- Home

- »

- Electronic & Electrical

- »

-

Soda Maker Market Size And Share, Industry Report, 2033GVR Report cover

![Soda Maker Market Size, Share & Trends Report]()

Soda Maker Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Mode Of Operation (Manual, Electric), By Type (Portable, Desktop), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-148-2

- Number of Report Pages: 141

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soda Maker Market Summary

The global soda maker market size was estimated at USD 918.1 million in 2024 and is projected to reach USD 1,148.0 million by 2030, growing at a CAGR of 3.8% from 2025 to 2030. The growth is driven by the increasing consumer preference for healthier, customizable beverage options and the convenience of at-home carbonation.

Key Market Trends & Insights

- North America held the largest share of the global soda maker market in 2024, accounting for 38.3%.

- The Canada soda maker industry is expected to grow at the fastest CAGR in North America, from 2025 to 2030.

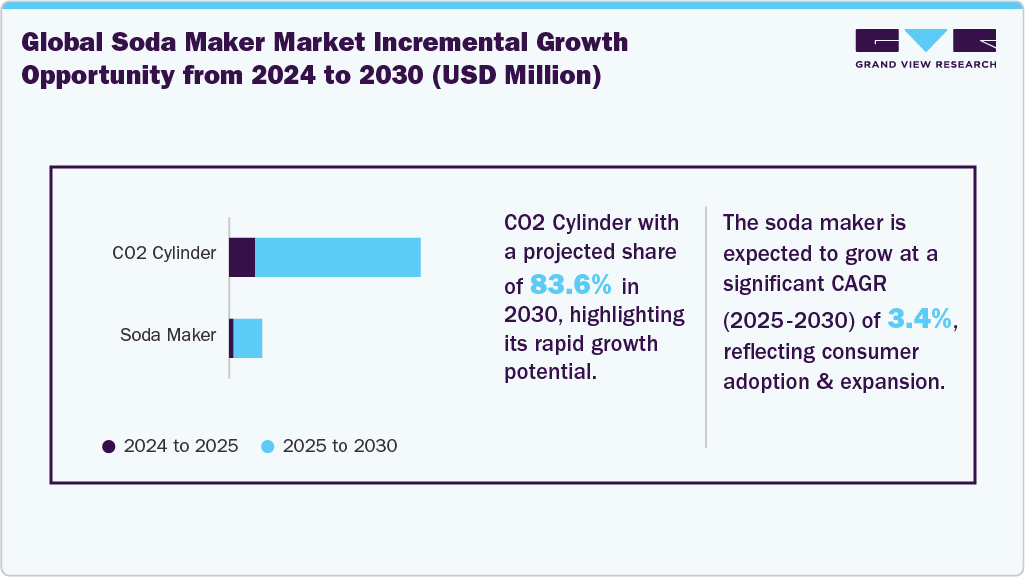

- By product, the CO2 cylinder segment dominated the market with the largest share of 83.1% in 2024.

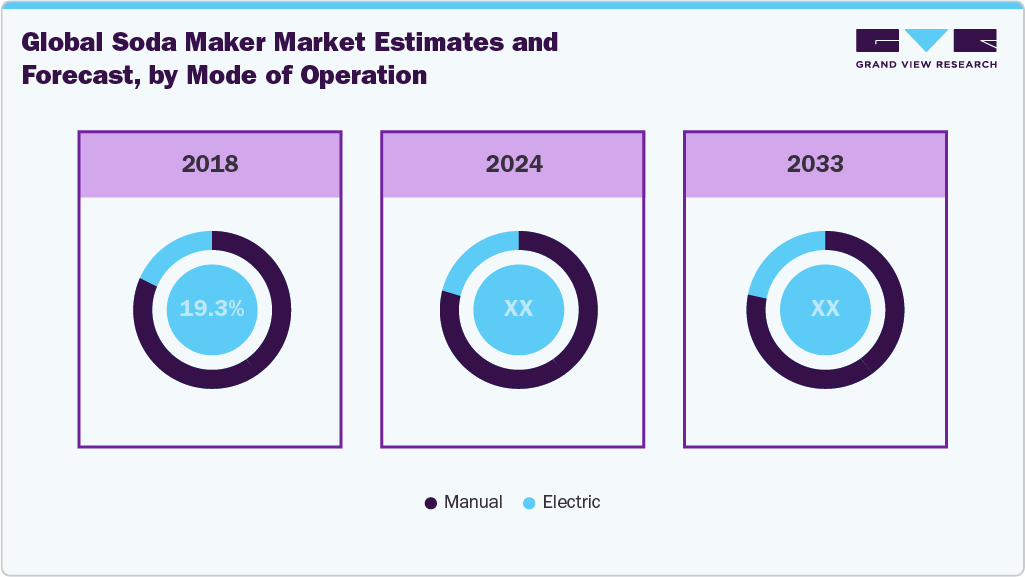

- By mode of operation, the manual segment dominated the market with a 79.2% share in 2024.

- By type, the desktop segment dominated the market and accounted for 85.7% in 2024.

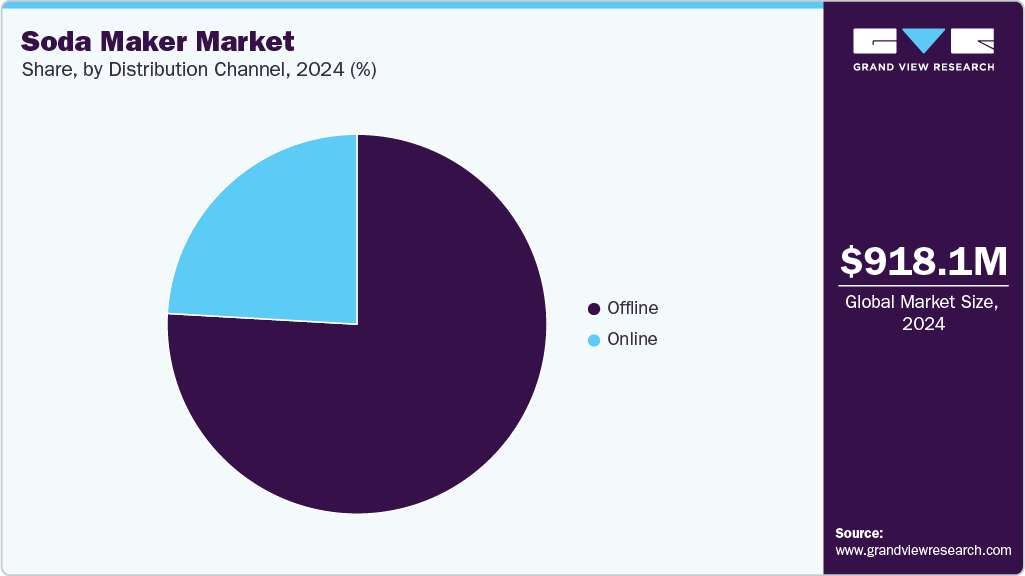

- Based on distribution channel, the offline segment accounted for the largest share of 75.9% of the revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 918.1 Million

- 2030 Projected Market Size: USD 1,148.0 Million

- CAGR (2025-2030): 3.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Rising awareness around reducing sugar intake and plastic waste drives adoption, while product innovation, improved designs, and expanding online and offline distribution channels further support market growth. Health consciousness and environmental awareness are also major influences shaping the soda maker industry. As consumers become increasingly aware of the health risks associated with high sugar intake and the environmental impact of single-use plastics, soda makers provide a compelling solution aligned with these values. The market is expected to witness steady growth in developed markets where health and sustainability concerns are particularly pronounced. Further advancements, such as the introduction of organic flavor options and enhanced carbonation technologies, are expected to appeal to health- and eco-conscious consumers.

The popularity of soda makers has increased as they offer convenience, customization, and the ability to reduce plastic waste associated with store-bought sodas. Consumers are increasingly drawn to the ability to adjust carbonation levels, choose flavors, and create sparkling water or sodas at home, aligning with trends toward health-conscious and eco-friendly lifestyles. The market growth is further supported by rising disposable incomes, increased home consumption of beverages, and technological advancements in smart and portable soda makers, which enhance user experience and convenience.

Product Insights

The CO2 cylinder segment dominated with the largest global revenue share of 83.1% in 2024. It is expected to record the fastest CAGR over the forecast period, highlighting its dominant role in the soda maker market. This can be attributed to their critical role in providing consistent carbonation for soda makers. Their widespread availability, refillability, and durability contribute to strong consumer preference and sustained market demand.

Aarke Inc. enhances the user experience through programs like the CO2 cylinder Loop Exchange, which allows customers to exchange their empty 60L cylinders for full ones delivered directly to their doorstep. This service is simple and flexible, with no subscriptions or monthly commitments. Each exchange is priced at USD 21 per cylinder and includes free shipping. Such initiatives ensure a continuous supply of CO2 for home carbonation and promote sustainability and convenience, reinforcing the segment’s critical role in the evolving market for soda makers.

The soda maker segment is projected to grow at a significant CAGR of 3.4% from 2025 to 2030, as more consumers seek convenient, cost-effective ways to make carbonated drinks at home. These devices allow users to carbonate water at home, offering CO2 cylinder convenience and reducing reliance on single-use plastic bottles. Increasing awareness of environmental sustainability, rising disposable incomes, and urban lifestyle changes have fueled the adoption of such products.

Mode of Operation Insights

The manual soda maker market segment accounted for the largest share of 79.2% of the revenue in 2024. These soda makers are designed specifically for home use. They are typically compact, countertop devices that allow users to carbonate water and create carbonated beverages in small batches. Manual soda makers are often preferred by individuals who enjoy the hands-on experience of creating their own carbonated drinks and who prefer a more compact and portable option for home use. They are typically easy to use and offer the flexibility to adjust the level of carbonation according to personal preference.

The electric soda maker market is projected to grow at the fastest CAGR of 4.6% from 2025 to 2030. The appeal of electric soda makers lies in their ease of use and consistent carbonation. With the automated process, users can achieve precise carbonation levels with minimal effort. Electric soda makers may offer additional features, such as adjustable carbonation settings, flavor dispensers, and digital displays for monitoring CO2 cylinder carbonation levels.

Type Insights

The desktop soda maker industry segment accounted for the largest global revenue share of 85.7% in 2024. Desktop soda makers are compact, countertop-friendly devices for home use, easy access, and immediate carbonation at the touch of a button. These models are ideal for kitchens with limited space, allowing users to quickly carbonate water or other beverages without the need for bulky equipment. Brands have introduced sleek, stylish designs with features such as adjustable fizz levels, electronic carbonation, and compatibility with various flavors, making them functional appliances and lifestyle statement pieces in modern kitchens.

The portable soda maker market is projected to grow at the fastest CAGR of 4.1% from 2025 to 2030. Portable soda makers are gaining popularity as consumers seek convenience and flexibility in creating sparkling beverages. Compact and lightweight, these devices allow users to carbonate water or other drinks anywhere, at home, in the office, or outdoors, making them ideal for travel, small apartments, and active lifestyles. The rising trend toward health-conscious and eco-friendly living, combined with the desire for personalized beverages, is driving demand. For instance, the OTE Portable Sparkling Water Machine is a portable handheld soda maker ideal for use on a bar cart or desk. It is easy to assemble and produces fizzy, tasty seltzer in just a few steps using an 8-gram CO₂ charger.

Distribution Channel Insights

The offline segment accounted for the largest share of 75.9% of the revenue in 2024. Supermarkets and hypermarkets are ideal distribution channels for a soda maker due to their wide reach and convenience. These outlets offer a one-stop shopping experience, allowing customers to easily access a variety of modes of operation, including different brands and types of bottled water. Walmart, Target, and Tesco provide consumers access to popular soda-maker brands. These retailers also enhance the shopping experience through in-store displays, promotional offers, and product demonstrations, making it easier for customers to compare models, explore features, and make informed purchase decisions.

The online segment is projected to grow at the fastest CAGR of 4.9% from 2025 to 2030. Online platforms have a global reach, enabling manufacturers to target a broader audience beyond their local markets. These online channels often facilitate direct-to-consumer sales, reducing reliance on intermediaries and lowering CO2 cylinder distribution costs. For instance, a variety of soda maker brands, including Breville InFizz Fusion, Philips GoZero, SodaStream E-Terra, MySoda Woody, Aerflo, Bottle Plus, and DEAUVIOR, are available on online platforms, offering consumers an extensive selection of portable and desktop carbonation options.

Regional Insights

The North America soda maker market held the largest revenue share of 38.3% in 2024. In North America, there has been a noticeable shift in consumer preferences as more people have begun reducing their sugary and artificially flavored beverages in favor of more natural, low-calorie alternatives. This growing awareness has increased the popularity of home carbonation devices, such as CO₂ carbonators and soda makers. The trend extends beyond simple hydration and is closely tied to health consciousness, cost savings, and environmental responsibility. Health concerns have played a significant role in this movement. People are increasingly seeking control over the ingredients in their drinks, preferring to avoid the sugars, preservatives, and artificial additives commonly found in commercial sodas-ingredients often linked to health problems like obesity, diabetes, and heart disease. Many also believe carbonated water offers digestive benefits or a soothing effect, making it a preferred choice over still water.

U.S. Soda Maker Market Trends

The U.S. led the North America soda maker industry in 2024. In the U.S., consumers increasingly seek the convenience of making carbonated drinks at home, allowing them to control sweetness levels and experiment with flavors. Hospitality businesses also contribute to growth as restaurants and cafes aim to offer personalized, high-quality soda experiences that enhance customer satisfaction. Sustainability plays a vital role, with consumers and businesses alike choosing soda makers to reduce plastic waste and the carbon footprint associated with packaged beverages.

Europe Soda Maker Market Trends

The soda maker industry in Europe is experiencing significant growth. The popularity of soda water in Europe can be attributed to several factors. Firstly, European consumers often prioritize the consumption of natural and healthier beverages. Furthermore, the widespread presence of natural mineral springs throughout Europe has significantly shaped the region’s cultural and health-driven preference for carbonated mineral water. These springs naturally yield water rich in minerals such as calcium, magnesium, and bicarbonates, which are often carbonated naturally due to underground pressure and dissolved carbon dioxide. This has fostered a deep-rooted European tradition of consuming sparkling mineral water, valued for its refreshing qualities and perceived health benefits. This long-standing appreciation has, in turn, contributed to the growing popularity of home soda makers, as consumers seek to recreate the taste and experience of natural sparkling water at home-often enhancing it with fruits or herbs for added flavor and wellness.

Asia Pacific Soda Maker Market Trends

The soda market industry in Asia Pacific is projected to grow at the fastest CAGR of 4.4% from 2025 to 2030. Several key factors reflecting shifting consumer lifestyles and preferences propel the market growth. Rising health awareness is one of the major drivers, as concerns over sugar intake and obesity prompt consumers to seek healthier alternatives such as sparkling water and low-calorie flavored drinks. Additionally, tech-friendly middle-class households increasingly embrace smart kitchen appliances, including soda makers with digital interfaces and app-based controls. Moreover, a growing interest in DIY beverage preparation, rooted in the cultural preference for homemade food and drinks, further fuels the demand for customizable soda solutions.

The India soda maker market is expected to witness steady growth in the coming years, fueled by increasing health awareness and a shift from sugary beverages to healthier, homemade sparkling drinks. Rising urbanization, disposable incomes, and changing lifestyles encourage consumers to adopt convenient home carbonation solutions. In addition, the growing trend of home entertainment and personalized beverages is boosting demand for portable and desktop soda makers.

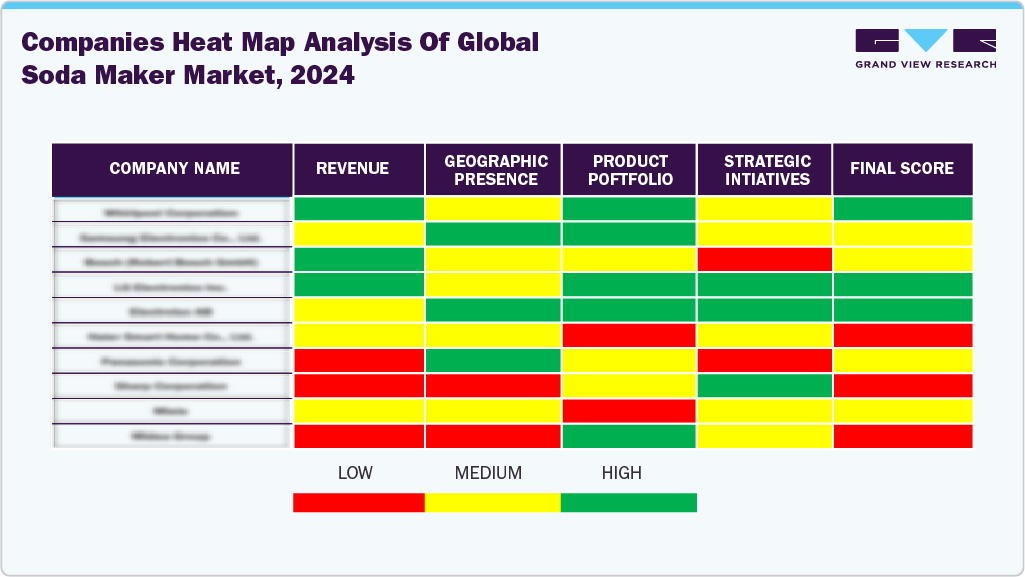

Key Soda Maker Company Insights

Key players in the soda maker market include SodaStream, Drinkmate, and MySoda. These companies employ a range of strategic initiatives to sustain and enhance their competitive advantage in a rapidly evolving marketplace. One of their primary approaches is a strong emphasis on innovation-continually developing and launching advanced soda maker models that cater to changing consumer preferences. For instance, many manufacturers are introducing machines with customizable carbonation levels, integrated flavor infusion systems, and sleek, space-saving designs that appeal to modern kitchens.

-

SodaStream, a subsidiary of PepsiCo, is a leading global home carbonation system manufacturer that enables consumers to transform ordinary tap water into sparkling water and flavored beverages. SodaStream also promotes a health-conscious lifestyle by encouraging reduced consumption of sugary drinks, positioning its systems as a smart alternative for modern, wellness-focused households. SodaStream's product lineup includes sparkling water makers, CO₂ cylinders, reusable bottles, and various flavor concentrates.

-

Aarke is popular for its premium home carbonation systems, particularly the Aarke Carbonator series. The company creates high-quality kitchen appliances that seamlessly blend aesthetics, functionality, and durability. Aarke's product portfolio includes sparkling water makers, water filter pitchers, electric kettles, and accessories, all crafted from durable materials like stainless steel.

Key Soda Maker Companies:

The following are the leading companies in the soda maker market. These companies collectively hold the largest market share and dictate industry trends.

- SodaStream Inc.

- Aarke AB.

- i-Drink Products Inc.

- Hamilton Beach Brands Holding Company

- Mysoda

- iSi GmbH

- Drinkpod

- Mr. Butler

- Sparke

- Ninja Thirsti drink system (SharkNinja Operating, LLC.)

Recent Developments

-

In May 2025, SMEG USA, the Italian appliance brand known for its retro inspired and design-focused products, introduced its first sparkling beverage appliance, the Sparkling Water Maker, as part of its Collezione Line.

-

In January 2025, iSi GmbH launched the Twist'n Sparkle Virtuoso, a premium sparkling beverage system, at The Inspired Home Show in Chicago. This debut marked iSi's entry into the international hydration market, showcasing their expertise in pressurized gas technology.

-

In September 2024 , Sodastream Inc. introduced four new products that redefine home carbonation and modern hydration, the Enso and ART GOLD sparkling water makers, the SodaStream Crafted Cocktail Mixers, and the Fizz & Go COOL Carbonating Bottle.

-

In April 2024, Mysoda signed an agreement to acquire Linde Gas AB’s home carbonation operations in Sweden, Denmark, Norway, Iceland, and the Baltics, including the Linde, AGA, and Aqvia brands. This strategic acquisition aims to solidify Mysoda’s position as a leading player in Northern Europe's home carbonation market.

Soda Maker Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 950.4 million

Revenue Forecast in 2030

USD 1,148.0 million

Growth rate

CAGR of 3.8% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode of operation, type, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Sweden; China; India; Japan; Australia & New Zealand

Key companies profiled

SodaStream Inc.; Aarke AB.; i-Drink Products Inc.; Hamilton Beach Brands Holding Company; Mysoda; iSi GmbH; Drinkpod; Mr. Butler; Sparkel; Ninja Thirsti drink system (SharkNinja Operating, LLC.)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soda Maker Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global soda maker market report based on product, mode of operation, type, distribution channel, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Soda Maker

-

CO2 Cylinder

-

-

Mode of Operation Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Manual

-

Electric

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Portable

-

Desktop

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global soda maker market size was estimated at USD 918.1 million in 2024 and is expected to reach USD 950.4 million in 2025.

b. The global soda maker market is expected to grow at a compounded growth rate of 3.8% from 2025 to 2030 to reach USD 1,148.0 million by 2030.

b. The manual soda maker segment dominated the soda maker market with a share of 79.2% in 2024. They are typically easy to use and offer the flexibility to adjust the level of carbonation according to personal preference.

b. Some key players operating in the soda maker market include SodaStream Inc., AARKE AB, i-Drink Products Inc, Hamilton Beach Brands Holding Company, Mysoda

b. Key factors that are driving the market growth include increased awareness about the health risks associated with excessive sugar intake, concerns about artificial sweeteners, and a growing interest in overall well-being.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.