- Home

- »

- Plastics, Polymers & Resins

- »

-

Hydrogel Market Size And Share, Industry Report, 2030GVR Report cover

![Hydrogel Market Size, Share & Trends Report]()

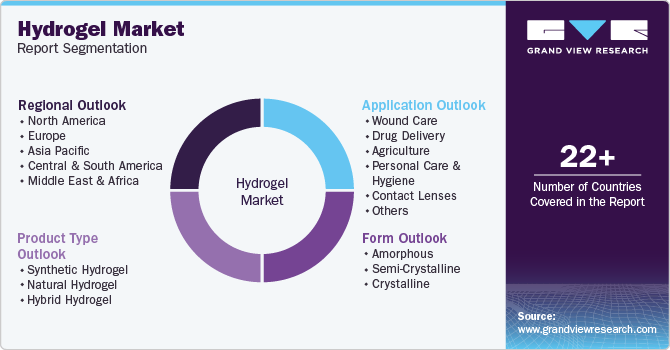

Hydrogel Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Synthetic Hydrogel, Natural Hydrogel, Hybrid Hydrogel), By Form (Amorphous, Semi-Crystalline, Crystalline), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-503-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrogel Market Summary

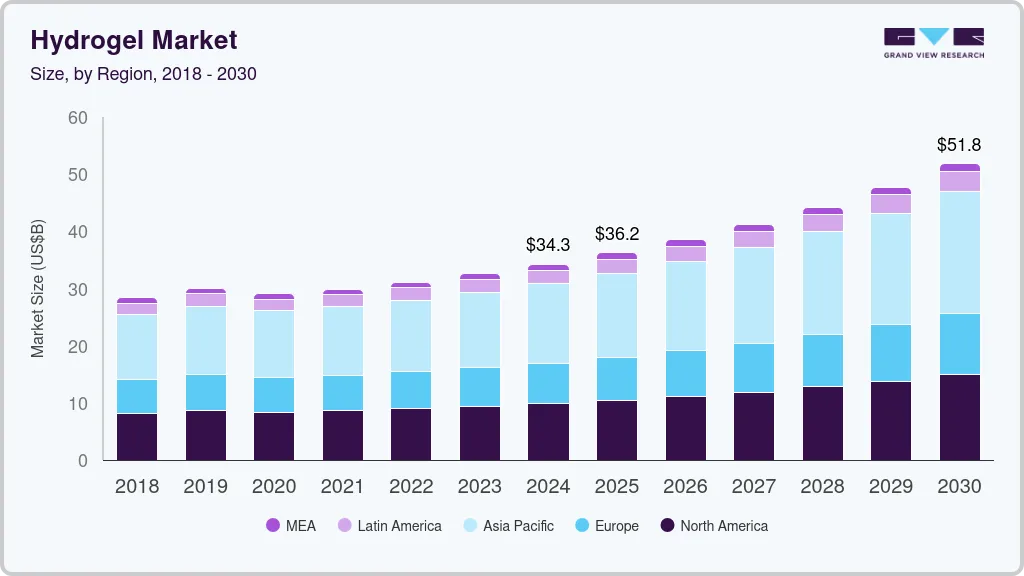

The global hydrogel market size was estimated at USD 34,250.8 million in 2024 and is projected to reach USD 51,821.2 million by 2030, growing at a CAGR of 7.4% from 2025 to 2030. The rising demand for wound care products is one of the primary drivers of the global market.

Key Market Trends & Insights

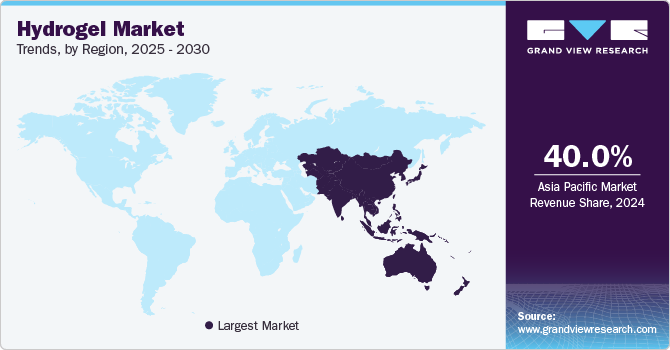

- Asia Pacific hydrogel market dominated the global market and accounted for the revenue share of over 40.0% in 2024.

- The Hydrogel market in the U.S. is primarily driven by robust research infrastructure.

- By product type, the synthetic hydrogel segment recorded the largest market revenue share of over 59.0% in 2024.

- By form, the amorphous segment accounted for the largest market share of over 57.0% in 2024.

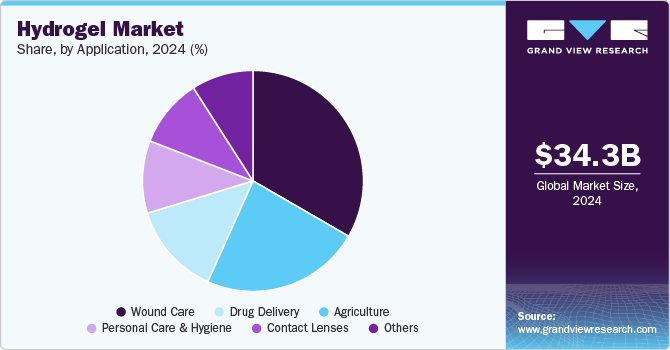

- By application, the wound care segment recorded the largest market share of over 33.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 34,250.8 Million

- 2030 Projected Market Size: USD 51,821.2 Million

- CAGR (2025-2030): 7.4%

- Asia Pacific: Largest market in 2024

Hydrogels, due to their high water content and biocompatibility, are widely used in medical applications such as wound dressings, burn care, and surgical applications.

Another significant factor driving the market is the growing use of hydrogels in personal care and hygiene products. Hydrogels are integral to the production of diapers, sanitary pads, and adult incontinence products due to their high absorbent properties. The increasing global birth rate in developing regions, coupled with the aging population and rising awareness about hygiene, has led to a surge in the demand for superabsorbent polymers (SAPs), a type of hydrogel. Companies like Procter & Gamble and Kimberly-Clark have been leveraging hydrogel technology to create innovative hygiene products that offer superior absorption and comfort.

The increasing adoption of hydrogels in drug delivery systems is also a crucial growth factor. Hydrogels are gaining traction in the pharmaceutical industry as carriers for targeted and sustained drug release. Their ability to encapsulate drugs and release them in a controlled manner makes them suitable for applications in oncology, ophthalmology, and chronic disease management. For instance, researchers are developing hydrogel-based systems for delivering cancer drugs directly to tumor sites, reducing side effects and improving treatment efficacy. The rising focus on precision medicine and advancements in hydrogel formulations are expected to further boost their application in this field.

Moreover, the expanding applications of hydrogels in emerging industries such as wearable technology and soft robotics are contributing to market growth. Hydrogels' unique properties, including flexibility, self-healing, and responsiveness to external stimuli, make them ideal for use in electronic skin, biosensors, and actuators. For example, researchers are exploring hydrogel-based materials for use in smart contact lenses that monitor glucose levels in real time. The rapid advancements in these cutting-edge applications are creating new growth opportunities for hydrogel manufacturers, particularly in developed markets like North America and Europe.

Product Type Insights

The synthetic hydrogel segment recorded the largest market revenue share of over 59.0% in 2024. The demand for synthetic hydrogels is primarily driven by their use in advanced medical applications, such as contact lenses, injectable gels, and drug delivery systems, due to their controlled swelling behavior and biocompatibility. Additionally, growth in the healthcare industry and advancements in polymer chemistry are boosting their adoption.

Natural hydrogels are derived from biological polymers, such as alginate, chitosan, gelatin, and hyaluronic acid. They are biodegradable, biocompatible, and mimic the extracellular matrix, making them ideal for tissue engineering, wound healing, and cosmetics applications. Natural hydrogels are also widely used in agriculture and food packaging due to their eco-friendly nature. The rising preference for environmentally sustainable materials and the increasing demand for natural and organic personal care products are key drivers for natural hydrogels.

Hybrid hydrogels combine synthetic and natural polymers to leverage the benefits of both. These hydrogels offer improved mechanical strength, tunable degradation rates, and enhanced biocompatibility. Due to their superior properties, they are widely used in areas such as drug delivery, tissue scaffolding, and 3D bioprinting.

Form Insights

The amorphous segment accounted for the largest market share of over 57.0% in 2024. Amorphous hydrogels are non-structured, highly flexible, and exhibit no distinct crystalline pattern. They are often transparent and soft, enabling them to conform to irregular surfaces, which makes them ideal for wound care, drug delivery, and moisturizing applications. The demand for amorphous hydrogels is driven by their versatility in biomedical applications, such as wound care and tissue engineering.

Semi-crystalline hydrogels feature a combination of crystalline and amorphous regions, offering a balance of strength and flexibility. These hydrogels are known for their controlled swelling behavior, making them suitable for applications requiring precise water absorption, such as agriculture, drug delivery systems, and controlled-release fertilizers.

Crystalline hydrogels have a highly organized structure, providing rigidity and stability. These hydrogels are often employed in applications that require defined shape retention and mechanical strength, such as packaging, scaffolding in tissue engineering, and industrial uses. Their reduced swelling capacity compared to amorphous and semi-crystalline hydrogels allows them to maintain structural integrity under stress.

Application Insights

The wound care segment recorded the largest market share of over 33.0% in 2024. Hydrogels are extensively used in wound care due to their ability to maintain a moist environment, which is critical for wound healing. The growing prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, and the rising aging population drive the demand for hydrogel-based wound care products. Additionally, advancements in hydrogel formulations, such as antimicrobial and bioactive hydrogels, further bolster market growth.

Hydrogels are employed as drug delivery systems due to their biocompatibility, high water content, and controlled release properties. They can encapsulate a variety of drugs, including small molecules and macromolecules, ensuring targeted and sustained delivery to specific tissues. The demand for non-invasive drug delivery methods, increased focus on personalized medicine, and advancements in hydrogel nanotechnology for smart drug delivery systems are key factors driving the adoption of hydrogels in this segment.

Hydrogels are used in agriculture to enhance water retention in soils, improve crop yield, and optimize fertilizer usage. These superabsorbent polymers reduce water wastage, particularly in arid and semi-arid regions, and improve soil structure. The rising need for sustainable farming practices, increasing awareness about water conservation, and government initiatives promoting hydrogel usage in agriculture drive market growth. Climate change and water scarcity concerns also boost the adoption of hydrogels.

Region Insights

Asia Pacific hydrogel market dominated the global market and accounted for the revenue share of over 40.0% in 2024. Rapidly expanding healthcare infrastructure, increasing research investments, and a growing pharmaceutical and medical device industry are key catalysts behind the region's market dominance. Countries such as China, Japan, South Korea, and India are leading this transformation, with substantial government support for advanced medical technologies and biomedical innovations.

China Hydrogel Market Trends

China Hydrogel market is primarily driven by its country's robust pharmaceutical and medical device manufacturing infrastructure, coupled with substantial government investments in biotechnology and healthcare innovation. The Chinese government's strategic policy initiatives, such as the "Made in China 2025" plan, have explicitly prioritized biomaterials and medical technology as key development areas. This national-level support has enabled domestic hydrogel manufacturers to receive significant funding, tax incentives, and research grants, accelerating technological innovation and manufacturing capabilities.

North America Hydrogel Market Trends

The region's growing healthcare expenditure, aging population, and increasing prevalence of chronic wounds and diseases are additional catalysts driving hydrogel market demand. Sophisticated healthcare systems, high patient awareness, and willingness to adopt cutting-edge medical technologies make North America an attractive market for hydrogel manufacturers. The combination of technological innovation, research excellence, and significant healthcare infrastructure ensures that North America remains a dominant force in the global hydrogel market.

The Hydrogel market in the U.S. is primarily driven by robust research infrastructure, significant investments in biomedical innovation, and advanced manufacturing capabilities. In the healthcare sector, U.S. medical institutions and research universities are pioneering hydrogel applications in wound healing, tissue engineering, and drug delivery systems. The U.S. Food and Drug Administration's supportive regulatory framework for innovative medical technologies further accelerates commercialization of these advanced hydrogel solutions.

Europe Hydrogel Market Trends

The European market's leadership is particularly evident in biomedical applications, where countries like Germany, France, and the United Kingdom are pioneering hydrogel technologies for wound healing, tissue engineering, and drug delivery systems. For instance, research institutions and companies in these countries are developing sophisticated hydrogel-based wound dressings that can actively monitor healing progress and release medications precisely, representing significant advancements in medical treatment strategies.

Hydrogel market in the Germany is primarily driven by its robust technological innovation, strong manufacturing capabilities, and strategic focus on advanced materials research. The country's pharmaceutical, medical device, and biotechnology industries have been particularly instrumental in pushing hydrogel applications forward, especially in medical and healthcare sectors. The German market's position is exemplified by companies such as BASF and Evonik, which have heavily invested in developing cutting-edge hydrogel technologies. These firms are pioneering innovations in areas such as wound dressings, drug delivery systems, and tissue engineering.

Key Hydrogel Company Insights

The global hydrogel market is characterized by intense competition, with numerous established players and emerging companies vying for market share. Key players, such as 3M, Smith & Nephew, Cardinal Health, and Johnson & Johnson, dominate the market with strong product portfolios and significant investments in research and development. Emerging players, particularly in Asia-Pacific, are gaining traction by offering cost-effective and specialized hydrogel solutions, further intensifying competition. Strategic partnerships, mergers and acquisitions, and a focus on sustainability are prevalent trends shaping the competitive landscape as companies strive to meet evolving consumer demands and regulatory standards.

Key Hydrogel Companies:

The following are the leading companies in the hydrogel market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson

- Cardinal Health

- 3M Company

- Coloplast

- B. Braun Melsungen

- Smith & Nephew

- Derma Sciences

- Royal DSM

- Dow Corning Corporation

- Paul Hartmann

- Ashland

- Evonik Industries

Recent Developments

-

In November 2024, UPM Biomedicals launched FibGel, the world's first injectable nanocellulose hydrogel specifically designed for permanent implantable medical devices. This innovative product is made entirely from birch wood cellulose and water, making it a safe, sustainable, and biocompatible alternative to traditional hydrogels derived from synthetic or animal sources.

-

In July 2024, Cosmos Health successfully completed the pilot production and scale-up phases for its weight management hydrogel, CCX0722. This achievement marks the conclusion of the development phase for this biocompatible hydrogel, which is designed to assist in weight management and is made from natural ingredients. The hydrogel has demonstrated a swelling ratio exceeding 100 g/g, indicating significant improvements in its properties during the scale-up process.

Global Hydrogel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36,223.3 million

Revenue forecast in 2030

USD 51,821.2 million

Growth rate

CAGR of 7.4% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, form, application, region

States scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Key companies profiled

Johnson & Johnson; Cardinal Health; 3M Company; Coloplast; B. Braun Melsungen; Smith & Nephew; Derma Sciences; Royal DSM; Dow Corning Corporation; Paul Hartmann; Ashland; Evonik Industries

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogel Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Hydrogel market report based on product type, form, application, and region:

-

Product Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Synthetic Hydrogel

-

Natural Hydrogel

-

Hybrid Hydrogel

-

-

Form Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Amorphous

-

Semi-Crystalline

-

Crystalline

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Wound Care

-

Drug Delivery

-

Agriculture

-

Personal Care & Hygiene

-

Contact Lenses

-

Others

-

-

Region Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hydrogel market was estimated at USD 34.25 billion in 2024 and is expected to reach USD 36.22 billion by the year 2025.

b. The global hydrogel market is expected to witness high revenue growth of 7.42% from 2025 to 2030 to reach USD 51.82 billion by 2030 due to their high water content and biocompatibility, which are widely used in medical applications such as wound dressings, burn care, and surgical applications.

b. The wound care application commanded the largest share of 33.35% in the year 2024. The growing prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, and the rising aging population drive the demand for hydrogel-based wound care products

b. Some key players operating in the hydrogel market include Johnson & Johnson; Cardinal Health; 3M Company; Coloplast; B. Braun Melsungen; Smith & Nephew; Derma Sciences; Royal DSM; and Dow Corning Corporation

b. The increasing adoption of hydrogels in drug delivery systems is also a crucial growth factor. Hydrogels are gaining traction in the pharmaceutical industry as carriers for targeted and sustained drug release.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.