- Home

- »

- Next Generation Technologies

- »

-

Smart Robots Market Size, Share & Growth Report, 2030GVR Report cover

![Smart Robots Market Size, Share & Trends Report]()

Smart Robots Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Operating Environment (Ground, Marine), By Mobility, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-611-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Robots Market Summary

The global smart robots market size was valued at USD 33.83 billion in 2024 and is projected to reach USD 131.46 billion by 2030, growing at a CAGR of 26.5% from 2025 to 2030. The growing adoption of modern technologies such as Artificial Intelligence (AI), Internet of Things (IoT), Machine Learning (ML), Intelligent Process Automation (IPA), and others, the rising integration of robotic technology with existing systems, and ongoing research and development activities in the field are driving the growth of this market.

Key Market Trends & Insights

- The U.S. smart robots market dominated the regional industry with a revenue share of 76.5 % in 2024.

- Asia Pacific dominated the smart robots market with the largest revenue share of 51.3% in 2024.

- Based on component, hardware segment dominated the global smart robots market with largest revenue share of 62.6% in 2024.

- In terms of operating environment, the ground smart robots segment held the largest revenue share of the global market in 2024.

- Based on mobility, the mobile smart robots segment is expected to dominate the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33.83 Billion

- 2030 Projected Market Size: USD 131.46 Billion

- CAGR (2025-2030): 26.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The emergence of advanced technologies has enabled companies to focus on performance enhancements and cost reductions by integrating innovative systems and tools. Smart robots, machines that can perform required tasks with the help of AI technology integration, equipped with the capacity to learn from experiences and modify their responses according to environmental changes, play a major role in this transition. Smart robots are extensively used in multiple business processes by various industries, including retail, manufacturing, automotive, food & beverages, hospitality, facility management, transportation, e-commerce, and others.

Smart robots, empowered by actuators, smart sensors, a power source, and smart control systems, are utilized in multiple processes, including warehousing, delivery of goods, assembly line tasks, food processing, task automation, logistics automation, inventory management, and more. Multiple large enterprises are adopting smart robots to ensure improved productivity, enhanced employee safety and reduced operational overheads.

For instance, in October 2024, Amazon, one of the prominent companies in the retail industry, announced the commencement of operations in its most advanced fulfillment center in Shreveport, Louisiana. The facility, across 3 million square feet and five floors, is equipped with advanced AI and innovation-based robotics technology, including its systems, such as Sequoia, an intelligent inventory management system, and Robin, Cardinal, & Sparrow, a combination of AI-powered robotic arms.

In addition, growing investments by government agencies and private organizations in multiple countries, including the U.S., South Korea, China, India, and Japan, and funding programs to support research and innovation, such as Horizon Europe by the European Commission, are contributing to the growth opportunities for this market.

Component Insights

Based on component, hardware segment dominated the global smart robots market with largest revenue share of 62.6% in 2024. The smart robots operate with the help of advanced technologies that require continuous input of data and information. Hardware plays an important role in ensuring the uninterrupted flow of information about the surrounding environment, commands, strength, and seamless retrieval of data. This includes technology-driven elements such as smart sensors, actuators, power sources, and control systems. Increasing industrial application, growth in innovation, rising deployment of high-performance and large-size robotic systems, and growing investments in hardware research are some growth drivers for this segment.

The software segment is anticipated to grow at the fastest CAGR during the forecast period. The development of intelligent software technology, which can be integrated with hardware equipped with innovation, is an integral part of smart robotics. The abilities of smart robots to learn from experiences, use algorithms, ensure a change in response according to the environment, and the software technologies drive more. Growing research & development activities, the emergence of modern technologies, increasing focus on the inclusion of AI in business processes, and ease of availability & accessibility are projected to fuel the growth of this segment in the approaching years.

Operating Environment Insights

The ground smart robots segment held the largest revenue share of the global market in 2024. Industry advancements and the growing application of smart robot technology in multiple areas influence this segment. Currently, ground mobile robots are extensively deployed by businesses and agencies operating in agriculture, military & defense, humanitarian demining, search & rescue, manufacturing, retail, construction, and others. Ground mobile robots are often equipped with locomotion systems and intelligent sensor technology.

The marine smart robots segment is anticipated to experience the fastest CAGR from 2025 to 2030 owing to the rise in marine exploration and its associated challenges. In recent times, innovation related to the development of remotely operated underwater vehicles, autonomous underwater vehicles, unmanned surface vessels, and other equipment empowered by smart robotics has experienced advancements at a rapid pace. Demand from industries such as ocean cleanup, marine education, object recovery, offshore oil & gas, environmental surveys, infrastructure inspections, and others is expected to generate growth for this segment.

Mobility Insights

The mobile smart robots segment is expected to dominate the global market in 2024 owing to increasing utilization in industries such as retail and e-commerce warehousing for multiple activities and growing adoption by sectors such as agriculture, sports broadcasting, media & entertainment, hospitality, food processing, and others. Mobile smart robots are equipped with abilities to move from stationed areas to activity areas without repetitive commands or instructions with the help of smart sensors and advanced imaging technology assistance. For instance, in October 2024, a major retailer subsidiary of Sabancı Holding, operating in nearly 1200 stores, CarrefourSA, deployed Tally, an advanced autonomous inventory robot, by Simbe Robotics, Inc.

The stationary smart robots segment is anticipated to experience significant growth during the forecast period due to rising utilization in manufacturing processes by industries such as automotive, food processing, electronics, consumer goods, and others, increasing application in sectors such as military & defense, aerospace, security management, critical infrastructure management, and cost-effectiveness as well as higher intelligence capacities offered by the advanced systems. The stationary robots are bolted to surfaces, including floors, ceilings, walls, or other surfaces. They are equipped with robotic arms of different sorts, including Articulated Robotic Arms, Selective Compliance Assembly Robot Arms, Polar robotic arms, and more.

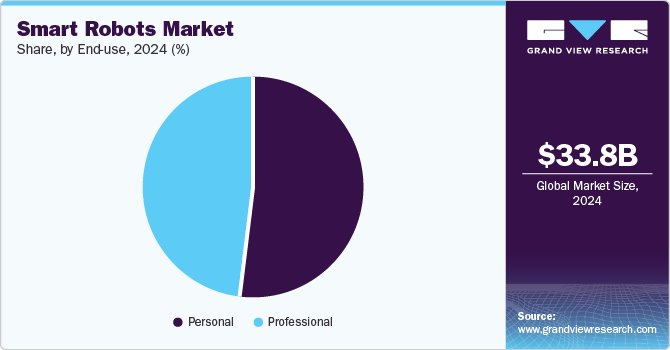

End Use Insights

The personal use segment held the largest revenue share of the global industry based on end use owing to rise in use of smart robots for companionship duties, educational assistance, household assistance, repetitive task completions, and more. The availability of affordable personal robots, increasing focus on research and development activities, improving accessibility, and growing awareness regarding the benefits of smart robotics technology's assistance are expected to generate an upsurge in demand for this segment in the approaching years.

The professional use segment is projected to experience the fastest CAGR of 27.9% from 2025 to 2030. The demand and growing utilization in industries such as military & defense, law enforcement, public relations, logistics management, manufacturing, agriculture, healthcare, and others mainly influence this segment. These industries extensively use smart robots to enhance existing processes, ensure improved productivity, reduce operating overheads, minimize task completion time, lower human error, and increase operational excellence.

For instance, in October 2023, SABO S.A., one of the key service providers in the robotics industry, completed a major project assigned by DEMO S.A., a prominent pharmaceutical company in Greece. SABO S.A. facilitated collaboration between DEMO S.A. and FANUC’s Europe team to provide customized robotics solutions. DAMO SA. utilized multiple robots by FANUC to implement uninterrupted production while ensuring enhanced outcomes and reduction in production costs.

Regional Insights

North America smart robots market held a significant revenue share of the global industry in 2024 owing to factors such as continuous research & development activities in the region, a growing number of new entrants in the robotics industry from North America, a large number of manufacturers and service providers who have already deployed smart robots technology and rise in use of smart robots by military and defense industry.

U.S. Smart Robots Market Trends

The U.S. smart robots market dominated the regional industry with a revenue share of 76.5 % in 2024. Increasing demand from the U.S. army, increasing adoption by automotive and other manufacturing facilities, the presence of multiple key companies from the country's innovation and robotics technology market, and rising utilization by retail organizations are some of the key growth drivers for this market.

Europe Smart Robots Market Trends

Europe is identified as lucrative region of global smart robots market in 2024. The rapid pace of digital transformation and rising adoption of smart robot technology by multiple industries, including pharmaceutical production, personal care, IT & telecom, BFSI, and others, encouragement and support offered by numerous governments in the region, availability of various smart robotic solutions, and growing awareness about high throughput attained by implementation of smart robotics technology are driving demand in this market.

Germany smart robots market held significant revenue share of the regional industry owing to robust manufacturing sector, growing adoption of collaborative robots in industrial applications, increasing availability of advanced robotics technology, ongoing research and development activities, rise in collaborations and more.

Asia Pacific Smart Robots Market Trends

Asia Pacific dominated the smart robots market with the largest revenue share of 51.3% in 2024 owing to presence of multiple key industry participants in the region, early adoption trends in terms of technology, ease of availability, existing application of smart robots technology in various industries, growing demand for military & defense, and increasing use by manufacturing companies in the region.

China smart robots market dominated the regional industry in 2024 owing to increasing use of smart robots in large manufacturing enterprises in the country, extensive nature of ongoing research & development activities in robotics, rapid pace of innovation and its implementations in various application areas, and government support for advancements in robotics

Key Smart Robots Company Insights

Some of the key companies in the smart robots market include Boston Dynamics, Fanuc Corporation, Omron Corporation, Kawasaki Heavy Industries, Ltd., and others. Major market participants have adopted strategies such as innovation, enhanced focus on research and development activities, expansions, portfolio enhancements, partnerships, and collaborations to address growing competition and rising technology adoption.

- Boston Dynamics, one of the prominent companies in robotic technology industry, develops highly mobile robots for industrial applications. Its portfolio includes products such as Spot, Stretch, and solution associated with thermal sensing, visual inspection, acoustic imaging, perimeter checks and more.

- Fanuc Corporation, a major market player in robotics and automation offers extensive range of products and services including industrial robots for manufacturing, collaborative robots, and others.

Key Smart Robots Companies:

The following are the leading companies in the smart robots market. These companies collectively hold the largest market share and dictate industry trends.

- iRobot Corporation

- Kawasaki Heavy Industries, Ltd.

- Fanuc Corporation

- Omron Corporation

- Intuitive Surgical Operations, Inc.

- OTC Daihen Inc.

- Panasonic Industry Europe GmbH

- Yaskawa Electric Corporation

- Kuka AG (Midea Group)

- Boston Dynamics

Recent Developments

-

In July 2024, FANUC America Corporation, one of the prime companies in robotics and automation, launched a newly developed facility spanning 650,000 square feet, backed by an investment of nearly USD 110 million, in Auburn Hills, Michigan. The newly developed West Campus facility represents 67 acres of land.

Smart Robots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.62 billion

Revenue forecast in 2030

USD 131.46 billion

Growth rate

CAGR of 26.5% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, operating environment, mobility, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa

Key companies profiled

iRobot Corporation; Kawasaki Heavy Industries, Ltd.; Fanuc Corporation; Omron Corporation; Intuitive Surgical Operations, Inc.; OTC Daihen Inc.; Panasonic Industry Europe GmbH; Yaskawa Electric Corporation; Kuka AG (Midea Group); Boston Dynamics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Robots Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart robots market report based on component, operating environment, mobility, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Actuators

-

Sensors

-

Power Source

-

Control Systems

-

-

Software

-

-

Operating Environment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ground

-

Marine

-

-

Mobility Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mobile

-

Stationary

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal

-

Companionship

-

Education

-

Others

-

-

Professional

-

Military & Defense

-

Law Enforcement

-

Public Relationship

-

Logistics Management

-

Industrial

-

Field/Agriculture

-

Healthcare Assistance

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.