- Home

- »

- Medical Devices

- »

-

Soft Contact Lenses Market Size, Industry Report, 2030GVR Report cover

![Soft Contact Lenses Market Size, Share & Trends Report]()

Soft Contact Lenses Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Hydrogel, Silicone Hydrogel), By Design (Spherical Lens, Toric Lens), By Application, By Distribution Channel, By Usage, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-511-7

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soft Contact Lenses Market Summary

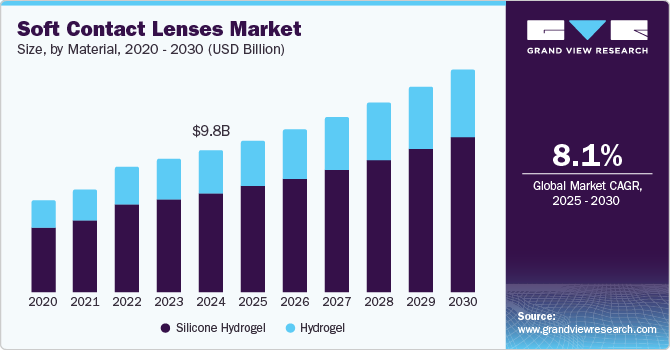

The global soft contact lens market size was estimated at USD 9,818.0 million in 2024 and is projected to reach USD 15,459.8 million by 2030, growing at a CAGR of 8.0% from 2025 to 2030. The industry is driven by increasing vision-related disorders such as myopia, presbyopia, and astigmatism, fueled by rising screen time and aging populations worldwide.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of material, silicone hydrogel accounted for the largest revenue share of 70% in 2024.

- Hydrogel is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9,818.0 Million

- 2030 Projected Market Size: USD 15,459.8 Million

- CAGR (2025-2030): 8.0%

- North America: Largest market in 2024

Technological advancements, including smart contact lenses and moisture-retaining materials, are enhancing comfort and expanding applications beyond vision correction, such as health monitoring. The growing preference for daily disposable lenses due to their hygiene benefits and convenience is also boosting market demand.

The increasing incidence of refractive errors such as myopia, hyperopia, presbyopia, and astigmatism is a major driver of the soft contact lens market. According to the World Health Organization (WHO), at least 2.2 billion people globally have vision impairment, with one-third requiring corrective measures. Myopia, in particular, has become a significant concern, especially in Asia-Pacific, where countries like China and South Korea report myopia prevalence rates exceeding 80% among young adults. The rising digital screen usage and prolonged exposure to blue light further contribute to eye strain and worsening vision conditions, accelerating the demand for soft contact lenses.

Manufacturers are continuously innovating materials and lens designs to enhance comfort, breathability, and durability. The development of silicone hydrogel lenses has improved oxygen permeability, reducing the risk of dry eyes and discomfort. Additionally, smart contact lenses capable of monitoring glucose levels for diabetics and detecting early signs of eye diseases are gaining traction. For example, Mojo Vision is developing augmented reality (AR)-enabled lenses, while companies like Alcon and Johnson & Johnson are investing in sensor-embedded lenses for real-time health monitoring. These advancements are expanding the applications of soft contact lenses beyond vision correction.

Daily disposable contact lenses are increasingly preferred due to their hygiene benefits, convenience, and reduced risk of infections compared to reusable lenses. The market for daily disposables is expected to grow at a CAGR of over 6% due to rising consumer awareness about eye health. According to a study by the American Academy of Optometry, daily disposable lenses significantly reduce the risk of microbial keratitis (a severe eye infection) compared to monthly lenses. Leading brands such as Acuvue Oasys 1-Day (Johnson & Johnson) and Dailies Total 1 (Alcon) dominate this segment, with ongoing innovations in hydration and comfort.

Public health campaigns and increasing optometric visits have boosted awareness of vision care. According to the Centers for Disease Control and Prevention (CDC), only 50% of people with vision problems in the U.S. seek eye care due to the lack of awareness. However, government and private sector initiatives promoting early diagnosis and correction of refractive errors are driving market growth. For instance, organizations like WHO’s Vision 2020 Initiative aim to eliminate avoidable blindness, which indirectly fuels demand for corrective lenses, including soft contact lenses.

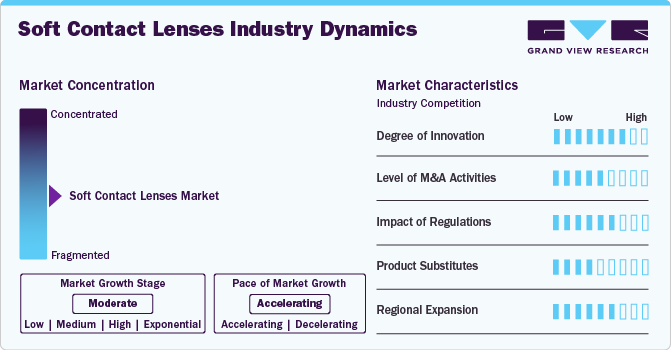

Market Concentration & Characteristics

The industry is experiencing rapid innovation driven by advancements in materials science, technology, and the integration of health-related features into contact lenses. Key innovations in this segment include lenses that are not only designed for vision correction but also for enhanced comfort, extended wear, and disease prevention. For instance, there have been developments in lenses with integrated smart features such as sensors to monitor blood glucose levels, which are especially useful for diabetic patients. This trend reflects a significant shift towards incorporating health-monitoring capabilities into everyday wearables. Additionally, new materials like silicone hydrogel are being continuously improved to offer better breathability and comfort for extended use.

The level of mergers and acquisitions (M&A) in the industry is high, as companies look to consolidate their market position, expand their product portfolio, and invest in research and development. A notable example is Johnson & Johnson Vision Care's acquisition of several smaller players in the soft contact lens sector to improve its technological capabilities and expand its product offerings. Collaborations between technology firms and optical companies to develop smart contact lenses and other futuristic solutions have also contributed to the ongoing consolidation of the market.

The industry is highly regulated due to the direct impact these products have on consumers' health. Regulations by bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) ensure that manufacturers adhere to strict safety, manufacturing, and quality control standards. For instance, the FDA has approved multiple brands, such as ACUVUE, based on their compliance with these standards. With the rising demand for smart and multifocal lenses, regulatory bodies are expected to implement stricter guidelines to ensure consumer safety, especially for lenses that integrate sensors or are designed for prolonged usage.

Product expansion in the industry is significant, driven by the continuous introduction of new designs, materials, and features. Manufacturers are developing lenses tailored to specific consumer needs, such as lenses for presbyopia (multifocal lenses), astigmatism (toric lenses), and myopia control. For example, in 2023, Alcon launched its TOTAL30 Multifocal lenses for presbyopia, which are gaining traction in the market. Additionally, the growing demand for daily disposable soft contact lenses, which are convenient and hygienic, has prompted several manufacturers to introduce products that offer enhanced comfort, moisture retention, and long-lasting wear.

Regional expansion in the industry is growing, particularly in emerging markets, where increasing awareness about eye health and disposable incomes drive demand for corrective solutions. North America continues to be the largest market, accounting for a significant share of the global revenue. However, Asia-Pacific is witnessing the fastest growth, fueled by the rising prevalence of refractive errors, rapid urbanization, and an aging population. For example, in China and India, the demand for corrective solutions, including soft contact lenses, is increasing due to the rise in myopia cases. In Japan, innovations in moisture-retaining lenses and digital eye strain-relief lenses are expanding the market's scope.

Material Insights

The silicone hydrogel segment accounted for the largest revenue share of more than 70.0% in 2024, primarily due to its breathability, comfort, and suitability for extended wear. Silicone hydrogel lenses allow more oxygen to pass through to the cornea, which improves comfort and reduces the risk of dryness and irritation. Innovations in hybrid soft lenses combining silicone hydrogel with gas-permeable materials are also contributing to market growth. These lenses offer sharp vision, and comfort, and are ideal for individuals with complex eye conditions like astigmatism and keratoconus.

The hydrogel segment is estimated to register a growth rate of over 8.32% from 2025 to 2030 due to its high-water content, ensuring superior comfort and oxygen permeability, making it ideal for users with dry or sensitive eyes. The rising demand for daily disposable hydrogel lenses, particularly for their hygiene benefits, affordability, and moisture retention, is fueling growth, especially in emerging markets. Additionally, cosmetic and colored hydrogel lenses are gaining popularity, particularly in Asia-Pacific and the Middle East, due to their vibrant pigmentation and comfort.

Design Insights

Spherical soft contact lenses are the most widely used, accounting for the largest share of the market. These lenses are typically prescribed for myopia, hyperopia, and presbyopia. They are easy to wear and are commonly available in various prescriptions. However, the growing demand for toric lenses (for astigmatism) and multifocal lenses is driving the market forward. Innovations like moisture gradient technology and advanced materials for enhanced comfort have helped make toric lenses more popular. For instance, in 2023, Alcon launched TOTAL30 for astigmatism, which uses water gradient technology for added comfort and moisture retention throughout the day.

The toric lenses segment is estimated to observe a CAGR of over 10.80% over the forecast period. The segment is driven by the rising prevalence of astigmatism, which affects nearly 36% of patients seeking vision correction globally. Increasing awareness and early diagnosis of refractive errors have led to a higher demand for customized toric lenses, which provide superior stability and clear vision compared to standard spherical lenses. Advancements in lens design and materials, such as silicone hydrogel toric lenses, offer better oxygen permeability and prolonged wear comfort, driving their adoption.

Distribution Channel Insights

The retail segment accounted for the largest revenue share, more than 45.2%, in 2023. The segment is driven by the growing preference for convenient purchasing channels, including optical stores, supermarkets, and online platforms. Brick-and-mortar optical retailers continue to dominate due to personalized fitting services, expert consultations, and immediate product availability, while e-commerce platforms are rapidly gaining traction with competitive pricing, subscription models, and home delivery options.

The E-commerce segment is estimated to record a CAGR of over 9.68% from 2025 to 2030 as they have become increasingly important in the soft contact lens market. With consumers seeking convenience, competitive pricing, and home delivery services, online retailers like 1-800 Contacts, Lens.com, and others are seeing substantial growth. However, brick-and-mortar optical shops and optometrist offices still hold a significant share of the market, particularly in regions with a high prevalence of eye care professionals.

Application Insights

The corrective segment accounted for the largest revenue share, more than 45.6%, in 2024. The segment is majorly driven by the rising prevalence of refractive errors such as myopia, hyperopia, astigmatism, and presbyopia across the globe. According to the World Health Organization (WHO), nearly 2.2 billion people globally suffer from vision impairment, with a significant portion requiring corrective lenses. Additionally, advancements in toric and multifocal lenses provide better vision correction for astigmatism and presbyopia, thereby fostering market growth. The increasing use of digital screens has also contributed to rising eye strain and vision problems, boosting the demand for corrective contact lenses among younger populations.

The cosmetic segment is anticipated to hold a significant CAGR during the forecast period. The segment growth is due to the increasing demand for aesthetic enhancement, particularly among younger consumers and individuals engaged in the fashion, media, and entertainment industries. The rising popularity of colored and decorative lenses for personal expression and beauty trends has significantly contributed to market growth. Technological advancements, such as UV protection, moisture-retaining materials, and enhanced oxygen permeability, have improved comfort and safety, making cosmetic lenses more appealing for long-term use. Furthermore, the expanding e-commerce and online retail channels have made these lenses more accessible, driving increased adoption, particularly in regions like Asia-Pacific, where beauty-conscious consumers are a major growth driver.

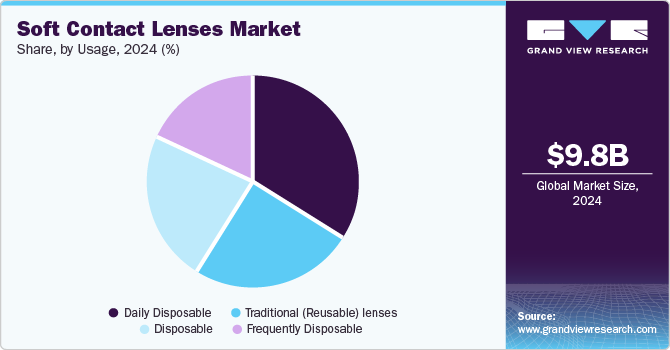

Usage Insights

The daily disposable lens segment held the largest share of revenue, more than 34.2%, in 2024. This is due to the ease of use, hygiene benefits, and comfort they offer. These lenses are preferred by individuals with busy lifestyles and athletes who require flexibility and convenience. Daily disposable lenses are seen as the healthiest option, as they minimize the risk of lens buildup and bacteria accumulation. The growing preference for disposable lenses is also driven by their affordability, as they eliminate the need for cleaning solutions and storage cases.

The daily disposable segment is driven by growing consumer preference for convenience, hygiene, and eye health benefits. These lenses eliminate the need for cleaning and storage, significantly reducing the risk of bacterial infections and eye complications such as microbial keratitis and dry eye syndrome. Increased awareness of ocular health, particularly among younger demographics and first-time users, has boosted demand for single-use lenses. Additionally, the rising prevalence of myopia and astigmatism due to increased screen time and digital eye strain has accelerated the adoption of daily disposables as a hassle-free vision correction solution.

Regional Insights

North America soft contact lenses market accounted for the largest share, over 37.2%, in 2024 and is expected to grow significantly over the coming years. This region is characterized by high adoption rates of soft contact lenses and a strong focus on technological innovation. Research and development activities are highly concentrated in this region, with companies continuously launching new products, such as CooperVision’s MyDay Energys lenses designed to address digital eye strain. Moreover, the increasing awareness of ocular health and the aging population are major drivers. Advances in smart lenses and ortho-k (orthokeratology) lenses are anticipated to further fuel the market growth in the coming years.

U.S. Soft Contact Lenses Market Trends

The soft contact lens market in the U.S. is driven by ongoing innovations and mergers within the sector. In particular, the adoption of smart contact lenses equipped with sensors that track glucose levels and other health metrics has gained traction. There is also a growing demand for ortho-k lenses, which reshape the cornea overnight for myopia control. Additionally, the senior population in the U.S. has heightened the demand for corrective solutions for age-related vision problems, such as macular degeneration and cataracts, propelling the market growth.

Europe Soft Contact Lenses Market Trends

The soft contact lens market in Europe is witnessing a steady shift toward more innovative products designed for comfort and convenience. The popularity of daily disposable lenses is rising due to their hygiene benefits and ease of use. Moreover, advancements in smart lenses that monitor health conditions like glucose levels are also emerging. Notably, in October 2023, Alcon launched TOTAL30 Multifocal lenses, a first-of-its-kind monthly water gradient multifocal lens for presbyopia. This innovation is gaining traction among aging populations and eye care professionals in Europe.

The UK soft contact lens market is marked by an increasing focus on eye health awareness and the growing prevalence of myopia among younger individuals. As a result, there has been a notable surge in demand for myopia control lenses. Additionally, online sales channels are becoming increasingly popular as consumers prioritize convenience and competitive pricing. In line with global sustainability trends, eco-friendly packaging and sustainable materials are becoming more prevalent in the UK market. Product innovations are also catering to the aging population with the introduction of multifocal lenses for vision correction at various distances.

The soft contact lens market in France is driven by consumer demand for both functional and aesthetic products, such as colored contact lenses. There has also been a notable increase in the adoption of moisture-retaining lenses to alleviate dry eye syndrome, which is becoming more common in the population. Fashion-conscious consumers are opting for customizable contact lenses that not only provide vision correction but also act as a fashion accessory. Manufacturers are addressing these needs by introducing colored and cosmetic lenses alongside corrective lenses.

Asia Pacific Soft Contact Lenses Market Trends

The soft contact lens market in Asia Pacific is fueled by increasing disposable incomes, awareness of eye health, and the rising prevalence of myopia, especially among children and young adults. The emergence of smart lenses designed to monitor health metrics, such as glucose levels, is a key trend in the region. Additionally, the aging population, particularly in countries like China and India, is driving demand for multifocal and toric lenses to address age-related vision conditions such as presbyopia. The market in Asia Pacific is expected to continue expanding as innovations in contact lenses gain traction.

Japan soft contact lens market is known for its preference for high-quality products and cutting-edge technology. Companies are investing heavily in research to explore next-generation materials, such as those that can enhance the comfort of contact lenses for users with dry eye syndrome. In March 2024, Menicon announced plans to develop materials using advanced technology that will help recycle plastic waste and improve sustainability. There is also a rising demand for lenses that can mitigate digital eye strain, particularly as screen time among Japan's population continues to increase. Colored and cosmetic lenses are also gaining popularity.

The soft contact lens market in India is undergoing rapid growth, driven by changing lifestyles, urbanization, and a rising prevalence of myopia, particularly among children and young adults. The market is highly price-sensitive, but consumers are increasingly seeking quality products. Affordability and accessibility are important factors driving growth. Companies are introducing budget-friendly options that cater to the demand for reliable and high-quality products. In 2024, Alcon launched its Clareon intraocular lenses in India, reinforcing its presence and expanding its reach within the country’s eye care industry.

Latin America Soft Contact Lenses Market Trends

The soft contact lens market in Latin America is driven by increased awareness of eye health and the rising prevalence of vision-related issues. The shift toward daily disposable lenses is particularly evident due to their hygiene benefits and convenience. Specialty lenses, such as toric lenses for astigmatism and multifocal lenses for presbyopia, are becoming more popular as consumers demand tailored solutions for their specific vision needs. With the increasing use of digital screens, conditions like dry eye syndrome are more prevalent, prompting demand for moisture-retaining and comfortable lenses.

Brazil soft contact lens market stands out within Latin America due to its large population and diverse consumer base. Innovations in lens technology, particularly the advent of silicone hydrogel lenses, have revolutionized comfort and oxygen permeability, contributing to the popularity of soft contact lenses in the country. E-commerce platforms are playing a vital role in providing greater access to contact lenses, especially among younger consumers who prefer online shopping. Furthermore, Brazil’s healthcare initiatives and growing focus on eye care have contributed to the increased awareness of corrective solutions, boosting the demand for soft contact lenses.

Middle East & Africa Soft Contact Lenses Market Trends

The soft contact lens market in the Middle East & Africa is seeing significant growth due to increasing disposable incomes and rising awareness of eye health. The shift toward daily disposable lenses is evident, as they are perceived as more hygienic and convenient compared to traditional reusable lenses. Additionally, the demand for specialty lenses such as toric lenses for astigmatism and multifocal lenses for presbyopia is rising, particularly due to the aging population in several MEA countries. The market is also expanding as consumers become more conscious of their eye health and explore various corrective lens options.

Saudi Arabia soft contact lens market is expanding rapidly, fueled by lifestyle changes, technological innovations, and increased awareness of eye care. New products such as colored contact lenses and smart contact lenses with integrated sensors are capturing consumer interest. There is also a growing concern regarding ocular diseases like diabetic retinopathy and dry eye syndrome, which are becoming prevalent due to lifestyle factors like excessive screen time. With a rapidly aging population, demand for age-related vision correction solutions such as multifocal lenses is also expected to increase.

Key Soft Contact Lenses Company Insights

Companies operating within the industry are concentrating on mergers, partnerships, acquisitions, and introducing new products to enhance their presence in the market. For instance, in July 2024, experts said that toric soft contact lenses should be the standard correction method for individuals with low to moderate astigmatism. This recommendation is based on their effectiveness in providing a stable and clear vision for astigmatic patients.

Key Soft Contact Lenses Companies:

The following are the leading companies in the soft contact lenses market. These companies collectively hold the largest market share and dictate industry trends.

- Bausch + Lomb Inc.

- Acuvue (Johnson & Johnson)

- Alcon Vision Llc

- Carl Zeiss Ag

- Cooper Vision Inc.

- Essilor International

- Hoya Corporation

- Menicon Co., Ltd.

- SEED Co., Ltd.

Recent Developments

- In January 2023 , Carter Ledyard’s client CooperVision, Inc. finalized its acquisition of SynergEyes, Inc., which offers a diverse array of specialty contact lenses, including unique hybrid lenses. These products enhance CooperVision’s portfolio, particularly its Onefit scleral lenses.

- In October 2023 , XPANCEO, a deep tech startup, raised $40 million in a seed funding round to develop the first contact lenses featuring augmented reality (AR) capabilities. Opportunity Ventures (Asia), based in Hong Kong, led this funding round. The capital will be utilized to advance the next prototype, which aims to integrate multiple features into a single device.

Soft Contact Lenses Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.50 billion

Revenue forecast in 2030

USD 15.46 billion

Growth Rate

CAGR of 8.05% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, design, application, distribution channel, usage, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Johnson & Johnson Services, Inc. (Johnson & Johnson Vision Care, Inc.); Bausch + Lomb; ALCON INC.; CooperCompanies (CooperVision); Contamac; HOYA CORPORATION (HOYA Corporation Contact Lens Division); SEED Co., Ltd.; EssilorLuxottica; Menicon Co., Ltd.; Euclid Vision Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soft Contact Lenses Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global soft contact lenses market report based on material, design, application, distribution channel, usage and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicone Hydrogel

-

Hydrogel

-

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Spherical Lens

-

Toric Lens

-

Multifocal Lens

-

Other Lens

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Corrective

-

Therapeutic

-

Cosmetic

-

Prosthetic

-

Lifestyle-oriented

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Eye Care Professionals

-

Retail

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Daily Disposable

-

Disposable

-

Frequently Disposable

-

Traditional (Reusable) lenses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global soft contact lenses market size was estimated at USD 9.82 billion in 2024 and is expected to reach USD 10.50 billion in 2025.

b. The global soft contact lenses market is expected to grow at a compound annual growth rate of 8.05% from 2025 to 2030 to reach USD 15.46 billion by 2030.

b. North America dominated the soft contact lenses market with a share of more than 37.2% in 2024. This is attributable to the rise in the number of visual inaccuracies and rising product innovations.

b. Some key players operating in the soft contact lenses market include Bausch + Lomb Inc., Acuvue (Johnson & Johnson), Alcon Vision Llc, Carl Zeiss Ag, Cooper Vision Inc., Essilor International, Hoya Corporation, Menicon Co., Ltd., and SEED Co., Ltd.

b. Key factors that are driving the soft contact lenses market growth include an increase in the purchasing power of consumers in developing countries and the need for eliminating the use of spectacles along with the rising adoption of contact lenses to enhance aesthetic appearance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.