- Home

- »

- Electronic & Electrical

- »

-

Smart Mirror Market Size, Trends, and Analysis Report, 2030GVR Report cover

![Smart Mirror Market Size, Share & Trends Report]()

Smart Mirror Market (2023 - 2030) Size, Share & Trends Analysis Report By Installation Type (Wall Mounted, Free-Standing), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-990-6

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Mirror Market Summary

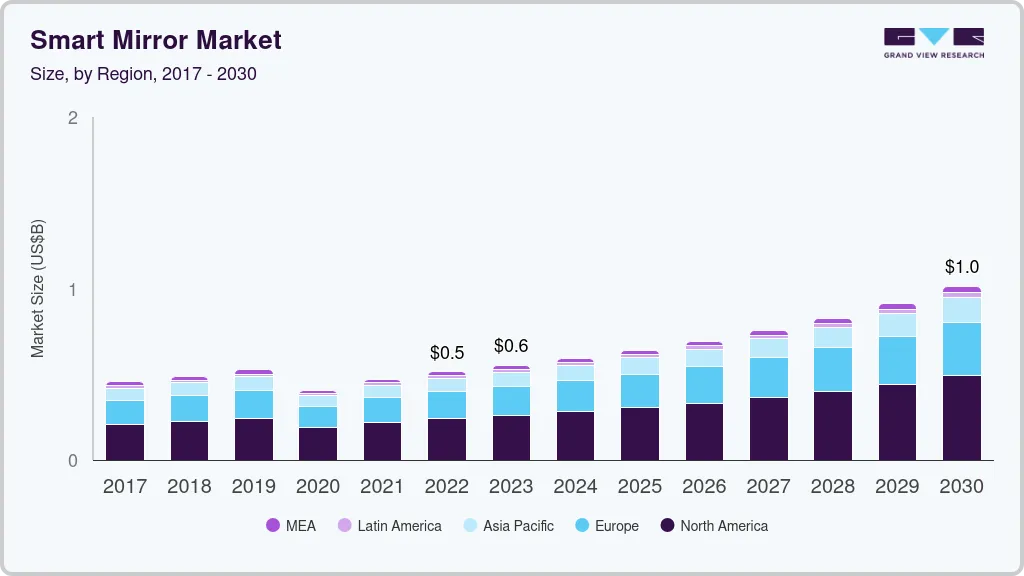

The global smart mirror market size was estimated at USD 514.6 million in 2022 and is projected to reach USD 1,012.6 million by 2030, growing at a CAGR of 8.8% from 2023 to 2030. The use of smart mirrors in the retail industry has been growing as it helps improve customer shopping experience.

Key Market Trends & Insights

- North America held a share of over 45.0% of the global market in 2022.

- U.S. smart mirror market is expected to expand at a CAGR of 9.5% over the forecast period.

- By installation type, the wall-mounted smart mirror segment accounted for a share of over 80.0% in 2022.

- By application, the commercial spaces segment accounted for a share of over 55.0% in 2022.

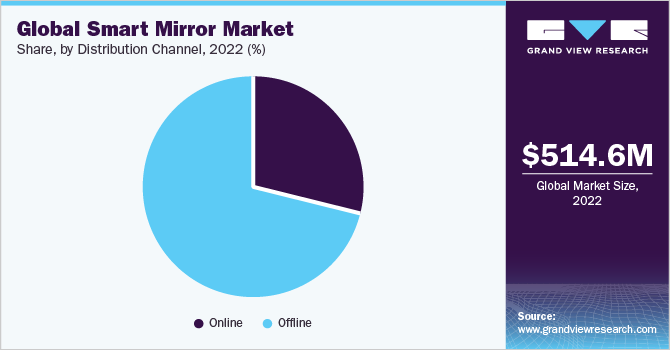

- By distribution channel, sales through the offline channel segment accounted for a share of over 70.0% of the global revenue in 2022.

Market Size & Forecast

- 2022 Market Size: USD 514.6 Million

- 2030 Projected Market Size: USD 1,012.6 Million

- CAGR (2023-2030): 8.8%

- North America: Largest market in 2022

For instance, in February 2022, MySize, an AI-driven measurement solutions provider, launched an interactive smart mirror to be used in physical stores. The FirstLook Smart Mirror has a touch display that resembles a mirror and provides advanced features such as an interactive 3D try-it-on experience, personalized and accurate size and style recommendations, and a contactless third-party POS system. This enhances consumers' overall shopping experience.The rising popularity of smart home devices influences the global market. Smart mirrors can seamlessly integrate with other smart devices and systems within a smart home ecosystem. They can act as control centers, providing notifications, displaying information, and enabling connectivity with other smart devices, making them an attractive addition to smart homes. Smart mirrors can easily be integrated with voice assistant technology such as Alexa or Google Assistant, and music & entertainment streaming services such as Netflix, and others. For instance, Evervue USA Inc. offers magic mirrors that enable easy integration of streaming services such as Netflix, Hulu, and others. The growing demand for smart home products coupled with the increasing interest of manufacturers and technology companies in the segment is expected to drive the market during the forecast period.

Magic mirrors can easily be deployed in diverse commercial spaces such as hotels & resorts, fitness centers and gyms, spas and salons, shopping malls, and others and play a significant role in elevating the customer experience. Smart mirrors offer value-added services such as virtual experience, entertainment, and personalized information, which enhance customer satisfaction and engagement in above-mentioned spaces. In addition, as consumers are becoming more conscious regarding their grooming routines, skincare, and well-being, owing to which these products are observing significant growth. Smart mirrors have various features, including skin analysis and personalized recommendations, which cater to the rising demand for providing informative and interactive experiences in the beauty and wellness sector.

Moreover, smart mirrors enable virtual try-on of makeup, accessories, and clothing providing an immersive shopping experience to customers, owing to which it is gaining popularity in retail space. In addition, smart mirrors also have the ability to display product information, promotions, and targeted advertisement, which creates an interactive and engaging experience for consumers, thus contributing to its increased adoption and market growth. In addition, consumers across the globe are actively seeking customized and personalized experiences in various aspects of their daily lives, including personal grooming and home decor. Smart mirrors cater to this need and provide the ability to personalize display preference, lighting, and others, along with offering customized recommendations for wellness, fashion, and beauty. Additionally, the integration of advanced technology such as computer vision, VR, and AR enables the integration of interactive features such as voice controls, touch controls, and others, further enhancing the overall functionality and user experience.

However, smart mirrors are often integrated with sensors, cameras, and connectivity features that increase concerns regarding consumer security and privacy. Smart mirrors collect and process personal data, which, if not handled with precaution and securely, may lead to unauthorized access or results in privacy breaching. Such factors make it crucial for consumers to build trust in such products and restrain the adoption of smart mirrors among consumers. In addition, advanced technologies such as connectivity features, sensors, and integrated displays are incorporated into smart mirrors, resulting in higher product costs. Developing and manufacturing smart mirrors need high initial investment for manufacturers. The higher price point of smart mirrors may restrain consumers from spending on such products, thus restraining market growth.

Furthermore, the demand for smart mirrors is expected to increase in developing countries of the Asia Pacific region as the residents are increasingly adopting smart home products and commercial places have started deploying automated products in their premises. In addition, the increasing emphasis and demand for sustainable and energy efficient smart mirrors that consume less energy or power is further expected to create key opportunities for market growth in the coming years. Additionally, easy online distribution of smart mirrors owing to the increased adoption of e-commerce, is also anticipated to provide opportunities to market players. Innovation and the introduction of advanced tech-enabled smart mirrors across the distribution channel will benefit market growth in the coming years. Manufacturers should capitalize on the popularity of e-commerce among millennials and Gen Z by making the products available through online channels and further adopting the omnichannel strategy.

Installation Type Insights

The wall-mounted smart mirror segment accounted for a share of over 80.0% in 2022. This can be attributed to the rising consumer preference for wall-mounted smart mirrors over free-standing ones. There is usually a higher risk that free-standing mirrors might fall or topple over, a risk that is much less with wall-mounted mirrors. Moreover, since smart mirrors are quite expensive compared to ordinary mirrors, consumers tend to be more careful, thereby preferring wall-mounted smart mirrors. A wall-mounted smart mirror also helps conserve space by clearing up the floor area and improves the overall appearance of a room. Since bathrooms tend to be compact in most homes, space-saving solutions like wall-mounted smart mirrors are in high demand.

Free-standing smart mirrors are anticipated to expand at a CAGR of 8.0% over the forecast period from 2023 to 2030due to their versatility, convenience, and aesthetic appeal. These mirrors are standalone units that do not require wall installation, making them suitable for various applications and spaces. One key factor driving the growth of free-standing smart mirrors is their flexibility in placement. Unlike wall-mounted mirrors, free-standing models can be easily moved and repositioned according to the users’ preferences or changing room layouts. This adaptability makes them popular in retail stores, fashion boutiques, and beauty salons where visual merchandising and product displays are crucial. For instance, in June 2022, multinational clothing company H&M installed free-standing smart mirrors on the sales floor and in dressing rooms at its COS Beverly Hills store in California, providing customers with interactive fashion suggestions and virtual try-on experiences. The retailer plans to extend the technology to more stores across the country.

Application Insights

Application of smart mirror in commercial spaces is accounted for a share of over 55.0% in 2022. The adoption of smart mirrors in the commercial sector has experienced significant growth in recent years due to their ability to enhance customer experiences, improve engagement, and provide valuable data for businesses. These devices offer various functionalities that cater to different industries, transforming the way businesses interact with customers. One industry where smart mirrors have gained traction is retail. They are used in stores to create interactive and immersive shopping experiences, enabling customers to virtually try on clothing, accessories, or makeup. This technology enhances customer convenience, reduces return rates, and boosts sales.

The application of smart mirrors in residential spaces is expected to expand at a CAGR of 8.6% over the forecast period. Smart mirrors are increasingly sought-after by homeowners due to their innovative features and ability to enhance the overall functionality and aesthetics of residential spaces. One key factor contributing to the growth of the smart mirror market in the residential sector is the rising demand for smart home solutions. As homeowners embrace the concept of interconnected devices and automated systems, smart mirrors have emerged as an integral component of smart homes. These mirrors offer a range of features, such as built-in lighting, touch controls, voice assistance, and connectivity with other smart devices, making them an appealing addition to modern residences.

Distribution Channel Insights

Sales through offline channel accounted for a share of over 70.0% of the global revenue in 2022. Brick-and-mortar stores offer unique advantages that appeal to certain customers and contribute to the overall sales of smart mirrors through this channel. Offline channels provide customers with the opportunity to physically see and experience the products before making a purchase. This hands-on experience allows customers to assess the quality, design, and functionality of smart mirrors, which can be particularly important when investing in a high-end product like a smart mirror. In addition, offline channels often have knowledgeable sales staff who can provide personalized assistance and guidance to customers. They can offer product demonstrations, answer questions, and address any concerns, helping customers make informed decisions. This level of customer service can be a significant advantage for those who value face-to-face interactions and expert advice. This gives offline channels a competitive edge over online platforms and will help the segment retain its dominant market position during the forecast period.

The sales through the online channel is projected to expand at a CAGR of 10.6% over the forecast period. Compared to offline distribution channels, the popularity of e-commerce channels is expected to grow over the projected period owing to the increasing number of market players setting up shop online. Industry players have been offering customers the ability to place and track orders online on their own platforms, e-commerce sites, or third-party platforms like Shopify. In this regard, the emergence of high-end online shopping platforms is expected to drive the sales of smart mirrors in the coming years. The growing sales of smart mirrors through online channels are primarily due to convenience. Customers can easily browse through products by various brands and compare prices and features of different smart mirrors without having to physically visit different stores. They can also read reviews from other customers and make informed decisions.

Regional Insights

North America held a share of over 45.0% of the global market in 2022. Integrating smart speakers like Alexa into these mirrors are further enhances their adoption in North American households. With new startups like Lululemon and technology firms like Google investing in smart mirrors, customers are increasing learning about the advancements in AI and its use in smart mirrors. As technology continues to advance, smart mirrors are likely to offer even more innovative features and become increasingly common in daily lives.

Moreover, U.S. smart mirror market is expected to expand at a CAGR of 9.5% over the forecast period driven by factors such as increasing consumer interest in connected devices, and a focus on customized services. According to a survey conducted by Bloomberg in 2020, 25% of U.S. households already owned at least one Alexa device. This paves the way for smart mirror companies to market their products with system compatibility with Alexa, thus driving the market. In addition, the market in U.K. is expected to expand at a CAGR of 9.5% over the forecast period. Smart mirror manufacturers in the U.K. offer a range of models with different sizes, designs, and additional functionalities like LED lighting, demister pads, Bluetooth connectivity, and built-in audio systems. This allows consumers to select a smart mirror that suits their specific needs and preferences.

The Asia Pacific smart mirror market is anticipated to expand with a CAGR of 8.2% over the forecast period. The strong presence of key manufacturers and technological advancements in countries like China, Japan, and South Korea is propelling the growth of the smart mirror market in Asia Pacific. These countries are known for their innovation in the electronics and technology sectors, allowing for the development and deployment of cutting-edge smart mirror solutions. The startup culture surrounding smart mirrors in India is marked by a dynamic and rapidly evolving ecosystem, where entrepreneurs are harnessing technology to create novel and engaging experiences for consumers in various domains. Australia is focusing on smart homes and incorporating more devices and technologies, offering greater interoperability and customization options, boosting the smart mirrors market.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as new product launches partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In March 2022, Portl launched a personalized smart mirror as a wellness and fitness device. This smart mirror functions as a personal trainer, corrects posture, and suggests workout routines. It has access to numerous on-demand workouts, including yoga, HIIT, and strength training. The sensors integrated into the product also keep track of the user's glucose, blood pressure, respiratory rate, ECG, and more.

-

In February 2022, MySize launched its smart mirror "FirstLook", which has a mirror-like touch display that enhances the shopping experience of consumers in physical stores by providing a contactless checkout procedure.

-

In January 2022, Wellnesys announced the launch of its smart mirror "ARIA", which is integrated with smart sensing solutions, computer vision, and AR/VR to provide an immersive and interactive digital experience. The mirror offers workouts, posture training for fitness, functions as a smart home product, and integrates various applications such as virtual makeup and diet recommendations to achieve individual goals, and more.

Some of the prominent players in the smart mirror market include:

-

ELECTRIC MIRROR, INC.

-

Séura

-

Hidden Television

-

Majestic Mirror & Frame

-

AVIS Electronics company

-

FOSHAN ETERNA INTELLIGENT BATHROOM CO., LTD.

-

Reflectel

-

LumiDesign

-

Evervue USA Inc.

-

Videotree

Smart Mirror Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 551.8 million

Revenue forecast in 2030

USD 1,012.6 million

Growth rate

CAGR of 8.8% from 2023 to 2030

Base year for estimation

2022

Report updated

June 2023

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Installation type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

ELECTRIC MIRROR, INC.; Séura; Hidden Television; Majestic Mirror & Frame; AVIS Electronics company; FOSHAN ETERNA INTELLIGENT BATHROOM CO., LTD.; Reflectel; LumiDesign; Evervue USA Inc.; Videotree

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Mirror Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global smart mirror market report on the basis of installation type, application, distribution channel, and region:

-

Installation Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Wall Mounted

-

Free-Standing

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart mirror market size was estimated at USD 514.6 million in 2022 and is expected to reach USD 551.8 million in 2023.

b. The global smart mirror market is expected to grow at a compound annual growth rate of 8.8% from 2023 to 2030 to reach USD 1,012.6 million by 2030.

b. North America dominated the smart mirror market with a share of 46.85% in 2022. This is attributable to the growing number of product launches and investments in advanced technology are further expected to augment the demand for smart mirrors across the region.

b. Some key players operating in the smart mirror market include Electric Mirror, Inc., Séura, ad notam USA LLC, Majestic Mirror & Frame, Avis Electronics, Foshan Eterna Intelligent Bathroom Co., Ltd., MirrorMedia Ltd., LumiDesign, Evervue USA Inc., and Videotree.

b. Key factors that are driving the smart mirror market growth includes growing use of smart mirrors in the retail industry to improve the customer experience is driving the growth of the market. This trend is expected to remain a prominent factor in augmenting product demand throughout the forecast period. Furthermore, key companies have been amplifying their product portfolios by incorporating new and innovative products in the market, to gain maximum market share.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.