- Home

- »

- IT Services & Applications

- »

-

Software Composition Analysis Market Size Report, 2030GVR Report cover

![Software Composition Report]()

Software Composition Analysis Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Cloud, On-premise), By Enterprise Size (SMEs, Large Enterprises), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-379-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Software Composition Analysis Market Summary

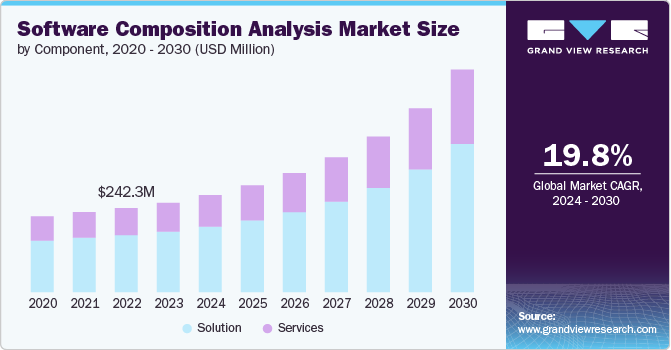

The global software composition analysis market size was estimated at USD 266.2 million in 2023 and is expected to grow at a CAGR of 19.8% from 2024 to 2030.The market is rapidly expanding due to the increasing reliance on open-source software in modern applications and the growing need to manage security vulnerabilities and license compliance.

Key Market Trends & Insights

- North America held the largest market share of over 38% in the market in 2023.

- By component, the solution segment accounted for the largest market share of over 67% in 2023.

- By deployment, the cloud segment accounted for the largest market share of over 55% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 266.2 Million

- 2030 Projected Market Size: USD 880.63 Million

- CAGR (2024-2030): 19.87%

- North America: Largest market in 2023

Software Composition Analysis (SCA) tools help organizations identify, track, and manage open-source components within their software, ensuring that these components are free from known vulnerabilities and comply with licensing requirements.

Key drivers of this market include the rise in cyber threats targeting software supply chains, stringent regulatory requirements such as GDPR and HIPAA, and the shift towards DevSecOps practices that integrate security early in the development process. The healthcare sector is experiencing particularly high growth in the SCA market due to its stringent regulatory environment and increased cyber threats. Major players in the market, such as Synopsys, Snyk, Sonatype, Veracode, and WhiteSource, offer comprehensive solutions that cater to various industries, including BFSI, IT and telecommunications, and retail.

The increasing use of open-source software is a significant driver for the software composition analysis market. Organizations across various industries are leveraging open-source components to accelerate development processes, reduce costs, and benefit from the collective innovation of global developer communities. Open-source software offers the flexibility and scalability needed for modern applications, allowing companies to build robust solutions without starting from scratch. However, as the adoption of open-source components grows, so does the complexity of managing these components. Each piece of open-source software can have multiple dependencies and may introduce vulnerabilities that could be exploited by malicious actors. Furthermore, compliance with open-source licenses is critical to avoid legal repercussions. This heightened reliance on open-source software necessitates effective management solutions to ensure that all components are secure, up-to-date, and comply with relevant licenses. SCA tools address these needs by providing automated solutions for identifying, tracking, and managing open-source components, thereby mitigating risks and ensuring that organizations can safely leverage the benefits of open-source innovation.

Component Insights

The solution segment accounted for the largest market share of over 67% in 2023. SCA solutions have significantly advanced in their capabilities, making them indispensable for organizations. These solutions now offer real-time monitoring, which allows continuous surveillance of open-source components for any emerging vulnerabilities. AI-driven vulnerability detection enhances the accuracy and speed of identifying potential security risks, reducing the burden on development teams and minimizing false positives. Furthermore, seamless integration with development environments and CI/CD pipelines ensures that security checks are embedded throughout the software development lifecycle, from code writing to deployment. This integration facilitates the early detection and remediation of vulnerabilities, aligning with the shift-left security approach.

The services segment is expected to grow at a CAGR of 20.41% during the forecast period. Many organizations, particularly small and medium-sized enterprises (SMEs), lack the in-house expertise and resources to manage SCA processes effectively. Managed services offer a cost-effective solution by outsourcing these tasks to experts. Furthermore, managed services provide ongoing monitoring and management of open-source components, ensuring continuous protection against vulnerabilities and compliance issues without overburdening internal teams.

Deployment Insights

The cloud segment accounted for the largest market share of over 55% in 2023. Cloud-based SCA solutions offer scalable resources that can easily adapt to the varying needs of organizations, accommodating everything from small projects to large enterprise applications. Cloud deployment allows organizations to quickly implement and scale SCA tools as their software development needs evolve, providing flexibility in managing open-source components across different projects and teams. Similarly, cloud-based SCA tools integrate seamlessly with DevOps practices and continuous integration/continuous deployment (CI/CD) pipelines, facilitating automated and continuous monitoring of open-source components throughout the development lifecycle.

The on-premise segment is expected to grow at a significant CAGR during the forecast period. Organizations that prioritize control over their IT assets, including software tools like SCA solutions, typically do so to align with their organizational culture and governance principles. These organizations often have strict policies regarding data security, compliance, and risk management, which require comprehensive oversight and direct management of technology assets. By opting for on-premise deployment of SCA solutions, these organizations retain full control over their data, infrastructure, and security protocols. This approach allows them to implement customized security measures, integrate seamlessly with existing IT environments, and adhere strictly to regulatory requirements without relying on external service providers.

Enterprise Size Insights

The large enterprises segment held a market share of over 57% in 2023 and is expected to dominate the market by 2030. Large enterprises operate on a scale that involves managing extensive and diverse software environments, which often include a multitude of open-source components. These components are critical for driving innovation, reducing development costs, and accelerating time-to-market for new products and services. However, the complexity of these software ecosystems introduces significant challenges in terms of security and compliance management. By continuously scanning and analyzing these components, SCA tools identify vulnerabilities, assess license compliance, and monitor for any potential security risks. This proactive approach ensures that large enterprises can effectively manage and mitigate risks associated with their software assets, safeguarding against potential security breaches, intellectual property issues, and regulatory non-compliance. Moreover, SCA tools enable enterprises to maintain operational resilience and agility, supporting their ongoing digital transformation initiatives while maintaining robust software security practices across their complex software environments.

The SMEs segment is expected to grow at a significant CAGR of 21.22% over the forecast period. SMEs typically face constraints in terms of budget, manpower, and expertise, making it challenging to maintain robust cybersecurity measures manually. SCA tools play a pivotal role in addressing these challenges by automating the identification of vulnerabilities within open-source components used in their software applications. By leveraging automated scanning and analysis capabilities, SCA tools enable SMEs to detect potential security weaknesses promptly and efficiently, minimizing the need for extensive manual oversight. This automation not only enhances the speed and accuracy of vulnerability management but also optimizes resource allocation, allowing SMEs to focus their limited resources on other critical business priorities.

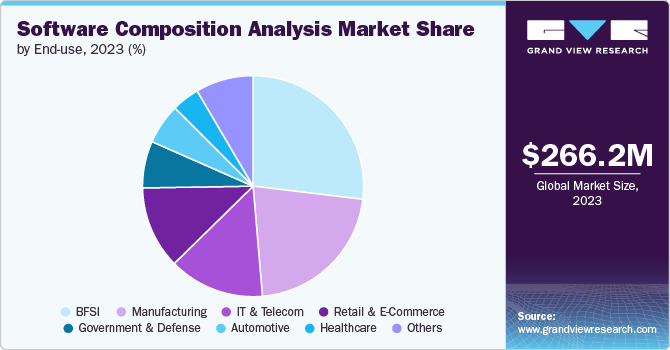

End-use Insights

The BFSI segment accounted for the largest market share of over 26% in 2023. Financial institutions are attractive targets for cyberattacks due to the immense value of financial data and the potential financial gains for malicious actors. These institutions handle sensitive information such as customer financial records, transaction details, and personal identification data, making them prime targets for cybercriminals seeking to steal money, commit fraud, or disrupt financial markets. In this high-stakes environment, SCA tools play a crucial role in enhancing cybersecurity posture. By continuously scanning and analyzing open-source components used in their software applications, SCA tools identify vulnerabilities that could be exploited by attackers. These vulnerabilities might exist in libraries, frameworks, or dependencies integrated into financial systems. Prompt identification and mitigation of these vulnerabilities are essential to reducing the attack surface and strengthening defenses against potential exploits.

The retail & e-commerce segment is expected to grow at a significant CAGR over the forecast period. Retailers and e-commerce companies are leveraging digital technologies to drive sales, optimize inventory management, and elevate the overall customer experience. As part of this transformation, there is a significant reliance on integrating open-source components into their software solutions. These components provide cost-effective and innovative functionalities but also introduce security and compliance challenges. This integration of open-source software necessitates robust SCA tools to effectively manage and mitigate risks associated with vulnerabilities and license compliance issues. SCA tools play a crucial role in continuously monitoring and analyzing open-source components used in digital platforms, ensuring they meet stringent security standards and regulatory requirements. Thus, SCA becomes integral to supporting the ongoing digital transformation initiatives that drive growth and competitiveness in these dynamic sectors.

Regional Insights

North America held the largest market share of over 38% in the market in 2023. North America, including the United States and Canada, maintains rigorous regulatory frameworks across industries like healthcare (HIPAA), finance (PCI-DSS), and government (FISMA). These regulations mandate strict data protection and software compliance standards. SCA solutions are pivotal for enterprises in these sectors, ensuring adherence to regulatory requirements by identifying and mitigating vulnerabilities within open-source software components. By managing licensing issues and enhancing software security practices, SCA tools help organizations maintain compliance, mitigate risks of data breaches, and uphold trust among stakeholders, crucially supporting their efforts to safeguard sensitive information and meet regulatory mandates effectively.

U.S. Software Composition Analysis Market Trends

The U.S. market is growing significantly at a CAGR of 18.76% from 2024 to 2030. U.S. boasts a robust IT infrastructure, facilitating widespread cloud computing adoption. This environment supports the deployment of cloud-based SCA solutions, which offer significant benefits such as scalability, flexibility, and cost-efficiency. Cloud-based SCA tools can seamlessly adapt to the varying demands of enterprises, from startups to large corporations, ensuring effective management of open-source software security and compliance. The ability to scale resources on demand, coupled with reduced upfront costs and maintenance, makes cloud-based SCA solutions an attractive option for U.S. businesses aiming to enhance their cybersecurity posture and regulatory compliance efficiently.

Asia Pacific Software Composition Analysis Market Trends

The market in Asia Pacific is projected to grow significantly at a CAGR of 22.22% from 2024 to 2030. Asia Pacific is undergoing rapid digital transformation across various sectors, resulting in widespread adoption of open-source software to drive innovation and efficiency. This surge in open-source usage necessitates robust management of security and compliance to prevent vulnerabilities and legal issues. SCA tools are critical in this context, as they provide comprehensive oversight of open-source components, identifying potential risks and ensuring adherence to regulatory standards. The growing reliance on digital technologies and open-source software in the region fuels the demand for SCA solutions, making them indispensable for maintaining secure and compliant software development practices.

Europe Software Composition Analysis Market Trends

The market in Europe is expected to grow significantly at a CAGR of 20.10% from 2024 to 2030. Europe's robust open-source community fosters collaborative development and encourages the widespread adoption of open-source software across various industries. This collaborative environment accelerates innovation and reduces costs, but also brings challenges in managing security and compliance. SCA tools are essential in this context, as they provide the necessary oversight to identify and mitigate vulnerabilities, ensure license compliance, and maintain the integrity of open-source components. The reliance on open-source software in Europe drives the demand for SCA solutions, making them crucial for organizations aiming to leverage open-source benefits while safeguarding against associated risks.

Key Software Composition Analysis Company Insights

The key companies in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Software Composition Analysis Companies:

The following are the leading companies in the software composition analysis market. These companies collectively hold the largest market share and dictate industry trends.

- Arnica, Inc.

- Checkmarx

- Contrast Security, Inc.

- Flexera Inc.

- FOSSA

- JFrog

- Mend.io

- NexB, Inc

- Qwiet

- Snyk Limited

- Sonatype Inc.

- Synopsys, Inc.

- Veracode Inc.

- WhiteHat Security,Inc.

Recent Developments

-

In April 2024, Synopsys launched Black Duck Supply Chain Edition, a comprehensive SCA solution designed to enhance software supply chain security. This new offering integrates multiple open-source detection technologies, automated Software Bill of Materials (SBOM) analysis, and malware detection. It helps development and security teams identify and mitigate risks in open-source, third-party, and AI-generated code, addressing vulnerabilities, license conflicts, and malicious code. The tool ensures extensive coverage of software dependencies, providing actionable insights and compliance management across the entire application lifecycle.

-

In March 2024, GitGuardian introduced a new SCA module designed for DevSecOps environments. This module helps security and developer teams by offering a unified solution for vulnerability remediation. It allows for the quick identification of unsafe dependencies, prioritization of incidents by severity, and provides remediation guidance. The SCA module also monitors legal risks in the software supply chain, ensuring compliance with license and security policies. This tool supports shift-left practices and integrates with GitGuardian’s CLI tool ggshield, enhancing security throughout the development process.

Software Composition Analysis Market Scope

Report Attribute

Details

Market size value in 2024

USD 296.91 million

Revenue forecast in 2030

USD 880.63 million

Growth rate

CAGR of 19.87% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

Arnica, Inc.; Checkmarx; Contrast Security, Inc.; Flexera Inc.; FOSSA; JFrog; Mend.io; NexB, Inc; Qwiet; Snyk Limited; Sonatype Inc.; Synopsys, Inc.; Veracode Inc.; WhiteHat Security,Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Software Composition Analysis Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global software composition analysis market report based on component, deployment, enterprise size, end-use, and region:

-

Software Composition Analysis Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

Professional Services

-

Managed Services

-

-

-

Software Composition Analysis Deployment Outlook (Revenue; USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Software Composition Analysis Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Software Composition Analysis End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Manufacturing

-

Government & Defense

-

Retail & E-Commerce

-

Automotive

-

Healthcare

-

Others

-

-

Software Composition Analysis Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global software composition analysis market was valued at USD 266.29 million in 2023 and is expected to reach USD 296.91 million in 2024.

b. The global software composition analysis market is expected to grow at a compound annual growth rate of 19.87% from 2024 to 2030 to reach USD 880.63 million by 2030.

b. The solution segment held the largest revenue share of more than 67% in 2023 in the global software composition analysis market. Software Composition Analysis (SCA) solutions have significantly advanced in their capabilities, making them indispensable for organizations. These solutions now offer real-time monitoring, which allows continuous surveillance of open-source components for any emerging vulnerabilities.

b. Key players operating in the software composition analysis market include Synopsys, Inc., Sonatype Inc, WhiteHat Security, Inc., Veracode Inc., Flexera Inc., Contrast Security, Inc., NexB, Inc., FOSSA, JFrog, Checkmarx, Arnica, Inc., Mend.io, Qwiet and Snyk Limited

b. Key drivers of this market include the rise in cyber threats targeting software supply chains, stringent regulatory requirements such as GDPR and HIPAA, and the shift towards DevSecOps practices that integrate security early in the development process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.