Software-defined Automation Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment (On-premises, Cloud-based), By Application (Process Automation, Network Automation), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-462-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Software-defined Automation Market Trends

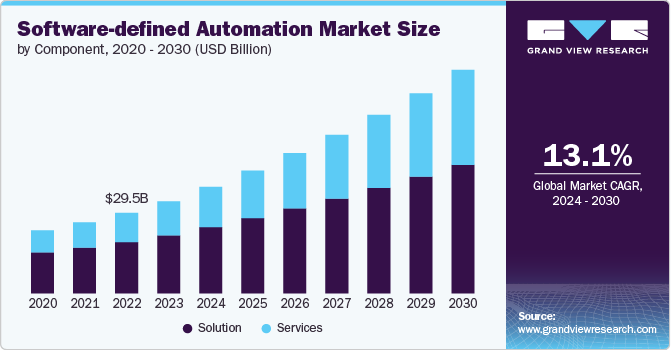

The global software-defined automation market size was valued at USD 33,688.7 million in 2023 and is expected to grow at a CAGR of 13.1% from 2024 to 2030. The demand for software-defined automation (SDA) solutions is rapidly becoming a key trend as organizations increasingly seek to streamline operations and reduce costs. SDA allows businesses to automate repetitive tasks and optimize workflows, drastically cutting down on manual effort and reducing the risk of errors. This growing focus on automation translates into faster process execution, scalability, and operational agility. Companies are leveraging SDA to enhance resource allocation and boost productivity, positioning it as a vital component for staying competitive in today's fast-paced market.

Moreover, the rapid evolution of cloud computing technologies has significantly bolstered the growth of the software-defined automation market. Cloud platforms offer scalable resources and flexible infrastructure, which complement SDA solutions by providing a robust environment for deployment and management. Integration with cloud services enables organizations to leverage automation for improved resource utilization, cost management, and enhanced agility. This synergy between cloud computing and SDA is a major driver of market expansion.

There is a growing emphasis on integrating automation technologies to modernize operations as businesses embark on digital transformation journeys. Software-defined automation plays a critical role in this transformation by enabling the automation of complex processes and data management tasks. This helps organizations achieve greater operational agility, accelerate time-to-market, and enhance overall productivity. The push for digital transformation is a significant catalyst for the adoption of SDA solutions.

Additionally, the increasing complexity of IT infrastructures, driven by diverse applications, multi-cloud environments, and expanding data volumes, is propelling the need for software-defined automation. SDA solutions provide a unified approach to managing and automating these complex environments, simplifying operations and improving visibility. By automating network management, resource allocation, and configuration, organizations can effectively handle the complexity of modern IT landscapes and maintain operational efficiency, thereby boosting market growth.

Furthermore, as cybersecurity threats become more sophisticated, organizations are investing in automation solutions to bolster their security postures. Software-defined automation enables the automation of security processes, such as threat detection, response, and compliance management, thereby enhancing the ability to quickly address vulnerabilities and mitigate risks. By automating security operations, organizations can ensure more consistent and timely protection against cyber threats, driving growth in the SDA market.

Component Insights

The solution segment accounted for the largest market share of over 62% in 2023, owing to the increasing reliance on software-defined technologies across various industries. This growth can be attributed to the growing demand for efficient, scalable, and cost-effective solutions that enhance operational capabilities. Organizations are increasingly adopting software-defined approaches to streamline their operations, improve resource management, and reduce dependency on traditional hardware. As a result, the solutions segment, which includes software-defined networking, computing, and storage, has become the backbone of modern IT infrastructure, driving significant market growth and innovation.

The services segment is expected to grow at the highest CAGR of over 15% from 2024 to 2030, driven by the increasing need for ongoing support, maintenance, and consulting services as organizations transition to software-defined environments. The demand for specialized services that ensure optimal performance, security, and compliance is rising, as businesses adopt complex software-defined solutions. Additionally, the integration of emerging technologies such as artificial intelligence and machine learning into service offerings is expected to enhance automation and operational efficiency, further fueling growth in this segment.

Deployment Insights

The on-premises segment registered the largest revenue share in 2023, owing to its established presence and the preference of many organizations for maintaining control over their IT environments. On-premises solutions offer enhanced security and compliance, as businesses can keep sensitive data within their own infrastructure, mitigating risks associated with data breaches and regulatory requirements. Additionally, the ability to customize and optimize on-premises systems to meet specific organizational needs has made this model attractive for enterprises with complex operational demands, leading to its significant revenue contribution in the market.

The cloud-based segment is expected to grow at a highest CAGR from 2024 to 2030, driven by the increasing adoption of cloud technologies across various industries. Organizations are increasingly recognizing the benefits of cloud-based solutions, such as scalability, flexibility, and cost-effectiveness. The shift towards remote work and the need for agile IT infrastructure are prompting businesses to migrate to cloud platforms, which facilitate easier resource management and deployment of applications. Furthermore, advancements in cloud security and the integration of artificial intelligence and machine learning into cloud services are enhancing their appeal, positioning the cloud-based segment for substantial growth in the coming years.

Application Insights

The information technology & telecom segment registered the largest revenue share in 2023, owing to the critical role these sectors play in driving digital transformation across industries. Organizations are increasingly leveraging software-defined automation to enhance operational efficiency, improve service delivery, and reduce costs. The demand for advanced IT solutions, such as software-defined networking and data management, has surged as businesses seek to optimize their infrastructure and respond to the growing complexities of modern technology environments. This trend is expected to fuel the segmental growth in coming years.

The retail & e-commerce segment is expected to grow at a highest CAGR from 2024 to 2030, driven by the rapid expansion of online shopping and the increasing integration of automation technologies in retail operations. The shift towards e-commerce has accelerated, particularly in the wake of the COVID-19 pandemic, as consumers increasingly prefer the convenience of online shopping. Retailers are adopting software-defined automation to streamline inventory management, enhance customer experiences, and improve supply chain efficiency. As digital transactions continue to rise and consumer expectations evolve, the retail and e-commerce segment is poised for significant growth, reflecting broader trends in consumer behavior and technological advancement.

End-use Insights

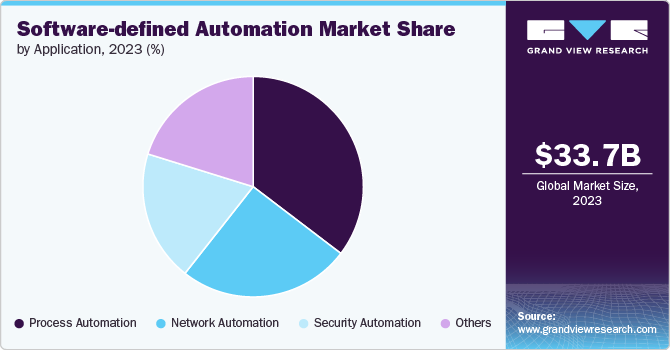

The process automation segment registered the largest revenue share in 2023, owing to the increasing adoption of automation technologies across various industries. As organizations strive to streamline their operations, reduce costs, and improve efficiency, process automation has become a critical component of their digital transformation strategies. By automating repetitive tasks and workflows, businesses can minimize human errors, increase productivity, and enhance overall process reliability. The growing demand for solutions that can automate complex processes, from manufacturing to customer service is expected to drive segmental growth in coming years.

The network automation segment is expected to grow at a highest CAGR from 2024 to 2030, fueled by the increasing complexity of network infrastructures and the need for efficient management and optimization. As organizations embrace cloud computing, the Internet of Things (IoT), and other emerging technologies, the demand for automated network management solutions is on the rise. Network automation enables businesses to provision, configure, and monitor network devices and services more efficiently, reducing manual intervention and improving overall network performance. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into network automation solutions is expected to enhance predictive maintenance, proactive issue resolution, and real-time optimization, further driving the segment's growth in the coming years

Regional Insights

The market in North America accounted for the highest revenue share of over 37% in 2023, driven by its early adoption of advanced technologies and a high concentration of tech-savvy enterprises. The region’s strong focus on operational efficiency and digital transformation initiatives further accelerates the demand for automation solutions. Additionally, robust investment in IT infrastructure and innovation supports the widespread implementation of software-defined automation technologies.

U.S. Software-Defined Automation Market

The market in the U.S. is anticipated to grow at a CAGR of over 10% from 2024 to 2030. The U.S. leads in software-defined automation adoption due to its large and diverse tech sector, driving demand for advanced automation solutions to enhance operational efficiency. Major tech hubs and significant investments in digital transformation initiatives contribute to rapid market growth. Additionally, the presence of numerous leading technology companies and a strong emphasis on innovation further fuel the adoption of automation technologies.

Asia Pacific Software-Defined Automation Market Trends

The market in Asia Pacific is anticipated to grow at a CAGR of over 15% from 2024 to 2030. The Asia Pacific region is experiencing rapid growth in software-defined automation driven by a surge in digital transformation efforts and a burgeoning tech landscape. The region’s expanding industrial base and increasing demand for efficient operational processes drive the adoption of automation technologies. Additionally, government initiatives supporting technological advancements and infrastructure development contribute to the region's accelerating market growth.

Europe Software-Defined Automation Market Trends

The software-defined automation market in Europe is expected to grow at a CAGR of over 12% from 2024 to 2030. Europe’s market is growing due to increased regulatory pressures and a strong focus on digital transformation across various industries. The region’s diverse and complex IT environments drive the need for automation solutions that can simplify and streamline operations. Additionally, substantial investments in research and development and a supportive regulatory environment encourage the adoption of advanced automation technologies.

Key Software-defined Automation Company Insights

Some of the key players operating in the market are Siemens AG, Mitsubishi Electric India Pvt. Ltd, and among others.

-

Siemens AG is a global conglomerate specializing in technology and engineering. It operates in several key areas including automation, digitalization, and smart infrastructure, aiming to address complex industry challenges and contribute to modern societal needs. With its extensive history, Siemens has a significant presence in both industrial and digital industries worldwide, emphasizing innovation and sustainability in its operations.

-

Mitsubishi Electric India Pvt. Ltd is a diversified global electronics and electrical equipment manufacturer. It operates across various sectors including energy and electric systems, industrial automation, information and communication systems, electronic devices, and home appliances. The company is dedicated to contributing to society through its technology, focusing on the development and manufacture of environmentally responsible products and solutions.

Beckhoff Automation GmbH & Co. KG, Juniper Networks, and among others are some of the emerging market participants in the software-defined automation market.

-

Beckhoff Automation GmbH & Co. KG is known for its innovations in automation technology. It specializes in PC-based control systems for industrial automation, integrating PLC, motion control, and IoT functionalities into a unified platform. Beckhoff's technology is utilized across a variety of industries worldwide to enhance efficiency and optimize operations, reflecting their commitment to engineering and technological advancement.

-

Juniper Networks is a multinational corporation focuses on networking products. The company designs and markets a wide Component of products, including routers, switches, network management software, network security products, and software-defined networking technology. Juniper Networks aims to provide high-performance networking & cybersecurity solutions to service providers, enterprise companies, and public sector organizations globally.

Key Software-defined Automation Companies:

The following are the leading companies in the software-defined automation market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG

- Mitsubishi Electric India Pvt.Ltd

- Hewlett Packard Enterprise (HPE)

- Yokagawa India Ltd.

- Beckhoff Automation GmbH & Co. KG

- Bosch Rexroth Corporation

- Emerson Electric Co.

- Rockwell Automation, Inc.

- Cisco Systems, Inc.

- Juniper Networks

Recent Developments

-

In July 2024, Emerson Electric Co. is enhancing its flagship Ovation automation platform by incorporating a software-defined framework. This update will empower utilities to more effectively utilize data, cutting-edge technologies, and artificial intelligence (AI). Such advancements are aimed at propelling the sectors towards remarkable operational efficiency and addressing the growing need for dependable, cost-efficient, and eco-friendly energy and water solutions.

-

In May 2024, Broadcom Inc. partnered with SEW-EURODRIVE, which is at the forefront of drive automation technology, to pioneer the transition to a new phase of software-driven manufacturing through SEW-EURODRIVE's DriveOperations framework. This extensive collection of applications aims to help businesses improve their operational performance, lower expenses, and more efficiently handle intricate activities.

-

In May 2024, Red Hat, Inc. and Deloitte, a top-tier audit, consulting, tax, and advisory services, have partnered to address the challenges of managing software ecosystems with multiple vendors across various sectors. This collaboration includes a holistic approach to aid in the creation, systems engineering, testing, and management of software-defined vehicle (SDV) product portfolios.

Software-defined Automation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 39,011.5 million |

|

Revenue forecast in 2030 |

USD 81,769.9 million |

|

Growth rate |

CAGR of 13.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Siemens AG; Mitsubishi Electric India Pvt.Ltd; Hewlett Packard Enterprise (HPE); Yokagawa India Ltd.; Beckhoff Automation GmbH & Co. KG; Bosch Rexroth Corporation; Emerson Electric Co.; Rockwell Automation, Inc.; Cisco Systems, Inc.; Juniper Networks |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Software-defined Automation Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global software-defined automation market report based on component, deployment, application, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Process Automation

-

Network Automation

-

Security Automation

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Information Technology & Telecom

-

Banking, Financial Services, & Insurance (BFSI)

-

Retail & E-commerce

-

Healthcare & Life Sciences

-

Manufacturing

-

Automotive

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global software-defined automation market size was estimated at USD 33,688.7 million in 2023 and is expected to reach USD 39,011.5 million in 2024.

b. The global software-defined automation market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030 to reach USD 81,769.9 million by 2030.

b. North America dominated the software-defined automation market with a share of around 37% in 2023, driven by its early adoption of advanced technologies and a high concentration of tech-savvy enterprises.

b. Some key players operating in the software-defined automation market include Siemens AG, Mitsubishi Electric India Pvt.Ltd, Hewlett Packard Enterprise (HPE), Yokagawa India Ltd., Beckhoff Automation GmbH & Co. KG, Bosch Rexroth Corporation, Emerson Electric Co., Rockwell Automation, Inc., Cisco Systems, Inc., Juniper Networks

b. Key factors that are driving the software-defined automation market growth include the demand for software-defined automation (SDA) solutions, rapid evolution of cloud computing technologies, and growing emphasis on integrating automation technologies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."