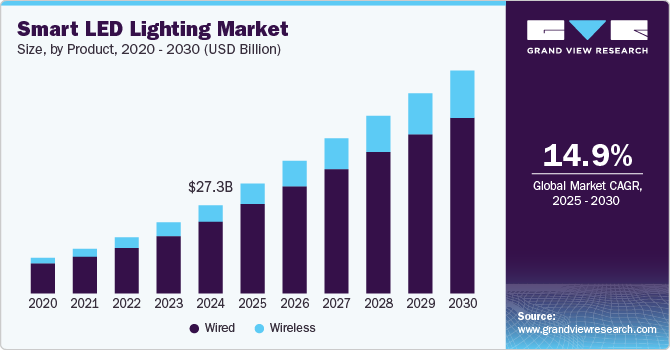

The global smart LED lighting market size was valued at USD 27.32 billion in 2024 and is projected to reach USD 68.47 billion by 2030, growing at a CAGR of 14.9% from 2025 to 2030. The increasing focus on sustainable lighting solutions by government organizations worldwide and rapid growth in the popularity and adoption of smart homes are expected to boost market expansion.

Key Market Trends & Insights

- North America smart LED lighting market accounted for a leading revenue share of 39.7% in the global market in 2024.

- The Asia Pacific region is expected to grow at a substantial CAGR from 2025 to 2030.

- Based on product, the wired segment accounted for a dominant revenue share of 81.3% in the global market in 2024.

- In terms of technology, the hybrid technology segment accounted for a leading revenue share in the smart LED lighting industry in 2024.

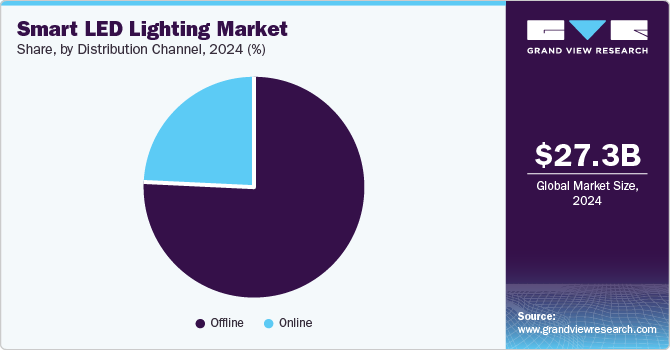

- Based on distribution channel, the offline segment accounted for a dominant revenue share in the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.32 Billion

- 2030 Projected Market Size: USD 68.47 Billion

- CAGR (2025-2030): 14.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, rising awareness regarding technologies such as wireless optical networking data transmission and the Internet of Things (IoT) has strengthened competition in the smart LED lighting industry. In recent years, the heightened demand for energy-efficient lighting systems has prompted the adoption of innovative products, including smart LED lights.With consumers and businesses continuously looking for ways to reduce their carbon footprints and energy costs, LED lights have emerged as a popular alternative, ensuring more efficient lighting and consuming less energy. According to the U.S. Department of Energy (DOE), residential LEDs, particularly ENERGY STAR-rated products, utilize around 75% less energy than incandescent lighting while also lasting 25 times longer than their conventional counterparts.

The highly efficient and directional nature of these products has made them an ideal option for various industrial applications. LEDs are being increasingly used in street lights, walkway lighting, parking garage lighting, modular lighting, refrigerated case lighting, and task lighting. Many consumers prefer the aesthetic appeal of smart LED lights, as they offer customizable color schemes, mood lighting, and other features. This trend is particularly noticeable in urban areas where modern lifestyles and home décor trends are becoming more technology-oriented.

The rapidly growing popularity of smart homes, particularly in developed economies, presents another notable opportunity for market expansion. Consumers are increasingly looking for ways to automate their homes for greater convenience, security, and energy efficiency. In December 2024, Corvi LED, which develops advanced lighting solutions, announced the launch of its ‘Bulb9 Smart’ product range in two options, CH2 and CH5. These products have been designed to optimize smart home integration. The smart bulb combines customizable features, seamless Bluetooth connectivity, and energy efficiency via Corvi’s proprietary Smart Home application, providing a convenient and sustainable option for modern households. The emergence of several start-ups in this area and the increasing frequency of such product developments is anticipated further to strengthen the expansion of the smart LED lighting industry.

Product Insights

The wired segment accounted for a dominant revenue share of 81.3% in the global market in 2024. Wired LED lighting systems typically involve permanent installations, making them suitable for both residential and commercial applications. Wired smart LEDs can be controlled via smart home hubs, mobile apps, or voice assistants, and they often offer superior performance in terms of stability and reliability compared to their wireless counterparts. The increasing need to personalize living spaces and ensure a modern look has driven the demand for different types of wired solutions. For instance, smart LED recessed lights are often installed into ceilings for a sleek, modern look and can be wired directly to a power source. They are commonly used for ‘downlighting’ and can be controlled via smart home hubs for brightness and color adjustments. Meanwhile, wired LED strips are typically used for accent lighting, under-cabinet lighting, or for backlighting in home theaters. They are flexible and thus can be bent and installed in various spaces.

The wireless segment is expected to grow at the highest CAGR from 2025 to 2030. Wireless smart LED lights have increasingly become a popular choice for homeowners and businesses looking to enhance their lighting systems with smart, remote-controlled features. Unlike wired smart lights, these lights connect to a user’s network using WiFi, Bluetooth, or other wireless protocols such as Zigbee or Z-Wave, allowing for remote control, automation, and integration with other smart home devices. Wireless smart LED lights offer flexibility in installation, energy efficiency, and a wide range of control options, making them suitable for a variety of use cases in both residential and commercial settings. Wireless smart LED lights are extremely easy to install, driving their popularity among renters or consumers who do not want to hardwire their lights.

Technology Insights

The hybrid technology segment accounted for a leading revenue share in the smart LED lighting industry in 2024. Hybrid technology in smart LED lighting generally refers to the combination of multiple energy sources or functionalities in a single lighting system. It may involve the combination of solar power with LED lighting, integration of IoT connectivity with other technologies, or the use of hybrid power sources. By combining LED technology with solar power, motion sensors, or other energy-saving technologies, hybrid LED lights can significantly reduce energy consumption. Furthermore, over a period of time, the technology can lead to reduced electricity costs and lower maintenance requirements, especially when integrated with energy-saving technologies such as solar or motion sensing.

The Zigbee segment is expected to grow at the fastest CAGR during the forecast period. The technology has a unique feature known as mesh networking, which enables the creation of a network where each light acts as a repeater, passing data to the next device. This allows the lights to communicate over a larger area without the need for a direct line of sight to the hub or controller. Mesh networking also enhances system reliability because if one device fails or is turned off, other devices can still maintain the communication network. Zigbee is also known to work seamlessly with various smart home devices, including Google Home and Amazon Alexa, which have witnessed high demand among modern homeowners. Zigbee-based smart LED lights can further be controlled remotely via smartphone apps, voice assistants, or through a smart home hub, making them a highly convenient option for consumers.

Distribution Channel Insights

The offline segment accounted for a dominant revenue share in the global market in 2024. Offline sales primarily take place through physical retail stores, showrooms, and distributors. A sizeable proportion of consumers still prefers to physically inspect smart LED lighting solutions before making a purchase. This includes checking the build quality, design, color temperature, brightness, and ease of installation. Additionally, customers can get direct assistance from sales staff who explain the features, compatibility with other smart home devices, and potential savings on electricity. This is especially important for new consumers who have specific queries regarding setup, compatibility, and use cases.

Meanwhile, the online segment is anticipated to expand at the fastest CAGR from 2025 to 2030 in the smart LED lighting industry. Companies have established their own websites in addition to selling their products through platforms such as Amazon, thus improving customer awareness regarding these solutions. Consumers can browse a wide variety of smart LED lighting products, compare prices, read reviews, and access detailed product descriptions without visiting physical stores, enabling better-informed purchasing decisions. The continued growth in popularity of smart homes has compelled consumers to seek lighting solutions that integrate seamlessly with other smart devices such as Amazon Alexa, Google Assistant, and Samsung SmartThings. Online shopping allows consumers to check for compatibility with their existing systems before making a purchase.

Regional Insights

North America smart LED lighting market accounted for a leading revenue share of 39.7% in the global market in 2024. The substantial demand for this technology has been aided by factors including energy efficiency, sustainability initiatives, technological advancements, and the increasing adoption of Internet of Things (IoT) devices in regional economies. Regulatory bodies across North America are increasingly implementing energy efficiency standards and offering incentives for upgrading to energy-efficient lighting systems. This is particularly noticeable in the smart LED lighting segment, which helps in significantly reducing energy consumption while contributing to sustainability objectives. The continued focus on automation across both residential and commercial establishments presents another opportunity for regional solution providers to drive sales.

U.S. Smart LED Lighting Market Trends

The U.S. smart LED lighting market accounted for a dominant revenue share in the North American market in 2024. The rapidly growing adoption of IoT-enabled lighting systems, the growing popularity of smart homes, and improvements in connectivity protocols such as Bluetooth, WiFi, and Zigbee have helped drive market growth. Furthermore, the presence of several major industry players, including Cree Lighting, ABB, Philips, and Eaton, has established a highly competitive environment, resulting in more viable options for technologically-aware consumers. The product demand is particularly growing in the commercial segment, as a majority of the companies based in the country are committed to achieving Net Zero or carbon-neutral goals. Energy-efficient lighting systems such as smart LEDs play a vital role in meeting these objectives.

Europe Smart LED Lighting Market Trends

The European Smart LED Lighting market accounted for a significant revenue share in 2024, aided by rising consumer awareness regarding energy-efficient lighting technologies and the presence of extensive regulations that help shape product development and innovations. For instance, the Energy Efficiency Directive promotes energy-saving lighting solutions, including smart LEDs, to help meet the European Union’s climate and energy goals. In addition, the European Green Deal outlines ambitious targets for climate neutrality by 2050, driving the demand for innovative lighting solutions across commercial and residential segments. The well-established industrial sector, coupled with constant developments in the automotive and consumer electronics industries, has further helped sustain a strong demand for smart LED lighting systems in regional economies.

Asia Pacific Smart LED Lighting Market Trends

The Asia Pacific region is expected to grow at a substantial CAGR from 2025 to 2030. Economies, including China, India, Japan, and other Southeast Asian nations, are experiencing rapid urbanization. Smart LED lighting systems are increasingly being used in urban infrastructures, such as street lighting, commercial buildings, and public spaces, to improve energy efficiency and reduce operational costs. Moreover, the growing trend of home automation among consumers to enhance convenience, security, and energy efficiency in their homes has created notable opportunities for market players operating in the region. In India, the UJALA (Unnat Jyoti by Affordable LEDs for All) scheme implemented by the government aims to promote the efficient usage of energy in terms of consumption, savings, and lighting. This has led to improved awareness regarding LED solutions among citizens, aiding market expansion.

China smart led lighting market accounted for the largest revenue share in the Asia Pacific smart LED lighting market in 2024. The Chinese government is known for pushing numerous initiatives that can help substantially reduce energy costs for consumers and ensure that sustainability objectives are met. CLASP, a global non-profit organization, has been a long-term partner of the China National Institute for Standardization (CNIS), aiming to expedite the economy’s transition to more energy-efficient lighting solutions. In 2020, China laid out its objective to attain peak carbon emissions by 2030 as well as carbon neutrality before 2060. This would involve implementing strategies that give priority to energy efficiency and encourage the adoption of more advanced high-efficiency alternatives, which is anticipated to create positive industry developments in the coming years.

Key Smart LED Lighting Company Insights

Some major companies involved in the global smart LED lighting industry include Cree Lighting, Philips, and OSRAM, among others.

-

Cree Lighting is a U.S.-based manufacturer of advanced LED lighting solutions, including indoor lighting, outdoor lighting, and intelligent lighting offerings. The company is known for its high-performance LED fixtures and solutions, which are designed to help customers reduce energy consumption and improve sustainability while providing superior lighting quality. Cree Lighting has expanded its portfolio to include smart lighting products that integrate with smart building systems and home automation. Its intelligent products leverage the SmartCast technology, Synapse SimplySNAP, and Lutron to provide customers with improved functionality, energy savings, and enhanced user experience.

-

OSRAM, based in Austria, is a global provider of advanced light and sensor technologies. The company’s portfolio includes semiconductor-based light emitters, sensors, CMOS ICs, and software, along with a suite of traditional lighting technologies that cater to the industrial, automotive, medical, and consumer electronics sectors. OSRAM develops different types of LEDs, including white LEDs, color LEDs, UV-C LEDs, infrared LEDs, and multi-color LEDs, as well as modules and accessories. It has further introduced cutting-edge LED drivers for dynamic lighting applications in the automotive segment on the interior and exterior of vehicles.

Key Smart LED Lighting Companies:

The following are the leading companies in the smart LED lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Cree Lighting USA LLC

- Eaton

- Koninklijke Philips N.V.

- ABB

- Wipro

- Syska

- TVILIGHT Projects B.V.

- SiteWorx Software

- ACUITY BRANDS, INC.

- Bridgelux, Inc

- ams-OSRAM AG

Recent Developments

-

In November 2024, ams OSRAM announced the launch of the company’s first-ever street-approved LED retrofit offerings, the NIGHT BREAKER LED SMART H8 | H10 | H16 | HB4, for front fog lamps in vehicles. These solutions produce white light with a maximum color temperature of 6000 Kelvin, which is similar to daylight, across an especially wide beam. Moreover, they ensure a reduction in energy consumption by up to 60% and have been stated to last six times longer than traditional solutions due to the use of LED technology and a vibration-resistant design.

-

In March 2024, Philips Hue announced the expansion of its partnership with Samsung SmartThings to ensure enhanced interaction between Samsung TVs, the SmartThings ecosystem, and the Philips Hue Sync TV application. As per the deal, the Philips Hue Sync TV app became available as a monthly subscription option in addition to a one-time purchase plan. Furthermore, the application was released for customers in Hong Kong, Brazil, the Czech Republic, Poland, and Slovakia.

Smart LED Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34.18 billion

Revenue forecast in 2030

USD 68.47 billion

Growth Rate

CAGR of 14.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, Saudi Arabia, South Africa

Key companies profiled

Cree Lighting USA LLC; Eaton; Koninklijke Philips N.V.; ABB; Wipro; Syska; TVILIGHT Projects B.V.; SiteWorx Software; ACUITY BRANDS, INC.; Bridgelux, Inc; ams-OSRAM AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart LED Lighting Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart LED lighting market report based on product, technology, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Hybrid

-

Dali

-

WiFi

-

Bluetooth

-

Zigbee

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.